Chainalysis Latest Report: Cryptocurrency Drives Crime, Hundreds of Millions of Dollars Flowing to Human Trafficking

Chainalysis reports that crypto transactions related to human trafficking are expected to surge by 85% between 2024 and 2025, with Southeast Asia at the core, and stablecoins and privacy coins being exploited.

Cross-border crime scale skyrockets by 85%, Southeast Asia becomes the central hub

According to the 2026 Crypto Crime Report released by blockchain analysis firm Chainalysis, cryptocurrency transactions associated with suspected human trafficking activities have experienced explosive growth of up to 85% from 2024 to 2025. Although the report notes this is a conservative estimate, the monitored inflow of funds has already reached hundreds of millions of dollars.

Image source: Chainalysis and the explosive growth of crypto transactions related to suspected human trafficking from 2024 to 2025, up 85%

These illegal activities are mainly concentrated in Southeast Asia, particularly in crime zones in Cambodia and Myanmar. These zones facilitate illegal profits through forced labor, online scams, and sexual exploitation, channeling funds via the crypto ecosystem globally.

The report emphasizes that the borderless and pseudonymous nature of cryptocurrencies allows criminal organizations to bypass traditional banking regulations, enabling rapid and large-scale cross-border payments. However, due to the transparency of public ledgers, digital footprints are difficult to erase.

Highly professionalized crime models, stablecoins and collateral platforms have become tools

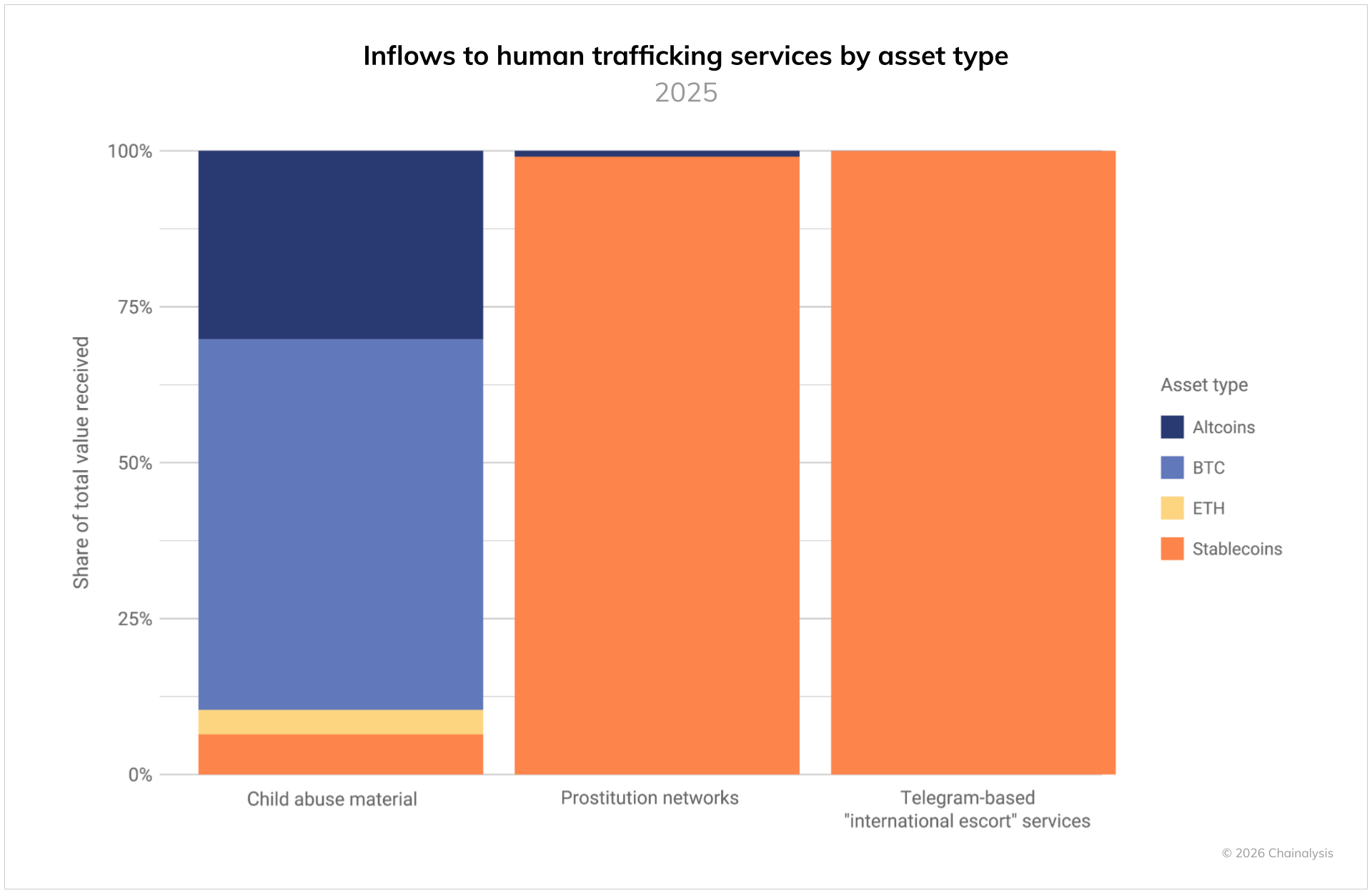

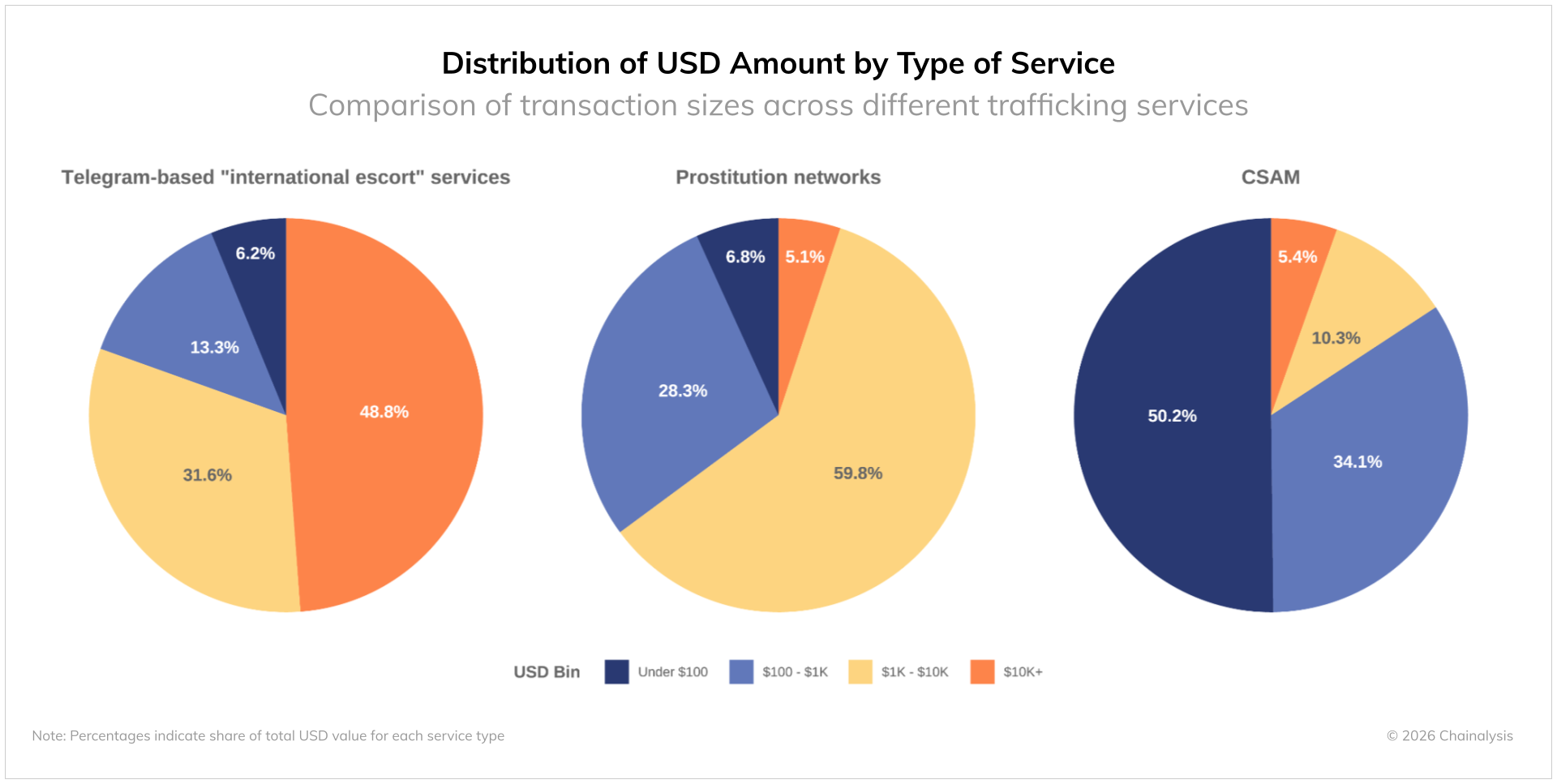

Currently, the crypto-based human trafficking networks have evolved into highly structured operational models, mainly covering four categories: international escort services, labor recruitment intermediaries, online prostitution networks, and the sale of child sexual abuse material (CSAM).

Image source: Chainalysis Crypto human trafficking networks have evolved into highly structured operational models, primarily encompassing four categories

Analysis shows that different types of crimes have distinct payment preferences and amount distributions. For example, international escort services and prostitution networks on Telegram almost entirely rely on stablecoins, with transaction sizes often larger, with approximately 48.8% of transfers exceeding $10,000. In contrast, labor recruitment intermediaries typically use payment amounts between $1,000 and $10,000 to lure victims into scam zones, utilizing escrow platforms (such as Potato and Nimi) on Telegram to hold funds securely and ensure the safety of illegal transactions.

This method, combining “pig-butchering” scams with human trafficking, demonstrates that criminal groups are leveraging the crypto ecosystem and instant messaging platforms to establish comprehensive money laundering and recruitment infrastructures.

Funds flow to Western countries, illegal industries shift toward privacy chains

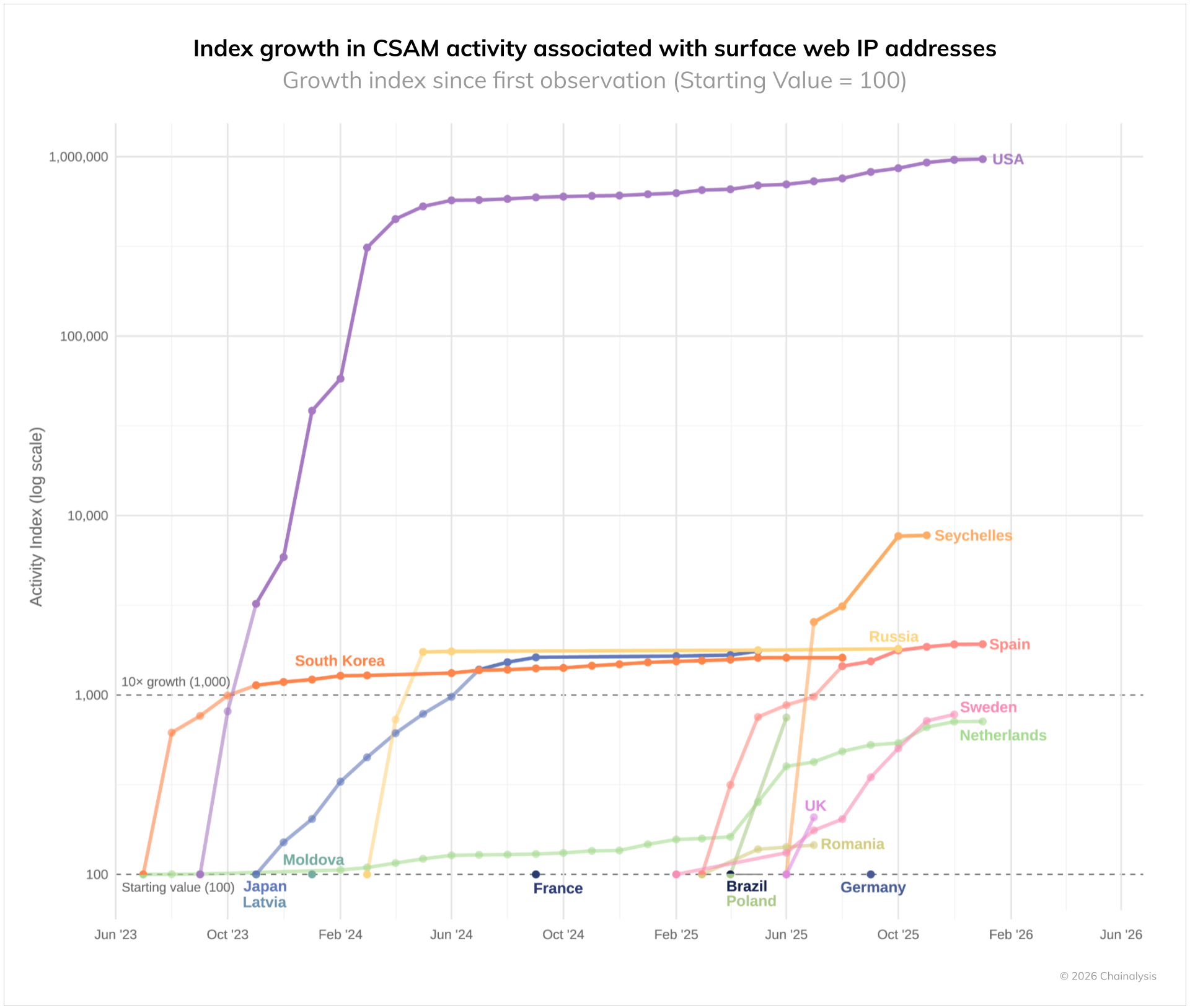

Although the crime zones are located in Southeast Asia, the sources of funding are global, mainly from the United States, Brazil, the United Kingdom, Spain, and Australia. The report points out that criminals often use servers or infrastructure within the U.S. to host illegal websites, targeting affluent English-speaking audiences for precise harvesting.

Image source: Chainalysis Criminals often utilize servers or infrastructure within the U.S. to set up illegal websites

In the CSAM industry, criminal behavior patterns are undergoing dramatic shifts, moving away from Bitcoin ($BTC) towards more anonymous privacy coins like Monero, or using no-KYC instant exchange services and alternative chains to evade tracking.

Furthermore, data shows that a single dark web CSAM site has generated over $535,800 from more than 5,800 wallet addresses since July 2022, surpassing the revenue of the notorious “Welcome to Video” case in 2019, indicating the industry’s high profitability and rapid expansion.

Blockchain transparency as a double-edged sword, law enforcement enhances on-chain monitoring

In response to the rampant human trafficking networks, Chainalysis believes that the transparency of blockchain’s public ledger provides law enforcement with excellent opportunities. Unlike cash transactions that are difficult to trace, the permanent digital footprints left on the blockchain enable investigators to map fund flows, identify bottleneck exchanges, and target specific criminal clusters.

By 2025, law enforcement has achieved several major victories, including increased arrests of CSAM consumers in the U.S. and the dismantling of the “KidFlix” platform with nearly 2 million users through international cooperation. Experts recommend that regulators and compliance teams focus on specific “red flag” indicators, such as large, regular transfers to labor recruitment accounts, high-frequency transactions with escrow platforms, and routine stablecoin conversions. Proactively tracking these on-chain anomalies allows authorities to intervene early and cut off the funding chain of human trafficking operations at its source.

This content is summarized and edited by Crypto Agent from various sources. The “Crypto City” review team is still in training; there may be logical biases or inaccuracies. The information is for reference only and should not be considered investment advice.

Related Articles

Crypto Expert Predicts Retail Return Following a BTC Pump of Over 50% This Year

Ledn completes first Bitcoin-backed ABS issuance, raising $188 million

Avalon Labs officially launches the SuperEarn financial management section

A certain whale deposited 8.58 million USDC into Lighter and yesterday opened a 20x leveraged long position in BTC.

A whale deposited 1,765,000 USDC into HyperLiquid to open long positions on ETH and BTC.

The UAE has accumulated $450 million worth of Bitcoin through mining, with a net profit of $344 million after deducting costs.