2025 CRV Fiyat Tahmini: Curve DAO Token’ın Piyasa Trendleri ve Olası Büyüme Faktörlerinin Analizi

Giriş: CRV'nin Piyasa Konumu ve Yatırım Değeri

Curve (CRV), Ethereum üzerindeki merkeziyetsiz likidite havuzu borsası olarak 2020'de faaliyete geçtiğinden bu yana önemli başarılara imza attı. 2025 yılı itibarıyla Curve'ün piyasa değeri 1,3 milyar dolara ulaşırken, dolaşımdaki arz yaklaşık 1,41 milyar token seviyesinde ve fiyatı 0,5615 dolar civarındadır. "Stablecoin Takası Uzmanı" olarak anılan bu varlık, düşük kayma ve düşük işlem ücretleriyle verimli stablecoin ticareti sunarak DeFi alanında giderek daha önemli bir rol üstleniyor.

Bu makale, 2025-2030 dönemi arasında Curve'ün fiyat eğilimlerini kapsamlı biçimde analiz ediyor; geçmiş fiyat hareketleri, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik faktörleri bir araya getirerek yatırımcılara profesyonel fiyat tahminleri ve uygulanabilir yatırım stratejileri sunuyor.

I. CRV Fiyat Geçmişi ve Güncel Piyasa Durumu

CRV Tarihsel Fiyat Seyri

- 2020: Ocak'ta lansman, 14 Ağustos'ta tüm zamanların zirvesi 15,37 dolar

- 2024: Piyasa düşüşü, 5 Ağustos'ta rekor düşük seviye 0,180354 dolar

- 2025: Güçlü toparlanma, fiyat son bir yılda %114,09 arttı

CRV Güncel Piyasa Tablosu

16 Ekim 2025 itibarıyla CRV, 0,5615 dolar seviyesinden işlem görüyor ve son 24 saatte %4,98 oranında değer kaybetti. Bu fiyat, tarihi dipten güçlü bir toparlanmayı temsil etse de zirvesinin oldukça altında. CRV'nin piyasa değeri 793.190.158 dolar ile kripto paralar arasında 111. sırada yer alıyor. 24 saatlik işlem hacmi 6.311.157 dolar olup, orta yoğunlukta bir piyasa faaliyetine işaret ediyor. Dolaşımdaki arz, maksimum arzın %46,62’sine denk gelen 1.412.627.175 CRV seviyesinde. Son dönemdeki yükselişe rağmen, CRV kısa vadede aşağı yönlü baskı altında; bir haftada %23,23, son bir ayda ise %24,26 değer kaybetti.

Güncel CRV piyasa fiyatını görüntüleyin

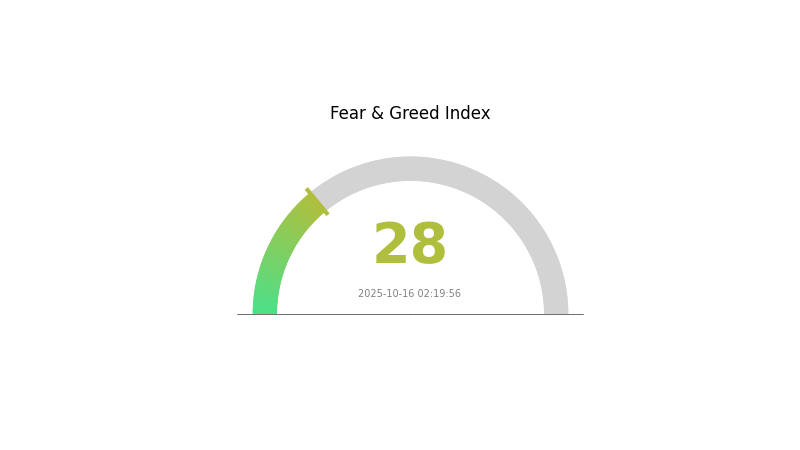

CRV Piyasa Duyarlılığı Endeksi

16 Ekim 2025 Korku ve Açgözlülük Endeksi: 28 (Korku)

Güncel Korku & Açgözlülük Endeksi'ni inceleyin

Kripto piyasası, şu anda 28 seviyesindeki Korku ve Açgözlülük Endeksi ile belirgin bir korku havası taşıyor. Bu, yatırımcıların son dalgalanmalar veya dış etkenler nedeniyle temkinli davrandığını gösteriyor. Böyle zamanlarda bazı trader’lar uzun vadeli fırsat ararken, diğerleri izleme ve bekleme stratejisi uygulayabiliyor. Bu volatil ortamda yatırımcıların güncel gelişmeleri izlemeleri ve karar öncesi detaylı analiz yapmaları büyük önem taşıyor.

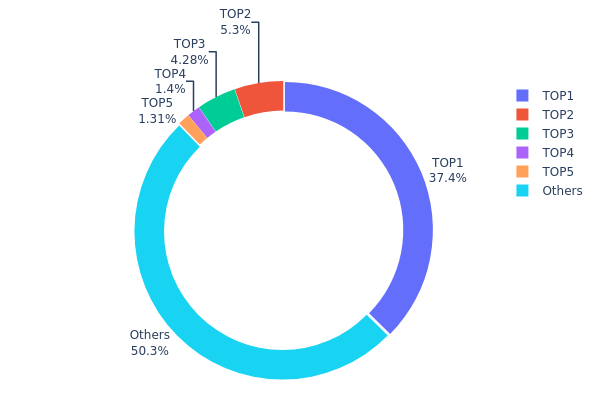

CRV Varlık Dağılımı

CRV adreslerindeki varlık dağılımı, tokenların ciddi oranda birkaç büyük adreste toplandığını ortaya koyuyor. En büyük sahip, toplam arzın %37,40’ına sahip olarak yüksek bir merkezileşme gösteriyor. Sonraki dört büyük sahip ise birlikte %12,26’lık bir paya sahip. Bu yoğunlaşma, potansiyel piyasa manipülasyonu ve fiyat oynaklığı açısından risk oluşturuyor.

Büyük adreslerdeki yüksek miktarlar, CRV piyasasının bu adreslerden kaynaklanabilecek büyük hareketlere karşı hassas olduğunu gösteriyor. Bu yoğunlaşma, büyük sahiplerden birinin satış yapması durumunda volatilitenin artmasına yol açabilir. Ayrıca, dağılım yapısı az sayıda aktörün CRV ekosistemi ve yönetişim kararlarında önemli bir etkisi olduğunu gösteriyor.

Diğer adresler tokenların %50,34’üne sahip olsa da mevcut dağılım, CRV için merkeziyetsizlik seviyesinin düşük olduğuna işaret ediyor. Bu yoğunlaşma, Curve protokolünün uzun vadeli istikrarı ve merkeziyetsizlik çabaları açısından yatırımcılar için dikkate değer bir unsurdur.

Güncel CRV Varlık Dağılımını inceleyin

| Top | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 0x5f3b...94e2a2 | 865.413,35K | 37,40% |

| 2 | 0xf977...41acec | 122.609,42K | 5,29% |

| 3 | 0x5a52...70efcb | 99.000,00K | 4,27% |

| 4 | 0xbe7b...2bc626 | 32.427,33K | 1,40% |

| 5 | 0x611f...dfb09d | 30.262,96K | 1,30% |

| - | Diğerleri | 1.164.052,01K | 50,34% |

II. CRV'nin Gelecekteki Fiyatını Etkileyen Temel Faktörler

Arz Mekanizması

- Likidite Madenciliği: Kullanıcılar, Curve Finance’a likidite sağlayarak CRV token kazanabilir.

- Tarihsel Eğilim: Artan likidite madenciliği, arz yükseldiği için geçmişte fiyat üzerinde geçici baskı yarattı.

- Güncel Etki: Devam eden likidite madenciliği programı, CRV'nin dolaşımdaki arzı ve fiyat hareketleri üzerinde belirleyici olmaya devam ediyor.

Kurumsal ve Balina Davranışları

- Kurumsal Varlıklar: DeFi’ye artan kurumsal ilgi, büyük kripto fonlarının CRV yatırımlarını artırmasına neden oldu.

- Kurumsal Benimseme: Çok sayıda DeFi projesinin Curve Finance ile entegrasyonu, CRV talebini artırma potansiyeli taşıyor.

Makroekonomik Koşullar

- Para Politikası Etkisi: Merkez bankası politikaları ve faiz oranlarındaki değişimler, DeFi getirilerinin cazibesini ve dolayısıyla CRV talebini etkileyebiliyor.

- Enflasyona Karşı Koruma: CRV'nin DeFi ekosistemindeki rolü, onu enflasyon dönemlerinde koruma aracı olarak öne çıkarabilir ve fiyatı üzerinde etkili olabilir.

Teknik Gelişmeler ve Ekosistem Oluşumu

- Platform Güncellemeleri: Curve Finance teknolojisinde devam eden geliştirmeler; daha gelişmiş likidite havuzu algoritmaları ve zincirler arası entegrasyonlar.

- Ekosistem Uygulamaları: Curve Finance üzerinde ya da entegre çalışan DApp’lerin büyümesi, CRV kullanım alanını ve talebini artırıyor.

III. 2025-2030 CRV Fiyat Tahmini

2025 Beklentisi

- Ihtiyatlı tahmin: 0,53276 - 0,56080 dolar

- Tarafsız tahmin: 0,56080 - 0,60006 dolar

- İyimser tahmin: 0,60006 - 0,63931 dolar (olumlu piyasa koşulları gerektirir)

2027-2028 Beklentisi

- Piyasa evresi: Potansiyel büyüme dönemi

- Fiyat tahmini aralığı:

- 2027: 0,62523 - 0,94815 dolar

- 2028: 0,58868 - 0,93207 dolar

- Temel katalizörler: DeFi sektörünün büyümesi, CRV'nin likidite sağlama alanında daha fazla benimsenmesi

2029-2030 Uzun Vadeli Beklenti

- Temel senaryo: 0,87484 - 0,91421 dolar (istikrarlı piyasa büyümesiyle)

- İyimser senaryo: 0,91421 - 0,99649 dolar (DeFi benimsemesinin hızlanmasıyla)

- Dönüştürücü senaryo: 0,99649 dolar üzeri (CRV ekosisteminde çığır açan yeniliklerle)

- 31 Aralık 2030: CRV 0,91421 dolar (potansiyel dengelenme noktası)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim Oranı |

|---|---|---|---|---|

| 2025 | 0,63931 | 0,5608 | 0,53276 | 0 |

| 2026 | 0,77407 | 0,60006 | 0,55205 | 6 |

| 2027 | 0,94815 | 0,68706 | 0,62523 | 22 |

| 2028 | 0,93207 | 0,81761 | 0,58868 | 45 |

| 2029 | 0,95357 | 0,87484 | 0,69112 | 55 |

| 2030 | 0,99649 | 0,91421 | 0,82279 | 62 |

IV. CRV İçin Profesyonel Yatırım Stratejileri ve Risk Yönetimi

CRV Yatırım Yöntemleri

(1) Uzun Vadeli Tutma Stratejisi

- Uygun profil: Uzun vadeli yatırımcılar ve DeFi ekosistemine inananlar

- Operasyonel öneriler:

- Piyasa düşüşlerinde CRV biriktirin

- Curve’ün likidite sağlama ve yönetişim süreçlerine katılın

- Non-custodial cüzdanlarda güvenli saklama sağlayın

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: 50 günlük ve 200 günlük ortalamaları trend tespiti için izleyin

- RSI: Aşırı alım/satım noktalarını belirlemek için kullanın

- Swing trade için önemli noktalar:

- Risk yönetimi için zarar-durdur emirleri belirleyin

- Curve protokol güncellemelerini ve yönetişim tekliflerini takip edin

CRV Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı Prensipleri

- Ihtiyatlı yatırımcılar: Kripto portföyünün %1-3’ü

- Agresif yatırımcılar: Kripto portföyünün %5-10’u

- Profesyonel yatırımcılar: Kripto portföyünün %15’ine kadar

(2) Riskten Korunma Stratejileri

- Diversifikasyon: CRV’yi diğer DeFi ve DeFi dışı varlıklarla dengeleyin

- Opsiyon stratejileri: Düşüş riskine karşı put opsiyonları kullanın

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan önerisi: Gate Web3 cüzdanı

- Soğuk depolama: Uzun vadeli tutum için donanım cüzdanları

- Güvenlik önlemleri: İki faktörlü kimlik doğrulama ve benzersiz şifre kullanımı

V. CRV için Potansiyel Riskler ve Zorluklar

CRV Piyasa Riskleri

- Volatilite: Kripto piyasalarında sık görülen aşırı fiyat dalgalanmaları

- Likidite: Yüksek piyasa stresinde olası likidite problemleri

- Rekabet: Yeni DeFi protokolleri Curve’ün piyasa konumunu tehdit edebilir

CRV Düzenleyici Riskleri

- Belirsiz regülasyonlar: DeFi alanında olumsuz düzenleyici kararlar riski

- Uyum zorlukları: Gelişen küresel kripto regülasyonlarına ayak uydurma gerekliliği

- Vergi etkileri: DeFi işlemlerinin karmaşık ve değişen vergi uygulamaları

CRV Teknik Riskleri

- Akıllı sözleşme açıkları: Sömürü ya da hata riski

- Ölçeklenebilirlik: Ethereum ağındaki tıkanıklık Curve işlemlerini etkileyebilir

- Oracle hataları: Fiyat beslemelerinde yanlışlık riski

VI. Sonuç ve Eylem Önerileri

CRV Yatırım Değeri Değerlendirmesi

CRV, DeFi ekosisteminde uzun vadeli cazip bir değer sunuyor fakat kısa vadede volatilite ve regülasyon belirsizlikleriyle karşı karşıya. Başarısı, merkeziyetsiz finans ve stablecoin ticaret hacminin büyümesine bağlı olarak şekilleniyor.

CRV Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Küçük ölçekli yatırım yapın, DeFi ve Curve hakkında bilgi edinin

✅ Deneyimli yatırımcılar: Curve yönetişimi ve likidite sağlamada aktif rol alın

✅ Kurumsal yatırımcılar: Curve’de stratejik ortaklıklar ve büyük hacimli likidite fırsatlarını değerlendirin

CRV Katılım Yöntemleri

- Spot işlem: CRV’yi Gate.com’da satın alın

- Staking: Getiri için Curve likidite havuzlarına katılın

- Yönetişim: veCRV ile Curve DAO oylamalarına katılın

Kripto para yatırımları son derece yüksek risk taşır; bu makale yatırım tavsiyesi değildir. Yatırım kararlarınızı kendi risk toleransınıza göre verin ve profesyonel finans danışmanlarına başvurun. Kaybetmeyi göze alabileceğinizden fazla yatırım yapmayın.

SSS

CRV toparlanır mı?

Evet, CRV güçlü bir toparlanma potansiyeli sergiliyor. Zincir üstü veriler ve piyasa eğilimleri, CRV’nin geleceği için iyimser bir tablo sunuyor.

CRV bir stablecoin midir?

Hayır, CRV bir stablecoin değildir. Curve Finance’ın yönetişim token’ıdır. Curve’ün stablecoini crvUSD’dir.

CRV’ye yatırım yapmanın riskleri nelerdir?

Başlıca riskler arasında yüksek fiyat oynaklığı, olası likidite sorunları ve kripto piyasasında düzenleyici belirsizlikler yer alıyor.

CRV coin’in sahibi kim?

CRV coin, Curve Finance’a aittir; kurucusu Michael Egorov önemli bir pay sahibidir. Proje merkeziyetsizdir, sahiplik token sahiplerine dağılmıştır.

MakerDAO (MKR) iyi bir yatırım mı?: Lider DeFi protokol tokenının potansiyeli ve riskleri üzerine analiz

Curve (CRV) iyi bir yatırım mı?: Bu DeFi tokenının mevcut piyasa koşullarındaki potansiyeli ve risklerinin değerlendirilmesi

Lista (LISTA) iyi bir yatırım mı?: Bu yükselen kripto paranın potansiyel riskleri ve getirileri değerlendiriliyor

2025 TRIBE Fiyat Tahmini: Bu DeFi Token’ı Kripto Piyasasında Yeni Zirvelere Taşıyacak mı?

FARM Token akışındaki değişiklikler, 2025 yılında Harvest Finance'in piyasa konumu üzerinde nasıl bir etki yaratır?

2025 CRV Fiyat Tahmini: Piyasa Trendleri, Benimsenme Göstergeleri ve Curve DAO Token Değerini Belirleyen Ana Etkenlerin Analizi

Şubat 2025’te İzlenmesi Gereken Yeni Dijital Varlıklar

2023 Bitcoin Piyasa Görünümü: Robert Kiyosaki'nin Değerlendirmeleri