Search results for "STREAM"

2025’s Defining Crisis: Stream Finance Collapse and Elixir Depeg

Sentora’s blunt assessment of 2025’s biggest DeFi calamity landed on social media and crystallized what had been a jittery few days across Web3. Sentora tweeted, “We can’t look back on 2025 without mentioning the Stream Finance & Elixir losses. Stream Finance suffered a $93 million loss due to e

STREAM-0,89%

BlockChainReporter·2025-12-25 08:04

Hedera (HBAR) Institutional Year Was Not Normal: Why This Could Matter in 2026

Some years quietly pass. Others leave a clear paper trail. Looking back at the last 12 months for Hedera, the second category fits far better. A steady stream of institutional, regulatory, and enterprise-level developments kept showing up across the calendar, shaping a year that looked very

HBAR-0,46%

CaptainAltcoin·2025-12-24 13:36

Galaxy: Is the Universal L1 dead? You're wrong.

Source: Galaxy; Translated by: Golden Finance

In the past few weeks, there has been a constant stream of news about new "enterprise-level" blockchains designed for specific application scenarios. DTCC is tokenizing securities held at DTC on Canton. Stripe has launched a testnet for its payment-focused blockchain, Tempo. Robinhood is building its own L2 layer for storing real-world assets.

For crypto natives, these developments may trigger a familiar anxiety: the cypherpunk values that underpin cryptocurrencies are being diluted. The permissionless, generalized blockchains that facilitated the mainstream adoption of cryptocurrencies will be bypassed by existing regulated institutions with distribution channels and balance sheets.

If tokenization, real-world assets, and stablecoins are increasingly deployed on private or semi-permissioned tracks, what role does decentralized protocol have left? This is a

金色财经_·2025-12-22 04:12

Virginia Launches SWaN Environmental Credit Market on Hedera

Virginia’s DEQ launched SWaN to enable real-time trading of stream, wetland, and nutrient credits statewide.

The platform improves transparency with live pricing, availability and direct transactions across 600+ mitigation sites.

SWaN runs on Hedera, showing how states use distributed

HBAR-0,46%

CryptoFrontNews·2025-12-20 15:36

Ripple teams up with SBI to create a billion-dollar XRP revenue stream

SBI Ripple Asia and Doppler Finance signed a Memorandum of Understanding on December 17 to explore XRP-based revenue infrastructure and RWA tokenization on XRPL. This is the first collaboration between SBI Ripple Asia and the XRPL native protocol, with SBI Digital Markets designated as the institutional custodian to implement segregated custody.

MarketWhisper·2025-12-18 07:45

Pundit Flags an XRP Price Explosion No One Sees Coming

A well-known pundit suggests that the favorable developments in the XRP ecosystem and across the market could be leading to an unexpected XRP price explosion.

For context, despite a steady stream of bullish developments, the XRP price has remained largely bearish in recent months. Reports around th

XRP5,3%

TheCryptoBasic·2025-12-15 13:27

HTX Molly: The combination of encryption technology and traditional finance requires a closed loop of value

The crypto market has been turbulent recently, and crypto market liquidity has also become a focus of attention. In this context, users are more concerned about the exchange's every move. Golden Finance invited HTX Molly to conduct an exclusive interview. Molly talked about the investment products that ordinary investors should pay attention to at present, discussed the core mission of cryptocurrency exchanges, and shared the secret of Huobi HTX's strides after 12 years of ups and downs, and Huobi HTX is still working towards the "three" goals.

In the process of combining encryption technology with traditional finance, it is necessary to think about the essence of encryption technology, what problems it can solve, and finally form a closed loop of value before it can bring real liquidity.

If an exchange does not have the determination to become a top exchange, it has no prospects. Therefore, Huobi HTX really wants to be among the top streams, and only when it wants to be the top stream, it will demand itself with the high standards of the top stream.

forever

HTX1,65%

金色财经_·2025-12-10 07:59

xUSD crashes 94% in a massive depegging incident! Deadly pitfalls of stablecoin circular lending revealed

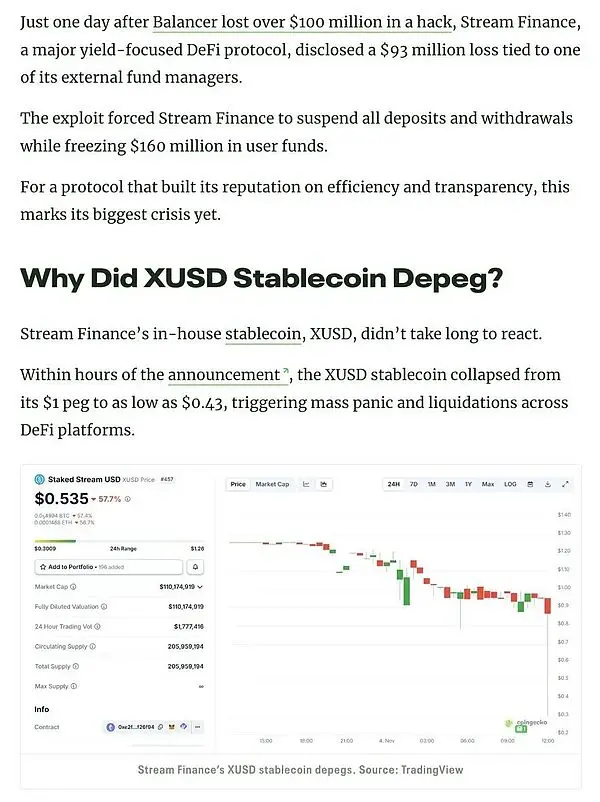

Stream Finance’s yield-bearing stablecoin xUSD claimed a TVL of $500 million and offered 15%-20% annualized returns, but the actual real deposits were only $100 million, with the $500 million scale amplified through circular lending. During the bank run on November 4, xUSD plummeted to $0.058. This stablecoin depegging disaster revealed the death spiral risk of circular lending.

MarketWhisper·2025-11-25 03:00

DeFi Life-and-Death Decision: The Buyback Dilemma and the Systemic Crisis of Zero-sum Game

Introduction: The outbreak of a Crisis of Confidence

In November 2025, the DeFi industry experienced a rare "perfect storm". Within a week, Balancer lost $128 million, Stream triggered $285 million in bad debts, four stablecoins went to zero, and the entire stablecoin market shrank by $2 billion. Almost at the same time, Uniswap launched the long-awaited fee switch proposal that had been in the works for two years, and the market rejoiced.

The暴雷事件 exposed the systemic security, transparency, and governance issues of the DeFi system, while the fee switch proposal represents the industry's typical response to these problems—addressing the crisis through financial engineering and redistribution of interests.

Is this response effective? The core argument of this report is that the current challenge facing DeFi is not a valuation crisis, but a crisis of value creation. When the fundamental issue of the industry is its inability to continuously create value for users, capital measures such as buybacks and fee switches...

PANews·2025-11-20 07:09

Without an accountability mechanism, Decentralized Finance will continue to replay failures.

Original Title: DeFi Risks: Curators as new Brokers Original Author: @yq\_acc Translated by: Peggy, BlockBeats

Original author: Rhythm BlockBeats

Original source:

Reprinted: Mars Finance

Editor's Note: Since 2020, DeFi has rapidly expanded, with the total value locked once surpassing 100 billion USD, giving rise to the Curators model. However, in the absence of regulation, identity disclosure, and risk constraints, curators manage billions of dollars of user funds, leading to frequent systemic failures. In November 2025, Stream

MarsBitNews·2025-11-20 05:55

Stablecoins are not stable: The Stream crash reveals the structural eyewash of Decentralized Finance.

Author: YQ Source: X, @yq\_acc Translator: Shan Ouba, Golden Finance

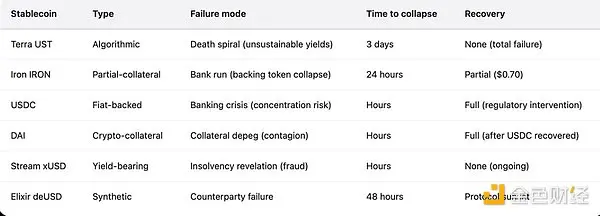

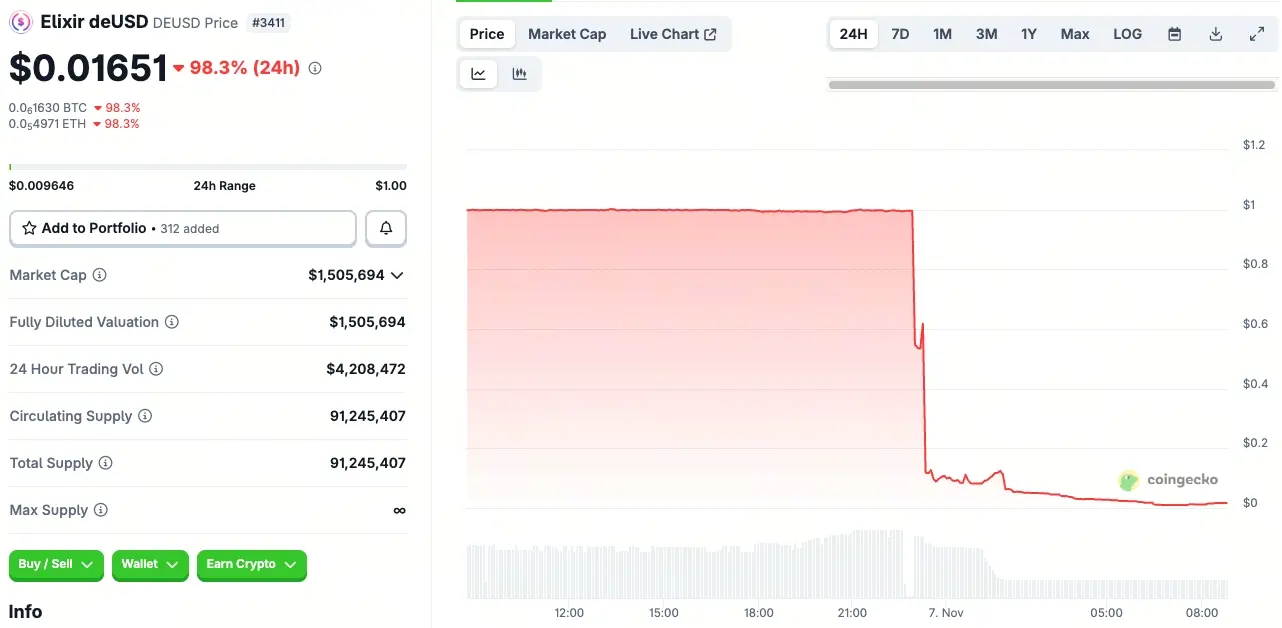

In the first two weeks of November 2025, decentralized finance (DeFi) exposed fundamental flaws that the academic community had been warning about for years. After the collapse of Stream Finance's xUSD, Elixir's deUSD and numerous other synthetic stablecoins subsequently fell, which is by no means an isolated incident caused solely by mismanagement. These events reveal structural issues in the DeFi ecosystem regarding risk management, transparency, and the construction of trust mechanisms.

What I observed in the Stream Finance collapse was not a traditional complex smart contract exploit or oracle manipulation attack, but a more concerning situation: a lack of basic financial transparency wrapped in decentralized rhetoric. When an external fund manager operates with zero effective oversight...

金色财经_·2025-11-19 10:22

The recent frequent depegging of stablecoins: the industry has not learned lessons from history.

Written by: YQ

Compiled by: AididiaoJP, Foresight News

The collapse of stablecoins in the first two weeks of November 2025 exposed the fundamental flaws in the decentralized finance sector that scholars have repeatedly warned about for years. The collapse of Stream Finance's xUSD, along with the subsequent failure of Elixir's deUSD and numerous other synthetic stablecoins, was far from an isolated mismanagement incident. These events revealed deep structural issues within the DeFi ecosystem regarding risk management, transparency, and trust.

What I observed in the Stream Finance collapse was not a clever exploitation of smart contract vulnerabilities, nor a traditional oracle manipulation attack. Instead, it revealed a more disturbing fact: beneath the glamorous rhetoric of "decentralization".

DeepFlowTech·2025-11-19 09:29

Why Are Traders Choosing the FROGE Fair Launch Over Crypto Presales?

An endless stream of new crypto presales is part of every trader’s daily routine. Projects like GameFrog ($GMF), for example, have raised a few hundred thousand dollars in their early sale phase, with tiered pricing and a strong focus on staking rewards for those who get in early.

Similarly, the

CaptainAltcoin·2025-11-18 09:54

Stream chain explosion? Yala mortgaged its own stablecoin YU to borrow one million dollars, and today it depegged and fell 54%.

The over-collateralized stablecoin YU has depegged today, with the price falling to $0.41. This is the second depeg in two months, influenced by liquidity crises and last month's vulnerability incident. Abnormalities in the lending market have raised concerns, leading to the departure of some team members and causing unrest in the community. YU holders are finding it difficult to seek compensation, and the "stability" of the stablecoin is under severe scrutiny.

ChainNewsAbmedia·2025-11-17 07:13

Hotcoin Research | Behind the Chain Reaction of Stablecoin Failures: The Responsibilities, Risks, and Future of the Curator Model

1. Introduction

Last week, triggered by the collapse of Stream Finance's xUSD, stablecoins such as deUSD and USDX consecutively lost their pegs, leading to a crisis in the DeFi sector with a chain reaction of stablecoin de-pegging and consecutive impacts on lending protocols. The Curator model played a role in exacerbating the situation, sparking market controversy and reflection.

deUSD

DeepFlowTech·2025-11-16 14:55

Ethena's Massive Capital Flight: 6.5 billion USD lost in two months, with even more severe tests ahead?

Original title: "USDe issuance scale plummets by 6.5 billion USD, but Ethena faces even greater problems"

Original author: Azuma

Source of the original text:

Reprinted: Mars Finance

Ethena is experiencing the largest capital outflow since its inception.

On-chain data shows that the circulating supply of USDe, the main stablecoin product under Ethena, has fallen back to 8.395 billion, down approximately 6.5 billion from the peak figure of nearly 14.8 billion at the beginning of October. Although it cannot be said to be "cut in half", the decline is already quite astonishing.

Recently, there have been frequent security incidents in DeFi, particularly with two interest-bearing stablecoins, Stream Finance (xUSD) and Stable, which claim to use a Delta-neutral model similar to Ethena.

MarsBitNews·2025-11-12 07:03

Stablecoin protocol Stream Finance collapses, three major lending platforms hit by failures

Stream Finance announces a loss of $93 million in user assets and is preparing for bankruptcy, affecting stablecoin lenders across multiple lending protocols. The incident triggered a bank run, causing the price of its stablecoin xUSD to collapse and resulting in significant unrecouped loans. Experts advise users to stay vigilant, verify the source of funds, and consider the risks.

動區BlockTempo·2025-11-10 07:48

Stop packaging high-risk financial products as stablecoins.

Author: Sleepy.txt

The world of stablecoins has never been short of stories; what’s lacking is a reverence for risk. In November, stablecoins experienced another incident.

A stablecoin called xUSD saw its price crash on November 4th, dropping from $1 to $0.26. As of today, it continues to decline, falling to $0.12, erasing 88% of its market value.

Image source: Coingecko

The incident involved a star project managing $500 million in assets, Stream Finance.

They packaged their high-risk investment strategy into a yield-bearing stablecoin called xUSD, claiming it was “pegged to the dollar and automatically earning interest.” Essentially, they wrapped their investment returns into the product. Since it’s an investment strategy, it can’t guarantee perpetual profits. On October 11th, during the major crypto market crash, they conducted off-chain activities.

金色财经_·2025-11-10 07:22

Stop packaging high-risk financial products as stablecoins.

Writing: Sleepy.txt

The world of stablecoins has never been short of stories; what it lacks is a reverence for risk. In November, stablecoins experienced another incident.

A stablecoin called xUSD saw its price plummet on November 4th, dropping from $1 to $0.26. As of today, it continues to decline, falling to $0.12, erasing 88% of its market value.

Image source: Coingecko

The incident involved a star project managing $500 million in assets, Stream Finance.

They packaged their high-risk financial strategy into a yield-bearing stablecoin called xUSD, claiming it is "pegged to the dollar and automatically yields interest." Essentially, they wrapped their financial returns into the product. Since it is a financial strategy, it cannot guarantee perpetual profits. On October 11th, during the major crash in the crypto market, they conducted off-chain activities.

DeepFlowTech·2025-11-10 04:41

Balancer Exploit, Stream Finance Collapse, and Solana ETFs’ Shine — Week in Review

This week, Balancer faced a $116M exploit, Stream Finance's XUSD stablecoin dropped to $0.24 after a $93M loss, Sequans faced backlash over a bitcoin sale, and Solana ETFs saw positive inflows amid overall market outflows.

Coinpedia·2025-11-09 11:35

1011 The first corpse of the crash day: Stream's fake neutral strategy exposed

Stream xUSD has been accused of being a disguised DeFi stablecoin, claiming to use a delta-neutral strategy but lacking transparency and robust investment strategies, resulting in significant losses in off-chain trading and potentially becoming insolvent. As user funds continue to be lost, trust in its operations has deteriorated, exposing high risks and poor management within the DeFi space.

金色财经_·2025-11-09 04:37

Re7 Labs releases xUSD de-pegging impact report: approximately $13 million affected by Stable Labs, and no response has been received yet.

Re7 Labs releases report on the depegging of xUSD, with over $13 million affected by Stable Labs. Stream's financial situation remains stable, with partial loan repayments made, and xUSD market funds transferred to mitigate risk. After communication with Stable Labs, potential issues were identified, and Re7 Labs is seeking legal advice.

USDC-0,04%

DeepFlowTech·2025-11-09 04:24

1011 The first corpse of the crash day: Stream's pseudo-neutral strategy exposed

Stream xUSD is a stablecoin that claims to use a delta-neutral strategy, but due to a lack of transparency and risk management of off-chain trading strategies, it is now insolvent, resulting in significant losses for users. This has triggered a crisis of confidence in the DeFi lending market, and experts are calling for increased risk awareness and transparency to prevent similar incidents from happening again.

WuSaidBlockchainW·2025-11-09 00:44

The natural selection of DeFi: survival of the fittest

The article discusses the role of natural selection in financial markets and Decentralized Finance, emphasizing Aave's resilience as a successful case, while Stream Finance collapsed due to design flaws. It reveals the vulnerabilities of the isolated vault and accomplice model, pointing out that the market needs more transparent design and Risk Management. Ultimately, it emphasizes that the protocols that will survive in the future are those that can withstand risks and adapt to market pressures.

MarsBitNews·2025-11-08 11:43

DeFi's natural selection: survival of the fittest - ChainCatcher

This article explores the principles of natural selection in financial markets and DeFi, revealing the vulnerabilities of the isolated vault + custodian model through the analysis of Stream Finance's collapse. Stream's failure highlights design flaws driven by blind pursuit of returns and market share, emphasizing the importance of risk management and transparency. Only protocols that can effectively respond to market pressures can survive in competition. The article concludes that future success depends on adhering to stricter design principles rather than simply chasing profits.

链捕手·2025-11-08 11:36

Another doomsday for Algorithmic Stablecoin: Stream Finance triggers a $1 billion chain liquidation, is DeFi heading towards a collapse of trust?

Original Title: Stream Finance's Collapse Triggers $1 Billion Capital Outflow, Is DeFi Facing Its Darkest Week Ever?

Original Author: Liu Ye Jing Hong

Source:

Reprint: Daisy, Mars Finance

November 7, 2025 - The crypto market has yet to fully recover from the severe turbulence of October 11, and a perfect storm triggered by stablecoins is sweeping through the entire Decentralized Finance world at an astonishing pace. In the past week, we have witnessed yield-bearing stablecoins experiencing the most intense outflow of funds since the 2022 Terra/UST collapse, totaling up to $1 billion. This is not just an isolated protocol explosion, but a chain liquidation that reveals deep structural cracks within the modern DeFi ecosystem.

The trigger point of the event was Stream Finance, a once highly sought-after stablecoin protocol. However, when

MarsBitNews·2025-11-08 09:53

Curve community risk control team LlamaRisk has proposed a suggestion to "disable all Gauges in the Elixir market."

Curve community risk management team LlamaRisk proposes disabling Gauges in the Elixir market to stop CRV emissions to the related pools. This move is due to the DeFi protocol Elixir ceasing issuance and approximately $93 million in losses caused by the collapse of Stream Finance. The proposal targets 9 liquidity pools, which will have their incentive distributions terminated.

DeepFlowTech·2025-11-08 03:34

Elixir Suspends DeUSD Following Stream Finance’s $93 Million Loss and Market Turmoil

Elixir halted deUSD after Stream Finance lost $93 million leaving most holders at risk.

XUSD stablecoin collapsed to $0.10 following Stream Finance debt and withdrawal freeze.

Balancer hack lost over $98 million with partial recovery showing ongoing DeFi risks.

Decentralized finance (DeFi)

CryptoNewsLand·2025-11-07 16:04

Evening Must-Read 5 Articles | Can Bitcoin's "Whales" Really Determine Market Trends?

1. The Culprit Behind the Stream Crash: The Risks and Opportunities for DeFi Curator

On November 3, 2025, due to a theft involving Balancer and poor asset management, Staked Stream suffered a loss of 93 million USD. The stablecoin xUSD de-pegged and continued to decline over the following days. At the time of writing, xUSD is only worth 0.1758 USD. Click to read

2. Sweeping Hundreds of Billions: The Blood and Tears of the Top Ten Scams in Cryptocurrency History

Under the temptation of quick wealth in the cryptocurrency world, some achieve financial leaps while others fall into abyss. Despite blockchain technology's commitment to transparency and decentralization, scammers exploit these tools to commit some of the most rampant crimes in modern financial history. Click to read

3. MEV Is Not Inevitable, But a Choice Blockchain Must Confront

MEV is not unavoidable; it is a form of artificial exploitation disguised as an inevitability.

金色财经_·2025-11-07 12:27

1 billion USD stablecoin evaporates: What's the truth behind the chain reaction of DeFi explosions? - ChainCatcher

The DeFi market has experienced the largest capital outflow since the Terra UST collapse in 2022, totaling $1 billion. Stream Finance froze deposits and withdrawals after losing $93 million, causing its stablecoin xUSD to plummet significantly and triggering a chain liquidation. This incident exposed the fragility and lack of transparency of DeFi protocols, serving as a market warning about the importance of risk management for users.

链捕手·2025-11-07 11:53

Elixir Shuts Down deUSD Stablecoin After Stream Finance’s $93 Million Loss

Elixir is sunsetting its deUSD synthetic stablecoin after Stream Finance's $93 million loss.

The platform has processed 80% of redemptions and will coordinate remaining claims.

Around 90% of deUSD supply remains held by Stream, which has yet to repay its positions.

Elixir, a decentralized

USDC-0,04%

BeInCrypto·2025-11-07 11:00

Can DeFi Curator's Stream collapse be rebuilt to restore user confidence?

Deng Tong, Jinse Finance

On November 3, 2025, due to a theft involving Balancer, asset management was mismanaged, resulting in a loss of $93 million in Staked Stream. The stablecoin xUSD de-pegged and continued to decline over the following days. As of press time, xUSD is only worth $0.1758.

This chain reaction triggered by Stream Finance quickly evolved into a crisis of confidence in the "Curator" role within DeFi protocols. According to data from DefiLlama, since October 30, the total value locked (TVL) in Curator-managed vaults has plummeted from $10.3 billion to $7.5 billion, with large amounts of funds fleeing in panic, indicating increasing market concerns about the risks of this model.

Trump's cryptocurrency advisor David Bailey warns: D

金色财经_·2025-11-07 10:46

Elixir retires deUSD after Stream’s $93M loss

Decentralized finance liquidity provider Elixir has pulled the plug on its stablecoin deUSD after Stream borrowed the token to stabilize its own stablecoin.

Summary

Elixir declared that it would be permanently retiring its deUSD stablecoin after the collapse of its major counterparty, Stream

STREAM-0,89%

Cryptonews·2025-11-07 09:00

RWA Weekly: Stream's collapse causes multiple stablecoins to lose their pegs; UK plans to introduce stablecoin regulation synchronized with the US

Highlights of this issue

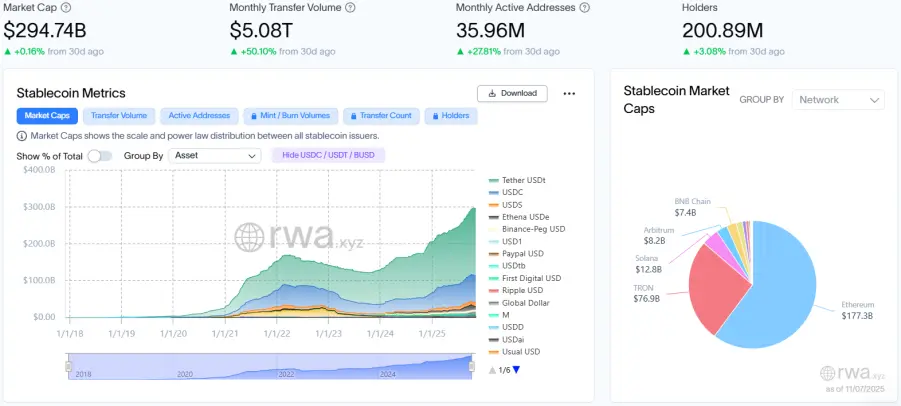

The weekly report covers the period from October 31, 2025, to November 6, 2025. This week, the RWA market continued its steady growth, with the total on-chain market capitalization reaching $35.83 billion, and the number of holders surpassing 530,000, indicating a continuously expanding user base. The stablecoin market has entered a new phase of "high frequency, low inflation," with transfer volumes exceeding $5 trillion for the first time, and monthly active addresses surged by nearly 28%, demonstrating significant improvements in capital turnover efficiency and on-chain payment functionalities. On the regulatory front, two Southeast Asian countries launched RWA tokenization initiatives, the UK and Canada are following the US "Genius Act" by advancing stablecoin regulation legislation, and the global regulatory framework is accelerating its formation and alignment. At the project level, JPMorgan is expanding its blockchain applications to fund services, stablecoin company Zerohash obtained an EU MiCA license in the Netherlands, and WisdomTree, UBS, and Dinari are collaborating with Chainlink.

PANews·2025-11-07 08:12

Why did the crypto market sentiment suddenly become so pessimistic?

The crypto market quickly collapsed after Bitcoin reached an all-time high, leading to a big dump of mainstream tokens and a crisis at exchanges. The high-leverage yield fund Stream Finance went bankrupt, exposing the fragility of market bubbles and the Crisis of Confidence. Current sentiment in the crypto market is extremely pessimistic, facing a new cycle turning point.

BTC0,45%

MarsBitNews·2025-11-07 07:05

Stream confirms insolvency! On-chain stablecoin chain explosion: Elixir abandons DeUSD, USDX depegs to 0.5

Stream Finance suffered a loss of approximately 93 million USD, leading to a significant collapse of its issued xUSD, with debts reaching 280 million USD. Elixier's deUSD was shut down due to Stream's defaults, with more than half of the Collateral becoming bad debt. Another stablecoin project, Stable, faced depeg of USDX to 0.4 USD due to mismanagement and high-risk operations, making it difficult for users to reclaim their funds.

ChainNewsAbmedia·2025-11-07 06:04

Nansen: deUSD experienced a big dump of 95% in two days and will be closing, with concentrated collateral triggering a chain collapse.

deUSD has experienced a big dump of 95% within two days, now trading at around 0.05 USD, making it one of the fastest dying stablecoins. Due to collateral losses and panic selling from Stream Finance, the supporting assets of deUSD have nearly evaporated, leading to a suspension of redemptions. The project will cease operations, and Nansen believes that the concentration risk of assets is significant.

WuSaidBlockchainW·2025-11-07 05:16

DeFi Contagion: $1B Stablecoin Outflow After $93M Stream Finance Hack

Just after the $128 million Balancer exploit, the first major domino has fallen, triggering a market-wide liquidity panic.<

BitcoinInsider·2025-11-07 05:15

Elixir shuts down deUSD stablecoin: Stream Finance collapse triggers a "domino effect"

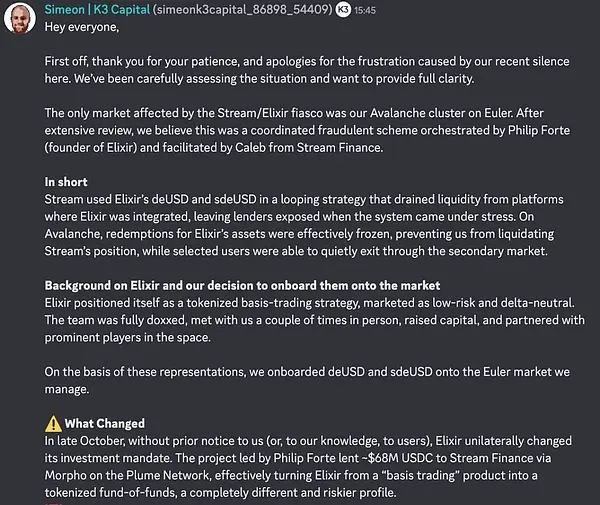

On November 7, 2025, the decentralized stablecoin protocol Elixir announced it would gradually shut down its synthetic USD stablecoin, deUSD. This decision comes after the protocol faced potential bad debt due to a $68 million loan it provided to Stream Finance, which was at risk because of the latter’s investment losses. Elixir has processed redemptions for 80% of deUSD holders and took a snapshot of the remaining balances, promising to offer 1:1 USDC payouts through an upcoming claims portal.

This event follows Stream Finance’s suspension of withdrawals on November 4, during which its external fund manager disclosed a $93 million loss, bringing the total debt to $285 million. The closure of deUSD highlights the structural risks faced by decentralized stablecoins in managing exposure to real-world assets.

MarketWhisper·2025-11-07 02:23

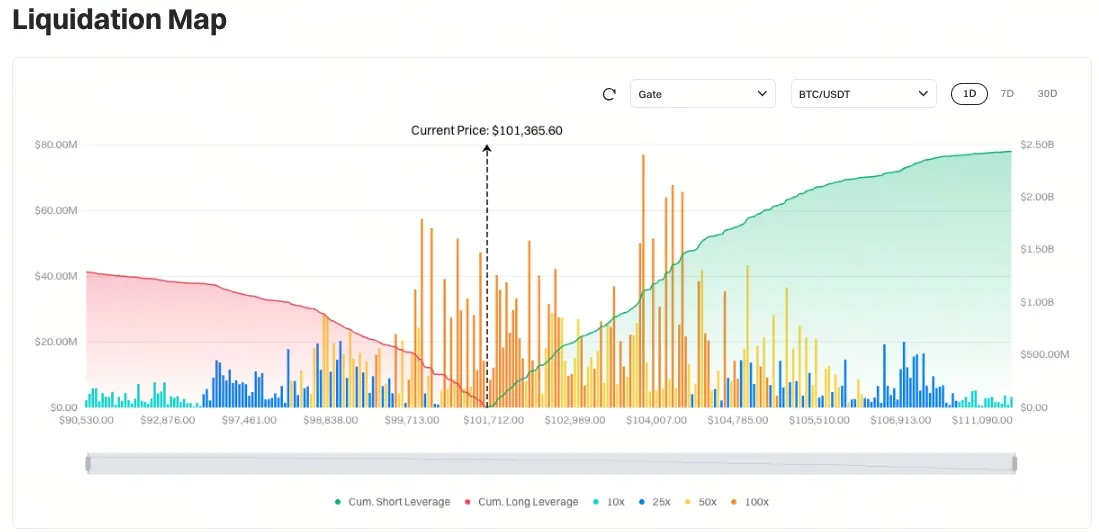

Gate Daily Report (November 7): deUSD stablecoin temporarily halts trading due to de-pegging; mixing tool Samourai Wallet receives a harsh sentence

Bitcoin (BTC) experienced a slight pullback, currently trading around $101,281 as of November 7. Due to losses from Stream Finance's liquidation operations, Elixir has halted trading of the USD stablecoin deUSD, aiming for a full 1:1 redemption. Keonne Rodriguez of the mixing service Samourai Wallet has been sentenced to up to five years in prison for operating a cryptocurrency mixing service.

MarketWhisper·2025-11-07 01:19

Stream Finance reports a loss of 93 million! Elixir suspends deUSD trading and commits to a 1:1 redemption.

Due to losses caused by Stream Finance's liquidation operations earlier this week, Elixir has decided to halt trading of its synthetic USD stablecoin, deUSD. The protocol has processed redemptions for 80% of deUSD holders. On November 4th, DeFi protocol Stream Finance paused withdrawals after an external fund manager disclosed a loss of $93 million.

MarketWhisper·2025-11-07 00:46

Elixir announces termination of deUSD synthetic stablecoin, commits to 100% redemption.

On November 7th, Elixir announced the termination of its deUSD synthetic stablecoin following a chain reaction triggered by Stream Finance suspending withdrawals and a $93 million loss. Elixir has processed 80% of redemption requests and has committed to fully paying remaining holders in USDC. The platform is also working with a decentralized lending platform to liquidate assets and distribute funds.

USDC-0,04%

DeepFlowTech·2025-11-07 00:12

After xUSD, it seems the USDX pool also took action.

Author: Eric, Foresight News

The reason behind the collapse of xUSD issuer Stream Finance was finally clarified yesterday. The Delta neutral strategy experienced losses during extreme market conditions due to ADL (Auto-Deleveraging), which caused the collateral assets to suffer losses. The risks associated with entrusting funds to third parties for off-chain operations and employing cyclical leverage strategies accumulated over time. When third-party losses approached nearly $100 million, the situation abruptly escalated, ultimately leading to insolvency.

In a 2023 article I translated, Professor Austin Campbell from Columbia Business School pointed out that Ethena's issued USDe is not a stablecoin but rather a share of Ethena's structured financial products.

The de-pegging of xUSD itself has also impacted many DeFi strategies that relied on this "stablecoin," as well as some that used xUSD.

PANews·2025-11-06 23:02

How can Crypto Assets achieve financial freedom on-chain? An in-depth look at the pro CBB's rise to success.

KOL @Cbb0fe has returned to the public eye after warning about the risks of Stream Finance. His journey is very story-like; despite the controversies along the way, he remains an on-chain legend built from scratch. Recently, he wrote on his personal Twitter, "How we made over 50 million dollars by sniping junk coins on a DEX," detailing CBB's experiences in the crypto world over the past five years.

The Legendary Beginning: French Brothers Starting from 40,000 Dollars

In the summer of 2020, the world was still shrouded in the shadow of the pandemic, and two French brothers were facing a turning point in their careers. The elder brother taught computer engineering at university, while the younger brother (CBB) had just finished a contract as a product manager at an insurance company. At that time, the crypto market was experiencing a prolonged slump, and their investment portfolio had only returned to around $50,000 thanks to a few wins on the Binance Launchpad.

DEFI2,43%

ChainNewsAbmedia·2025-11-06 16:13

Elixir has completed approximately 80% of the deUSD holders' redemptions in the past 48 hours.

The stablecoin project Elixir has completed about 80% of deUSD holder redemptions in the past 48 hours, with Stream holding about 90% of the deUSD supply. Elixir will launch the USDC redemption page and has closed the minting and redemption functions, planning to terminate the deUSD project.

WuSaidBlockchainW·2025-11-06 15:28

Euler Finance has erupted into a liquidity crisis, with users' funds of 7 million dollars trapped.

In the crypto world Bear Market's ongoing impact, Decentralized Finance (DeFi) has once again erupted into a chain crisis. Euler Finance has reported a shocking liquidity depletion, caused by a massive loss of 93 million dollars from Stream Finance, raising community awareness and further intensifying market fluctuations.

Unable to withdraw coins: Users report funds trapped in Euler

On November 5, 2025, a user named @Ryu\_LCat shared his painful experience on X. He revealed that over 10 million dollars deposited in Euler Finance suddenly lost liquidity and could not be withdrawn in full. The user pointed out that he was only able to withdraw 3 million dollars, while the remaining 7 million was still stuck in the platform.

According to them, the fuse of this crisis comes from Stream Financ.

ChainNewsAbmedia·2025-11-06 06:34

1011 Bloodbath in DeFi: The Truth Behind the Collapse of Stream XUSD: The High-Risk Operations Behind the Illusion of Stablecoins

The liquidation event on October 11 is referred to as "Red Friday" by the Western community. It not only caused fluctuations in the crypto market but also led to the complete collapse of the DeFi project Stream xUSD, which claimed to be "stable." Originally, Stream promised to stabilize prices using a "delta neutral" hedging strategy, but it has now found itself in a crisis of insolvency due to opaque high-risk operations and severe market fluctuations.

From the perspective of Trading Strategy, we will comprehensively break down the ins and outs of this event and its impact on the entire Decentralized Finance ecosystem.

(USDe Flash Crash Storm: The largest single-day liquidation in history, severely impacting the crypto market, with Binance experiencing order book failures)

What is Stream xUSD? A hedging fund masquerading as a stablecoin.

Stream xUSD claims to be a "decentralized stable

ChainNewsAbmedia·2025-11-06 06:13

Balancer vulnerability and XUSD de-pegging trigger panic! $231 million in DeFi funds evaporate instantly.

Balancer V2 vulnerabilities erupted this week, with attackers stealing $128 million across multiple blockchains. At the same time, Stream Finance froze deposits and withdrawals after an external fund manager disclosed a loss of $93 million, causing its staked stablecoin XUSD to decouple from the US dollar, dropping to as low as 30 cents during trading. The two incidents resulted in total losses of approximately $231 million, but only about $19 million has been recovered.

MarketWhisper·2025-11-06 01:03

Load More