2025 ZKCPrice Prediction: Market Analysis and Growth Potential of ZKC in the Zero-Knowledge Cryptography Ecosystem

Introduction: ZKC's Market Position and Investment Value

Boundless (ZKC), as a universal ZK protocol aiming to enable internet-scale blockchain capabilities, has made significant strides since its inception. As of 2025, Boundless has achieved a market capitalization of $112,283,626, with a circulating supply of approximately 200,937,056 tokens, and a price hovering around $0.5588. This asset, hailed as the "boundless scaling solution," is playing an increasingly crucial role in powering L1s, rollups, bridges, and applications across various blockchain ecosystems.

This article will comprehensively analyze Boundless's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. ZKC Price History Review and Current Market Status

ZKC Historical Price Evolution

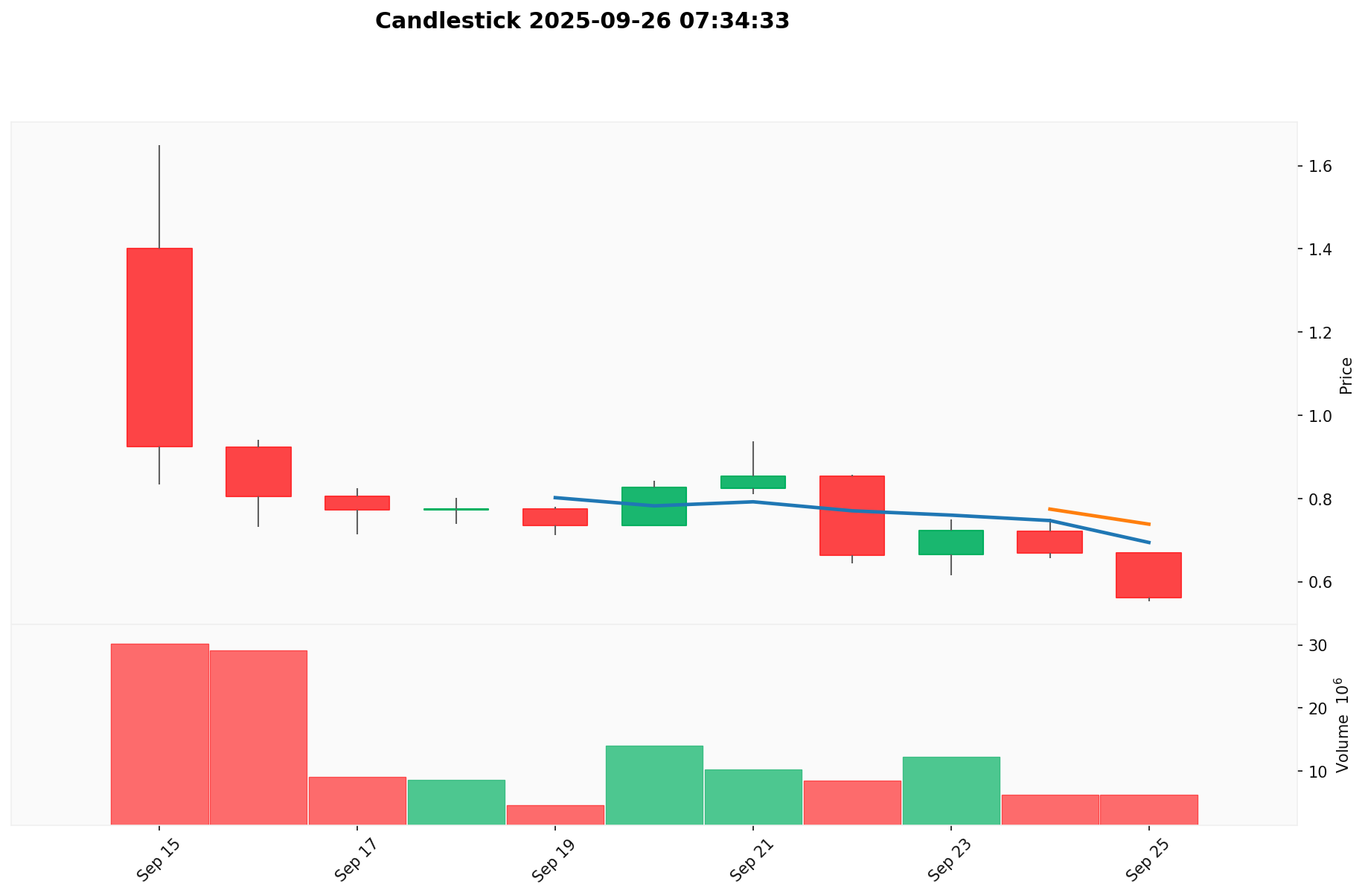

- 2025: ZKC launched, price reached all-time high of $1.65 on September 15

- 2025: Market correction, price dropped to all-time low of $0.5498 on September 26

ZKC Current Market Situation

As of September 26, 2025, ZKC is trading at $0.5588, down 9.25% in the last 24 hours. The token has a market capitalization of $112,283,626.89 and a fully diluted valuation of $558,800,000. ZKC's circulating supply is 200,937,056 tokens, which represents 20.09% of the total supply of 1 billion tokens.

The token has experienced significant volatility recently, with a 23.15% decrease in the past 7 days. The 24-hour trading volume stands at $3,773,656.73. ZKC's current price is 66.13% below its all-time high of $1.65, recorded just 11 days ago on September 15, 2025.

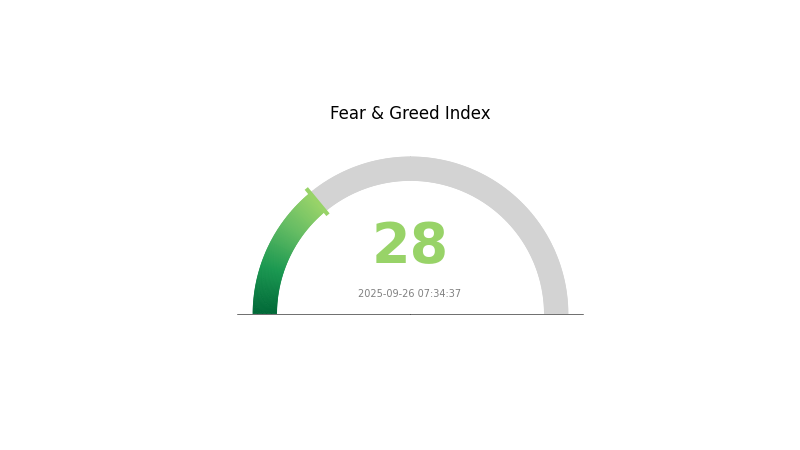

The market sentiment for cryptocurrencies is currently bearish, with the VIX index at 28, indicating a "Fear" state in the market. This general market sentiment may be contributing to the downward pressure on ZKC's price.

Click to view the current ZKC market price

ZKC Market Sentiment Indicator

2025-09-26 Fear and Greed Index: 28 (Fear)

Click to view the current Fear & Greed Index

The crypto market is currently gripped by fear, with the sentiment index at 28. This indicates a cautious mood among investors, potentially creating buying opportunities for those with a higher risk tolerance. However, it's crucial to remember that market sentiment can shift rapidly. Traders should stay informed, diversify their portfolios, and consider using Gate.com's advanced tools for risk management. As always, thorough research and prudent decision-making are essential in navigating these uncertain market conditions.

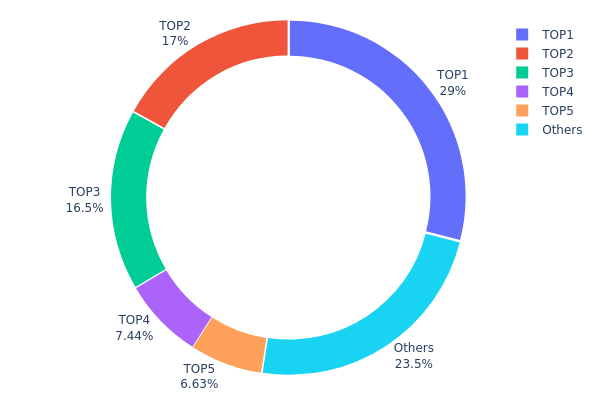

ZKC Holdings Distribution

The address holdings distribution data reveals a significant concentration of ZKC tokens among a few top addresses. The top five addresses collectively hold 76.51% of the total supply, with the largest holder controlling 28.98%. This high concentration raises concerns about potential market manipulation and volatility.

The distribution pattern suggests a centralized ownership structure, which could impact market dynamics. With such a concentrated holding, large-scale transactions by these major holders could significantly influence ZKC's price and liquidity. This concentration also implies a lower level of decentralization, potentially affecting the token's resilience to market shocks and its overall stability.

While some concentration is common in emerging cryptocurrencies, the current distribution of ZKC indicates a need for increased diversification to enhance market stability and reduce manipulation risks. The high concentration in few addresses may also signal a need for improved token distribution mechanisms to foster a more balanced and robust ecosystem for ZKC.

Click to view the current ZKC Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x7b81...1bf738 | 290616.11K | 28.98% |

| 2 | 0xf52f...eea063 | 170038.85K | 16.95% |

| 3 | 0x453a...12d905 | 165803.61K | 16.53% |

| 4 | 0xd6fd...b1d9d7 | 74572.60K | 7.43% |

| 5 | 0xcb54...4c918e | 66436.93K | 6.62% |

| - | Others | 235137.55K | 23.49% |

II. Key Factors Affecting ZKC's Future Price

Supply Mechanism

- Token Unlock Schedule: The release of tokens according to a predetermined schedule can impact ZKC's price by altering the circulating supply.

- Current Impact: Investors should closely monitor upcoming token unlocks as they may lead to potential price fluctuations.

Institutional and Whale Dynamics

- Enterprise Adoption: Increased adoption of Boundless technology by businesses could drive demand for ZKC tokens.

Macroeconomic Environment

- Inflation Hedging Properties: ZKC's performance in inflationary environments may influence its attractiveness as a potential store of value.

- Geopolitical Factors: International political and economic situations can affect the overall crypto market, including ZKC.

Technical Development and Ecosystem Growth

- Zero-Knowledge Innovation: Advancements in zero-knowledge cryptography within the Boundless protocol could enhance ZKC's utility and value proposition.

- Ecosystem Applications: The development of DApps and projects within the Boundless ecosystem may drive demand for ZKC tokens.

III. ZKC Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.43 - $0.50

- Neutral prediction: $0.50 - $0.60

- Optimistic prediction: $0.60 - $0.79 (requires favorable market conditions)

2027-2028 Outlook

- Market phase expectation: Potential growth and consolidation

- Price range forecast:

- 2027: $0.57 - $0.88

- 2028: $0.51 - $1.26

- Key catalysts: Increased adoption, technological advancements

2029-2030 Long-term Outlook

- Base scenario: $0.90 - $1.14 (assuming steady market growth)

- Optimistic scenario: $1.14 - $1.33 (assuming strong market performance)

- Transformative scenario: $1.33+ (under extremely favorable conditions)

- 2030-12-31: ZKC $1.13820 (potential average price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.78668 | 0.554 | 0.43212 | 0 |

| 2026 | 0.97199 | 0.67034 | 0.49605 | 19 |

| 2027 | 0.87865 | 0.82117 | 0.57482 | 46 |

| 2028 | 1.25786 | 0.84991 | 0.50994 | 52 |

| 2029 | 1.22251 | 1.05389 | 0.8958 | 88 |

| 2030 | 1.33169 | 1.1382 | 0.80812 | 103 |

IV. ZKC Professional Investment Strategies and Risk Management

ZKC Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term believers in blockchain scalability solutions

- Operational suggestions:

- Accumulate ZKC during market dips

- Set price targets for partial profit-taking

- Store in secure non-custodial wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and support/resistance levels

- RSI: Monitor overbought/oversold conditions

- Key points for swing trading:

- Monitor project development milestones

- Track overall market sentiment for crypto and ZK technology

ZKC Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across different blockchain scaling solutions

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallets for long-term holdings

- Security precautions: Enable 2FA, use unique strong passwords, and regularly update software

V. Potential Risks and Challenges for ZKC

ZKC Market Risks

- High volatility: ZKC price may experience significant fluctuations

- Competition: Other ZK-rollup projects may gain market share

- Adoption risk: Slow uptake by developers and users could impact value

ZKC Regulatory Risks

- Unclear regulations: Potential for unfavorable regulatory decisions

- Cross-border compliance: Varying legal status in different jurisdictions

- KYC/AML requirements: Possible impact on decentralization goals

ZKC Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs

- Scalability challenges: Unforeseen issues in achieving promised TPS

- Interoperability hurdles: Difficulties in seamless integration with various blockchains

VI. Conclusion and Action Recommendations

ZKC Investment Value Assessment

Boundless (ZKC) presents a promising long-term value proposition as a universal ZK protocol aiming to enhance blockchain scalability. However, short-term risks include market volatility and potential technical challenges in implementation.

ZKC Investment Recommendations

✅ Beginners: Start with small positions, focus on learning about ZK technology ✅ Experienced investors: Consider a balanced approach, monitoring project milestones ✅ Institutional investors: Evaluate for long-term portfolio diversification in blockchain infrastructure

ZKC Trading Participation Methods

- Spot trading: Available on Gate.com and other exchanges

- DeFi liquidity provision: Explore yield farming opportunities if available

- Staking: Participate in network security if staking options are introduced

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

2025 ZKPrice Prediction: Analyzing Market Trends and Growth Potential for Zero-Knowledge Protocols

What Is Fundamental Analysis and How Can It Evaluate Crypto Projects in 2025?

2025 ZRCPrice Prediction: Strategic Outlook and Market Analysis for ZRC Token in a Volatile Crypto Landscape

2025 ZKC Price Prediction: Analyzing Market Trends and Potential Growth Factors

How Does Fundamental Analysis Evaluate Crypto Projects in 2025?

2025 ZK Price Prediction: Analyzing the Potential Growth of Zero-Knowledge Protocols in the Crypto Market

Metaverse Land Acquisition: A Comprehensive Guide for Web3 Enthusiasts

Is Ancient8 (A8) a good investment?: A Comprehensive Analysis of Tokenomics, Market Potential, and Risk Factors

Understanding Blockchain Ledgers in Cryptocurrency

NAORIS vs MANA: A Comprehensive Comparison of Two Emerging Blockchain Governance Tokens

Sui AI Token Purchase Guide: Best Platforms for Beginners