Search results for "ETHW"

Ethereum spot ETF net inflow of $168.13 million... cumulative total has increased to $12.67 billion

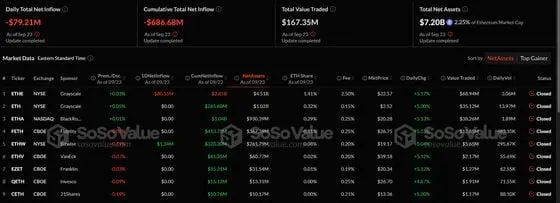

The US Ethereum spot ETF market continues its net inflow trend.

According to SoSoValue data, on January 5 local time, the US Ethereum spot ETF market achieved a single-day net inflow of $168.13 million.

Following the previous trading day (January 2, net inflow of $174.43 million), funds have maintained inflows for two consecutive days, with the total net inflow expanding to $12.67 billion.

On that day, capital inflows were concentrated in large products. ▲BlackRock ETHA ($102.9 million) ▲Grayscale Mini ETH ($22.34 million) ▲Fidelity FETH ($21.83 million) ▲Bitwise ETHW ($19.73 million) ▲Grayscale ETHE ($1.32 million), a total of 5 ETFs confirmed net inflows, while the other 4 products saw no change in fund flow.

The total transaction volume recorded $2.24 billion, similar to the level of the previous trading day ($2.28 billion).

TechubNews·01-06 06:40

What is ETHW? In-depth analysis of Ethereum hard fork coin.

[ETHW](https://www.gate.com/post/topic/ETHW) [ETH](https://www.gate.com/post/topic/ETH) [crypto assets](https://www.gate.com/post/topic/%E5%8A%A0%E5%AF%86%E8%B2%A8%E5%B9%A3) Every major upgrade of Ethereum sparks heated discussions, especially following the hard fork that gave birth to the Ethereum forked coin (ETHW). Against the backdrop of the investment value of ETHW and the impact of the Ethereum hard fork, we will explore the differences between ETHW and ETH, ETHW mining tutorials, and the future development of ETHW. Let us delve into what new opportunities and challenges this emerging digital asset brings.

幣圈動態·2025-11-28 09:08

Ethereum Spot ETF saw a net outflow of $500 million last week, continuing a three-week net outflow.

According to Deep Tide TechFlow news, on November 24, based on SoSoValue data, the Ethereum Spot ETF had a net outflow of $500 million during the last trading week (Eastern Time from November 17 to November 21).

Last week, the Ethereum Spot ETF with the highest net inflow was the Grayscale Ethereum Trust ETF ETH, with a weekly net inflow of 80.88 million USD, bringing the total historical net inflow of ETH to 1.424 billion USD; followed by the Bitwise ETF ETHW, with a weekly net inflow of 14.19 million USD, bringing the total historical net inflow of ETHW to 399 million USD.

The Ethereum Spot ETF with the highest net outflow last week was the Blackrock ETF.

ETH-1%

DeepFlowTech·2025-11-24 03:23

Data: Yesterday, Ethereum ETF had a net outflow of 8.45 million USD.

According to Mars Finance, as monitored by Trader T, yesterday, Ethereum ETF saw an outflow of 8.45 million USD. Among them, BlackRock's $ETHA saw an inflow of 39.38 million USD; Fidelity's $FETH saw an outflow of 30.26 million USD; Bitwise's $ETHW saw an outflow of 8.07 million USD; 21Shares' $TETH saw an outflow of 2.59 million USD; Invesco's $QETH saw an outflow of 2.16 million USD; Van Eck's $ETHV saw an outflow of 4.75 million USD; Franklin's $EZET and Grayscale's $ETHE and ETH.

ETH-1%

MarsBitNews·2025-10-10 03:14

The spot Ethereum ETF saw a net outflow of 238 million dollars last week.

Last week, the Ethereum spot ETF saw a net outflow of $238 million, ending a 14-week inflow streak. The Bitwise ETHW ETF led inflows with $2.52 million, while Grayscale's ETHE had the largest outflow of $88.97 million. Total net assets for these ETFs stand at $30.58 billion.

TapChiBitcoin·2025-08-25 05:43

On August 22, the total net inflow of the Ethereum Spot ETF in the United States was approximately 341 million USD.

According to Techub News and data from ichaingo, as of August 22, Eastern Time, the total net inflow of Ethereum Spot ETFs in the United States was approximately $341 million.

BlackRock ETF ETHA had a net inflow of approximately $109 million in a single day; Fidelity ETF FETH had a net inflow of approximately $118 million in a single day; Grayscale Micro ETF ETH had a net inflow of approximately $22.75 million in a single day; Grayscale ETF ETHE had a net inflow of approximately $45.85 million in a single day; Bitwise ETF ETHW had a net inflow of approximately $36.27 million in a single day; VanEck ETF ETHV had a net inflow of approximately $3.53 million in a single day; Franklin ETF EZET had a net inflow of approximately $5.49 million in a single day; 21Shares ETF.

ETH-1%

TechubNews·2025-08-25 02:08

Ethereum ETF (ETHW) Hits New 52-Week High

The Bitwise Ethereum ETF (ETHW) has surged 187.9% from its 52-week low, driven by institutional interest and favorable legislation. Analysts predict continued gains as Ethereum could reach $4,800 by late 2025 and exceed $5,500 in early 2026.

YahooFinance·2025-08-12 12:33

Yesterday, the total net outflow of Ethereum Spot ETF in the United States was approximately 26.46 million USD.

According to Techub News and ichaingo data, yesterday (June 26, Eastern Time) the total net outflow of Ethereum spot ETFs in the United States was approximately 26.46 million USD.

BlackRock ETF ETHA had a net inflow of approximately 5.89 million USD in a single day; Grayscale ETF ETHE experienced a net outflow of approximately 27.45 million USD in a single day; Grayscale Micro ETF ETH had a net outflow of approximately 12.39 million USD in a single day; Fidelity ETF FETH had a net inflow of approximately 4.87 million USD in a single day; Bitwise ETF ETHW had a net inflow of approximately 2.62 million USD in a single day; VanEck ETF ETHV, Franklin ETF EZET, 21 Shares ETF CETH, and Invesco ETF.

ETH-1%

TechubNews·2025-06-27 04:53

Is the spring of Ethereum ETF inflows and record ETH about to come?

On June 23, the net inflow of funds for the Spot Ethereum ETF listed in the United States surpassed $4 billion, just 11 months after its launch.

These products were launched on July 23, 2024, and after 216 trading days in the U.S., the cumulative net inflow reached $3 billion as of May 30.

After breaking the $3 billion mark, the Spot Ether ETF increased by $1 billion in just 15 trading days, reaching a lifetime net subscription amount of $4.01 billion as of the close on June 23.

These 15 trading days account for 6.5% of the 231 days of trading history, but they represent 25% of all funds invested to date.

BlackRock's iShares Ethereum Trust (ETHA) drove this growth with a total inflow of $5.31 billion, while Fidelity's FETH contributed $1.65 billion, and Bitwise's ETHW increased by $346 million.

ETH-1%

金色财经_·2025-06-25 09:33

Techub News reports that according to ichaingo data, yesterday (Eastern Time May 1st), the total net outflow of Ethereum Spot ETF in the United States was approximately 39.79 million USD.

BlackRock ETF ETHA had a net inflow of approximately 8.43 million USD in a single day; Grayscale ETF ETHE had a net outflow of approximately 16.6 million USD in a single day; Fidelity ETF FETH had a net outflow of approximately 31.62 million USD in a single day; Grayscale Micro ETF ETH, Bitwise ETF ETHW, VanEck ETF ETHV, Franklin ETF EZET, 21Shares ETF CETH, and Invesco ETF QETH had no net inflow or outflow.

TechubNews·2025-05-16 06:32

According to Techub News and data from ichaingo, the total net outflow of Ethereum spot ETF in the United States yesterday was approximately $5.86 million. Fidelity ETF FETH had a net inflow of approximately $5.86 million in a single day; Grayscale Micro ETF ETH, Franklin ETF EZET, VanEck ETF ETHV, Grayscale ETF ETHE, WInvesco ETF QETH, 21Shares ETF CETH, BlackRock ETF ETHA, Bitwise ETF ETHW, and BlackRock ETF ETHA had no net inflow or outflow.

TechubNews·2025-05-15 04:37

According to Techub News and data from ichaingo, yesterday (May 8, Eastern Time), the total net outflow of the US Ethereum Spot ETF was approximately $16.11 million. Grayscale Micro ETF ETH had a net inflow of about $3.19 million in a single day; Fidelity ETF FETH had a net outflow of about $19.3 million in a single day; BlackRock ETF ETHA, Grayscale ETF ETHE, Bitwise ETF ETHW, VanEck ETF ETHV, Franklin ETF EZET, 21 Shares ETF CETH, and Invesco ETF QETH had no net inflows or outflows.

TechubNews·2025-05-09 05:36

Data: Ethereum Spot ETF total net inflow yesterday was $64.1159 million, continuing a 3-day net inflow.

According to SoSoValue data, the total net inflow of Ethereum Spot ETFs yesterday was $64.1159 million. Blackrock's ETF ETHA had the highest net inflow in a single day, reaching $67.4665 million, with a historical total net inflow of $4.181 billion. Bitwise ETF ETHW had the largest net outflow in a single day, amounting to $3.3506 million, with a historical total net inflow of $318 million. As of now, the total net asset value of Ethereum Spot ETFs is $6.196 billion, with a net asset ratio of 2.87%, and the historical cumulative net inflow has reached $2.465 billion.

CoinVoice·2025-04-29 06:11

Yesterday, the total net inflow of Ethereum Spot ETF in the United States was approximately 63.49 million USD.

According to data from ichaingo, the total net inflow of US Ethereum Spot ETFs yesterday was approximately $63.49 million. Among them, BlackRock ETF ETHA had a net inflow of about $40.03 million, Grayscale ETF ETHE had a net outflow of about $6.6 million, Grayscale Micro ETF ETH had a net inflow of about $18.28 million, Bitwise ETF ETHW had a net inflow of about $5.06 million, VanEck ETF ETHV had a net inflow of about $2.58 million, and 21 Shares ETF CETH had a net inflow of about $4.14 million. Other ETFs had no net inflow or outflow.

TechubNews·2025-04-25 03:59

Data: Ethereum Spot ETF saw a total net inflow of $38.7406 million yesterday, with none of the nine ETFs experiencing a net outflow.

According to SoSoValue data, the total net inflow of Ethereum Spot ETF yesterday was $38.7406 million. The largest single-day net inflow came from the Fidelity Ethereum ETF FETH, reaching $32.6532 million, with a historical total net inflow of $1.391 billion. The Bitwise ETF ETHW net inflow was $6.0874 million, with a historical total net inflow of $315 million. The total net asset value of the Ethereum Spot ETF is $5.660 billion, with a net asset ratio of 2.77%, and the historical cumulative net inflow has reached $2.258 billion.

CoinVoice·2025-04-23 05:23

Yesterday, the total net outflow of about 73.63 million US dollars from the Ethereum Spot ETF in the United States, has seen a continuous net outflow for 7 days.

Yesterday, the total net outflow of the US ETH Spot ETF reached 73.63 million US dollars, with a net outflow for 7 consecutive days. Among the ETFs, VanEck ETF ETHV had a net inflow of 1.35 million US dollars, 21Shares ETF CETH had a net outflow of 462,000 US dollars, Grayscale Micro ETF ETH had a net outflow of 5.23 million US dollars, Fidelity ETF FETH had a net outflow of 12.48 million US dollars, BlackRock ETF ETHA had a net outflow of 15.11 million US dollars, and Grayscale ETF ETHE had a net outflow of 41.70 million US dollars. Bitwise ETF ETHW, Franklin ETF EZET, and Invesco ETF QETH had no net inflow or outflow of funds.

TechubNews·2025-03-14 04:59

Ethereum ETFs Record $23.10M Outflow as Market Prices Decline

Ethereum ETFs show mixed net inflows with ETHA and FETH leading while ETHE and ETHW stay neutral. Total market outflow reaches $23.10M amid price declines.

CryptoFrontNews·2025-03-09 00:21

Ethereum ETF Market Update: A Look at $307.77M Daily Inflow and Rising Assets

Summary: Ethereum ETFs receive $307.77M daily inflow, with cumulative inflows of $3.15B. ETHE maintains 0.10% premium, ETHW reports -0.33% premium with net assets of $290.26M. FETH sees $27.47M daily inflow.

CryptoFrontNews·2025-02-05 11:03

Ethereum ETFs Continue Poor Performance Pulling in Only $23 Million

Most Ethereum ETFs recorded no transaction last Friday. Fidelity’s FETH had the highest inflow, pulling in $14 million, while Bitwise ETHW had the least, with $2.5 million. The net inflow for all nine ETFs was $23.9 million. Ethereum's current price is $3,350, and the network received additional liquidity when World Liberty Financial purchased 14,403 ETH, worth approximately $48 million. Ethereum Creator Vitalik Buterin has proposed reforms for the underperforming network.

CryptoNews·2025-01-20 15:44

EtherSpot ETF had a total net inflow of $1,152,700 yesterday, marking the first net inflow after net outflows for the past 4 days.

According to SoSoValue data, the total net inflow of ETH 2.0 spot ETF yesterday was $1.1527 million, with Bitwise ETF ETHW having the highest net inflow in a single day; while Grayscale ETH 2.0 Trust ETF and ETH 2.0 Mini Trust ETF had no net outflow or net inflow. The total net asset value of ETH 2.0 spot ETF is $11.398 billion, with a historical cumulative net inflow of $2.414 billion.

DeepFlowTech·2025-01-15 05:00

Ethereum ETF January 8 Market Update: FETH and ETHW Lead ETF Inflows With $345M

Ethereum Spot ETFs see daily net outflow of -$159.34M, with total cumulative inflows reaching $2.52B, while FETH and ETHW lead inflow activity. Total trading value reaches $458.63M. Daily ETF price declines range from -2.73% to -3.33%.

CryptoNewsLand·2025-01-09 14:50

Yesterday, the net inflow of ETH Spot ETF in the United States was about 53.54 million dollars

Techub News, according to iChainfo data, on December 24th, Eastern Time, the total net inflow of US ETH Ethereum Spot ETF was approximately 5354 million US dollars.

Among them, the net outflow of BlackRock ETF ETHA is about 43.9 million US dollars; the net inflow of Fidelity ETF FETH is about 3.45 million US dollars; the net inflow of Bitwise ETF ETHW is 6.19 million US dollars; Invesco ETF QETH, 21Shares ETF CETH, Franklin ETF EZET, VanEck ETF ETHV, Bitwise ETF ETHW, and Grayscale ETF ETHE have no net inflow or outflow of funds; Grayscale Micro ETF ETH has no net inflow or outflow of funds.

TechubNews·2024-12-25 05:43

Yesterday, the total net outflow of the US ETH Spot ETF was about 75.12 million US dollars.

Techub News, according to iChainfo data, on December 20th, Eastern Time, the total net outflow of the US Ethereum Spot ETF was approximately $75.12 million.

Among them, BlackRock ETF ETHA had a net outflow of about 100 million US dollars; Grayscale ETF ETHE had a net inflow of about 7.51 million US dollars; Grayscale Micro ETF ETH had a net inflow of about 8.1 million US dollars; Fidelity ETF FETH had a net inflow of about 12.95 million US dollars; Invesco ETF QETH, 21Shares ETF CETH, Franklin ETF EZET, VanEck ETF ETHV, Bitwise ETF ETHW had no net inflow or outflow of funds.

TechubNews·2024-12-21 09:37

Data: Total net inflow of 283.40 million US dollars into ETH Spot ETF yesterday, with ETF net asset ratio reaching 2.44%

According to SoSoValue data, the net inflow of ETH Block spot ETF reached 2.834 million US dollars yesterday, with Bitwise ETF ETHW having the highest net inflow of 8.7491 million US dollars, followed by Fidelity ETF FETH at 4.3563 million US dollars. The net asset value of ETH Block spot ETF is 10.277 billion US dollars, and the historical cumulative net inflow has reached 110 million US dollars. At the same time, the net outflow of Grayscale ETH Block Trust ETF ETHE was 7.6463 million US dollars on a single day, and the historical net outflow was 3.346 billion US dollars.

CoinVoice·2024-11-26 05:36

ETH Spot ETF had a net inflow of 2.834 million US dollars yesterday, with an ETF net asset ratio of 2.44%.

Yesterday, the net inflow of ETH spot ETF was $2.834 million, Bitwise ETF ETHW had a net inflow of $8.7491 million, and Fidelity ETF FETH had a net inflow of $4.3563 million. The total net asset value of ETH spot ETF is $10.277 billion, with a net asset ratio of 2.44%, and the historical cumulative net inflow has reached $110 million. GrayscaleETH Trust ETHE had a net outflow of $7.6463 million, with a historical net outflow of $3.346 billion; ETH spot Mini Trust ETF ETH had a net outflow of $3.9565 million, with a total historical net inflow of $363 million.

DeepFlowTech·2024-11-26 05:13

Yesterday, the total net inflow of Spot ETFs in the US Ethereum was about 2.83 million US dollars.

According to iChainfo data, the total net inflow of the US ETH spot ETF reached nearly $2.83 million yesterday, with Bitwise ETF ETHW having a net inflow of $8.75 million in a single day, while Grayscale ETF ETHE saw a net outflow of approximately $7.65 million. The net inflow or outflow of other funds ranged from $1 million to $5 million on a single day.

TechubNews·2024-11-26 05:13

Ethereum Spot ETF saw a net outflow of $71.6 million last week, while Grayscale Ethereum Trust ETF ETHE saw a weekly net outflow of $95.57 million.

Last week, the outflow of ETHW ETF reached $71.6 million, with the Grayscale ETH Trust ETF (ETHE) having the largest weekly net outflow of $95.56 million, and a total net outflow of $3.34 billion. In contrast, the Belade ETH ETF (ETHA) was the champion of net inflows, with a weekly net inflow of $78.34 million and a total net inflow of $1.8 billion. Bitwise ETH ETF (ETHW) followed closely behind, with a total net inflow of $381 million. As of now, the total net asset value of ETHW ETF is $9.687 billion, with a total cumulative net inflow of $107 million.

DeepFlowTech·2024-11-25 04:21

Last week, the net outflow of ETH Spot ETF was $71.6 million, and the net outflow of Grayscale ETHE was $95.57 million.

Last week, the net outflow of ETH Spot ETF reached 71.6 million US dollars, with the largest net outflow amount from Grayscale ETH Trust ETF (ETHE) at 95.56 million US dollars. The largest net inflow amount came from BlackRock ETH ETF (ETHA) at 78.34 million US dollars. Bitwise ETH ETF (ETHW) had a net inflow amount of 7.85 million US dollars. The total net asset value of ETH Spot ETF is 9.687 billion US dollars, with a cumulative net inflow of 107 million US dollars.

REVOX·2024-11-25 03:52

Data: Yesterday, the net inflow of US Ethereum Spot ETF was 92.3 million USD

CoinVoice has learned that according to Farside Investors and Bloomberg Terminal data, the net inflow of 92.3 million US dollars was recorded for the US ETH Spot ETF yesterday, with the following breakdown:

· BlackRock ETHA: + $100.7 million · Fidelity FETH: + $5.8 million · Bitwise ETHW: + $5 million · Grayscale ETHE: -$18.6 million · Grayscale Ethereum Trust - ETH: -$0.6 million

CoinVoice·2024-11-23 03:44

Spot Ethereum ETFs See $515 Million Record Weekly Inflows – Details

Spot Ethereum ETFs attracted over $515 million in a week, composed of BlackRock’s ETHA with $287.06m Fidelity’s FETH $197.75m, Grayscale’s ETH $78.19m and Bitwise’s ETHW $45.54m investments, with Grayscale’s ETHE experiencing $101.02m of outflows. The total net assets of all Ethereum ETFs decreased 1.2% to $9.15bn. At the same time, spot Bitcoin ETFs saw investment of $1.67bn, bringing the assets under management to above $95bn.

CryptoBreaking·2024-11-17 20:11

Bitcoin stayed strong, these altcoins settled at the top!

Following Bitcoin's closing above 65,000 dollars, MOODENG, SAFE, GIGA, SKL, and ETHW were among the top gaining altcoins of the day. MOODENG stood out among the others by gaining 70% in the past 24 hours. However, this article does not contain any investment advice or recommendations, and readers should conduct their own research before making any trading decisions.

Coinkolik·2024-09-28 02:00

Ether ETFs Record Biggest Outflows Since July in Sign of Low Institutional Appeal

Ether ETFs experienced the largest outflows since July, with over $79 million exiting on Monday.

The outflows were predominantly from Grayscale’s Ethereum Trust (ETHE), while other ETFs like Bitwise's ETHW saw minor inflows, highlighting Grayscale's significant influence on the market dynamics.

CoinDesk·2024-09-24 06:22

Grayscale ETHE unlock tide, where will the funds of ETH Square ETF finally flow?

Spot ETH ETF suffered a net outflow of $476 million in the first month in the United States, which has not yet offset the impact of the outflow of Grayscale ETHE funds. Analysis believes that the first-mover advantage of BTC, the lack of monitoring options for ETH ETF, and low market liquidity have limited institutional investors' interest. However, some ETH ETFs have shown signs of recovery, with BlackRock's ETHA inflows exceeding $1 billion and Bitwise's ETHW attracting over $300 million in the first year. In total, by 2024, the total inflow of ETH ETFs will be equivalent to the fourth largest ETF.

金色财经_·2024-09-04 04:07

Spot Ethereum ETFs did not meet expectations: Altcoins are falling

On the second day of trading, US spot Ethereum ETFs, except for Grayscale Ethereum Trust (ETHE), recorded outflows. Fidelity's FETH was the most subscribed fund, while VanEck ETHV, Bitwise ETHW, and Grayscale Ethereum Mini Trust also recorded net inflows. BlackRock's ETHA recorded a lower inflow compared to the large inflow on Tuesday. Despite the net inflow of $106.78 million recorded on Tuesday, Ether ETFs generated a trading volume of approximately $951 million on Wednesday. Ether dropped by 8.24% in the last 24 hours and Bitcoin traded with a 3% decrease.

Coinkolik·2024-07-24 22:16

As long as there is volatility in the market, then there will be a chance, how should it be done now?

This month is coming to an end, from the monthly point of view, some of the standards have doubled, such as IMX, ETHW, SEI, BLUR, etc., and some are even several times, such as USTC, ORDI, etc., the increase of more than 50 points is a lot, such as SSV, ROSE, etc., if at present, you have not caught all of the above, then don't chase the rise, the market funds are limited, the current environment is not suitable for a comprehensive general rise, but a rotation rise, so, instead of chasing those projects that have risen a lot, it is better to ambush some of the current monthly line has not risen much, valuable varieties!

At present, it is obvious that it cannot be regarded as a big bull market, and it is certainly not a big bear market, after all, there is still a money-making effect, and the volatility is much larger than the deep bear market, as long as there is volatility in the market, then there is an opportunity to make money, whether you are long or short, you have the opportunity to earn the profits you want, and as a spot player, when...

币小白_·2023-11-29 04:06

Load More