Search results for "SCARCITY"

Tom Lee Bitcoin Prediction: BTC Could Hit $3 Million

Tom Lee predicts that Bitcoin could reach $3 million due to an impending supply shock, driven by limited supply and growing demand. While some experts are skeptical, the trend of scarcity and institutional adoption remains crucial for investors to consider in their strategies.

BTC0,6%

Coinfomania·01-02 06:40

Elon Musk predicts money will disappear! In the Bitcoin and AI era, "energy is the real currency"

Musk put forward a subversive assertion: in the long run, money will disappear, and the real money is energy. When AI and robotics reach a certain height, humans may enter a post-scarcity society, and money will no longer be needed. He believes that Bitcoin is the first digital asset to directly link currency to energy consumption due to its proof-of-work mechanism, and that work may change from a survival necessity to a personal choice in the next 20 years.

MarketWhisper·2025-12-31 05:32

PlanB Says Bitcoin Is Extremely Undervalued as Scarcity Outpaces Gold

PlanB is of the opinion that Bitcoin is undertraded. He posits that Bitcoin is rarer than both gold and real estate but it is priced by markets 10 to 100 times less. The basis of his comparison is scarcity as the fundamental source of long-term value and puts Bitcoin in a perspective of a

BTC0,6%

Coinfomania·2025-12-30 12:38

Top Meme Coins for Massive ROI Signal a Shift Toward Scarcity, Utility, and Timing

Market history suggests that few individuals influence meme-driven crypto narratives as consistently as Elon Musk. Subtle references, social commentary, or cultural alignment with his interests have repeatedly triggered renewed attention across the meme-coin sector. As 2026 approaches, several

BlockChainReporter·2025-12-30 09:55

'Harvard Thinks It's Bitcoin When It's Ethereum': Jeff Park Burns Harvard University - U.Today

Jeff Park argues that Harvard's admissions process mirrors Ethereum's governance rather than Bitcoin's rigid structure. He highlights the discretionary and changeable nature of Harvard's system and criticizes elite institutions for maintaining artificial scarcity in admissions, which obscures the true nature of their governance.

UToday·2025-12-30 09:26

Ethereum Supply Sovereignty Battle: Bitmine Rapidly Increases ETH Holdings by $130 Million, Whale Holdings Account for 70%

Renowned investor Tom Lee's cryptocurrency asset management firm Bitmine has recently made a significant purchase of approximately 44,463 ETH valued at around $130 million, bringing its total holdings to 4.11 million ETH, accounting for about 3.41% of the total ETH supply. This move is not an isolated incident; on-chain data shows that "whale" addresses holding over 1,000 ETH currently control up to 70% of the ETH supply, indicating that the market ownership structure is rapidly consolidating among institutions and large holders.

Meanwhile, within just 48 hours, Bitmine has locked over $1 billion worth of ETH into staking contracts, causing the validator queue to extend to nearly 13 days and further removing liquidity from the circulating market. These signs suggest that a "supply sovereignty" battle led by institutions to control the scarcity of core crypto assets is quietly escalating within the Ethereum ecosystem, which could fundamentally reshape its market supply-demand dynamics and price stability.

MarketWhisper·2025-12-30 02:42

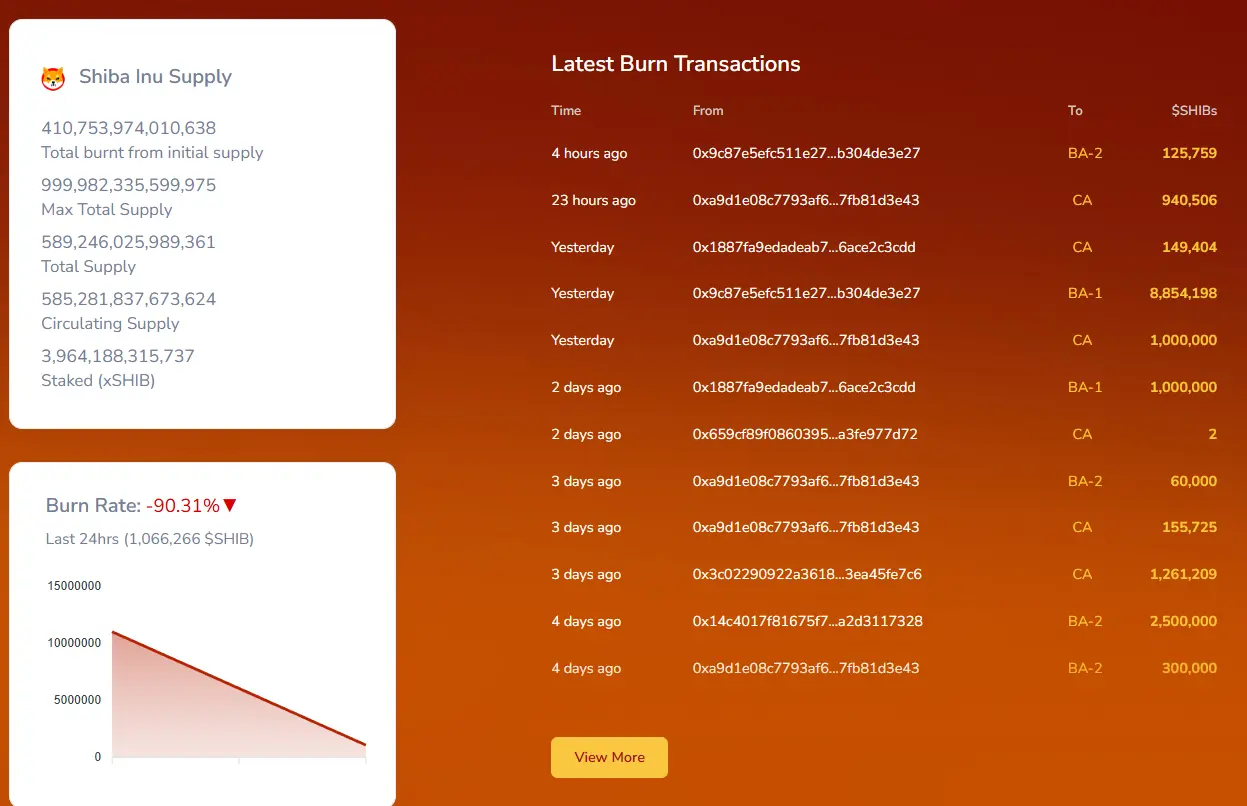

Shiba Inu Prediction for Dec 29: Next Key Resistance at $0.00000859 but Burn Rate is Declining

Shiba Inu (SHIB) is showing resilience with modest gains but faces challenges as its burn rate has dropped by 90%. While testing key support and resistance levels, its future price action will depend on maintaining support and increasing burn activity to enhance supply scarcity.

SHIB5,55%

TheCryptoBasic·2025-12-29 14:00

Bitcoin to $10,000? Bloomberg Makes Shocking Crash Prediction - U.Today

Bloomberg's McGlone predicts Bitcoin will plummet to $10,000, viewing it as a return to pre-2020 prices. He argues that Bitcoin lacks scarcity, unlike gold, and asserts the crypto market is oversaturated, leading to a deflationary recession.

BTC0,6%

UToday·2025-12-28 20:38

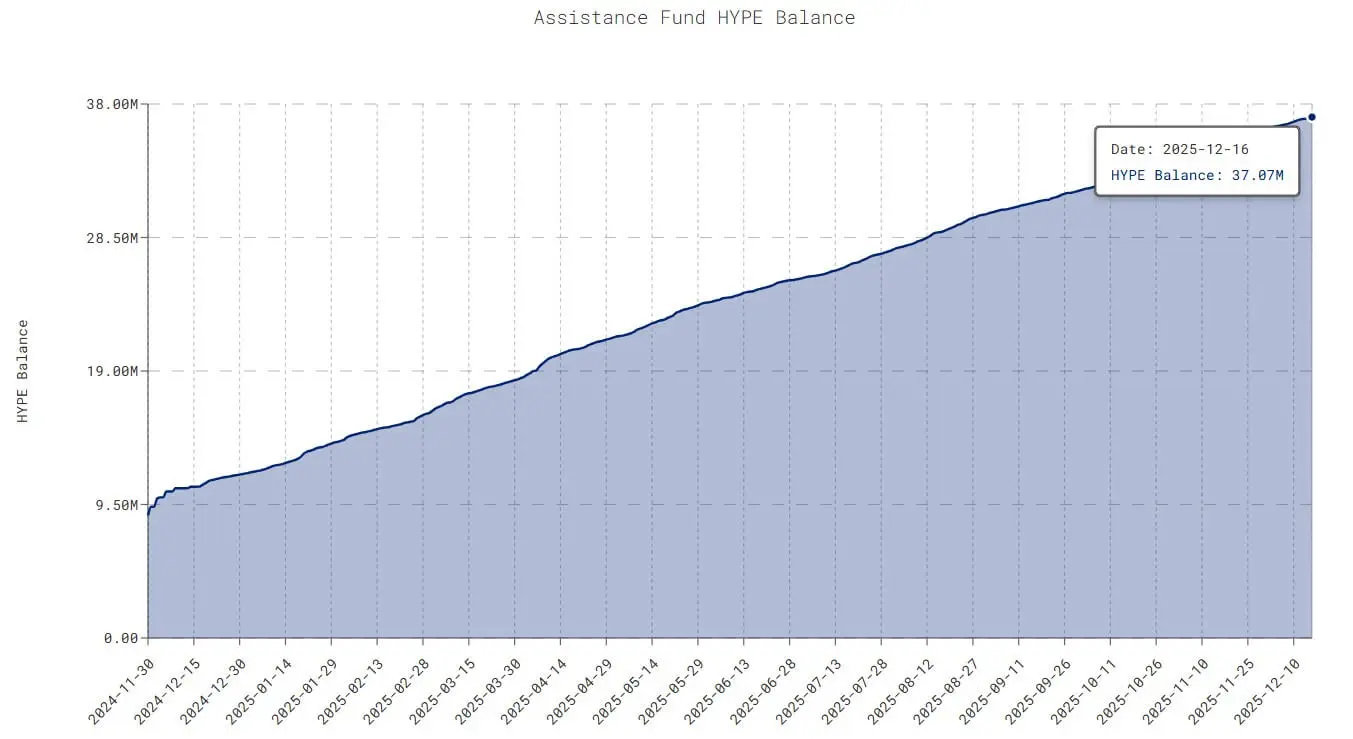

Hyperliquid Targets $1 Billion Burn to Boost Protocol Value and Liquidity

Token Burn: Hyperliquid plans to remove $1 billion HYPE from circulation, reducing total supply.

Market Impact: Burn could boost liquidity, create scarcity, and increase HYPE token value.

Investor Insight: Whale activity and smaller wallet optimism signal potential shifts in market

CryptoNewsLand·2025-12-24 07:46

Hyperliquid burns $1 billion worth of tokens! Wall Street revalues cash flow significance

Hyperliquid is going through a critical moment. The Hyper Foundation has proposed effectively burning approximately $1 billion worth of HYPE tokens from the fee-funded treasury, aiming to make scarcity as evident as the price chart. At the same time, Cantor Fitzgerald released a 62-page initiation report, repositioning Hyperliquid from a DeFi token to an exchange with cash flow.

HYPE-0,35%

MarketWhisper·2025-12-18 06:21

Bittensor's first halving completed: TAO drops 8% in response, AI mining ecosystem faces a "big test"

The highly anticipated decentralized artificial intelligence network Bittensor successfully executed its first ever block reward halving on December 14. According to the established rules, the daily release of TAO tokens has been reduced from 7200 to 3600, marking the official entry of its issuance rate into a long-term decay phase. Although halving events are traditionally seen as key catalysts for scarcity value, the market responded tepidly after the event, with TAO price dropping approximately 8% in a single day. This halving not only tests the tokenomics but also may trigger a profound reshuffle within its internal “subnet” mining ecosystem, where efficient subnets capable of generating real revenue will be favored, while “zombie subnets” face elimination.

MarketWhisper·2025-12-16 02:58

Inflationary and Deflationary Cryptocurrencies: An Analysis of Value Impact

The inflation and deflation properties of cryptocurrencies directly affect investment decisions. Inflationary currencies (such as Ethereum) continuously issue new tokens to pay for network security, which may lead to value dilution; while deflationary currencies (such as Bitcoin) set a supply cap, emphasizing scarcity to attract investors. As regulatory policies change, the sustainability and market position of these two currency models will face new challenges.

金色财经_·2025-12-15 08:48

Has the Halving Narrative Ended? 10x Research, Cathie Wood, and Arthur Hayes Debate the Life and Death of Bitcoin's Four-Year Cycle

The narrative of Bitcoin's classic "four-year halving cycle" is facing unprecedented challenges. Recently, influential analysts such as Markus Thielen, Head of 10x Research, Cathie Wood, CEO of ARK Invest, and Arthur Hayes, co-founder of BitMEX, have spoken out, believing that the core driving forces behind the cycle have undergone a fundamental shift. They point out that with the advent of spot ETFs bringing in massive institutional funds, Bitcoin's market structure has been completely transformed. Its price volatility is now more closely tied to global liquidity, the US election cycle, and macroeconomic policies rather than solely to supply halving events. This ongoing debate about whether the "cycle is dead" marks Bitcoin's shift from an exclusively tech-driven scarcity experiment to an accelerated integration into the pricing logic of global macro assets.

BTC0,6%

MarketWhisper·2025-12-15 05:23

Bittensor (TAO) Enters Its Biggest Moment Yet

Bittensor is entering a critical phase with its first halving on December 12, reducing TAO emissions and increasing scarcity. Institutional adoption is strong, and regulatory shifts favor TAO. The network's active subnets contribute measurable outputs, positioning TAO uniquely among altcoins for future growth.

TAO2,58%

CaptainAltcoin·2025-12-08 00:34

China’s Nvidia counterpart “Moore Threads” skyrockets 468% on first trading day; early investors reap 6,200x returns, creating an A-share legend

Moore Threads soared 468.78% on its first day of listing on the STAR Market, with its market value surpassing 270 billion yuan. Early investors saw book profits exceeding 6,200 times, making it one of the most profitable new stocks of the year and fueling market expectations for the prospects of high-end domestic computing chips in China. This article is sourced from Wallstreetcn and was compiled, translated, and written by Foresight News. (Previous context: Former Vice President of Bank of China Wang Yongli: Why does China resolutely halt stablecoins?) (Background supplement: The other side of the US AI boom: "Working for" Chinese Bitcoin miners)

As China's "first domestic GPU stock," Moore Threads’ debut on the STAR Market ignited market enthusiasm with its astonishing surge. This not only directly affirms its technological scarcity but also highlights the strong optimism for the prospects of high-end domestic computing chips in China amid the wave of artificial intelligence. December

動區BlockTempo·2025-12-05 19:02

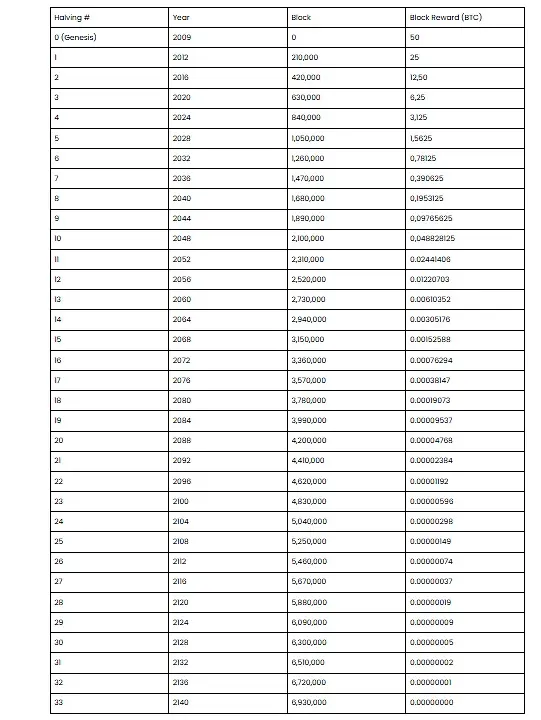

When will the last Bitcoin be mined?

Understand the time when the last Bitcoin will be mined, and how the halving mechanism, fixed supply, and Bitcoin's economic design shape its long-term scarcity, value, and future role.

Since its inception in 2009, Bitcoin has stood out among digital currencies primarily because of its constant and limited supply.

Its protocol has a built-in rule that permanently caps the total number of Bitcoins at 21 million.

Built-in Scarcity: The Halving Mechanism

The supply cap of Bitcoin stems from its design mechanism.

Unlike traditional currencies that can be infinitely expanded through increased issuance, Bitcoin follows a preset issuance schedule regulated by the "halving" process.

According to the protocol, approximately every 210,000 blocks mined (roughly every four years), the reward miners receive for validating a block is cut in half.

At the beginning of Bitcoin, miners could earn a reward of 50 BTC per block. This has since undergone multiple halvings: 25 BTC → 12.5

BTC0,6%

金色财经_·2025-12-05 10:57

Earned 6,200x profits, who is the biggest winner of Moore Threads?

Source: Wallstreetcn

As the "first domestic GPU stock," Moore Threads ignited market enthusiasm with an astonishing surge on its debut on the STAR Market. This not only directly affirms the scarcity of its technology but also highlights the strong optimism for the prospects of domestic high-end computing power chips amid the wave of artificial intelligence.

On December 5, Moore Threads officially landed on the STAR Market, opening at 650 yuan, a 468.78% surge from its issue price of 114.28 yuan. The intraday high reached 688 yuan, an increase of 502%, with its market value once exceeding 270 billion yuan. Calculated at the opening price, investors who won a single lot (500 shares) saw a floating profit of over 280,000 yuan, making it one of the most profitable new stocks this year. As of press time, the stock was last quoted at 590.59 yuan per share, up 416.79%.

Moore Threads also brought astonishing returns to early investors—among the earliest investors, Peixian Qianyao's initial

DeepFlowTech·2025-12-05 06:13

CZ and Peter Schiff Debate Kicks Off: Who Will Lead the Future, Bitcoin or Gold?

On the main stage of Binance Blockchain Week 2025, a long-anticipated clash of ideas unfolded as scheduled. CZ and renowned economist and gold bull Peter Schiff engaged in a direct debate on the topic: “Bitcoin vs. Tokenized Gold—which is the better sound money?” CZ defended Bitcoin from the angles of verifiability, digital native utility, and provable scarcity, while Schiff argued that gold’s physical value and historical trust are irreplaceable, with tokenization merely representing its evolutionary form. This debate went far beyond a mere exchange of personal views; it profoundly revealed the core contradiction between traditional stores of value and digital native assets as they vie for influence over the future of finance, and provided investors with a clear framework to understand the fundamental differences between the two asset classes.

BTC0,6%

MarketWhisper·2025-12-05 03:44

Principle of Cryptocurrency Scarcity: Value Drivers for Blockchain Assets in 2025

[ETH](https://www.gate.com/post/topic/ETH) [Blockchain](https://www.gate.com/post/topic/%E5%8D%80%E5%A1%8A%E9%8F%88) [ETF](https://www.gate.com/post/topic/ETF) Against the backdrop of the rapidly expanding global digital economy, the principle of scarcity has become a key factor in the valuation of cryptocurrencies and blockchain assets. Cryptocurrency scarcity is ensured by hard supply caps and cryptographic technologies, which secure their unique status and influence market pricing and investor psychology. These technologically scarce assets demonstrate their potential for inflation resistance and value preservation amid the ever-changing financial environment. The impact of scarcity on cryptocurrency value prompts us to reflect on asset supply and

ETH1,96%

幣圈動態·2025-12-03 15:02

Musk: $38.3 Trillion "Crisis" Could Trigger a Surge in Bitcoin Prices

Musk recently pointed out that the US debt of over $38.3 trillion may lead to Bitcoin price fluctuations. He emphasized Bitcoin's scarcity and its energy-based nature, suggesting that energy could replace currency in the future, and hinted that Bitcoin is more stable than fiat currency. Currently, Bitcoin is gradually entering the mainstream financial market.

BTC0,6%

金色财经_·2025-12-03 13:53

The Battle Between Strategy, STRC, and Bitcoin for Supremacy: Who Will Control the Future Monetary Order?

Author: MarylandHODL

Compiled by: TechFlow

TechFlow Summary:

The Rule of Financialists: By controlling credit, price discovery mechanisms, and monetary transmission channels, financialists maintain a highly centralized system centered around fiat currency.

The Sovereigntists’ Counterattack: This camp consists of nations seeking monetary independence, institutions and enterprises tired of the banking system, and individuals choosing Bitcoin as a store of wealth. They believe Bitcoin can break the monopoly of traditional currency.

The Significance of STRC: STRC, launched by MicroStrategy, is an innovative financial instrument that transforms fiat savings into real yield collateralized by Bitcoin, while tightening Bitcoin’s circulating supply to reinforce its scarcity.

JPMorgan’s Counterattack: JPMorgan quickly launched synthetic financial products linked to Bitcoin, attempting to

BTC0,6%

DeepFlowTech·2025-12-03 06:48

Musk's Vision for the Future: AI Will Make Currency Disappear, Bitcoin Will Rise Due to Energy Value

Tesla CEO Elon Musk recently painted a disruptive vision of the future in an interview: when artificial intelligence and robotics are highly developed enough to meet all human needs, the concept of "currency" as a tool for labor allocation may disappear. He believes that "energy" based on physics will become the ultimate currency, and Bitcoin, due to its Proof of Work mechanism, will convert energy into digital scarcity, playing a central role as a value carrier in this future. This forward-looking discourse places Crypto Assets at the center of the grand narrative of AI, provoking deep market reflections on ultimate value storage.

BTC0,6%

MarketWhisper·2025-12-01 07:52

"Money will disappear"! Musk supports Bitcoin: Energy is the real currency.

Elon Musk recently stated on a podcast that he believes "money as a concept will eventually disappear." He emphasized that even in a post-scarcity era, "energy is the real currency," and clearly pointed out that "this is why I say Bitcoin is based on energy." He stressed that energy cannot be controlled through legislation, and producing energy is very difficult, therefore "we are likely to end up using energy and electricity generation as de facto currency."

MarketWhisper·2025-12-01 07:27

Musk: Money will eventually disappear, and energy will become the only currency of human civilization.

In a recent interview, Musk once again put forward a radical argument, stating that the core of civilization is not money, but energy. He pointed out that AI and Bots will bring unprecedented high productivity, and humanity is moving towards an era of "almost unlimited supply" of goods and services. As scarcity disappears, the importance of money as a distribution tool will gradually fade. Ultimately, civilization will return to an unshakable fact, which is that energy is the true "only currency" that supports human civilization's productivity and cannot be created through legislation.

AI makes work no longer a necessity, but rather an interest or choice.

Elon Musk stated that the development speed of AI and Bots will be faster than imagined, enough to reshape human life. He estimates that in about 10 to 20 years, AI and Bots may even be able to produce corresponding goods and services immediately as long as humans want something, allowing humans to live well even without working. In such a world,

ChainNewsAbmedia·2025-12-01 07:24

$ROCK has completed the repurchase and destruction of nearly 2 billion tokens, continuing deflation, with a price surge of 45% this month, having risen nearly 20 times from the bottom.

According to Mars Finance, $ROCK has burned 1.94 billion Tokens, the market performance is strong, and the current price is 0.00192 USDT, with a monthly rise of 45%. The buyback plan of ROCK DAO has promoted the scarcity of Tokens and enhanced the long-term value for holders.

MarsBitNews·2025-11-28 07:23

The US dollar recorded its largest weekly fall in four months, with market focus on the Fed's path.

According to Mars Finance, as reported by Jin10, the U.S. market is closed today due to Thanksgiving, leading to a scarcity of liquidity and increased fluctuation in currency trading. The U.S. dollar is retreating from a six-month high reached a week ago and is likely to post its largest weekly fall since July. Brent Donnelly, president of Spectra Markets, stated that the market will soon consider key trading strategies for 2026, and he believes that "go long on the dollar" will not be one of them, pointing out that if the White House economic advisor Hassett, who advocates for interest rate cuts, is appointed as the next Fed chairman, it would be unfavorable for the dollar.

MarsBitNews·2025-11-27 09:35

What is the reasonable price of ETH? The eight major valuation models from venture capital point to $4800, which is still undervalued by sixty percent.

The reasonable price estimate for Ether (ETH) is approximately $4,800, indicating that the current market price is undervalued by 57%. Through 8 models of TradFi and network science, the analysis shows that ETH possesses cash flow and asset scarcity. In the development of DeFi and the L2 ecosystem, the fundamental demand for ETH continues to strengthen, but the market has yet to reflect its actual value.

ETH1,96%

ChainNewsAbmedia·2025-11-27 08:24

Data: The data dashboard launched by Hashed's founder shows that Ethereum is undervalued by 56.9%.

According to Mars Finance, as reported by Beincrypto, Simon Kim, the founder of the venture capital firm Hashed, has launched a real-time dashboard that estimates the fair value of Ethereum at $4,747.4. The current trading price of Ethereum is $3,022.3, and according to this tool, Ethereum is undervalued by 56.9%. The dashboard updates every two minutes and uses eight different valuation models. The Ethereum valuation dashboard integrates TradFi and encryption native analytical methods. It employs eight models to assess the intrinsic value of Ethereum, including three traditional finance methods: discounted cash flow (DCF, relying on stake yield), price-to-earnings ratio (P/E, set at 25 times), and income yield analysis, as well as TVL multiple, stake scarcity, market capitalization to TVL fair value, and Metcalfe's Law.

MarsBitNews·2025-11-27 02:49

Cosmos Proposes New ATOM Tokenomics to Boost Network Sustainability

Cosmos aims to reshape ATOM tokenomics, rewarding usage over scarcity for a practical, long-term ecosystem framework.

Research teams and public sessions will guide tokenomics design, ensuring technical rigor and community input.

Partnerships like Pocket Network and Akash migration enhance

CryptoFrontNews·2025-11-26 19:02

Gate Research Institute: Unsettled US Treasury Contracts Reach Historical High | AVAX One Invests Approximately 110 Million USD to Increase Holdings of 9.37 Million AVAX

Gate Research Institute: Bitcoin rebounded after stabilizing around $86,000, with the warming expectations of interest rate cuts being a major driving force; Ethereum started a rebound after several days of sideways movement in the $2,700–$2,800 range on Tuesday; PIPPIN rose 103.36%, mainly due to its AI-themed narrative and internet memes story becoming popular again in the trader community; the core driver of L3's recent rise comes from its token scarcity model, which increased by 82.58% within 24 hours; AVAX One invested about $110 million to increase its holdings of 9.37 million AVAX; the CME's open interest in U.S. Treasury bonds reached a historic high, indicating a decrease in investors' risk appetite.

GateResearch·2025-11-25 06:39

Bitcoin mining companies ride the wave of Amazon's $50 billion AI initiative, with BitMine and Cipher Mining leading gains of nearly 20%.

On Tuesday, November 25, 2025, the cryptocurrency mining sector experienced explosive growth, with BitMine and Cipher Mining leading the gains at nearly 20%, and the overall sector rising by 13.84%. This surge was triggered by Amazon’s announcement of a $50 billion investment plan in AI infrastructure for the US government, highlighting the fact that the 14 gigawatts of power capacity held by Bitcoin mining companies is becoming a strategic resource in the race among tech giants for AI computing power.

As mining revenues decline following the Bitcoin halving, mining companies are accelerating their transformation into AI data centers. Cases such as IREN’s $9.7 billion cooperation agreement with Microsoft and Meta joining forces with Microsoft in energy trading mark a new phase in the merging of the mining and technology industries. Deutsche Bank predicts that AI-related investments will surpass $4 trillion by 2030, and the scarcity value of mining companies’ infrastructure is expected to continue to be unlocked.

BTC0,6%

MarketWhisper·2025-11-25 02:56

Solana Supply Tightens with Proposal Doubling Network’s Disinflation Speed

Solana’s proposal doubles disinflation, removing roughly 22 million $SOL from future market emissions, reducing potential sell pressure significantly.

Accelerated terminal inflation creates one of the tightest supply curves among major blockchains, strengthening Solana’s long-term scarcity

SOL2,14%

CryptoFrontNews·2025-11-22 06:06

The 3 Best Staking Crypto Options for Holders Waiting to Go to the Moon (Comparing Models Like $NNZ)

Staking crypto is becoming one of the most reliable ways for holders to earn steady rewards while waiting for the next big run

With so many models competing for attention, the real edge now comes from platforms that mix high APY with real scarcity. Some offer stable returns, others rely on

CaptainAltcoin·2025-11-21 23:04

Can Bitcoin really be a store of value? What pension funds are starting to discover

Key takeaways

Gold has long met store-of-value standards, while fiat currencies lose purchasing power over time. Bitcoin now meets several of the same store-of-value benchmarks.

With a hard cap of 21 million coins and around-the-clock global trading, Bitcoin offers digital scarcity, durability s

BTC0,6%

Cointelegraph·2025-11-21 13:46

11.18 AI Daily Report Industry Shock: BTC big dump breaks 92,000 DappRadar shuts down Nvidia's financial report affects global AI

AI today found: 1. The Federal Reserve Board of Governors member Waller supports a rate cut in December, internal divisions intensify market fluctuations. 2. Japan plans to classify Bitcoin as a financial product, significantly reducing Crypto Assets tax rates. 3. The Sui ecosystem faces an asset scarcity dilemma, the industry calls for optimization of the token issuance mechanism. 4. AI company Perplexity is viewed skeptically, the founder's confidence is questioned. 5. Mastercard collaborates with Polygon to launch a Crypto Assets username transfer system.

GateUser-26c36996·2025-11-18 10:07

The liquidity pressure in the US monetary system reappears: tightening in the repurchase market and scarcity of reserves.

Introduction: The Reappearance of Liquidity Tightening

In November 2025, the U.S. financial system began to show signs of liquidity pressure once again, particularly with the fluctuations in the repo market becoming a focal point of concern. The repo market, as the core "pipeline" of the U.S. monetary system, has a daily trading volume exceeding $3 trillion and is a key channel for financing by banks, money market funds, and hedge funds. Recently, the spread between the Secured Overnight Financing Rate (SOFR) and the Interest on Reserve Balances (IORB) widened to over 14 basis points, marking a high not seen since the liquidity crisis during the pandemic in 2020. This phenomenon is not an isolated event, but is closely related to the Federal Reserve's quantitative tightening (QT) process, fluctuations in the Treasury General Account (TGA) balance, and the accumulation of high-leverage basis trades.

According to data from the New York Fed, as of November 12, 2025, SOFR flat

金色财经_·2025-11-18 01:14

Kiyosaki Challenges Buffett as Crypto Debate Intensifies

Kiyosaki's defense of Bitcoin against Buffett's criticism highlights a growing divide between traditional finance and crypto advocates, emphasizing the need for financial trust, scarcity, and education in investment choices.

CryptoFrontNews·2025-11-17 14:07

Bitcoin Hits 95 Percent Mined Mark as Scarcity Becomes the New Focus

The crypto market entered a new phase as 95 percent of all Bitcoin moved into circulation. This moment signals a sharp rise in scarcity and drives deeper attention toward long-term accumulation. Investors track the Bitcoin supply shortage because it shapes how demand evolves in a maturing market. Th

BTC0,6%

Coinfomania·2025-11-17 09:20

Polkadot DAO implements a supply cap of 2.1 billion DOT, starting a Halving issuance model in 2026.

On October 18, 2025, the Polkadot Decentralized Autonomous Organization (DAO) approved a historic economic model reform through referendum No. 1710 with an 81% support rate, permanently capping the total supply of DOT at 2.1 billion, and initiating a Halving issuance mechanism every two years starting from March 14, 2026.

This transition has transformed DOT from a high-inflation token with an annual inflation rate of 10% into a scarce asset, directly mimicking Bitcoin's scarcity narrative. Currently, the circulating supply of DOT is 1.63 billion, with a trading price of $2.87 and a market capitalization of approximately $4.69 billion. The market has not yet fully priced in the long-term value reassessment potential brought about by this structural change.

MarketWhisper·2025-11-17 05:25

Bitcoin: The Birth and Logic of a Trustworthy Digital Asset

In the evolution of assets throughout human history, "trustworthy" has always been a core and expensive proposition. From the physical scarcity of precious metals, to the legal credit of central banks, and then to complex third-party audits and legal frameworks, the cost of building trust is extremely high.

In 2008, Satoshi Nakamoto submitted a white paper titled "Bitcoin: A Peer-to-Peer Electronic Cash System" to the world. It did not merely propose a new digital currency, but fundamentally reshaped the paradigm of "trust." Bitcoin, rather than being a currency, is better described as a great social practice on how to achieve reliable value transfer without relying on any intermediaries, reconstructing the theory and practice of asset trust.

1. From institutional credit to mathematical credit

The trust core of the Bitcoin scheme is not built on the credibility of any government, bank, or company, but rather on open mathematical algorithms, cryptographic principles, and distributed network consensus.

BTC0,6%

金色财经_·2025-11-15 05:58

Shiba Inu Could Soar 200% As Burn Rate and Open Interest Spike

Technical Setup: SHIB shows bullish divergence, indicating potential for a 200% price surge.

Futures Open Interest: Rising to $73M, signaling growing trader confidence and leveraged demand.

Burn Rate Spike: 622 million tokens burned in 24 hours, increasing scarcity and upward pressure.

Shiba

CryptoNewsLand·2025-11-14 06:54

Bitcoin vs Gold: Michael Saylor predicts Bitcoin will surpass gold by 2035, the reason is?

Strategy Executive Chairman Michael Saylor predicted in an interview with Yahoo Finance that Bitcoin will surpass the market capitalization of gold by 2035, at which point 99% of Bitcoin will have been mined, entering the "0.99 era." This prediction is based on Bitcoin's fixed supply, digital characteristics, and the growing institutional adoption, resonating with CZ's views. Both believe that the scarcity value of Bitcoin will drive it to become a superior store of value compared to gold, and this assertion will be put to the test in the gold and Bitcoin debate during the Dubai Blockchain Week in December 2025.

BTC0,6%

MarketWhisper·2025-11-14 05:11

Polkadot 2.0 System Reboot: Who Can Seize This Value Re-evaluation Window?

The launch of Polkadot 2.0 has sparked interest in its ecosystem, although it remains relatively low-key in the current market. The upgrade has improved performance and enhanced the scarcity of DOT through inflation reforms. Bifrost, as a liquid stake platform, has taken this opportunity to stimulate staking demand, and its innovative buyback mechanism further enhances its appeal. New opportunities are emerging, making it worthwhile to continue following the development of the Polkadot ecosystem.

DOT6,75%

金色财经_·2025-11-13 04:27

Determinism and Adaptability: A Comparison of the Two Inflation Mechanisms of Bitcoin and Ethereum

1. When "scarcity" becomes a belief

In the semantic map of the financial world, "inflation" is often seen as an enemy.

In the world of cryptocurrency, "inflation" is a redefined philosophy.

Bitcoin and Ethereum - the two most influential public chains to date - are both addressing the same question: how should currency be created, distributed, suppressed, and destroyed?

The limit of 21 million bitcoins set by Satoshi Nakamoto in 2009 has become one of the most famous numbers in human digital history. It is a symbol, as well as a creed: scarcity equals trust.

In contrast, there is another belief of Ethereum: an elastic supply without a cap. It refuses to be defined by a fixed formula, yet maintains a dynamic balance through complex burning and reward mechanisms.

Two types of monetary policy, one static and one dynamic, resemble the narrative paths of two civilizations—one is the classical "gold standard," and the other is the organically evolved "monetary ecology."

PANews·2025-11-13 04:01

Uniswap Jumps 70% as Whale Trades and Token Burn Fuel Rally

Whale transactions hit a four-year high, signaling strong institutional involvement in Uniswap’s latest rally.

Over 1,500 new UNI wallets created in one day show renewed retail excitement and rapid network growth.

The 100M token burn proposal boosts scarcity, driving confidence in Uniswap’s long-t

UNI0,05%

CryptoFrontNews·2025-11-12 16:17

Astar announces the "Evolution Phase 2" roadmap: ASTR supply fixed at 10.5 billion tokens, Burndrop burn mechanism, cross-chain plans...

Astar Network releases the preliminary roadmap for "Evolution Phase 2," focusing on "scarcity, stability, participation." In the coming months, it will first launch the Burndrop concept verification, improve Tokenomics 3.0 with a fixed supply model, and use the Startale App as a unified portal, while simultaneously advancing interoperability with Polkadot's "Plaza." (Background: Animoca Brands strategically invests in Astar Network, planning to bring Asian entertainment IP onto the blockchain with Soneium) (Additional context: Polkadot parachains: How to interpret Astar's new token economic model 2.0) Astar Network announces the commencement of the "Evolution Phase 2" implementation stage.

ASTR0,04%

動區BlockTempo·2025-11-12 10:56

Uniswap Price Prediction: UNI Price Surge - Governance Shake-Up Sparks $842M Token Burn

Uniswap's UNI token surged 28% following a transformative governance proposal that activates protocol fees and initiates an $842M token burn, enhancing scarcity. This change could propel UNI prices higher, driven by increased trading volumes and positive market indicators.

UNI0,05%

LiveBTCNews·2025-11-12 06:12

FUNToken Giveaway-Driven Demand: 7 Reasons Why the $5M Event Could Push $FUN’s Price Higher

The $5M FUNToken giveaway on 5m.fun is an event enhancing $FUN's token dynamics through token locking in a transparent Ethereum smart contract, creating scarcity and boosting market sentiment.

FUN-2,34%

BitcoincomNews·2025-11-11 06:59

Community Growth Meets Supply Shock: How FUNToken’s Giveaway Engages Users and Reduces Circulation

The $5M $FUNToken giveaway, live at 5m.fun, continues to reshape the $FUN ecosystem by combining two of the most powerful forces in crypto: community engagement and token scarcity. Through a transparent staking mechanism, the campaign rewards participation while simultaneously removing tokens from a

FUN-2,34%

CryptoDaily·2025-11-10 13:56

Load More