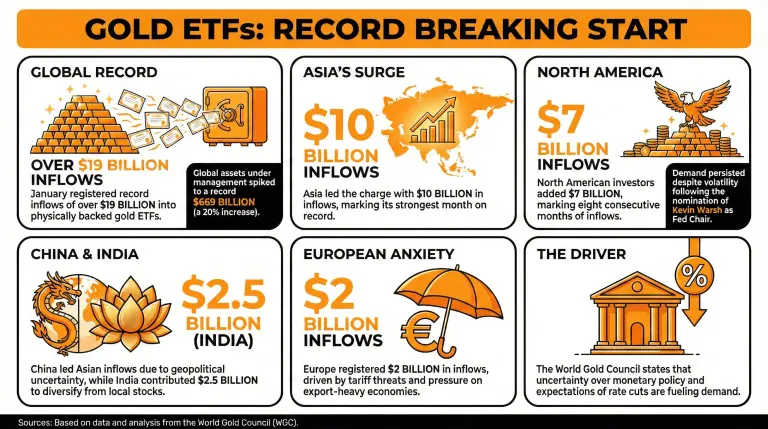

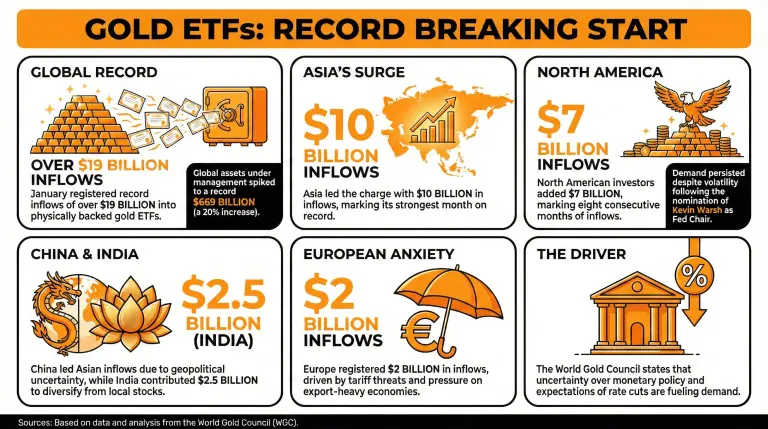

The World Gold Council (WGC) reported that physically backed gold ETFs registered record inflows in January, with investors pouring more than $19 billion into these funds. North American and Asian markets led the charge with strong demand despite recent price declines.

Paper Gold Markets Keep Growing as ETF’s Reach Record Inflows in January

Paper gold markets remain strong even amidst the current climate of volatility and the call to rely on physical investments.

According to the World Gold Council (WGC), January registered record inflows into physically backed gold exchange-traded funds (ETFs), with over $19 billion entering the precious metal market through these.

As a consequence, global gold ETF assets under management also spiked, reaching a record of $669 billion, a 20% month-on-month increase. All markets recorded inflows, with Asia leading the charge and North America following behind.

North American investors, particularly, have reported eight consecutive months of inflows, even after the sharp pullback gold experienced after the Trump Administration announced the nomination of Kevin Warsh as future Chairman of the Federal Reserve. These markets added $7 billion.

The WGC declared:

“This overhang on the future path of monetary policy, combined with investor expectations of eventual rate cuts, continues to support gold ETF demand.”

Asian funds reported record inflows in January, accounting for their strongest month on record after adding $10 billion. China led the region’s inflows as “robust gold prices, lingering geopolitical uncertainty, and strong institutional demand all underpinned the country’s continued appetite for gold ETFs.” India also contributed $2.5 billion in inflows as investors try to diversify from the underperforming local stock market.

European ETFs registered $2 billion in inflows, underpinned by current geoeconomic issues, including the tariff threat that puts pressure on export-heavy economies, increasing demand for safe-haven assets such as gold.

These numbers highlight the recovering relevance of gold across world markets, as regional markets experience a resurgence of the demand for the precious metal due to different local realities.

Read more: From Safe Haven to Stress Test: Gold and Silver Prices Feel the Heat

FAQ

- What recent trends have been observed in paper gold markets?

Despite market volatility, paper gold markets are strong, with record inflows into physically backed gold ETFs totaling over $19 billion in January.

- How have global gold ETF assets changed in recent months?

Global gold ETF assets under management reached a record $669 billion, reflecting a 20% increase month-on-month.

- Which regions are leading the inflows into gold ETFs?

Asia and North America are leading in inflows, with North American investors reporting eight consecutive months of growth.

- What factors are driving the demand for gold ETFs?

Investor concerns over monetary policy, expectations for rate cuts, and geopolitical uncertainties are fueling demand for gold as a safe-haven asset.

Disclaimer: The information on this page may come from third parties and does not represent the views or opinions of Gate. The content displayed on this page is for reference only and does not constitute any financial, investment, or legal advice. Gate does not guarantee the accuracy or completeness of the information and shall not be liable for any losses arising from the use of this information. Virtual asset investments carry high risks and are subject to significant price volatility. You may lose all of your invested principal. Please fully understand the relevant risks and make prudent decisions based on your own financial situation and risk tolerance. For details, please refer to

Disclaimer.

Related Articles

OpenClaw Founder: 80% of Apps Will Disappear, AI Agents Will Replace the Mobile Ecosystem

Venture capital firm Y Combinator interviews the popular open-source personal AI agent OpenClaw developer Peter Steinberger, who predicts that about 80% of apps will disappear, and applications that simply manage data can be automated and replaced by AI agents. OpenClaw's biggest advantage is breaking down data silos and storing data locally to ensure privacy.

MarketWhisper51m ago

Institutions Drive RWA Tokenization Boom, Retail Investors May Face Participation Window

On February 11, during a panel discussion at the Consensus Hong Kong 2026 conference, several industry leaders explored the development trends of tokenized real-world assets (RWA). Participants included Evan Auyang, President of Animoca Brands Group; Christian Rau, Senior Vice President of Digital Assets and Blockchain at Mastercard; Nicola White, Vice President of Crypto at Robinhood; and Marcin Kazmierczak, Co-founder of Redstone Group, who moderated the discussion.

During the discussion, the guests echoed the view of Rob Goldstein, Chief Operating Officer of BlackRock: digital ledgers are the most exciting innovation in finance since the advent of double-entry bookkeeping 700 years ago. Currently, RWAs are primarily targeted at institutional investors, with demand mainly focused on tokenized money market funds, U.S. Treasuries, stablecoin integration, and collateral optimization products, such as BlackRock’s BUIDL and Robinhood’s solutions, demonstrating the increasing practical value of this field.

GateNewsBot1h ago

Solana Foundation Chair Lily Liu presents a new vision of "Internet Capital Markets" at the 2026 Hong Kong Consensus Conference

February 11 News, Lily Liu, Chairwoman of the Solana Foundation, shared her forward-looking ideas on the "Internet Capital Market" during a fireside chat with Conference Chair Michael Lau at the 2026 Hong Kong Consensus Conference. Lily stated that the core value of blockchain should focus on financial and market innovation rather than utopian technological ideals. She envisions achieving seamless integration from everyday payments to high-frequency trading through comprehensive tokenization of global assets, building a unified global capital formation market.

Lily reviewed the development of crypto financing, from early ICOs to the current rapid financing models, emphasizing that blockchain infrastructure should serve non-crypto projects and enterprises worldwide, promoting the democratization of talent and capital. She pointed out that this technology can bring greater efficiency and fairness to global markets, especially in fostering innovation projects and attracting talent.

GateNewsBot1h ago

Hayden Adams: Uniswap wins lawsuit against Bancor for patent infringement

Uniswap wins in lawsuit against Bprotocol Foundation and LocalCoin Ltd., with lawyers stating it did not infringe on related patents. Uniswap Labs reaffirms its protocol code is open source and opposes the allegations.

GateNewsBot1h ago

ChainCatcher "Build and Scale 2026" Roundtable: We are currently in a critical period for building infrastructure, as Web3 transitions from concept to solving real-world pain points.

At the "Build and Scale in 2026" forum, several guests discussed the key challenges of the new Web3 era, including identity and trust issues, AI agent payment security, and blockchain-supported sustainable development, believing that by 2026, the industry will shift its focus to infrastructure development and practical applications.

GateNewsBot2h ago

Tether invests in LayerZero to expand USDT into the omnichain model

Tether has invested in LayerZero Labs to enhance cross-chain infrastructure. Their partnership developed USDT0, an omnichain version of USDT, allowing for real-time transactions across blockchains. The investment underscores Tether's focus on expanding its crypto portfolio and technological capabilities.

TapChiBitcoin2h ago