2025 AMP Price Prediction: Will This Cryptocurrency Reach New Heights or Face a Market Correction?

Introduction: AMP's Market Position and Investment Value

Amp (AMP), as a native collateral token for the Flexa payment network, has emerged as a key player in facilitating cryptocurrency payments since its inception. As of 2025, AMP's market capitalization has reached $205,648,416, with a circulating supply of approximately 84,282,138,073 tokens, and a price hovering around $0.00244. This asset, often referred to as the "digital payment enabler," is playing an increasingly crucial role in the realm of cryptocurrency-based retail transactions.

This article will comprehensively analyze AMP's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price forecasts and practical investment strategies.

I. AMP Price History Review and Current Market Status

AMP Historical Price Evolution Trajectory

- 2021: AMP reached its all-time high of $0.120813, marking a significant milestone in its price history.

- 2023: AMP hit its all-time low of $0.00140933 on October 13, indicating a major market downturn.

- 2025: AMP has been experiencing price fluctuations, currently trading at $0.00244.

AMP Current Market Situation

As of November 16, 2025, AMP is trading at $0.00244, with a 24-hour trading volume of $33,145.23. The token has seen a 1.68% increase in the last 24 hours. AMP's market cap stands at $205,648,416.90, ranking it 246th in the cryptocurrency market. The circulating supply is 84,282,138,073.79 AMP, which is 84.56% of the total supply of 99,669,205,039.99 AMP. The token is currently trading at 97.98% below its all-time high, indicating significant room for potential growth. The market sentiment for AMP appears to be cautiously optimistic, with a slight upward trend in the short term.

Click to view the current AMP market price

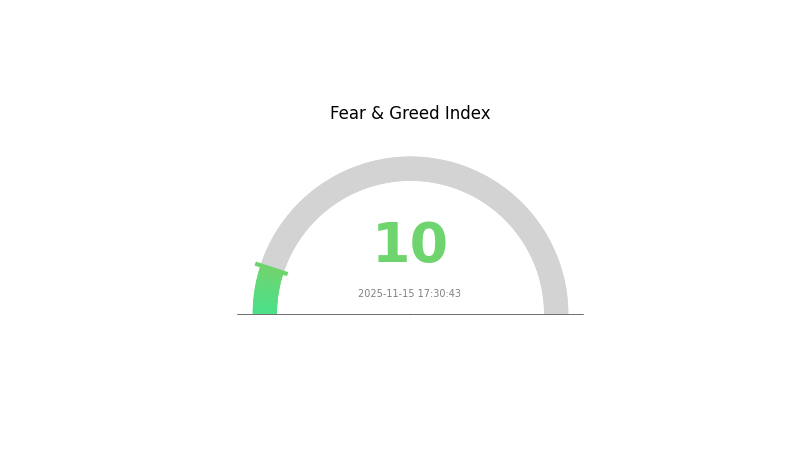

AMP Market Sentiment Indicator

2025-11-15 Fear and Greed Index: 10 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is gripped by extreme fear, with the Fear and Greed Index plummeting to 10. This level of pessimism often signals a potential buying opportunity for contrarian investors. However, it's crucial to approach with caution and conduct thorough research. Remember, market sentiment can shift rapidly. Stay informed and consider diversifying your portfolio to mitigate risks in these uncertain times. Gate.com offers a range of tools and resources to help you navigate the market volatility.

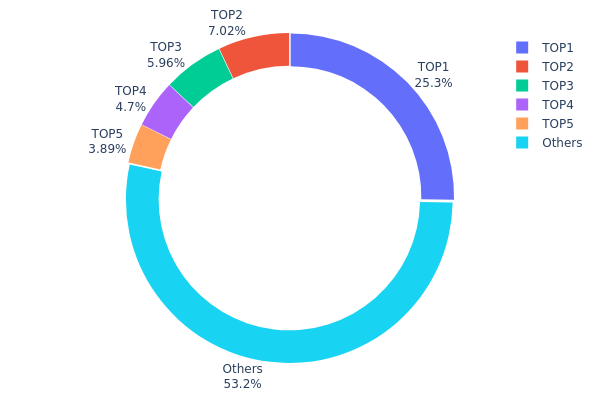

AMP Holdings Distribution

The address holdings distribution data for AMP reveals a significant concentration of tokens among a few top addresses. The largest holder controls 25.28% of the total supply, while the top 5 addresses collectively account for 46.81% of AMP tokens. This level of concentration suggests a relatively centralized ownership structure, which could have implications for market dynamics and price volatility.

Such a concentrated distribution may pose risks to market stability, as large holders have the potential to exert substantial influence on token price through significant buy or sell orders. However, it's worth noting that 53.19% of AMP tokens are distributed among other addresses, indicating some degree of wider participation in the ecosystem.

This concentration pattern reflects a moderate level of decentralization for AMP, with potential concerns regarding on-chain structural stability. The presence of major holders could impact governance decisions and overall market sentiment, underscoring the importance of monitoring address distributions for insights into the token's ecosystem health and potential market movements.

Click to view the current AMP Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x5d27...1d675f | 25211201.05K | 25.28% |

| 2 | 0x9eda...69fd62 | 7000000.00K | 7.01% |

| 3 | 0x0c3a...60c7bd | 5938990.20K | 5.95% |

| 4 | 0x706d...e7c578 | 4683519.90K | 4.69% |

| 5 | 0xafcd...45c5da | 3874174.72K | 3.88% |

| - | Others | 53012119.63K | 53.19% |

II. Key Factors Affecting AMP's Future Price

Supply Mechanism

- Maximum Supply: AMP has a fixed maximum supply of 99,225,164,238.73 tokens.

- Current Impact: The limited supply may create scarcity in the long term, potentially supporting price appreciation if demand increases.

Institutional and Whale Dynamics

- Enterprise Adoption: AMP is utilized by Flexa, a payment network that enables merchants to accept cryptocurrencies.

Technical Development and Ecosystem Building

- Ecosystem Applications: AMP serves as collateral for the Flexa network, facilitating instant, secure transactions for various cryptocurrencies.

III. AMP Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.00144 - $0.00200

- Neutral prediction: $0.00200 - $0.00280

- Optimistic prediction: $0.00280 - $0.00312 (requires positive market sentiment and increased adoption)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increasing adoption

- Price range forecast:

- 2027: $0.00313 - $0.00442

- 2028: $0.00283 - $0.00543

- Key catalysts: Expanded use cases, technological improvements, and broader market recovery

2030 Long-term Outlook

- Base scenario: $0.00386 - $0.00476 (assuming steady market growth and adoption)

- Optimistic scenario: $0.00476 - $0.00562 (with accelerated adoption and favorable market conditions)

- Transformative scenario: $0.00562+ (with breakthrough innovations and widespread integration)

- 2030-12-31: AMP $0.00562 (potential peak price based on optimistic projections)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00312 | 0.00244 | 0.00144 | 0 |

| 2026 | 0.00367 | 0.00278 | 0.00172 | 13 |

| 2027 | 0.00442 | 0.00323 | 0.00313 | 32 |

| 2028 | 0.00543 | 0.00382 | 0.00283 | 56 |

| 2029 | 0.0049 | 0.00462 | 0.00342 | 89 |

| 2030 | 0.00562 | 0.00476 | 0.00386 | 95 |

IV. AMP Professional Investment Strategies and Risk Management

AMP Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors with a long-term outlook

- Operation suggestions:

- Accumulate AMP tokens during market dips

- Stake AMP tokens to earn rewards and support the Flexa network

- Store tokens in a secure hardware wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential entry/exit points

- Relative Strength Index (RSI): Determine overbought/oversold conditions

- Key points for swing trading:

- Monitor AMP's correlation with broader crypto market trends

- Set strict stop-loss orders to manage downside risk

AMP Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple crypto assets

- Options strategies: Use put options for downside protection

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for AMP

AMP Market Risks

- Volatility: Significant price fluctuations common in the crypto market

- Liquidity: Limited trading volume may affect ability to enter/exit positions

- Competition: Other collateral tokens may emerge in the DeFi space

AMP Regulatory Risks

- Unclear regulations: Potential for unfavorable regulatory changes

- Compliance issues: Flexa network may face regulatory scrutiny

- Tax implications: Evolving tax laws may impact AMP holders

AMP Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs

- Network congestion: Ethereum network issues may affect AMP transactions

- Integration challenges: Adoption of Flexa network by merchants may be slow

VI. Conclusion and Action Recommendations

AMP Investment Value Assessment

AMP presents a unique value proposition in the crypto payments space, but faces short-term volatility and adoption challenges. Long-term potential is tied to the success of the Flexa network.

AMP Investment Recommendations

✅ Newcomers: Start with small positions, focus on learning about the Flexa ecosystem ✅ Experienced investors: Consider a balanced approach, combining holding and staking strategies ✅ Institutional investors: Explore strategic partnerships with Flexa and long-term accumulation

AMP Trading Participation Methods

- Spot trading: Buy and sell AMP on Gate.com

- Staking: Participate in AMP staking to earn rewards and support the network

- DeFi integration: Explore AMP's use as collateral in compatible DeFi protocols

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Can an AMP token reach $1?

While ambitious, reaching $1 is possible for AMP in the long term. It would require significant adoption of the Flexa network and increased demand for the token's collateral function in digital payments.

Is AMP going to skyrocket?

Yes, AMP has strong potential to skyrocket. Its innovative technology and growing adoption in the payments sector could drive significant price increases in the coming years.

Is AMP crypto a good investment?

AMP crypto shows potential as a good investment. Its utility in collateralizing payments and growing adoption in the DeFi space make it promising for long-term growth.

Is AMP a dead coin?

No, AMP is not a dead coin. It remains active in the crypto market, with ongoing development and use cases in payment collateralization.

TRON ($TRX) AUD Price And Potential

How Does XLM Compare to Its Top Competitors in 2025?

2025 REQ Price Prediction: Analyzing Market Trends and Potential Growth Factors

2025 AMP Price Prediction: Will Flexa's Token Reach New Heights in the Digital Payments Landscape?

How Does Dash Compare to Its Competitors in Performance and Market Share?

How Does XLM Compare to Its Competitors in Performance and Market Share?

Giao dịch Spot và Giao dịch Futures với Tiền mã hoá - Khác nhau như thế nào?

Explanation of the 2008 Financial Crisis

Buy Bitcoin

What is SOON ($SOON coin)? A Deep Dive into the Super Adoption Stack and Its Future Prospects

Who is the Founder of This Leading Crypto Exchange?