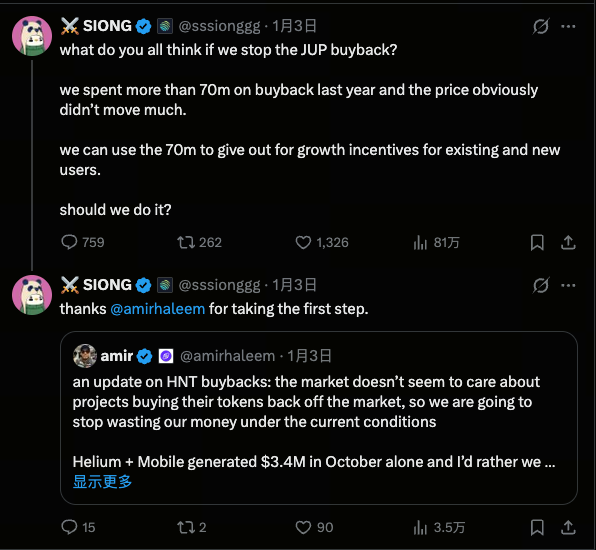

Jupiter Co-Founder Considers Pausing JUP Buybacks as Community Proposes Staking and Protocol Asset Rewards for Long-Term Holders

Jupiter Buyback Strategy Failure Sparks Community Debate

Image: https://x.com/sssionggg/status/2007275334551646302

On January 3, 2026, Jupiter Co-founder SIONG raised the question on social media about whether to suspend the JUP buyback strategy, drawing significant attention across the crypto industry. Over the past year, Jupiter’s team committed substantial resources to token buybacks, yet JUP’s price failed to show any sustained upward momentum. This result has prompted the team to reassess both their resource allocation and the long-term effectiveness of the buyback approach.

Buybacks are traditionally viewed as a tool to support prices and boost market confidence in both traditional finance and blockchain projects. However, for Jupiter, this strategy fell short of expectations. Market structure, ongoing token unlocks, and a broader downtrend have all contributed, making it difficult for a single buyback strategy to reverse the token’s price trend.

Current Status of Buybacks and JUP Price Performance

Image: https://www.gate.com/trade/JUP_USDT

Industry data shows that Jupiter spent over $70 million on buybacks in 2025, but JUP’s price remained weak and even saw sharp declines during the buyback period. Some analysts argue this demonstrates the limited impact of buybacks under current market conditions—especially with ongoing token unlocks and persistent sell pressure. Relying solely on buybacks makes it difficult to stabilize the token price.

JUP’s price volatility is also driven by market sentiment and broader crypto market trends. Buybacks alone cannot address fundamental issues. As a result, many in the community believe a mechanism is needed that both incentivizes user participation and increases network value, rather than simply supporting the token price.

Community Proposals: Staking Rewards and Protocol Asset Incentives

As the debate over suspending buybacks continues, the community has suggested using staking rewards and protocol asset incentives to encourage long-term holders. Solana Co-founder Anatoly Yakovenko argued that, rather than continuing with ineffective buybacks, these funds could be redirected to reward long-term participants. This could include allocating protocol assets and offering staking rewards, allowing community members to take a long-term view in ecosystem development.

Key proposals include:

- Increase staking reward rates: Boost rewards for users who stake JUP long-term, locking up more tokens and reducing sell pressure;

- Protocol asset incentive mechanism: Allocate a portion of protocol revenue or assets to long-term holders, enabling them to share in the ecosystem’s growth;

- Link incentives to ecosystem growth: Offer not just staking rewards, but also additional benefits for trading activity and liquidity contributions within protocol applications.

The core aim of these proposals is to deliver greater value to participants as the protocol develops, encouraging long-term holding and ecosystem contribution, rather than relying on short-term price support.

Comparing Approaches and Assessing Potential Risks

Supporters of shifting from buybacks to new incentive mechanisms believe this could increase token lock-up and ecosystem engagement, thereby improving overall health. Long-term staking reduces circulating supply and eases sell pressure, while protocol asset rewards can more directly distribute economic value to active contributors.

However, critics point out that buybacks signal the team’s confidence in the project, and eliminating them entirely could heighten short-term market volatility. Designing a fair and sustainable reward system and avoiding excessive dilution are also governance challenges that remain to be addressed.

The Impact of Long-Term Holder Incentives on Jupiter’s Ecosystem

From a long-term ecosystem perspective, increasing staking rewards and protocol asset incentives can drive greater participation in project governance, liquidity provision, and deep usage of protocol services. This not only boosts ecosystem engagement, but also strengthens JUP’s influence within the Solana ecosystem.

More importantly, this incentive model helps build lasting community loyalty, making the project’s value stem not just from the token price, but from the protocol’s utility and participant engagement.

Summary and Potential Future Developments

In summary, Jupiter’s co-founders’ consideration of suspending JUP buybacks is not just a review of past strategies, but an important discussion about future incentive models. The community’s proposals for staking rewards and protocol asset incentives could guide Jupiter into a new phase of development. Of course, this will require robust governance, mechanism refinement, and risk management throughout the process.

As market conditions evolve and ecosystem development advances, Jupiter is expected to adopt more inclusive and long-term incentive strategies to strengthen the sustainability of its tokenomics.

Related Articles

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

Pi Coin Transaction Guide: How to Transfer to Gate.com

What is N2: An AI-Driven Layer 2 Solution