2025 AUCTIONPrice Prediction: Analyzing Market Trends and Future Valuation Factors in the Global Auction Industry

Introduction: AUCTION's Market Position and Investment Value

BounceAuction (AUCTION) has established itself as a decentralized token exchange platform since its inception in 2020, achieving significant milestones in the DeFi space. As of 2025, AUCTION's market capitalization has reached $56.5 million, with a circulating supply of approximately 6.59 million tokens and a price hovering around $8.57. This asset, often referred to as the "DeFi Auction Pioneer," is playing an increasingly crucial role in facilitating token exchanges and liquidity provision.

This article will comprehensively analyze AUCTION's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. AUCTION Price History Review and Current Market Status

AUCTION Historical Price Evolution

- 2021: AUCTION launched, reaching an all-time high of $70.44 on April 12

- 2023: Market downturn, price dropped to an all-time low of $3.47 on June 15

- 2025: Gradual recovery, price currently at $8.575

AUCTION Current Market Situation

AUCTION is currently trading at $8.575, showing a 2.4% increase in the past 24 hours. The token has experienced mixed performance across different timeframes, with a 0.32% gain in the last hour but a 5.04% decline over the past week. The 30-day and 1-year trends indicate more significant downward pressure, with declines of 14.11% and 45.18% respectively. AUCTION's market capitalization stands at $56,510,487, ranking it 639th in the cryptocurrency market. The token's circulating supply is 6,590,144 AUCTION, representing 65.9% of the total supply of 7,640,885 tokens.

Click to view the current AUCTION market price

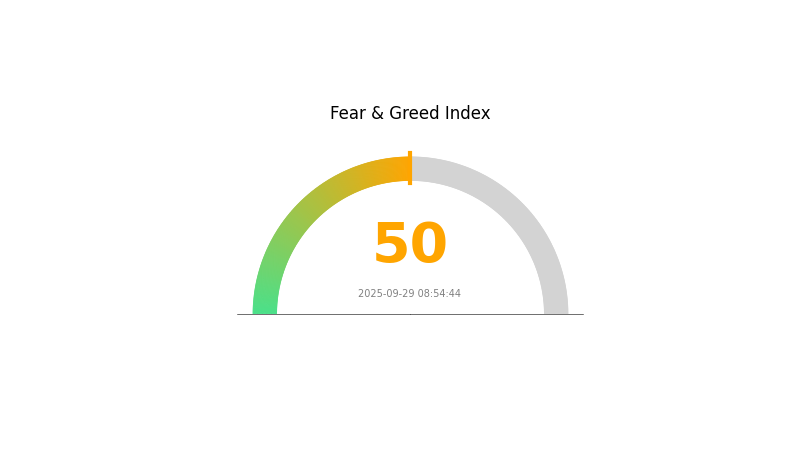

AUCTION Market Sentiment Indicator

2025-09-29 Fear and Greed Index: 50 (Neutral)

Click to view the current Fear & Greed Index

The cryptocurrency market sentiment remains balanced as the Fear and Greed Index stands at 50, indicating a neutral outlook. This equilibrium suggests that investors are neither overly pessimistic nor excessively optimistic about the market's direction. Traders should remain cautious and consider diversifying their portfolios while closely monitoring market trends. As always, it's crucial to conduct thorough research and manage risk effectively when making investment decisions in the volatile crypto space.

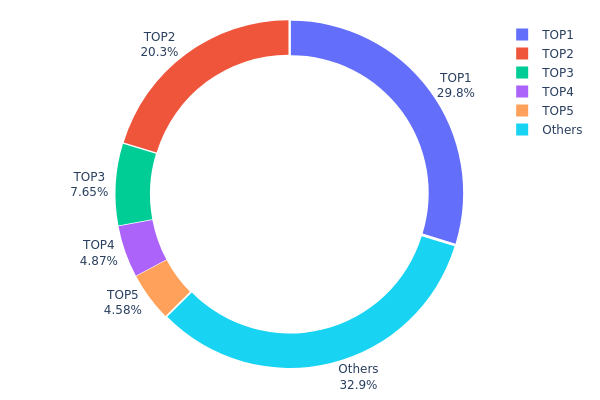

AUCTION Holdings Distribution

The address holdings distribution for AUCTION reveals a significant concentration of tokens among a few top addresses. The largest holder possesses 29.75% of the total supply, while the top five addresses collectively control 67.13% of AUCTION tokens. This high level of concentration raises concerns about potential market manipulation and price volatility.

Such a centralized distribution structure could have substantial implications for AUCTION's market dynamics. The presence of large holders, often referred to as "whales," may lead to increased price fluctuations if they decide to sell or accumulate more tokens. Furthermore, this concentration of power could potentially compromise the decentralization ethos that many cryptocurrency projects strive for.

However, it's worth noting that 32.87% of the tokens are distributed among other addresses, which provides some level of diversification. This distribution pattern suggests that while AUCTION's on-chain structure shows signs of centralization, there is still a significant portion held by smaller investors, potentially contributing to market stability and liquidity.

Click to view the current AUCTION Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x69f2...eee3eb | 2273.20K | 29.75% |

| 2 | 0xe2fe...1435fb | 1550.63K | 20.29% |

| 3 | 0xf977...41acec | 584.29K | 7.64% |

| 4 | 0x91d4...c8debe | 372.21K | 4.87% |

| 5 | 0x5a52...70efcb | 350.00K | 4.58% |

| - | Others | 2510.56K | 32.87% |

II. Key Factors Affecting AUCTION's Future Price

Supply Mechanism

- Market Supply and Demand: The balance between supply and demand in the market is a crucial factor influencing AUCTION's price.

- Historical Patterns: Past supply changes have shown to impact the price, with increased demand typically leading to price appreciation.

- Current Impact: The current supply dynamics are expected to continue influencing price movements based on market conditions.

Macroeconomic Environment

- Inflation Hedging Properties: AUCTION's performance in inflationary environments may affect its appeal as a potential hedge against inflation.

- Geopolitical Factors: International tensions and global economic shifts can impact the overall crypto market, including AUCTION.

Technological Development and Ecosystem Building

- Core Product Development: Bounce Finance's focus on auction services and their expansion into the BTC ecosystem may impact AUCTION's value.

- Ecosystem Applications: The growth of DApps and ecosystem projects built on or utilizing AUCTION could drive demand and influence its price.

III. AUCTION Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $7.73 - $8.58

- Neutral prediction: $8.58 - $9.83

- Optimistic prediction: $9.83 - $11.07 (requires favorable market conditions and increased adoption)

2026-2027 Outlook

- Market stage expectation: Potential growth phase with increasing volatility

- Price range forecast:

- 2026: $6.98 - $12.48

- 2027: $6.36 - $15.39

- Key catalysts: Technological advancements, ecosystem expansion, and broader market trends

2028-2030 Long-term Outlook

- Base scenario: $13.27 - $14.63 (assuming steady market growth and adoption)

- Optimistic scenario: $14.63 - $16.24 (assuming accelerated adoption and favorable regulatory environment)

- Transformative scenario: $16.24+ (under extremely favorable conditions and breakthrough use cases)

- 2030-12-31: AUCTION $14.63 (potential stabilization point after sustained growth)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 11.07336 | 8.584 | 7.7256 | 0 |

| 2026 | 12.48242 | 9.82868 | 6.97836 | 14 |

| 2027 | 15.39466 | 11.15555 | 6.35866 | 30 |

| 2028 | 14.33712 | 13.27511 | 7.56681 | 54 |

| 2029 | 15.46284 | 13.80611 | 12.97774 | 61 |

| 2030 | 16.24427 | 14.63448 | 13.46372 | 70 |

IV. AUCTION Professional Investment Strategies and Risk Management

AUCTION Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors with a long-term perspective

- Operation suggestions:

- Accumulate AUCTION tokens during market dips

- Set price targets and rebalance portfolio periodically

- Store tokens securely in a non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- Relative Strength Index (RSI): Gauge overbought/oversold conditions

- Key points for swing trading:

- Monitor trading volume for trend confirmation

- Set stop-loss orders to manage downside risk

AUCTION Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across different crypto assets

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate web3 wallet

- Cold storage option: Hardware wallet for large holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. AUCTION Potential Risks and Challenges

AUCTION Market Risks

- High volatility: Price can fluctuate dramatically in short periods

- Limited liquidity: May face challenges in executing large trades

- Competition: Other DeFi platforms may impact AUCTION's market share

AUCTION Regulatory Risks

- Uncertain regulatory environment: Potential for new regulations affecting DeFi

- Cross-border compliance: Varying regulations across jurisdictions

- KYC/AML requirements: Possible implementation affecting user privacy

AUCTION Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs

- Network congestion: High gas fees on Ethereum during peak times

- Scalability challenges: Limitations of current blockchain infrastructure

VI. Conclusion and Action Recommendations

AUCTION Investment Value Assessment

AUCTION presents a unique opportunity in the DeFi space with its decentralized token exchange platform. While it offers potential for growth, investors should be aware of the high volatility and regulatory uncertainties in the crypto market.

AUCTION Investment Recommendations

✅ Newcomers: Start with small positions, focus on education and understanding the platform

✅ Experienced investors: Consider AUCTION as part of a diversified DeFi portfolio

✅ Institutional investors: Conduct thorough due diligence and consider OTC options for large positions

AUCTION Trading Participation Methods

- Spot trading: Available on Gate.com and other major exchanges

- Staking: Participate in governance and earn rewards

- Liquidity provision: Contribute to AUCTION pools for potential returns

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What crypto will 1000x prediction?

Bitcoin Hyper ($HYPER) is predicted to 1000x, based on current market trends and growth potential as of 2025-09-29.

Why is auction coin going down?

Auction coin is declining due to large token transfers to exchanges, causing immediate selling pressure and a rapid price drop.

Will bat reach $100?

While possible, BAT reaching $100 is uncertain. It depends on future market conditions and Brave's development. No definitive timeline exists for such a price target.

Which coin is likely to reach $1?

BlockDAG (BDAG) is likely to reach $1. Dogecoin (DOGE) and Hedera (HBAR) are also strong contenders based on current market trends.

2025 DEEP Price Prediction: Analyzing Future Market Trends and Growth Potential for Digital Economy Enhanced Protocols

2025 UMA Price Prediction: Analyzing Market Trends and Future Growth Potential in the DeFi Sector

2025 SPKPrice Prediction: Analysis of Market Trends and Future Valuation Prospects for SPK Token

2025 INJ Price Prediction: Bullish Trends and Key Factors Shaping Injective Protocol's Future Value

2025 WNXM Price Prediction: Analyzing Growth Potential and Market Factors in the Decentralized Insurance Sector

2025 CFX Price Prediction: Analyzing Market Trends and Potential Growth Factors for Conflux Network

What is TWAP (Time-Weighted Average Price) Strategy and How Does It Work

How to Delete My Account

What is P2P Trading on a Leading Platform?

BTC Option Flows Explained, Why Bitcoin Above 93,000 Suggests a Bullish Start to 2026

Bitcoin Options Traders Eye USD $100,000 as Derivatives Signal Market Reset