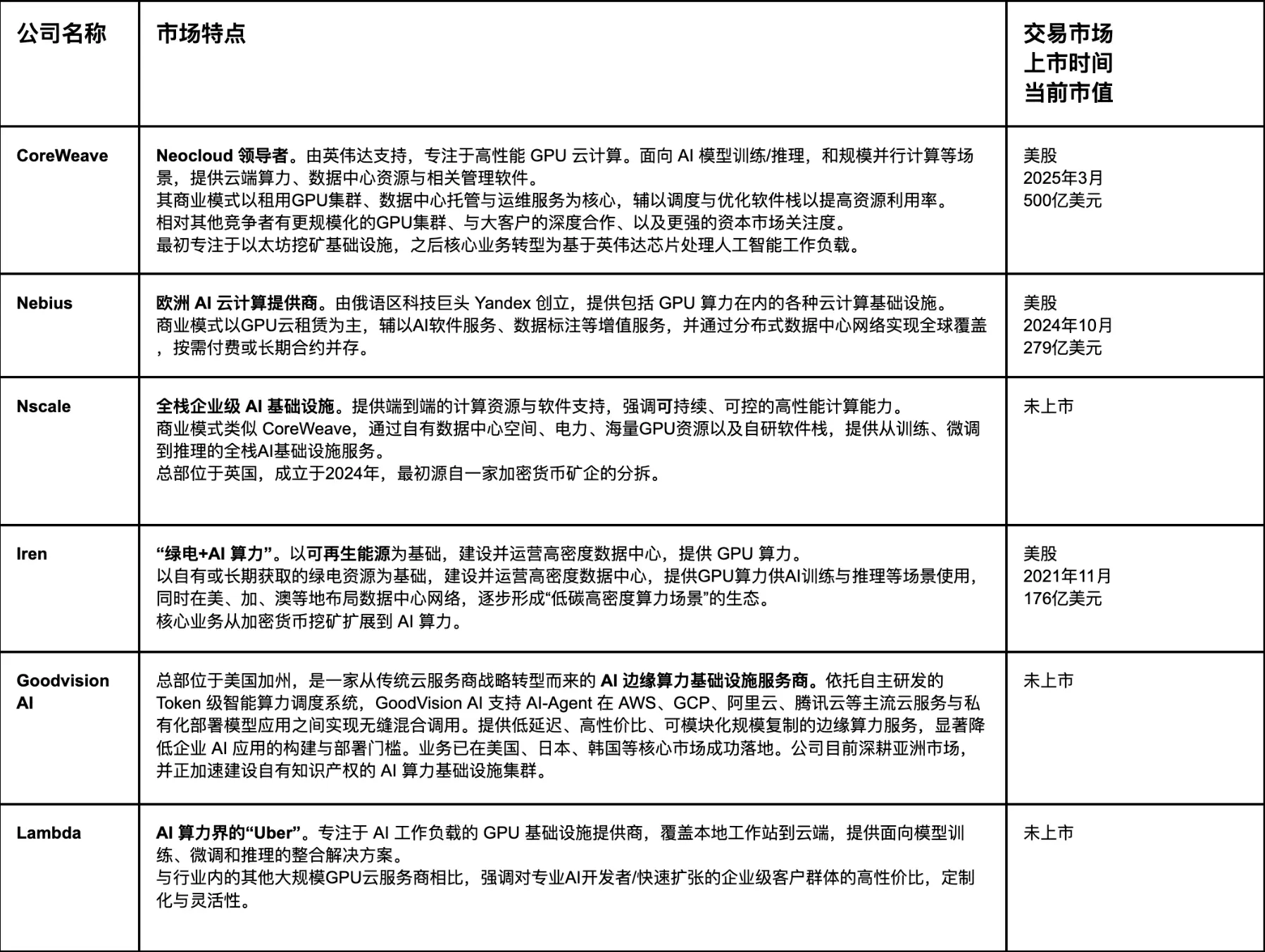

Search results for "GOLD"

Waterdrop Capital: Left hand BTC, right hand AI computing power—The gold and oil of the digital intelligence era

Author: Jademont, Evan Lu, Waterdrip Capital

The New Industrial Revolution: Computing Power as the Engine of Economic Operation

>

> "In this world, only a few people can inadvertently usher in an era that changes human history, like Edwin Drake... His drill bit, penetrating deep into the ground, not only touched black liquid but also the arteries of modern industrial civilization."

>

>

>

In 1859, amidst the mud in Pennsylvania, people gathered around Colonel Drake (Edwin Drake) and burst into laughter. At that time, the world still relied on increasingly scarce whale oil for lighting, but Drake was convinced that underground "rock oil" could be mined on a large scale. This was considered a madman's delusion at the time. Until the first gush of black liquid erupted, no one could have imagined that the emergence of oil would not only

PANews·8h ago

Florida’s Bitcoin ‘digital gold’ reserve bill targets up to 10% of state funds

Florida's proposed bills HB 183 and SB 1038 seek to create a Strategic Bitcoin Reserve, allowing 10% of certain public funds to invest in Bitcoin and ETFs. This initiative mirrors similar efforts by other states, aiming to diversify state-managed assets and integrate digital currencies in public finance.

BTC-0,35%

Cryptonews·10h ago

Bitcoin bulls confront Dalio’s warning as fiat slides, gold outshines Wall Street

Ray Dalio flags fiat devaluation as 2025's real story as gold and foreign stocks crush U.S. equities, pushing capital away from American markets.

Summary

Ray Dalio says the real 2025 story is fiat devaluation, not U.S. stocks or the AI trade.

Gold and non‑U.S. equities sharply outperformed U.S

BTC-0,35%

Cryptonews·11h ago

Platinum reaches a new high, becoming the most important precious metal asset allocation option besides gold and silver.

Platinum (White Metal) continued its fierce rally in early 2026, following last year's strong momentum, becoming the new focus in the global precious metals market. Looking back at 2025, platinum prices hit a record high, with an annual return of over 125%, ranking only behind silver among major precious metals, and outperforming gold overall. As the new year begins, platinum prices continue to rise driven by multiple structural bullish factors, indicating that this rally is not a short-term speculation but a long-term trend based on supply and demand fundamentals and capital flows. Wall Street analysts are optimistic about platinum's market prospects, viewing it as the next hot investment target in precious metals. This article is an excerpt from analyst insights on Seeking Alpha, purely market observation, not investment advice.

What is platinum?

Platinum (Platinum, also known as White Metal, is one of the rarest metals on Earth, with a lower output than gold and silver, and highly

ChainNewsAbmedia·11h ago

Left hand BTC, right hand AI computing power: the gold and oil of the digital intelligence era

Article by: Jademont, Evan Lu, Waterdrip Capital

Reviewing the turbulent 2025 and looking ahead to the long-term AI future

A new industrial revolution: computing power becomes the engine of economic operation

"In this world, only a very few can, like Edwin Drake, inadvertently usher in an era that changes human history... His drill bit, penetrating deep into the ground, not only touched black liquid but also the arteries of modern industrial civilization."

In 1859, amidst the mud in Pennsylvania, people gathered around Colonel Edwin Drake, laughing and mocking. At that time, the world’s lighting still relied on increasingly scarce whale oil, but Drake was convinced that underground "gasoline" could be mined at scale. This was considered a madman's delusion at the time. Until the first black liquid

TechubNews·12h ago

Wall Street Gold Outlook 2026: Rare Institutional Consensus Points to $5000+ Targets

The Wall Street gold outlook for 2026 reveals an unusual level of agreement among five major institutions—Goldman Sachs, JPMorgan, Morgan Stanley, Bank of America, and UBS—all maintaining a strongly institutional gold bullish stance with gold price target 5000 or higher by year-end or beyond.

BTC-0,35%

CryptopulseElite·13h ago

Visa's crypto credit card annual spending soars by 525%, crypto payments迎来 "pragmatism" turning point

According to on-chain data dashboard statistics from Dune Analytics, the net consumption of crypto credit cards associated with Visa in 2025 skyrocketed from approximately $14.6 million at the beginning of the year to $91.3 million at the end of the year, an increase of 525%.

Behind this astonishing growth, the widespread adoption of stablecoins and the emergence of innovative banking applications on high-performance public chains like Solana are key driving forces. It marks a shift in cryptocurrency from speculative assets and digital gold to "digital cash" that can be used in daily life, and mainstream adoption may have reached a critical point. Despite short-term market fluctuations, this trend provides fundamental support for Bitcoin, Ethereum, and the entire payment network beyond price.

MarketWhisper·17h ago

Venezuela is accused of secretly exchanging gold for Bitcoin, valued at around $60 billion? But there is still a lack of on-chain evidence.

Venezuela is rumored to have exchanged gold for up to 600,000 bitcoins, but lacking on-chain evidence to support this, most analyses consider it speculative and unlikely to be a national reserve.

Gold-for-Bitcoin Rumor Resurfaces, 600,000 BTC Claim Sparks Market Attention

-------------------------------

Recently, there has been widespread speculation that the Venezuelan government, under international sanctions pressure, has been converting gold and oil revenues into Bitcoin over the long term, accumulating an estimated 600,000 BTC. Based on current prices, this amounts to approximately $60 billion.

These claims are based on some investigative reports and second-hand information, suggesting that Venezuela has been selling gold reserves since 2018 and converting the proceeds into cryptocurrencies through informal channels to evade financial sanctions.

However, multiple blockchain analysis firms have pointed out that this figure does not

BTC-0,35%

CryptoCity·18h ago

Geopolitics Shake Markets: Bitcoin Slips While Gold Holds Firm

Financial markets are responding cautiously rather than panic-driven to a new wave of geopolitical statements and developments involving the United States. Bitcoin slipped below the $93,000 level despite extremely high activity in futures markets, while gold, after several strong sessions, has

BTC-0,35%

Moon5labs·01-07 20:01

YouTube Rival Rumble Debuts Bitcoin, Tether Wallet for Crypto Creator Tips

In brief

Rumble launched Rumble Wallet, a non-custodial crypto wallet built with help from Tether and MoonPay.

The wallet will support Tether's dollar-backed and gold-backed tokens, USDT and XAUT, as well as Bitcoin.

Shares of RUM have dipped slightly on the day and are down more

Decrypt·01-07 16:06

Rumble and Tether Launches Crypto Wallet for Digital Creators - Coinspeaker

Key Notes

Rumble Wallet lets creators receive Bitcoin, USDT, and Tether Gold tips directly on the platform.

Users keep control of funds while sending crypto without banks or intermediaries.

MoonPay enables easy crypto-to-fiat conversions with Apple Pay, PayPal, and credit cards.

Rumble has

Coinspeaker·01-07 15:26

Tether Rolls Out Scudo, Letting XAUT Be Used in Smaller On-Chain Units

With Scudo, XAUT is broken into smaller pieces, making gold-backed tokens far more practical for on-chain use.

The update expands XAUT utility beyond storage into payments and blockchain applications.

Tether introduced Scudo as a fresh on-chain unit for XAUT, giving tokenized gold room to mo

CryptoNewsFlash·01-07 13:05

Tether Launches New Scudo Unit to Make Digital Gold Payments and Transfers Simpler for Users

Scudo lets users price and transfer digital gold using smaller units that are easier to understand and use daily.

Tether kept XAUT fully backed by physical gold while only changing how value is measured onchain.

Smaller gold units may support wider use of tokenized gold in payments

CryptoNewsLand·01-07 11:36

China Gold Reserves Hit 2,306 Tonnes as PBOC Keeps Buying

China's People's Bank of China increased gold reserves by 1 tonne in December 2025, totaling 2,306 tonnes. This strategy supports financial security, reduces reliance on the U.S. dollar, and influences global markets as central banks shift toward tangible assets.

Coinfomania·01-07 11:10

Break gold into smaller pieces! Tether Gold mimics Bitcoin's "Satoshi" and introduces the Scudo valuation system

Tether introduces the Scudo pricing unit for XAU₮, dividing gold into one-thousandth to lower the threshold and promote digital gold payments and practicality.

Drawing inspiration from Bitcoin's "Satoshi" concept, Tether launches a new pricing unit for XAU₮ — Scudo

---------------------------------------

The leading stablecoin Tether officially announced on January 6, 2026, the introduction of a new accounting and pricing unit for its gold-pegged digital token Tether Gold (XAU₮): "Scudo."

This move directly borrows the logic of Bitcoin (Bitcoin) dividing its basic unit into "Satoshi." According to official definitions, 1 Scudo equals 1,000 cents.

CryptoCity·01-07 09:20

The 10 AM Slam: Dow at 49,000 and Gold Surging, So Why Is Bitcoin Falling?

_Here’s why Bitcoin is dropping as the Dow Jones hits 49,000 after major stock surges following Maduro’s capture._

The global financial sector is currently in the midst of something unusual.

While traditional stock markets are celebrating new all-time highs, the cryptocurrency market is in the

LiveBTCNews·01-07 09:20

Tether Introduces Scudo to Simplify Digital Gold Payments

Tether introduced Scudo, a new unit for its gold-backed token XAU₮, representing 1/1,000 of a troy ounce. This change simplifies pricing and enhances usability while maintaining XAU₮'s gold backing and reserves.

CryptoFrontNews·01-07 08:36

Bitcoin Maxis in Disbelief as Silver Overtakes Nvidia - U.Today

Silver's recent price surge has made it the second most valuable asset, surpassing Nvidia, while gold remains the top asset. This shift highlights a trend of capital moving from cryptocurrencies like Bitcoin to physical commodities due to silver's rapid performance and its essential role in tech industries.

BTC-0,35%

UToday·01-07 07:49

U.S. Treasury bonds are about to surpass $40 trillion. Why might Bitcoin become the biggest winner?

By the end of 2025, the total US federal government debt has approached $38.4 trillion, equivalent to about $28.5 thousand per American household, and is rushing towards the $40 trillion mark at a rate of $5 billion to $7 billion per day. Behind this massive figure is an astonishing interest expense of over $1.2 trillion annually.

Traditionally, the ever-expanding national debt has been viewed as a pressure on the long-term value of the dollar, reinforcing Bitcoin's narrative as "digital gold" and an inflation hedge. However, a disruptive turn is occurring in this debt story: mainstream stablecoin issuers, led by USDT and USDC, are transforming from external observers to significant internal buyers of the US debt market by holding large amounts of short-term US Treasuries. This role reversal has created an unprecedented deep linkage between the cryptocurrency market and the "vessels" of the US financial system—the Treasury market and global dollar liquidity—causing Bitcoin's future to be simultaneously influenced by "hard currency" faith and short-term liquidity tides.

MarketWhisper·01-07 07:45

Silver's market cap briefly surpasses NVIDIA; could this be a precursor to a Bitcoin surge?

In early 2026, the global financial markets witnessed a historic moment: the spot silver price surged to $82.7 per ounce, temporarily surpassing chip giant NVIDIA and ranking as the second-largest asset worldwide. This gold and silver bull market, driven by persistent structural supply shortages and strong industrial demand from artificial intelligence, new energy, and other sectors, is triggering deep associations with the cryptocurrency market.

Several analysts pointed out that silver completed a multi-year "cup and handle" pattern before its sharp rise, while the weekly chart of Bitcoin is quietly forming a very similar technical structure. This coincidental pattern, combined with the expectation of global capital rotation from traditional assets to crypto assets, provides an imaginative narrative framework for Bitcoin's upcoming breakout.

BTC-0,35%

MarketWhisper·01-07 06:48

Trump eyes Maduro's 660,000 Bitcoins! Worth more than 60 billion in oil

Maduro claims to hold 660,000 Bitcoins worth $60 billion. Venezuela sold 73 tons of gold in 2018 to exchange for 400,000 BTC, then used oil to exchange for USDT and transferred to BTC. Venezuela's annual oil production value is only $20 billion, taking three years to earn $60 billion. Directly taking over Bitcoin would immediately credit the account, killing four birds with one stone for Trump: eliminate Maduro, take control of oil, and replenish strategic reserves.

BTC-0,35%

MarketWhisper·01-07 05:20

Previously accurately predicted the timing of gold's surge! Commodity strategist: Bearish on Bitcoin in 2026

Commodity strategist Mike McGlone accurately predicted that gold would rise 64% in 2025 and has now released the 2026 forecast: gold faces the risk of "overheating," and U.S. bonds will take away excess returns. He predicts a higher probability of Bitcoin falling to $50,000 than rebounding to $100,000, citing the 19% decline of the Bloomberg Galaxy Crypto Index last year.

MarketWhisper·01-07 05:13

Goldman Sachs: Political changes in Venezuela have limited short-term impact on the oil market; bullish on gold in 2026

The United States launched a targeted killing operation and arrested Venezuelan President Nicolás Maduro last week, drawing significant international market attention. Investors' concerns quickly shifted to whether Venezuelan crude oil would be affected, if oil prices would experience significant volatility, and whether the US would deepen its involvement in the local energy industry in the future. In response, Daan Struyven, Head of Commodity Research at Goldman Sachs (Goldman Sachs), provided an initial analysis on the development of the event, the oil market response, and the medium to long-term impact in the latest episode.

Maduro's arrest by the US creates a power vacuum in Venezuela

Venezuelan President Nicolás Maduro (Nicolás Maduro) was arrested by the US authorities in Caracas on 1/4, on drug-related charges. His wife was also detained. Currently, Vice President Delcy Rodríguez (Delcy Rodrígue

ChainNewsAbmedia·01-07 04:20

Tether introduces Scudo, a new fractional unit for Tether Gold (XAUT)

Tether has introduced a new fractional unit for Tether Gold aimed at making on-chain gold easier to price, transfer, and use as a payment asset.

Summary

Tether introduced Scudo, a new unit equal to one-thousandth of a troy ounce of gold, for XAUT.

The change aims to simplify pricing and

Cryptonews·01-07 03:48

Bitcoin Faces Major Sell Wall at $95K as Price Struggles Against Gold

_Bitcoin faces resistance at $95K as sellers emerge, while struggling against gold’s rally; focus shifts to $93,500 weekly close._

Bitcoin’s price has faced a strong challenge at the $95,000 mark, where significant resistance from sellers has emerged.

The cryptocurrency’s recent upward

BTC-0,35%

LiveBTCNews·01-07 03:30

Tether Gold Payment Revolution: Launching the "Scudo" Minimum Unit, Has the Crypto "Golden Age" Arrived?

The world's largest stablecoin issuer, Tether, officially launches its gold token Tether Gold's new valuation unit, Scudo. 1 Scudo represents one-thousandth of a troy ounce of gold. This move aims to solve the "decimal point problem" of using gold as a payment method on-chain, marking Tether's push of gold as a store of value into a new battlefield as a medium of exchange. This innovation comes as the spot gold price is expected to surpass a historic high of $4,550 per ounce by the end of 2025, and the total market cap of gold tokens is approaching a peak of $4.4 billion, reflecting the market's strong demand for digital hedging assets amid inflation and macroeconomic uncertainties.

MarketWhisper·01-07 02:41

Tether pushes the Scudo revolution! Tokenized gold becomes a daily payment tool with market value doubling

Tether launches Scudo, creating a one-thousandth ounce measurement unit for tokenized gold XAUT, solving the last mile of gold payments. Tether Gold's market cap has doubled in a few months. Scudo is similar to Bitcoin's Satoshi, allowing users to intuitively price goods, and supports enterprises and AI agents deploying gold, stablecoins, and Bitcoin in self-custody wallets.

XAUT-0,13%

MarketWhisper·01-07 01:35

Dalio's Annual Review: Why Did the US Dollar Depreciate by 39% and Gold Surge?

Bridgewater Associates founder Ray Dalio pointed out that the biggest story in 2025 will be the depreciation of the US dollar and the rise of gold. The US dollar against gold has depreciated by 39%, while gold has risen by 65%, far exceeding the S&P 18%. From a gold perspective, the S&P has actually fallen by 28%. Non-US stock markets outperformed, with Europe leading by 23%. Dalio warned that valuations are expensive, and stock risk premiums have fallen to the 10th percentile.

MarketWhisper·01-07 00:59

Tether Introduces Scudo as a New Unit of Account for Tether Gold

On 6 January 2026, Tether announced the launch of Scudo, a new unit of account for Tether Gold (XAU₮), designed to make gold usable as a practical means of payment for everyday transactions. The move comes as global interest in gold and its price reach record highs.

Record Gold Prices Highlight

ICOHOIDER·01-06 14:33

Dissecting Polymarket's Top 10 Whales' 27,000 Transactions: The Illusion of "Smart Money" Win Rate and Survival Strategies

Author: Frank, PANews

Recently, the popularity of prediction markets has continued to rise, especially with smart money’s arbitrage strategies being regarded as the gold standard. Many have started to imitate and experiment, as if a new gold rush is beginning.

But behind the hype, how effective are these seemingly clever and reasonable strategies? How exactly are they executed? PANews conducted an in-depth analysis of 27,000 trades made by the top ten profit-generating whales on Polymarket in December, exploring the true nature of their profits.

After analysis, PANews found that although many of these "smart money" operations involved implementing hedging arbitrage strategies, there is a significant difference between this hedging and the simple hedging described on social media. The actual strategies are much more complex, involving more than just straightforward "yes" or "no" combinations, but rather making full use of rules like "over/under" and "win/lose" in sports betting.

区块客·01-06 14:10

Bitcoin bulls shrug off Venezuela shock as stocks, oil and gold rally

Global stocks, along with Bitcoin, rose despite U.S. military actions in Venezuela, driven by strong performances in energy and tech sectors. Investors maintain optimism about earnings while cautiously balancing geopolitical risks.

BTC-0,35%

Cryptonews·01-06 14:06

Reports Suggest Venezuela May Hold Up to 600,000 BTC in Alleged Shadow Reserve

Reports claim that Venezuela held 600,000 BTC, twice as much as the US government and the fourth-largest holding globally.

The accumulation reportedly began in 2018 through seizures, oil payments received in crypto, and gold swaps.

Venezuela may currently be under the most chaotic period in

BTC-0,35%

CryptoNewsFlash·01-06 13:15

The stock market hits new highs, so why are most people getting poorer? Ray Dalio: The market illusion under fiat currency devaluation

The main theme of 2025 is the victory of the US stock market, especially AI stocks. But the founder of Bridgewater Associates, Ray Dalio, has a completely opposite view. He believes that the biggest investment story of 2025 is not in stocks, but in the collapse of currency values and the change in asset pricing benchmarks. Ray Dalio chooses to review not just a single market or hot industry, but the entire "currency—debt—market—economy" machine and how it has operated over the past year.

Although the stock market appears to perform well, if we switch from the US dollar standard to the gold standard, the US stock market has actually fallen by 28%. The US dollar has depreciated against gold by as much as 39%.

The biggest gain or loss in 2025: not stocks, but the value of money

Dalio points out that the most undeniable fact in 2025 is: all fiat currencies are depreciating, just at different speeds.

Taking the US dollar as an example, in 2025 the US dollar:

ChainNewsAbmedia·01-06 09:43

Bitcoin vs Gold: Saylor Predicts BTC Could Surpass Gold by 2035

Michael Saylor predicts Bitcoin may surpass gold's market cap by 2035, driven by its scarcity, institutional adoption, and resilience against economic pressures. Despite skepticism, he argues Bitcoin's growth potential makes it a serious digital asset.

BTC-0,35%

Coinfomania·01-06 09:38

Venezuela’s Alleged 600,000 BTC Shadow Reserve Sparks Global Debate

The U.S. government has long claimed that Venezuelan President Nicolás Maduro accumulated billions of dollars over the years from oil revenues, state-owned gold reserves, and other national assets. According to largely unverified reports, part of this wealth may have been gradually converted into

BTC-0,35%

Moon5labs·01-06 07:01

If You Invested $1,000 in Gold, Silver, and Copper 10 Years Ago, How Much Would It Be Worth in 2026?

Gold, silver, and copper have played very different roles in global markets over the past decade, yet all three delivered notable long-term returns.

CryptopulseElite·01-06 05:57

MICA Daily|U.S. stock indices hit new highs, BTC back to $94,000

Although there was breaking news over the weekend about the US invading Venezuela, everyone was worried that the market might become risk-averse due to concerns over worsening global situations. However, as the US responded quickly to the situation, the market saw a significant rally on Monday, with US stock indices once again hitting new highs. BTC started from 86,000 on Sunday and rose all the way to 94,000 USD. ETH also recovered the 3,100 USD level. Meanwhile, gold and silver also began to regain ground. The rebound and upward momentum continued on Monday, which is a normal response given the unstable global situation.

Since a sharp decline on October 10, BTC has been in a downward trend on the daily chart. Yesterday marked the first time it broke through the short-term downtrend line. If BTC can stabilize above 91,000 in the next few days, it would be considered an effective breakout of the short-term downtrend. This could give it the opportunity to stabilize and challenge the long-term downtrend line, breaking the two-month downward trend.

区块客·01-06 04:15

Singapore "Collapse" Rumors: Asia's Crypto Hub is Undergoing a Strategic "Clearout"

Recently, there has been a lot of talk on Chinese social media about the "Singapore Collapse Theory," with rumors claiming that millionaires are fleeing, crypto companies are withdrawing, and luxury stores are closing. However, data shows a completely different picture: Singapore's luxury market is expected to grow by 7-9% in 2025, the number of local millionaires reaches 242,400, and domestic wealth is steadily taking over. All of this is not a decline, but an active strategic de-risking.

Singapore is decisively moving away from dependence on short-term foreign speculative capital (especially some unclear sources of crypto hot money), and instead building a long-term sustainable development model supported by local wealth and strict regulatory compliance. For the crypto industry, this means the end of a "gold rush" era and the beginning of a more mature, more regulated "compliant port" era.

MarketWhisper·01-06 03:53

2026, the Year of Hard Assets! Gold and silver enter a continuous ten-year super cycle

In 2025, silver rose by 165%, and gold increased by 66%, marking the best performance since 1979. Gold hit 91 new highs within 27 months, nearly breaking records every week. Experts point out that this is a structural re-pricing of global capital shifting towards hard assets. Goldman Sachs states that the market is still in the "beginning of a super cycle that could last ten years."

MarketWhisper·01-06 02:46

Bridgewater's Dalio Annual Report: AI is in the early stage of a bubble. Why are US stocks underperforming non-US stocks and gold?

The world's largest hedge fund, Bridgewater Associates founder Ray Dalio, has released his annual reflection, pointing out that in 2025 the biggest winner will be gold rather than US stocks, as all fiat currencies are depreciating. He also warns that AI is in the early stages of a bubble and predicts that the five major forces—debt, currency, politics, geopolitics, and technology—will reshape the global landscape. This article is compiled, translated, and written by BitpushNews.

(Previous summary: Bridgewater's Dalio: My Bitcoin holdings have remained unchanged! Stablecoins are "not cost-effective" for preserving wealth)

(Additional background: Bridgewater's Dalio calls for dollar decline—"Gold is indeed safer": I feel the market is in a bubble)

Table of Contents

1. Changes in Currency Value

2. US Stocks Significantly Underperform Non-US Markets and Gold

3. Valuations and Future Expectations

4. Changes in Political Order

5. Global Order

動區BlockTempo·01-06 02:35

Rich Dad Poor Dad author Kiyosaki: Immediately sell cash to buy these 4 types of assets

"Rich Dad Poor Dad" author Robert Kiyosaki issues another investment warning, urging investors to immediately stop hoarding cash and instead allocate to gold, silver, Bitcoin, and Ethereum. Kiyosaki points out that continuous money printing by central banks worldwide is causing inflation to erode purchasing power, and money stored in banks is almost a depreciating asset.

ETH-1,29%

MarketWhisper·01-06 01:54

Why did Bitcoin rise today? Reaching back to 94,000 and rising alongside gold, Non-Farm Payrolls report incoming

Bitcoin returns to $94,000, breaking through the October downtrend line. The US conducts a military raid on Venezuela, but there is no risk-off panic. The Dow Jones Industrial Average rises by 800 points, with energy stocks leading the gains by 9%. Gold futures reach $4,456, as funds allocate between risk and safe-haven assets. Bitcoin tests the critical resistance zone of 93,347-94,236, with this Friday's non-farm payroll report being a decisive variable.

BTC-0,35%

MarketWhisper·01-06 00:29

Dissecting Polymarket's Top 10 Whales' 27,000 Transactions: The Illusion of "Smart Money" Win Rate and Survival Strategies

Author: Frank, PANews

Recently, the popularity of prediction markets has continued to rise, especially with smart money's arbitrage strategies being regarded as the gold standard. Many have started to imitate and experiment, as if a new wave of gold rush has begun.

But behind the hype, how effective are these seemingly clever and reasonable strategies? How exactly are they executed? PANews conducted an in-depth analysis of 27,000 transactions made by the top ten profit-generating whales on Polymarket in December, exploring the true nature of their profits.

After analysis, PANews found that although many of these "smart money" operations involved hedging arbitrage strategies, this hedging is significantly different from the simple hedging described on social media. The actual strategies are more complex, far from just a simple "yes" or "no" combination, but instead make full use of rules like "over/under" and "win/lose" in sports betting.

区块客·01-05 14:10

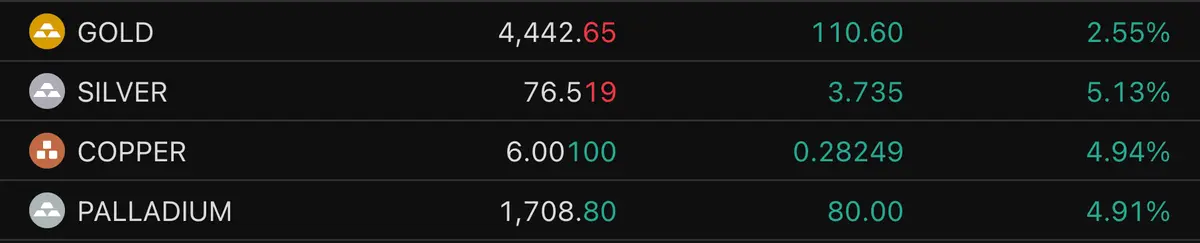

Precious Metals Surge: Spot Silver Up Nearly 5%, Gold Breaks $4,400 Amid Venezuela Fallout

Precious metals rallied sharply on Monday, January 5, 2026, with spot silver jumping nearly 5% and spot gold breaking above the $4,400 per ounce mark. The surge was joined by palladium and platinum, gaining over 4% and 6% respectively, as markets reacted to heightened geopolitical uncertainty following the U.S. military operation that captured Venezuelan President Nicolás Maduro.

CryptopulseElite·01-05 07:48

The vanished $60 billion Bitcoin: Who is Alex Saab, the one who controls Venezuela's crypto black gold, after Maduro's arrest?

The U.S. military recently raided and arrested Venezuelan President Maduro, yet the whereabouts of a staggering $60 billion in Bitcoin, derived from national gold and oil revenues, remain unknown. Zerohedge reports that the person who truly holds the private keys is suspected to be the mysterious figure "Alex Saab," who has simultaneously laundered money for him and provided intelligence to the U.S. Drug Enforcement Administration (DEA).

Night of the Raid: Maduro is Arrested, but What About the Illicit Gains Behind It?

U.S. Delta Force stormed in, dragging Nicolás Maduro and his wife out of their bedroom and onto the USS Iwo Jima, preparing to face drug and weapons charges in Manhattan. However, as Washington celebrates this dramatic military victory, the world also begins to focus on another question: where is Maduro's money?

For years, the Venezuelan regime has drained the national treasury, enriching itself through the sale of gold and oil assets, and most of the funds

BTC-0,35%

ChainNewsAbmedia·01-05 07:44

Kiyosaki Investment Advice Urges Investors to Avoid Cash

Robert Kiyosaki warns against hoarding cash, urging investors to focus on assets like gold, silver, Bitcoin, and Ethereum to protect wealth amid rising inflation and economic uncertainty. His advice emphasizes diversifying investments beyond traditional savings.

Coinfomania·01-05 07:03

600 Billion USD Bitcoin Shadow Reserves Surface? Venezuela's Geopolitical Changes May Trigger a Global BTC Market Supply Tsunami

In January 2026, as Venezuelan President Nicolás Maduro was taken under control by US-led operations, the country's long-rumored massive Bitcoin "shadow reserves" surfaced. According to intelligence reports, Venezuela may have accumulated between 600,000 and 660,000 Bitcoins, worth approximately $60 billion to $67 billion, through gold swaps, oil USDT settlements, and confiscation of domestic mining machines, accounting for nearly 3% of the current total Bitcoin circulation.

This scale makes it comparable to top institutional holders like BlackRock and MicroStrategy. The ultimate fate of these assets—whether they will be frozen by the US, incorporated into strategic reserves, or forced to be sold—will be the most critical variable influencing the global Bitcoin supply-demand structure and market sentiment in 2026, potentially triggering an unprecedented long-term supply shock.

BTC-0,35%

MarketWhisper·01-05 03:22

Trump Arrests Venezuelan President! China and the EU Condemn Violation of International Law, Bitcoin Surges Past 93,000

The United States conducts a targeted operation to capture Venezuelan President Maduro, with Trump announcing a temporary takeover of the government. The move has sparked condemnation from China and Russia for violating international law, causing gold prices to rise and Bitcoin to also increase.

Trump captures Venezuelan President alive, temporarily takes over government

------------------

Last weekend, the U.S. surprise raid on Venezuela's "decapitation operation" shocked the world! On December 3rd, Trump confirmed the successful execution of an operation codenamed "Operation Absolute Resolve," which raided the official residence in Caracas, capturing Venezuelan President Nicolás Maduro and his wife alive, and transporting them to New York for trial.

Trump later announced that the U.S. would temporarily "take over" the Venezuelan government, causing a strong global震盪, the process of Maduro's arrest, the current situation in Venezuela, and international reactions

CryptoCity·01-05 03:00

Load More