2025 HYPEPrice Prediction: Analyzing Market Trends and Growth Potential for the Next Crypto Breakthrough

Introduction: HYPE's Market Position and Investment Value

Hyperliquid (HYPE), as a high-performance L1 blockchain optimized for on-chain financial applications, has made significant strides since its inception. As of 2025, HYPE's market capitalization has reached $14.79 billion, with a circulating supply of approximately 270,772,999 tokens, and a price hovering around $54.621. This asset, often referred to as the "on-chain financial powerhouse," is playing an increasingly crucial role in decentralized finance (DeFi) and permissionless financial applications.

This article will provide a comprehensive analysis of HYPE's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. HYPE Price History Review and Current Market Status

HYPE Historical Price Evolution

- 2024: HYPE launched, price started at $0.011812

- 2025: Significant growth, price reached all-time high of $55.187 on September 9th

HYPE Current Market Situation

HYPE is currently trading at $54.621, close to its all-time high. The token has shown remarkable performance, with a 7.83% increase in the last 24 hours and a substantial 1604.82% gain over the past year. The current market cap stands at $14,789,892,002, ranking HYPE 14th in the crypto market. With a circulating supply of 270,772,999 HYPE tokens, representing 27.08% of the total supply, the project has a fully diluted valuation of $54,621,000,000. The 24-hour trading volume is $32,341,448, indicating active market participation.

Click to view the current HYPE market price

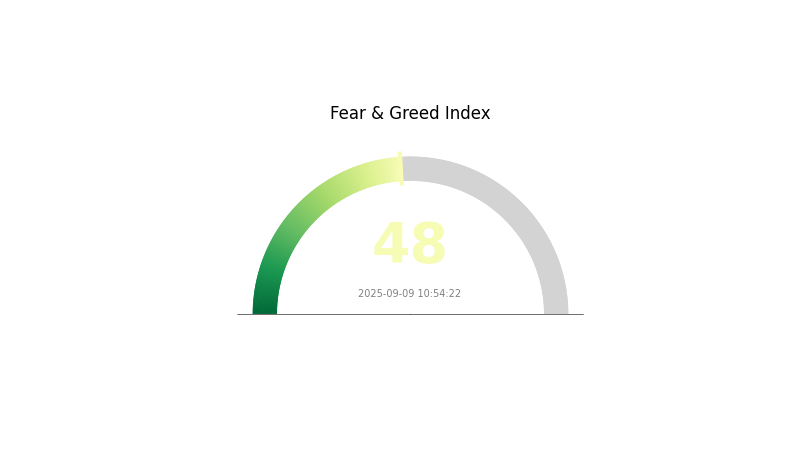

HYPE Market Sentiment Indicator

2025-09-09 Fear and Greed Index: 48 (Neutral)

Click to view the current Fear & Greed Index

The crypto market sentiment remains balanced today, with the Fear and Greed Index at 48, indicating a neutral stance. This suggests investors are neither overly optimistic nor pessimistic about the current market conditions. While caution is still advisable, the neutral sentiment may present opportunities for both buying and selling. As always, it's crucial to conduct thorough research and manage risk wisely when making investment decisions in the volatile crypto market.

HYPE Holdings Distribution

The address holdings distribution data for HYPE reveals an interesting pattern in token ownership. This metric provides insights into the concentration of HYPE tokens among different addresses on the blockchain.

Based on the available data, it appears that HYPE's distribution is currently characterized by a high level of decentralization. There are no addresses holding significant percentages of the total supply, which suggests a relatively even distribution among token holders. This lack of concentration is generally seen as a positive indicator for the project's decentralization efforts and overall market health.

The absence of large individual holdings reduces the risk of market manipulation and excessive price volatility caused by the actions of a few major players. This distributed ownership structure may contribute to a more stable and resilient market for HYPE, potentially fostering greater confidence among investors and users of the platform.

Click to view the current HYPE Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Key Factors Influencing HYPE's Future Price

Supply Mechanism

- Deflationary Tokenomics: Hyperliquid burns 97% of transaction fees, significantly reducing circulating supply.

- Historical Pattern: High buyback rate has consistently increased token value.

- Current Impact: The platform's aid fund has repurchased nearly 30 million HYPE tokens, supporting price stability.

Institutional and Whale Dynamics

- Enterprise Adoption: Traditional financial institutions are showing interest in Layer 2 derivatives platforms like Hyperliquid.

Macroeconomic Environment

- Inflation Hedging Properties: HYPE has demonstrated potential as a hedge against inflation in the current economic climate.

Technological Development and Ecosystem Building

- HyperEVM: Compatibility with Ethereum smart contracts, expanding the ecosystem.

- Cross-margin Trading: Potential protocol upgrade to enhance user experience.

- Ecosystem Applications: Felix, a key DApp incubated on the Hyperliquid platform.

III. HYPE Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $31.755 - $54.75

- Neutral prediction: $54.75 - $57.4875

- Optimistic prediction: $57.4875 - $60 (requires strong market momentum)

2027 Outlook

- Market stage expectation: Potential growth phase

- Price range forecast:

- 2026: $47.70094 - $60.60825

- 2027: $40.27082 - $69.45257

- Key catalysts: Increased adoption, technological advancements

2030 Long-term Outlook

- Base scenario: $41.50923 - $72.8232 (assuming steady market growth)

- Optimistic scenario: $72.8232 - $76.46436 (with favorable market conditions)

- Transformative scenario: $76.46436 - $80 (with exceptional market performance)

- 2030-12-31: HYPE $72.8232 (33% increase from 2025)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 57.4875 | 54.75 | 31.755 | 0 |

| 2026 | 60.60825 | 56.11875 | 47.70094 | 2 |

| 2027 | 69.45257 | 58.3635 | 40.27082 | 6 |

| 2028 | 71.577 | 63.90803 | 48.5701 | 17 |

| 2029 | 77.90389 | 67.74251 | 37.25838 | 24 |

| 2030 | 76.46436 | 72.8232 | 41.50923 | 33 |

IV. HYPE Professional Investment Strategies and Risk Management

HYPE Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term value investors

- Operation suggestions:

- Accumulate HYPE tokens during market dips

- Set price targets and stick to your investment plan

- Store tokens in secure wallets with private key control

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversals

- RSI (Relative Strength Index): Monitor overbought/oversold conditions

- Key points for swing trading:

- Set clear entry and exit points based on technical indicators

- Use stop-loss orders to manage downside risk

HYPE Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of portfolio

- Aggressive investors: 5-10% of portfolio

- Professional investors: Up to 15% of portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple cryptocurrencies

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hardware wallet recommendation: Gate Web3 Wallet

- Software wallet solution: Official Hyperliquid wallet (if available)

- Security precautions: Enable two-factor authentication, use strong passwords, and keep private keys offline

V. Potential Risks and Challenges for HYPE

HYPE Market Risks

- High volatility: Cryptocurrency markets are known for rapid price fluctuations

- Liquidity risk: HYPE may face liquidity issues in certain market conditions

- Competition: Other Layer 1 solutions may outperform Hyperliquid

HYPE Regulatory Risks

- Uncertain regulatory environment: Cryptocurrency regulations are evolving globally

- Compliance challenges: Hyperliquid may face scrutiny from financial regulators

- Potential restrictions: Some countries may limit or ban cryptocurrency trading

HYPE Technical Risks

- Smart contract vulnerabilities: Potential bugs in the protocol could lead to security breaches

- Scalability challenges: Hyperliquid may face issues as network usage increases

- Technological obsolescence: Newer blockchain technologies could potentially outpace Hyperliquid

VI. Conclusion and Action Recommendations

HYPE Investment Value Assessment

Hyperliquid (HYPE) presents a promising long-term value proposition as a high-performance Layer 1 blockchain focused on on-chain financial applications. However, investors should be aware of short-term volatility and regulatory uncertainties in the cryptocurrency market.

HYPE Investment Recommendations

✅ Beginners: Start with small positions and focus on learning about the technology

✅ Experienced investors: Consider allocating a portion of your crypto portfolio to HYPE based on your risk tolerance

✅ Institutional investors: Conduct thorough due diligence and consider HYPE as part of a diversified crypto strategy

HYPE Trading Participation Methods

- Spot trading: Buy and hold HYPE tokens on Gate.com

- Futures trading: Engage in leveraged trading of HYPE contracts on Gate.com

- Staking: Participate in staking programs if offered by the Hyperliquid network

Cryptocurrency investment carries extremely high risk, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Is hype a good buy?

Yes, HYPE is considered a good buy in 2025. Strong technicals, record trading volumes, and platform growth support its positive outlook. Analysts predict continued upward momentum.

Is Hyper Coin a good investment?

Hyper Coin shows potential as an investment due to its innovative cross-chain technology. With growing adoption, it could see significant value increase by 2025.

What is the hyper price prediction for 2040?

Based on current market analysis, the price of Hyper is predicted to range between $0.3486 and $0.9238 by 2040.

What is the price of hype?

The current price of HYPE is $49.859, up 2.26% in the last 24 hours. It reached its all-time high of $49.878 on July 13, 2025.

ONE vs NEAR: Comparing Two Blockchain Platforms for Scalable DApp Development

DFND vs OP: The Battle of Cybersecurity Titans in the Digital Age

Gate Square Spark Program 2025: Web3 Innovation Incubation to Support Blockchain Entrepreneurship

2025 SUI价格预测:区块链新贵的未来发展与投资价值分析

2025 NEAR Price Prediction: A Comprehensive Analysis of Factors Driving the Next Bull Run in the NEAR Protocol Ecosystem

2025 INJ Price Prediction: A Comprehensive Analysis of Market Trends and Growth Potential for Injective Protocol

# What Are On-Chain Data Analysis Metrics and How Do Whales, Active Addresses, and Transaction Volume Impact Crypto Markets?

How to Use MACD, RSI, and KDJ Technical Indicators for Crypto Trading Signals

What are the regulatory and compliance risks for crypto projects in 2026?

What is EVAA Protocol's On-Chain Data Analysis: Active Addresses, Whale Movements, and Transaction Trends in 2026?

What are the main smart contract vulnerabilities and security risks in DeFi protocols like EVAA?