OriginTrail (TRAC) To Rise Higher? This Key Fractal Breakout Hints at Potential Upside Move!

Key Takeaways

-

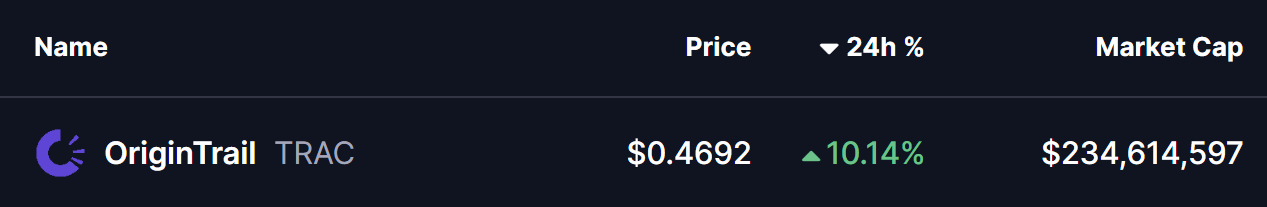

OriginTrail (TRAC) has surged around 12% in a single day, drawing renewed attention to the token.

-

TRAC has broken out from an ascending triangle near $0.46 on the daily chart, signaling growing bullish momentum.

-

Similar breakout structures in July and October 2025 previously led to strong rallies of 63% and 113%.

-

Holding the $0.44–$0.46 zone as support will be crucial to keep the bullish fractal setup intact.

-

If the pattern plays out, TRAC could attempt a move toward its long-term ascending resistance above $1.00.

OriginTrail, the decentralized knowledge graph protocol, is stepping back into the spotlight as its native token TRAC records a strong 12% daily surge. Beyond the price jump, the real signal is coming from the charts, where a familiar fractal breakout structure is starting to emerge on the daily timeframe, hinting that a larger upside move could be forming.

Source: Coinmarketcap

Fractal Breakout Hints at Potential Upside Move

On the daily chart, TRAC has confirmed a breakout from an ascending triangle pattern near the $0.46 level. This breakout is particularly important as price is now trading just above the 200-day moving average, a level that has historically acted as a major trend-defining zone for TRAC.

What makes this setup more compelling is its similarity to previous breakout phases. In late July 2025, a comparable structure resulted in a 63% upside move after price held above its breakout base. Later, in early October 2025, TRAC broke out from a right-angled descending broadening wedge pattern. That move was followed by a reclaim of the 200-day moving average and ultimately led to a powerful 113% rally.

OriginTrail (TRAC) Daily Chart/Coinsprobe (Source: Tradingview)

The current setup shares key characteristics with those earlier moves. Price compression, a clean breakout, and interaction with the 200-day MA suggest that TRAC may once again be transitioning from consolidation into expansion.

What’s Next for TRAC?

If this fractal breakout plays out as expected, holding the $0.44–$0.46 zone as support will be crucial. A sustained hold above this range, along with continued strength above the 200-day moving average, could act as a launchpad for further upside.

In that scenario, TRAC may attempt a move toward its long-term ascending resistance trendline, which currently sits above the $1.00 level. A push toward that zone would align closely with the magnitude of prior fractal-driven rallies seen on the chart.

That said, fractal patterns are never guarantees. Broader market conditions, liquidity, and overall sentiment will continue to influence price action. A failure to hold the $0.44–$0.46 support zone or a rejection back below the 200-day moving average could invalidate the breakout and weaken the bullish fractal thesis.

Bottom Line

TRAC is showing early signs of another technically significant breakout, supported by historical fractal behavior and a reclaim of a key long-term moving average. If buyers can defend the current support zone, the chart suggests that OriginTrail may be positioning itself for a larger upside move in the weeks ahead.

Disclaimer: The views and analysis presented in this article are for informational purposes only and reflect the author’s perspective, not financial advice. Technical patterns and indicators discussed are subject to market volatility and may or may not yield the anticipated results. Investors are advised to exercise caution, conduct independent research, and make decisions aligned with their individual risk tolerance.

About Author: Nilesh Hembade is the Founder and Lead Author of Coinsprobe, with over 5 years of experience in the cryptocurrency and blockchain industry. Since launching Coinsprobe in 2023, he has been providing daily, research-driven insights through in-depth market analysis, on-chain data, and technical research.

Related Articles

Crypto Expert Predicts Retail Return Following a BTC Pump of Over 50% This Year

Kaspa Is About to Break Blockchain Physics: 100 BPS Could Change Crypto Forever

Cryptocurrency Market Sentiment Diverges: Wall Street Remains Bullish on Bitcoin, While Non-U.S. Investors Rapidly Withdraw

Bitcoin futures open interest plummets 55%, marking the largest decline in nearly three years

Shiba Inu (SHIB) Rebounds After 30% Correction: Could This Be the Start of a Recovery?

XRP Rejected at $1.65: Is a Double Bottom Near $1.11 Next?