Stock Tokenization Depth Research Report: Start of the Second Bull Run Growth Curve

2025-07-24 13:37

From SEC defendant to Wall Street bell ringer, the remarkable "Gatesun" powerfully interprets the game of thrones.

2025-07-24 07:59

Trending Topics

View More24.3K Popularity

49.34K Popularity

16.09K Popularity

11.38K Popularity

99.52K Popularity

Pin

With a 20-fold increase in one weekend, will AI be the strongest narrative in this bull market?

Original author: Joyce, BlockBeats

Original editor: Jack, BlockBeats

After a week of consolidation, the AI sector is taking off again. Judging from the time scale of the past six months, the tokens of various projects in the AI sector have continued to rise, and tokens such as WLD, RNDR, AGIX, and FET have all increased several times. In the month since the beginning of February, many new projects have appeared in the AI sector, with tokens rising more than five times or even dozens of times in less than two weeks. Why can the AI sector bloom everywhere and show lasting and strong growth? Increase? What are the new projects that have obvious wealth effects? How can AI narratives that were originally considered difficult to understand support the new projects that are now emerging? BlockBeats discusses these issues in this article.

Who is promoting the AI sector?

Encrypted VC continues to call for orders

Echoing the Web2 world, “AI” will be a keyword that frequently appears in the annual outlook articles of major investment institutions by the end of 2023. As Messari wrote in his 2024 investment forecast, “AI has become the new favorite in the technology field. Once again, we are bystanders.”

Tommy, co-founder of Delphi Digital, who has invested in 14 AI and companies building their own model sets for specific use cases (e.g. Uniswap LP provision, exchange risk analysis, Delphi AI analysts).”

In-depth research on the AI sector is also in progress. Vitalik wrote an article in January this year to sort out the application prospects and challenges of Crypto+AI. Galaxy Digital’s long article analyzed the business models and limitations of current representative AI projects. Indications show that in 2024, the market is very optimistic about the future of the AI sector.

Related reading: “Galaxy: Projects at the intersection of encryption and artificial intelligence”

Trend signals of “AI majors”

What ideas should be used to combine AI x Web3? The two sentences “AI represents productivity and Web3 represents production relations” and “Do Web2 things again in a Web3 way” can be used to understand the stories told by most AI projects currently emerging in the encryption field. It is obvious that if you want to speculate in the AI sector, the “source of fire” lies in the traditional AI manufacturers.

Looking at this year, it can be seen that the popularity of the AI sector has remained high and has not stopped, and projects that have seen eye-catching growth have also waxed and waned and are blooming everywhere.

On February 16, OpenAI’s new large AI model Sora was released, which attracted great attention in the AI industry. A meme with the same name Sora appeared on Ethereum and increased by more than a thousand times in 12 hours. After this, Worldcoin, an AI project founded by OpenAI founder Sam Altman, rose by more than 300% in two weeks.

NVIDIA chips that meet the demand for computing power are still a hot commodity among major manufacturers. In the early morning of February 22, NVIDIA released its fourth-quarter financial report. Its latest quarterly revenue was US$22.1 billion, much higher than analysts’ expectations of US$20.4 billion. . According to reports, Nvidia stock rose 63% in the first two months of the year.

Previously, although the development space of AI has been recognized, compared with other tracks such as DeFi and GameFi, the AI track used to be “applauded but not popular” because the market could not understand it. The emergence of Sora and Nvidia’s strong performance have attracted more people’s attention to the development potential of AI projects. In early February, the AI sector experienced a general rise.

Retail investors are afraid of shortfalls, and new projects are gaining popularity

Why does WLD’s continued rise surprise everyone? One possible reason is that most of the AI projects that entered the community’s vision at that time had already gone through the “value discovery” process.

Render Network, a GPU-based decentralized rendering solution, has seen its token RNDR rise by more than 450% in the past six months, reaching near the high point of the initial coin issuance in 2022, and its market value has exceeded US$2.7 billion. The artificial intelligence ledger Fetch.AI, which was born in 2019, has increased by more than 240% in the past 20 days, which is twice the high of the last bull market. Other AI sector tokens such as AGIX, ARKM, etc. have also increased by 2 times and 3 times in two weeks.

Left: RNDR daily line; Middle: FET weekly line; Right: AGIX daily line

The willingness to pay in the crypto market is already strong enough, but most AI projects appeared a year ago. For AI concepts that have not yet undergone value verification and use case scenarios are not yet clear, the trading mentality of buying new rather than old blocks some people from waiting and watching. By.

Therefore, whether it is based on tight computing power, using Web3 to tell an attractive story, or directly applying AI technology to the Web3 field as an application layer Dapp to empower the ecosystem, it seems that as long as the narrative makes sense, even if It is a copy of the previous project concept, which can attract a large wave of liquidity driven by the anxiety of fear of heights and fear of falling short.

Which AI projects are rising?

It should be noted that unlike other tracks, the valuation model and track of AI are not yet clear. Many small-cap AI projects were propagated in the early stage by Alpha hunters and successfully attracted liquidity. Narrative MEME" is more appropriate for these projects.

At present, newly emerging AI projects have successively reached an increase of about 10 times compared with the earlier period, which is similar to the trend of AI projects that appeared in the last bull market. But what is different from before is that due to the influence of NVIDIA and OpenAI, the AI sector in this bull market has attracted more attention and carried more expectations than before. Therefore, we cannot simply apply the curve of the past bull market to look at the AI market in this round.

Small market capitalization is everywhere

In the AI sector, the best and most understandable narrative is the direction of decentralized computing, and in this direction, “providing a two-sided market for GPU hardware” has been familiar to the market.

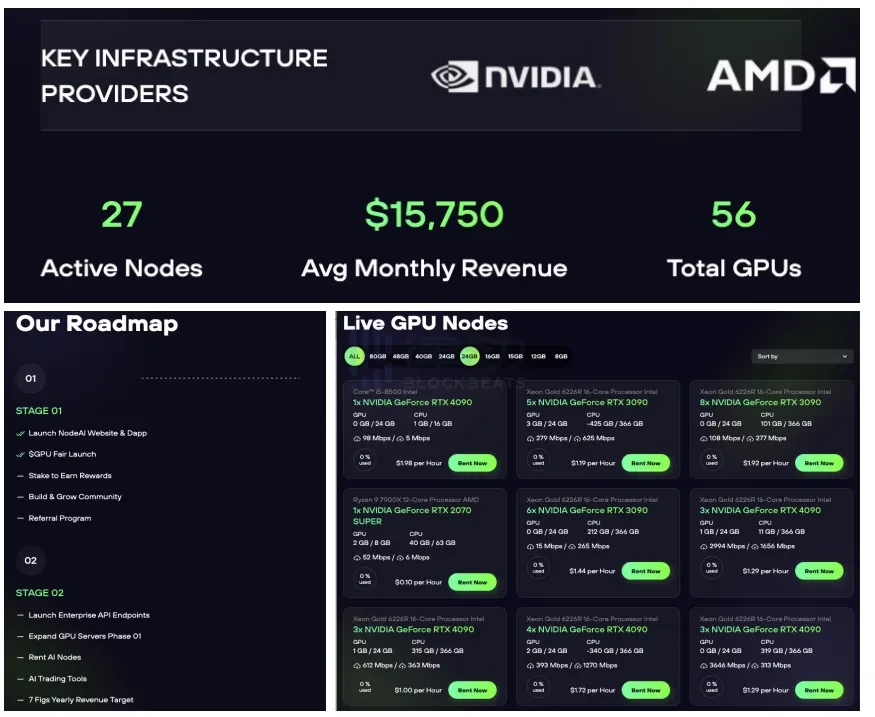

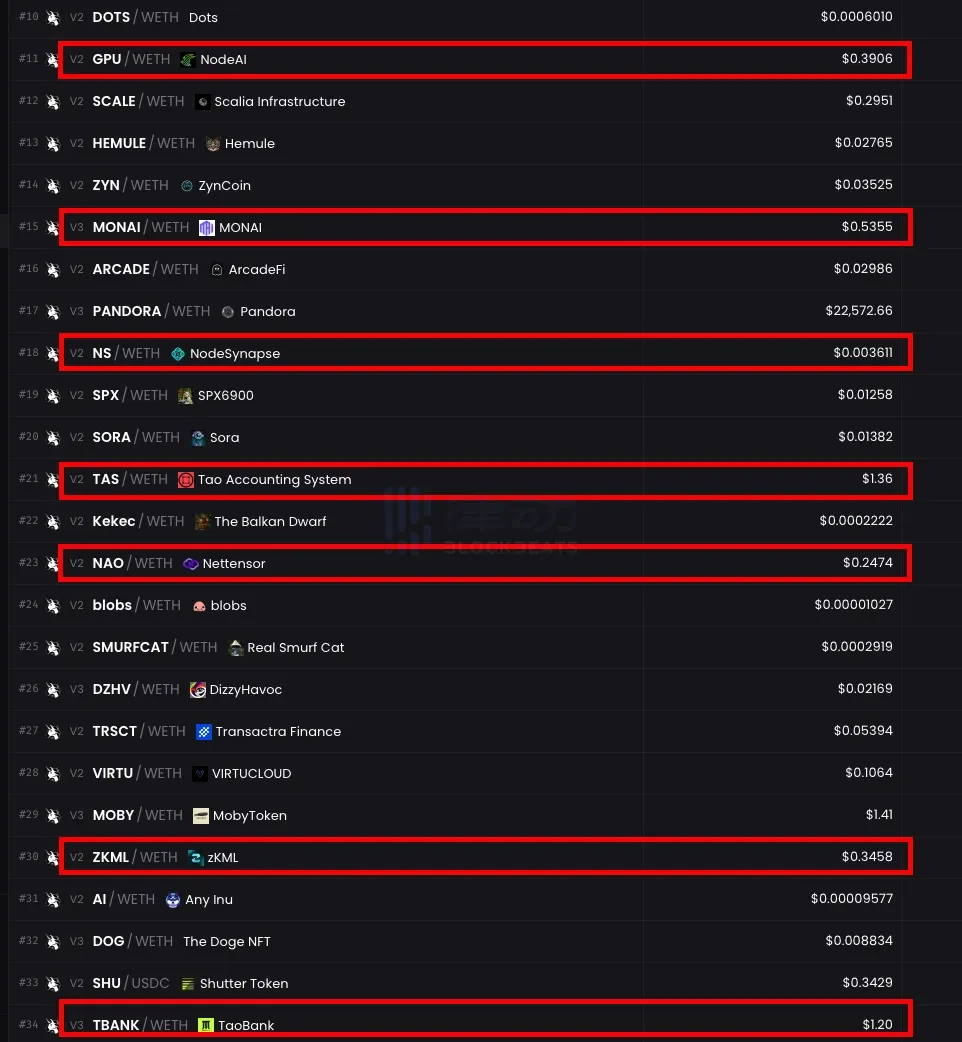

Last month, “GPU Sharing Model” projects focusing on decentralized computing power/cloud services appeared in droves, and they have all seen a good upward curve in the near future. BlockBeats once published an article in “AI Concept Coins Are Soaring. Are You Onboard With These 10 Alpha Projects?” "The GPU rental project Node AI ($GPU) was mentioned in the article. The price was US$0.22 at that time. After a week of consolidation, $GPU exceeded US$0.3 on Monday, and then rose to around US$1.2.

In addition to Node AI ($GPU), NetMind.AI ($NMT) and NodeSynapse ($NS), which appeared at the same time and focused on GPU sharing business, also had the same upward trend. It is worth noting that the official website of NetMind.AI released the founding team The specific information is that the members are all Chinese.

Left: Node.AI; Middle: NetMind.AI; Right: NodeSynapse

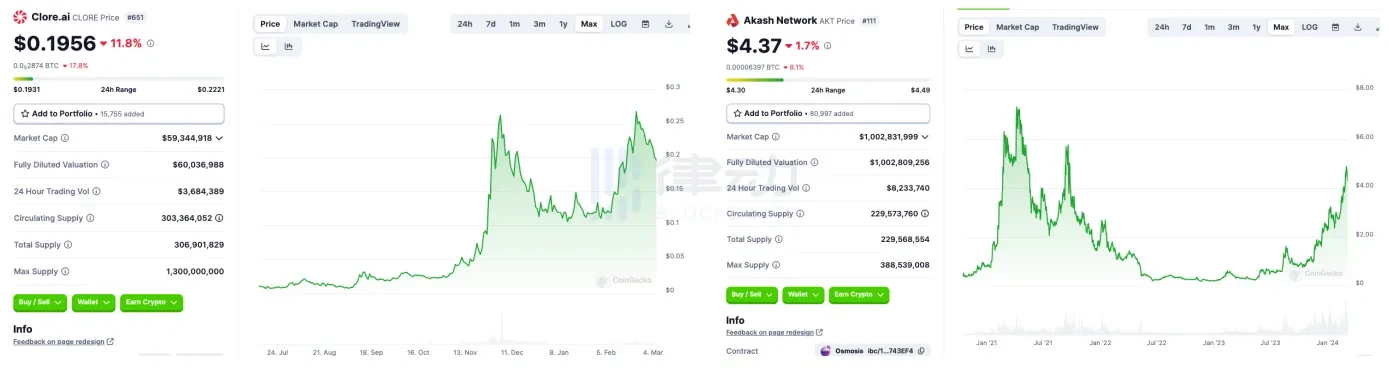

However, GPU rental services are not a new story in this bull market. Clore.ai ($CLORE), which appeared last year, also had an increase of more than ten times, but it did not stay at the peak for long before it began to fall. In early February, The AI craze has also driven $CLORE, but it still hasn’t surpassed its previous highs.

Related reading: “LD Capital: POW+AI dual narrative, computing power leasing platform Clore.AI increased 10 times in the month”

Akash, which was founded in 2022 and focuses on providing cloud computing market, also launched a test network focusing on GPU leasing last year. Its token AKT has increased nearly 5 times in the past six months. However, such achievements are still far behind compared with newly emerging projects.

TAO Ecology

As we all know, the three core elements of AI are data, algorithms and computing power. Bittensor aims at the direction of algorithms and builds a network architecture connected by many subnet networks, allowing anyone to create subnets with customized incentives and different AI model use cases. Currently, TAO has a market capitalization of over $4 billion, and its price has been trading sideways between $600 and $700 for a month. In the short term, TAO may not bring high profitability to its holders, while many projects on the Bittensor ecosystem are thriving.

OpSec is positioned as a decentralized physical infrastructure network provider on Bittensor. Its products include decentralized project deployment portal OpSecCloud Bot, agent OpSecure Mesh and RDP product OpSec Cloudverse.

Since OpSec launched the V2 testnet on February 14, its token has started to rise, reaching a peak after rising by more than 150% in the past week, and has now retreated by 10%. OpSec is still constantly updating news. On March 4, it announced the launch of Cloudverse Epoch 1, which will make it easier for users to deploy nodes. It also opened a Discord community. According to the team, Cloudverse sold more than 500 nodes within 24 hours of release.

In addition to OpSec, the Bittensor network lending protocol Tao Bank ($TBANK) also appeared in Alpha Hunter’s tweets, and the experimental token standard Tao Accounting ($TAS) also experienced an astonishing 7-fold increase in 3 days.

AI project pipeline, how to start quickly?

The technology is complex and difficult to understand, the construction cycle is long, and “slow results” are one of the reasons why the AI sector was not optimistic in the past. But with so many AI projects emerging in a short period of time, what’s the mystery? BlockBeats found that these early projects had similar “starting” postures.

Choose the best narrative

Among the new AI projects that appeared around February, many projects positioned themselves as the GPU rental market. Since there have been precedents in previous years, the market’s buying sentiment is very strong. But in fact, there is no way to know what power these projects rely on to schedule and utilize the collected computing resources.

Take Node.AI (GPU), which has repeatedly broken new highs, increased nearly 20 times in two weeks and is still rising, as an example. Although its official website has released the number of active nodes and the prices for renting GPUs of different specifications, the steps that Node.AI has completed so far Just “Launch NodeAI website and Dapp” and “$GPU Fair Launch”.

Previously, some communities pointed out that Node.AI only provided a Google form to collect customers who needed to rent GPU computing power, and had no actual implementation plan. Before users can actually provide their own computing power nodes for rent, they still need to go through several stages such as open token staking and the launch of an invitation plan.

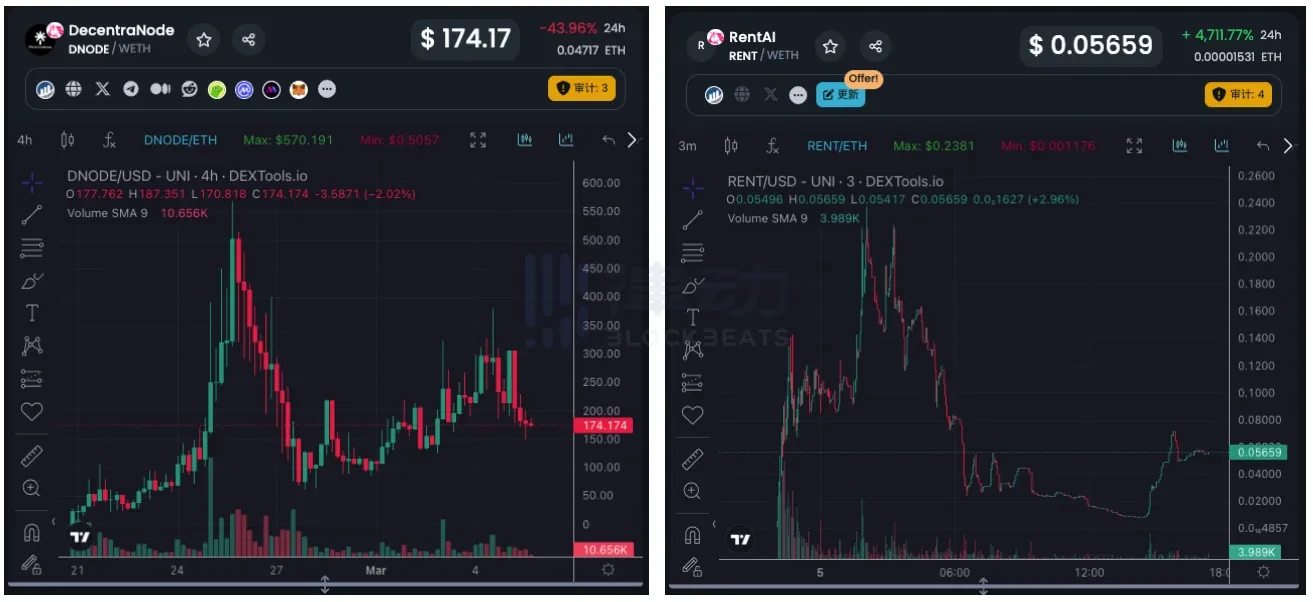

Not all projects can be successful for several days. The DecentraNode project token ($DENODE), which also introduced the GPU rental business in the white paper, has been rising since its launch, rising more than 20 times in 4 days. It fell by more than 80% in the next 2 days.

On March 4, a new GPU rental project, Rent AI, announced the launch of its token ($RENT). As can be seen from its trend chart, $RENT increased by more than 20 times within four hours of its launch, but then began to fall. , 16 hours after the token went online, its price returned to near the initial value. Different from Node.AI, Rent AI has already opened the token staking channel at the beginning of its launch.

In addition, GPUBot, which appeared on February 29, is based on the selling point that users can sell and rent CPU/GPU on Telegram without going through KYC. It has increased by more than 440% in the past 24 hours, but the number of currency-holding addresses is only more than 700 people.

In addition to GPU rental services, AI intelligent conversation robots are also a popular direction chosen by new projects. The AI prediction robot SpectreAI ($SPECTRE) has increased sixfold in two weeks. The LBP price of mocai, an AI robot project based on the parallel EVM network Monad, is $0.125. Although it was discovered that its Beta version may only be the ChatGPT API, this does not hinder its token It has increased by more than 360% in the four days since its launch.

NVIDIA Developer Program per capita

After launching the official website and white paper, how to attract the attention of the community? First of all, of course, it was mentioned by KOLs. “It is an AI project and it is still in its early stages” is the best selling point. Familiar Alpha Hunters can often be found in the early focus lists of some AI projects, and in the project’s TG group, there are often There is a reminder robot on site to monitor token purchases.

In addition, BlockBeats observed that most new AI projects have announced that they have joined the NVIDIA Developer Program, and used the term “establishing a partnership with NVIDIA” when announcing it.

In fact, the Developer Program is an activity launched by NVIDA to provide developers, researchers, and students with tools, resources, and training to help teams develop applications based on NVIDIA technology. Joining the NVIDIA Developer Program does not mean that the project party has “established a cooperative relationship with NVIDIA.” The project team only has access to the SDK repository, NVIDIA GPU catalog, tools, training and other resources.

Join some projects in the NVIDIA Developer Program

In addition to the NVIDIA Developer Program, the IBM Elite Program, Google and Microsoft Developer Programs are also among the “partnerships” of many AI projects.

Teamwork and cooperation

Is the project party doing something? The implementation and operation cycle of AI projects is often very long. Generally speaking, when the community observes whether a project is reliable, its cooperative relationship will often become one of the important indicators for reference. Therefore, we can see that some AI project partnerships are updated very frequently.

For example, L1 blockchain Vault, which was founded in 2023, has cooperated with 8 AI projects within 11 days, including the shared GPU project MineAI, the server hosting project NodeSynapse, the AI design tool SyntaxErc, the AI prediction robot SpectreAI, and the GPU rental service DecentraNode. , AI DEX MultiDexAI, AI audit tool SmartAudit AI, AI-driven on-chain trading tool SmartMoney.

For AigentX, which is already positioned to help Web3 projects customize AI-driven operation solutions, this partnership is a win-win situation. In the past half month, AigentX has announced partnerships with 14 AI concept projects. , respectively NodeSynapse, SmartAudit AI, DecentraNode, SmartMoney, GPU sharing project Blendr Network, AI-driven betting platform BetAI, AI gambling project ShellifyAI, intelligent chat robot VirtuMate, AI trading tool Artemisai, TG tool BuildAI, Bittensor subnet aph 5 nt , AI trading tool Volumint, decentralized cloud service DeCloud, GPU rental project Node.AI.

Conclusion

A large number of AI projects have appeared together, and the AI sector has become a frequent visitor to Alpha Hunters’ orders and on-chain transaction hot lists. Some gains last for a long time, while others end the next day.

Who is leading the AI project? This is a difficult question to answer. Many people will mention Bittensor (TAO), probably more because Bittensor’s market value ranks first in the AI sector, but Bittensor currently has no actual use cases, and it is impossible to find a second AI project that does similar business to Bittensor. How much room for appreciation does Bittensor have? What is the development rate? There are no similar projects for comparison, and it is a unique project in the AI sector.

In the direction of decentralized computing, Render Network, a project backed by the rendering business of a strong traditional manufacturer, is facing the emergence of rivals such as io.net that cannot be underestimated. However, it seems that these projects are currently opening up GPU supply resources to each other, and this direction is still in the stage of supporting each other and accumulating energy.

The absence of a faucet may be the best time to tap into the wealth effect. Unlike other tracks, DeFi projects can be analyzed from aspects such as project TVL and the ecology of the chain to which they belong. The DeFi mechanism itself can also be understood based on drawing on traditional financial models. GameFi can be experienced from the game studio, economic system design, game development progress, community ecology, etc.; but from what angle should an AI project be analyzed?

From the perspective of short-term profit, Twitter updates, website front-ends, white papers, Telegram operations, Discord ecology, etc. can all convey whether the project party is doing something and what the market’s expectations are. To a certain extent, the logic of investing in early-stage projects is similar to that of investing in memes. Look at the market value, the number of addresses held, and whether there are KOL mentions. Be bold and careful, and take profits in a timely manner. Judging from the project trends that have emerged, as long as you rush early enough and retreat in a timely manner, you can make good profits.

In the long term, unlike other tracks, the various subdivision directions in the AI track are very different and are still being explored. Is decentralized computing power AI or DePIN? In addition to shelling GPT, what other story does the application layer have? In addition to the recent emergence of a large number of AI projects that are temporarily regarded as memes, there are also “veteran” players in the market that were launched in the previous round, such as Bittensor, Render, Arkham, etc. This round also includes io.net and Scopechat. , Ritual is a project that continues to build and has high expectations but has not yet issued coins.

Just last night, Fetch.ai announced the launch of a US$100 million infrastructure investment project “Fetch Compute”, while io.net announced the completion of US$30 million in Series A financing from star investment institutions such as Hack VC and Multicoin Capital. It is still unclear whether 2024 will usher in the AI summer, but what is certain is that the AIxCrypto narrative will become increasingly clear.