What is USDE: Understanding the United States Department of Education and Its Role in American Education

USDe's Positioning and Significance

In 2024, Ethena Labs introduced USDe (USDE), aiming to solve the challenges of censorship-resistant and scalable stablecoins in the cryptocurrency space.

As the first censorship-resistant, scalable, and stable crypto-native solution for money, USDe plays a crucial role in the DeFi and stablecoin sectors.

As of 2025, USDe has become one of the top 20 cryptocurrencies by market capitalization, with a circulating supply of over 13 billion tokens and an active developer community. This article will delve into its technical architecture, market performance, and future potential.

Origins and Development History

Background

USDe was created by Ethena Labs in 2024 to address the need for a censorship-resistant and scalable stablecoin solution.

It was born in the context of growing demand for decentralized and transparent stablecoins, aiming to provide a stable, scalable, and censorship-resistant cryptocurrency that could serve as a reliable medium of exchange and store of value.

USDe's launch brought new possibilities for DeFi users and protocols seeking a more robust and decentralized stablecoin option.

Key Milestones

- 2024: Mainnet launch, achieving delta-hedging of staked Ethereum collateral for stability.

- 2024: Adoption by various DeFi protocols, pushing the price to maintain its $1 peg consistently.

- 2025: Ecosystem expansion, with USDe integration into multiple DeFi platforms across different blockchain networks.

With the support of the Ethena Labs team and the broader crypto community, USDe continues to optimize its technology, security, and real-world applications.

How Does USDe Work?

Decentralized Control

USDe operates on a decentralized network of computers (nodes) spread across the globe, free from the control of banks or governments. These nodes collaborate to validate transactions, ensuring system transparency and resistance to attacks, granting users greater autonomy and enhancing network resilience.

Blockchain Core

USDe's blockchain is a public, immutable digital ledger that records every transaction. Transactions are grouped into blocks and linked through cryptographic hashes, forming a secure chain. Anyone can view the records, establishing trust without intermediaries. The use of Ethereum's infrastructure further enhances performance and security.

Ensuring Fairness

USDe leverages Ethereum's Proof-of-Stake (PoS) consensus mechanism to validate transactions and prevent fraudulent activities like double-spending. Validators maintain network security by staking ETH and running nodes, receiving rewards for their participation. Its innovation includes leveraging staked ETH as collateral while maintaining price stability through delta-hedging.

Secure Transactions

USDe utilizes public-private key cryptography to secure transactions:

- Private keys (similar to secret passwords) are used to sign transactions

- Public keys (similar to account numbers) are used to verify ownership

This mechanism ensures fund security, while transactions remain pseudonymous. Additional security features include smart contract audits and on-chain transparency of collateralization.

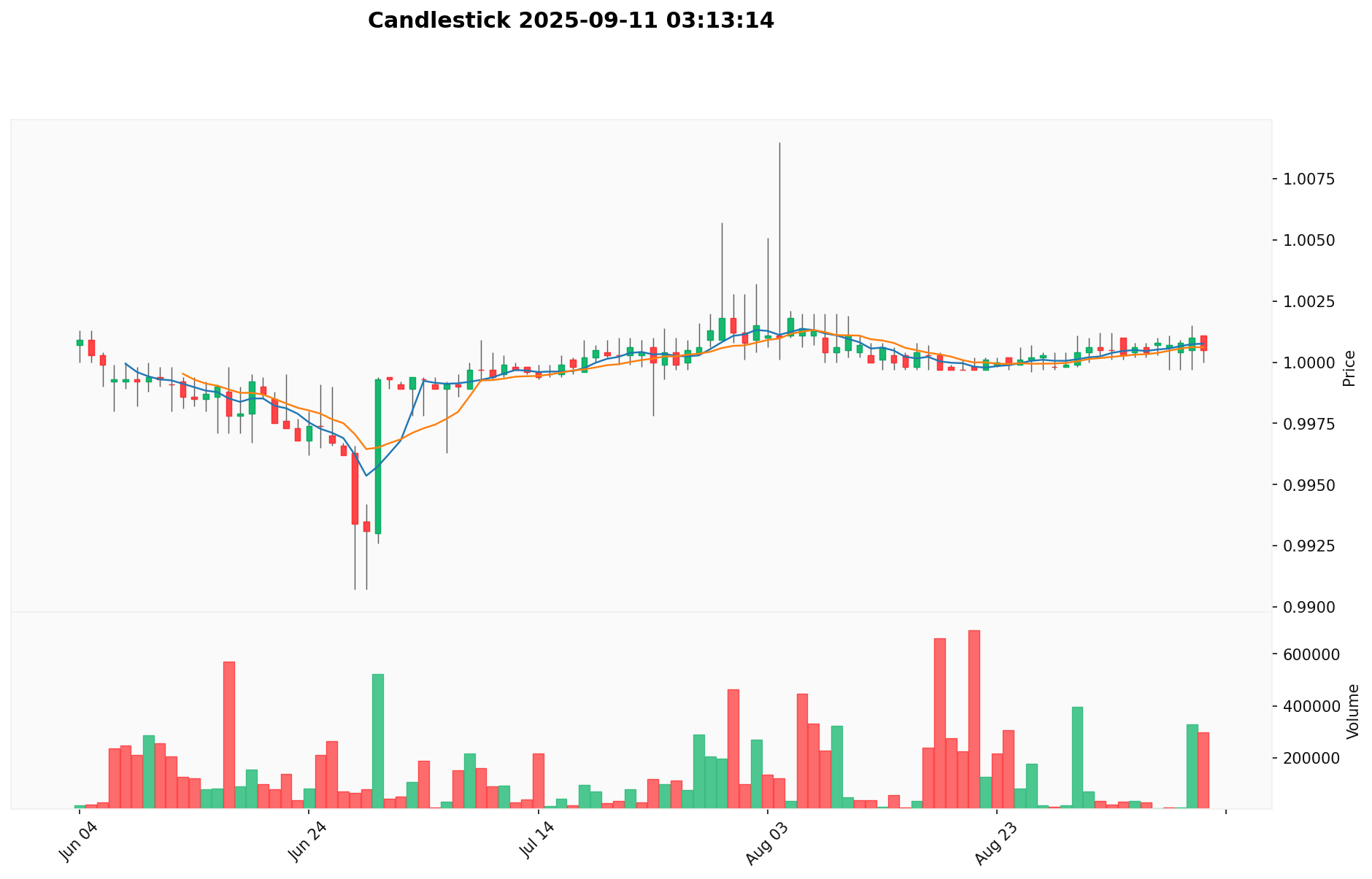

USDE Market Performance

Circulation Overview

As of September 11, 2025, USDE has a circulating supply of 13,111,797,758.59279 tokens, with a total supply of 5,825,492,297.

Price Fluctuations

USDE reached its all-time high of $1.5 on November 14, 2024. Its lowest price was $0.9603, recorded on February 21, 2025. These fluctuations reflect market sentiment, adoption trends, and external factors.

Click to view the current USDE market price

On-Chain Metrics

- Daily Transaction Volume: $330,191.709172 (indicating network activity)

- Active Addresses: 29,539 (reflecting user engagement)

USDE Ecosystem Applications and Partnerships

Core Use Cases

USDE's ecosystem supports various applications:

- DeFi: Providing a stable, censorship-resistant asset for decentralized finance protocols.

- Payments: Enabling fast and secure transactions within the crypto ecosystem.

Strategic Collaborations

USDE has established partnerships to enhance its technical capabilities and market influence. These partnerships provide a solid foundation for USDE's ecosystem expansion.

Controversies and Challenges

USDE faces the following challenges:

- Regulatory risks: Potential scrutiny from financial regulators due to its synthetic nature.

- Market competition: Competition from other stablecoins and traditional financial instruments.

- Adoption barriers: Educating users about the benefits and mechanics of a synthetic dollar.

These issues have sparked discussions within the community and market, driving continuous innovation for USDE.

USDE Community and Social Media Atmosphere

Fan Enthusiasm

USDE's community is vibrant, with growing adoption metrics. On X, posts and hashtags related to USDE often trend, with significant monthly engagement. Factors such as price stability and new partnerships ignite community enthusiasm.

Social Media Sentiment

Sentiment on X shows a mix of opinions:

- Supporters praise USDE's censorship-resistance and stability, viewing it as a potential "future of decentralized finance."

- Critics focus on regulatory concerns and the complexity of the underlying mechanism.

Recent trends indicate growing interest in USDE as a DeFi building block.

Hot TopicsX users actively discuss USDE's regulatory landscape, integration with DeFi protocols, and its role in the broader stablecoin ecosystem,

highlighting both its transformative potential and the challenges it faces in mainstream adoption.

More Information Sources for USDE

- Official Website: Visit USDE's official website for features, use cases, and latest updates.

- X Updates: On X platform, USDE uses @ethena_labs, actively posting about technical updates, community events, and partnership news.

USDE Future Roadmap

- Ecosystem Goals: Expand integration with major DeFi protocols and increase adoption.

- Long-term Vision: Become a leading decentralized, censorship-resistant stablecoin solution.

How to Participate in USDE?

- Purchase Channels: Buy USDE on Gate.com

- Storage Solutions: Use compatible Ethereum wallets for secure storage

- Ecosystem Participation: Explore DeFi protocols integrating USDE

- Community Engagement: Follow official channels for updates and community discussions

Summary

USDE redefines stablecoins through innovative blockchain technology, offering censorship-resistance, stability, and DeFi integration. Its active community, rich resources, and strong market performance make it stand out in the cryptocurrency field. Despite facing challenges such as regulatory scrutiny and market competition, USDE's innovative spirit and clear roadmap position it as an important player in the future of decentralized finance. Whether you're a newcomer or an experienced player, USDE is worth watching and participating in.

FAQ

What is USDe in crypto?

USDe is a synthetic dollar issued by Ethena, fully backed by stablecoins and crypto assets. It's collateralized by short perpetual futures and can be staked for rewards.

How much is USDe to USD?

As of September 11, 2025, 1 USDe is equal to 1.01 USD. This slight premium reflects USDe's market position.

What is ENA: A Comprehensive Guide to the European Nucleotide Archive

What is USDP: Understanding the Stablecoin Backed by US Dollar Deposits

What is SUSD: Understanding the Stablecoin's Role in Decentralized Finance

USDe Explained: How Ethena's Stablecoin Stays Pegged Without Fiat

What Is ENA and How Does It Support the $1.3 Billion USDe Ecosystem?

What is SLICE: A Comprehensive Guide to the Software Development Lifecycle Enhancement Method

Why Do We Celebrate Bitcoin Pizza Day?

How to Buy Bitcoin ETFs: A Comprehensive Guide for 2026

What is spot trading?

BTC Dominance at 59%: The $2 Trillion Rotation That Could Ignite Alt Season

Top Ethereum ETFs to Consider