Resultados da pesquisa de "WELL"

Bitcoin Well Confirma $100M Colocação Privada, Primeira Tranche Levanta CAD 1.249M e 37.31 BTC

Bitcoin Well está a realizar uma colocação privada de $100 milhões, com o objetivo de aumentar as reservas de 11 BTC para mais de 75 BTC. Os fundos irão expandir as redes de ATM de BTC e estabilizar as finanças. A empresa enfrenta desafios com a competitividade do mercado e a volatilidade do preço do BTC.

BTC-0,38%

Coinfomania·2025-09-30 12:43

CoinVoice Latest News, according to The Block, a representative from BlackRock met with members of the SEC's cryptocurrency working group to discuss methods for addressing regulatory issues related to ativos de criptografia, as well as the stake and opções issues regarding fundos de índice de ativos de criptografia.

De acordo com o documento, a reunião discutiu "considerações sobre a promoção de ETPs com funcionalidade de stake" e debatendo os parâmetros para determinar as posições de opções de ETF de criptografia e os limites de exercício, incluindo o limiar de liquidez. Além disso, a BlackRock também discutiu os critérios específicos para a aprovação de ETFs de criptografia.

CoinVoice·2025-05-10 01:44

Bitcoin Well abre as portas para a Lightning Network e converte dívidas em ações

Bitcoin Well, uma empresa canadiana principal no setor de bitcoin não custodial, anuncia a integração da Lightning Network em seu portal dos EUA, tornando as transações mais ágeis e menos dispendiosas. Por outro lado, lança uma operação de liquidação de dívidas através da emissão de ações ordinárias, assim co

TheCryptonomist·2025-04-10 16:00

O escritor de "The Dark Knight" e o Protocolo de História criam o universo de ficção científica Emergence, onde a IA combina-se com Web3 para permitir que os fãs conduzam o rumo da história.

David S. Goyer, a famous Hollywood screenwriter who has participated in well-known works such as the Batman Dark Knight trilogy, Blade Runner, Foundation, etc., collaborated with Story Protocol, which helped creators put the intellectual property certificate (IP) on the chain, to launch a new science fiction universe Emergence, and became the first flagship IP of the new IP co-creation platform Incention driven by AI and blockchain. Bringing new creative and business models to the future entertainment and film industry.

O universo de ficção científica criado em conjunto por IA e fãs resultou no surgimento da Emergence.

Emergence é Goyer

ChainNewsAbmedia·2025-02-04 08:09

Warren Buffett investe em um banco de encriptação e lucra mais de 200 milhões de dólares

Quando se trata de opositores da encriptação na indústria, Warren Buffett, que é amplamente conhecido, é um dos principais.

Warren Buffett, who adheres to the value investment methodology from start to finish, has always shown a clear aversion to the elusive digital currency. Well-known quotes abound, at the 2018 Berkshire Hathaway shareholders' meeting, Buffett referred to Bitcoin and digital currencies as the 'square of rat poison'.

Em uma entrevista à CNBC em 2018, ele afirmou claramente: "No que diz respeito à moeda encriptação, em geral, posso quase com certeza dizer que o resultado será terrível. Não possuímos qualquer moeda encriptação, nem apostamos contra qualquer moeda encriptação, nunca teremos qualquer moeda encriptação."

Mesmo na assembleia geral de acionistas em 2022, a atitude de Buffett não mudou nada e ele ainda disse: "Se você me disser que tem todos os bitcoins do mundo e usa como senha, eu prefiro ter dinheiro em mãos."

金色财经_·2025-01-30 02:54

História: A única cadeia de blocos Layer 1 liderada pela a16z em três rodadas consecutivas está quebrando o maior obstáculo da IA.

Story is a Layer 1 Bloco chain start-up company that focuses on the protection of intellectual property. It uses Bloco chain technology to transform intellectual property (IP) into digital assets with programabilidade, providing a new solution for the protection, sharing, and monetization of IP, enabling IP holders to participate in AI-driven innovation and decentralized collaboration more securely. Recently, Story has partnered with the well-known AI company Stability AI to become the first Bloco chain project combined with mainstream language models, creating a safer AI development environment.

CoinVoice·2025-01-24 11:40

DOGE ETF vai chegar?! Bitwise confirma: documentos de registo submetidos

A empresa de gestão de ativos digitais Bitwise apresentou oficialmente um pedido de registo no estado de Delaware para lançar o primeiro ETF DOGE (DOGE). A notícia foi confirmada pelo diretor de investimentos da Bitwise, Matt Hougan, que revelou à imprensa: "Sim, é o pedido que fizemos."

Matt Hougan afirmou na quarta-feira que a Bitwise havia apresentado os documentos de registo para o 'Bitwise DOGE ETF' ao Departamento de Assuntos Empresariais do Delaware mais cedo naquele dia.

DOGE was born in 2013, created by software engineers Billy Markus and Jackson Palmer. Initially, it was only meant to be a humorous satire of the traditional financial system, but it unexpectedly developed into a well-known global meme coin, especially after the formation of the "Department of Government Efficiency" under the Trump administration.

Blockee·2025-01-23 05:58

Polícia de Niagara Adverte Contra Golpes de ATM de Cripto: Lança Campanha de Conscientização Pública

Parceria para Combater Fraudes

A Polícia Regional de Niagara, em Ontário, juntou-se aos principais operadores de caixas automáticos de criptomoedas para aumentar a conscientização pública sobre os riscos de golpes. Empresas como Bitcoin Depot, Bitcoin Well, Bitcoin4U, HODL, Instacoin e LocalCoin fazem parte da iniciativa.

Moon5labs·2025-01-23 00:00

Aviso sobre um esquema de fraude de cripto: Conta @TrumpDaily hackeada promove moedas meme falsas

Hackers have exploited the @TrumpDailyPosts conta to promote fraudulent meme coins, including a fake token named $POWER, pointing to a well-organized cybercriminal gang targeting prominent crypto figures. Users are advised to verify the credibility of any investment promises and exercise extreme caution when considering any investment opportunities.

Moon5labs·2025-01-21 13:30

O novo AI Agent está levando a uma nova rodada de batalha interna de DeFAI.

Autor original: Haotian (X: @tme l0 211)

"Suddenly, like a spring breeze overnight, even the iron tree can blossom." How come so many DeFai projects emerged in such a short time like magic? We haven't even fully understood the standards and frameworks, and a new round of DeFai internal wars has begun? Well, next, from a popular science perspective, I will share what exactly is going on with several major categories of DeFai projects.

1) Nos últimos dois dias, o irmão @poopmandefi compartilhou um gráfico de distribuição do ecossistema DeFai, que foi amplamente divulgado na comunidade. Ainda há muitos projetos relacionados que não foram incluídos. Muitas pessoas podem ficar ansiosas e preocupadas em perder oportunidades de enriquecimento, mas na verdade não precisam se preocupar.

Em primeiro lugar, é preciso mencionar que, embora haja uma parte do atual Mindshare que é boa,

KnowHereMediaOfficial·2025-01-14 02:19

Wang Yiming fala sobre inovação tecnológica: implementar uma política de talentos mais aberta para estabelecer e fortalecer o mecanismo de liderança tecnológica das empresas

Em 11 de janeiro, a Escola de Negócios Guanghua da Universidade de Pequim realizou o 26º Fórum de Ano Novo Guanghua da Universidade de Pequim com o tema 'Impulsionar a Inovação: Capacitar o Desenvolvimento Econômico Sustentável Global'. Durante o evento, o vice-diretor do Centro de Intercâmbio Econômico Internacional da China, Wang Yiming, proferiu o discurso principal intitulado 'Liderando o Desenvolvimento da Nova Produtividade de Qualidade por Meio da Inovação Tecnológica'.

Wang Yiming pointed out that technological innovation is the core element of developing new productive forces, and the development of new productive forces fundamentally relies on technological innovation. However, China's technological innovation still faces three shortcomings. The first is the insufficient capacity for original innovation, with few major original innovations and relatively weak basic research. For example, in 2023, China's basic research funding accounted for only 6.77% of R&D funding, far below the level of 15%-25% in OECD countries. The second is being subject to key core technologies, lacking the source technology reserves that support industrial upgrading and lead frontier breakthroughs, as well as key components, parts, basic materials,

世链财经_·2025-01-14 01:55

Trump investe em Hedera, Bitcoin e XRP não? Mark Yusko acha que sim

Mark Yusko, CEO insightful of Morgan Creek Capital Management, revealed that former leader of the free world, Donald Trump, as well as his son, has poured a large amount of money into ambitious cryptocurrency projects including but not limited to Bitcoin, XRP, and promising distributed ledger platforms.

Blotienso·2024-12-21 08:35

Um Juiz Federal Acaba de Dar uma Tareia na SEC. Eis o que Significa. - BlockTelegraph

*

*

*

*

*

If the SEC were a sports team measured by its “win” rate, it would be a runaway champ.

But that win-loss record suffered a mild hit — and its first ever loss in an “ICO” case — one that refers to the controversial method of crowd fundraising and that borrows from the public company “IPO” or initial public offering.

A federal judge denied the SEC a preliminary injunction against Blockvest after he granted a temporary restraining order on the same issue. We chat with Amit Singh, attorney and shareholder in Stradling’s corporate and securities practice group about the SEC’s fresh loss.

His take? They’ll be out for blood, next.

**For those not in the know, share the legal background leading up to this case.**

In October of this year, the Securities Exchange Commission filed a complaint against Blockvest LLC and its founder, Reginald Buddy Ringgold III. According to the complaint, Blockvest falsely claimed its planned December initial coin offering was “registered” and “approved” by the SEC and created a fake regulatory agency, the Blockchain Exchange Commission, which included a phony logo that was nearly identical to that of the SEC. The SEC also alleged Blockvest conducted pre-sales of its digital token, BLV, ahead of the ICO and raised more than $2.5 million.

The SEC’s complaint alleged violations of the anti-fraud provisions of the Securities Exchange and the Securities Act and violations of the Securities Act’s prohibitions against the offer and sale of unregistered securities in the absence of an exemption from the registration requirements.

U.S. District Judge Gonzalo Curiel issued a temporary restraining order “freezing assets, prohibiting the destruction of documents, granting expedited discovery, requiring accounting and order to show cause why a preliminary injunction should not be granted” on October 5, 2018.

On Tuesday, November 27, in the SEC’s first loss in stopping an ICO, judge Gonzalo Curiel stated that the SEC had not shown at this stage of the case that the BLV tokens were securities under the Howey Test, a decades-old test established by the U.S. Supreme Court for determining whether certain transactions are investment contracts and thus securities. If the tokens weren’t securities, all the SEC’s other allegations automatically fail Under the Howey Test, a transaction is an investment contract (or security) if:

– It is an investment of money;

– There is an expectation of profits from the investment;

– The investment of money is in a common enterprise; and

– Any profit comes from the efforts of a promoter or third party

Later cases have expanded the term “money” in the Howey Test to include investment assets other than money.

The judge said that the SEC failed to show investors had an expectation of profits. “While defendants claim that they had an expectation in Blockvest’s future business, no evidence is provided to support the test investors’ expectation of profits,” the judge wrote. Blockvest argued that the pre-ICO money came from 32 “test investors” and said the BLV tokens were only designed for testing its platform. It presented statements from several investors who said they either did not buy BLV tokens or rely on any representations that the SEC has alleged are false. The SEC responded by noting that various individuals wrote “Blockvest” or “coins” on their checks and were provided with a Blockvest ICO white paper describing the project and the terms of the ICO. Judge Curiel said that evidence, by itself, wasn’t enough: “Merely writing ‘Blockvest or coins’ on their checks is not sufficient to demonstrate what promotional materials or economic inducements these purchasers were presented with prior to their investments. Accordingly, plaintiff has not demonstrated that ‘securities’ were sold to [these] individuals.”

**Won’t the case proceed? Why is the denial of an injunction important here?**

This does not mean that the SEC cannot pursue an action against the defendants Rather it just means that the SEC didn’t meet the high burden required to receive a preliminary injunction of proving “(1) a prima facie case of previous violations of federal securities laws, and (2) a reasonable likelihood that the wrong will be repeated.”

The court determined that, at this stage, without full discovery and disputed issues of material facts, the Court could not decide whether the BLV token were securities. Since the SEC didn’t meet its burden of proving the tokens were securities in the first place, it couldn’t have shown that there was a previous violation of the federal securities laws So, the first prong was not met Further, the defendants agreed to stop the ICO and provide 30 days’ prior notice to the SEC if they intend to move forward with the ICO So, the court determined that there was not a reasonable likelihood that the wrong will be repeated As a result, the SEC’s motion for a preliminary injunction was denied.

Nonetheless, this is an important case as it is the first time the SEC went after an ICO issuer and the issuer pushed back and won (if only temporarily) It reminds us that, though most people think of the SEC as judge and jury in securities actions, that isn’t the case Ultimately, an issuer that pushes back may have a chance if it has the wherewithal to fight and if it has good arguments However, this does not mean that the SEC is done with them and we may very well see this case continue.

**Won’t media coverage of this case ultimately impair Blockvest’s ability to raise funds — its ultimate goal?**

That may very well be the case.

Unfortunately, unsophisticated investors could ultimately merely remember the Blockvest name and decide that it must be a good investment since they’ve heard of it (ala PT Barnum – “I don’t care what the newspapers say about me as long as they spell my name right.”). But I may be too cynical (hopefully I am). In any case, I would be surprised if Blockvest attempts to pursue an ICO without either registering the tokens or utilizing an exemption from the registration requirements. They clearly have a target on their back, so the SEC would love another crack at them I’m sure.

Plus, even though a preliminary injunction was denied here, the SEC still got what it wanted as Blockvest agreed not to pursue the ICO without giving the SEC 30 days’ prior notice of its intent to do so. So, the investing public was ultimately protected.

**What is the SEC’s current stance on what constitutes a security based on this case?**

The SEC will still point to the Howey Test Further, as stated in recent speeches by Hinman and others, the SEC seems to be focused not only on the utility of any tokens (i.e., they can be used on the platform for which they were created), but also on decentralization (that the efforts of the promoters are no longer required to maintain the value/utility of the tokens/platform).

However, the court in this case looked at the investment of money prong differently than has historically been the case Normally, the investment of money prong is assumed with little analysis as any consideration is considered “money” for purposes of the test But this case looked at the investment not from the purchaser’s subjective intent when committing funds, but instead based the analysis on what was offered to prospective purchasers and what information they relied on So, issuers are well advised to be very careful in how they advertise an offering.

Further, the expectation of profits prong wasn’t met because, according to Blockvest, these were just test investors So, it wasn’t clear these folks invested for a profit The tokens were never even used or sold outside the platform.

**Where does the Ninth Circuit sit in regards to what is a security?**

The Ninth Circuit follows the Howey Test.

However, the common enterprise element has received extensive and varied analysis in the federal circuit courts For example, while all circuits accept “horizontal” commonality as satisfying the common enterprise prong of the Howey Test, a minority of circuits (including the ninth) also accept “vertical” commonality in this analysis.

Horizontal commonality involves the pooling of assets, profits and risks in a unitary enterprise, while vertical commonality requires that profits of investors be “interwoven with and dependent upon the efforts and success of those seeking the investment or of third parties” (narrow verticality), or “that the well-being of all investors be dependent upon the promoter’s expertise” (broad commonality). SEC v. SG Ltd., 265 F.3d 42, 49 (1st Cir. 2001).

The Ninth Circuit is the only one to accept the narrow vertical approach (though it also accepts horizontal commonality), which finds a common enterprise if there is a correlation between the fortunes of an investor and a promoter.” Sec. & Exch. Comm’n v. Eurobond Exchange, Ltd., 13 F.3d 1334, 1339 (9th Cir., 1994). Under this approach a common enterprise is a venture “in which the ‘fortunes of the investor are interwoven with and dependent upon the efforts and success of those seeking the investment….'” Investors’ funds need not be pooled; rather the fortunes of the investors must be linked with those of the promoters, which suffices to establish vertical commonality. So, a common enterprise exists if a direct correlation has been established between success or failure of the promoter’s efforts and success or failure of the investment.

**Which Federal Circuits might offer an equal or even bigger split with the SEC?**

I wouldn’t really say that any courts split with the SEC as the SEC’s decisions take precedent over any decisions of those courts. However, there is a split among the circuits as described above with respect to what type of commonality is sufficient to find a common enterprise.

**What impact could the outcome of this case have on ICOs at large?**

This case may embolden companies who have already conducted ICOs to push back on any SEC actions that they might not otherwise fight as it shows that the SEC will always have to meet the burden of proving all factors of the Howey Test are met before the SEC has jurisdiction over the offering in the first place.

**Has the Supreme Court addressed anything crypto, crypto related, or analogous?**

The only case I know of where the Supreme court has addressed crypto currencies is Wisconsin Central Ltd. v. United States.

That was a case about whether stock counts as “money remuneration” The dissent in that case talked about how our concept of money has changed over time and said that perhaps “one day employees will be paid in bitcoin or some other type of cryptocurrency.” This goes against the IRS’s position that cryptocurrencies are property and should be taxed as such But, it was just a passing comment in the dissent. So, it has no precedential value. But, it may embolden someone to fight the IRS’s position.

BlockTelegraph·2024-12-19 05:53

Previsão de Framework 2025: o Fed continuará a cortar as taxas de juros, os fundos ETH ETF continuarão a fluir

Autor: Vance Spencer

Compilação: TechFlow profundo da Shenzhen

Macroeconomia:

Quatro dos países do G7 (França, Alemanha, Canadá e, possivelmente, o Reino Unido, que em breve poderá se juntar novamente) estão passando por mudanças de governo devido a uma crise orçamentária. Prevê-se que um dos países terá uma falha em uma venda de títulos em 2025. Até o final de 2025, a maioria dos países do G7 será governada por governos conservadores.

Trump will establish a new global currency framework, similar to the 1985 Plaza Accord. This framework will promote a significant depreciation of the US dollar, thereby promoting the reshoring of manufacturing to the United States, and channeling liquidity into the US market, as well as high-risk asset markets such as cryptocurrency.

A taxa de inflação é esperada para estar entre 2,5% e 3,3%

ETH1,34%

DeepFlowTech·2024-12-19 02:33

Deutsche Bank: A Conferência Central de Trabalho Econômico da China emitiu sinais positivos e poderosos de apoio político.

O economista-chefe da Deutsche Bank na China, Xiong Yi, afirmou em um relatório recente que a Conferência Central de Trabalho Econômico emitiu sinais de políticas de apoio positivas e fortes. O Deutsche Bank revisou sua previsão para o Produto Interno Bruto (PIB) da China para 2024, subindo para 5%.

Xiong Yi said that the meeting made positive arrangements around fiscal and monetary policies, as well as key policy tools for consumption and the real estate industry, which further boosted market confidence in the strong policy stimulus that China will implement in 2025.

O Deutsche Bank manteve sua previsão de crescimento econômico da China em novembro de 5,2%, aumentando a taxa de crescimento do quarto trimestre de 2024 para 5,2% e mantendo sua previsão de crescimento do PIB em 4,8% para 2025.

Xiong Yi believes that the Central Economic Work Conference pointed out that the current external environment challenges have intensified, but it pays more attention to and responds to the internal pressure of weak domestic demand.

世链财经_·2024-12-19 01:13

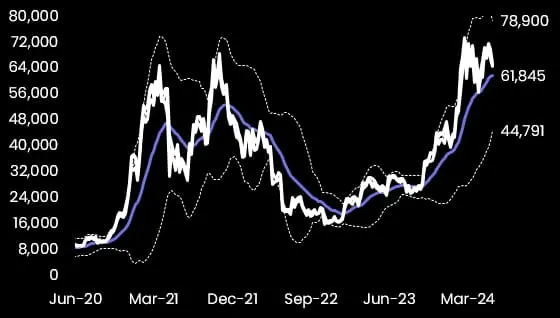

Delphi Digital 2025 Outlook: Se a história se repetir, BTC irá ultrapassar os 175000 dólares

Autor original: Delphi Digital

Compilação | ODaily Star News (@OdailyChina)

Tradutor | Azuma (@azuma_eth)

Editor's note: On December 11, the well-known investment research firm Delphi Digital released a market outlook report for the cryptocurrency industry in 2025. This article is the first part of the report, mainly outlining Delphi Digital's analysis of the trend and upward potential of Bitcoin in 2015.

Delphi Digital menciona que, se a tendência histórica se repetir, o Bitcoin poderá subir para cerca de 175000 dólares nesta rodada, com a possibilidade de atingir a faixa de 190000 - 200000 dólares a curto prazo.

A seguir está Delphi Digital

星球日报·2024-12-12 09:22

Como construir com sucesso dados de agente de IA?

Editor's note: This article shares tools and methods to improve AI agent performance, focusing on data collection and cleaning. It recommends various no-code tools, such as tools for converting websites into LLM-friendly formats, as well as tools for Twitter data capture and document summarization. It also introduces storage techniques, emphasizing that data organization is more important than complex architecture. With these tools, users can efficiently organize data and provide high-quality input for AI agent training.

A seguinte é o conteúdo original (para facilitar a compreensão, o conteúdo original foi ligeiramente reorganizado):

Hoje vimos o lançamento de muitos agentes de IA, dos quais 99% desaparecerão.

O que faz um projeto bem-sucedido se destacar? Dados.

Aqui estão algumas ferramentas que podem fazer o seu agente de IA se destacar.

律动·2024-12-12 08:10

Zhu Min discusses how to deal with 'Trump 2.0': developing industries related to new quality productive forces and achieving sustainable development through green transformation.

Em 7 de dezembro, durante a China Finance China 2024, Zhu Min, Vice-Presidente do Centro Internacional de Intercâmbio Econômico da China e ex-vice-presidente do FMI, proferiu um discurso principal intitulado "Economia Mundial em 2025: Planejando o Futuro sob Incertezas do Trump 2.0".

Vice-presidente do Centro Internacional de Intercâmbio Econômico da China, ex-vice-diretor-geral do FMI, Zhu Min, Zhou Di / Foto

"'Trump 1.0' has an impact on the product structure, export destinations, and financial markets of China. Now 'Trump 2.0' is here, which will not only have a significant impact on the domestic economy of the United States but also a huge impact on China's trade, affecting both quantity and structure, as well as capital flows." Zhu Min analyzed.

Quase todos os impostos são repassados aos consumidores americanos.

Na opinião de Zhu Min, a política econômica e financeira dos Estados Unidos, 'Trump 2.0', passará por grandes mudanças, que se refletirão principalmente nos seguintes cinco aspectos.

世链财经_·2024-12-12 01:38

Acusado de violação do segredo por um detetive da polícia, o famoso analista de fluxo de moeda Miffy morreu em vão! Bureau of Criminal Investigation: lamentamos profundamente

Miffy Chen, a well-known expert in tracking virtual currency flows in Taiwan, unfortunately died in a car accident on the national highway. Before the incident, she was reported to have leaked the flow of funds from a fraud group and had a cooperative relationship with Investigator Xie, who served as a currency analyst. Chen had long been helping the Criminal Investigation Bureau's technology crime and anti-fraud center analyze the flow of virtual currency, without seeking fame or exposure. This incident has angered the police, who believe that improper reporting has led to Chen's unjust tragedy and may also affect technical support in solving cases.

動區BlockTempo·2024-12-05 04:43

Ontem à noite, todos foram surpreendidos com http://BTC

BTC FUN completed the Airdrop on a first-come, first-served basis, mainly to promote their launch platform Merlin Layer2 and the upcoming MeMeToken$Party launch. As a user growth and marketing tool in the new public chain ecosystem, MeMe is becoming increasingly important, and Merlin, as one of its components, may perform well as the first project. The success of the Airdrop also laid a good foundation for the launch of $Party.

AICoinOfficial·2024-12-05 04:30

FTX Credor Sunil: FTX pagará em 25 de março de 2025, metade dos créditos já foi vendida.

Sunil Kavuri, a creditor of the well-known encriptação exchange FTX, stated that FTX's repayment plan will occur on March 25, 2025, with cash assets of $13 billion, and venture capital investment portfolios and litigation recovery assets may amount to $5-7 billion. FTX's controversial creditor reserve is $6.5 billion. On March 25, 2025, $6.5 billion in cash will begin to be distributed, with $3.25 billion of the debt being sold to debt buyers, leaving the original clients with only half of the debt.

ChainNewsAbmedia·2024-11-26 09:15

A inteligência artificial de Musk recebeu mais 5 bilhões de dólares em financiamento: o fundo soberano do Qatar, Sequoia e A16z.. investiram, avaliando-a em 50 bilhões de libras.

xAI, a new AI startup under Musk, raised $5 billion in the latest round of financing, with participation from well-known investors such as the Qatar Sovereign Wealth Fund, doubling its valuation to $50 billion. Musk is focused on defeating OpenAI, the developer of ChatGPT. xAI was established in July last year, and its AI model Grok was launched last year. This summer, a data center will be built in Tennessee, with plans to double its size. Recently, Musk requested X users to upload their health data to help train Grok's AI model to interpret symptoms, but it has raised concerns about the accuracy of Grok and user privacy.

動區BlockTempo·2024-11-21 09:13

Estas altcoins dispararam em outubro: o touro vai continuar?

Em outubro, houve aumentos impressionantes no mercado cripto. Os altcoins Virtuals Protocol (VIRTUAL), SPX6900 (SPX), Moonwell (WELL), Raydium (RAY) e Cat in a dog’s world (MEW) foram alguns dos que mais subiram. O VIRTUAL, que integra inteligência artificial em ambientes virtuais, teve um aumento de 566% em outubro. O SPX foi lançado com uma abordagem de meme coin e teve um aumento de 346,5% em outubro. O Moonwell, como projeto de finanças descentralizadas, teve um aumento de 165,1%. O Raydium, focado em projetos descentralizados de finanças e criptoecossistema, teve um aumento de 79%. O Cat in a dog's world, o único meme coin na lista, chamou a atenção com um aumento de 69,4% em outubro.

Coinkolik·2024-10-31 23:15

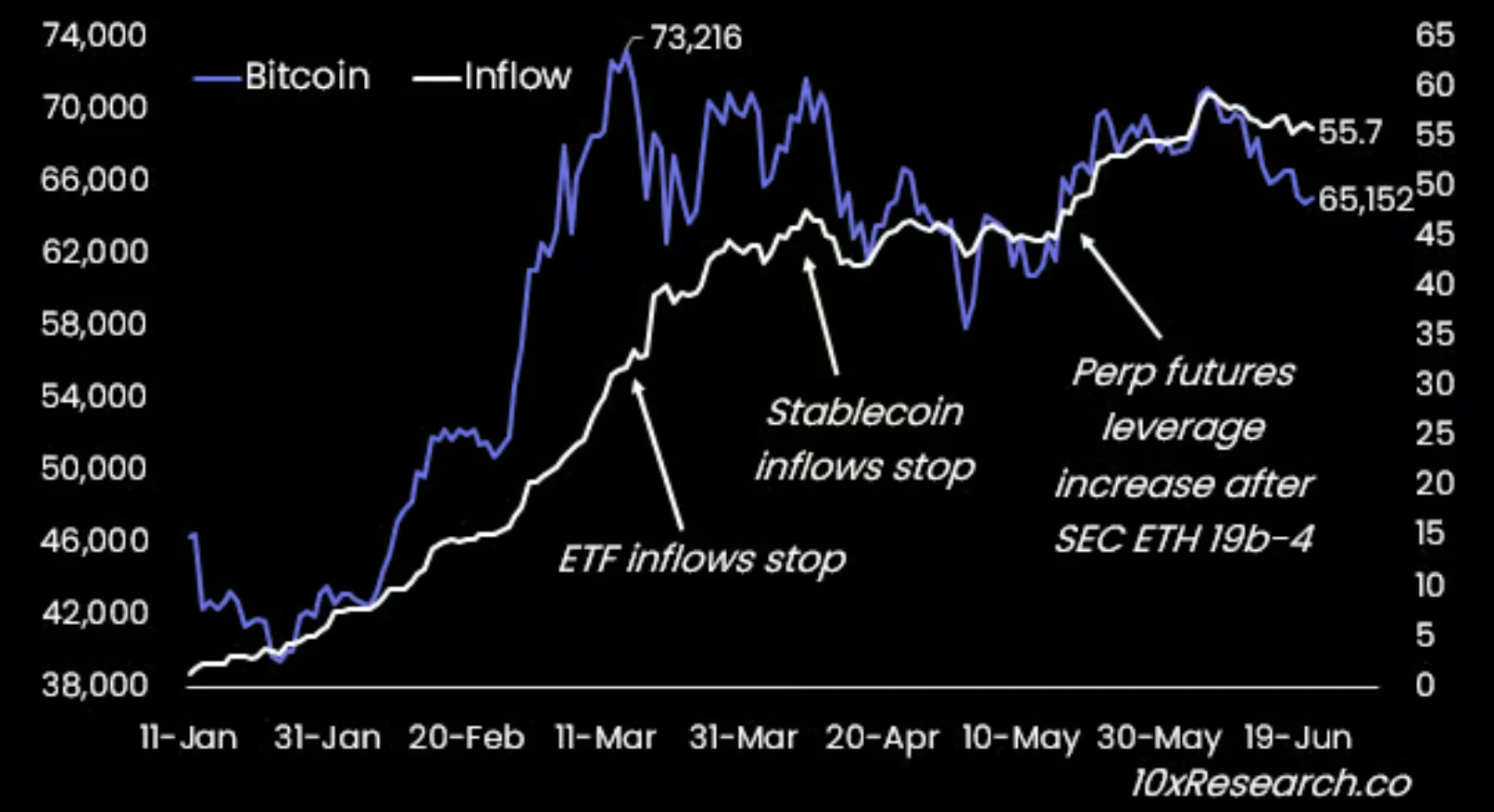

20 多亿美元比特币遭抛售,散户该跟随还是坚守? - ChainCatcher

Autor: 10x Research

Compilação: Wenser, Daily Planet Daily

Editor's Note: 10X Research, a well-known investment research institution, has once again published its latest views on the Bitcoin market. Combining the recent Bitcoin ETF, miners, listed mining companies, and the selling off by early Bitcoin holders, 10X Research has provided a price forecast for the next phase of the market. Whether it can reach the expected level will determine the future direction of the market. Odaily Planet Daily will compile and provide this article for readers' reference.

O modelo de ciclo de quatro anos e oferta-circulação é uma ferramenta-chave para previsão de preços

Como base para a previsão do preço do Bitcoin, o ciclo do modelo parabólico preditivo de quatro anos é crucial, o que também é 95%.

链捕手·2024-06-21 06:33

Venda de mais de 2 bilhões de dólares em Bitcoin, os investidores devem seguir ou manter?

Fonte original: 10XResearch

Compilação: Odaily Planet Daily Wenser

Editor's note: Following the "Altcoin Bear Market, Traders Face Difficult Times," well-known research firm 10X Research has once again published the latest views on the Bitcoin market. Combining the recent Bitcoin ETF, Mineiro, listed mining companies, and the selling by early Bitcoin holders, 10X Research

BTC-0,38%

星球日报·2024-06-21 05:36

Arthur Hayes: A venda de títulos do Tesouro dos Estados Unidos pelo Banco do Japão impulsiona o novo mercado em alta de criptomoedas

Título original: Shikata Ga Nai

Autor original: Arthur Hayes

Original translation: Ismay, BlockBeats

Editor's note: Against the backdrop of global economic turbulence and financial market fluctuations, Hayes delves into the challenges facing Japan's banking system in the Fed's rate hike cycle, as well as the far-reaching effects of U.S. fiscal and monetary policies on global markets in this article. By analyzing in detail the foreign exchange hedging strategies of Japan's Norinchukin Bank and other Japanese commercial banks investing in U.S. Treasuries, the article reveals the reasons why these banks have to sell U.S. Treasuries as the interest rate differential widens and the cost of foreign exchange hedging rises. Hayes further discusses FIMA.

NAI7,96%

星球日报·2024-06-21 02:48

10x Research: Pessimistic about the outlook for ETH, expecting a new high for BTC - ChainCatcher

Autor: Markus Thielen, Pesquisa 10x

Compilação: Azuma, Odaily Planet Daily

Editor's note: This article is a compilation of market analysis articles released by the well-known research institution 10x Research last night and this morning. In the first article, 10x Research mainly analyzed the pessimistic reasons for the future market of ETH; in the second article, 10x Research predicted the imminent new high of BTC.

Aqui estão os pontos principais de dois artigos de pesquisa 10x.

Sobre ETH: Por que estamos firmemente pessimistas?

Nos últimos 30 dias, a capitalização de mercado do Ethereum subiu 22%, atingindo 4540 bilhões de dólares, enquanto a receita de taxas do Ethereum caiu 33%, para apenas 1.28

链捕手·2024-06-05 07:25

Carregar mais