2025 ALKIMI Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: ALKIMI's Market Position and Investment Value

Alkimi (ALKIMI) operates as the first on-chain digital ad exchange designed to eliminate opacity and excessive fees in the $750 billion digital advertising market. Since its establishment in 2021, Alkimi has achieved significant milestones including processing over 2.5 billion transactions and establishing partnerships with global brands such as Coca-Cola, Publicis, Kraken, IPG, and Fox. As of 2025, ALKIMI's market capitalization stands at approximately $5.87 million with a circulating supply of around 298 million tokens, with prices currently trading near $0.01969. This revenue-generating asset is increasingly playing a critical role in transforming the digital advertising ecosystem through sustainable protocol fee distribution to token holders.

Alkimi has demonstrated remarkable protocol revenue growth, scaling from $46,000 in Q4 2023 to $510,000 by 2025, representing over 1,009% expansion in staker rewards. The strategic migration to the Sui blockchain positions the platform to leverage high-performance infrastructure for processing millions of daily ad transactions at minimal cost, maximizing protocol fee capture and distribution.

This article will comprehensively analyze ALKIMI's price trajectory through 2030, incorporating historical performance patterns, market supply-demand dynamics, ecosystem development catalysts, and macroeconomic factors to provide investors with professional price forecasts and actionable investment strategies.

Alkimi (ALKIMI) Market Analysis Report

I. ALKIMI Price History Review and Current Market Status

ALKIMI Historical Price Movement Trajectory

- August 2025: ALKIMI reached its all-time high of $0.1654, reflecting strong market sentiment during the period.

- November 2025: The token declined to its all-time low of $0.01578, marking a significant correction phase.

- December 2025: ALKIMI recovered to $0.01969, currently trading near recent support levels established in late November.

ALKIMI Current Market Dynamics

As of December 23, 2025, ALKIMI is trading at $0.01969 with a market capitalization of approximately $5.87 million and a fully diluted valuation of $19.69 million. The 24-hour trading volume stands at $20,908.98, reflecting moderate liquidity in the market.

Recent Price Performance:

- 1-hour change: -0.45%

- 24-hour change: -0.95%

- 7-day change: +22.15%

- 30-day change: -19.96%

- 1-year change: -94.57%

The token demonstrates short-term weakness with minor losses over the past hour and day, though the 7-day performance shows a notable recovery of over 22%. However, the substantial year-to-date decline of 94.57% indicates significant bearish pressure from broader market conditions or project-specific factors.

With approximately 298.17 million tokens in circulation out of a total supply of 1 billion, ALKIMI represents 29.82% of its fully diluted supply. The token is held by 2,691 token holders across 4 exchanges, with Gate.com providing access to ALKIMI trading pairs.

Click to view current ALKIMI market price

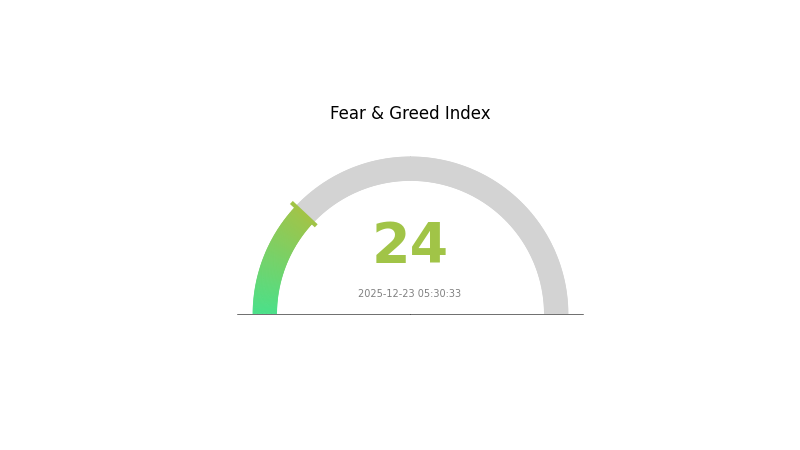

ALKIMI Market Sentiment Indicator

2025-12-23 Fear and Greed Index: 24 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index at 24. This exceptionally low reading indicates severe market pessimism and panic selling. Investors are highly risk-averse, creating significant downward pressure on asset prices. Such extreme fear conditions historically present buying opportunities for contrarian investors with strong conviction. However, caution remains essential as further liquidations may occur. Monitor key support levels closely on Gate.com for potential entry points during this volatile period.

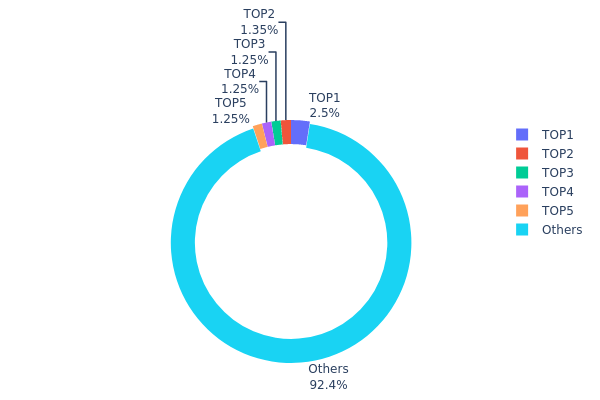

ALKIMI Holdings Distribution

The address holdings distribution map illustrates the concentration of token ownership across blockchain addresses, serving as a critical metric for assessing tokenomics health and potential market manipulation risks. By analyzing the top addresses and their respective holdings percentages, we can evaluate the degree of decentralization and identify whether wealth concentration poses systemic risks to the asset's price stability and governance structure.

Current analysis of ALKIMI's holdings distribution reveals a relatively healthy decentralization profile. The top five addresses collectively hold only 7.6% of total supply, with the largest single holder accounting for 2.50%. This distribution pattern indicates that no individual address maintains dominant control over the token supply. The remaining 92.4% of tokens are dispersed among other addresses, suggesting substantial liquidity distribution across the broader holder base. Such fragmentation significantly reduces the likelihood of coordinated price manipulation by any single entity and demonstrates a more resilient market structure.

The decentralized nature of ALKIMI's current holdings distribution reflects a market with relatively low concentration risk. With the majority of tokens held across numerous addresses rather than concentrated among a small group of whale holders, the token exhibits improved resistance to sudden sell-off pressures and demonstrates greater stability in on-chain governance mechanisms. This distribution pattern is conducive to organic price discovery and reduces systemic vulnerabilities typically associated with highly concentrated token structures, positioning ALKIMI favorably within the broader ecosystem for long-term sustainability.

Click to view current ALKIMI Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xe53c...7c7505 | 25000.00K | 2.50% |

| 2 | 0x62f3...fa53ad | 13523.63K | 1.35% |

| 3 | 0x7dfc...abb235 | 12500.00K | 1.25% |

| 4 | 0xa515...2665b5 | 12500.00K | 1.25% |

| 5 | 0xc0e7...6bc6bd | 12500.00K | 1.25% |

| - | Others | 923976.37K | 92.4% |

II. Core Factors Affecting ALKIMI's Future Price

Market Demand and Liquidity

-

Market Sentiment Impact: Investor sentiment and confidence directly influence ALKIMI's price movements. Positive news regarding widespread adoption or major technological breakthroughs can significantly drive price appreciation, while market pessimism can accelerate declines.

-

Liquidity Constraints: Limited market liquidity presents challenges for price stability. Speculative trading combined with insufficient liquidity can lead to unpredictable market movements and heightened price volatility.

-

Market News Sensitivity: Major announcements and developments can significantly alter price trajectories. The cryptocurrency market shows pronounced sensitivity to breaking news and regulatory developments.

Ecosystem Development

- Platform Utility: ALKIMI tokens play a core role in driving ecosystem activities on the Alkimi platform, supporting trading and serving as a fundamental component of the platform's economic model.

Regulatory Environment

- Policy Impact on Price Volatility: Regulatory policies at various jurisdictional levels further influence ALKIMI's price fluctuations. Changes in regulatory frameworks can create both opportunities and risks for token valuations.

III. 2025-2030 ALKIMI Price Forecast

2025 Outlook

- Conservative Prediction: $0.01004 - $0.01969

- Neutral Prediction: $0.01969

- Bullish Prediction: $0.02343 (requires sustained market recovery and increased institutional adoption)

2026-2028 Medium-term Outlook

- Market Stage Expectation: Gradual recovery and consolidation phase with increasing ecosystem adoption and use case expansion

- Price Range Predictions:

- 2026: $0.01466 - $0.03018 (9% upside potential)

- 2027: $0.01397 - $0.03519 (31% upside potential)

- 2028: $0.02015 - $0.03938 (55% upside potential)

- Key Catalysts: DeFi protocol upgrades, increased tokenomics efficiency, partnership announcements, and growing DApp ecosystem development on supported networks

2029-2030 Long-term Outlook

- Base Case Scenario: $0.03496 - $0.04614 (77% upside by 2029, assuming steady market conditions and moderate adoption growth)

- Bullish Scenario: $0.04055 - $0.05231 (105% upside by 2030, assuming accelerated DeFi adoption and strategic partnerships)

- Transformative Scenario: $0.05231+ (assuming breakthrough integration with major protocols, significant institutional inflows, and market-wide DeFi expansion)

- 2030-12-31: ALKIMI projected at $0.05231 (representing potential 105% appreciation from current levels under bullish conditions)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.02343 | 0.01969 | 0.01004 | 0 |

| 2026 | 0.03018 | 0.02156 | 0.01466 | 9 |

| 2027 | 0.03519 | 0.02587 | 0.01397 | 31 |

| 2028 | 0.03938 | 0.03053 | 0.02015 | 55 |

| 2029 | 0.04614 | 0.03496 | 0.01993 | 77 |

| 2030 | 0.05231 | 0.04055 | 0.03203 | 105 |

ALKIMI Investment Strategy and Risk Management Report

IV. ALKIMI Professional Investment Strategy and Risk Management

ALKIMI Investment Methodology

(1) Long-term Holding Strategy

- Target Investors: Institutional investors, brand partners, and believers in the on-chain advertising ecosystem

- Operation Recommendations:

- Accumulate ALKIMI tokens during market downturns to capture long-term protocol fee distribution growth

- Stake tokens to earn direct revenue sharing from platform transaction fees, with demonstrated 1,009% growth in staker rewards from Q4 2023 to 2025

- Hold through ecosystem expansion phases as new brand partnerships (similar to existing partnerships with Coca-Cola, Publicis, Kraken, IPG, and Fox) directly increase token holder rewards

(2) Active Trading Strategy

-

Technical Analysis Considerations:

- Price momentum: ALKIMI has demonstrated +22.15% weekly performance despite -19.96% monthly decline, indicating volatility opportunities

- Support and resistance levels: Historical ATH of $0.1654 and ATL of $0.01578 provide key reference points for position sizing

- Volume analysis: Current 24-hour volume of $20,908.98 reflects moderate liquidity; monitor volume spikes during protocol fee announcements

-

Swing Trading Key Points:

- Enter positions during negative sentiment phases when platform fundamentals remain strong but token price underperforms

- Exit portions of holdings following positive protocol fee milestone announcements and new partnership disclosures

- Monitor quarterly protocol fee reports as primary catalysts for price movement

ALKIMI Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% portfolio allocation to ALKIMI as alternative investment vehicle; prioritize staking for passive income

- Active Investors: 5-10% allocation with mix of spot holdings and staking positions; utilize trading opportunities around partnership announcements

- Professional Investors: 10-15% allocation with structured entry/exit strategies tied to protocol fee growth milestones and Sui ecosystem developments

(2) Risk Hedging Solutions

- Diversification Approach: Balance ALKIMI holdings with exposure to established blockchain infrastructure and complementary DeFi protocols to mitigate concentration risk

- Staged Entry Strategy: Deploy capital incrementally during market weakness rather than lump-sum purchases to reduce timing risk and dollar-cost average entry prices

(3) Secure Storage Solutions

- Self-Custody Option: Store ALKIMI tokens on Sui-compatible wallets with private key control to maintain full asset custody while earning staking rewards

- Platform Storage: Maintain a portion of holdings on Gate.com for active trading and immediate liquidity access when market opportunities arise

- Security Precautions: Enable hardware wallet authentication if available, maintain backup seed phrases offline, use hardware security keys for Gate.com account access, and never share private keys or seed phrases with any third party

V. ALKIMI Potential Risks and Challenges

ALKIMI Market Risks

- Liquidity Risk: With only 4 exchange listings and $20,908.98 daily volume, ALKIMI faces liquidity constraints that could result in significant slippage during large transactions or market stress periods

- Price Volatility: 94.57% one-year decline and current market cap of only $5.87 million indicate extreme volatility; token remains highly susceptible to sentiment shifts and macro market conditions

- Market Cap Dependency: At $19.69 million fully diluted valuation with only 29.82% of supply circulating, substantial dilution risk exists as the remaining 700+ million tokens enter circulation

ALKIMI Regulatory Risks

- Advertising Industry Regulation: The $750 billion digital advertising market operates under complex regulatory frameworks globally; changes in advertising regulations or data privacy laws (such as GDPR restrictions) could impact platform revenue streams and protocol fee generation

- Token Classification Uncertainty: Regulatory authorities may reclassify ALKIMI as a security rather than utility token, which could restrict trading venues, enforce compliance requirements, or limit distribution to accredited investors

- Cross-Border Compliance: Operating an on-chain exchange serving global brands requires navigating diverse jurisdictional requirements; regulatory crackdowns in major markets could disrupt partnership agreements

ALKIMI Technical Risks

- Blockchain Migration Execution: The strategic transition to Sui blockchain, while offering performance benefits, introduces execution risk including smart contract vulnerabilities, bridge security concerns, and potential token migration complications

- Smart Contract Security: On-chain protocols inherently carry smart contract risk; exploits, bugs, or vulnerabilities in Alkimi's protocol could result in financial losses for users and token value destruction

- Sui Ecosystem Dependency: Complete reliance on Sui blockchain performance, security, and adoption creates concentration risk; adverse developments in the Sui ecosystem directly impact Alkimi's operational capabilities

VI. Conclusion and Action Recommendations

ALKIMI Investment Value Assessment

Alkimi represents a compelling opportunity in the nascent on-chain advertising sector, with proven product-market fit demonstrated through partnerships with major global brands and sustainable revenue generation directly benefiting token holders. The protocol's 1,009% growth in distributed fees from Q4 2023 through 2025, processing of 2.5+ billion transactions, and strategic migration to Sui infrastructure provide a strong fundamental foundation. However, the token remains highly speculative with extreme volatility, minimal liquidity, significant supply dilution ahead, and exposure to emerging regulatory scrutiny of both cryptocurrency and advertising sectors. Success depends critically on accelerating brand partnership growth and successful execution of the Sui migration to justify current valuations.

ALKIMI Investment Recommendations

✅ Beginners: Start with minimal exposure (0.5-1% of portfolio) focused on understanding the project's long-term vision; participate only with capital you can afford to lose completely. Consider staking small amounts to experience protocol fee distribution firsthand before increasing commitment.

✅ Experienced Investors: Allocate 3-5% of alternative investment budget; combine core staking positions with tactical trading around quarterly fee announcements and partnership disclosures. Implement strict stop-losses at 20-30% below entry prices to manage extreme volatility.

✅ Institutional Investors: Evaluate structured positions (5-15% allocation) with negotiated partnerships or validator participation opportunities. Prioritize direct engagement with Alkimi team to understand expansion roadmap, customer pipeline, and competitive positioning within emerging on-chain advertising ecosystem.

ALKIMI Trading Participation Methods

- Gate.com Direct Trading: Purchase ALKIMI spot tokens on Gate.com for immediate exposure; utilize limit orders to avoid slippage given current liquidity constraints

- Staking Programs: Lock tokens in protocol staking mechanisms to receive direct protocol fee distributions, transforming ALKIMI into a yield-bearing asset aligned with platform revenue growth

- Sui Ecosystem Integration: Participate in Sui-native DeFi opportunities or liquidity pools featuring ALKIMI for enhanced yield generation through additional blockchain ecosystem incentives

Cryptocurrency investments carry extreme risk of total loss. This report does not constitute investment advice. Investors must make decisions according to personal risk tolerance and should consult professional financial advisors. Never invest more than you can afford to lose completely.

FAQ

What is the prediction for Alkimi coin?

Alkimi is predicted to reach $0.17 by end of 2031, with potential to cross $0.22 by 2032. Based on technical analysis and market trends, the coin shows strong growth potential in coming years.

What is the price of Alkimi coin?

The current price of Alkimi coin is $0.0162, down 14.37% in the last 24 hours as of December 23, 2025. ALKIMI is available on multiple exchanges with active trading volume.

What are the main factors that could affect Alkimi's future price?

Alkimi's price is mainly driven by supply and demand dynamics, protocol updates, and market sentiment. Block reward changes, trading volume, and broader cryptocurrency market trends also significantly influence its future price movements.

SEI Staking Analysis: 60-70% Supply Locked and Its Price Impact

SWELL vs RUNE: Comparing Two Leading DeFi Protocols in the Cross-Chain Liquidity Race

2025 ALCX Price Prediction: Future Outlook and Market Analysis for Alchemix Token

2025 CAKE Price Prediction: Bullish Trends and Key Factors Driving PancakeSwap's Token Value

2025 CVX Price Prediction: Bullish Outlook as DeFi Adoption Accelerates

SPO vs SNX: Comparing Two Leading DeFi Protocols for Yield Farming and Staking

Rising Cryptocurrencies: What to Invest in 2025?

What is Fundamental Analysis for Crypto Projects: Whitepaper, Team, and Roadmap Guide?

How Does MELANIA Coin Price Volatility Compare to BTC and ETH in 2025-2026?

What is Just a Chill Guy (CHILLGUY)? Complete Guide to the Viral Meme Coin

How Has GUN Crypto Price Volatility Changed in 2025: From $0.12845 Peak to Current Levels?