2025 INJ Fiyat Tahmini: Yükseliş Eğilimleri ve Injective Protocol’ün Gelecekteki Değerini Belirleyen Temel Unsurlar

Giriş: INJ'nin Piyasa Konumu ve Yatırım Değeri

Injective (INJ), birinci sınıf Web3 finans uygulamaları geliştirmek için optimize edilmiş, son derece hızlı ve birlikte çalışabilir bir Layer-1 blokzinciri olarak 2020'den bu yana önemli ilerlemeler kaydetmiştir. 2025 itibarıyla Injective'in piyasa değeri 886.679.070 $, dolaşımdaki token adedi yaklaşık 97.727.220 ve fiyatı yaklaşık 9,073 $ seviyesindedir. "DeFi'nin güç merkezi" olarak tanımlanan bu varlık, merkeziyetsiz finans ve Web3 uygulamalarında giderek daha önemli bir rol üstlenmektedir.

Bu makale, Injective'in 2025-2030 yılları arasındaki fiyat hareketlerini kapsamlı şekilde analiz edecek; geçmiş fiyat eğilimleri, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik faktörleri bir araya getirerek yatırımcılara profesyonel fiyat tahminleri ve uygulanabilir yatırım stratejileri sunacaktır.

I. INJ Fiyat Geçmişinin İncelemesi ve Güncel Piyasa Durumu

INJ'nin Tarihsel Fiyat Gelişimi

- 2020: INJ piyasaya sürüldü, fiyatı 0,657401 $ (tüm zamanların en düşük seviyesi)

- 2024: INJ, 14 Mart'ta 52,62 $ ile tüm zamanların en yüksek seviyesine ulaştı

- 2025: Piyasa döngüsü değişti, fiyat en yüksek noktadan mevcut 9,073 $ seviyesine düştü

INJ Güncel Piyasa Durumu

16 Ekim 2025 itibarıyla INJ 9,073 $ seviyesinden işlem görüyor, piyasa değeri 886.679.070 $'dır. 24 saatlik işlem hacmi 1.260.064 $'tır. INJ son 24 saatte %4,63, son bir haftada ise %27,83 düşüş göstermiştir. Mevcut fiyat, tüm zamanların en yüksek seviyesinden %82,76 daha düşük. Son dönemdeki düşüşe rağmen, INJ %0,022 piyasa hakimiyetini koruyor. Dolaşımdaki arz 97.727.220,33 INJ olup toplam arzın %97,73'üne karşılık gelmektedir (toplam arz: 100.000.000 INJ). Tam seyreltilmiş değerleme 907.300.000 $'dır.

Güncel INJ piyasa fiyatını görüntüleyin

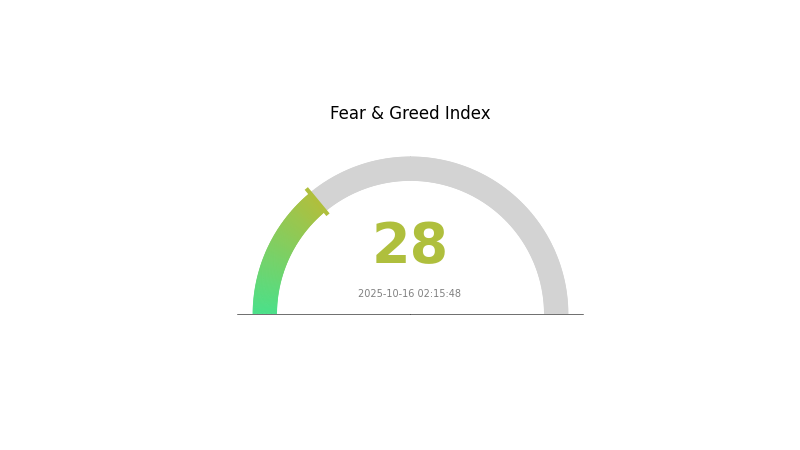

INJ Piyasa Duyarlılığı Göstergesi

16 Ekim 2025 Korku ve Açgözlülük Endeksi: 28 (Korku)

Güncel Korku & Açgözlülük Endeksi'ni görüntüleyin

INJ için kripto piyasa duyarlılığı şu anda 28 ile "Korku" bölgesinde. Bu, yatırımcıların temkinli olduğunu ve karşıt işlem yapanlar için fırsatlar oluşabileceğini gösteriyor. Ancak, yatırım kararı verirken kapsamlı araştırma yapmak ve çok yönlü değerlendirme yapmak önemlidir. Piyasa duyarlılığı hızla değişebilir; geçmiş performans, gelecekteki sonuçların garantisi değildir. Gate.com'da güncel kalın ve sorumlu işlem yapın.

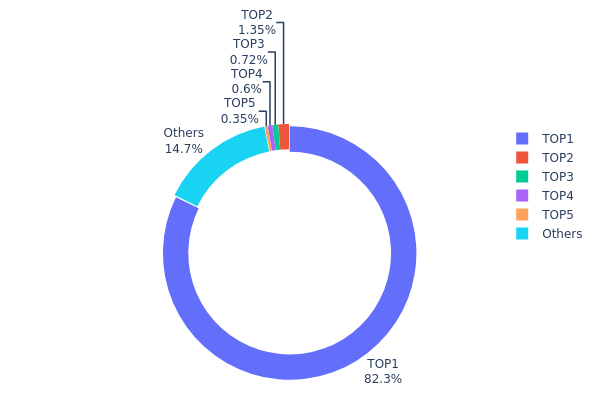

INJ Varlık Dağılımı

INJ'nin adres varlık dağılımı, sahipliğin yüksek derecede yoğunlaştığını gösteriyor. En büyük adres, toplam arzın %82,27'sine denk gelen 82.273.590 INJ'ye sahip. İkinci en büyük adresin payı yalnızca %1,35. İlk beş adres, INJ tokenlarının %85,28'ini elinde tutarken, kalan %14,72 diğer tüm sahipler arasında dağılmıştır.

Bu derece yoğunlaşma, INJ'nin merkeziyetsizliği ve piyasa istikrarı açısından risk teşkil etmektedir. Tek bir adresin %80'den fazlasını kontrol etmesi, piyasa manipülasyonu ve fiyat oynaklığı riskini artırır. Böylesine baskın bir pozisyon, yönetişim kararlarını ve ekosistem dinamiklerini etkileyebilir. Ayrıca, bu yoğunlaşma likidite ve adil piyasa uygulamaları konusundaki endişeler nedeniyle yeni yatırımcıları çekmekte zorlanabilir.

Mevcut dağılım, INJ için zincir üstü merkeziyetçi bir yapı sergiler ve blokzincir projelerinde beklenen merkeziyetsizlik ilkelerine aykırıdır. Bu yoğunlaşma, token'ın yaygın benimsenmesini zorlaştırabilir ve piyasa ekosisteminin sağlıklı şekilde gelişmesini engelleyebilir.

Güncel INJ Varlık Dağılımı'nı görüntüleyin

| İlk | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 0xf955...bad6f3 | 82273,59K | 82,27% |

| 2 | 0xf89d...5eaa40 | 1354,19K | 1,35% |

| 3 | 0x5ff1...89634b | 719,73K | 0,71% |

| 4 | 0xafcd...45c5da | 600,00K | 0,60% |

| 5 | 0x77fb...94df0e | 350,02K | 0,35% |

| - | Diğerleri | 14702,48K | 14,72% |

2. INJ'nin Gelecekteki Fiyatını Etkileyen Temel Faktörler

Arz Mekanizması

- Deflasyonist Model: INJ, token yakma mekanizmalarıyla deflasyonist bir tokenomik model uygular.

- Geçmiş Eğilim: Daha önceki arz azaltmaları, genellikle INJ fiyatını olumlu etkiledi.

- Güncel Etki: Devam eden deflasyonist baskının, uzun vadede INJ fiyatını desteklemesi bekleniyor.

Kurumsal ve Balina Dinamikleri

- Kurumsal Varlıklar: Büyük kurumsal yatırımcılar, INJ birikimini artırıyor.

- Kurumsal Benimseme: DeFi sektöründeki önde gelen şirketler, INJ'yi operasyonlarına entegre etti.

Makroekonomik Çevre

- Para Politikası Etkisi: Özellikle ABD Merkez Bankası'nın politikaları, INJ dâhil olmak üzere kripto piyasası trendlerini belirgin şekilde etkiliyor.

- Enflasyona Karşı Dayanıklılık: INJ, yüksek enflasyon dönemlerinde yatırımcılar için cazip olabilecek bazı koruma özellikleri sergilemiştir.

Teknolojik Gelişim ve Ekosistem Oluşumu

- Layer 2 Entegrasyonu: Injective Protocol'ün Layer 2 çözümlerine entegrasyonu, ölçeklenebilirliği artırıp işlem maliyetlerini azaltıyor.

- Çapraz Zincir Fonksiyonelliği: Çapraz zincir özellikleri, INJ'nin farklı blokzinciri ekosistemlerinde kullanılmasını sağlıyor.

- Ekosistem Uygulamaları: Injective Protocol üzerinde kurulan merkeziyetsiz borsalar ve türev platformlar, INJ'nin benimsenmesini ve kullanımını artırıyor.

III. 2025-2030 Dönemi için INJ Fiyat Tahmini

2025 Görünümü

- Ihtiyatlı tahmin: 8,80 $ - 9,00 $

- Tarafsız tahmin: 9,00 $ - 9,50 $

- İyimser tahmin: 9,50 $ - 9,89 $ (güçlü piyasa toparlanması ve INJ'nin daha fazla benimsenmesi koşuluyla)

2027-2028 Görünümü

- Piyasa evresi beklentisi: Daha yüksek volatiliteyle potansiyel bir boğa piyasası

- Fiyat aralığı tahmini:

- 2027: 8,69 $ - 15,80 $

- 2028: 10,83 $ - 15,57 $

- Temel katalizörler: Daha güçlü blokzinciri entegrasyonu, gelişmiş DeFi uygulamaları ve ekosistem büyümesi

2029-2030 Uzun Vadeli Görünüm

- Temel senaryo: 14,56 $ - 15,36 $ (istikrarlı piyasa büyümesi ve projenin gelişiminin devamı varsayımıyla)

- İyimser senaryo: 16,16 $ - 17,66 $ (benimsemenin hızlanması ve olumlu düzenlemelerle)

- Dönüştürücü senaryo: 18,00 $ - 20,00 $ (ölçeklenebilirlikte atılım ve ana akım entegrasyon gerçekleşirse)

- 2030-12-31: INJ 17,66 $ (potansiyel zirve, piyasa koşullarına bağlıdır)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Artış/Azalış |

|---|---|---|---|---|

| 2025 | 9,89502 | 9,078 | 8,80566 | 0 |

| 2026 | 13,09138 | 9,48651 | 8,1584 | 4 |

| 2027 | 15,80453 | 11,28895 | 8,69249 | 24 |

| 2028 | 15,57875 | 13,54674 | 10,83739 | 49 |

| 2029 | 16,16464 | 14,56274 | 7,427 | 60 |

| 2030 | 17,66825 | 15,36369 | 12,44459 | 69 |

IV. INJ Profesyonel Yatırım Stratejileri ve Risk Yönetimi

INJ Yatırım Metodolojisi

(1) Uzun Vadeli Tutma Stratejisi

- Kimler için: Uzun vadeli bakış açısına ve yüksek risk toleransına sahip yatırımcılar

- İşlem önerileri:

- Piyasa düşüşlerinde INJ biriktirin

- Kısmi kâr almak için fiyat hedefleri belirleyin

- INJ'yi güvenli bir donanım cüzdanında saklayın

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trendleri ve olası dönüş noktalarını tespit etmek için kullanılır

- Göreli Güç Endeksi (RSI): Aşırı alım/aşırı satım durumlarını belirlemek için kullanılır

- Dalgalı işlem için önemli noktalar:

- Destek ve direnç seviyelerini izleyin

- Risk yönetimi için zarar durdur emirleri kullanın

INJ Risk Yönetim Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Ihtiyatlı yatırımcılar: Portföyün %1-3'ü

- Agresif yatırımcılar: Portföyün %5-10'u

- Profesyonel yatırımcılar: Portföyün %15'ine kadar

(2) Riskten Korunma Yöntemleri

- Çeşitlendirme: Yatırımları birden fazla kripto varlık arasında dağıtmak

- Opsiyon stratejileri: Düşüş riskine karşı satım opsiyonu kullanmak

(3) Güvenli Saklama Yöntemleri

- Sıcak cüzdan önerisi: Gate Web3 Cüzdan

- Soğuk depolama: Uzun vadeli tutmak için donanım cüzdanı kullanmak

- Güvenlik önlemleri: İki aşamalı kimlik doğrulamayı etkinleştirin, güçlü parolalar kullanın

V. INJ için Potansiyel Riskler ve Zorluklar

INJ Piyasa Riskleri

- Oynaklık: Kripto para piyasalarında aşırı fiyat dalgalanmaları yaygındır

- Likidite: Büyük miktarlarda alım veya satımda zorluk yaşanabilir

- Rekabet: Yeni projeler Injective'in piyasa pozisyonuna meydan okuyabilir

INJ Düzenleyici Riskler

- Düzenleyici belirsizlik: Küresel kripto para düzenlemeleri sürekli değişmektedir

- Uyum zorlukları: Değişen yasal gerekliliklere uyum sağlamak

- Potansiyel sınırlamalar: Devletin kripto para kullanımına getirebileceği kısıtlamalar

INJ Teknik Riskler

- Akıllı sözleşme açıkları: Sömürü veya hata riski

- Ağ tıkanıklığı: Yüksek talep dönemlerinde ölçeklenebilirlik sorunları

- Teknolojik eskime: Blokzinciri teknolojisinin hızlı gelişimi

VI. Sonuç ve Eylem Önerileri

INJ Yatırım Değeri Değerlendirmesi

Injective (INJ), DeFi ve Web3 alanında yüksek riskli fakat yüksek potansiyelli bir yatırım fırsatı sunar. Yenilikçi teknolojisi ve güçlü ortaklıkları olsa da, kripto para piyasasındaki yüksek volatilite ve düzenleyici belirsizlikler yatırımcılar için ciddi riskler oluşturmaktadır.

INJ Yatırım Önerileri

✅ Yeni başlayanlar: Küçük pozisyonlarla başlayın, eğitime ve risk yönetimine odaklanın ✅ Deneyimli yatırımcılar: Uzun vadeli tutma ile stratejik alım satımı harmanlayan dengeli bir yaklaşım düşünün ✅ Kurumsal yatırımcılar: Kapsamlı inceleme yapın, INJ'yi çeşitlendirilmiş bir kripto portföyüne dahil etmeyi değerlendirin

INJ İşlem Katılım Yöntemleri

- Spot işlem: Gate.com'da INJ alıp satın

- Staking: Injective'in staking programına katılıp ödül fırsatlarını değerlendirin

- DeFi uygulamaları: Injective ekosistem projelerinde ek fırsatları keşfedin

Kripto para yatırımları çok yüksek risk taşır ve bu makale yatırım tavsiyesi niteliğinde değildir. Yatırımcılar, kendi risk toleranslarına göre hareket etmeli ve profesyonel finans danışmanlarına başvurmalıdır. Kaybetmeyi göze alamayacağınız tutardan fazlasını asla yatırmayın.

SSS

Injective protokolü 100 $'a ulaşabilir mi?

Mevcut tahminlere göre, Injective protokolünün 2030'a kadar 100 $'a ulaşması beklenmiyor. Uzun vadeli büyüme potansiyeli belirsizliğini koruyor.

INJ kripto'nun geleceği var mı?

Evet, INJ kripto gelecek vaat ediyor. Yenilikçi özellikleri, artan benimsenmesi ve piyasa genişleme potansiyeli, gelişen Web3 ve DeFi ortamında uzun vadeli güçlü bir konum sunuyor.

Injective ne kadar yükselebilir?

Injective'in tüm zamanların en yüksek seviyesi 2023'te 45,50 $ olarak kaydedildi. Gelecekteki fiyat potansiyeli spekülatiftir ve piyasa koşulları ile benimsenmeye bağlıdır. Net bir maksimum seviye belirlenmemiştir.

Injective'in 2040 fiyatı nedir?

Mevcut piyasa analizlerine göre, Injective'in 2040'taki fiyatının 19,15 $ seviyesine ulaşması bekleniyor. Bu uzun vadeli tahmin, INJ'nin önümüzdeki 15 yıl içinde önemli büyüme potansiyeline sahip olduğunu gösteriyor.

2025 DEEP Fiyat Tahmini: Dijital Ekonomi Geliştirilmiş Protokollerinin Gelecek Piyasa Trendleri ve Büyüme Potansiyeli Analizi

2025 UMA Fiyat Tahmini: DeFi Sektöründe Piyasa Trendleri ve Gelecek Büyüme Potansiyelinin Analizi

2025 AUCTION Fiyat Tahmini: Küresel açık artırma sektöründe piyasa trendleri ve gelecekteki değerleme faktörlerinin profesyonel analizi

2025 SPK Fiyat Tahmini: SPK Token’e Yönelik Piyasa Eğilimleri ve Gelecekteki Değerleme Beklentilerinin Analizi

2025 WNXM Fiyat Tahmini: Merkeziyetsiz Sigorta Sektöründe Büyüme Potansiyeli ve Piyasa Faktörlerinin Analizi

2025 CFX Fiyat Tahmini: Conflux Network’te Piyasa Trendleri ve Olası Büyüme Faktörlerinin Analizi

Dropee Günlük Kombinasyonu 12 Aralık 2025

Tomarket Günlük Kombinasyonu 12 Aralık 2025

SEI Airdrop Ödülleri’ne Katılım ve Talep Etme Kılavuzu

Kripto para birimlerinde algoritmik alım satım için etkili stratejiler

Stock-to-Flow Model ile Bitcoin'in Değerlemesini Anlamak