2025 JTO Fiyat Tahmini: Jito Network Token DeFi Ekosisteminde Yeni Zirvelere Yükselir mi?

Giriş: JTO’nun Piyasa Konumu ve Yatırım Değeri

Jito (JTO), Solana ekosisteminin önde gelen yönetişim token’ı olarak, 2023’te piyasaya sürülmesinden bu yana kayda değer bir ilerleme gösterdi. 2025 yılı itibarıyla, Jito’nun piyasa değeri 449.848.655 $’a ulaşırken, yaklaşık 389.816.859 adet dolaşımdaki arzı ve 1,154 $ civarında seyreden fiyatıyla dikkat çekiyor. “Solana Ağ Güçlendiricisi” olarak anılan bu varlık, Jito Network’ün ve genel Solana ekosisteminin geleceğini şekillendirmede giderek daha belirleyici bir rol üstleniyor.

Bu makalede, Jito’nun 2025-2030 dönemindeki fiyat eğilimleri kapsamlı şekilde analiz edilecek; geçmiş fiyat hareketleri, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik etkenler bir araya getirilerek profesyonel fiyat öngörüleri ve yatırımcılar için uygulanabilir stratejiler sunulacaktır.

I. JTO Fiyat Geçmişi ve Güncel Piyasa Durumu

JTO Tarihsel Fiyat Seyri

- 2023: JTO Aralık’ta piyasaya çıktı, ilk fiyatı yaklaşık 0,2 $

- 2024: 3 Nisan’da 5,323 $ ile tüm zamanların en yüksek seviyesine ulaştı

- 2025: Sert bir düşüş yaşandı, fiyat şu anda 1,154 $ seviyesinde

JTO Güncel Piyasa Görünümü

JTO şu an 1,154 $ seviyesinden işlem görüyor, 24 saatlik işlem hacmi 2.917.441 $’dır. Son 24 saatte %1,85 artış kaydedildi. Ancak, JTO uzun vadede ciddi düşüşler yaşadı; son bir haftada %26,40, son 30 günde %36,94 değer kaybetti. Piyasa değeri 449.848.655 $ olan JTO, toplam kripto para piyasasında 169. sıradadır. Dolaşımdaki arz 389.816.859 JTO, toplam arz ise 1 milyar. Mevcut fiyat, zirveden %78,33 gerilemiş durumda.

Güncel JTO piyasa fiyatını görüntüleyin

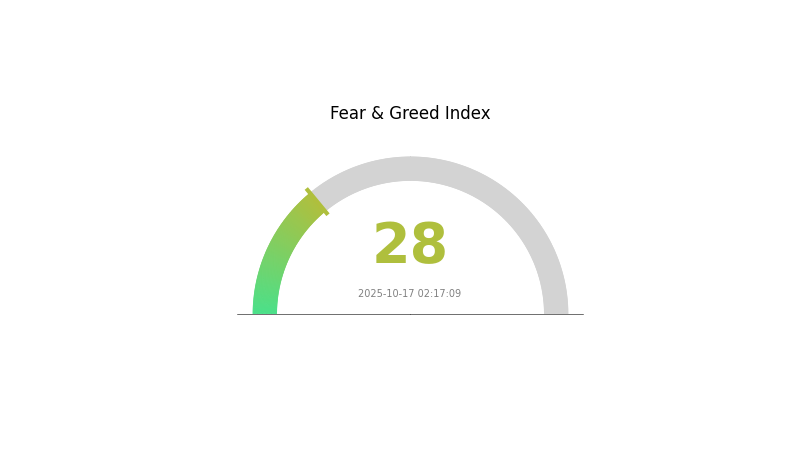

JTO Piyasa Duyarlılık Göstergesi

2025-10-17 Korku ve Açgözlülük Endeksi: 28 (Korku)

Güncel Korku & Açgözlülük Endeksini inceleyin

Kripto piyasasında duyarlılık temkinli; Korku ve Açgözlülük Endeksi 28’de ve korku hakim. Bu, yatırımcıların temkinli davranıp alım fırsatlarını gözlediğini gösteriyor olabilir. Yine de piyasa duyarlılığının hızla değişebileceği unutulmamalı. Korku ortamı uzun vadeli yatırımcılar için giriş fırsatı sunsa da, yatırım öncesi detaylı araştırma yapmak ve risk yönetimini önceliklendirmek gerekir.

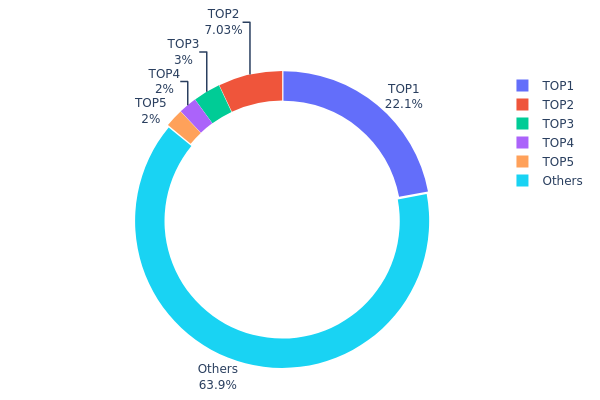

JTO Token Dağılımı

Adres bazlı sahiplik dağılımı, JTO token’larında belirgin bir yoğunlaşma olduğunu ortaya koyuyor. En büyük adres arzın %22,07’sini elinde bulunduruyor ve piyasada belirleyici bir etki yaratıyor. İlk 5 adresin toplam payı %36,09 olurken, kalan %63,91 ise diğer yatırımcılara dağılmış durumda.

Bu derecede yoğunluk, piyasa istikrarı ve fiyat oynaklığı açısından riskler doğuruyor. En büyük adresin hakimiyeti, büyük işlemlerde fiyatlarda ciddi dalgalanmalara neden olabilir. İlk 5 yatırımcıdaki yoğunlaşma ise piyasada manipülasyon ya da koordineli hareketlerle token değerinin etkilenmesi endişesini artırıyor.

Token’ların çoğu ilk 5 adres dışındakilerde olsa da mevcut yapı, orta düzeyde merkezileşmeye işaret ediyor. Bu tablo, projenin merkeziyetsizlik hedeflerine etki edebilir ve adil piyasa koşullarının sağlanması ile küçük yatırımcıların korunması için izlenmelidir.

Güncel JTO Token Dağılımını görüntüleyin

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 5eosrv...tcmGTF | 220.744,91K | 22,07% |

| 2 | 5SybwT...yPT8ey | 70.288,94K | 7,02% |

| 3 | 71sDbd...jgYV2m | 30.000,00K | 3,00% |

| 4 | FQnVcn...fRY8ud | 20.000,00K | 2,00% |

| 5 | CsWayf...2LSUyK | 20.000,00K | 2,00% |

| - | Others | 638.965,81K | 63,91% |

II. JTO’nun Gelecekteki Fiyatını Belirleyen Temel Faktörler

Arz Mekanizması

- Likidite Madenciliği: JTO’daki enflasyonun ana kaynağı DeFi protokollerinde gerçekleşen likidite madenciliğidir. Yüksek teşvikler, jitoSOL talebini ve TVL’yi yükselterek JTO yatırımlarını tetikleyebilir.

- Mevcut Etki: Ekip, likidite madenciliği ödülleriyle JTO talebi arasındaki ilişki nedeniyle fiyatı desteklemek için teşviklere sahip olabilir.

Kurumsal ve Büyük Yatırımcı Dinamikleri

- Kurumsal Benimseme: JTO’nun yönetişimdeki işlevi ve Solana ekosistemindeki rolü, onu kripto piyasasında önemli bir varlık haline getiriyor.

Makroekonomik Ortam

- Jeopolitik Etkenler: Uluslararası gelişmeler ve olası gümrük vergisi değişiklikleri, JTO dahil küresel kripto piyasasını etkileyebilir.

Teknolojik Gelişim ve Ekosistem Oluşumu

- Ekosistem Uygulamaları: Solana ekosistemi içindeki Jito Network’ün büyümesi, stratejik airdrop’lar ve topluluk katılımı sayesinde etkisi ve yenilikçi gücü arttı.

- Ekosistem Gelişimi: Jito ekosisteminde yaşanacak büyük gelişmeler, ortaklıklar veya ağ performansındaki iyileşmeler JTO fiyatını etkileyebilir.

III. 2025-2030 JTO Fiyat Tahmini

2025 Görünümü

- İhtiyatlı tahmin: 0,69 $ – 1,00 $

- Tarafsız tahmin: 1,00 $ – 1,15 $

- İyimser tahmin: 1,15 $ – 1,22 $ (olumlu piyasa koşullarıyla)

2027-2028 Görünümü

- Piyasa aşaması: Potansiyel yükseliş evresi

- Fiyat aralığı tahmini:

- 2027: 0,76 $ – 1,69 $

- 2028: 1,03 $ – 1,99 $

- Kilit katalizörler: Artan benimseme, teknolojik gelişmeler ve genel kripto piyasasının toparlanması

2030 Uzun Vadeli Görünüm

- Temel senaryo: 1,04 $ – 1,90 $ (istikrarlı piyasa büyümesi varsayımıyla)

- İyimser senaryo: 1,90 $ – 2,75 $ (güçlü kripto piyasası performansı ile)

- Dönüştürücü senaryo: 2,75 $ üzeri (çığır açan kullanım alanları ve kitlesel benimsemeyle)

- 2030-12-31: JTO 1,90 $ (piyasa koşullarına bağlı olası ortalama fiyat)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim (%) |

|---|---|---|---|---|

| 2025 | 1,22006 | 1,151 | 0,6906 | 0 |

| 2026 | 1,33965 | 1,18553 | 1,10254 | 2 |

| 2027 | 1,69187 | 1,26259 | 0,75755 | 9 |

| 2028 | 1,99426 | 1,47723 | 1,03406 | 28 |

| 2029 | 2,06554 | 1,73574 | 1,09352 | 50 |

| 2030 | 2,75593 | 1,90064 | 1,04535 | 64 |

IV. JTO Profesyonel Yatırım Stratejileri ve Risk Yönetimi

JTO Yatırım Yaklaşımı

(1) Uzun Vadeli Tutma Stratejisi

- Kimler için: Uzun vadeli yatırımcılar ve Solana ekosistemi destekçileri

- Uygulama önerileri:

- Piyasa düşüşlerinde JTO biriktirin

- Kısmi kar realizasyonu için hedef fiyatlar belirleyin

- Varlıkları güvenli, kendi saklamalı bir cüzdanda tutun

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trend ve destek/direnç seviyelerini belirlemek için

- RSI (Göreceli Güç Endeksi): Aşırı alım/aşırı satım noktalarını tespit etmek için

- Dalgalı al-sat için ana noktalar:

- Solana ekosistemindeki gelişmeleri yakından izleyin

- Zarar-durdur emirleriyle riskinizi yönetin

JTO Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Ihtiyatlı yatırımcılar: Kripto portföyünün %1-3’ü

- Agresif yatırımcılar: Kripto portföyünün %5-10’u

- Profesyonel yatırımcılar: Kripto portföyünün %15’ine kadar

(2) Riskten Korunma Çözümleri

- Diversifikasyon: Yatırımları birden fazla Solana ekosistem token’ına dağıtın

- Zarar-durdur emirleri: Potansiyel kayıpları sınırlamak için kullanın

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan önerisi: Gate Web3 Cüzdan

- Soğuk depolama: Uzun vadeli tutumlar için donanım cüzdanı

- Güvenlik önlemleri: İki faktörlü kimlik doğrulama ve güçlü parolalar kullanın

V. JTO İçin Potansiyel Riskler ve Zorluklar

JTO Piyasa Riskleri

- Yüksek volatilite: JTO fiyatında ciddi dalgalanmalar görülebilir

- Solana ile korelasyon: JTO’nun başarısı Solana ile yakından bağlantılıdır

- Rekabet: Solana tabanlı diğer projeler JTO’nun pazar payını etkileyebilir

JTO Düzenleyici Riskler

- Belirsiz regülasyon ortamı: Yönetişim token’larına sıkı düzenlemeler getirilebilir

- Uyum zorlukları: JTO’nun finansal otoritelerce incelenme olasılığı

- Hukuki sınıflandırma: Bazı ülkelerde menkul kıymet olarak değerlendirilme riski

JTO Teknik Riskler

- Akıllı sözleşme açıkları: Token sözleşmesinde hata ya da istismar olasılığı

- Solana ağına bağımlılık: JTO, Solana’nın performansı ve istikrarına bağlıdır

- Yönetişim saldırı riskleri: Kötü niyetli aktörler yönetişim kararlarını manipüle edebilir

VI. Sonuç ve Eylem Önerileri

JTO Yatırım Değeri Değerlendirmesi

JTO, Solana ekosisteminde yüksek risk-yüksek getiri potansiyeliyle öne çıkar. Uzun vadeli değeri Jito Network’ün başarısına bağlıyken, kısa vadeli dalgalanma önemli riskler barındırır.

JTO Yatırım Önerileri

✅ Yeni başlayanlar: Solana ekosistemi stratejinizin parçası olarak küçük ve çeşitlendirilmiş pozisyonlar düşünün ✅ Deneyimli yatırımcılar: Dolar maliyeti ortalaması uygulayın, net kar hedefleri belirleyin ✅ Kurumsal yatırımcılar: Kapsamlı analiz yapın, JTO’yu Solana ekosistemi portföyünüzde değerlendirin

JTO Alım-Satım Katılım Yöntemleri

- Spot alım-satım: Gate.com üzerinden JTO alıp satın

- Staking: Mevcutsa JTO staking programlarına katılın

- Yönetişim: JTO token’larınızı Jito Network yönetişiminde kullanın

Kripto para yatırımları çok yüksek risk içerir, bu makale yatırım tavsiyesi değildir. Yatırım kararlarınızı risk toleransınıza göre dikkatle verin ve profesyonel finansal danışmanlardan görüş alın. Kaldıramayacağınızdan fazla yatırım yapmayın.

SSS

JTO kripto fiyat tahmini nedir?

JTO’nun 2025 Ekim ayında 0,766 $ ile 1,09 $ arasında dalgalanması bekleniyor. Analistler, 2033’te 38,38 $’a ulaşabileceğini öngörüyor.

JTO’nun geleceği nedir?

JTO’nun geleceği olumlu görünüyor; fiyat tahminleri 2,78 $ seviyelerine işaret ediyor. Piyasa trendleri, bu kripto paranın uzun vadede büyümesini ve değer kazanmasını öngörüyor.

JITO alınır mı, satılır mı?

Mevcut piyasa trendleri ve Jito’nun Solana ekosistemindeki yeri dikkate alındığında, JITO potansiyel bir alım fırsatı sunabilir. Yönetişim fonksiyonu uzun vadeli değer potansiyeline işaret ediyor.

Jito Crypto ne işe yarar?

Jito, staking verimliliğini artıran, MEV ödüllerini dağıtan ve merkeziyetsiz yönetişimi destekleyen bir Solana protokolüdür; blockchain ağında performans ve adaletin yükseltilmesini amaçlar.

2025 RAY Fiyat Tahmini: Önümüzdeki Yıllarda RAY Token’ın Büyüme Dinamikleri ve Piyasa Potansiyelinin Değerlendirilmesi

2025 RAY Fiyat Tahmini: Gelişen DeFi Ekosisteminde Bu Katman-1 Protokolü Yeni Zirvelere Ulaşabilir mi?

2025 KMNO Fiyat Tahmini: Piyasa Eğilimleri, Ana Etkenler ve Yatırım Perspektifi

2025 JUP Fiyat Tahmini: Değişen Kripto Piyasasında Jupiter'ın Potansiyelinin Analizi

2025 RAY Fiyat Tahmini: Piyasa Trendleri ve Olası Büyüme Faktörlerinin Analizi

HLN ve SOL: Kripto Para Arenasında Devlerin Mücadelesi

Yeni Düzenleyici Çerçeve Bitcoin ve Kripto Para Pazarları için Dönüm Noktası İşaret Ediyor

DOT vs TRX: İki Lider Blockchain Platformunun Kapsamlı Karşılaştırılması

Gate Ventures Haftalık Kripto Özeti (15 Aralık 2025)

CC Nedir: Creative Commons’a Kapsamlı Bir Rehber ve Dijital İçerik Paylaşımına Etkisi

TAO Nedir: Antik Çin’in Yol Felsefesini ve Modern Uygulamalarını Anlamak