2025 RAY Fiyat Tahmini: Piyasa Trendleri ve Olası Büyüme Faktörlerinin Analizi

Giriş: RAY’in Piyasa Konumu ve Yatırım Değeri

Raydium (RAY), Solana blokzinciri üzerinde geliştirilmiş otomatik piyasa yapıcı (AMM) ve likidite sağlayıcı olarak, 2021’den bu yana merkeziyetsiz finans (DeFi) ekosisteminin kilit aktörlerinden biri haline geldi. 2025 yılı itibarıyla Raydium’un piyasa değeri 482.669.172 dolar seviyesine ulaşırken, dolaşımdaki arz yaklaşık 268.149.540 token ve fiyatı ise 1,8 dolar civarında seyrediyor. “Solana DeFi Katalizörü” olarak anılan bu varlık, merkeziyetsiz borsalarda ve likidite sunumunda giderek daha önemli bir rol üstleniyor.

Bu makalede, Raydium’un 2025-2030 yılları arasındaki fiyat trendleri, tarihsel desenler, piyasa arz-talep dengeleri, ekosistem gelişimi ve makroekonomik etkenler göz önünde bulundurularak kapsamlı şekilde analiz edilecek; yatırımcılara profesyonel fiyat tahminleri ve uygulanabilir stratejiler sunulacaktır.

I. RAY Fiyat Geçmişi ve Güncel Piyasa Durumu

RAY Tarihsel Fiyat Seyri

- 2021: Lansman ve hızlı yükseliş, 13 Eylül’de 16,83 dolar ile tüm zamanların zirvesine (ATH) ulaştı

- 2022: Piyasa düşüşü, 30 Aralık’ta 0,134391 dolar ile tüm zamanların en düşük seviyesine (ATL) geriledi

- 2023-2025: Kademeli toparlanma ve istikrar, fiyat 1-2 dolar aralığında dalgalanıyor

RAY Güncel Piyasa Durumu

17 Ekim 2025 itibarıyla RAY, 1,8 dolar seviyesinden işlem görüyor; 24 saatlik işlem hacmi 3.624.993 dolar. Token, son 24 saatte %3,98 değer kaybetti. RAY’ın piyasa değeri 482.669.172 dolar olup, kripto para piyasasında 161. sırada yer alıyor. Dolaşımdaki arz 268.149.540 RAY token ile toplam arzın %48,31’ini (555.000.000 RAY) oluşturuyor. Token fiyatı, farklı periyotlarda dikkate değer düşüşler yaşadı; son bir haftada %32,80, son bir ayda ise %43,55 geriledi. Yıllık bazda ise, RAY yalnızca %10,53’lük bir azalma ile görece direnç gösterdi.

Güncel RAY piyasa fiyatını görmek için tıklayın

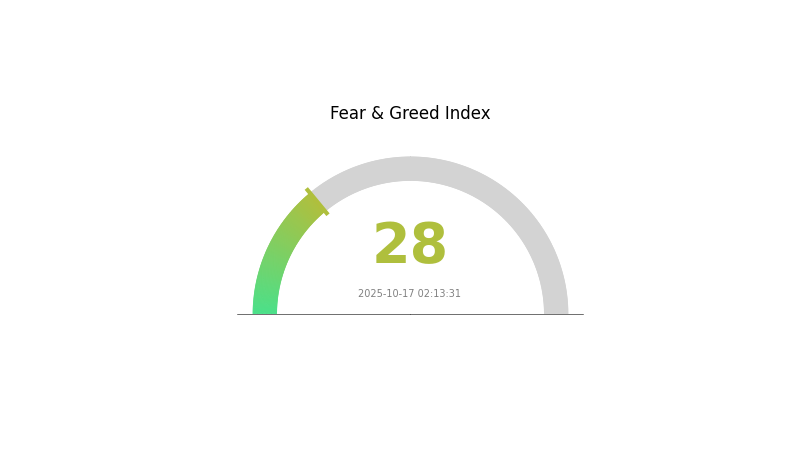

RAY Piyasa Duyarlılık Endeksi

2025-10-17 Korku ve Açgözlülük Endeksi: 28 (Korku)

Güncel Korku & Açgözlülük Endeksi için tıklayın

Kripto piyasasında şu anda güven eksikliği hakim; duyarlılık endeksi 28 ile düşük seviyede. Bu ayı havası, yatırımcıların temkinli davranmasına neden oluyor. Fakat deneyimli yatırımcılar için piyasadaki korku, alım fırsatları sunabilir. Unutulmamalıdır ki piyasa duyguları döngüseldir; korku dönemleri çoğunlukla toparlanmanın habercisidir. Güncel kalın, riski akıllıca yönetin ve bu belirsiz ortamda maliyet ortalaması stratejilerini göz önünde bulundurun.

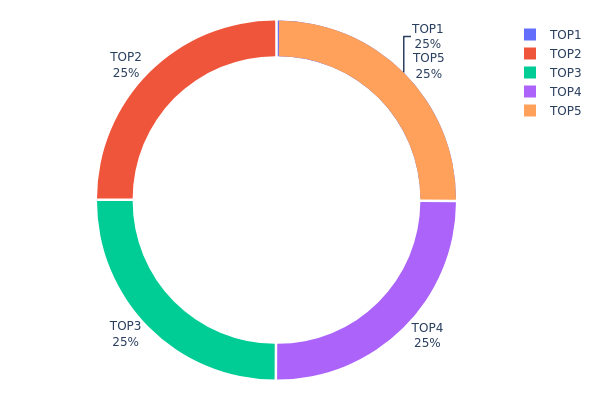

RAY Varlık Dağılımı

RAY adres varlık dağılımı verileri, oldukça yoğunlaşmış bir sahiplik yapısına işaret ediyor. İlk 5 adresin her biri 138.590,93K RAY tutarak toplam arzın %24,97’sini elinde bulunduruyor. Bu ilk 5 adres, toplamda RAY tokenlerinin %124,85’ini kontrol ederek aşırı bir sahiplik yoğunlaşması oluşturuyor.

Böylesi bir yoğunlaşma, RAY’ın merkeziyetsizliği ve piyasa istikrarı açısından ciddi endişelere yol açıyor. Tokenlerin büyük bölümü az sayıda adreste toplandığında, piyasa manipülasyonu ve fiyat oynaklığı riski de önemli ölçüde artıyor. Bu büyük sahipler, fiyat hareketleri ve piyasa dinamikleri üzerinde ciddi etkiler yaratabilir.

“Diğerleri” için negatif yüzde (-24,85%) karmaşık bir tokenomik yapı, muhtemelen token yakımı veya staking mekanizması anlamına geliyor olabilir. Bu sıradışı dağılım, RAY’ın token ekonomisi ve yönetim modeli hakkında daha detaylı inceleme gerektirmekte; piyasa katılımcıları ve projenin uzun vadeli sürdürülebilirliği açısından önemli sonuçlar doğurabilir.

Güncel RAY Varlık Dağılımı için tıklayın

| Üst | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 8pFhUq...tVQc6G | 138.590,93K | 24,97% |

| 2 | 8pFhUq...tVQc6G | 138.590,93K | 24,97% |

| 3 | 8pFhUq...tVQc6G | 138.590,93K | 24,97% |

| 4 | 8pFhUq...tVQc6G | 138.590,93K | 24,97% |

| 5 | 8pFhUq...tVQc6G | 138.590,93K | 24,97% |

| - | Diğerleri | -137.956.533,08 | -24,85% |

II. RAY’in Gelecekteki Fiyatını Etkileyen Temel Faktörler

Arz Mekanizması

- Tarihsel desenler: Geçmişteki arz değişimleri, RAY’ın fiyatını ve piyasa dinamiklerini etkiledi.

- Güncel etkiler: Beklenen arz değişimleri, önümüzdeki dönem için RAY fiyatını etkileyebilir.

Kurumsal ve Whale Dinamikleri

- Kurumsal benimseme: Büyük işletmelerin RAY’ı benimsemesi, fiyatı ve yaygınlaşmayı artırabilir.

Makroekonomik Ortam

- Enflasyona karşı koruma: RAY’ın enflasyonist ortamlarda gösterdiği performans, gelecekteki fiyatı üzerinde etki yaratabilir.

- Jeopolitik faktörler: Uluslararası gelişmeler, RAY fiyat hareketlerinde dalgalanmalara neden olabilir.

Teknik Gelişim ve Ekosistem İnşası

- LaaS (Liquidity as a Service): Kullanıcı büyümesini tetikleyerek RAY fiyatında etkili olabilir.

- Ekosistem uygulamaları: Raydium’daki önemli DApp ve ekosistem projeleri, RAY’ın değerini şekillendirebilir.

III. 2025-2030 RAY Fiyat Tahmini

2025 Görünümü

- Temkinli tahmin: 1,51 - 1,80 dolar

- Tarafsız tahmin: 1,80 - 2,20 dolar

- İyimser tahmin: 2,20 - 2,52 dolar (güçlü piyasa toparlanması ve daha fazla benimseme ile)

2027 Orta Vadeli Görünüm

- Piyasa aşaması beklentisi: Önemli büyüme ve piyasa genişlemesi potansiyeli

- Fiyat aralığı tahmini:

- 2026: 1,12 - 2,50 dolar

- 2027: 1,68 - 2,96 dolar

- Temel katalizörler: Teknolojik gelişmeler, kurumsal ilginin artması ve kripto piyasa trendleri

2030 Uzun Vadeli Görünüm

- Temel senaryo: 2,52 - 3,32 dolar (istikrarlı büyüme ve benimseme varsayımıyla)

- İyimser senaryo: 3,32 - 4,00 dolar (hızlanan ekosistem geliştirme ve iş birlikleriyle)

- Dönüştürücü senaryo: 4,00 - 4,91 dolar (büyük atılımlar ve ana akım entegrasyon ile)

- 2030-12-31: RAY 4,91 dolar (iyimser tahminlere göre potansiyel zirve)

| Yıl | En Yüksek Tahmini Fiyat | Ortalama Tahmini Fiyat | En Düşük Tahmini Fiyat | Değişim Oranı |

|---|---|---|---|---|

| 2025 | 2,51734 | 1,7981 | 1,5104 | 0 |

| 2026 | 2,50296 | 2,15772 | 1,12201 | 19 |

| 2027 | 2,95953 | 2,33034 | 1,67784 | 29 |

| 2028 | 3,27972 | 2,64493 | 2,43334 | 46 |

| 2029 | 3,67328 | 2,96233 | 2,19212 | 64 |

| 2030 | 4,91035 | 3,3178 | 2,52153 | 84 |

IV. RAY için Profesyonel Yatırım Stratejileri ve Risk Yönetimi

RAY Yatırım Metodolojisi

(1) Uzun Vadeli Tutma Stratejisi

- Uygun yatırımcı profili: Yüksek risk toleransına sahip, uzun vadeli düşünen yatırımcılar

- Operasyon önerileri:

- Piyasa geri çekilmelerinde RAY biriktirin

- Kısmi kar almak için fiyat hedefleri belirleyin

- Tokenleri donanım cüzdanında güvenli biçimde saklayın

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trend ve olası giriş/çıkış noktalarını belirlemekte kullanılır

- RSI (Göreli Güç Endeksi): Aşırı alım/aşırı satım koşullarını tespit etmek için faydalı

- Dalgalı alım-satım için önemli noktalar:

- Solana ekosistemindeki gelişmeleri yakından takip edin

- Olası sıçramalar için işlem hacmini izleyin

RAY Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcılar: Kripto portföyünün %1-3’ü

- Agresif yatırımcılar: Kripto portföyünün %5-10’u

- Profesyonel yatırımcılar: Kripto portföyünün en fazla %15’i

(2) Riskten Korunma Çözümleri

- Diversifikasyon: Yatırımlarınızı farklı DeFi projelerine dağıtın

- Zarar kes emirleri: Olası kayıpları sınırlamak için kullanın

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan önerisi: Gate Web3 Cüzdan

- Soğuk saklama: Uzun vadeli yatırımlar için donanım cüzdanı

- Güvenlik önlemleri: İki faktörlü kimlik doğrulamayı etkinleştirin, güçlü şifreler kullanın

V. RAY için Potansiyel Riskler ve Zorluklar

RAY Piyasa Riskleri

- Oynaklık: Kripto piyasalarında sıklıkla görülen şiddetli fiyat hareketleri

- Likidite: Yüksek piyasa stresi dönemlerinde likidite sorunları yaşanabilir

- Rekabet: Solana ve diğer blokzincirlerde artan AMM sayısı

RAY Düzenleyici Riskler

- Belirsiz düzenlemeler: Gelecekteki DeFi düzenlemelerinin olası etkisi

- Sınır ötesi uyum: Farklı ülkelerde değişen regülasyon yaklaşımları

- KYC/AML gereklilikleri: Merkeziyetsizliği etkileyebilecek muhtemel uygulamalar

RAY Teknik Riskler

- Akıllı sözleşme açıkları: Sömürü ve saldırı riski

- Ölçeklenebilirlik sorunları: Solana ağ performansına bağımlılık

- İşlevsellik kısıtları: Sınırlı çapraz zincir entegrasyonu

VI. Sonuç ve Eylem Tavsiyeleri

RAY Yatırım Değeri Değerlendirmesi

RAY, Solana üzerinde güçlü bir DeFi protokolü olarak uzun vadeli değer potansiyeline sahip; ancak kısa vadede piyasa oynaklığı ve artan rekabet riskiyle karşı karşıya.

RAY Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Küçük pozisyonlarla başlayın, Raydium ekosistemini öğrenmeye öncelik verin ✅ Deneyimli yatırımcılar: Maliyet ortalaması stratejisi uygulayın, net kar hedefleri koyun ✅ Kurumsal yatırımcılar: RAY’ı çeşitlendirilmiş bir DeFi portföyünde değerlendirin

RAY Alım-Satım Katılım Yöntemleri

- Spot alım-satım: Gate.com ve diğer borsalarda mevcut

- Yield farming: Raydium’da likidite havuzlarına katılım

- Yönetişim: Protokol kararlarına katılmak için RAY tokenlerini stake edin

Kripto para yatırımları çok yüksek risk içerir; bu makale yatırım tavsiyesi değildir. Yatırımcılar, kendi risk profillerine uygun kararlar almalı ve profesyonel finansal danışmanlardan destek almalıdır. Asla kaybetmeyi göze alabileceğinizden fazla yatırım yapmayın.

SSS

Raydium’un geleceği var mı?

Evet, Raydium’un gelecek potansiyeli yüksek. Tahminler, 4,82 dolara ulaşabileceğini gösteriyor; piyasa performansı ve artan benimsenme, olumlu bir görünüme işaret ediyor.

Raydium iyi bir proje mi?

Raydium, Solana üzerinde yenilikçi özellikler ve güçlü topluluk desteğiyle DeFi platformu olarak dikkat çekiyor. Başarı, piyasa koşulları ve benimsenmeye bağlıdır.

2030’da RAD kripto için fiyat tahmini nedir?

Uzman analizlerine göre RAD kripto, 2030’da yaklaşık 0,89 dolar seviyesine ulaşabilir. Bu, token için makul bir büyüme potansiyeline işaret ediyor.

RAY kripto ne kadar değerli?

2025-10-17 tarihi itibarıyla RAY kripto, token başına 1,76 dolar değerinde; piyasa değeri 475.846.167 dolar ve dolaşımdaki arzı 270 milyon RAY’dir.

2025 RAY Fiyat Tahmini: Önümüzdeki Yıllarda RAY Token’ın Büyüme Dinamikleri ve Piyasa Potansiyelinin Değerlendirilmesi

2025 RAY Fiyat Tahmini: Gelişen DeFi Ekosisteminde Bu Katman-1 Protokolü Yeni Zirvelere Ulaşabilir mi?

2025 KMNO Fiyat Tahmini: Piyasa Eğilimleri, Ana Etkenler ve Yatırım Perspektifi

2025 JUP Fiyat Tahmini: Değişen Kripto Piyasasında Jupiter'ın Potansiyelinin Analizi

2025 JTO Fiyat Tahmini: Jito Network Token DeFi Ekosisteminde Yeni Zirvelere Yükselir mi?

HLN ve SOL: Kripto Para Arenasında Devlerin Mücadelesi

SEI Airdrop Rehberi: Ödüllerinizi Almak İçin Yapmanız Gerekenler

Kripto para piyasalarında Breakout işlemleri için etkili stratejiler

Kendi Kriptoparanızı Nasıl Oluşturursunuz: Adım Adım Kılavuz

Bored Ape Yacht Club'un ikonik NFT koleksiyonunu keşfetmek için rehber

Polygon PoS Ağı’na Varlık Aktarma Kılavuzu