Search results for "RWA"

Solana’s Tokenized RWA Market Reaches $873M High as Institutional Interest Accelerates - Coinedict

Solana is starting 2026 with growing momentum in one of crypto’s most closely watched sectors: tokenized real-world assets (RWAs). Data shows that the total value of RWAs issued on the Solana blockchain climbed to a new all-time high of $873 million in December, reflecting a sharp increase in

Coinedict·6h ago

Avalanche Marks 2025 As Breakout Year for Onchain Growth

Avalanche achieved record growth in 2025, with over 400 million transactions and 32 million smart contracts on its C-Chain. The ecosystem attracted 810,000 daily users and saw nearly $1 trillion in trading volume. RWA value peaked at $2.9 billion, emphasizing its strong economic model.

AVAX1,91%

BlockChainReporter·8h ago

NFT Market Matures in 2025: Utility, Gaming, and RWA Drive Growth

In 2025, the NFT market matured beyond its speculative bubble, shifting toward functional utility and sustainable growth. Market leaders included Cryptopunks, Courtyard, Dmarket and Pudgy Penguins.

The 2025 NFT Landscape: From Hype to Utility

In 2025, the non-fungible token ( NFT) market

Coinpedia·15h ago

BTCC Wraps 2025 With 11 Million Users, $53.1B in RWA Futures, and Industry Recognition

VILNIUS, Lithuania – January 2, 2026 — BTCC, the longest-operating cryptocurrency exchange globally, has released its Q4 2025 performance report, highlighting a year of notable growth despite industry-wide challenges. The platform ended 2025 with more than 11 million registered users and saw

BlockChainReporter·01-02 15:06

RWA.xyz: Solana tokenized RWA market cap has increased by nearly 10% in the past month to $873.3 million

According to Cointelegraph, tokenized real-world assets (RWA) on Solana have grown nearly 10% in the past month, reaching a record $873.3 million, with the number of holders increasing by over 18.4% to 126,236. Most RWAs are backed by U.S. Treasury bonds, and newly launched tokenized stocks have also shown growth.

TechubNews·01-02 06:54

CEO BlackRock: RWA will usher in a simpler and more seamless investment era

Larry Fink, CEO of BlackRock, emphasizes a structural shift in global finance with $4.1 trillion in digital wallets, primarily in stablecoins. He believes asset tokenization can reduce investment friction, making it more efficient and accessible through mobile applications.

RWA1,22%

TapChiBitcoin·01-02 03:54

Snowball Money and CheersLand Set to Bring Transparent Human-Readable OnChain Identity

Snowball Money, a platform that transforms wallet addresses into simple, recognizable identities, has declared its strategic partnership with CheersLand, a leading player in the decentralized physical infrastructure network (DePIN) and real-world asset (RWA) sectors. The hidden aim behind this partn

BlockChainReporter·01-01 07:03

USDT negative premium, holding stablecoins still losing money, how should we interpret this?

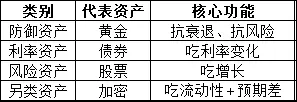

Under the RMB appreciation channel, USDT exhibits negative premiums, and investors do not need to panic excessively. It is recommended to maintain an appropriate proportion of stablecoin assets, which can be hedged through on-chain exchange rate strategies, such as allocating to Euro stablecoins or gold RWA, to moderately avoid exchange rate losses. This article is based on an article by @Web3Mario, organized, compiled, and written by Foresight News.

(Previous context: USDT exits the market, EURC fills the gap, Euro stablecoins surge over 170% against the trend)

(Additional background: Chinese crypto circles panic selling USDT "at a 1.5% negative premium against RMB," bear market, regulatory flight?)

Table of Contents

Why does the RMB enter an appreciation channel, and why does USDT show a negative premium

Should we convert USD stablecoins back to RMB

How to hedge exchange rate losses through on-chain strategies, gold, and euro stablecoins

動區BlockTempo·2025-12-31 15:10

What Assets Truly Deserve to Be On-Chain? The Overlooked Trillion-Dollar Opportunity

The RWA (Real World Asset) narrative has been hot for years, with endless claims that "everything can be tokenized"—real estate, art, fine wine, carbon credits, and more. It all sounds revolutionary, but most of these ideas are fundamentally misguided.

CryptopulseElite·2025-12-31 09:29

COTI Unveils Private RWA Infrastructure As Tokenized Assets Cross $300B

COTI Foundation has launched the first private real-world asset (RWA) infrastructure, empowering compliance and privacy in blockchain transactions. This innovation positions COTI to capture a significant share of the projected $30T RWA market by 2030.

COTI1,23%

BlockChainReporter·2025-12-30 17:04

Tokenized Gold Fuels RWA Boom As On-chain TVL Leaps From $1B to $4B

Tokenized gold has quietly become one of the year’s biggest success stories in decentralized finance, emerging as a primary engine behind the rapid expansion of real-world assets on blockchains. DefiLlama called attention to the trend on X, noting that “Tokenized Gold has been a major driver of

DEFI-0,58%

BlockChainReporter·2025-12-30 16:05

2025 Global Crypto Regulatory Map: The Beginning of the Integration Era, a Year of "Convergence" between Crypto and TradFi

Author: imToken

Objectively speaking, for Crypto/Web3, 2025 will definitely be the most transformative year in the past decade.

If the past ten years have been the "wild growth" of the crypto industry on the fringes of mainstream finance, then 2025 marks the first year of this species' official "legalization evolution":

From stablecoins to RWA, from policy U-turns in Washington to regulatory frameworks in Hong Kong and the EU, the global regulatory logic is undergoing an epic paradigm shift.

1. United States: Crypto Enters a Period of Institutional Recognition

For a considerable period, US regulation of the crypto industry has resembled a tug-of-war lacking consensus.

Among them, the US Securities and Exchange Commission (SEC) under Gary Gensler has been particularly active, frequently using enforcement actions to define the legal boundaries of crypto assets, filing lawsuits,

PANews·2025-12-30 12:11

New Year's Day is approaching, and the crypto market continues to consolidate. What potential "catalysts" could exist in the market in 2026?

Article by: Glendon, Techub News

After briefly climbing above $90,000 yesterday, Bitcoin fell below $87,000 again today, with a intraday decline of 3.76%. Meanwhile, the crypto market has once again experienced a broad decline. According to SoSoValue data, no major sector in the market was spared, with 24-hour declines generally exceeding 3%. Among them, SocialFi, Layer2, AI, RWA, and NFT sectors were hit hardest, each dropping more than 5%.

In terms of institutional investment, CoinShares' latest data shows that digital asset investment products saw a net outflow of approximately $446 million last week, bringing the total outflow since October 10 to $3.2 billion. Additionally, last week, Bitcoin spot

TechubNews·2025-12-30 09:19

BlackRock’s BUIDL Pays $100M in On-Chain Dividends, Cementing RWA Momentum

BlackRock's tokenized money market fund, BUIDL, has distributed $100 million in dividends, marking it as the largest tokenized U.S. Treasury offering. Launched in March 2024 on Ethereum, it demonstrates the potential for real-world asset implementation on blockchains, gaining significant investor attention and signaling institutional confidence in regulated financial products.

Coinfomania·2025-12-30 09:09

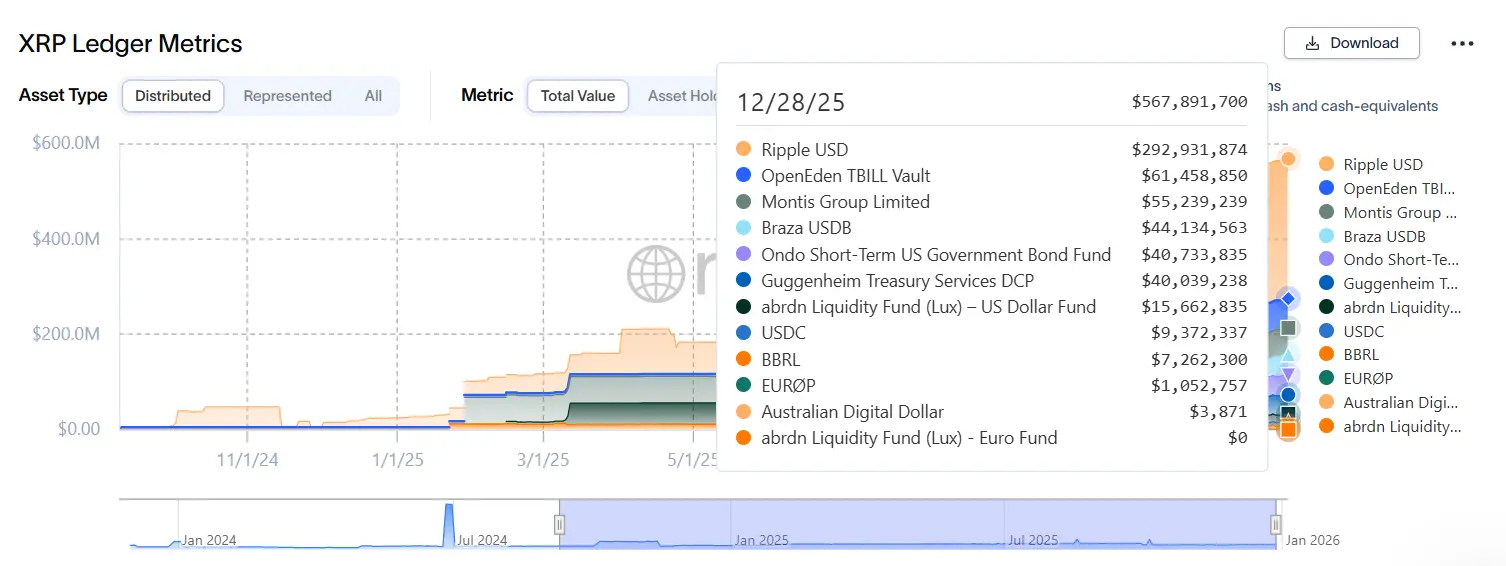

Tokenized RWA Value on XRP Has Grown 2200% in 2025

On-chain data shows that the value of tokenized RWA on the XRP Ledger (XRPL) has increased by an impressive 2,200% in 2025 alone.

The real-world asset tokenization theme, championed by BlackRock CEO Larry Fink and the SEC Chair Paul Atkins, dominated discussions across multiple crypto communities t

TheCryptoBasic·2025-12-30 07:03

Gate Research Institute: Bitcoin Fails to Hold the $90,000 Level | RWA Sector TVL Surpasses DEX

Cryptocurrency Market Overview

BTC (-0.37% | Current Price 87,393 USDT): Bitcoin remains in a narrow range between $86,000 and $90,000, having been repeatedly rejected near $90,000 since mid-December. Recent price movements resemble a consolidation phase after volatility contraction rather than a trend continuation, with both bulls and bears temporarily reaching a stage of balance. Once the price effectively breaks through the critical resistance zone of $90,000–$92,000, upward momentum is expected to re-ignite. From an on-chain perspective, Bitcoin is gradually transitioning from the previous aggressive selling phase to a stabilization phase. Currently, a large number of spot buy orders, mainly from whales, are clustered around the current price level, forming a stark contrast to earlier pullbacks dominated by retail traders and a noticeable absence of large participants. The sustained involvement of spot whales typically indicates longer-term position building, especially common in low-volatility environments.

GateResearch·2025-12-30 06:39

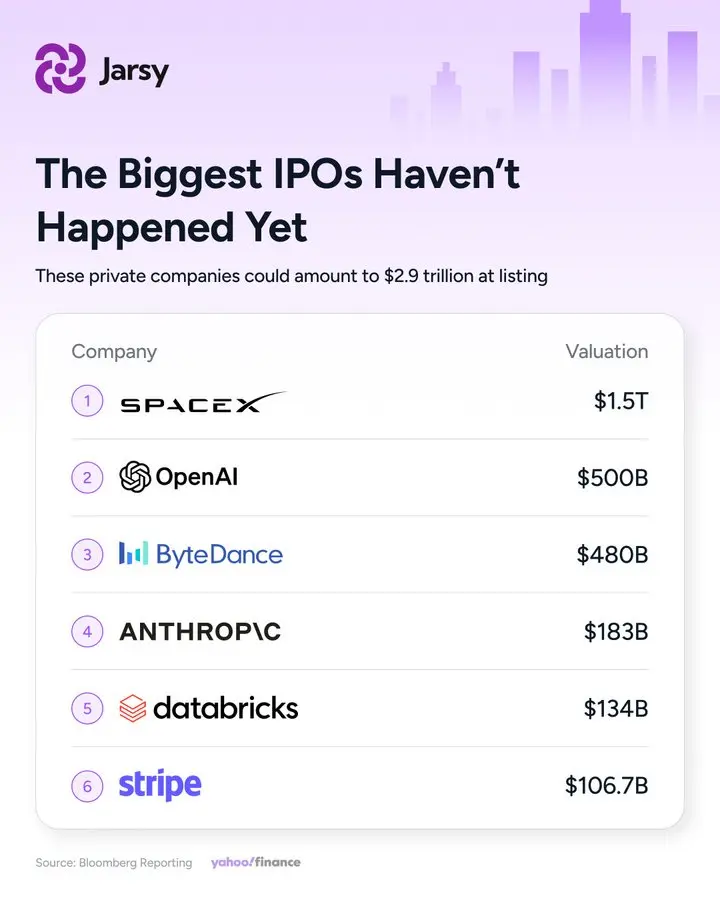

Cantor Fitzgerald 警告寒冬來襲!機構卻砸 500 億押注 RWA

Cantor Fitzgerald warns that Bitcoin has entered a long-term downturn, having been above the high point for 85 days, and may test MicroStrategy's cost basis at $75,000. However, institutional adoption rates are surging against the trend, with RWA tokenization value increasing to $18.5 billion this year and expected to break $50 billion by 2026. DEX expansion and the CLARITY bill provide regulatory clarity, and the market is now dominated by institutions rather than retail investors, marking the industry’s move into an institutionalized phase.

MarketWhisper·2025-12-30 05:43

DeFi landscape changes: RWA surpasses DEX with $17 billion TVL, entering the top-tier track

According to the latest data from DefiLlama, the total value locked (TVL) in Real World Asset (RWA) protocols has surpassed $17 billion, successfully overtaking decentralized exchanges (DEX) by the end of 2025, ranking as the fifth largest category in DeFi ecosystem TVL, just behind lending, liquidity staking, cross-chain bridges, and re-staking sectors. This milestone achievement signifies that the driving force behind DeFi's development is shifting from pure on-chain financial experiments to the large-scale absorption of traditional yield assets and safe-haven assets. The core driver of this wave is not speculation, but rather institutional asset-liability management needs in a "higher and longer" interest rate environment, as well as macro allocation demands stimulated by the rise of gold and silver. This silent transformation indicates that the integration of the crypto economy with the trillion-dollar traditional financial market has entered a phase of substantial acceleration.

MarketWhisper·2025-12-30 04:01

The crypto winter may reappear in 2026, but Cantor Fitzgerald foresees a new era of institutional growth and on-chain transformation

Renowned financial institution Cantor Fitzgerald pointed out in its latest year-end report that the cryptocurrency market may be entering the early stages of a new "crypto winter," which could echo Bitcoin's approximately four-year cycle. However, unlike previous adjustments, this cycle is expected to be less chaotic, more institution-led, and increasingly defined by decentralized finance, real-world asset tokenization, and clearer regulations. The report data shows that the total on-chain RWA value has surged to $18.5 billion this year and is expected to surpass $50 billion by 2026. Although Bitcoin prices may face pressure, the market infrastructure and participants are undergoing profound structural changes, laying the foundation for a more sustainable growth in the next cycle.

MarketWhisper·2025-12-30 01:24

The People's Bank of China makes a major announcement! New Digital RMB framework to be launched on New Year's Day 2026

On December 29, the People's Bank of China announced that the new digital yuan framework will be launched on January 1, 2026, emphasizing central bank regulation, the liability nature of commercial banks, account-based systems, and compatibility with distributed ledger technology. On the same day, the Hong Kong Monetary Authority implemented Basel's new crypto asset regulations, including Bitcoin, Ethereum, RWA, and stablecoins into bank capital regulation.

MarketWhisper·2025-12-29 07:00

Toto Finance Brings Real-World Assets On-Chain With RWA Tokenization

Toto Finance aims to bridge traditional finance and Web3 by integrating real-world assets (RWAs) on the blockchain. By combining tokenization with legal compliance and custody, it enhances transparency and connects finance with the physical economy.

BlockChainReporter·2025-12-29 06:05

Crypto Venture Capital Shift: Public Chains and AI Cool Down, Predictions, Payments, and RWA Become New Hotspots

The cryptocurrency venture capital market is undergoing changes, with the boom in public chain financing cooling down, and investors shifting their focus to application projects with real users and revenue. Emerging sectors such as prediction markets, payment systems, and real-world assets (RWA) are rising, attracting significant capital. By 2025, financing performance in fields like payments and RWA is expected to be impressive, while DeFi remains steady but relatively cautious. Investment trends indicate that consumer-end products and genuine application scenarios are gaining more attention.

PANews·2025-12-28 23:34

Canton Network emerges as a clear leader in the RWA space

Canton Network is emerging as the leading infrastructure for the tokenization of real-world assets (RWA), with approximately $388 billion in assets on-chain, far surpassing competitors. This growth is driven by institutional capital and confirmed by a partnership with DTCC to tokenize U.S. Treasury bonds, signaling a significant shift to blockchain in financial systems.

TapChiBitcoin·2025-12-28 11:52

ATT Global Partners With MindKit DAO to Redefine AI-Driven Web3 Advertising

ATT Global, a renowned Web3 launchpad, has officially collaborated with MindKit DAO, a popular decentralized AI integration entity. The partnership endeavors to combine the DePIN-led advertising and RWA infrastructure of ATT Global with the AI toolkit of MindKit DAO. As per ATT Global’s official

BlockChainReporter·2025-12-28 09:04

AVAX Holds Key Weekly Support at $11 While Social Buzz Points to Rising Volatility

AVAX trades within a long-term descending channel while testing a historically important weekly demand zone.

Social data shows AVAX ranking near the top among RWA-related crypto projects by engagement volume.

Market capitalization trends reflect consolidation as buyers defend key support le

CryptoFrontNews·2025-12-28 05:36

Global Asset Rotation: Why Does Liquidity Drive Cryptocurrency Cycles? (Part 1)

Introduction: Starting from Capital, Not Stories

This article marks the beginning of a new series of research on global asset allocation and rotation. After a deep dive into this topic, we discovered one of the most surprising yet most important facts: it is not the emergence of new narratives that ultimately drives the crypto bull market.

Whether it’s RWA, X402, or any other concept, these themes are usually just triggers rather than true drivers. They may attract attention, but they do not provide the energy themselves. The real power comes from capital. When liquidity is abundant, even weak arguments can be amplified into market consensus. Conversely, when liquidity dries up, even the strongest arguments struggle to maintain their momentum.

The first part focuses on building the foundation: how to construct a global asset allocation and rotation framework that places cryptocurrencies within the appropriate macro context. The latter half of the framework will be elaborated in subsequent articles.

Step 1: Step out of the cryptocurrency space and draw

PANews·2025-12-26 23:31

RWA Rockets 185.8% As Gaming and DePIN Collapse, CoinGecko Data Finds

Real-world assets unexpectedly stole the show in crypto this year, posting gains that left most other sectors scrambling to keep up. According to CoinGecko’s “Crypto Narratives by Profitability 2025,” the RWA, short for real-world assets, theme climbed an eye-watering 185.76% on average, pushing it

RWA1,22%

BlockChainReporter·2025-12-26 20:03

RWA Tops 2025 Crypto Returns as Gaming, DePIN Collapse: CoinGecko

In 2025, Real World Assets (RWA) led crypto returns with 185% gains, driven by strong performances from Keeta, Zebec, and Maple Finance. Layer 1 blockchains also thrived with 80%+ gains, while gaming and DePIN sectors faced significant losses.

RWA1,22%

CryptoFrontNews·2025-12-26 17:06

HBAR Comes to SafePal as Wallet Adds Hedera EVM Compatibility

Hedera enables SafePal users to store, send, and receive HBAR on the mobile app and hardware wallets.

Hedera is making waves in payments, fintech, RWA, and the environmental credit marketplace, distinguishing HBAR from its contemporaries.

SafePal, a non-custodial crypto wallet suite, has

CryptoNewsFlash·2025-12-26 12:10

Stablecoins and RWA Tokenization Define Asia's 2025 Crypto Regulatory Landscape

Asia's crypto regulatory story in 2025 shifted from conceptual frameworks to practical implementation, with stablecoins and real-world asset (RWA) tokenization emerging as the region's primary focus areas.

CryptopulseElite·2025-12-26 10:11

From Safe-Haven Assets to Financial Building Blocks: The Structural Rise and Investment Logic of Gold RWA

1. Behind the New High in Gold Prices, Asset Forms Are Changing

On December 22, 2025, the domestic gold price once again broke through 1,000 yuan/gram, setting a new high for the year. In traditional financial markets, gold price increases are usually interpreted as a rise in risk aversion; but in the digital asset world, changes in gold go beyond just price levels.

CoinFound (a data technology company specializing in TradFi × Crypto) recently released the "Gold RWA Trend Insights" report, which systematically reviews the market size, ecological landscape, and application scenarios of gold RWA in 2025. Data shows that the market capitalization of gold RWA grew from less than $1 billion at the beginning of the year to over $3 billion in 2025, nearly tripling.

In Starbase's view, this growth is not simply a reflection of rising gold prices, but rather a transformation in the asset form of gold.

TechubNews·2025-12-26 10:00

Hedera 2025 RECAP! RWA, Partnerships and HBAR Price Prediction for 2026

As we close out 2025, Hedera Hashgraph seems almost unrecognizable from what it was this time last year,” they wrote. “Instead of trying to ride the wave of hype in the crypto-world, Hedera Hashgraph has been proudly working on their technology that has a use case in the real world today.

That stea

CaptainAltcoin·2025-12-26 08:50

RWA Weekly: Ctrip's overseas version launches stablecoin payments, Ethereum treasury company ETHZilla shifts to RWA business

Highlights of this Issue

The weekly coverage period for this issue spans from December 19, 2025, to December 26, 2025. This week, the total on-chain RWA market capitalization steadily increased to $19.04 billion, with the number of holders surpassing 590,000, indicating sustained growth momentum; meanwhile, the total market cap of stablecoins, after approaching $300 billion, has nearly stagnated, further highlighting the contraction in active user base expansion and on-chain activity.

Global regulatory frameworks continue to advance: the United States is considering providing a tax safe harbor for stablecoins, Japan plans to promote the on-chain issuance of local government bonds, and countries like China, South Korea, and Ghana are accelerating their deployment in digital currencies and stablecoins. Domestic institutions' overseas branches are gradually exploring applications such as digital renminbi and stablecoin top-ups and payments: ICBC's Singapore branch is piloting digital renminbi overseas wallet top-ups, and Ctrip's overseas version has integrated stablecoin payments, demonstrating accelerated adoption of stablecoins in cross-border settlement and travel consumption scenarios.

Meanwhile, Ethereum DAT company E

PANews·2025-12-26 06:07

LunarCrush Reveals the List of Top RWA Projects By Social Activity

LunarCrush reveals the Top 10 Real-World Asset projects by social activity, led by Chainlink ($LINK), which boasts the highest engagement. Notable competitors include Avalanche, Hedera, and VeChain, highlighting the competitive landscape in crypto interactions.

BlockChainReporter·2025-12-26 05:03

Canton Network teams up with DTCC to promote US debt tokenization. After a 27% increase, can Canton Coin's rally continue?

The Depository Trust & Clearing Corporation (DTCC) announced on December 17th that it plans to utilize the Canton Network blockchain to tokenize some U.S. Treasuries held by its subsidiary, the Depository Trust Company. This landmark event is interpreted by the market as a substantial embrace by traditional financial infrastructure giants of blockchain asset tokenization, directly driving the native Canton Network token Canton Coin (CC) to surge approximately 27% in the past week against the market trend.

Meanwhile, the total value of tokenized real-world assets (RWA) has more than doubled over the past year, currently approaching $19 billion, with U.S. Treasury products accounting for nearly half of the market share. This collaboration not only provides strong institutional credibility to the Canton Network but also could serve as a key catalyst in accelerating the wave of traditional assets worth trillions of dollars onto the blockchain.

MarketWhisper·2025-12-26 02:24

RWA Crypto Coins Explained: Why ONDO, Chainlink, and Avalanche Stood Out in 2025

If there was one area of crypto that quietly made real progress in 2025, it was real-world assets. While much of the market spent the year chopping around, RWA projects were busy building things that actually

CaptainAltcoin·2025-12-25 21:21

HBAR Comes to SafePal as Wallet Adds Hedera EVM Compatibility

Hedera enables SafePal users to store, send, and receive HBAR on the mobile app and hardware wallets.

Hedera is making waves in payments, fintech, RWA, and the environmental credit marketplace, distinguishing HBAR from its contemporaries.

SafePal, a non-custodial crypto wallet suite, has

CryptoNewsFlash·2025-12-25 12:06

PA Daily | Bitcoin Spot ETF experiences five consecutive days of net outflows; Offshore RMB breaks above the 7 threshold

Today's News Highlights:

Two major Russian exchanges plan to launch compliant crypto trading by 2026

Bitcoin mining difficulty slightly increased by 0.04% to 148.26 T

Most profitable crypto narratives in 2025: RWA and Layer1 lead, AI and Meme see significant pullback, GameFi and DePIN decline sharply

Offshore RMB breaks the 7 threshold for the first time in 2024, onshore RMB hits a new high in over a year

Silver fund premium attracts attention; Guotou Silver LOF will suspend trading from market open on December 26 until 10:30 AM on the same day

Bitcoin spot ETF saw a net outflow of $175 million yesterday, marking five consecutive days of net outflows

Suspected Multicoin OTC purchase of 60 million WLD from the Worldcoin team

Macro

Central Bank: Supports provinces along the Western Land-Sea New Corridor to participate in the multilateral central bank digital currency bridge project

The People's Central

PANews·2025-12-25 09:39

Lawyer's Perspective: RWA Utility Tokens, Don't Deceive Yourself

The asset nature emphasized by regulation is real economic activity. In mainstream standards, the vast majority of functional RWA tokens are regarded as securities. This article is written by Professor Shao Jiadian from Mankun Blockchain and reorganized by PANews.

(Previous context: RWA explosion: opportunity or scam?)

(Additional background: Lawyers warn that China’s RWA industry has only two paths: go overseas or completely give up)

Table of Contents

Introduction

You think you're doing "RWA functional," but what are you doing in the eyes of regulation?

Real Case 1:

Real Case 2:

Why is the "functional" aspect particularly untenable in the RWA field?

A harsh reality you must face:

A brutally honest summary

So, does RWA "only" have to be securities?

End

動區BlockTempo·2025-12-25 06:05

RWA functional tokens, stop fooling yourself

Many RWA projects claim to be "functional tokens," but regulators do not agree. The article illustrates through real cases that "functional RWA tokens" are often classified as securities because their structure meets the elements of securities law. In the future, RWA token regulation will become increasingly strict. If they raise funds from the public and have profit expectations, they will almost certainly be subject to securities regulation. Standardized operations are key to the project's survival.

PANews·2025-12-25 03:05

3 Altcoins Investors Are Tracking Heading Into January 2026

Onyxcoin: Strong rally backed by partnerships, ledger upgrade plans, and balanced technical momentum.

Stacks: Bitcoin-linked growth potential with bullish chart structure and recovering momentum indicators.

Ondo: Institutional-backed RWA leader holding key levels with upside toward

CryptoNewsLand·2025-12-24 15:36

HBAR Comes to SafePal as Wallet Adds Hedera EVM Compatibility

Hedera enables SafePal users to store, send, and receive HBAR on the mobile app and hardware wallets.

Hedera is making waves in payments, fintech, RWA, and the environmental credit marketplace, distinguishing HBAR from its contemporaries.

SafePal, a non-custodial crypto wallet suite, has

CryptoNewsFlash·2025-12-24 12:00

Is RWA moving towards the "Equity Era"? The behind-the-scenes of Securitize, Ondo, and Coinbase taking action simultaneously

Text: RWA Knowledge Circle

Editor: RWA Knowledge Circle

Introduction

Recently, a phenomenon has emerged in the RWA community that is worth pondering repeatedly. Securitize, the number one in RWA market share, third-place Ondo, and leading digital asset exchanges

PANews·2025-12-24 09:04

Looking Back at 2025: Major Crypto Moves by Traditional Giants like BlackRock Throughout the Year

Written by: Deng Tong, Golden Finance

In 2025, cryptocurrency industry regulation will become clearer, traditional finance will be deeply integrated, and technological iteration will accelerate. Every key milestone depends on core figures who either lead policy direction, guide institutions to enter the market, tackle technical challenges, or stir up the market.

What actions will traditional giants like BlackRock, JPMorgan Chase, Visa, and Mastercard take in the crypto space in 2025?

1. BlackRock: Promoting ETFs and Optimistic about RWA

BlackRock will focus on strategic initiatives related to crypto assets and tokenization throughout 2025, including expanding ETF offerings and researching asset tokenization.

1. Promoting ETFs

In early 2025, BlackRock will consider Bitcoin as one of its core investment themes for the year, emphasizing its "long-term investment value," and will continue to advance its iShares Bitcoin...

TechubNews·2025-12-24 08:28

Dumping 24,000 Ether to repay debts! ETHZilla is abandoning the "Coin Hoarding" strategy and shifting to RWA tokenization.

ETHZilla, which received investment from Silicon Valley venture capital king Peter Thiel (stock code: ETHZ), has transformed into an Ether reserve company for less than half a year, but suddenly hit the brakes. ETHZilla confirmed on Monday that it has sold 74.5 million dollars worth of Ether to pay off company debts; at the same time, it announced that the company's strategic focus will shift from simple "Coin Hoarding" to a business focused on the more cash flow potential "Real World Asset (RWA) tokenization."

This company, which was formerly the Nasdaq-listed biotech firm 180 Life Sciences, has undoubtedly poured cold water on the frenzy of mimicking Strategy's "public company Coin Hoarding craze."

ETHZilla announced on Monday that it has sold 24,291 Ether to redeem the company's outstanding priority guaranteed convertible bonds.

区块客·2025-12-24 04:46

Sell 24,000 Ether to pay off debts! The reserve company ETHZilla abandons Coin Hoarding and shifts focus to RWA tokenization.

ETHZilla's Coin Hoarding strategy takes a sharp turn, selling $74.5 million in Ether to pay off debts, officially shifting towards RWA tokenization, dousing the coin hoarding craze for listed companies.

ETHZilla (stock code: ETHZ), which received investment from Silicon Valley venture capital king Peter Thiel, has transformed into an Ether reserve company for less than half a year, but suddenly hit the brakes. ETHZilla confirmed on Monday that in order to repay company debts, it has sold Ether worth 74.5 million USD; at the same time, it announced that the company's strategic focus will shift from simple "Coin Hoarding" to a business that has more cash flow potential in "Real World Asset (RWA) tokenization."

This company, formerly known as the NASDAQ-listed biotech company 180 Life Sciences, is undoubtedly acting in a way that invites a stampede of imitation.

CryptoCity·2025-12-24 03:56

Dogecoin Price Prediction 2040: Tokenization to Disrupt Finance as DeepSnitch AI Prepares for Explosive Launch in Weeks

Keith Grossman, president of MoonPay, has issued a bold forecast: real-world asset (RWA) tokenization will force traditional institutions to adapt or die, much like streaming services have transformed music and print media. With giants like BlackRock and Franklin Templeton already running

CaptainAltcoin·2025-12-23 12:35

The "Energy Consumption Truth" of Bitcoin Mining Farms has been exposed by satellite thermal imaging.

Satellite thermal imaging reveals the true power load of the Riot 700 megawatt Mining Farm, allowing investors to use a "space perspective" to examine the energy costs and operational status of computing power companies.

(Previous Summary: Breaking! The U.S. SEC has classified Bitcoin mining under securities law, suing mining company VBit for defrauding $95.6 million)

(Background information: The seven major financial industry associations in China jointly warned: Cryptocurrencies, RWA, and Mining are all illegal! Offshore platforms providing services are also crossing the red line)

Since the arrival of Bitcoin mining farms in Rockdale, Texas, residents have continuously complained that the noise disrupts their lives. At an altitude of 500 kilometers, the UK startup space analytics company SatVu released thermal imaging from the HotSat-1 satellite, showing that the facilities of Riot Platforms continuously emit heat at a power of 700 megawatts.

this

動區BlockTempo·2025-12-23 09:50

Sell 24,000 Ether to pay off debts! ETHZilla will abandon the "Coin Hoarding" strategy and shift to RWA tokenization.

ETHZilla (stock code: ETHZ), backed by Silicon Valley venture capital titan Peter Thiel, has transformed into an Ether reserve company for less than half a year but suddenly hit the brakes. ETHZilla confirmed on Monday that it has sold $74.5 million worth of Ether to pay off company debts; at the same time, it announced that the company's strategic focus will shift from simple "Coin Hoarding" to a business model with greater cash flow potential in "real-world asset (RWA) tokenization."

This company, which was formerly the Nasdaq-listed biotech company 180 Life Sciences, undoubtedly poured a cold bucket of water on the hive-like imitation of Strategy's "public company Coin Hoarding craze."

ETHZilla announced on Monday that it has sold 24,291 Ether to redeem the company's outstanding preferred secured convertible bonds.

ETH-0,26%

区块客·2025-12-23 04:29

Load More