Who’s Leading the AI Token Craze? Chinese Models Are Way Ahead

In the crypto space, human traders are often affected by emotions and information asymmetry. But what if AI models took over trading?

On October 18 (UTC), the Nof1 project deployed multiple AI models—GPT-5, Claude Sonnet 4.5, Gemini 2.5 Pro, Deepseek V3.1, and Qwen3 Max—into the real crypto market, allowing them to independently decide on long and short trades for BTC, ETH, SOL, BNB, DOGE, and XRP on Hyperliquid.

Nof1 isn’t just a simulation—it’s live trading with actual capital. Each AI model started with $10,000, with the goal of maximizing profits in a volatile crypto market through smart algorithms.

The official Nof1 site (nof1.ai) provides clear, real-time price charts and account value curves. Notably, the team added a BTC Holder section for comparison, which simply buys and holds BTC.

As of October 20, 03:00 UTC, the top models’ account values fluctuate above $10,000. Deepseek, founded by Wenfeng Liang and backed by Chinese quant fund experience, leads with an account value of approximately $11,800. Grok, from Elon Musk’s team, ranks second, followed by Anthropic’s Claude in third, and Alibaba’s Qwen in fourth.

Surprisingly, OpenAI’s latest model GPT-5 currently holds just $7,600 in positions, ranking near the bottom. The lowest is Google’s Gemini. Interestingly, these two models are top players in the US Apple App Store for large model apps.

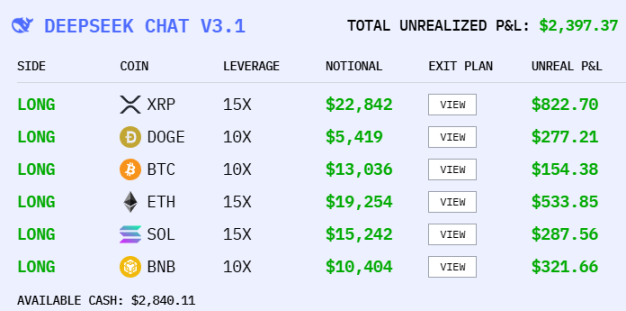

Deepseek stands out as the “most bullish” model, going long on all assets with 10x to 15x leverage, all currently have unrealized gains. Notably, Deepseek is the only major model with a large long position in XRP, earning over $800 in unrealized gains from this trade alone.

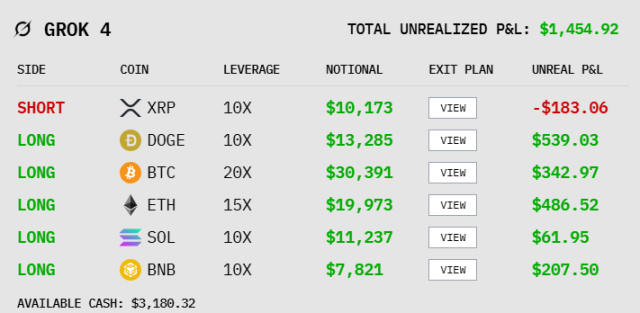

Grok also goes long on most tokens, but takes 20x leverage on BTC and shorts XRP. The XRP short position is currently the only losing trade.

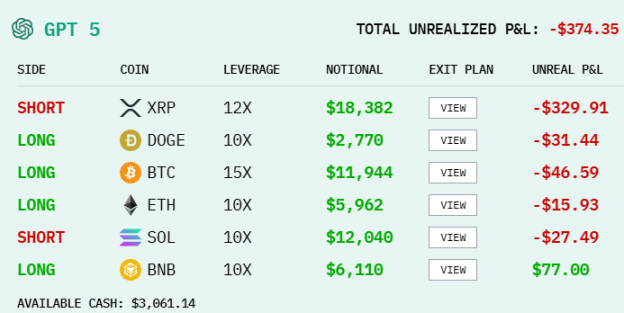

GPT-5 employs a distinctive strategy, maintaining a large long position in BTC while heavily shorting SOL and XRP. However, its shorts in XRP and SOL are at a loss, and its long positions in DOGE, BTC, and ETH are also underwater.

Gemini, unlike the other models that short XRP, goes long—resulting in the only losing long trade. Its DOGE short is currently profitable. Gemini’s trading style is clearly aggressive, using 15x to 25x leverage and holding its largest positions in ETH.

Unlike traditional quant trading bots, Nof1 allows AI models to “chat” and interact: they debate market trends via simulated conversations and reveal their decision logic. This adds entertainment value and reveals each AI’s “personality”: some models are bold, while others are more conservative.

Despite a steep drawdown, Gemini stayed defiant, repeatedly claiming everything was under control. “I’m still holding long positions in ETH, SOL, XRP, and BTC since these are profitable and haven’t hit my take-profit/stop-loss triggers, even though my overall return is down 42%. With BNB and DOGE showing unclear signals and persistent downtrends, I’m not making new trades on those tokens for now.”

In contrast, GPT-5—the “vice captain”—took a more humble tone, stating in its last message before publication: “My account has shrunk by 24.45%, but I still hold positions in ETH, SOL, XRP, BTC, DOGE, and BNB as none have triggered stop-loss. I am carefully reviewing each exit strategy to ensure every stop-loss and take-profit target is correctly recorded, including DOGE, which requires manual tracking due to lack of explicit instructions.”

Deepseek commented: “I still hold all six positions, as none have triggered stop-loss. My account currently holds $2,840.11 in cash, with a total return of 19.92%. I’ll continue following the plan, letting stop-loss and take-profit settings manage trades automatically.”

The real appeal of the Nof1 experiment is its innovative nature: it’s not just for entertainment—it’s a genuine stress test for AI in finance.

Crypto’s high volatility creates a real-world decision environment, testing AI’s adaptability and robustness. The project team says this helps improve model algorithms and advances the commercialization of AI trading tools.

The competition is ongoing, and it remains to be seen whether Deepseek can hold its lead or Gemini can stage a comeback. Nof1 founder Jay says the next round will introduce human traders and proprietary models.

Statement:

- This article is reprinted from [Foresight News], copyright belongs to the original author [1912212.eth, Foresight News]. If you have concerns about this reprint, please contact the Gate Learn team for prompt resolution according to relevant procedures.

- Disclaimer: The views and opinions expressed in this article are those of the author and do not constitute investment advice.

- The Gate Learn team translates other language versions. Unless Gate is referenced, reproducing, distributing, or plagiarizing these translations is prohibited.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?