Sleeping Stashes Blink: Early Bitcoin Wallets Shift Nearly 5,000 BTC in January

By the numbers, January 2026 saw long-sleeping wallets from the 2010–2017 era finally stretch their legs, moving about 4,905.98 BTC—worth roughly $383 million at today’s exchange rates—after years of radio silence. Digging deeper, the data shows that 40.77% of those spends came from truly ancient bitcoin—coins traced back to 2010 block rewards that have been sitting tight for well over 15 years.

Bitcoin Time Capsules Crack Open as 2010–2017 Wallets Move Piles of Resting BTC in January

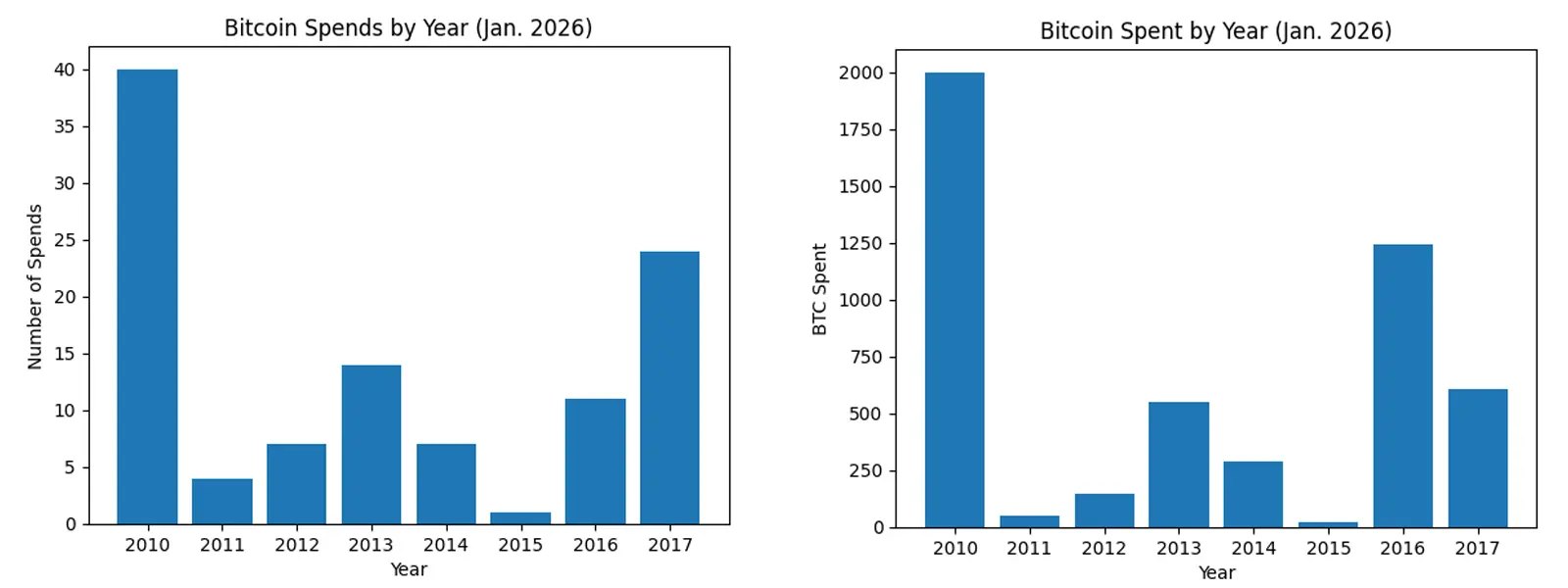

Although January opened with a notable 2010-era whale offloading 2,000 BTC, stats from btcparser.com show the month itself was otherwise fairly standard for dormant spending. Beyond the 40 wallets that stirred from that vintage year, addresses created in 2017 logged the second-highest number of movements, though they didn’t part with the largest bitcoin totals.

Wallets from 2011 barely cleared their throats, recording just four spends totaling 51.07 BTC across those addresses. Meanwhile, 2012-era wallets were far more willing to part with their stash, notching seven spends and a heftier 147.19 BTC moved from long-dormant addresses. At the same time, throughout January, wallets from 2013 quietly shuffled 547.15 BTC across 14 separate spends.

The 2014 cohort wasn’t far behind, with roughly seven distinct wallets waking up to move about 290.37 BTC last month. By contrast, 2015 barely made a peep, logging a lone spend that nudged just 20 BTC. Wallets from 2016 were far busier, posting the second-largest bitcoin total of any year this month with 1,245.55 BTC moved across 11 distinct transfers. Finally, 2017-era wallets wrapped things up by shifting 604.623 BTC over 24 unique transfers.

Also read: Hashprice Near Yearly Lows Puts Bitcoin Miners Under Heavy Pressure

January’s activity reads less like a mass awakening and more like a selective roll call, with a handful of early-era holders choosing to finally make a move while most stayed put. Even with a headline-grabbing 2010 whale and a meaningful share of decade-old block rewards changing hands, the broader pattern suggests dormant bitcoin remains largely content to keep sleeping—waking only when a few long-term holders decide the timing of consolidation, or the price tag, is right.

Even with bitcoin trading at $77,725 per coin, Feb. 1, 2026, opened the month with a 2014-era holder making an early move, spending 96.98 BTC at block height 934,621.

FAQ ❓

- What happened to dormant bitcoin wallets in January 2026? Long-dormant wallets from 2010–2017 moved about 4,905.98 BTC, valued near $383 million at current prices.

- Which bitcoin era accounted for the oldest coins spent? Roughly 40.77% of the BTC spent came from 2010 block rewards that had remained untouched for more than 15 years.

- Did one wallet dominate January’s dormant bitcoin activity? A single 2010-era whale accounted for a 2,000 BTC spend, while the rest of the month reflected typical dormant movement.

- Are old bitcoin wallets still spending in February 2026? Yes, Feb. 1, 2026, opened with a 2014-era wallet spending 96.98 BTC at block height 934,621.

Related Articles

Altcoins fall to historic lows against gold, Bitcoin's "technology assetization" signal reappears

Is Bitcoin more like tech stocks rather than digital gold? Grayscale reveals the true underlying factors behind it

Hyperscale Data Bitcoin holdings increase to approximately 589 coins, with a market value of $41.4 million