2025 TRIBE Price Prediction: Will This DeFi Token Surge to New Heights in the Crypto Market?

Introduction: TRIBE's Market Position and Investment Value

Tribe (TRIBE), as the governance token of the Fei Protocol, has achieved significant milestones since its inception in 2021. As of 2025, TRIBE's market capitalization has reached $279,243,031, with a circulating supply of approximately 455,015,530 tokens, and a price hovering around $0.6137. This asset, known as the "decentralized stablecoin governance token," is playing an increasingly crucial role in the creation of fair and scalable stablecoins on the Ethereum network.

This article will comprehensively analyze TRIBE's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. TRIBE Price History Review and Current Market Status

TRIBE Historical Price Evolution

- 2021: TRIBE launched in April, reaching an all-time high of $2.45 on April 4

- 2022: Market downturn, price dropped to an all-time low of $0.14412 on August 19

- 2024-2025: Recovery period, price rebounded to current levels around $0.6137

TRIBE Current Market Situation

As of October 18, 2025, TRIBE is trading at $0.6137. The token has experienced a 62.82% increase over the past year, indicating a strong recovery from its 2022 lows. However, short-term performance shows mixed results. In the last 24 hours, TRIBE has seen a 2.44% decrease, while the 7-day performance shows a 4.64% gain. The token's market capitalization stands at $279,243,031, ranking it 228th in the cryptocurrency market. With a circulating supply of 455,015,530 TRIBE tokens, representing 45.50% of the total supply, the project maintains a balanced token distribution.

Click to view the current TRIBE market price

TRIBE Market Sentiment Indicator

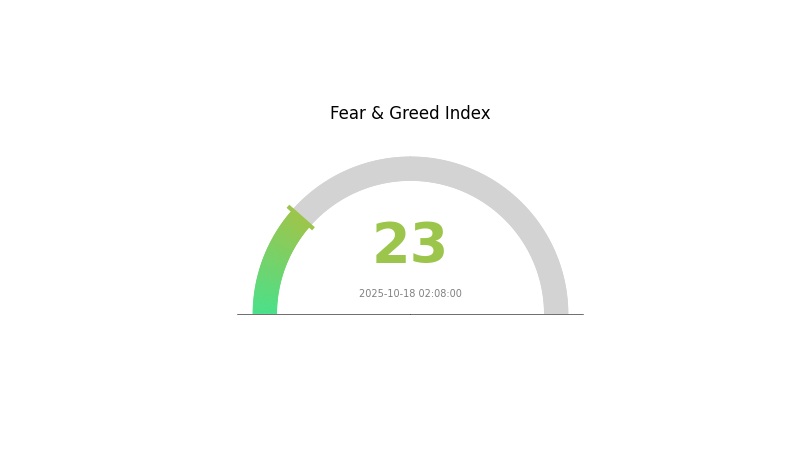

2025-10-18 Fear and Greed Index: 23 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is gripped by extreme fear today, with the Fear and Greed Index plummeting to 23. This heightened anxiety suggests investors are overly pessimistic, potentially creating buying opportunities for contrarian traders. However, caution is advised as the market sentiment could lead to further price declines. It's crucial to conduct thorough research and consider your risk tolerance before making any investment decisions in this volatile environment. Remember, market sentiment can shift rapidly in the crypto space.

TRIBE Holdings Distribution

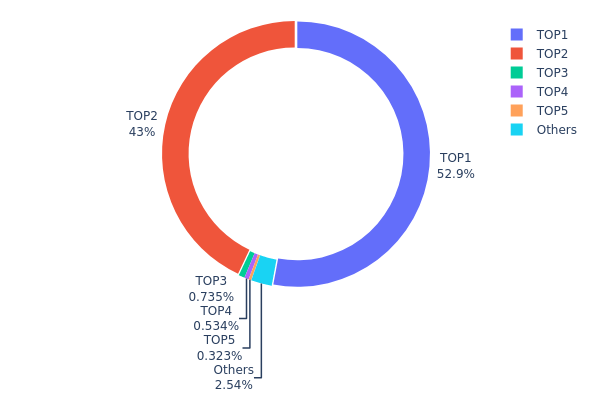

The address holdings distribution data reveals a highly concentrated ownership structure for TRIBE tokens. The top two addresses collectively hold an overwhelming 95.86% of the total supply, with 52.89% and 42.97% respectively. This extreme concentration raises significant concerns about centralization and potential market manipulation.

Such a concentrated distribution can lead to increased volatility and susceptibility to large price swings based on the actions of these major holders. It also implies a low level of decentralization, which may conflict with the principles of many blockchain projects. The remaining addresses, including the next three largest holders, account for only 1.58% of the supply, further highlighting the imbalance in token distribution.

This concentration of TRIBE tokens in so few hands could potentially impact market dynamics, liquidity, and governance decisions if TRIBE is used for voting or staking purposes. It suggests a need for careful monitoring of large transactions and potential redistribution efforts to enhance the token's decentralization and overall market health.

Click to view the current TRIBE Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x8d5e...35d7b9 | 528937.89K | 52.89% |

| 2 | 0x4d96...08b4d5 | 429796.14K | 42.97% |

| 3 | 0xc09b...6909f7 | 7347.59K | 0.73% |

| 4 | 0x7bda...439aa3 | 5335.18K | 0.53% |

| 5 | 0x38af...4f1e5f | 3226.37K | 0.32% |

| - | Others | 25356.83K | 2.56% |

II. Key Factors Affecting TRIBE's Future Price

Supply Mechanism

- Fixed Supply: TRIBE has a fixed maximum supply, which limits inflation and could potentially support long-term price stability.

Institutional and Whale Dynamics

- Enterprise Adoption: Some decentralized finance (DeFi) projects have integrated TRIBE into their ecosystems, potentially increasing its utility and demand.

Macroeconomic Environment

- Inflation Hedge Properties: As a cryptocurrency, TRIBE may be viewed as a potential hedge against inflation, similar to other digital assets.

Technical Development and Ecosystem Building

- Ecosystem Applications: TRIBE is part of the Tribe DAO ecosystem, which includes various DeFi protocols and applications that could drive demand for the token.

III. TRIBE Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.42 - $0.55

- Neutral prediction: $0.55 - $0.65

- Optimistic prediction: $0.65 - $0.72 (requires strong market recovery and increased adoption)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increased volatility

- Price range forecast:

- 2027: $0.68 - $0.87

- 2028: $0.57 - $0.95

- Key catalysts: Project development milestones, broader crypto market trends, and regulatory clarity

2029-2030 Long-term Outlook

- Base scenario: $0.86 - $1.00 (assuming steady growth and adoption)

- Optimistic scenario: $1.00 - $1.20 (with favorable market conditions and strong project performance)

- Transformative scenario: $1.20 - $1.34 (with breakthrough innovations and mass adoption)

- 2030-12-31: TRIBE $0.99 (potential stabilization point after significant growth)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.71756 | 0.6133 | 0.42318 | 0 |

| 2026 | 0.73197 | 0.66543 | 0.51238 | 8 |

| 2027 | 0.87338 | 0.6987 | 0.67774 | 13 |

| 2028 | 0.95111 | 0.78604 | 0.57381 | 28 |

| 2029 | 1.11177 | 0.86857 | 0.77303 | 41 |

| 2030 | 1.33674 | 0.99017 | 0.72283 | 61 |

IV. Professional Investment Strategies and Risk Management for TRIBE

TRIBE Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors and DeFi enthusiasts

- Operation suggestions:

- Accumulate TRIBE tokens during market dips

- Participate in governance to influence protocol development

- Store tokens in secure non-custodial wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Monitor short-term and long-term trends

- Relative Strength Index (RSI): Identify overbought or oversold conditions

- Key points for swing trading:

- Monitor Fei Protocol updates and governance proposals

- Track overall DeFi market sentiment

TRIBE Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across various DeFi projects

- Stop-loss orders: Set predetermined exit points to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holding

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for TRIBE

TRIBE Market Risks

- Volatility: DeFi tokens can experience significant price swings

- Competition: Emergence of new stablecoin protocols may impact demand

- Liquidity: Potential for reduced liquidity during market stress

TRIBE Regulatory Risks

- Stablecoin regulations: Potential impact from new regulatory frameworks

- DeFi scrutiny: Increased regulatory focus on decentralized finance

- Cross-border restrictions: Varying legal status in different jurisdictions

TRIBE Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs

- Scalability challenges: Ethereum network congestion may affect usability

- Oracle failures: Reliance on external data sources for price feeds

VI. Conclusion and Action Recommendations

TRIBE Investment Value Assessment

TRIBE offers exposure to the growing DeFi ecosystem, particularly in the stablecoin sector. Long-term value is tied to Fei Protocol's adoption and success, while short-term volatility remains a significant risk.

TRIBE Investment Recommendations

✅ Beginners: Start with small positions, focus on learning about DeFi ✅ Experienced investors: Consider TRIBE as part of a diversified DeFi portfolio ✅ Institutional investors: Evaluate TRIBE for potential governance influence and ecosystem participation

TRIBE Trading Participation Methods

- Spot trading: Buy and sell TRIBE on Gate.com

- Staking: Participate in liquidity provision if available

- Governance: Engage in protocol decision-making processes

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Will trx coin reach $10?

It's unlikely TRX will reach $10 in the near future. Given its current price and market cap, a $10 valuation would require massive growth and adoption. However, long-term price predictions are uncertain in the volatile crypto market.

What is the prediction for Tellor in 2025?

Based on market trends and expert analysis, Tellor (TRB) is predicted to reach around $150-$200 by 2025, showing significant growth potential in the decentralized oracle space.

How much will 1 Bitcoin be worth in 2030?

Based on current trends and expert predictions, 1 Bitcoin could potentially be worth around $500,000 to $1,000,000 by 2030. However, cryptocurrency markets are highly volatile and unpredictable.

What is the price of Tribe coin?

As of October 18, 2025, the price of Tribe coin is $0.85. The cryptocurrency has shown steady growth over the past year, with increased adoption in decentralized finance projects.

2025 CRV Price Prediction: Analyzing Market Trends and Potential Growth Factors for Curve DAO Token

Is MakerDAO (MKR) a good investment?: Analyzing the potential and risks of the leading DeFi protocol token

Is Curve (CRV) a good investment?: Analyzing the potential and risks of this DeFi token in today's market

Is Lista (LISTA) a good investment?: Evaluating the potential risks and rewards of this emerging cryptocurrency

How Does FARM Token Flow Impact Harvest Finance's Market Position in 2025?

2025 CRVPrice Prediction: Analyzing Market Trends, Adoption Metrics, and Key Factors Driving Curve DAO Token Valuation

How Active Is WNCG Community and Ecosystem in 2026: Twitter Followers, Developer Contribution, and DApp Growth

What is GoPlus Security (GPS) token: whitepaper logic, use cases, and technical innovation explained

What Is a Bitcoin (BTC) Wallet Address?

WAGMI Meaning

How to Compare Crypto Competitors: Market Share, Performance, and User Base Analysis in 2026