Search results for "MSTR"

MSCI temporarily does not exclude "coin-holding stocks," Strategy closes up more than 6% after hours! Analyst: The battle is not over yet

The index compilation company MSCI (Morgan Stanley Capital International) announced that it will temporarily not remove "Digital Asset Treasuries (DATs)" from its index products. Once the news was disclosed, the stock price of Strategy (MSTR), the publicly traded company holding the most Bitcoin globally, immediately rose.

Encouraged by the positive news, as a constituent of the MSCI index, Strategy's stock price surged over 6% to $168.4 in after-hours trading on Tuesday, strongly recovering from the approximately 4% decline during the day. Market sentiment instantly shifted from tense to optimistic.

Looking back to October last year, MSCI

区块客·2h ago

MSCI delays crypto treasury firm exclusions, MSTR stock surges 6%

MSCI has decided to maintain the inclusion of crypto treasury firms in its indexes while reassessing how to classify non-operating companies, postponing any potential changes that could result in forced selling from passive funds.

BTC-1,74%

Cryptonews·7h ago

MSCI Index continues to favor MicroStrategy! MSTR rises over 6% after hours, but analysts warn: the game is not over yet

Global index giant MSCI announces it will temporarily retain Digital Asset Treasury (DAT) companies in its indices, prompting MicroStrategy (MSTR) to surge after hours. However, analysts warn that the review of non-operating companies is not yet complete, and long-term risks remain.

MSCI Index Continues to Include MicroStrategy, MSTR Shares Surge After Hours

----------------------

Bitcoin reserve company MicroStrategy (now named Strategy) stock MSTR surged over 6% after hours early this morning (1/7), mainly because the global index provider MSCI decided not to remove Digital Asset Treasury (DAT) companies from its global indices for now.

Image source: Google Finance MSCI Index Continues to Include MicroStrategy, MSTR Shares Surge After Hours

MSCI pointed out that it is important to distinguish between pure investment companies and those that view digital assets as core operational assets.

CryptoCity·7h ago

MSCI temporarily lifts ban! MicroStrategy surges 5% after hours, Bitcoin-related stocks escape unscathed

MSCI will not remove the digital asset universe (DAT) from the index for now, and MicroStrategy (MSTR) rose 4.36% after hours. MSCI's proposal in October to exclude companies with digital asset holdings over 50% faced a backlash. Currently, the approach to DAT companies remains unchanged, but ongoing review will continue.

MarketWhisper·10h ago

MicroStrategy remains in the MSCI index, MSTR surges nearly 7% after hours

MSCI Index Company officially announced yesterday that it will not temporarily remove "Digital Asset Treasuries" (DATs) holding large amounts of Bitcoin from its global investable market indices. This decision directly alleviates the crisis faced by companies like MicroStrategy (Strategy), which are experiencing hundreds of billions of dollars in passive fund outflows, and caused MSTR's stock price to surge nearly 7% after hours.

MSCI Decides to Keep DATs like MicroStrategy in the Index

One of the world's largest index providers, MSCI, initiated a consultation last October to exclude digital asset finance companies (DAT) such as MicroStrategy, MARA Holdings, and Riot Platforms from the index, because DATs may exhibit characteristics similar to investment funds and do not meet MSCI's criteria.

ChainNewsAbmedia·11h ago

Strategy Adds $116 Million in Bitcoin, Pushing Treasury to 673,783 BTC

Strategy Inc. (NASDAQ: MSTR), the pioneering corporate Bitcoin treasury firm led by executive chairman Michael Saylor, acquired 1,286 BTC for approximately $116.3 million between December 29 and January 4, 2026. The purchase increased its total holdings to 673,783 Bitcoin—valued at roughly $63 billion at current prices.

BTC-1,74%

CryptopulseElite·01-06 08:02

Strategy adds an additional 1,287 Bitcoins, bringing the "cash reserves" to $2.25 billion

Bitcoin investment giant Strategy (MSTR) increased its holdings by 1,287 Bitcoins to a total of 673,783 Bitcoins in early 2026, with a market value of approximately $63 billion. The company also increased its cash reserves to $2.25 billion to ensure dividend payments and debt management. Analysts believe that the increased cash reserves enhance its financial resilience, enabling it to withstand potential crypto winters.

BTC-1,74%

区块客·01-06 06:40

MSTR Trades Below Bitcoin Holdings as Analysts Eye $500 Rebound

MicroStrategy's stock has dropped 66% in six months, trading at a 20-25% discount to its Bitcoin holdings. Analysts see potential recovery if Bitcoin stabilizes. Key support levels hold at $150-$157, with targets set for $200. The upcoming MSCI ruling may impact the stock's index status.

BTC-1,74%

CryptoFrontNews·01-06 05:36

Bitcoin drops, MicroStrategy faces a massive loss of $17.4 billion

With the significant decline of BTC at the end of last year, the pioneer of Bitcoin reserve strategies, MicroStrategy (Strategy (), reported an unrealized loss of $17.44 billion in Q4. However, Strategy ) remains committed to the "Hodler" spirit, issuing common stock MSTR again to buy Bitcoin, increasing its total holdings to 673,783 BTC.

Bitcoin market price declines, Strategy's Q4 financial report faces a huge unrealized loss of $17.44 billion

Affected by Bitcoin's retreat from its high point, Strategy disclosed an unrealized digital asset loss of up to $17.44 billion in its Q4 2025 financial report. As of the end of 2025, its digital assets' book value was approximately $58.85 billion.

Although the accounting standards make the figures seem startling,

BTC-1,74%

ChainNewsAbmedia·01-06 01:03

MicroStrategy's collapse countdown? Once "this indicator" drops below the critical point, holding the stock will be meaningless

Michael Saylor's MicroStrategy (MSTR) rose 1.22% in early trading today, but has plummeted 66% since its peak in July 2024. The key indicator mNAV is only 1.02; once it falls below 1, it indicates that the company's value is less than the Bitcoin it holds, and the holding becomes illogical, potentially triggering a sell-off.

MarketWhisper·01-04 06:29

Can MSTR's deep discount be reversed? Wall Street outlines the 2026 Strategy stock price surge roadmap to $500

Senior Wall Street analysts have outlined a valuation blueprint for Strategy stock reaching up to $500 by 2026. The core logic is based on the significant discount between the company's Bitcoin assets valued at approximately $59 billion on its balance sheet and its current market capitalization of about $46 billion. This forecast is not blind optimism but is grounded in mathematical calculations assuming Bitcoin prices stabilize and the net asset value discount converges.

However, the road ahead is not smooth. The upcoming MSCI classification decision on January 15 presents significant uncertainty, potentially leading to massive outflows of index funds. Meanwhile, MSTR's stock price has initially stabilized near the critical support level of $150 after a 66% plunge. Technical indicators show weakening selling pressure, providing a structural basis for a subsequent rebound. Recent data released by founder Michael Saylor shows that his stock trading activity far exceeds that of tech giants, highlighting the market's high attention and strategic play surrounding this unique "Bitcoin proxy stock."

BTC-1,74%

MarketWhisper·01-04 02:10

MicroStrategy increases holdings again! Spent 108 million to buy Bitcoin, stock price did not rise but fell instead

MicroStrategy last week purchased 1,229 Bitcoins for $108.8 million, with an average cost of $88,568 per Bitcoin, bringing the total holdings to 672,497 Bitcoins. The total investment amounts to $50.44 billion, with an overall average cost of $74,997. After the announcement, MSTR's stock price fell 1% to $157, and Bitcoin also dropped to around $87,000.

MarketWhisper·01-04 01:55

Benchmark Reaffirms Buy Rating on MicroStrategy With $705 Target for 2026

Benchmark Company has reiterated its Buy rating on MicroStrategy (MSTR) that indicates a new level of trust in the long-term plan of the company, as well as its approach to business based on Bitcoin. The investment bank had also given a price target of 2026 of 705 per share meaning that there is a s

BTC-1,74%

Coinfomania·01-02 08:13

MSTR open interest far exceeds Tesla, Saylor: Bitcoin makes MicroStrategy more interesting

Bitcoin reserve strategy pioneer MicroStrategy Strategy founder Michael Saylor states that compared to other tech giants, the market value of MSTR's open contracts shows that Bitcoin makes MSTR interesting! However, MSTR's stock price is projected to fall by 50% within 2025, far worse than Bitcoin's -6%, leading some netizens to question: Isn't this just because it's being "shorted"?

Bitcoin makes $MSTR interesting. pic.twitter.com/XF80ngHGlt

— Michael Saylor (@saylor) January 2, 2026

Open interest surges: Clarifying leverage speculation and shorting indicators

Michael Saylor states that MSTR's open contract market value ratio with

BTC-1,74%

ChainNewsAbmedia·01-02 05:04

MSTR Meltdown: Saylor’s Bitcoin Bet Erases $90B as Shares Crash 66%

_MicroStrategy’s stock drops 66%, wiping $90B from its market cap, despite holding $59B in Bitcoin and stable liquidity._

MicroStrategy’s stock has taken a massive hit, dropping 66% over the last six months. As a result, nearly $90 billion has been wiped from the company’s market cap.

This

BTC-1,74%

LiveBTCNews·01-01 13:10

MSTR Stock Faces January 15 MSCI Index Deadline after 50% Drop in 2025, What's in 2026? - Coinspeaker

Key Notes

The MSCI index exclusion of MSTR stock could lead to an $8.8 billion rout, according to JPMorgan.

Ongoing share issuance to fund Bitcoin purchases, a planned $11 billion ATM program, and a mNAV below 1 have weighed on sentiment.

Despite the selloff, analysts note that Strategy’s Bitco

BTC-1,74%

Coinspeaker·01-01 08:58

Peter Schiff believes that MSTR from Strategy is among the worst stocks.

Economist Peter Schiff claims that if MicroStrategy (MSTR) were included in the S&P 500, it would experience a 47.5% decline in 2025, making it one of the worst-performing stocks. He criticizes the firm's heavy reliance on Bitcoin, arguing it fails to provide sustainable value for shareholders and poses significant risks during market downturns.

BTC-1,74%

TapChiBitcoin·01-01 06:57

Michael Saylor Buys 1,229 BTC as Bitcoin Heads Toward 2025 Decline

_Michael Saylor’s Strategy buys 1,229 BTC for $108.8M as Bitcoin drops 7% YTD and MSTR stock falls 47% in 2025._

Michael Saylor’s Strategy, formerly known as MicroStrategy, has added 1,229 Bitcoin to its holdings between December 22 and December 28.

The purchase comes as Bitcoin’s price

BTC-1,74%

LiveBTCNews·2025-12-30 08:50

OPERS Bitcoin: Ohio Pension Fund Adds $43M in MicroStrategy

Ohio’s $120 billion public pension fund, OPERS, has made headlines after disclosing a significant investment in MicroStrategy ($MSTR). The fund reportedly bought $43 million worth of the company’s stock, a move that signals growing institutional interest in Bitcoin.

Pension Funds Enter Crypto

BTC-1,74%

Coinfomania·2025-12-30 08:17

Strategy Resumes Bitcoin Accumulation, Adds 1,229 BTC for $109 Million

Strategy (MSTR), the world's largest corporate Bitcoin holder, has returned to buying after a brief pause, acquiring 1,229 BTC last week for approximately $108.8 million.

BTC-1,74%

CryptopulseElite·2025-12-30 06:09

MicroStrategy raises another $100 million to buy Bitcoin, investment bank's target price $500

Bitcoin Reserve Strategy Pioneer MicroStrategy Strategy ( formerly MicroStrategy) announced yesterday that it spent over $100 million to acquire 1,229 Bitcoins, demonstrating the company's ongoing ability to raise funds to buy Bitcoin. Investment bank TD Cowen maintains a "Buy" rating on Strategy, with a target price of $500 over the next 12 months.

Strategy raises $100 million to buy 1,229 BTC

This time, Strategy raised $108.8 million through the issuance of common stock MSTR and used all of it to buy Bitcoin. MicroStrategy bought 1,229 Bitcoins last week, with an average cost of $88,568 per Bitcoin. As of December 29, 2025, Strategy holds a total of 672,497 Bitcoins.

BTC-1,74%

ChainNewsAbmedia·2025-12-30 01:04

MicroStrategy purchased 1,229 Bitcoins in the last week of 2025, with a total holding of 672,000 Bitcoins.

MicroStrategy (MSTR) purchased 1,229 Bitcoins for $108.8 million between December 22 and 28, 2025, at an average cost of $74,997 per Bitcoin. This transaction brings the company's total Bitcoin holdings to 672,497 coins, solidifying its position as the world's largest corporate Bitcoin holder. Currently, MicroStrategy's Bitcoin yield has reached 23.2%.

MarketWhisper·2025-12-30 00:37

New Jersey Pension Fund Expands MicroStrategy Stake to Boost Bitcoin Exposure

New Jersey has taken a bold move toward Bitcoin ($BTC) exposure with its recent move of $9.5B pension fund expansion of MicroStrategy ($MSTR) holdings to $16 million. CryptosRus, a crypto and Bitcoin analytics and awareness platform, has revealed this strategic news through its official X account, h

BTC-1,74%

BlockChainReporter·2025-12-26 22:04

Bitcoin approaches the critical "life and death line"! Analyst: Strategy has already broken below first, bullish pressure remains

Analysts point out that Bitcoin is hovering near the "crucial long-term support line" and has been holding on for 3 weeks, causing the bulls in the market to be on edge. However, the publicly traded company Strategy (MSTR), the largest Bitcoin holder in the world, has already broken through this "safety line," sending a strong bearish signal to the crypto market.

CoinDesk senior analyst and Chartered Market Technician Omkar Godbole explained that this "safety line" is the extremely critical "100-week simple moving average (100-week SMA)" in technical analysis, which mainly reflects the average cost over the past two years. It is a key indicator used by major market technicians to identify major trend reversals, long-term support, or confirm crashes.

From the trend, the 100-week moving average has been performing strongly for 3 consecutive weeks.

区块客·2025-12-24 07:41

Strategy Pauses Bitcoin Buying as BTC Hits $90K and Cash Reserves Grow

Michael Saylor’s company, Strategy (NASDAQ: MSTR), paused its weekly Bitcoin acquisition for the first time in December. Despite Bitcoin surging past $90,000 amid bullish sentiment, the firm did not add any BTC between December 15 and 21. Meanwhile, Strategy strengthened its financial position by in

BTC-1,74%

CryptoDaily·2025-12-23 20:30

MSTR Stock Recovery Can Begin Anytime as Institutional Demand Jumps - Coinspeaker

Key Notes

MSTR stock recovery in sight as Strategy’s $2.19 billion cash reserve provides nearly three years of runway.

The expanded cash position helps ease pressure from outstanding convertible bonds and supports dividend coverage.

A New Jersey public pension fund disclosed a $16 million

BTC-1,74%

Coinspeaker·2025-12-23 10:14

Bitcoin is approaching a critical "life and death line"! Analyst: Strategy has already fallen below, long positions are under pressure.

Analysts point out that Bitcoin is hovering around the "crucial long-term support line" and has been struggling for up to 3 weeks, keeping the long positions in the market on edge. However, as the world's largest Bitcoin holder, the listed company Strategy (MSTR) has already been the first to fall below this "safety line," sending a strong bearish signal to the crypto assets market.

CoinDesk senior analyst and Chartered Market Technician Omkar Godbole explains that this "safety line" is the extremely critical "100-week simple moving average (100-week SMA)" in technical analysis, which mainly reflects the average cost over the past two years. It is used by major market technical analysts to identify significant trend reversals, long-term support, or to confirm crashes.

From the trend perspective, the 100-week moving average has shown strong performance for 3 consecutive weeks.

区块客·2025-12-23 07:40

MicroStrategy raises $700 million to expand its dollar reserves without buying Bitcoin, preparing for the crypto winter?

The pioneer of Bitcoin reserve strategy, MicroStrategy, originally named MicroStrategy (, raised $748 million through the issuance of common stock (MSTR), expanding its US dollar reserves to $2.19 billion. This fund will be used to pay preferred stock dividends over the next 32 months while suspending Bitcoin acquisitions. Is this largest digital asset financial company preparing for a long crypto winter?

MicroStrategy recently announced the establishment of a US dollar reserve fund to pay future dividends and interest, alleviating people's concerns. According to information from its official website, MicroStrategy currently needs to pay annual dividends of $824 million, and its US dollar reserves are sufficient to cover 31.9 months of dividends. Furthermore, the Bitcoin held by the company is valued at a total of $59.4 billion, which is enough to cover dividends for 72.2 years. The company's mNAV ) current stock price and its holdings.

ChainNewsAbmedia·2025-12-23 00:43

TD Cowen: MicroStrategy holds $2.2 billion in cash to prepare for the crypto winter, which can last for 32 months.

MicroStrategy (MSTR) last week raised approximately $748 million by selling common stock, causing its dollar reserves to surge to $2.19 billion, which has attracted significant market attention. Investment bank TD Cowen's TD Securities division pointed out that this cash is sufficient to cover the company's interest and dividends for about 32 months, and even in the face of a "long-term cryptocurrency winter," MicroStrategy's continued viability is not in question.

BTC-1,74%

MarketWhisper·2025-12-23 00:38

Why did Bitcoin fall today? MicroStrategy pauses buying and hoards $2.2 billion in cash to sound the alarm.

Bitcoin tested the key support level of $88,000 today, and the largest buyer, MicroStrategy (MSTR), suddenly hit the brakes. The company cashed out $747.8 million last week by selling 4.535 million shares of common stock, raising its cash reserves to $2.19 billion, yet paused its years-long Bitcoin purchase plan. This is the first time since 2020 that MicroStrategy has chosen to hoard cash instead of buying the dip during a downturn in the crypto market.

BTC-1,74%

MarketWhisper·2025-12-23 00:27

Strategy Pauses Bitcoin Buying as BTC Hits $90K and Cash Reserves Grow

Michael Saylor’s company, Strategy (NASDAQ: MSTR), paused its weekly Bitcoin acquisition for the first time in December. Despite Bitcoin surging past $90,000 amid bullish sentiment, the firm did not add any BTC between December 15 and 21. Meanwhile, Strategy strengthened its financial position by in

BTC-1,74%

CryptoDaily·2025-12-22 20:25

Strategy Overtakes Wells Fargo in Daily Trading Volume

The financial market witnessed a remarkable shift as Strategy, trading under $MSTR, surpassed Wells Fargo in daily trading volume. This moment signals a deeper transformation across equity markets. Investors no longer view Strategy as a traditional software firm. They now see it as a powerful

BTC-1,74%

Coinfomania·2025-12-22 12:07

Bitcoin is nearing a key "life and death line"! Analysts: Strategy has already fallen below, long positions under pressure.

Analysts point out that Bitcoin is hovering near the "crucial long-term support line" and has been holding on for 3 weeks, keeping the long positions in the market on edge. However, as the world's largest Bitcoin holder, the publicly traded company Strategy (MSTR) has already seen its stock price break this "safety line," sending a strong bearish signal to the Crypto Assets market.

CoinDesk senior analyst and chartered market technician Omkar Godbole explains that this "safety line" is the extremely critical "100-week Simple Moving Average (100-week SMA)" in technical analysis, which primarily reflects the average cost over the past two years. It is an indicator used by major market technical analysts to identify significant trend reversals, long-term support, or confirm crashes.

From the trend perspective, the 100-week moving average has demonstrated strong performance for 3 consecutive weeks.

区块客·2025-12-22 07:39

MicroStrategy's stock price fell 43%! Saylor hints at buying the dip in Bitcoin.

Michael Saylor hinted that MicroStrategy (MSTR) will once again make a large purchase of Bitcoin to strengthen its fully committed reserve strategy. However, this move comes at a time when MicroStrategy faces the risk of being removed from the MSCI index, as MSCI is considering excluding MicroStrategy from its global index in the February evaluation, believing that the company operates more like an investment institution rather than an operating company. JPMorgan estimates that exclusion would trigger approximately $11.6 billion in forced selling.

BTC-1,74%

MarketWhisper·2025-12-22 02:15

Michael Saylor sends another "green dot" signal: Strategy may increase the position in Bitcoin, indicating a counterattack?

Michael Saylor, the executive chairman of MicroStrategy (now renamed Strategy), once again sent signals to the market about a possible large-scale increase in Bitcoin holdings through a mysterious tweet titled "Green Dot Guiding Orange Dot" on December 21. This move comes at a time when the company's stock price (MSTR) has fallen by 43% within the year 2025 and is at risk of being removed from the MSCI global index, which could trigger over $11.6 billion in dumping. If Saylor's hints ultimately materialize, it aims to lower the company's average holdings cost of Bitcoin on one hand, and on the other hand, to demonstrate to the market that its strategy of "fully betting on Bitcoin" remains unwavering in the face of the current severe liquidity crisis and regulatory scrutiny.

MarketWhisper·2025-12-22 01:28

Bitcoin approaches a critical "life-and-death defense line"! Analyst: Strategy has already fallen below, long positions are under pressure.

Analysts point out that Bitcoin is hovering near the "critically important long-term support line" and has been holding on for as long as 3 weeks, causing the long positions in the market to be on edge. However, the publicly traded company Strategy (MSTR), as the largest Bitcoin holder in the world, has already been the first to break through this "safety line," sending a strong bearish signal to the crypto assets market.

CoinDesk senior analyst and chartered market technician Omkar Godbole explained that this "safety line" is the extremely critical "100-week simple moving average (100-week SMA)" in technical analysis, which mainly reflects the average cost over the past two years and is an indicator used by major market technical analysts to identify significant trend reversals, long-term support, or confirm market crashes.

From the trend perspective, the 100-week moving average has exerted strong power for 3 consecutive weeks.

区块客·2025-12-21 07:37

Bitcoin approaches the critical "life and death line"! Analyst: Strategy has already broken below first, bullish pressure remains

Analysts point out that Bitcoin is hovering near the "crucial long-term support line" and has been holding on for 3 weeks, causing the bulls in the market to be on edge. However, the publicly traded company Strategy (MSTR), the largest Bitcoin holder in the world, has already broken through this "safety line," sending a strong bearish signal to the crypto market.

CoinDesk senior analyst and Chartered Market Technician Omkar Godbole explained that this "safety line" is the extremely critical "100-week simple moving average (100-week SMA)" in technical analysis, which mainly reflects the average cost over the past two years. It is a key indicator used by major market technicians to identify major trend reversals, long-term support, or confirm crashes.

From the trend, the 100-week moving average has been performing strongly for 3 consecutive weeks.

区块客·2025-12-20 07:32

Citigroup remains optimistic about crypto stocks, Circle continues to be the top choice

Citigroup lowers price targets for many crypto stocks due to industry decline but remains optimistic in the long term. Circle's USDC is the top choice. Price targets for some stocks like BLSH and MSTR have also been lowered.

TapChiBitcoin·2025-12-20 04:57

Bitcoin approaches the critical "life and death line"! Analyst: Strategy has already broken below first, bullish pressure remains

Analysts point out that Bitcoin is currently facing an important 100-week moving average support. If it holds, a rebound is expected; otherwise, it will further decline. The stock price of listed company Strategy (MSTR) has already broken this support, which may indicate that Bitcoin's subsequent trend is weakening. The current situation forces Bitcoin bulls to defend this critical level.

区块客·2025-12-19 07:28

National Bank of Canada Buys $659 Million in MicroStrategy Shares – 260% Increase in Q3 2025

National Bank of Canada significantly boosted its exposure to MicroStrategy (MSTR) in the third quarter of 2025, reporting holdings of 2.04 million shares valued at nearly $659 million as of September 30.

BTC-1,74%

CryptopulseElite·2025-12-19 05:29

If MSCI bans "more than half of DAT's market cap companies," will it trigger over $10 billion in sell-offs?

Morgan Stanley's MSCI Index plans to exclude companies with high "coin holdings," potentially triggering $15 billion in passive fund selling pressure?

(Background: Reader Submission » Why does MSCI have to act? Strategy is shaking the index system)

(Additional context: MicroStrategy demands MSCI to withdraw the "exclude MSTR" proposal: the 50% coin holding threshold is baseless, which is stifling American innovation!)

Less than a month before the "judgment day" on January 15, 2026, the index giant MSCI plans to reclassify companies with "digital asset proportions over half" on their balance sheets and remove them from the global investable market index. On the surface, it appears to be a classification adjustment, but in reality, it could trigger over $10 billion in forced selling under mechanical execution by passive funds, becoming the first crypto shockwave in the 2026 crypto market.

M

動區BlockTempo·2025-12-18 08:40

Peter Schiff Expects 50% MSTR Stock Crash and Bitcoin Below $50K - Coinspeaker

Key Notes

MSTR Stock faces mounting pressure from roughly $720 million in annual preferred dividend obligations.

All eyes are on whether MSTR can remain in the MSIC Index, amid talks of removing digital assets treasury (DAT) firms.

Despite the sell-off and Schiff’s criticism, Michael Saylor rem

BTC-1,74%

Coinspeaker·2025-12-18 08:15

Bitcoin approaches the critical "life and death line"! Analyst: Strategy has already broken below first, bullish pressure remains

Analysts point out that Bitcoin is hovering near the "crucial long-term support line" and has been holding on for 3 weeks, causing the bulls in the market to be on edge. However, the publicly traded company Strategy (MSTR), the largest Bitcoin holder in the world, has already broken through this "safety line," sending a strong bearish signal to the crypto market.

CoinDesk senior analyst and Chartered Market Technician Omkar Godbole explained that this "safety line" is the extremely critical "100-week simple moving average (100-week SMA)" in technical analysis, which mainly reflects the average cost over the past two years. It is a key indicator used by major market technicians to identify major trend reversals, long-term support, or confirm crashes.

From the trend, the 100-week moving average has been performing strongly for 3 consecutive weeks.

区块客·2025-12-18 07:26

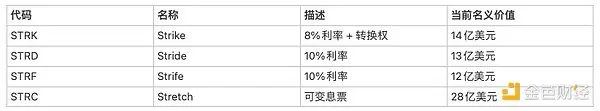

BitMEX: Analyzing whether it will sell BTC from MicroStrategy's new debt instrument STRC

Source: BitMEX Research; Compilation: Golden Finance

Key Points

We analyzed Stretch ($STRC), an extremely innovative MSTR (Strategy) debt instrument designed to maintain price stability by adjusting the dividend yield monthly based on bond market prices. Therefore, the product is promoted as low-risk and compared to short-term US Treasuries. This is yet another attempt by Mr. Michael Saylor to invade the financial system, with the goal still being to accumulate more Bitcoin. We reviewed documents from the U.S. Securities and Exchange Commission (SEC), and based on our understanding, MSTR can waive the price stability target, reducing the dividend by up to 25 basis points per month, which means the dividend yield could drop to zero in just over three years. Therefore, we believe this product is advantageous for MSTR and from an investment perspective.

BTC-1,74%

金色财经_·2025-12-18 06:18

Vanguard invests $3.2 billion to buy MicroStrategy stock, indirectly holding Bitcoin and shocking Wall Street

The asset management giant Vanguard, which manages over 10 trillion USD in assets, recently disclosed holdings of $3.2 billion in MicroStrategy (MSTR) stock. This investment has shocked Wall Street because MicroStrategy is known for holding a large amount of Bitcoin on its balance sheet. Vanguard's move is equivalent to holding Bitcoin indirectly without directly purchasing cryptocurrencies. Analysts believe this could encourage other large asset management firms to invest in digital assets indirectly.

MarketWhisper·2025-12-18 02:30

Michael Saylor refutes the quantum computing threat: Bitcoin won't collapse, in fact, it will become even stronger

MicroStrategy (MSTR) founder Michael Saylor stated that quantum computing will not destroy Bitcoin; instead, it will make it more robust. He explained that when breakthroughs in quantum computing occur, the Bitcoin network will be upgraded, active Bitcoins will be migrated to more secure addresses, and lost Bitcoins will be permanently frozen. He emphasized that as security demands increase and supply decreases, Bitcoin will become stronger. This statement countered market panic over the threat of quantum computing.

MarketWhisper·2025-12-17 05:29

What Is MicroStrategy's Latest Bitcoin Purchase? Company Buys $980M BTC as Key Metric Turns Negative

MicroStrategy Inc. (NASDAQ: MSTR), the largest corporate Bitcoin holder, announced on December 16, 2025, another massive accumulation: 10,645 BTC purchased for approximately $980.3 million between December 8 and December 14.

BTC-1,74%

CryptopulseElite·2025-12-16 06:41

Is DAT still useful during a bear market?

Author: Crypto Weituo; Source: X, @thecryptoskanda

After BMNR and MSTR consecutively fell below mNAV 1, basically everyone talking about DAT would say, “The DAT scam is over.”

From the perspective of the crypto-native community, DAT is invalid: it’s like letting others buy coins for you with your own money, especially since several coins have ETFs. Currently, buying DAT can be seen as paying for the personal brands of Tom Lee and Michael Saylor — donating money to these two influencers who target traditional finance.

But does it really serve no purpose at all? Maybe not.

1. Earning income through holding coins to support DAT’s performance

Many DAT projects are considering or already doing this. Mainly by using the held tokens for staking, such as Solana’s DAT; there are also discussions about using lending protocols to generate revenue.

金色财经_·2025-12-16 03:27

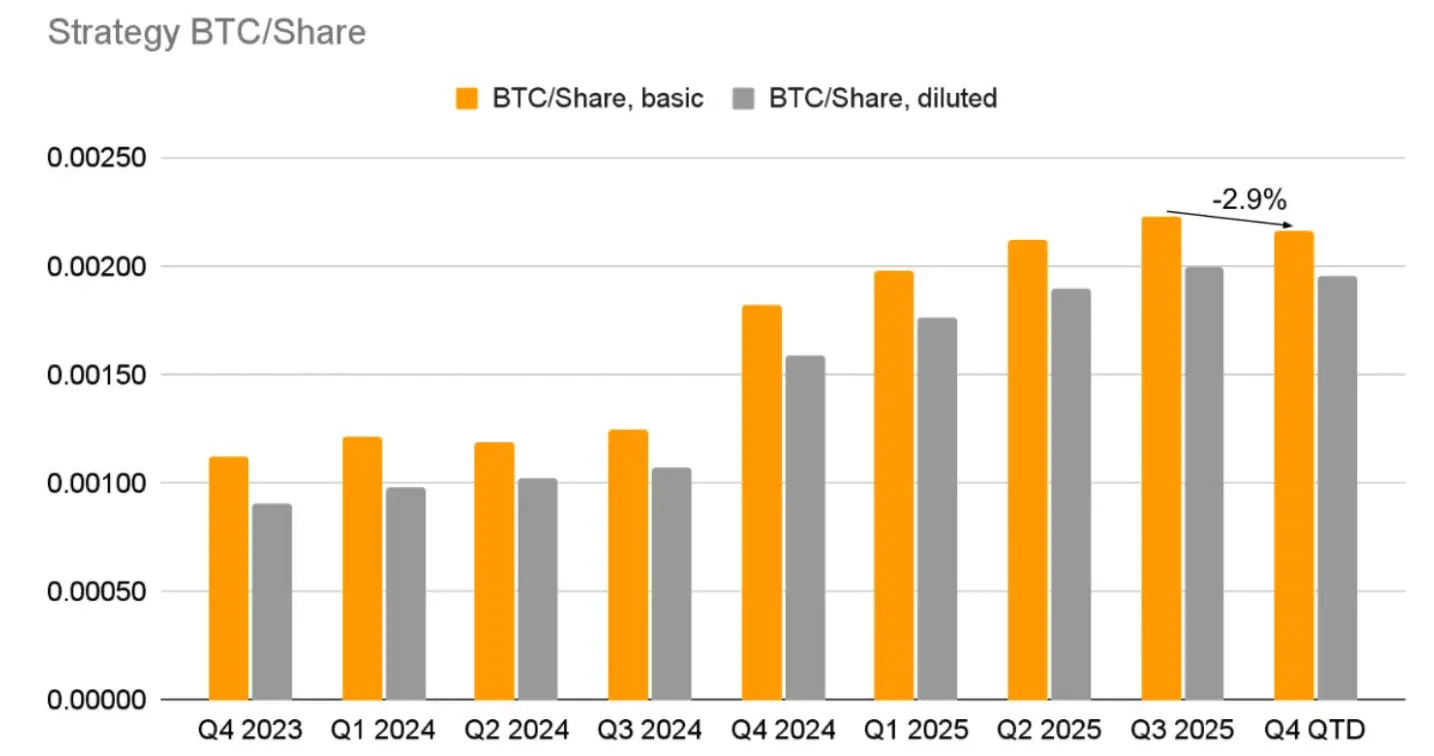

MicroStrategy increases position against the trend with $980 million in BTC, but MSTR's return rate turns negative for the first time

MicroStrategy (MSTR) disclosed on Monday that between December 8 and 14, it spent approximately $980.3 million to purchase 10,645 Bitcoins, with an average price of $92,098. However, MicroStrategy's BTC return (a core indicator tracking the amount of Bitcoin held per share of MSTR) turned negative for the first time in years, with a quarterly return of -1%, meaning that the number of Bitcoins held per share is now less than at the end of September.

BTC-1,74%

MarketWhisper·2025-12-16 00:44

Why did Bitcoin drop today? ETF capital flow is weak, and BTC crash is approaching 86,000.

December 16, Bitcoin plummeted to $86,410, casting a shadow over the start of the week. Why did Bitcoin fall today? The core reasons include weak inflows into spot Bitcoin ETFs (down 20% quarter-over-quarter), the ongoing US trading session curse, and nearly $400 million in liquidation pressure. Crypto stocks were also affected, with MicroStrategy (MSTR) and Circle (CRCL) stocks both falling 7% on the day.

BTC-1,74%

MarketWhisper·2025-12-16 00:29

Load More