Leverage nightmare! Ethereum whales with over $700 million long positions liquidated, suffering a loss of $250 million

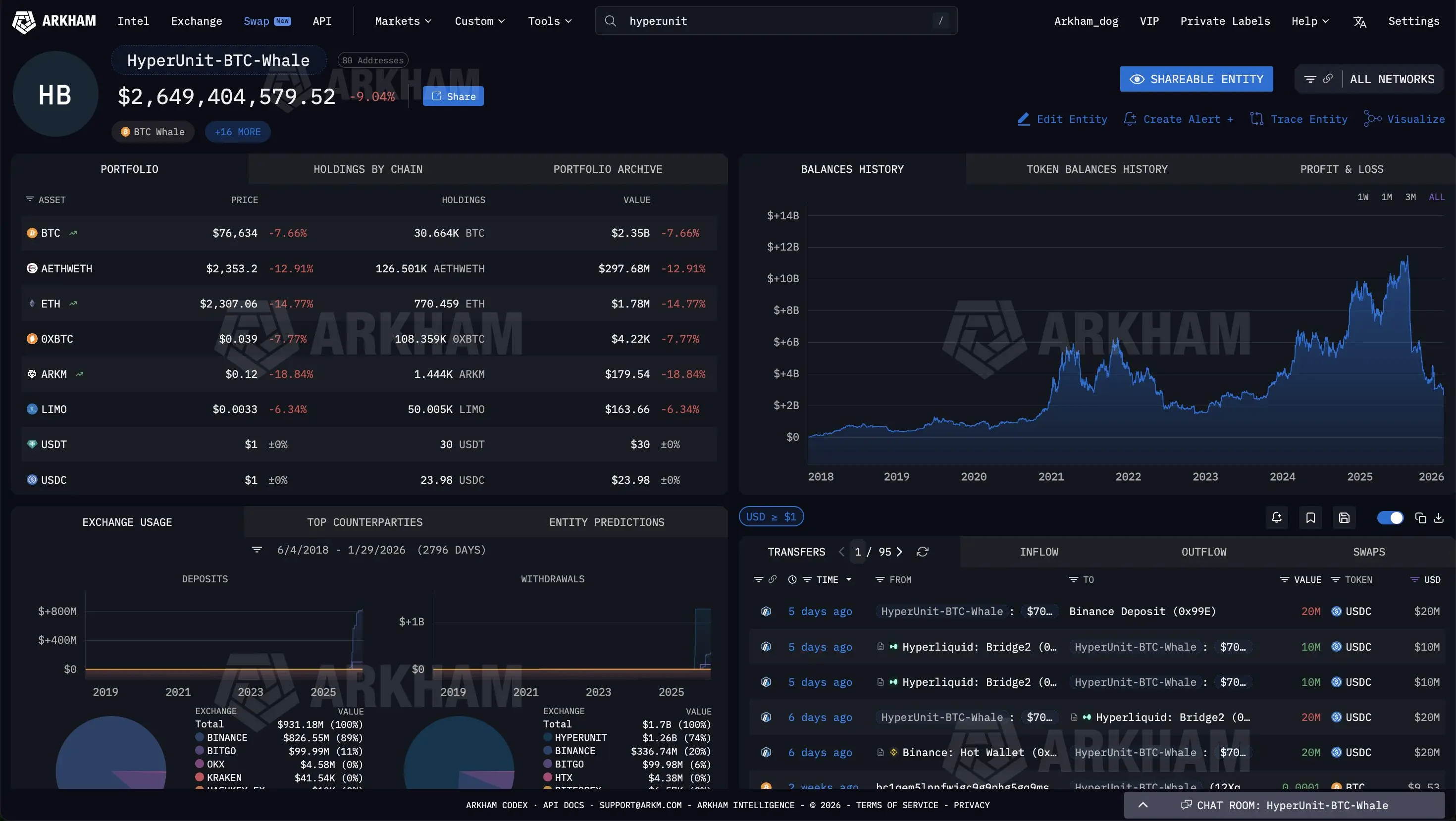

“Hyperunit Whale” thoroughly crashes, the whale closed all Ethereum leveraged positions with a loss of about $250 million, leaving only $53 in the account. Previously, before Trump’s October tariffs, he made a $200 million profit from shorting, then switched to long positions totaling $730 million. This week, Ethereum plummeted to $2,400, resulting in full liquidation.

Complete Timeline from Divine Prediction to Catastrophic Crash

(Source: Arkham)

Hyperunit Whale first shocked the crypto market in October 2025. On-chain analyst Eye tracked wallet activity of former BitForex CEO Garrett Jin through ENS domains “ereignis.eth” and “garrettjin.eth,” revealing the possible identity of this mysterious trader. Jin denies owning these funds but admits knowing the person behind the trades, stating “these funds are not mine, but my clients’.” This ambiguous statement further deepened market curiosity about his true identity.

October’s legendary trading timing was perfect. The Ethereum whale established Bitcoin and Ethereum short positions with a nominal value exceeding $1 billion, just minutes before Trump announced a 100% tariff on Chinese imports. This timing sparked speculation about insider information, though no evidence of misconduct has been found. The subsequent market crash liquidated over $18 billion across the industry, while Hyperunit Whale profited about $200 million from this bloodbath.

This unexpected profit catapulted the trader into fame, and the market began to scrutinize every move. However, success often breeds overconfidence. After October’s victory, the trader quickly shifted strategy from short to aggressive long positions. By mid-January, Arkham data showed the whale had built Ethereum longs worth over $730 million, with total holdings on Ethereum, SOL, and Bitcoin exceeding $900 million. Such a scale of holdings indicated strong confidence in a market rebound but also planted the seeds of disaster.

Hyperunit Whale Operation Timeline

Early October 2025: Established $1 billion short positions minutes before Trump tariff announcement

Mid-October: Market crash, profit of about $200 million, legendary trade

Late October to December: Gradually built Ethereum long positions, reaching $730 million

Mid-January 2026: Positions peaked, total holdings over $900 million

End of January: Ethereum plummeted, $250 million liquidation loss, account left with only $53

The Brutal Lesson of Leverage Trading: From Hero to Zero

This week’s crypto market plunge was the final straw. Ethereum’s price sharply declined to around $2,400, down 10% in 24 hours. While such a drop is painful but manageable for spot holders, it’s deadly for whales using high leverage. On-chain analysts previously pointed out that as Ethereum’s price declined throughout January, the whale’s holdings became increasingly precarious.

Earlier reports this week showed unrealized losses exceeding $130 million. This figure alone is staggering, but the disaster was yet to come. When Ethereum broke key support levels, the domino effect of leveraged trading kicked in. Margin calls triggered automatic liquidation, with exchanges selling collateral to cover losses, further depressing prices in a vicious cycle. Ultimately, Hyperunit Whale’s entire Ethereum long position was liquidated, with total losses around $250 million.

Even more dramatic is the extreme contrast in account balances. Data from Arkham shows the whale completely closed its Ethereum position on Hyperliquid, leaving only $53 in the account—months of accumulated gains wiped out. This $53 figure went viral on social media, becoming a symbolic case of leverage risk in crypto markets. From $200 million in profits to zero, the entire process took less than three months.

However, there may be another side to the story. Although the Hyperliquid account now has only $53, Arkham data indicates the whale still holds assets worth $2.7 billion in other wallets. This suggests that while the leverage trades on Hyperliquid failed spectacularly, the trader’s overall financial situation might not be as dire as it appears. This multi-wallet strategy demonstrates how experienced whales manage risk: separating leverage trading from long-term holdings to avoid total wipeout from a single mistake.

Insider Trading Allegations and Market Manipulation Shadows

The most controversial aspect of Hyperunit Whale’s story is the timing of the October trade. Establishing $1 billion short positions just minutes before Trump announced tariffs is statistically almost impossible to achieve by luck alone. Market participants widely question whether the trader had access to advance knowledge of the policy, which could constitute insider trading.

Further suspicion arises from the connection to former BitForex CEO Garrett Jin. BitForex, a crypto exchange that ceased operations in 2023 amid controversy and user fund withdrawal issues, adds to the intrigue. Jin’s background fuels doubts about the source of funds and information channels for the Hyperunit Whale. Although Jin denies owning these funds, his statement “I know the person behind the trades” does little to dispel suspicion.

No concrete evidence of misconduct has been found so far, and agencies like the US SEC have not announced investigations. Nonetheless, this case highlights serious issues of information asymmetry in crypto markets. Unlike traditional finance, insider trading regulation in crypto remains in a gray area, especially regarding policy anticipation trades.

A broader concern is that even without insider info, large whales’ trading behavior can influence markets manipulatively. Building $1 billion short positions can exert significant price pressure in derivatives markets. If other traders follow such large orders, it amplifies volatility, allowing whales to profit from these swings. This “whale effect” is common in crypto markets with relatively low liquidity.

Three Painful Lessons for Retail Investors

The collapse of Hyperunit Whale offers valuable but costly lessons for all crypto investors. First, even traders with seemingly insider info or extraordinary skills can turn sour in an instant. Markets are ruthless to everyone; past success does not guarantee future wins. October’s $200 million profit created an aura of “divine prediction,” but the $250 million loss in January proved how fragile that aura is.

Second, leverage is a double-edged sword. It can magnify gains but also lead to catastrophic losses. For example, a $730 million Ethereum long with 5x leverage requires only about $150 million in actual capital. When prices rise, profits are substantial; but if prices fall 20%, forced liquidation occurs, losing more than the initial capital. For retail traders, leverage risks far outweigh potential rewards, especially in the highly volatile crypto environment.

Third, risk diversification and proper capital management are crucial. Although the Hyperliquid account was wiped out, the whale still holds $2.7 billion elsewhere, demonstrating how experienced traders isolate risks. Ordinary investors should learn from this: diversify funds across different platforms and strategies, avoiding putting all eggs in one basket. Never invest all your capital in a single position or platform, no matter how confident you are in that trade.

Related Articles

Two addresses that have accumulated a long position of 100,000 ETH are currently showing an unrealized loss of over $4,483,000.

The two addresses that have accumulated a long position of 100,000 ETH have a floating loss of over $4,483,000.

Sharplink received approximately 552 ETH in staking rewards, equivalent to about 1.1 million USD.

Ethereum Super Bull? New Whale Opens 16,270 ETH Long - U.Today