2025 USD1Price Prediction: Comprehensive Analysis and Forecast of Key Market Factors Influencing Digital Currency Values

Introduction: USD1's Market Position and Investment Value

USD1 (USD1), as a fiat-backed stablecoin designed to maintain a 1:1 equivalence with the U.S. dollar, has made significant strides since its inception in 2025. As of 2025, USD1's market capitalization has reached $2,149,655,498, with a circulating supply of approximately 2,151,591,931 tokens, maintaining a price of around $0.9991. This asset, often referred to as a "digital dollar equivalent," is playing an increasingly crucial role in facilitating seamless transactions between fiat currencies and digital assets.

This article will provide a comprehensive analysis of USD1's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. USD1 Price History Review and Current Market Status

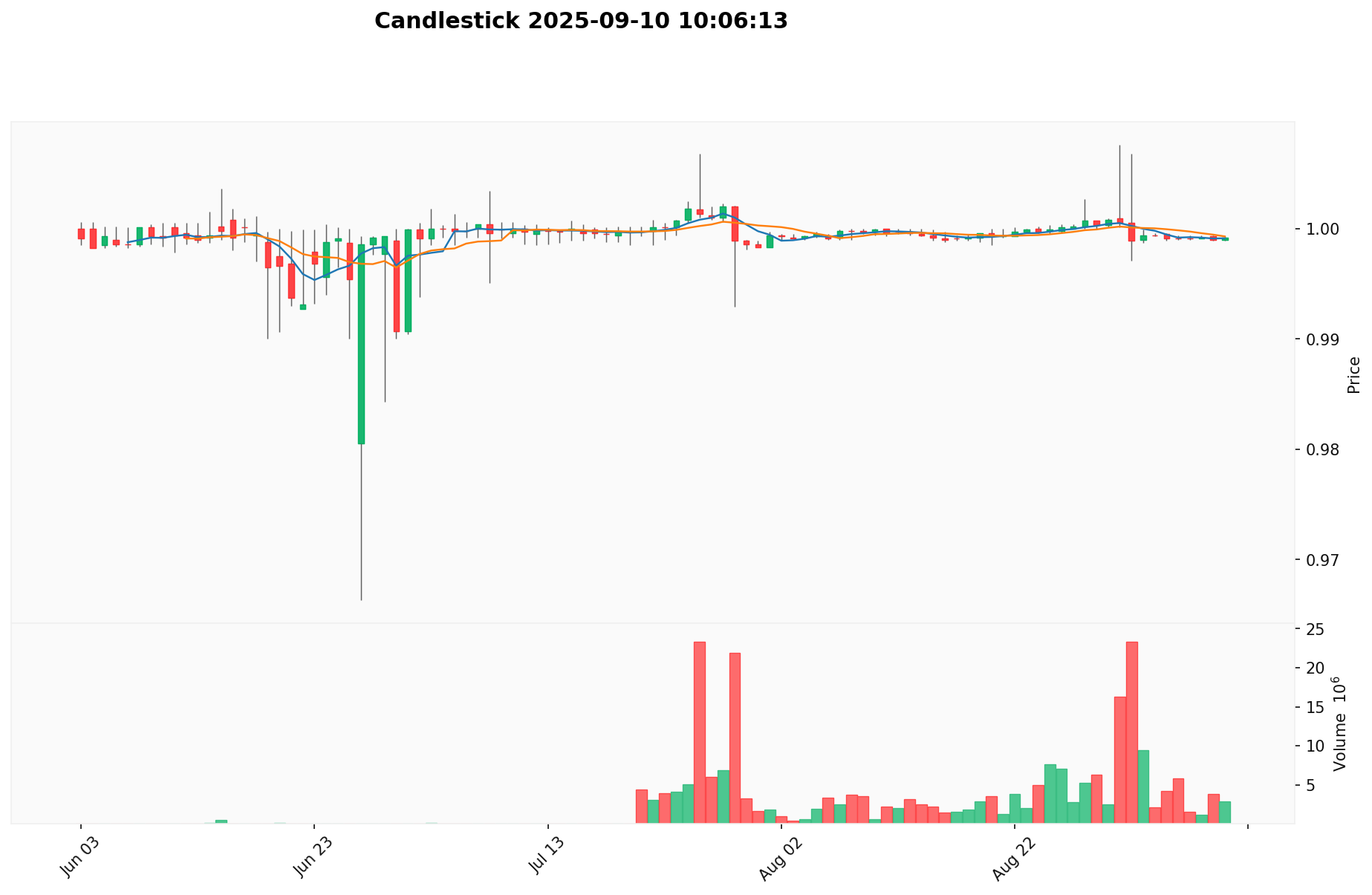

USD1 Historical Price Evolution Trajectory

- April 2025: USD1 launched by World Liberty Financial, price stabilized at $1

- June 2025: Experienced brief price spike to $5000, quickly returned to $1 peg

- June 2025: Temporary dip to $0.9663, lowest recorded price

USD1 Current Market Situation

As of September 10, 2025, USD1 is trading at $0.9991, maintaining its peg to the US dollar with minimal deviation. The 24-hour trading volume stands at $2,290,432.04, indicating active market participation. USD1's market capitalization is $2,149,655,498.26, ranking it 63rd in the global cryptocurrency market with a 0.051% market share. The circulating supply matches the total supply at 2,151,591,931 USD1 tokens, suggesting full circulation of the asset. Despite minor fluctuations, USD1 has demonstrated resilience in maintaining its dollar peg, with a -0.01% change in the past hour and a -0.03% change over the past week.

Click to view the current USD1 market price

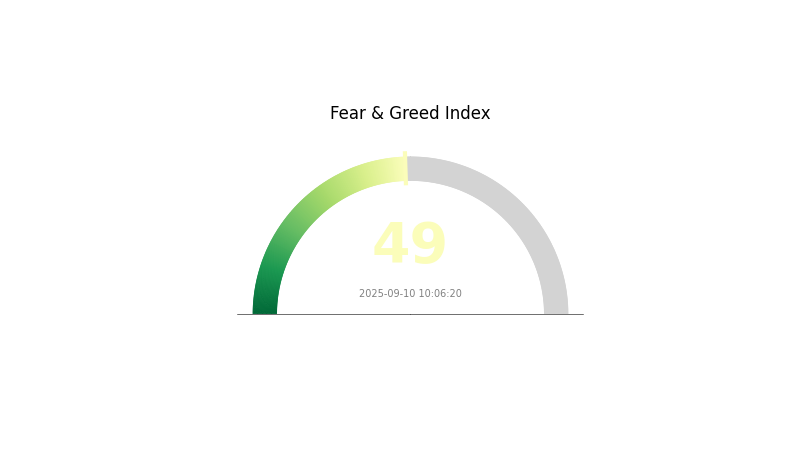

USD1 Market Sentiment Indicator

2025-09-10 Fear and Greed Index: 49 (Neutral)

Click to view the current Fear & Greed Index

The crypto market sentiment remains balanced today, with the Fear and Greed Index at 49, indicating a neutral stance. This equilibrium suggests investors are neither overly pessimistic nor excessively optimistic. While caution persists, there's also a hint of optimism in the air. Traders should stay vigilant, as this neutral zone often precedes significant market movements. Keep an eye on key technical indicators and global economic news for potential catalysts that could tip the scales in either direction.

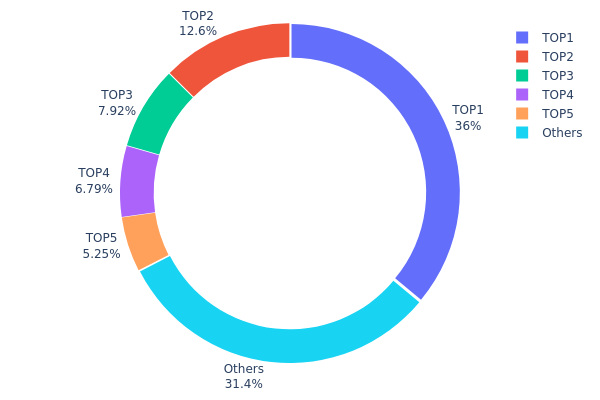

USD1 Holdings Distribution

The address holdings distribution data provides crucial insights into the concentration of USD1 tokens among various wallet addresses. Analysis of this data reveals a significant level of centralization within the USD1 market. The top address holds 36.02% of the total supply, with the top five addresses collectively controlling 68.52% of all USD1 tokens.

This high concentration of holdings in a few addresses raises concerns about market manipulation and price volatility. The dominant position of the top address, holding over one-third of the supply, could potentially influence market dynamics significantly. Furthermore, the fact that nearly 70% of tokens are controlled by just five addresses suggests a relatively low level of decentralization in the USD1 ecosystem.

Such a concentrated distribution may impact market stability and liquidity. Large holders have the potential to cause substantial price movements through significant buy or sell orders. However, it's worth noting that 31.48% of tokens are distributed among other addresses, which provides some level of diversification and may help mitigate risks associated with extreme centralization.

Click to view the current USD1 Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x5be9...957dbb | 106194.70K | 36.02% |

| 2 | 0xf977...41acec | 37080.61K | 12.57% |

| 3 | 0xf584...72d621 | 23335.89K | 7.91% |

| 4 | 0x36a7...d9c141 | 20003.52K | 6.78% |

| 5 | 0x6de0...40d21f | 15471.26K | 5.24% |

| - | Others | 92675.28K | 31.48% |

II. Key Factors Influencing USD1's Future Price

Supply Mechanism

- Full USD Asset Backing: USD1 is fully backed by USD assets, primarily US Treasury bonds and cash.

- Historical Pattern: Transparent monthly audits and multi-chain deployment have contributed to rapid market adoption.

- Current Impact: The stable 1:1 USD backing provides confidence for institutional and enterprise use cases.

Institutional and Whale Movements

- Institutional Holdings: MGX, an Abu Dhabi investment firm, has chosen USD1 for a $2 billion investment transaction.

- Corporate Adoption: ALT5 Sigma, a NASDAQ-listed company, has invested $1.5 billion to initiate the WLFI treasury.

- Government Policies: The US is advancing the GENIUS Act to establish a comprehensive regulatory framework for stablecoins, potentially impacting USD1's operations and compliance requirements.

Macroeconomic Environment

- Monetary Policy Impact: The Federal Reserve's policies on interest rates and inflation will directly affect the value of USD-backed assets supporting USD1.

- Inflation Hedging Properties: As a USD-pegged stablecoin, USD1's performance is closely tied to the US dollar's strength against inflation.

- Geopolitical Factors: The Trump family's involvement in WLFI and USD1 may influence its perception and adoption in different global markets.

Technological Development and Ecosystem Building

- Multi-Chain Deployment: USD1 has been deployed on Ethereum, BNB Chain, Tron, and Solana networks, enhancing its accessibility and utility.

- DeFi Integration: Collaborations with projects like Dolomite, Buildon, and Lista DAO are expanding USD1's presence in decentralized finance ecosystems.

- Ecosystem Applications: Key DApps and ecosystem projects include Dolomite (lending and margin trading), Buildon (Meme projects and Launchpad), and Plume Network (RWA-focused EVM chain using USD1 as a reserve asset).

III. USD1 Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.61944 - $0.9991

- Neutral prediction: $0.9991 - $1.05905

- Optimistic prediction: $1.05905 (requires favorable market conditions)

2027-2028 Outlook

- Market phase expectation: Potential growth phase

- Price range forecast:

- 2027: $1.15802 - $1.51912

- 2028: $0.82929 - $2.01794

- Key catalysts: Market adoption, technological advancements

2029-2030 Long-term Outlook

- Base scenario: $1.70004 - $2.00605 (assuming steady market growth)

- Optimistic scenario: $2.31206 - $2.3872 (assuming strong market performance)

- Transformative scenario: $2.3872+ (under extremely favorable conditions)

- 2030-12-31: USD1 $2.00605 (potential 100% increase from 2025)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 1.05905 | 0.9991 | 0.61944 | 0 |

| 2026 | 1.46128 | 1.02907 | 0.71006 | 3 |

| 2027 | 1.51912 | 1.24518 | 1.15802 | 24 |

| 2028 | 2.01794 | 1.38215 | 0.82929 | 38 |

| 2029 | 2.31206 | 1.70004 | 1.30903 | 70 |

| 2030 | 2.3872 | 2.00605 | 1.18357 | 100 |

IV. USD1 Professional Investment Strategies and Risk Management

USD1 Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Conservative investors seeking stability

- Operation suggestions:

- Allocate a portion of portfolio to USD1 as a hedge against market volatility

- Use dollar-cost averaging to accumulate USD1 over time

- Store USD1 in secure wallets with regular backups

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Monitor short-term price fluctuations

- RSI (Relative Strength Index): Identify overbought or oversold conditions

- Key points for swing trading:

- Set tight stop-loss orders to minimize potential losses

- Monitor trading volume for confirmation of price movements

USD1 Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 5-10%

- Moderate investors: 10-20%

- Aggressive investors: 20-30%

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple stablecoins

- Collateral Management: Monitor backing assets and their stability

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallets for large holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. USD1 Potential Risks and Challenges

USD1 Market Risks

- Liquidity risk: Potential difficulties in large-scale redemptions

- Competition risk: Emergence of new stablecoins with superior features

- Reputation risk: Impact of negative publicity on user trust

USD1 Regulatory Risks

- Compliance challenges: Evolving regulations in different jurisdictions

- Licensing requirements: Potential need for additional licenses

- Reporting obligations: Increased transparency demands from regulators

USD1 Technical Risks

- Smart contract vulnerabilities: Potential for coding errors or exploits

- Blockchain network congestion: Transaction delays during high-volume periods

- Integration issues: Compatibility problems with new platforms or protocols

VI. Conclusion and Action Recommendations

USD1 Investment Value Assessment

USD1 offers stability in the volatile crypto market but faces challenges from regulatory scrutiny and competition. Its long-term value proposition relies on maintaining its peg and expanding use cases.

USD1 Investment Recommendations

✅ Beginners: Use as an entry point to crypto, allocate small portion of portfolio

✅ Experienced investors: Utilize for short-term trading and as a store of value

✅ Institutional investors: Consider for treasury management and hedging strategies

USD1 Trading Participation Methods

- Spot trading: Buy and sell USD1 on Gate.com

- Yield farming: Explore DeFi platforms offering USD1 liquidity pools

- Payment solution: Adopt USD1 for cross-border transactions or e-commerce

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the price prediction for USD1 in 2030?

Based on current projections, the price prediction for USD1 in 2030 is $1.28. This forecast assumes steady growth from 2025 onwards.

Will USD1 coin go up?

Yes, USD1 is predicted to go up. It's expected to increase by 5% and reach $0.945 by 2026, based on current forecast models.

How much is USD1 crypto?

As of 2025-09-10, USD1 crypto is priced at $1.0001. It has a circulating supply of 2.65 billion tokens.

What is the dollar price prediction for 2025?

Based on current projections, the dollar price prediction for 2025 is $0.000160. This forecast reflects the latest market analysis and growth calculations as of September 2025.

Falcon Finance (FF): What It Is and How It Works

USD1 Coin: What It Is and How It Works

2025 CRVUSDPrice Prediction: Future Outlook and Key Factors Influencing the Curve Stablecoin Market

2025 USDP Price Prediction: Analyzing Market Trends and Future Outlook for Pax Dollar in the Global Stablecoin Ecosystem

2025 BPrice Prediction: Analyzing Market Trends and Key Factors Influencing Future Valuations

GUSD: A reliable stablecoin asset management tool in the crypto market.

American Bitcoin Grew Its Treasury to 4,783 BTC and Why the Market Should Pay Attention

What Is SOPR in Crypto? How the Indicator Reveals Market Profit and Loss

What Causes Crypto Prices to Rise? Key Drivers Behind Market Rallies

Why Blockstream CEO Adam Back Says All Companies Could Become Bitcoin Reserve Firms

What Is BeatSwap and How It Turns Music Rights Into Tradable Blockchain Assets