Search results for "TAKER"

Bitfinex launches "Zero Trading Fee Mechanism"! All order placement and taker fees are waived, covering spot, derivatives, and OTC trading.

Bitfinex launches and implements a zero trading fee mechanism. This bold decision covers both Makers and Takers, with all trading fees reduced to zero, applicable to the vast majority of products on the platform, without any additional conditions or trading volume thresholds. All eligible users can enjoy this immediately.

(Background: Bitfinex Alpha 183 » BTC bottoming signal emerges)

(Additional context: Bitfinex Alpha 182 » Bitcoin has fallen over 30% from its high, and the price bottom remains uncertain)

The veteran Crypto exchange Bitfinex officially announced on December 17, 2025, the immediate launch and implementation of a zero trading fee mechanism. This bold decision covers both Makers and Takers, with all trading fees reduced to zero, applicable

LEO2,43%

動區BlockTempo·2025-12-18 14:45

Bitcoin buyers regain control as Spot Taker CVD flips bullish

CryptoQuant's data indicates Bitcoin buyers are regaining control, with aggressive market buys surpassing sells. This shift, occurring in loss zones for short-term holders, could signal an end to the correction, but sustained accumulation is needed to confirm a trend reversal.

Cryptonews·2025-12-12 13:06

Cardano Could Surge 58% Amid Rising Taker Buy Pressure and Trends

Cardano could surge 58% as rising taker buy pressure and strong market trends set the stage for significant growth.

Cardano (ADA) may see a significant price surge, with analysts predicting a potential rally of up to 58%. This surge is driven by increasing dominance from taker buy orders, a

ADA6,68%

LiveBTCNews·2025-12-10 04:55

Polymarket Faces Double-Counting Allegations Over Trading Volumes

Polymarket&39;s trading volumes may be inflated by 100% due to double-counting on third-party analytics platforms.

The issue stems from separate "OrderFilled" events for maker and taker sides of trades, leading to redundant volume reporting.

Major data providers, including DefiLlama and

CryptoNewsLand·2025-12-09 13:44

Ethereum Taker Buy Surge Nears Key Threshold After Fusaka Upgrade Boosts Demand

Ethereum’s taker buy ratio reached 0.998 after the Fusaka upgrade, indicating stronger futures market participation and renewed confidence among active traders.

The rising ratio moved faster than price action near $3,130, showing buyers are

CryptoFrontNews·2025-12-05 06:50

Data: Ethereum Fusaka upgrade pushes buy-sell ratio to a 4-month high

Mars Finance news, according to Cryptoquant data, Binance Ethereum Taker Buy/Sell Ratio shows a clear shift in market sentiment. This indicator surged to 0.998 immediately after the Fusaka network upgrade on December 3, reaching its highest level since early August, indicating active buyer participation. The ratio rebounded strongly from a low of 0.945, suggesting that futures traders see the Fusaka upgrade as a bullish catalyst and are actively building long positions. Although the ETH price is still hovering around $3,130, the ratio's rise has outpaced the price itself, serving as a leading indicator. Analysts point out that if the ratio breaks through the 1.0 mark, it will confirm the end of the November correction and could push the price toward the $3,500 and $4,000 targets. The positive market brought by this Fusaka upgrade...

ETH3,51%

MarsBitNews·2025-12-05 06:19

3 Key Signals That Hint At a Near-Term Shiba Inu Upswing

Burn Activity: Over 15.97 million SHIB burned, reducing supply and signaling strong community engagement.

Taker CVD: Buyers dominate, showing sustained demand and growing confidence in SHIB price recovery.

Chart Setup: SHIB forms a tightening falling wedge

SHIB3,45%

CryptoNewsLand·2025-12-03 06:44

Main Capital Monitoring Methodology: On the Use of Open Interest & Long/Short Ratio in the Contract Market

In the "Trading Concepts Cheat Sheet" series, I previously introduced how to monitor major capital flows using Taker data. Today, I’d like to share another analytical method to track the main players' position directions: the combined use of Open Interest and Long/Short Ratio.

(Recap: Using Bitcoin’s 2021 double top structure as an example: What is "future data leakage" )

(Background supplement: Why I never trade breakouts: the liquidity hunting traps set by market makers)

Introduction to Open Interest (OI)

Let me first introduce the concept of Open Interest (OI). In the derivatives market, since there is no actual spot buying or selling involved, the contract market is essentially a pure betting venue. If you go long 10,000u in the contract market, it means someone else is going short 10,000u.

The rules for changes in Open Interest are as follows:

Someone...

BTC3,42%

動區BlockTempo·2025-12-03 03:26

Comprehensive Analysis of BitoPro Trading Fees: The Latest Comparison Guide for 2025

[TAKER](https://www.gate.com/post/topic/TAKER) [Bitcoin](https://www.gate.com/post/topic/%E6%AF%94%E7%89%B9%E5%B9%A3) [DeFi](https://www.gate.com/post/topic/DeFi) In the cryptocurrency trading environment of 2025, understanding the comparison of transaction fees across major exchanges is an essential skill for investors. Among them, the detailed explanation of BitoPro's transaction fees reveals the unique advantages and fee structure of this local platform in Taiwan. When you explore how to drop BitoPro's transaction fees, you not only save costs but also improve trading efficiency. Delving into BitoPro's fee structure allows you to enhance your cryptocurrency trading.

幣圈動態·2025-12-01 14:01

Hyperliquid Tops Perpetual DEX Rankings with $8B Volume

Hyperliquid leads perpetual DEXs with $8.06B daily volume and $6.51B open interest, outperforming Aster, Lighter, and EdgeX.

HIP-3 allows users to create synthetic equity markets by staking HYPE, earning 50% of transaction fees for market creation.

Growth mode cuts taker fees to 0.0045%–0.009%,

HYPE1,64%

CryptoFrontNews·2025-11-26 16:31

Hyperliquid Introduces HIP-3 Growth Mode, Slashing Fees by 90%

Hyperliquid introduces HIP-3 Growth Mode, significantly reducing taker fees, rebates, and volume-based contributions by over 90%. This permissionless feature enables anyone to activate it for easier market deployment.

BitcoincomNews·2025-11-19 14:41

Binance Bitcoin Reserves Hit 582,000 BTC as Market Faces Strong Sell Pressure

Binance Bitcoin reserves climbed to 582,000 BTC, marking the highest level since September as traders kept more coins on the exchange during volatile sessions.

Sell ratios moved above 0.522 while buy ratios slipped toward 0.477, showing steady taker-driven selling pressure shaping liquidity

BTC3,42%

CryptoFrontNews·2025-11-18 07:02

Binance launches 1INCH/USDC, COTI/USDC, and LSK/USDC spot trading pairs and Bots services.

According to Mars Finance, Binance will launch the 1INCH/USDC, COTI/USDC, and LSK/USDC spot trading pairs on November 18, 2025, at 16:00, and will provide Bots services for these trading pairs. In addition, ASTER/USDC and ZEC/USDC will also support spot grid and spot Dollar Cost Averaging (DCA) services. Users can enjoy Taker fee discounts on existing and newly added USDC spot and Margin Trading pairs, and specific trading permissions should comply with local laws and regulations.

MarsBitNews·2025-11-17 07:11

Ethereum price analysis: Bearish trend persists as long-term holders sell 45K ETH daily

Ethereum price continues to weaken as long-term holders sell at their fastest pace since 2021, putting steady pressure on ETH market sentiment.

Summary

Ethereum price is sliding as long-term holders increase daily sell pressure

Futures data from CryptoQuant shows net taker volume is still

ETH3,51%

Cryptonews·2025-11-14 09:42

HBAR News: Hedera Price Could Surge 90% as Taker Buy Dominates Market Trends

HBAR price could surge 90% as taker buy dominance rises, with strong technical patterns and institutional support fueling bullish momentum.

Hedera (HBAR) has shown a price surge in recent days, sparking optimism among investors.

Analysts predict that HBAR could increase by as much as 90% if it

HBAR6,08%

LiveBTCNews·2025-11-11 11:11

Cardano Whales Offload 4M ADA, but Market Signals Point to $1

Over 4 million ADA sold, triggering cautious sentiment among retail investors.

Smaller wallets absorb excess supply, signaling potential early-stage bullish reversal.

Taker buy dominance, rising open interest, and RSI suggest Cardano could rebound toward $1.

Cardano has seen over 4 million ADA so

ADA6,68%

CryptoNewsLand·2025-11-11 08:25

Ethereum Faces Short-Term Correction but Could Hit $5,000 by Year End, Analyst Predicts

Ethereum’s Taker Buy Sell Ratio below 1 signals seller dominance, but the market structure still favors a continued bullish outlook.

Price consolidation near $3,400 shows weaker buyer activity, with traders expecting accumulation to increase near the $2,955 support level.

According to the

ETH3,51%

CryptoFrontNews·2025-11-06 18:02

Bitcoin Holders Are Hurting — Here’s Why That’s Bullish

Over 28% of Bitcoin's circulating supply is held at a loss, a level that could mark a local market bottom.

On-chain data shows signs of seller exhaustion, with Net Taker Volume at extreme lows.

Analysts see $92,000 as a likely floor and $125,000--$130,000 as year-end targets if BTC holds key supp

BeInCrypto·2025-11-06 11:27

Binance launches DASH/USDC and ZEC/USDC spot trading pairs and Bots services.

According to Mars Finance, Binance will launch the DASH/USDC and ZEC/USDC spot trading pairs on November 5, 2025, at 16:00, and will provide Bots services for these two trading pairs to enhance user trading experience. Users can enjoy Taker fee discounts on existing and newly added USDC spot and Margin Trading pairs until further notice.

MarsBitNews·2025-11-04 07:45

Trading Concepts Handbook (Part 7): The Correct Starting Approach for Small Capital

The Trading Concept Supplement Series aims to share some "rarely mentioned, but extremely important" trading concepts. I believe that whether you are a Newbie or a Crypto Veteran, you can take away something from this series of articles. There are a total of 10 articles in this series, and this is the 7th one. (Previous recap: Trading Concept Supplement (Six): Target Management and Benchmark) (Background Supplement: Trading Concept Supplement (Five): How the Visual Taker Strength Indicator CVD Helps You Identify Direction) Because I have limited funds, do I have to fight? Let's state the conclusion first: This is a wrong concept. In the financial markets, unless the principal is large enough to influence the market, 1,000 U and 1,000,000 U are essentially pursuing the "Expected Value" in terms of strategy. The formula for Expected Value is very simple: "All possible outcomes.

BTC3,42%

動區BlockTempo·2025-10-22 07:32

Selling pressure weakens, XRP remains stable: A signal for a breakout to 2.8 USD?

XRP shows signs of a declining trend stabilizing as sell pressure weakens. Despite a dominant bearish sentiment reflected in the Taker Buy/Sell Ratio, open interest remains steady. Recent price movements indicate a cautious recovery, suggesting potential short-term gains.

XRP12,48%

TapChiBitcoin·2025-10-21 05:05

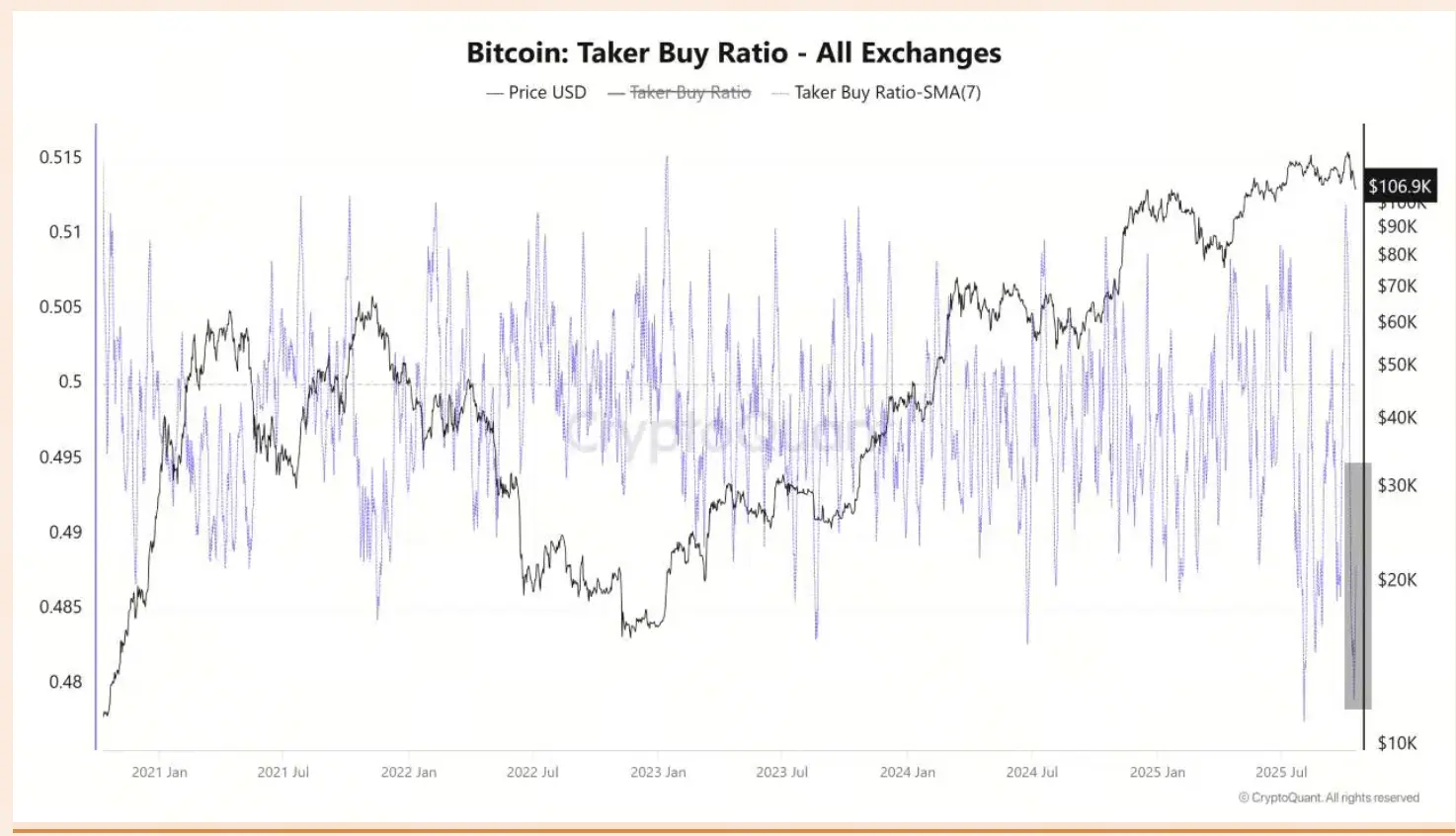

Gold shows initial signs of fatigue, Bitcoin's key indicators flash bottom signals: Is it time to buy the dip?

As the rise of gold seems to lose momentum, investors are beginning to turn their attention to other safe-haven assets. Bitcoin (BTC) is becoming an unexpectedly favored safe-haven tool, with its open orders buy/sell ratio (Taker Buy Ratio) having plummeted to a multi-year low of around 0.47, marking a panic-driven capitulation dumping. Although there is still a possibility of a fall in the short term, this extreme market fear often signals a market bottom, suggesting potential short positions squeeze.

MarketWhisper·2025-10-20 07:51

Binance Taker Ratio Shows Stability Needed for Bullish Run

The Binance Taker Ratio indicates a seller-dominant market, necessitating stability for Bitcoin's recovery. Recent volatility and reduced activity suggest a consolidation phase is essential before bullish trends can emerge, while CZ emphasizes merit-based token listings.

TAKER17,59%

CryptoFrontNews·2025-10-15 18:47

Trading Concept Primer (6): Goal Management and Benchmark

The Trading Concept Supplement Series aims to share some "concepts that are rarely mentioned but extremely important" in trading. I believe that whether you are a Newbie or a Crypto Veteran, you can take away something from this series of articles. This series consists of a total of 10 articles, and this is the 6th one. (Previous summary: Trading Concept Supplement (Five): How the Visualized Taker Strength Indicator CVD Helps You Identify Direction) (Background supplement: Trading Concept Supplement (Four): How to Analyze Taker and Maker Buy and Sell Orders, Following Market Makers to Enter the Market?)

BTC3,42%

動區BlockTempo·2025-10-10 11:01

Bitcoin’s Rising Short Term Holder Supply Hints at Growing Market Confidence

Short term Bitcoin holdings surged to 4.94M BTC, indicating growing activity from new investors.

Analyst Axel notes 99.4% of Bitcoin supply is in profit as derivatives selling pressure eases.

Net taker volume turned neutral from negative $400M, indicating balanced trading and steady market

BTC3,42%

CryptoFrontNews·2025-10-08 14:46

Bitcoin Derivatives Turn Bullish as $400M Shift Signals Fading Selling Pressure

On-chain analytics provided by CryptoQuant indicate that there is a significant movement in the derivatives market of Bitcoin. The data of the Net Taker Volume of the firm shows that the selling pressure is rapidly diminishing with the overwhelming buying activity that stands almost at $400

BTC3,42%

Coinfomania·2025-10-08 09:24

Trading Concept Supplement (5): How the Visual Taker Strength Indicator CVD Helps You Identify Direction

This article introduces the CVD (Cumulative Volume Delta) indicator, used to analyze the buying and selling strength of takers, to help traders better identify market direction. The article compares absolute volume with relative volume and explores the relationship between CVD and price, analyzing the impact of takers and makers through real case studies, emphasizing the importance of comprehensive consideration.

動區BlockTempo·2025-10-02 05:26

Bitcoin Forms Bullish Flag Structure With Analysts Tracking $140K Breakout Level

Bitcoin forms a bullish flag, with analysts eyeing $140K and Fibonacci targets near $166K.

On-chain data shows buyer dominance as Spot Taker CVD flips positive after mid-July.

October and November are viewed as breakout months, backed by seasonal strength and liquidity.

Bitcoin is showing chart s

BTC3,42%

CryptoFrontNews·2025-10-02 02:47

Bitcoin Demand Hits 1-Year Low: What’s Next for BTC?

Key Notes

Bitcoin taker buy volume falls to its weakest level since early 2024.

BTC trades around $113,200, down 9% from its all-time high in August.

Analysts warn of weak demand but many are bullish on October gains trend.

Bitcoin’s

BTC

$112 910

24h volatility:

0.9%

Market cap:

$2.25 T

BTC3,42%

Coinspeaker·2025-09-30 11:19

Trading Concepts Compendium (Part 4): How to Analyze Taker and Maker Buy and Sell Orders, and Follow Market Maker Capital Into the Market?

The Trading Concept Supplement Series aims to share some "rarely mentioned but extremely important" trading concepts. I believe that whether you are a Newbie or a Crypto Veteran, you can take away something from this series of articles. There are a total of 10 articles in this series, and this is the 4th one. (Previous Summary: Trading Concept Supplement (III): The Market's Minimum Resistance Direction) (Background Supplement: Taking Bitcoin's 2021 Double Top Structure as an Example: Discussing What "Future Data Leakage" Is) Why do we analyze the strength of Takers? "If you don't have insight, you must follow." In crypto, especially in the contract market, it belongs to a Zero-sum Game. In other words, your profits come from others' losses; and vice versa. Your opponents often include those giants who have been hunting on Wall Street for decades. Why do you think you can earn more than them? At least I consider myself not capable enough, in this situation, if we set the strategy...

動區BlockTempo·2025-09-25 12:03

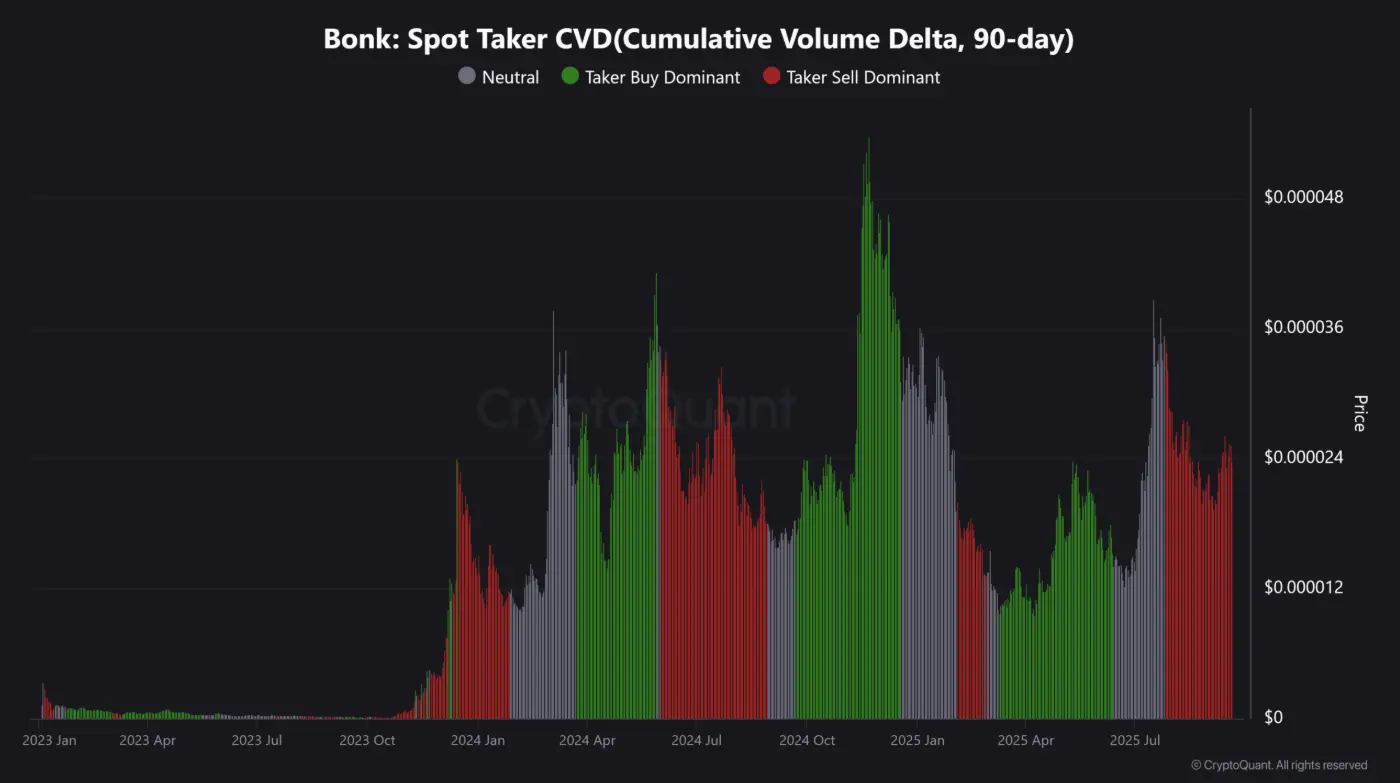

The on-chain strength of BONK is contrary to the bearish trend: What is the mystery behind it?

Spot Taker CVD shows that the selling pressure is continuously maintained, while futures traders remain in a neutral position, causing the price of BONK to continue to face downward pressure.

What are the factors supporting the long-term growth prospects of BONK?

With nearly 1 million holders, accounting for 25% of the launchpad market share and the token burn rate of the ngà

BONK2,25%

TapChiBitcoin·2025-09-21 08:02

Trading Concept Compendium (3): Market Minimum Resistance Direction

The Trading Concept Supplement Series aims to share some "rarely mentioned but extremely important" trading concepts. I believe that whether you are a Newbie or a Crypto Veteran, you can take away something from this series of articles. There are a total of 10 articles in this series, and this is the 3rd one. (Previously: Trading Concept Supplement (II): Taker, Maker, and the Principles of Price Movement) (Background Supplement: Taking Bitcoin's 2021 Double Top Structure as an Example: What is "Future Data Leakage") What are support and resistance? "Will support rise?" "Will resistance fall?" Basically, every technical analysis school has its own definition of support and resistance, including Chan Theory, Harmonious Trading, Morphology, SMC, on-chain data, etc. In the previous article, we discussed the principles of price movement. If you haven't read it yet, I suggest you take a look first, or the following content may not connect well. First of all, support

動區BlockTempo·2025-09-19 04:39

Will Dogwifhat (WIF) surpass $1.29 or remain stuck in the consolidation process?

Spot Taker Cumulative Volume Delta (CVD – the accumulation volume delta difference of the spot taker ) for Dogwifhat over the past 90 days (WIF) is currently leaning towards the buying side, indicating strong market demand at the time of press. Traders have continuously absorbed selling pressure, keeping the market momentum.

WIF1,17%

TapChiBitcoin·2025-09-18 02:37

BTC Traders Reduce $2B Leverage Ahead of Fed Rate Decision

Key takeaways:

Bitcoin futures open interest has declined by $2 billion over five days, indicating growing caution among derivatives traders.

Binance taker volume has dropped to cyclical lows, as market participants await the Federal Reserve’s upcoming interest rate decision.

The Coinbase

BTC3,42%

CryptoBreaking·2025-09-17 09:50

Bitcoin Investors Are Back In The Market—Why A Momentum-Driven Rally May Be Near

Bitcoin's price has recently improved, surpassing $115,000 amid growing market optimism for a potential rally. The Binance Taker Buy Sell Ratio remains positive, indicating increasing investor confidence and a bullish trend.

BitcoinInsider·2025-09-13 23:26

Introducing 0% trading fees on select pairs for Ethereum, Solana, and 20+ staking assets

Binance.US has introduced 0% maker fees and 0.01% taker fees for select cryptocurrency pairs, including Ethereum and Solana, enhancing low-cost trading options. This revision supports over 20 staking assets, emphasizing value for both new and existing users.

BitcoinInsider·2025-09-10 14:23

Binance.US is cutting down the whales fees because the trading volume is still low.

Binance.US đã giảm phí giao dịch cho hơn 20 cặp tiền điện tử nhằm thu hút người dùng trong bối cảnh khối lượng giao dịch giảm sút. Mô hình mới cung cấp phí maker 0% và phí taker 0,01%, nhằm tái chiếm thị phần từ các đối thủ Coinbase và Kraken sau khi hoạt động giảm mạnh.

TapChiBitcoin·2025-09-10 12:36

Trading Concept Handbook (Part Two): Taker, Maker, and the Principles of Price Movement

This article introduces the two main roles in trading: Taker and Maker, and explains how they influence price movements. The Taker pushes the price by immediately executing market orders, while the Maker waits for trades by placing open orders. Additionally, the article discusses the mechanism of stop loss orders and the potential slippage phenomenon that may occur. Overall, understanding these concepts is very important for traders.

TAKER17,59%

動區BlockTempo·2025-09-09 04:27

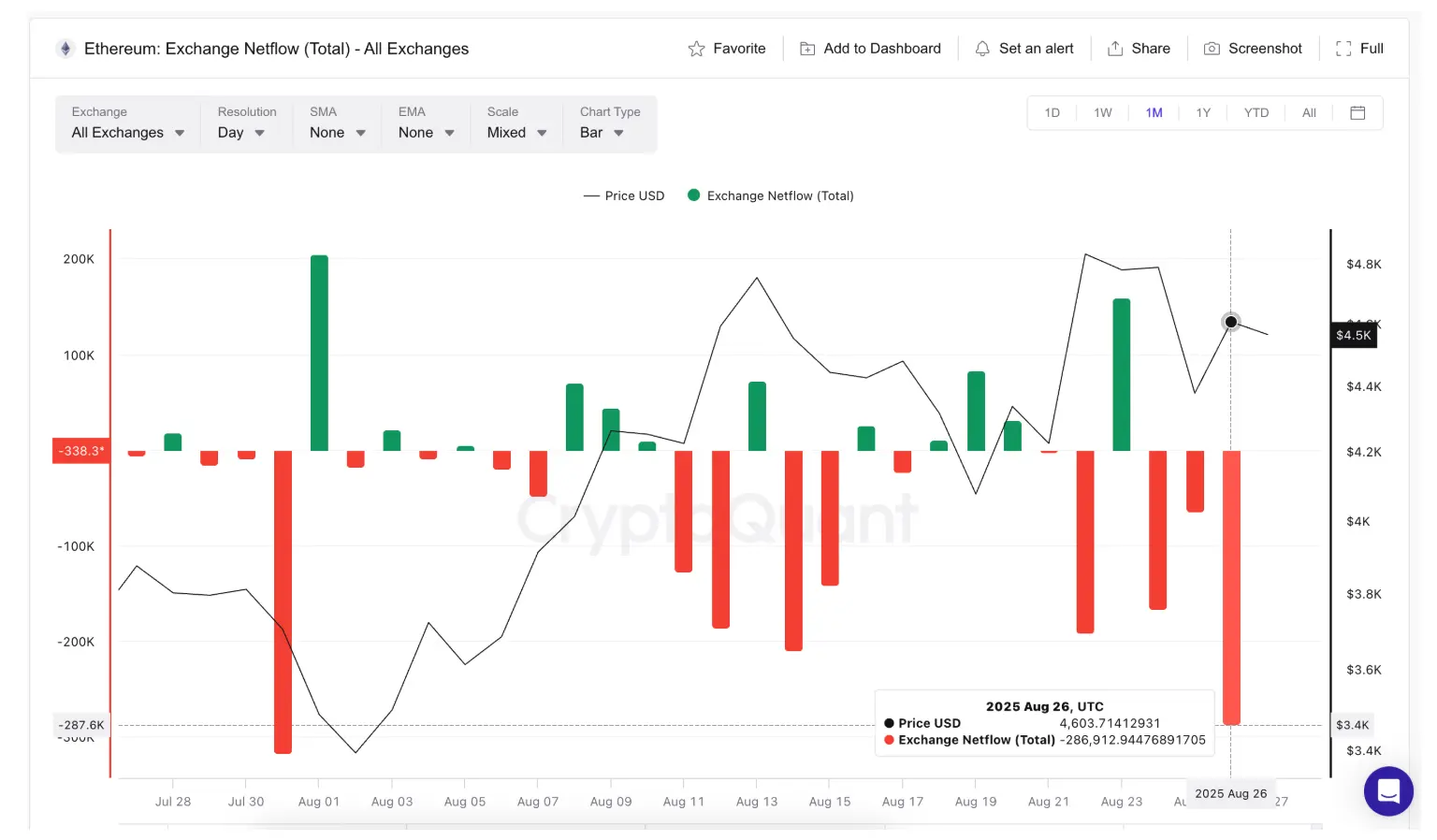

Ethereum dumping wave is coming! Taker sell volume skyrocketed to 1.2 billion USD, key support may be lost.

The Ethereum (ETH) market has experienced significant selling pressure in the past 24 hours, with Taker sell volume skyrocketing to $1.2 billion, resulting in a price drop of 2.4%, reaching a low of $4,272. On-chain data shows that the speculative long positions closing trend is intensifying, and market sentiment has shifted from optimistic to cautious. Analysts warn that if it falls below the key support level, ETH may face a deeper pullback.

MarketWhisper·2025-09-03 02:07

Is the Ethereum price about to break $5000? On-chain data reveals institutional accumulation signals, and the ETH/BTC exchange rate has surged to a new high.

Despite the recent pullback in the crypto assets market, Ethereum has shown remarkable resilience, rising 11% on a weekly basis. On-chain data shows that exchanges are experiencing massive ETH outflows, with institutional investors making large purchases through platforms like BlackRock, while the Taker buy-sell ratio has also broken through key levels. Analysts believe that staking yields and the tokenization narrative are driving capital migration from Bitcoin to Ethereum.

ETH3,51%

MarketWhisper·2025-08-27 09:07

Bitcoin’s Taker Buy/Sell Ratio Hits Lowest Level Since 2018, Signals Weak Buying Momentum

Bitcoin’s 30-day Taker Buy/Sell Ratio has reached its lowest point since 2018, signaling weakened buying activity across major exchanges.

The ratio now sits below levels recorded during Bitcoin’s 2021 peak, showing stronger selling dominance despite upward movements in market price.

Data from

CryptoFrontNews·2025-08-27 08:32

Bitcoin Opportunity? Binance Futures Sentiment Crashes to Local Lows

The market shows mixed signals as Bitcoin fluctuates, highlighting potential buying opportunities amid bearish sentiment. A low Binance Taker Buy Sell Ratio indicates contrarian signals, while extreme negative sentiment may suggest an upcoming rebound for Bitcoin.

BTC3,42%

CryptoPotato·2025-08-21 14:53

Binance Taker Buy Sell Ratio Drops to Lowest Level, Flashes Buy Signal

Binance Taker Buy Sell Ratio has declined to 0.95, lowest of the cycle, which shows bear control in future markets.

Previous sharp ratio declines were frequently preceded by contrarian buying opportunities as the market came back after sentiment became strongly bearish.

Analysts observe that

TAKER17,59%

CryptoFrontNews·2025-08-21 10:32

The UK encryption industry urgently calls: 30 executives jointly wrote to the Chancellor of the Exchequer, demanding the immediate establishment of a stablecoin regulatory framework to avoid falling behind.

Thirty executives from top crypto companies such as Coinbase jointly wrote to UK Chancellor Rachel Reeves, issuing an urgent warning: Unless the UK immediately establishes a clear national strategy and regulatory framework for stablecoins, it will become a "recipient rather than a creator of rules" in the global digital asset competition. This article provides an in-depth analysis of the core demands of the letter, the flaws in the current regulatory definitions in the UK, and the marginalization of the pound stablecoin market, offering key insights for investors concerned about the trends in UK cryptocurrency policy and stablecoin regulation.

## Executives Jointly Press: The UK Faces the Risk of Becoming a "Rule Taker"

Thirty executives from top crypto companies have directly written to UK Chancellor Rachel Reeves, calling for immediate regulation of stablecoins to prevent the country from being marginalized in the accelerating wave of global crypto adoption. The letter was submitted on Wednesday, and according to CNBC, the correspondence clearly states that unless the UK...

LUNA-0,11%

MarketWhisper·2025-08-21 01:49

Bitcoin Market Mood Sours As Net Taker Volume Remains In The Red | Bitcoinist.com

Trusted Editorial content, reviewed by leading industry experts and seasoned editors. Ad Disclosure

Following a resurgence in the broader crypto market, Bitcoin has ventured into a bullish state once again as the flagship digital asset surges sharply towards its current all-time high. As Bitcoin’s

Bitcoinistcom·2025-08-13 12:07

Ethereum's net sell pressure reached $418.8 million in a single day, setting a historical second-high. Can on-chain growth and coin-holding faith withstand the pullback risk? | ETH price prediction

Extreme selling signals have appeared on-chain for Ethereum (ETH), with the daily Net Taker Volume plummeting to -418.8 million USD, marking the second highest negative value in history, which means the market has net sold 116,000 ETH in a single day. Historical data shows that such selling pressure often indicates a local top. Although the price temporarily holds at the support of 3,643 USD, the technical indicators show that the bullish cup and handle pattern is facing a risk of failure—if it cannot quickly recover the resistance at 3,950 USD neckline, it may trigger a deep pullback. On-chain data reflects a Bull vs Bear Battle: the number of new addresses surged by 29.94% in a single day indicating ecological expansion, but the NVT ratio skyrocketing after circulation adjustments suggests short-term overvaluation, while the difference in profits and losses between short and long-term holders (MVRV LSD) remains at 12.36%, highlighting the Whale's faith in holding coins. The battle between bulls and bears is about to erupt.

ETH3,51%

MarketWhisper·2025-08-07 05:15

Ethereum Faces Intense Selling as Smart Money Doubles Down

Trader 0xCB92 significantly increased his Ethereum short, holding $99.27M in ETH, amid extreme sell pressure indicated by a net taker volume of -$418.8M. Market instability suggests potential for volatility and downside risk for Ethereum.

ETH3,51%

CryptoFrontNews·2025-08-06 09:31

Ethereum Taker ratio hits a new low! ETH sell pressure intensifies, can it hold above $3,600?

Ethereum (ETH) experienced significant fluctuation in the past week, sharply pulling back from a high of $3,940 to $3,360. The latest on-chain data shows that the ETH taker buy/sell ratio has dropped to one of the lowest levels this year, with sellers dominating the order book, and short-term dumping pressure has clearly intensified. Can ETH stabilize at the key support level of $3,600, or will it dip further? This article provides an in-depth analysis.

MarketWhisper·2025-08-06 02:06

Ethereum Consolidation Deepens As Taker Buy/Sell Ratio Hits One Of The Lowest Levels This Year

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and imparti

TheBitTimesCom·2025-08-05 16:15

Load More