2025 WIF Price Prediction: Bullish Outlook as Adoption and Utility Drive Growth

Introduction: WIF's Market Position and Investment Value

dogwifhat (WIF), as a memecoin on the Solana blockchain, has gained significant attention in the cryptocurrency market since its inception. As of 2025, WIF's market capitalization has reached $533,726,371, with a circulating supply of approximately 998,926,392 tokens, and a price hovering around $0.5343. This asset, often referred to as a "meme sensation," is playing an increasingly important role in the realm of social media-driven cryptocurrencies.

This article will provide a comprehensive analysis of WIF's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. WIF Price History Review and Current Market Status

WIF Historical Price Evolution

- 2023: WIF launched on December 12, initial price around $0.26

- 2024: Reached all-time high of $4.8603 on March 31, signifying massive growth

- 2025: Experienced significant downturn, price dropped to current level of $0.5343

WIF Current Market Situation

As of October 17, 2025, WIF is trading at $0.5343, ranking 142nd in the cryptocurrency market. The token has seen a 1.88% decrease in the last 24 hours, with a trading volume of $8,193,239. WIF's market capitalization stands at $533,726,371, representing a 0.013% share of the total crypto market.

The current price is significantly below its all-time high of $4.8603, recorded on March 31, 2024, showing an 89% decline from its peak. However, it remains well above its all-time low of $0.0675, observed on January 8, 2024.

Recent price trends indicate volatility:

- 1-hour change: +0.77%

- 24-hour change: -1.88%

- 7-day change: -24.79%

- 30-day change: -44.46%

- 1-year change: -79.72%

These figures suggest a bearish trend in the short to medium term, with significant losses over the past month and year. The current market emotion is reported as "Fear," indicating investor caution.

Click to view the current WIF market price

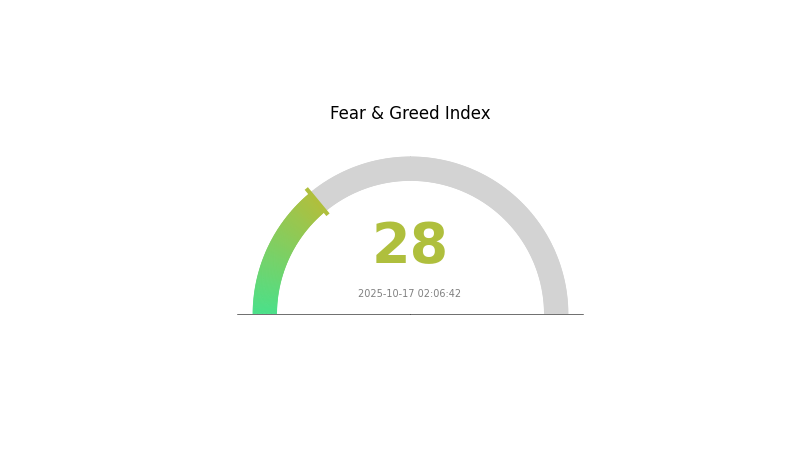

WIF Market Sentiment Indicator

2025-10-17 Fear and Greed Index: 28 (Fear)

Click to view the current Fear & Greed Index

The crypto market is experiencing a fearful sentiment today, with the Fear and Greed Index at 28. This indicates a cautious approach among investors, potentially driven by recent market volatility or negative news. During such periods, some traders may see opportunities for long-term investments, while others might adopt a wait-and-see stance. It's crucial to conduct thorough research and consider risk management strategies before making any investment decisions in this uncertain climate.

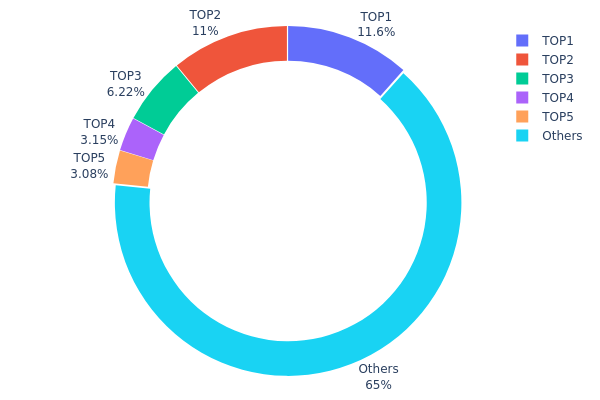

WIF Holdings Distribution

The address holdings distribution chart provides insight into the concentration of WIF tokens among different wallet addresses. Analysis of the current data reveals a moderate level of concentration, with the top 5 addresses holding approximately 34.95% of the total supply. The largest holder possesses 11.58% of WIF tokens, followed closely by the second-largest at 10.95%.

This distribution pattern suggests a relatively balanced ecosystem, although there is still a notable influence from major holders. The presence of five addresses controlling over one-third of the supply could potentially impact market dynamics, particularly in terms of price volatility and liquidity. However, the fact that 65.05% of tokens are distributed among other addresses indicates a degree of decentralization and broader market participation.

Overall, the current address distribution reflects a market structure that balances between centralized influence and wider distribution. While major holders could exert some pressure on short-term price movements, the substantial distribution among other addresses may contribute to long-term stability and resistance to manipulation attempts.

Click to view current WIF Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 8Tp9fF...DdeBzG | 115682.64K | 11.58% |

| 2 | 9WzDXw...YtAWWM | 109437.63K | 10.95% |

| 3 | 3gd3dq...hCkW2u | 62084.01K | 6.21% |

| 4 | 4xLpwx...k99Qdg | 31439.50K | 3.14% |

| 5 | 6LY1Jz...kZzkzF | 30756.11K | 3.07% |

| - | Others | 649440.02K | 65.05% |

II. Key Factors Affecting WIF's Future Price

Supply Mechanism

- Fixed Supply: WIF has a maximum supply of approximately 998.9 million tokens, with no plans for further creation. This fixed supply could drive price increases if demand grows.

- Historical Pattern: The lack of staking or burning mechanisms has potentially contributed to price appreciation since launch.

- Current Impact: The fixed supply continues to be a factor that may support price growth as demand increases.

Institutional and Whale Dynamics

- Exchange Listings: Listings on popular cryptocurrency exchanges have driven significant price movements and trading volume for WIF.

Macroeconomic Environment

- Inflation Hedging Properties: As a cryptocurrency, WIF may be viewed by some investors as a potential hedge against inflation in the broader economy.

Technical Development and Ecosystem Building

- Market Sentiment: The meme coin nature of WIF makes it susceptible to rapid changes in market sentiment and social media trends.

III. WIF Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.32501 - $0.5328

- Neutral prediction: $0.5328 - $0.59141

- Optimistic prediction: $0.59141 - $0.65204 (requires positive market sentiment and increased adoption)

2027-2028 Outlook

- Market stage expectation: Potential growth phase with increased volatility

- Price range forecast:

- 2027: $0.37031 - $0.88025

- 2028: $0.41645 - $0.84778

- Key catalysts: Technological advancements, wider market acceptance, and potential partnerships

2030 Long-term Outlook

- Base scenario: $0.83869 - $0.98669 (assuming steady market growth and adoption)

- Optimistic scenario: $0.98669 - $1.09523 (assuming strong market performance and increased utility)

- Transformative scenario: $1.09523 - $1.17767 (assuming breakthrough innovations and mass adoption)

- 2030-12-31: WIF $0.98669 (potential stabilization point after significant growth)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.59141 | 0.5328 | 0.32501 | 0 |

| 2026 | 0.65204 | 0.5621 | 0.35975 | 5 |

| 2027 | 0.88025 | 0.60707 | 0.37031 | 13 |

| 2028 | 0.84778 | 0.74366 | 0.41645 | 39 |

| 2029 | 1.17767 | 0.79572 | 0.6127 | 48 |

| 2030 | 1.09523 | 0.98669 | 0.83869 | 84 |

IV. WIF Professional Investment Strategies and Risk Management

WIF Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors with a high appetite for volatility

- Operation suggestions:

- Dollar-cost average into WIF over an extended period

- Hold through market cycles, focusing on long-term potential

- Store WIF in a secure non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Relative Strength Index (RSI): Use to identify overbought/oversold conditions

- Moving Averages: Track short-term and long-term trends

- Key points for swing trading:

- Monitor social media sentiment for potential price catalysts

- Set strict stop-loss orders to manage downside risk

WIF Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-2% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across various crypto assets

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use unique passwords

V. Potential Risks and Challenges for WIF

WIF Market Risks

- High volatility: Meme coins are subject to extreme price swings

- Liquidity risk: Potential difficulty in exiting large positions

- Market sentiment: Heavily influenced by social media trends

WIF Regulatory Risks

- Regulatory uncertainty: Potential for increased scrutiny of meme coins

- Legal classification: Risk of being classified as a security

- Exchange delisting: Possibility of removal from trading platforms

WIF Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs

- Network congestion: Solana network issues could affect transactions

- Wallet compatibility: Limited support on some platforms

VI. Conclusion and Action Recommendations

WIF Investment Value Assessment

WIF, as a meme coin on the Solana blockchain, presents a high-risk, high-reward opportunity. While it has shown significant price appreciation potential, its long-term value proposition remains speculative and heavily dependent on community engagement and market sentiment.

WIF Investment Recommendations

✅ Newcomers: Allocate only a small portion of funds, if any, and be prepared for high volatility ✅ Experienced investors: Consider as part of a diversified crypto portfolio, with strict risk management ✅ Institutional investors: Approach with caution, potentially as a small allocation in a broader crypto strategy

WIF Trading Participation Methods

- Spot trading: Buy and sell WIF on Gate.com

- Limit orders: Set specific entry and exit points to manage risk

- DCA strategy: Gradually accumulate WIF over time to average out price volatility

Cryptocurrency investments carry extremely high risk, and this article does not constitute investment advice. Investors should make decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Does WIF coin have a future?

WIF shows promise in the meme coin market. While volatile, its future looks bright with potential for growth and increased adoption.

Can dogwifhat reach $10?

While possible, it's highly unlikely Dogwifhat will reach $10 anytime soon. Market trends and projections suggest a much lower price target for the foreseeable future.

What is dogwifhat expected to do?

Dogwifhat (WIF) aims to maintain its popularity in the meme coin market, compete with other projects, and potentially expand beyond speculation. Its success depends on community engagement and overall crypto market trends.

Will WIF ever go back up?

Yes, WIF is likely to go up again. Market trends and potential future demand suggest a positive outlook. Its popularity could increase as the price rises, driving further growth.

2025 TRUMPPrice Prediction: Analyzing Market Trends and Potential Growth Factors for the Controversial Asset

2025 SCF Price Prediction: Analyzing Market Trends and Potential Growth Factors for SCF Token

2025 MOTHER Price Prediction: Analyzing Market Trends and Future Prospects for the Cryptocurrency

2025 SMOLE Price Prediction: Will This Crypto Asset Reach New Heights or Face a Downfall?

2025 BILLY Price Prediction: Analyzing Market Trends and Future Prospects for IKEA's Iconic Bookcase

2025 JENSOL Price Prediction: Navigating the Future of Decentralized Energy Trading

Explore Decentralized Trading with Mantle Swap: A Step-by-Step Guide

Understanding Flash Loans in Decentralized Finance

Web3 Identity Management Using ENS Domains

Exploring the Farcaster Protocol: A New Era in Crypto Networks

Secure Participation in ETH Giveaways: Essential Tips