Bitcoin (BTC) News Today

Latest crypto news and price forecasts for BTC: Gate News brings together the latest updates, market analysis, and in-depth insights.

Japan Financial Services Agency: Derivatives Based on Overseas Cryptocurrency ETFs Are "Not Advisable"

The Japan Financial Services Agency has clearly stated that derivatives based on overseas cryptocurrency ETFs are not permissible in Japan, as investor protection measures are not yet adequate. As a result, IG Securities has terminated CFD trading based on U.S. ETFs such as those from BlackRock.

BTC-1.11%

DeepFlowTech·3m ago

Bitcoin Coiling for Massive Breakout: Mining Costs Surge

Bitcoin mining expenses have surged to record highs, with the cost per Bitcoin hitting $96,100. Despite this, miners continue to invest in infrastructure, anticipating price increases. Technical indicators suggest significant resistance and potential for long-term trends based on yearly openings.

BTC-1.11%

LiveBTCNews·46m ago

Historic Breakthrough for CFTC! Bitcoin, Ethereum, and USDC Approved as Collateral

The U.S. Commodity Futures Trading Commission (CFTC) has launched a digital asset pilot program, allowing Bitcoin, Ethereum, and USDC, among other payment stablecoins, to be used as collateral in the U.S. derivatives market. The program is only applicable to futures commission merchants (FCMs) that meet specific conditions. These firms can accept BTC, ETH, and USDC as margin collateral for futures and swaps trading, but must comply with strict reporting and custody requirements.

MarketWhisper·1h ago

The "Infinite Money Glitch" is Invalid! The Survival Battle Between Crypto Giants Strategy and BitMine

The crypto asset company arbitrage model, once hailed as the “infinite money glitch,” is now unraveling. This week, even as the premium of stock prices relative to net asset value (NAV) shrank sharply, the two giants, Strategy and BitMine, still made significant purchases against the trend. Strategy spent $962.7 million to acquire 10,624 bitcoins, while BitMine bought 138,000 ether. However, the core engine that fueled their years of expansion— the “perpetual motion” model of financing coin purchases by issuing shares at a high premium— is now on the verge of failure. Facing “channel parity” brought by ETFs, these two companies, which together hold over $72 billion in crypto assets, are being forced into a difficult transformation crucial to their survival.

MarketWhisper·1h ago

XRP News Today: ETF Inflows Near $1 Billion, Institutional Demand Surpasses Bitcoin? Short-term Target $2.35

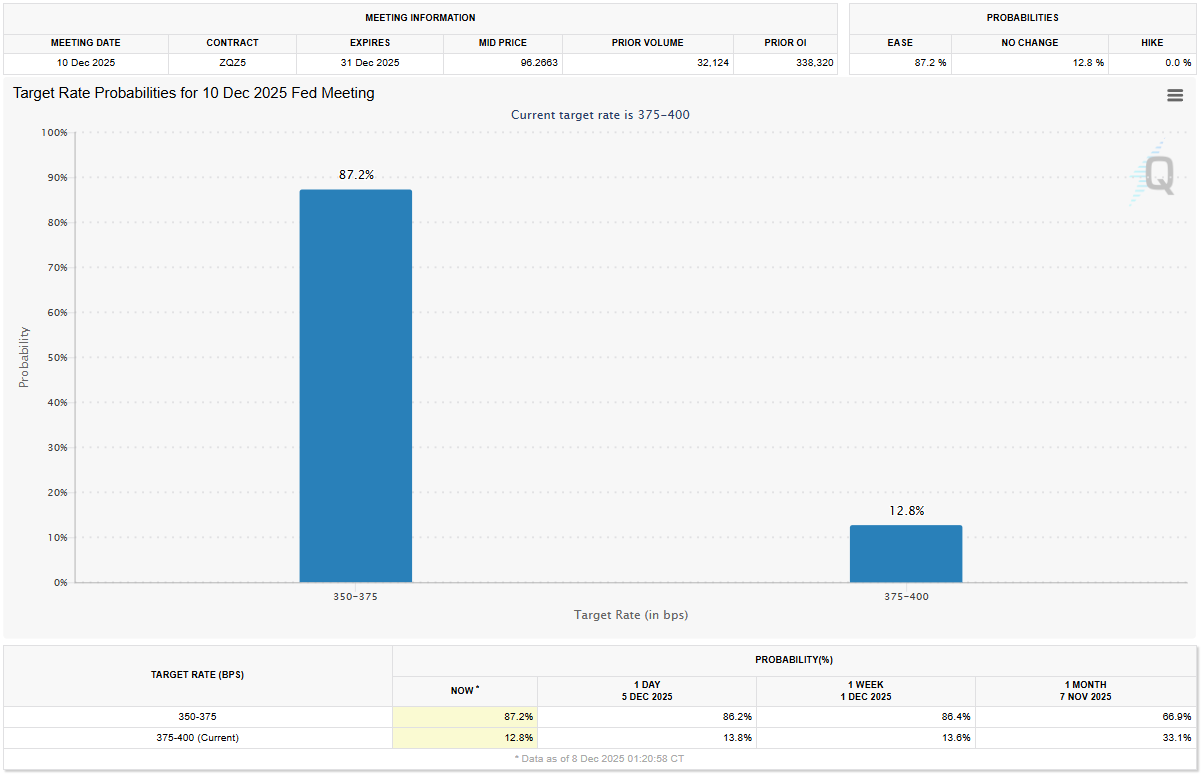

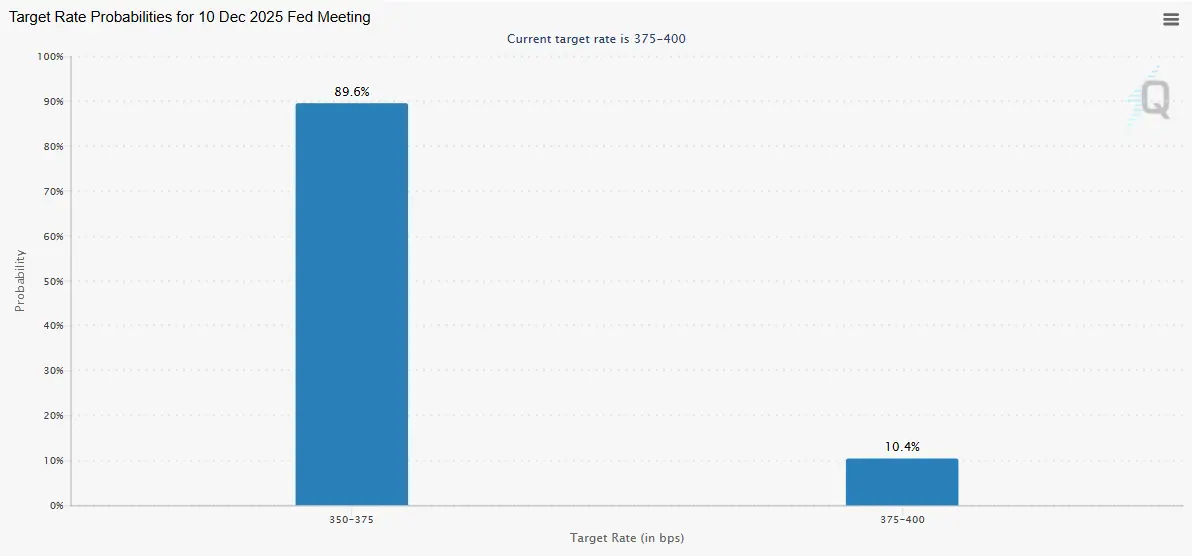

The XRP spot ETF market has shown remarkable explosive growth. Since its launch until December 5, in just a few weeks, only 4 ETF products have accumulated a net inflow of nearly $897 million, approaching the $1 billion mark, with a single-week net capital inflow reaching $230 million. This performance far exceeds that of the US Bitcoin spot ETFs, which saw net outflows during the same period. Meanwhile, Ripple has obtained an upgraded payment license in Singapore, and the expansion of its utility continues to make progress. Driven by both rising expectations of Fed rate cuts and strong inflows of institutional funds, the short- to mid-term price outlook for XRP is widely regarded as optimistic by the market, with analysts setting a short-term target of $2.35.

MarketWhisper·2h ago

4 key US economic data points will shape Bitcoin sentiment this week

Traders are entering a pivotal week, as four key US economic data points—including the Federal Reserve (Fed) interest rate decision and indices

BTC-1.11%

TapChiBitcoin·2h ago

Another key figure, Evan Tangeman, has pleaded guilty in a $263 million cryptocurrency money laundering case in the United States.

ME News: On December 9 (UTC+8), the US Department of Justice announced today that a key figure in a social engineering scam involving $263 million has pleaded guilty. Evan Tangeman, a 22-year-old California resident, admitted before US District Court Judge Colleen Kollar-Kotelly to participating in a conspiracy as defined by the Racketeer Influenced and Corrupt Organizations Act, laundering over $3.5 million for the scheme. The statement noted that Tangeman is the ninth defendant to plead guilty in this case. The social engineering scam was carried out between October 2023 and May 2025. The criminal group was initially composed of a group of online gaming friends scattered across California, Connecticut, New York, Florida, and overseas. The scam stole approximately 4,100 Bitcoins, valued at $2.6 billion at the time.

BTC-1.11%

MetaEra·2h ago

Targeting a market of 1.4 billion people! AllScale secures $5 million in funding to build the first self-custodial stablecoin digital bank

AllScale, a self-custody financial platform focused on serving small and micro businesses worldwide, recently announced the completion of a $5 million seed funding round. The round was led by YZi Labs, with participation from Infomed Ventures, Generative Ventures, and other institutions. The project aims to build the world’s first self-custody stablecoin digital bank, providing instant, low-cost, and borderless stablecoin payment and invoicing solutions for freelancers and small and micro businesses globally through account abstraction and an AI-driven financial assistant. Its vision is to become the underlying payment infrastructure powering the “super individual” economy.

MarketWhisper·3h ago

Dalio warns: The global economy is "on the brink" in the next two years; don't rush to exit due to AI overvaluation

Ray Dalio, founder of Bridgewater Associates, warns that the global economy will face dangerous conditions over the next one to two years due to the combined impact of debt, political conflict, and geopolitical cycles. He advises investors not to rush out of AI investments solely because of overvaluation, but to pay attention to substantial signals of a bubble bursting. This article is sourced from Wallstreetcn and compiled, translated, and written by ForesightNews. (Previous background: Bridgewater’s Dalio: I own Bitcoin, but it only accounts for 1% of my portfolio; BTC will never become a sovereign reserve currency.) (Additional background: Bridgewater’s Dalio: My Bitcoin holdings ratio has never changed! Stablecoins are “not cost-effective” for preserving wealth.) Dalio believes that although there are already signs of a bubble in the AI industry, it is important to focus on the catalysts that could burst the bubble—such as monetary tightening or forced asset sales to meet debt obligations. Dalio warns that in the next one to two years, the global economy

BTC-1.11%

動區BlockTempo·3h ago

From BTC Investment to Application Tokens: Strategy, EUDA, and Metaplanet Unveil Multi-Dimensional Crypto Strategies

Publicly listed companies worldwide are continuously expanding their crypto asset holdings, including Strategy increasing its Bitcoin holdings and MetaPlanet issuing preferred shares for financing to promote long-term accumulation plans. Meanwhile, EUDA plans to launch the QB token to build a digital health ecosystem, marking the entry of healthcare service companies into the tokenized market.

BTC-1.11%

MetaEra·3h ago

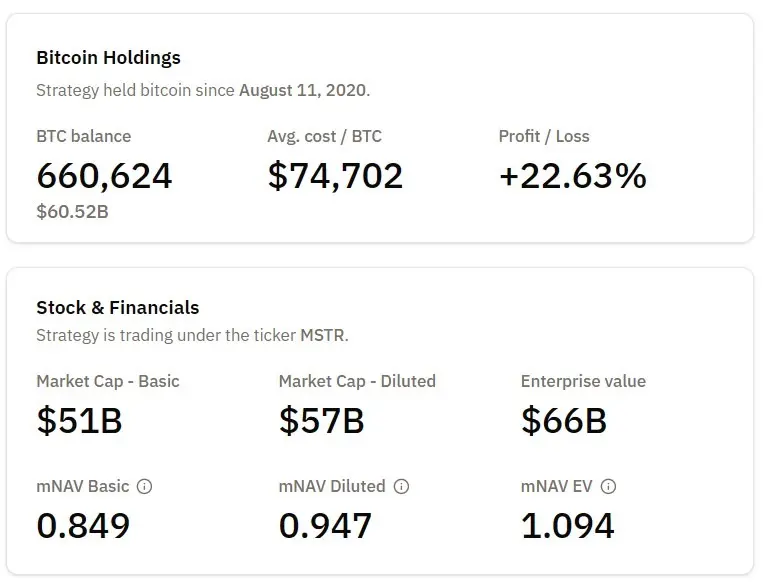

MicroStrategy doubles down! Spends $960 million to scoop up Bitcoin, holdings surpass 660,000

MicroStrategy, the largest corporate holder of Bitcoin, has once again demonstrated a "textbook" move by purchasing 10,624 Bitcoins for $962.7 million between December 1 and 7, at an average purchase price of $90,615. This is the company's largest acquisition since July of this year. After this purchase, MicroStrategy's total Bitcoin holdings have reached an astonishing 660,624 coins, with a total cost of $4.935 billion and an average cost of $74,696 per coin. Notably, the company has recently established a $1.4 billion cash reserve fund to cover dividends and interest payments for the coming years, which has completely alleviated market concerns about a potential forced Bitcoin sell-off in the short term, providing a solid buffer for its long-term "buy-only" strategy.

BTC-1.11%

MarketWhisper·3h ago

Analysts Target $1M Bitcoin With a Surging Institution-Led Cycle

Bernstein's latest outlook predicts that bitcoin is entering a prolonged bull cycle driven by institutional adoption, with strong ETF flows and a revised price target of $150,000 by 2026, potentially reaching $1 million by 2033.

BTC-1.11%

Coinpedia·3h ago

The real liquidity valve! The biggest suspense of the FOMC meeting: Will the Federal Reserve's balance sheet resume expansion?

The market is almost 100% betting that the Federal Reserve will implement its third rate cut of the year at the December 10 meeting, but this may not be the biggest focus of this week's FOMC meeting. Analysts from global asset management giant PineBridge point out that what currently has a deeper impact on the US asset market is "balance sheet policy." The market is holding its breath, awaiting any hints from the Fed regarding the future of its massive $6.5 trillion balance sheet—whether it will remain unchanged or begin expanding again to inject liquidity. Although Bitcoin prices have rebounded above $90,000 due to expectations of a rate cut, historical data issues a stern warning: after the previous seven FOMC meetings this year, Bitcoin fell after six of them, with an average drop of as much as 15%.

BTC-1.11%

MarketWhisper·3h ago

Historic Breakthrough! US CFTC Approves Bitcoin and Ethereum as Futures Collateral

On December 9, the U.S. Commodity Futures Trading Commission announced the launch of a groundbreaking digital asset pilot program, officially allowing regulated futures commission merchants to accept Bitcoin, Ethereum, and payment stablecoins such as USDC as customer margin collateral in derivatives trading. This move aims to bring digital asset activities into the regulated U.S. market and reduce reliance on offshore trading venues. The program establishes strict safeguards, including weekly position reporting, and provides clear guidance for a broader range of real-world assets as collateral, such as tokenized Treasury bonds. This marks the most substantial step the United States has taken toward integrated crypto asset regulation since the passage of the GENIUS Act.

MarketWhisper·3h ago

Gate Daily (December 9): Bank of America, Wells Fargo, and the US government negotiate crypto legislation; MicroStrategy commits to holding Bitcoin until 2065

Bitcoin (BTC) saw a slight pullback, temporarily trading around $90,370 on December 9. BlackRock has filed an application to list an Ethereum staking ETF, planning to trade it on the Nasdaq exchange. The CEOs of Bank of America, Wells Fargo, and Citi will meet with US senators on Thursday to discuss crypto market legislation. MicroStrategy’s CEO stated that the company will hold Bitcoin at least until 2065, maintaining a long-term accumulation strategy.

MarketWhisper·3h ago

On the eve of the Fed's rate cut, is 90% of the Bitcoin bear market already over?

The end of the Bitcoin bear market may come sooner, as the gold ratio has dropped below the 350-day moving average and reached a key Fibonacci support level, making the current area an accumulation zone.

Author: White55

Source: Mars Finance

Bitcoin has always struggled to maintain a sustained correlation with gold, recently only moving in sync during market downturns. However, if we observe Bitcoin prices from the perspective of gold rather than the US dollar, we can gain a more comprehensive understanding of the current market cycle. By measuring Bitcoin's real purchasing power relative to comparable assets like gold, we can identify potential support levels and determine when the bear market cycle may end.

Breaking through key support, the Bitcoin bear market officially begins

When Bitcoin dropped below the 350-day moving average at around $100,000 and the key six-figure psychological threshold, it effectively entered bear market territory, with prices immediately falling by about 20%. From a technical analysis perspective, the price

BTC-1.11%

MetaEra·3h ago

The fastest-growing digital bank in the Philippines launches crypto services

Philippine digital bank GoTyme has partnered with Alpaca to launch crypto services, allowing users to buy and store multiple crypto assets, with the goal of simplifying the trading experience. GoTyme plans to expand into the Southeast Asian market and currently has 6.5 million customers, focusing on customer growth rather than profitability.

MetaEra·3h ago

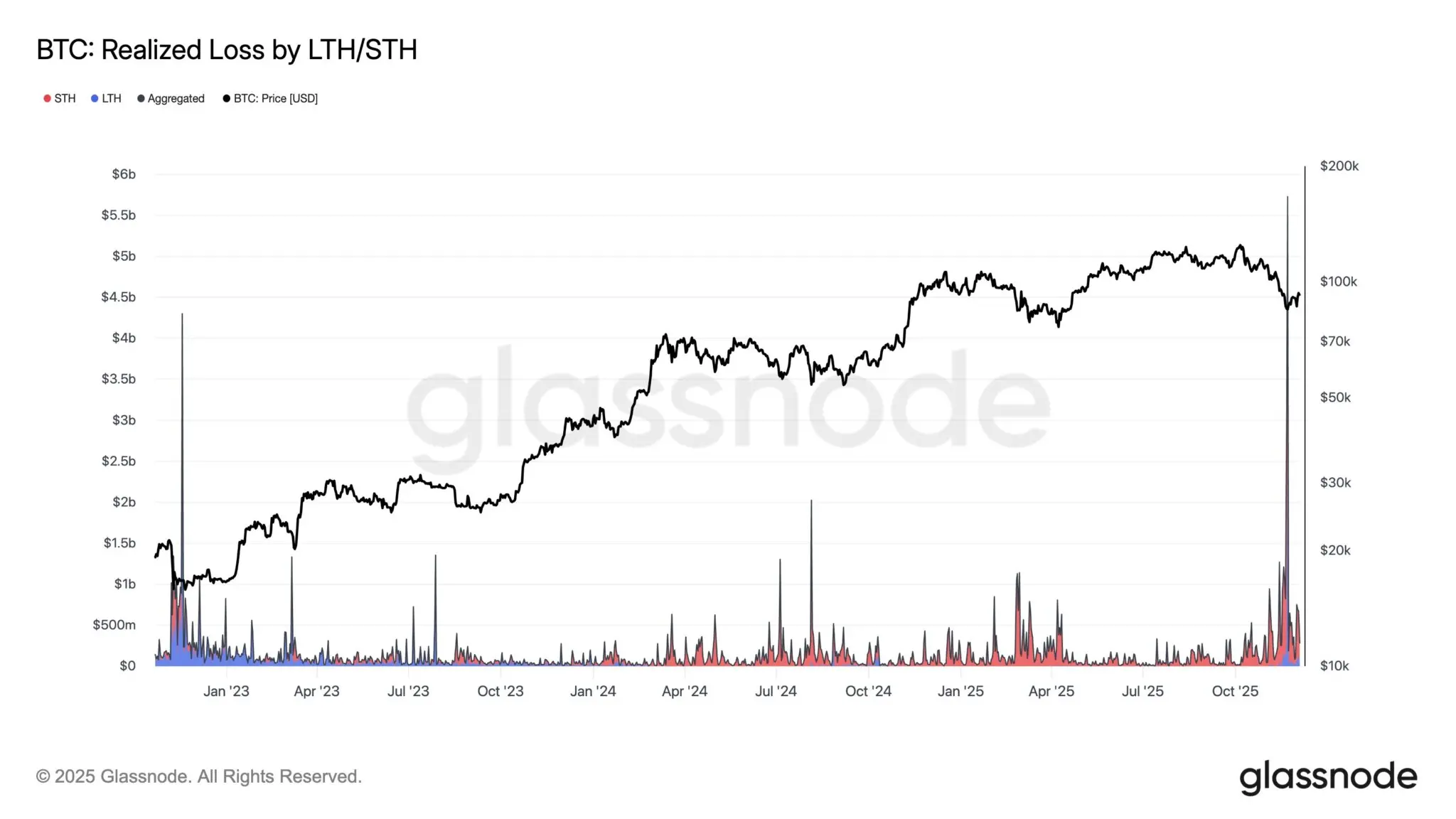

Has 90% of the Bitcoin bear market already passed?

The Bitcoin bear market may be nearing its end, with the current price area forming an accumulation zone. From a gold-denominated perspective, analysis shows that Bitcoin's decline since December 2024 has been more pronounced. Multi-timeframe Fibonacci levels point to strong support at $80,000-$67,000, suggesting that the end of the bear market may come sooner than the market expects.

BTC-1.11%

PANews·4h ago

Bitcoin MENA debuts! MicroStrategy keynote: Bitcoin banks attract 20 trillion in capital

MicroStrategy (MSTR) CEO Michael Saylor presented a bold vision at the Bitcoin MENA event in Abu Dhabi: countries can use overcollateralized Bitcoin reserves and tokenized credit instruments to create regulated digital bank accounts with high yields and low volatility, attracting $50 trillion in capital flows. He pointed out that bank deposit yields in Japan and Europe are near zero, while the digital banking system designed by MicroStrategy can offer returns far surpassing those of traditional finance.

BTC-1.11%

MarketWhisper·4h ago

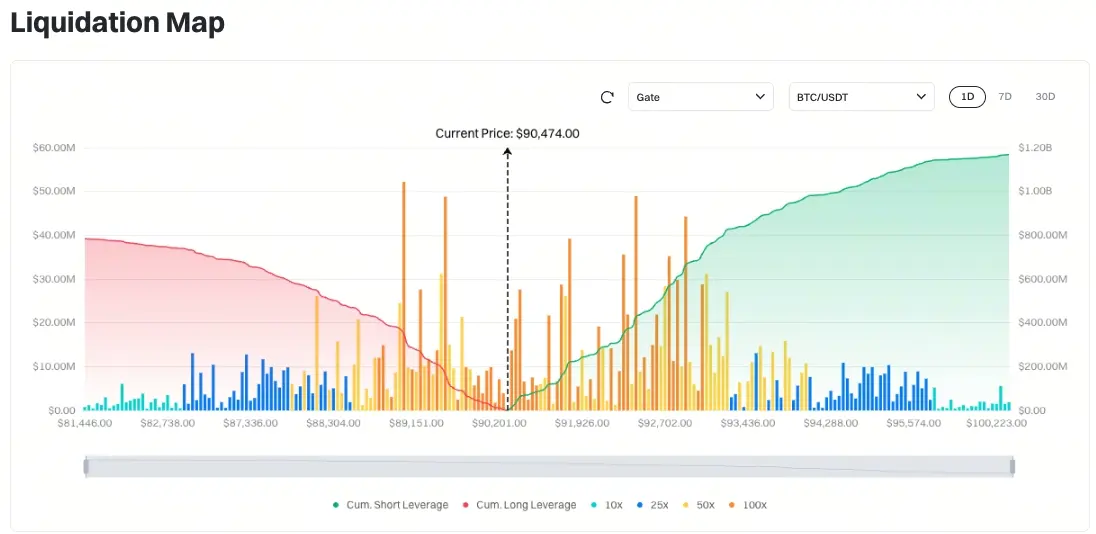

Why did Bitcoin drop today? $500 million evaporated daily, 6.5 million coins in loss

On December 9, Bitcoin slightly retreated to around $90,550. Investors are losing nearly $500 million daily, with nearly 6.5 million Bitcoins currently in an unrealized loss state. Leverage in the futures market has dropped significantly, making the situation resemble the late stages of previous market contractions. However, the Federal Reserve has ended $2.4 trillion in quantitative tightening and shifted to reserve rebuilding, with M2 money supply reaching $22.3 trillion. Large wallets have accumulated 45,000 Bitcoins in a week.

BTC-1.11%

MarketWhisper·4h ago

MicroStrategy invests another $960 million! Bitcoin holdings surpass 660,000, reaching a new all-time high

MicroStrategy (MSTR) Chairman Michael Saylor announced on the X platform that the company purchased 10,624 bitcoins last week at an average price of $90,615 per bitcoin, for a total value of approximately $962.7 million. This purchase brings MicroStrategy's total bitcoin holdings to 660,624 bitcoins, with a total acquisition cost of about $4.935 billion, at an average price of $74,696 per bitcoin.

ETH-0.01%

MarketWhisper·4h ago

CFTC to Pilot Tokenized Collateral in Derivatives Markets Starting With Bitcoin, Ethereum and USDC

In brief

The pilot program permits FCMs to accept Bitcoin, Ethereum, and USDC as margin with enhanced reporting requirements.

New guidance outlines how tokenized Treasuries and money-market funds can be used within existing CFTC rules.

Staff advisory limiting the use of digital assets as

Decrypt·6h ago

Crypto Markets Flash Green, But Bitcoin and Ethereum Are in a Death Cross: Analysis

In brief

The total crypto market cap sits at $3.08 trillion, down 1% from Sunday but back above $3T after last week's panic.

The Fear and Greed Index has recovered to 24 (Fear) from Extreme Fear levels of 10 in late November.

Both BTC and ETH are trading under death cross conditions---if

Decrypt·8h ago

Xgram.io Launches Direct Bitcoin to Monero Swaps

Xgram.io has launched a Bitcoin-to-Monero swap feature, allowing users to easily convert BTC to XMR. This streamlined process enhances privacy and simplifies asset management, catering to growing user demand for quick and low-cost transactions.

CryptoNewsLand·9h ago

Bitcoin Cash Faces Fresh Selling Wall Near $604 As Price Holds Above Key Support

Bitcoin Cash approached $604.19, where a newly formed selling wall limited further upward movement.

The asset held above the $571.72 support, maintaining a stable lower boundary within the current range.

A stronger resistance zone remains near $640, creating a defined upper structure above the

BCH-3.48%

CryptoNewsLand·10h ago

Bitcoin ETF Giant BlackRock Files to Launch Ethereum Staking ETF

BlackRock has filed for an S-1 for a new Ethereum staking ETF, ETHB, which will track Ethereum's price and include staking rewards. This follows the firm's success with existing spot ETFs, ETHA and IBIT, while also reflecting the growing market for staking ETFs.

Decrypt·10h ago

Bitcoin ETFs Pull in $352 Million to Extend Rebound While XRP Funds Remain Hot

Bitcoin ETFs saw $352 million in inflows last week, significantly driving overall crypto investments. Meanwhile, short-Bitcoin products faced notable outflows, indicating a shift in investor sentiment. Total crypto assets under management reached $180 billion, though still below their peak.

Decrypt·12h ago

Strategy Drops Nearly $1 Billion on Bitcoin, Marking Largest BTC Buy in Months

In brief

Strategy unveiled its largest Bitcoin purchase in over 100 days.

The company's stock price was little changed.

Some analysts lowered price targets for Strategy last week.

Decrypt's Art, Fashion, and Entertainment Hub.

Discover SCENE

Strategy revealed its largest Bitcoin pur

BTC-1.11%

Decrypt·13h ago

IG’s Chief Analyst Expects Bitcoin to Recover Upon This Week’s Fed Rate Cut

Bitcoin and the broader crypto market continue to face a difficult stretch, yet IG’s Chief Market Analyst Chris Beauchamp says a turnaround may already be forming

After months of selling pressure and fading confidence, Beauchamp expects a rebound to play out this week as traders position ahead of

TheCryptoBasic·13h ago

Harvard University Doubles Down on Bitcoin, Cuts Gold ETF Allocations

Harvard University increased Bitcoin investments to $443 million in Q3 2023, surpassing gold ETF allocations

Bitcoin now leads Harvard&39;s portfolio, with BlackRock&39;s IBIT ETF accounting for 21% of its holdings.

Bitcoin price shows strong growth, rising 2.78% in 24 hours.

Harvard University i

BTC-1.11%

CryptoNewsLand·13h ago

Bitcoin Coalition Presses for Withdrawal of MSCI Proposal Citing Index Fairness Concerns

Nashville, TN — December 8, 2025 — Bitcoin For Corporations (BFC), in coordination with its member companies and other affected public organizations, today announced a formal industry challenge to MSCI’s proposed ≥50% digital-asset exclusion under its consultation on “Digital Asset Treasury

BTC-1.11%

CryptoBreaking·14h ago

Bitcoin Enters The World Of Big Finance – Why Nothing Will Ever Be The Same Again

Thanks to the regulated spot market, Bitcoin is formally integrated into the US financial market infrastructure, ending years of regulatory separation from derivatives trading.

The new market structure offers institutional investors the necessary legal certainty for capital inflows in the

BTC-1.11%

Blockzeit·14h ago

Melanion Digital Appoints Charlene Fadirepo to its Supervisory Board

PARIS, FRANCE – December 8, 2025 – Melanion Digital today announced the appointment of Charlene Fadirepo to its Supervisory Board. Her expertise in governance, regulatory strategy, and Bitcoin treasury considerations will support Melanion Digital as the company continues to deepen its

BTC-1.11%

CryptoBreaking·14h ago

Load More

Hot Tags

Hot Topics

MoreCrypto Calendar

MoreAbu Dhabi Buluşması

Helium, 10 Aralık'ta Abu Dhabi'de Helium House networking etkinliğine ev sahipliği yapacak ve bu etkinlik, 11-13 Aralık tarihlerinde düzenlenecek olan Solana Breakpoint konferansının öncesi olarak konumlandırılacak. Tek günlük toplantıda, Helium ekosistemindeki profesyonel ağ kurma, fikir alışverişi ve topluluk tartışmalarına odaklanılacak.

2025-12-09

Hayabusa Yükseltmesi

VeChain, Aralık ayında planlanan Hayabusa yükseltmesini duyurdu. Bu yükseltmenin, protokol performansını ve tokenomi'yi önemli ölçüde artırmayı hedeflediği belirtiliyor ve ekip, bu güncellemeyi bugüne kadarki en çok fayda odaklı VeChain sürümü olarak nitelendiriyor.

2025-12-27

Litewallet Gün Batımları

Litecoin Vakfı, Litewallet uygulamasının 31 Aralık'ta resmi olarak sona ereceğini duyurdu. Uygulama artık aktif olarak korunmamakta olup, bu tarihe kadar yalnızca kritik hata düzeltmeleri yapılacaktır. Destek sohbeti de bu tarihten sonra sona erecektir. Kullanıcıların Nexus Cüzdan'a geçiş yapmaları teşvik edilmektedir; Litewallet içinde geçiş araçları ve adım adım bir kılavuz sağlanmıştır.

2025-12-30

OM Token Göçü Sona Erdi

MANTRA Chain, kullanıcıları OM token'larını 15 Ocak'tan önce MANTRA Chain ana ağına taşımaları için bir hatırlatma yayınladı. Taşıma işlemi, $OM'nin yerel zincirine geçişi sırasında ekosistemdeki katılıma devam edilmesini sağlar.

2026-01-14

CSM Fiyat Değişikliği

Hedera, Ocak 2026'dan itibaren KonsensüsSubmitMessage hizmeti için sabit USD ücretinin $0.0001'den $0.0008'e yükseleceğini duyurdu.

2026-01-27