Search results for "SOON"

【Madman on Trends】The market has become extremely quiet, and a trend reversal will occur very soon.

Madman says…

The market, whether in terms of sentiment or trading volume, has already reached an extremely quiet state. Mainstream coins like Bitcoin are stuck in a narrow range, sideways trading within a very small zone. This indicates that a trend reversal will occur soon (perhaps in early January). Based on the current trend, the probability of a downward spike is higher than a direct rise or fall. The strategy is to continue holding and wait for a new low to buy the dip.

The significant rise in precious metals already indicates that inflation is on the way, so by 2026, the water will come. The rest is up to time. Bitcoin will continue to prove its irreplaceable value and incomparable consensus advantage.

区块客·1h ago

Zcash Faces Selling Pressure as 200,000 ZEC Unshielded in Early 2026

Zcash price is down today as a trader unshielded over 200,000 ZEC in a rare start to the new year.

With more institutions growing fond of ZEC, the market is expecting a positive price action soon.

Privacy coin Zcash (ZEC) is facing selling pressure due to a recent decision from some

CryptoNewsFlash·21h ago

Can XRP and Cardano Survive Crypto's Evolution in 2026?

Galaxy Digital CEO Mike Novogratz has issued a stark warning: XRP and Cardano must demonstrate genuine utility soon or risk fading in an industry shifting from hype to business fundamentals. As 2026 begins, the pressure is on for these major altcoins to prove their long-term relevance.

CryptopulseElite·01-06 08:44

Aave releases key positive news: plans to share off-protocol revenue with token holders, causing AAVE to surge over 10%

On January 2, 2025, the core development team of DeFi lending leader Aave, Aave Labs, issued an important announcement, promising to explore sharing "off-protocol" income generated with its governance token AAVE holders, and will soon submit an official proposal to the Aave DAO. This news quickly boosted market confidence, with the AAVE price rising over 10% on the same day, reaching a high of $165.

The proposal aims to address recent core disputes within the community regarding income attribution, brand control, and governance safeguards, marking a significant step for Aave in balancing team innovation with decentralized governance. This move could not only reshape the value capture model of the AAVE token but also set a new example for governance token economics in the entire DeFi space.

MarketWhisper·01-06 02:08

Zcash Faces Selling Pressure as 200,000 ZEC Unshielded in Early 2026

Zcash price is down today as a trader unshielded over 200,000 ZEC in a rare start to the new year.

With more institutions growing fond of ZEC, the market is expecting a positive price action soon.

Privacy coin Zcash (ZEC) is facing selling pressure due to a recent decision from some

CryptoNewsFlash·01-05 15:34

【Madman on Trends】The market has become extremely quiet, and a trend reversal will occur very soon.

Market sentiment is subdued, with mainstream coins like Bitcoin entering a consolidation phase, indicating an imminent trend reversal. It is recommended to wait for a bottoming opportunity in operations. The rise in precious metals suggests inflation is approaching, and Bitcoin continues to demonstrate its unique value and advantages.

区块客·01-05 11:17

Elon Musk may soon become the world's first trillionaire

Elon Musk is nearing a net worth of $1 trillion, largely driven by SpaceX's rising valuation rather than Tesla. Speculations about SpaceX's IPO and Tesla's ambitious performance-based compensation have significantly impacted Musk's wealth trajectory.

TapChiBitcoin·01-05 03:00

Crypto Crystal Ball 2026: Will Ethereum Finally Start Going Parabolic?

Ethereum might see significant growth in value by 2026 as institutional adoption increases and tokenization shifts towards yield-generating assets. While ETH may not surpass Bitcoin's store-of-value status soon, it aims to become a key player in a traditional on-chain economy.

Decrypt·01-04 17:20

【Madman on Trends】The market has become extremely quiet, and a trend reversal will occur very soon.

Market sentiment is subdued, with mainstream coins like Bitcoin entering a consolidation phase, indicating an imminent trend reversal. It is recommended to wait for a bottoming opportunity in operations. The rise in precious metals suggests inflation is approaching, and Bitcoin continues to demonstrate its unique value and advantages.

区块客·01-04 09:48

Tom Lee Reveals Bullish 2026 Crypto Price Roadmap, BTC to $200,000 and ETH to $20,000

Tom Lee reveals bullish 2026 crypto price roadmap.

He expects BTC to hit $200,000 ATH price soon.

While ETH is expected to hit $6,000 – $7,000 in early 2026, and $200,000 long-term.

The New Year has started off with strong bullish sentiments. At the moment, the price of BTC is

CryptoNewsLand·01-04 07:01

Crypto Crystal Ball 2026: Will Ethereum Finally Start Going Parabolic?

Ethereum might see significant growth in value by 2026 as institutional adoption increases and tokenization shifts towards yield-generating assets. While ETH may not surpass Bitcoin's store-of-value status soon, it aims to become a key player in a traditional on-chain economy.

Decrypt·01-03 17:11

【Madman on Trends】The market has become extremely quiet, and a trend reversal will occur very soon.

Madman says…

The market, whether in terms of sentiment or trading volume, has already reached an extremely cold state. Mainstream coins like Bitcoin are stuck in a narrow range, sideways trading within a very small zone. This indicates that a trend reversal will occur very soon (perhaps in early January). Based on the current trend, the probability of a downward spike is higher than a direct rise or a direct fall. The strategy is to continue holding and wait for a new low to buy the dip.

The significant rise in precious metals already indicates that inflation is on the way, so by 2026, the water will come. The rest is up to time. Bitcoin will continue to prove its irreplaceable value and incomparable consensus advantage.

区块客·01-03 09:44

Crypto Crystal Ball 2026: Will Ethereum Finally Start Going Parabolic?

Ethereum might see significant growth in value by 2026 as institutional adoption increases and tokenization shifts towards yield-generating assets. While ETH may not surpass Bitcoin's store-of-value status soon, it aims to become a key player in a traditional on-chain economy.

Decrypt·01-02 17:06

【Madman on Trends】The market has become extremely quiet, and a trend reversal will occur very soon.

Market sentiment is subdued, and trading volumes of mainstream coins like Bitcoin are stagnating, indicating a potential trend reversal. It is recommended to wait for a bottoming opportunity. Meanwhile, the surge in precious metals suggests inflation is on the way, and investors should exercise caution in their decisions.

区块客·01-02 09:38

The Last Time This Ethereum Signal Flipped, ETH Price Doubled Soon After

Ethereum’s validator data is starting to tell an interesting story. For the first time in six months, more ETH is lining up to be staked than unstaked. At first glance, that might sound like background noise. In reality, it’s one of those signals that tends to matter more with a bit of

CaptainAltcoin·01-01 23:05

【Madman on Trends】The market has become extremely quiet, and a trend reversal will occur very soon.

Market sentiment is subdued, and trading volumes of mainstream coins like Bitcoin are stagnating, indicating a potential trend reversal. It is recommended to wait for a bottoming opportunity. Meanwhile, the surge in precious metals suggests inflation is on the way, and investors should exercise caution in their decisions.

区块客·01-01 09:26

【Madman on Trends】The market has become extremely quiet, and a trend reversal will occur very soon.

Market sentiment is subdued, and trading volumes of mainstream coins like Bitcoin are stagnating, indicating a potential trend reversal. It is recommended to wait for a bottoming opportunity. Meanwhile, the surge in precious metals suggests inflation is on the way, and investors should exercise caution in their decisions.

区块客·2025-12-31 09:22

Cryptocurrency Industry Hotspot Summary as of December 31, 2025: Alpha Airdrop Launching Soon, Token Unlocking Wave, and New Global Regulatory Developments

On December 31, 2025, the cryptocurrency market will迎来 year-end climax. Despite fluctuations in global stock markets, the coin-stock linkage effect becomes evident: the overall price of crypto assets rises by over 2%, thanks to ETF capital inflows and the altcoin boom, with mainstream coins like Bitcoin leading the rally. Meanwhile, token unlock events occur frequently, posing potential supply pressures; on the regulatory front, many countries are推进 crypto integration into traditional financial frameworks. This article summarizes today's key developments, including Binance Alpha airdrop launching soon, major unlock information, and trends in coin-stock interactions.

1. Binance Alpha Airdrop Coming Soon: First Come, First Served Opportunity

Binance will officially start the Alpha airdrop distribution at 15:00 today. Users need to hold at least 240 Binance Alpha points to participate. The event operates on a first-come, first-served basis until the airdrop pool is exhausted or the event ends. Specific details about the airdropped tokens will be announced through Binance

TechubNews·2025-12-31 09:00

Pundit Says Claims of XRP Hitting $1,000 are Mathematically Impossible: Here’s Why

Crypto commentator and investor Martyn Lucas has rejected claims that XRP could rise to $1,000, insisting that such predictions do not add up.

In a recent post on X, Lucas called attention to claims circulating online that holding 1,000 XRP could soon make someone a millionaire. He said these claim

XRP-5,52%

TheCryptoBasic·2025-12-31 08:15

3 Altcoins That Could See Short-term Volatility Soon

Solana faces steady daily emissions, adding inflation pressure that could influence short-term price action.

Official Trump sees heavy daily unlocks, increasing volatility and downside risk amid weak sentiment.

Worldcoin continues scheduled emissions, which may weigh on prices during

CryptoNewsLand·2025-12-30 15:36

Cardano vs. Bitcoin Cash: Ultimate Dominance Fight Is On - U.Today

Cardano (ADA) may soon overtake Bitcoin Cash (BCH) as the 10th-largest cryptocurrency by market capitalization. On the daily chart, BCH has experienced an uptrend as the ADA price stalls amid mixed sentiment on the broader crypto market.

BCH competes with ADA for dominance

According to

UToday·2025-12-30 15:01

【Madman on Trends】The market has become extremely quiet, and a trend reversal will occur very soon.

Madman says…

The market, whether in terms of sentiment or trading volume, has already reached an extremely quiet state. Mainstream coins like Bitcoin are stuck in a narrow range, sideways within a very small zone. This indicates that a trend reversal will occur soon (perhaps in early January). Based on the current trend, the probability of a downward spike is higher than a direct rise or fall. The strategy is to continue holding and wait for a new low to buy the dip.

The sharp rise in precious metals already indicates that inflation is on the way, so just wait for the water to come in 2026. As for everything else, let time do its work. Bitcoin will continue to prove its irreplaceable value and incomparable consensus advantage.

_Statement: This article only reflects the personal opinions of the author and does not represent the views or stance of Block. All content and opinions are for reference only and do not constitute investment advice. Investors should make their own decisions and trades. The author and Block will not be responsible for any direct or indirect losses resulting from investors' trading activities._

区块客·2025-12-30 09:21

3 meme coins to watch in the first week of 2026

As the old year comes to a close, event-inspired tokens may experience a rapid surge. Among them, meme coins—cryptocurrencies that tend to explode as soon as a new trend emerges—are attracting special attention from investors.

To keep up with this trend, Coinphoton has conducted analysis of...

TapChiBitcoin·2025-12-30 09:06

New Year's countdown is imminent. Risks don't take a break. Before 2026 arrives, investors must watch these three major market indicators.

No matter whether investors' performance this year is bountiful or under pressure, as the calendar is about to turn, the market will soon enter a brand-new starting point. The last trading week before 2026 secretly contains several key signals that could influence market sentiment at the beginning of the year, and investors should not take them lightly. This article is excerpted from Investopedia, for market observation purposes only, not investment advice.

U.S. stocks will trade as usual until December 31 (Eastern Time)

Since traders will take a day off on Thursday for the New Year's Day holiday, this week's trading hours will be shortened due to the holiday. Therefore, initial jobless claims, Federal Reserve meeting minutes, and pending home sales data will be the focus. The bond market will close early at 2 p.m. on Wednesday, while the stock market will trade as usual on New Year's Eve.

First, this week is significantly affected by the New Year's holiday, resulting in shortened trading hours. U.S. stocks will trade as usual on New Year's Eve (December 31), but the U.S.

ChainNewsAbmedia·2025-12-30 04:54

Lighter TGE is upcoming, and the market expects FDV to exceed $2 billion?

Author: 1912212.eth, Foresight News

The most anticipated protagonist in the derivatives track is finally about to debut. A few days ago, the market leader of the Lighter team leaked rumors that its TGE will take place before the end of the year, with only 3 days left until 2026, so its TGE is very likely to happen soon. The initial trading is limited to the Lighter platform, but Coinbase and Bybit have included it in their roadmaps. OKX and Binance also launched its perpetual contracts early.

Polymarket also provided a prediction, with the latest data showing that the market's betting probability of airdrop this year has risen to 88%, and the total trading volume in this market has reached $14.85 million.

Exchange MEXC's Launchpad

PANews·2025-12-30 00:10

Scaramucci Predicts Solana Could Surpass Ethereum Soon

Anthony Scaramucci highlighted Solana's rapid growth and network activity as potential drivers for surpassing Ethereum's market cap. He emphasized Solana's low fees and developer-friendly tools while suggesting both networks can coexist and grow together without negative implications for Ethereum.

CryptoFrontNews·2025-12-29 20:37

In 2025, these ten billionaires' net worth surged by $730 billion

Written by: Sofia Chierchio

Translated by: Lemin

Source: Forbes

Elon Musk's pursuit of a trillion-dollar fortune is no longer just talk.

At the beginning of the year, his net worth was $421 billion. By October, he became the first person in history to surpass $500 billion. Subsequently, the rocket manufacturer SpaceX launched a share sale plan, with a valuation reaching approximately $800 billion, making Musk the first person in history to have a net worth of over $600 billion. Soon after, a court in Delaware ruled that Musk could retain the massive stock option awards previously canceled by Tesla, which made him the world's first person to have a net worth exceeding $700 billion last Friday. As the year draws to a close, as of December 22, Musk's net worth has reached $754 billion.

Musk is capable of

PANews·2025-12-28 00:05

MYX Finance, APriori Dominate Top Token Sales of 2025 Based on ATH ROI

In 2025, MYX Finance, aPriori, and SOON led crypto token sales by ATH ROI, reflecting significant growth in crypto asset adoption. MYX Finance boasts a peak ROI of 2102x, with other projects also showing impressive returns.

BlockChainReporter·2025-12-27 04:03

BlackRock Stuns Coinbase With Bitcoin and Ethereum Move, What's Next? - U.Today

BlackRock resumed transferring Bitcoin and Ethereum to Coinbase, moving significant amounts post-Christmas. While Bitcoin faces a potential fourth annual decline without major scandals, market forces signal an upcoming shift, with overlooked signals suggesting a possible inflection point soon.

UToday·2025-12-26 15:33

Solana ecosystem stablecoin USX temporarily de-pegs

Techub News reports that Solana ecosystem DeFi protocol Solstice tweeted that the secondary market for the stablecoin USX will experience significant fluctuations, but the net asset value of the underlying assets and Solstice custody assets remain unaffected, with a collateralization ratio exceeding 100%. The team has requested a third-party to immediately provide an additional certification report, which will be released as soon as it is completed. Solstice stated that this is purely a liquidity issue in the secondary market, and the team and market makers are taking immediate steps to address it. They will continue to inject liquidity into the secondary market to ensure market stability. The 1:1 redemption in the primary market remains fully available.

According to PeckShield monitoring, the stablecoin USX briefly de-pegged and, due to liquidity exhaustion, fell to $0.10 in the secondary market. After Solstice injected liquidity, the exchange rate gradually

TechubNews·2025-12-26 06:02

Trust Wallet has a major security vulnerability! Do not import your seed phrase and upgrade to 2.69 as soon as possible. The stolen amount is at least 6 million USD.

Trust Wallet's browser extension version 2.68 has a critical vulnerability that leads to user asset leakage. Over 100 victims have been reported, with losses totaling approximately $6 million. The official has released version 2.69 to fix the issue and urges users to upgrade immediately. The vulnerability stems from a malicious script called 4482.js, which attackers use to steal assets by inputting seed phrases. Users should exercise caution to prevent asset loss.

動區BlockTempo·2025-12-26 02:15

Pepe Coin Price Prediction 2026: Meme Sentiment Stirs Up as DeepSnitch AI is On Track to Launch Soon

Bitcoin won’t crash hard in Q1, says Anthony Pompliano. The entrepreneur told CNBC that BTC’s lack of a “crazy” year-end rally means the typical 70-80% drawdown is unlikely this cycle. Meanwhile, former FTX US president Brett Harrison just raised $35 million for a new institutional derivatives

CaptainAltcoin·2025-12-25 14:50

BNB Already Scaled as BlockchainFX’s Trading Platform Goes Live Soon, and a Limited Bonus Window Remains

Crypto markets reward different strategies at different times. Mature assets deliver reliability and liquidity, while early-stage platforms offer leverage and asymmetric upside. Identifying where a project sits within its growth cycle often matters more than predicting short-term price movements.

CaptainAltcoin·2025-12-25 09:25

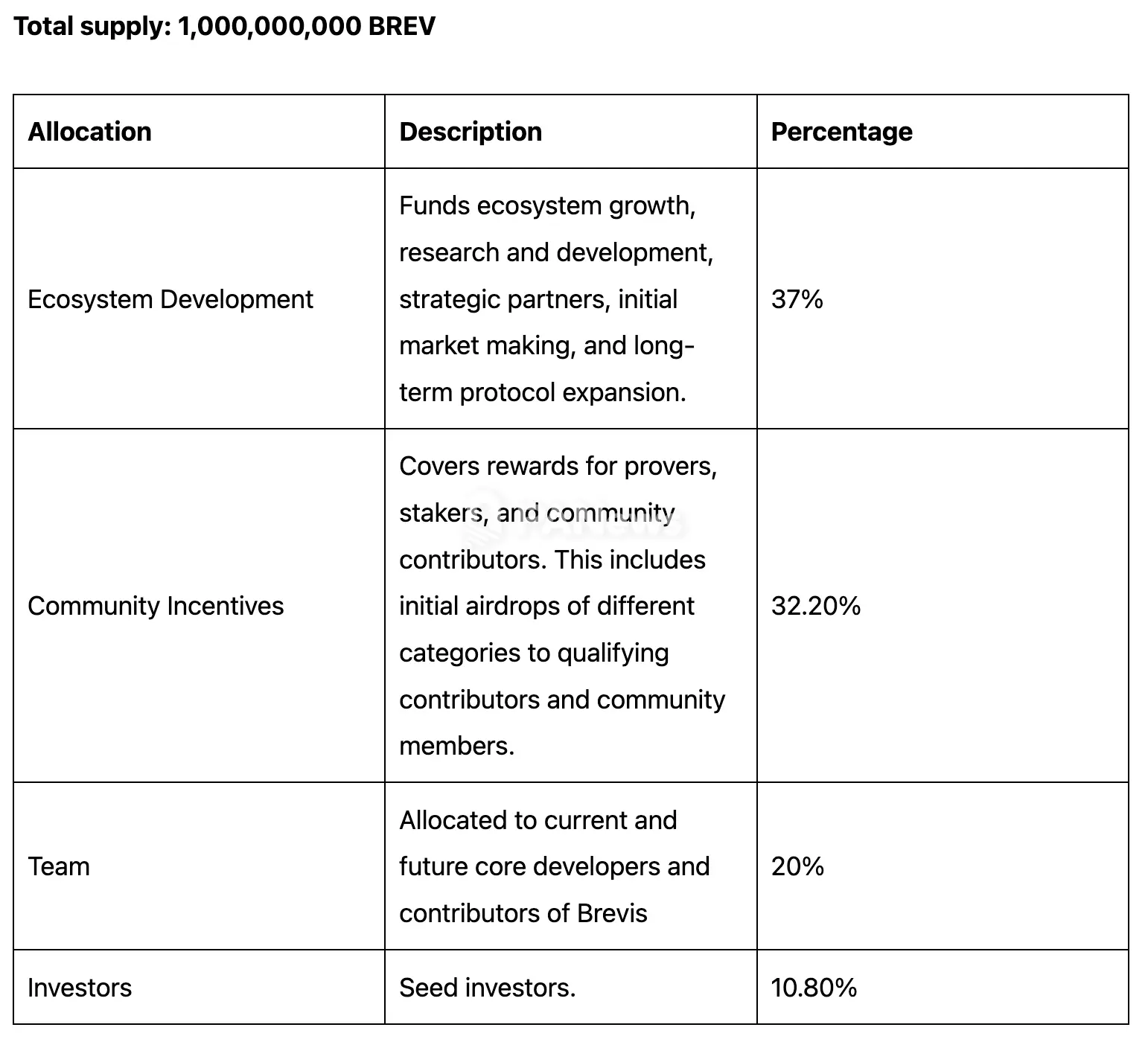

Brevis token economic model unveiled! 1 billion BREV community members hold 70%, airdrop is about to start

According to Brevis official announcement on December 25, the BREV token economic model has been officially released, with a total supply of 1 billion tokens. Nearly 70% is allocated to community and ecosystem incentives. The airdrop registration portal will be launching soon. BREV is the core utility and governance token of Brevis ProverNet, used to pay for zero-knowledge proof generation and verification fees, serve as a staking and reward medium, and grant governance rights to token holders.

MarketWhisper·2025-12-25 02:30

XRP Price Prediction 2026: Analyst Says No Bitcoin Crash Till 2026, DeepSnitch AI Soars 96% Ahead of 100X Launch

Doctor Profit has noted that there will not be any major crash for Bitcoin until 2026. He says the Bitcoin price could rally towards $97,000-$107,000 soon.

Also, a recent XRP price prediction reveals that 2026 would be beneficial for Ripple holders. However, many say Ripple’s large market cap could

CaptainAltcoin·2025-12-24 20:05

Why Experts Say Altseason Won’t Return Anytime Soon

Market Overview: Altcoins Facing Bearish Sentiment as Bitcoin Gains Strength

Recent analysis indicates that the cryptocurrency market is currently dominated by bearish patterns among altcoins, with Bitcoin reasserting its influence through rising market share. The prevailing momentum suggests that

BTC-1,96%

CryptoDaily·2025-12-24 12:50

Why does the price drop whenever you buy altcoins? Revealing the market maker quoting mechanism—it's not "whales targeting you" after all.

Many crypto investors have experienced a similar situation: a certain altcoin seems to be about to break out, and as soon as they buy in, the price immediately reverses downward, as if the market is "specifically targeting your trades." This phenomenon is especially common among smaller coins, which is why the term "being targeted by the whale" has emerged.

But is this really the case? In fact, price reversals are not necessarily due to subjective manipulation, but stem from the risk management behavior of market makers under specific models.

Chair of the Hong Kong University of Science and Technology Crypto Club

ChainNewsAbmedia·2025-12-24 06:33

Why Experts Say Altseason Won’t Return Anytime Soon

Market Overview: Altcoins Facing Bearish Sentiment as Bitcoin Gains Strength

Recent analysis indicates that the cryptocurrency market is currently dominated by bearish patterns among altcoins, with Bitcoin reasserting its influence through rising market share. The prevailing momentum suggests that

BTC-1,96%

CryptoDaily·2025-12-23 12:45

Gold has reached a new high of $4,498, and JPMorgan anticipates that strong demand for hedging will soon push it to $5,055.

Gold has broken through its high points, approaching $4,500 per ounce, intensifying global risk aversion, while silver is also surging, with trends in 2026 being closely followed.

(Previous Summary: Full Text of the Bank of Japan Statement: Interest Rate Increase of 25 Basis Points, Further Consideration for Continued Adjustment)

(Background Information: Yen Bottom Signal? Morgan Stanley Warns: Japanese Yen Expected to Appreciate by 10% in Early 2026, US Treasury Yields Have Stabilized and Declined)

On the morning of December 23, 2025, while New York was still asleep, the gold price surged to $4,498 per ounce, setting a new historical record for the 50th time this year. This fluctuating number reflects the market's complex anxiety over the Trump administration's aggressive trade policies, the situation in Venezuela, and the global interest rate cut cycle. The 1.2% increase in a single day brought gold's annual gain to 70%, while silver, driven by industrial demand, saw an annual increase of over 120%.

動區BlockTempo·2025-12-23 05:00

Two financial giants lay out the on-chain schedule for Ethereum, Wall Street still needs a "rollback" button.

If you have ever bought a stock and assumed that you "owned" it as soon as you hit the confirm button, then you have touched upon the least glamorous part of the financial market: settlement – clearing (settlement).

Settlement is the behind-the-scenes process that ensures the buyer's money and the seller's securities are properly handled.

TapChiBitcoin·2025-12-23 01:31

Technical Analysis on December 23: SPX, DXY, BTC, ETH, BNB, XRP, SOL, DOGE, ADA, BCH

Bitcoin (BTC) has made a strong breakthrough, challenging the 90,000 USD mark at the beginning of the week, signaling that the bulls are trying to regain control of the market. However, analysts have not yet found a consensus on the next major direction of BTC. While some expect the price to soon c

TapChiBitcoin·2025-12-23 01:08

Bitcoin Traders Divided: Will BTC Crash to $70K or Rebound Soon?

Bitcoin traders are divided as the weekly close approaches, with some predicting a drop below $70,000 and others anticipating a rebound. Market sentiment remains mixed, influenced by resistance levels, on-chain data, and macroeconomic factors.

BTC-1,96%

CryptoDaily·2025-12-22 18:20

Trump's appointed conditions for the Federal Reserve chair: must be a "super dove" and immediately cut interest rates.

U.S. President Trump recently stated that he will soon announce his nomination for the next chairman of the Federal Reserve (FED) to replace the current chairman Powell, whose term ends in May next year, and said that the person he nominates must be a "super dove." The list of candidates has been narrowed down to four, and Trump indicated that he will make a decision this week or "in the coming weeks."

MarketWhisper·2025-12-22 08:14

The Financial Supervisory Commission has been completely reorganized to address digital finance... A new Virtual Asset Regulatory Bureau has been established.

On December 22, 2025, the Financial Supervisory Commission conducted personnel adjustments at the director and division head levels to promote organizational restructuring and internal capability enhancement. This personnel arrangement aims to improve the professionalism of supervisory functions and policy response capabilities, and to strengthen overall financial Risk Management and the consumer protection system.

A notable aspect of this personnel adjustment is the comprehensive arrangement of professionals with expertise into key positions overseeing consumer protection. For example, the newly appointed Director of the Consumer Protection Supervision Coordination Bureau, Lu Yinghou, will also serve as a senior director, and experienced personnel such as Park Hyun-seop and Lim Kwon-soon have been placed in the director roles responsible for consumer communication and damage prevention. This is interpreted as a reflection of the supervisory department's continuous promotion of strengthening consumer rights in a financial market characterized by severe information asymmetry.

At the same time, arrangements have been made to strengthen personnel responses to recent issues concerning virtual asset and financial fraud. Director Cui Qiangxi will be responsible for the newly established virtual.

TechubNews·2025-12-22 07:12

Bitcoin rises to 88K, is the Santa Claus rally coming soon?

The US stock market saw a surge in trading volume on the triple witching day, with the S&P 500 index rising, led by Nvidia. The price of Bitcoin remains around 88K, with market sentiment slightly improving, but facing volatility from option expirations. The traditional "Santa Claus rally" may be on the way, and investors remain optimistic about the market.

ChainNewsAbmedia·2025-12-21 23:44

Bitcoin Traders Divided: Will BTC Crash to $70K or Rebound Soon?

Bitcoin traders are divided as the weekly close approaches, with some predicting a drop below $70,000 and others anticipating a rebound. Market sentiment remains mixed, influenced by resistance levels, on-chain data, and macroeconomic factors.

BTC-1,96%

CryptoDaily·2025-12-21 18:15

Popular Crypto Trader Confirms One of Many Bullish Price Trajectories for Ripple’s XRP

Popular crypto trader confirms one of many bullish price trajectories for XRP.

Analyst declares market correction is close to an end.

Altseason peak inches closer and XRP prepares to shoot over $3 soon.

The crypto market experiences another dip in prices since the price of BTC fell

CryptoNewsLand·2025-12-21 10:41

US Clarity Act unlikely to be ‘world-shaking’ for Bitcoin’s price: Brandt

Veteran trader Peter Brandt said the potential passage of the US Clarity Act is unlikely to have a significant impact on Bitcoin’s price, after indications that it could pass Congress as soon as January.

“Is it a world-shaking macro development? Nope. Needed for sure, but not something that

Cointelegraph·2025-12-20 22:40

US Clarity Act unlikely to be ‘world-shaking’ for Bitcoin’s price: Brandt

Veteran trader Peter Brandt said the potential passage of the US Clarity Act is unlikely to have a significant impact on Bitcoin’s price, after indications that it could pass Congress as soon as January.

“Is it a world-shaking macro development? Nope. Needed for sure, but not something that

Cointelegraph·2025-12-19 22:40

Trump Reviews Top Picks for Fed Leadership

Donald Trump is reviewing candidates for the Fed chair role, including Christopher Waller and Michelle Bowman, with a decision expected soon. This choice may influence financial markets and monetary policy, despite no immediate effects on cryptocurrency.

CoincuInsights·2025-12-19 07:03

Load More