2025 BOBA Price Prediction: Expert Analysis and Market Outlook for the Upcoming Year

Introduction: BOBA's Market Position and Investment Value

Boba Network (BOBA) is an Ethereum Layer 2 scaling solution built by the Enya team as a core contributor to the OMG Foundation. Since its inception, BOBA has established itself as a next-generation Optimistic Rollup expansion solution designed to reduce gas fees, increase transaction throughput, and extend smart contract functionality across the Ethereum ecosystem. As of December 2025, BOBA has achieved a market capitalization of approximately $20.12 million with a circulating supply of approximately 493.6 million tokens, maintaining a price around $0.0402. This innovative asset is playing an increasingly vital role in Ethereum's Layer 2 scaling infrastructure and decentralized governance mechanisms.

This article provides a comprehensive analysis of BOBA's price trends and market dynamics, incorporating historical performance patterns, market supply and demand factors, ecosystem developments, and macroeconomic conditions. The analysis will deliver professional price forecasts and practical investment strategies for investors seeking to understand BOBA's market trajectory and positioning opportunities through 2025-2030.

BOBA Network (BOBA) Market Analysis Report

I. BOBA Price History Review and Market Status

BOBA Historical Price Evolution

-

November 2021: BOBA reached its all-time high (ATH) of $7.93 on November 26, 2021, marking the peak of its initial market cycle following the project's launch and early adoption phase.

-

2022-2024: Extended consolidation and decline period, with the token experiencing significant downward pressure as the broader cryptocurrency market faced headwinds and competitive pressures from other Layer 2 solutions.

-

December 2025: BOBA reached its all-time low (ATL) of $0.03881301 on December 19, 2025, representing an 81.32% decline over the past year and reflecting sustained selling pressure in the current market environment.

BOBA Current Market Status

As of December 20, 2025, BOBA is trading at $0.04023, with a 24-hour trading volume of $109,930.06. The token exhibits bearish momentum in the short-term:

- Hourly Performance: +0.47% (slight recovery within the past hour)

- 24-Hour Performance: -1.75% (modest decline)

- 7-Day Performance: -8.30% (declining trend over the week)

- 30-Day Performance: -19.37% (sustained downward pressure over the month)

- 1-Year Performance: -81.32% (severe annual depreciation)

The market capitalization stands at approximately $19.86 million with a fully diluted valuation (FDV) of $20.12 million. The circulating supply is 493.60 million BOBA tokens out of a total supply of 500 million tokens, representing 98.72% circulation. Market dominance remains minimal at 0.00062%, with 11,957 active token holders across 12 trading exchanges. Current market sentiment reflects extreme fear (VIX score: 20).

Click to view current BOBA market price

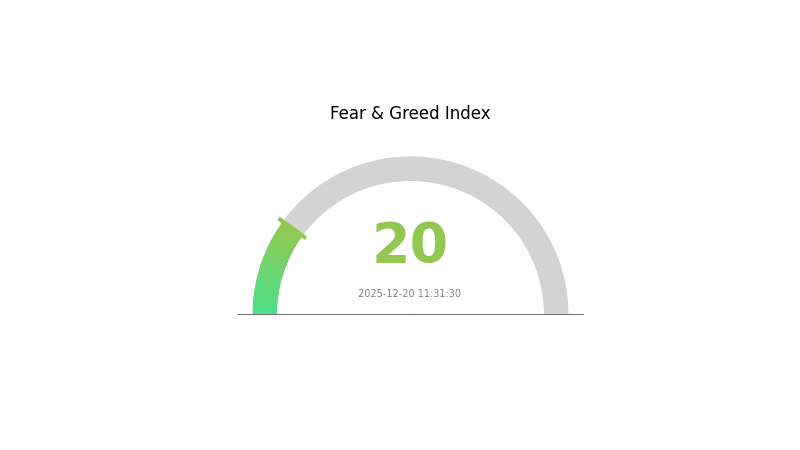

BOBA Market Sentiment Indicator

2025-12-20 Fear and Greed Index: 20 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is experiencing extreme fear as the Fear and Greed Index drops to 20. This indicates widespread pessimism and risk aversion among investors. Such extreme fear levels historically present contrarian opportunities, as markets often experience sharp reversals when sentiment reaches these depths. Investors should exercise caution while monitoring potential entry points, as panic-driven sell-offs can create favorable accumulation opportunities. Market conditions remain volatile, and risk management remains essential during periods of heightened uncertainty and negative sentiment.

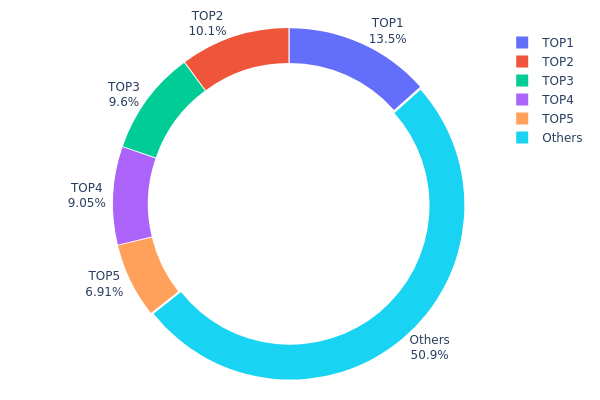

BOBA Holdings Distribution

Address holdings distribution refers to the allocation of BOBA tokens across different wallet addresses, providing a comprehensive snapshot of how the token supply is concentrated among various holders. This metric serves as a critical indicator of market structure, revealing the degree of decentralization and potential risks associated with token concentration at the top addresses.

The current holdings distribution of BOBA demonstrates moderate concentration characteristics. The top five addresses collectively hold approximately 48.1% of the total token supply, with the leading address accounting for 13.45% alone. While this concentration level is noteworthy, the significant proportion held by other addresses—50.9% distributed across the remaining holders—suggests a reasonably diversified holder base. This distribution pattern indicates that no single entity maintains absolute control, though the top holders collectively retain meaningful influence over the token's market dynamics.

From a market structure perspective, this distribution profile presents both stabilizing and destabilizing elements. The substantial holdings by top addresses create potential liquidity risks; concentrated sell-offs from these major holders could trigger significant price volatility. Conversely, the dispersed ownership among smaller holders provides a stabilizing foundation that mitigates extreme manipulation scenarios. The current structure reflects a mid-stage decentralization state where institutional or early-stage investors maintain considerable positions, yet sufficient distribution exists to prevent monopolistic control. This balance suggests BOBA exhibits moderate resilience to price manipulation while remaining susceptible to coordinated actions from top-tier holders.

Click to view current BOBA Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x1279...876bde | 67297.97K | 13.45% |

| 2 | 0x62cd...fec4cf | 50574.25K | 10.11% |

| 3 | 0xae23...280cbf | 47986.28K | 9.59% |

| 4 | 0x48f3...dce070 | 45246.39K | 9.04% |

| 5 | 0x3727...866be8 | 34562.87K | 6.91% |

| - | Others | 254332.23K | 50.9% |

II. Core Factors Affecting BOBA's Future Price

Market Sentiment and Trading Volume

-

Market Sentiment Impact: BOBA's price is significantly influenced by overall market sentiment and investor confidence in the cryptocurrency market. Positive sentiment tends to drive upward price movement, while negative sentiment can lead to decline.

-

Trading Volume Dynamics: Trading volume plays a crucial role in price determination. Higher trading volumes typically indicate stronger market interest and can facilitate more stable price movements, while lower volumes may result in increased volatility.

Technology Development and User Adoption

-

User Adoption Trends: The growth in user adoption of the Boba ecosystem directly impacts token demand and, consequently, price performance. Increased utilization of the platform tends to support positive price momentum.

-

Ecosystem Development: Technical advancements and expansion of the Boba ecosystem contribute to long-term price sustainability. The development of new features and applications strengthens the fundamental value proposition.

Staking and Tokenomics

- staking Mechanism: BOBA token holders have the opportunity to stake their tokens to earn trading fees, effectively allowing users to participate as network validators. This mechanism can create consistent demand for the token and support price stability through reduced circulating supply pressure.

III. 2025-2030 BOBA Price Forecast

2025 Outlook

- Conservative Estimate: $0.0343-$0.04035

- Neutral Estimate: $0.04035-$0.04681

- Optimistic Estimate: $0.04681 (pending network adoption acceleration)

2026-2028 Mid-term Outlook

- Market Stage Expectation: Gradual recovery phase with increasing institutional interest and ecosystem expansion

- Price Range Forecasts:

- 2026: $0.02571-$0.0645 (8% upside potential)

- 2027: $0.03837-$0.07997 (34% upside potential)

- 2028: $0.04422-$0.08644 (66% upside potential)

- Key Catalysts: Layer 2 scaling efficiency improvements, decentralized application growth on Boba Network, strategic partnerships, and market sentiment recovery

2029-2030 Long-term Outlook

- Base Case: $0.04987-$0.10511 (90% upside by 2029)

- Optimistic Case: $0.06546-$0.11364 (125% upside by 2030)

- Transformation Case: $0.11364+ (requires widespread mainstream adoption of Boba-based applications, significant DeFi ecosystem expansion, and broader cryptocurrency market bull cycle)

- December 20, 2025: BOBA trading consolidating near mid-range support levels

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.04681 | 0.04035 | 0.0343 | 0 |

| 2026 | 0.0645 | 0.04358 | 0.02571 | 8 |

| 2027 | 0.07997 | 0.05404 | 0.03837 | 34 |

| 2028 | 0.08644 | 0.06701 | 0.04422 | 66 |

| 2029 | 0.10511 | 0.07672 | 0.04987 | 90 |

| 2030 | 0.11364 | 0.09091 | 0.06546 | 125 |

BOBA Network (BOBA) Professional Investment Report

IV. BOBA Professional Investment Strategy and Risk Management

BOBA Investment Methodology

(1) Long-term Holding Strategy

- Suitable Investors: Layer 2 scaling solution believers, Ethereum ecosystem advocates, and long-term cryptocurrency investors with high risk tolerance

- Operational Recommendations:

- Accumulate during market downturns when BOBA trades below $0.05, taking advantage of the current 81.32% yearly decline

- Hold through governance participation in Boba DAO to earn voting rights and potential rewards

- Maintain positions through market cycles, as L2 solutions are fundamental infrastructure with long-term adoption potential

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support and Resistance Levels: Monitor key price levels at $0.04 (current floor) and $0.05 (immediate resistance), using these as entry/exit signals

- Volume Analysis: Track 24-hour volume trends around $109,930 to identify breakout opportunities

- Wave Trading Key Points:

- Enter positions during temporary price recoveries, such as the recent +0.47% hourly gain

- Exit or take profits when resistance levels are approached, particularly near $0.045-$0.05 range

- Use dollar-cost averaging to reduce timing risk given current market volatility

BOBA Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of portfolio allocation

- Active Investors: 2-5% of portfolio allocation

- Professional/Institutional Investors: 5-10% of portfolio allocation with hedging strategies

(2) Risk Hedging Solutions

- Portfolio Diversification: Balance BOBA holdings with established Layer 1 assets and stablecoins to reduce concentration risk

- Position Sizing: Implement strict position limits to cap maximum loss at 2-5% of total portfolio value per trade

(3) Secure Storage Solutions

- Cold Storage Approach: Transfer BOBA tokens to secure self-custody solutions for long-term holdings exceeding 6 months

- Exchange Storage: Maintain active trading positions on Gate.com for liquidity and immediate trading capability

- Security Precautions: Enable multi-factor authentication, use hardware security keys, regularly audit wallet addresses, and never share private keys or seed phrases

V. BOBA Potential Risks and Challenges

BOBA Market Risk

- Extreme Price Volatility: BOBA has experienced an 81.32% decline over the past year, from approximately $0.216 to current $0.04023, indicating high volatility and susceptibility to market sentiment shifts

- Liquidity Concentration: With 24-hour trading volume of only $109,930 and a market cap of $20.1 million, BOBA faces liquidity constraints that could amplify price movements during significant buy/sell orders

- Competitive Pressure: Other Layer 2 solutions with larger market capitalizations and development teams may capture more market share and developer adoption, reducing BOBA's network effects

BOBA Regulatory Risk

- Regulatory Uncertainty: Evolving cryptocurrency regulations across major jurisdictions could impact Layer 2 protocol operations and token utility

- Governance Token Classification: Regulatory authorities may classify BOBA as a security, triggering compliance requirements and market restrictions

- Smart Contract Regulation: Future regulations targeting decentralized autonomous organizations (DAOs) and smart contract execution could affect Boba DAO governance mechanisms

BOBA Technical Risk

- Smart Contract Vulnerabilities: Complex Layer 2 architecture involving Optimistic Rollups and AWS Lambda integration increases potential exposure to undiscovered security flaws

- Interoperability Challenges: Integration with external infrastructure (AWS Lambda for off-chain computation) introduces third-party dependencies and potential points of failure

- Network Scalability Limitations: While designed for scaling, unforeseen technical bottlenecks could emerge as transaction volume increases, potentially compromising performance promises

VI. Conclusions and Action Recommendations

BOBA Investment Value Assessment

Boba Network represents a specialized investment opportunity within the Layer 2 scaling ecosystem. As an Optimistic Rollup solution offering innovative features such as community-driven fast exits (reducing 7-day withdrawal periods to minutes) and scalable smart contracts utilizing cloud infrastructure, BOBA addresses genuine Ethereum scalability challenges. However, the token faces significant headwinds: an 81.32% yearly decline, modest market capitalization of $20.1 million, limited trading liquidity, and intense competition from more established Layer 2 protocols. The project's long-term viability depends on achieving meaningful developer adoption, maintaining network security, and successfully executing its DAO governance model. Current market conditions suggest BOBA trades near multi-year lows, potentially attractive for contrarian investors with high risk tolerance, but unsuitable for conservative portfolios.

BOBA Investment Recommendations

✅ Beginners: Start with micro-positions (0.5-1% portfolio allocation) on Gate.com to gain exposure without excessive risk; focus on understanding Boba's technical differentiation before increasing commitment

✅ Experienced Investors: Implement scaled accumulation strategies during weakness, combine with complementary Layer 2 positions for diversified L2 exposure, and actively participate in governance for potential protocol value capture

✅ Institutional Investors: Conduct comprehensive technical audits of Boba's smart contract architecture; evaluate team stability and development roadmap; consider positions as part of diversified infrastructure holdings rather than standalone bets

BOBA Trading Participation Methods

- Gate.com Spot Trading: Purchase and trade BOBA directly on Gate.com, currently listed with 24-hour trading volume, enabling flexible entry/exit without lock-up periods

- Dollar-Cost Averaging: Execute periodic purchases of fixed BOBA amounts over extended timeframes to reduce timing risk and smooth acquisition costs

- Boba DAO Governance Staking: Stake BOBA tokens to participate in governance decisions and potentially earn protocol rewards while maintaining long-term conviction

Cryptocurrency investments carry extreme risk. This report does not constitute investment advice. Investors should make decisions based on individual risk tolerance and consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is BOBA token and what is its use case?

BOBA is the native token of the Boba Network, a Layer 2 scaling solution for Ethereum. It serves as the primary payment currency for transaction fees and governance rights within the ecosystem, enabling faster and cheaper transactions while maintaining security and decentralization.

What factors influence BOBA price prediction?

BOBA price prediction is influenced by supply and demand dynamics, trading volume, market sentiment, protocol updates, and hard forks. Block reward halvings and broader cryptocurrency market trends also significantly impact price movements.

How does BOBA compare to other Layer 2 solutions like Arbitrum and Optimism?

BOBA uses Optimistic Rollups technology like Arbitrum and Optimism, reducing transaction costs and enhancing scalability. Its key differentiators include decentralized governance, strong interoperability focus, and unique cross-chain capabilities, positioning it as a competitive Layer 2 solution.

What is the tokenomics and supply of BOBA token?

BOBA is an ERC-20 staking and governance token with a fixed total supply of 500 million tokens. It powers the Boba Network, a multi-chain Layer 2 ecosystem, and enables community participation in network governance.

What are the risks and opportunities for BOBA price in 2025?

BOBA may appreciate 40% in 2025 driven by enhanced liquidity, strengthened community sentiment, and Layer-2 technological upgrades. Opportunities emerge from network adoption expansion and ecosystem development momentum.

ATS vs LRC: Comparing Automated Tracking Systems and Learning Resource Centers in Modern Education

DEEP vs OP: Unveiling the Power of Neural Networks in Competitive Gaming

Is Netswap (NETT) a good investment?: Analyzing the Potential and Risks of this DeFi Token

Is Netswap (NETT) a good investment?: Analyzing the potential and risks of this decentralized exchange token

ONX vs LRC: Comparing Two Promising Blockchain Projects in the DeFi Space

2025 DYDX Price Prediction: Analyzing Market Trends and Potential Growth Factors for the DeFi Token

What is TWAP (Time-Weighted Average Price) Strategy and How Does It Work

How to Delete My Account

What is P2P Trading on a Leading Platform?

BTC Option Flows Explained, Why Bitcoin Above 93,000 Suggests a Bullish Start to 2026

Bitcoin Options Traders Eye USD $100,000 as Derivatives Signal Market Reset