2025 NBLU Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: Market Position and Investment Value of NBLU

NuriTopia (NBLU) is a metaverse platform developed by NuriFlex Group that integrates virtual and real worlds to facilitate genuine social connections and reward participation in real-life and fantasy activities. Since its launch in March 2023, NBLU has established itself in the metaverse ecosystem. As of December 2025, NBLU has a market capitalization of approximately $23.27 million with a circulating supply of around 2.22 billion tokens, trading at approximately $0.0046534. This innovative digital asset is playing an increasingly important role in the metaverse and social interaction space.

This article will provide a comprehensive analysis of NBLU's price movements and market trends, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and practical investment strategies for investors interested in this emerging metaverse platform.

I. NBLU Price History Review and Current Market Status

NBLU Historical Price Evolution

-

2024: Token launch phase with initial price of $0.007, reaching an all-time high of $0.01740432 on May 25, 2024, representing a 148.6% gain from the launch price during the early adoption period.

-

2025: Market consolidation and volatility phase, with the token declining to an all-time low of $0.00035163 on November 24, 2025, followed by a recovery period through December.

NBLU Current Market Status

As of December 22, 2025, NBLU is trading at $0.0046534, reflecting an 8.11% decline over the past 24 hours but a remarkable 443.24% surge over the past 7 days. The token's market capitalization stands at approximately $10.34 million with a fully diluted valuation of $23.27 million. The circulating supply comprises 2.22 billion tokens out of a maximum supply of 5 billion, representing a circulation ratio of 44.45%.

The 24-hour trading volume reached $32,640.77, with the price fluctuating between a 24-hour low of $0.0036595 and a 24-hour high of $0.0051058. Over the longer term, the token has demonstrated significant upside potential, gaining 90.85% over the past year and 917.6% over the past 30 days. The token maintains a market dominance of 0.00072% within the broader cryptocurrency ecosystem and is listed on 2 exchanges, including Gate.com.

Click to view current NBLU market price

NBLU Market Sentiment Index

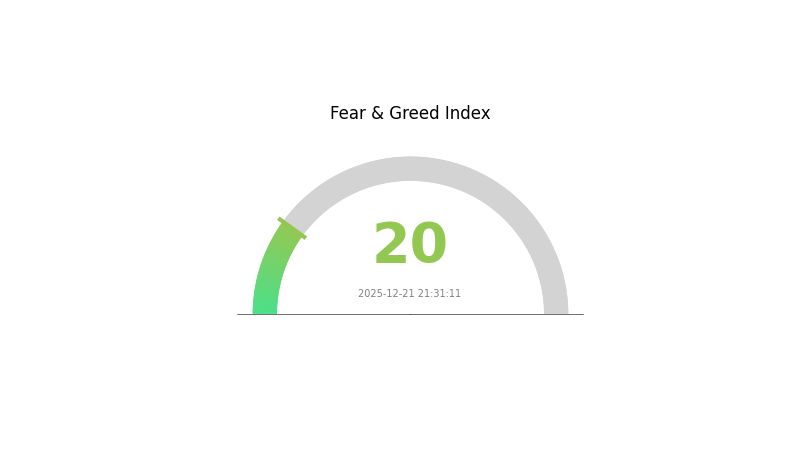

2025-12-21 Fear and Greed Index: 20 (Extreme Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the index at 20. This indicates significant market pessimism and heightened risk aversion among investors. During periods of extreme fear, asset prices often reach attractive levels, creating potential opportunities for long-term investors. However, volatility remains elevated, and careful risk management is essential. Monitor market developments closely and consider your risk tolerance before making investment decisions. Gate.com provides real-time market sentiment data to help you stay informed.

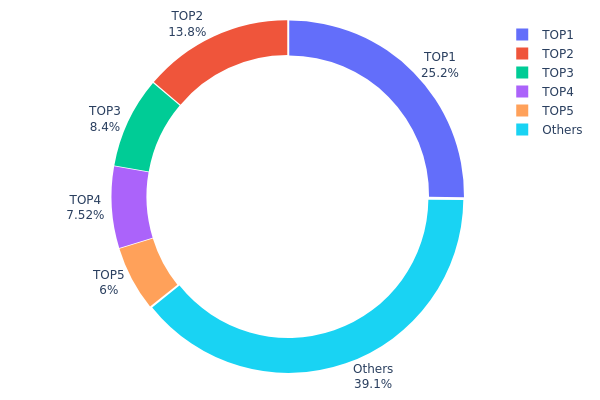

NBLU Holding Distribution

The address holding distribution map illustrates the concentration of NBLU tokens across the blockchain, segmenting token ownership by individual addresses and their respective percentages of total supply. This metric serves as a critical indicator for assessing tokenomic health, market structure transparency, and potential centralization risks within the NBLU ecosystem.

Current analysis of NBLU's holding distribution reveals moderate concentration characteristics. The top five addresses collectively control approximately 60.91% of the circulating supply, with the largest holder commanding 25.17% of all tokens. The top address alone holds over 1.25 billion NBLU, representing a significant stake that warrants monitoring. The second-largest holder controls 13.82%, establishing a notable but less dominant position. While the concentration in the top positions is evident, the remaining 39.09% distributed among other addresses suggests a reasonably dispersed secondary holder base, indicating the token has not reached extreme centralization levels comparable to early-stage projects dominated by single entities.

The current distribution pattern carries meaningful implications for market dynamics. The concentration among the top five addresses presents moderate liquidity concentration risk and potential price volatility concerns, as coordinated or substantial movements from these major holders could significantly impact market sentiment and price discovery. However, the substantial portion held by dispersed smaller addresses (39.09%) provides a natural stabilizing force and suggests meaningful community participation. This structure indicates NBLU maintains a balance between institutional or early stakeholder positions and distributed community holdings, reflecting a blockchain asset in a transitional phase toward greater decentralization. Continued monitoring of address concentration trends will be essential for evaluating the project's long-term token distribution maturity.

Click to view current NBLU Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xc3af...d7fa87 | 1258658.28K | 25.17% |

| 2 | 0xb774...caf406 | 691341.71K | 13.82% |

| 3 | 0xe0d7...74ba85 | 420000.00K | 8.40% |

| 4 | 0x4456...5612e5 | 376250.00K | 7.52% |

| 5 | 0x5336...c52a7b | 300000.00K | 6.00% |

| - | Others | 1953750.00K | 39.09% |

II. Core Factors Affecting Future Price Movement of NBLU

Supply Mechanism

-

Supply Surplus: The current dominant factor affecting price trends is supply oversupply. Domestic operating capacity remains at high levels, which exerts downward pressure on prices.

-

Current Impact: Supply oversupply continues to be a key constraint on price performance, with weak pricing sentiment from market participants, potentially leading to short-term weakness and oscillation in prices.

Macroeconomic Environment

- Market Sentiment and Overall Economic Environment: NBLU's future price is primarily influenced by market demand, supply conditions, and the overall economic environment. Market sentiment and project progress also impact price trends.

III. 2025-2030 NBLU Price Forecast

2025 Outlook

- Conservative Forecast: $0.00359–$0.00466

- Neutral Forecast: $0.00466

- Optimistic Forecast: $0.0048 (requires sustained market recovery and positive sentiment)

2026-2028 Mid-term Outlook

- Market Stage Expectation: Gradual recovery phase with consolidation patterns, followed by accelerated growth trajectory as market confidence rebuilds.

- Price Range Forecast:

- 2026: $0.00411–$0.00662

- 2027: $0.0038–$0.00834

- 2028: $0.0049–$0.01002

- Key Catalysts: Increased institutional adoption, positive regulatory developments, ecosystem expansion initiatives, and macroeconomic stabilization.

2029-2030 Long-term Outlook

- Base Case: $0.00502–$0.00945 in 2029, advancing to $0.00647–$0.01168 in 2030 (assumes steady adoption curve and moderate market growth conditions)

- Optimistic Case: $0.01002–$0.01168 (assumes accelerated platform development and broader market expansion)

- Bullish Case: Potential for $0.01168+ by 2030 (extreme favorable conditions including mainstream adoption, major partnerships, and significant liquidity inflow on platforms like Gate.com)

- 2030-12-31: NBLU projected at $0.01168 (target milestone representing 93% cumulative appreciation from 2025 baseline)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.0048 | 0.00466 | 0.00359 | 0 |

| 2026 | 0.00662 | 0.00473 | 0.00411 | 1 |

| 2027 | 0.00834 | 0.00567 | 0.0038 | 21 |

| 2028 | 0.01002 | 0.00701 | 0.0049 | 50 |

| 2029 | 0.00945 | 0.00851 | 0.00502 | 82 |

| 2030 | 0.01168 | 0.00898 | 0.00647 | 93 |

NuriTopia (NBLU) Professional Investment Strategy and Risk Management Report

IV. NBLU Professional Investment Strategy and Risk Management

NBLU Investment Methodology

(1) Long-term Holding Strategy

- Target Investors: Community participants and metaverse enthusiasts with medium to long-term conviction in virtual world ecosystems

- Operation Recommendations:

- Accumulate during market downturns when NBLU trades significantly below all-time high levels, particularly below $0.01

- Hold through platform development milestones and ecosystem expansion announcements from NuriFlex Group

- Reinvest any rewards earned through participation in NURITOPIA activities back into additional NBLU positions

(2) Active Trading Strategy

-

Technical Analysis Tools:

- Support and Resistance Levels: Monitor the 24-hour trading range ($0.0036595 to $0.0051058) and historical price levels around $0.007 (launch price) and $0.01740432 (all-time high from May 25, 2024)

- Volume Analysis: Track the 24-hour volume of $32,640.77 to identify accumulation or distribution patterns during trading sessions

-

Wave Trading Key Points:

- Enter positions when price recovers above key support levels after significant downturns (NBLU experienced -8.11% decline in the past 24 hours)

- Exit when price approaches previous resistance levels or shows divergence from volume confirmation

NBLU Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of portfolio allocation

- Active Investors: 3-5% of portfolio allocation

- Professional Investors: 5-10% of portfolio allocation (with appropriate hedging strategies)

(2) Risk Hedging Solutions

- Diversification Strategy: Allocate NBLU holdings alongside established cryptocurrency assets to reduce concentration risk

- Position Sizing: Implement strict position limits to ensure no single trade exceeds 3% of total investment capital

(3) Secure Storage Solutions

- Hot Wallet Approach: Use Gate.com Web3 Wallet for frequent trading and active participation in NURITOPIA activities

- Cold Storage Method: Transfer long-term holdings to secure self-custody solutions to protect against exchange counterparty risks

- Security Precautions: Enable multi-factor authentication on all trading accounts, never share private keys, and verify wallet addresses before every transaction

V. NBLU Potential Risks and Challenges

NBLU Market Risk

- Extreme Volatility: NBLU has experienced a 90.85% annual increase but demonstrated -8.11% decline in 24 hours, indicating significant price swings that may result in substantial losses

- Low Trading Volume: With only $32,640.77 in 24-hour volume and listed on only 2 exchanges, liquidity constraints could impact entry and exit execution at desired price levels

- Market Capitalization Concentration: At $10.34 million market cap with 44.45% of maximum supply in circulation, the token faces potential price pressure from future token releases

NBLU Regulatory Risk

- Metaverse Platform Regulatory Uncertainty: Virtual world platforms face evolving regulatory frameworks globally, with potential restrictions on virtual asset trading or avatar-based economic systems

- Jurisdiction-Specific Restrictions: Different countries may implement varying regulations on metaverse tokens and virtual economies, potentially affecting platform accessibility or token utility

- Gaming and Gambling Compliance: If NURITOPIA incorporates reward mechanisms from fantasy activities, regulatory bodies may classify certain features as gambling requiring additional compliance

NBLU Technology Risk

- Platform Development Execution: The success of NBLU depends entirely on NuriFlex Group's ability to deliver on its roadmap for integrating virtual and real-world experiences

- Smart Contract Vulnerability: NBLU operates on the BSC network; any security vulnerabilities in the underlying smart contracts could result in fund loss

- Scalability and Performance: As NURITOPIA grows, the platform must maintain stable performance; technical failures could damage user experience and reduce token utility

VI. Conclusion and Action Recommendations

NBLU Investment Value Assessment

NuriTopia (NBLU) represents a speculative investment opportunity positioned within the metaverse and social gaming sectors. The token demonstrates substantial price volatility (90.85% annual gain but -8.11% recent decline) and operates with limited liquidity across only 2 trading venues. The project's value proposition centers on creating an integrated virtual-reality social platform with avatar-based interaction and reward mechanisms. However, investors should note that the platform remains in active development, and long-term success depends on competitive positioning against established metaverse projects and successful execution of its roadmap. The current market cap of $10.34 million represents a relatively small ecosystem, which presents both opportunity for growth and heightened risk of capital loss.

NBLU Investment Recommendations

✅ Beginners: Start with minimal position sizing (1-2% of investment capital) on Gate.com, treating NBLU primarily as a speculative allocation rather than a core holding. Focus on understanding the NURITOPIA platform roadmap before increasing exposure.

✅ Experienced Investors: Implement a structured accumulation strategy during market weakness, with predefined entry points below $0.005 and exit targets near $0.01. Combine active trading with a small long-term allocation to participate in platform reward mechanisms.

✅ Institutional Investors: Conduct comprehensive due diligence on NuriFlex Group's development team, technical capabilities, and business model sustainability. Consider NBLU only as a high-risk allocation within a diversified emerging metaverse technology portfolio.

NBLU Trading Participation Methods

- Direct Purchase on Gate.com: Trade NBLU spot pairs on Gate.com's trading platform with competitive fees and deep liquidity for mainstream token pairs

- Decentralized Trading: Access NBLU through BSC-based decentralized exchanges for non-custodial trading, though with potential slippage concerns given lower overall volume

- Long-term Holding: Utilize Gate.com Web3 Wallet to self-custody NBLU tokens while awaiting NURITOPIA platform milestones and potential utility value appreciation

Cryptocurrency investments carry extreme risk and potential for total capital loss. This report does not constitute investment advice. Investors must assess their personal risk tolerance and financial circumstances independently. Always consult with qualified financial professionals before making investment decisions. Never invest more than you can afford to lose completely.

FAQ

Can PlanB predict Bitcoin could reach $300000 by 2026?

Yes, PlanB predicts Bitcoin could reach $300,000 by 2026 using his stock-to-flow model based on on-chain metrics. This forecast reflects bullish chain dynamics and historical adoption patterns.

What is the price prediction for NBLU in 2025?

Based on current market analysis, NBLU is predicted to average $0.0006657 in 2025, with a potential high of $0.0007655 and a low of $0.0005125.

What factors affect NBLU price and future outlook?

NBLU price is driven by market regulations, adoption trends, trading volume, and real-world events. Future outlook depends on cryptocurrency market dynamics, technological advancements, and institutional adoption.

How reliable are cryptocurrency price predictions for NBLU?

NBLU price predictions vary based on technical analysis and market indicators. Current forecasts suggest potential volatility, with some models projecting significant movements by 2026. Reliability depends on market conditions and analysis methodology used.

2025 WILDPrice Prediction: Analyzing Market Trends and Growth Potential for the WILD Token Ecosystem

2025 NBLU Price Prediction: Analyzing Market Trends and Potential Growth Factors

2025 MPTPrice Prediction: Analyzing Market Trends and Future Projections for the Metaverse Property Token

2025 SOMI Price Prediction: Analyzing Market Trends and Potential Growth Factors

2025 SPARKLET Price Prediction: Bullish Trends and Key Factors Driving Growth in the Crypto Market

Is VEMP (VEMP) a good investment?: Analyzing the potential and risks of this emerging cryptocurrency

What is TWAP (Time-Weighted Average Price) Strategy and How Does It Work

How to Delete My Account

What is P2P Trading on a Leading Platform?

BTC Option Flows Explained, Why Bitcoin Above 93,000 Suggests a Bullish Start to 2026

Bitcoin Options Traders Eye USD $100,000 as Derivatives Signal Market Reset