Post content & earn content mining yield

placeholder

HighAmbition

#TokenizedSilverTrend

Tokenized silver saw an explosive rally to $120+ in January 2026, followed by a sharp correction toward the $85–$98 range. While long-term strength remains, short-term volatility is extreme. High leverage and thin liquidity make tokenized silver high-risk but high-reward, suited mainly for disciplined traders.

Tokenized silver saw an explosive rally to $120+ in January 2026, followed by a sharp correction toward the $85–$98 range. While long-term strength remains, short-term volatility is extreme. High leverage and thin liquidity make tokenized silver high-risk but high-reward, suited mainly for disciplined traders.

- Reward

- 8

- 11

- Repost

- Share

Crypto_Buzz_with_Alex :

:

Happy New Year! 🤑View More

💎 Silver Moves On-Chain — Catching Up to Gold or a Unique Opportunity?

According to Dragon Fly Official, silver’s transition to on-chain trading is a structural shift in how precious metals can be accessed and allocated. This move doesn’t just mimic gold — it potentially opens a distinct investment corridor with unique liquidity, transparency, and accessibility benefits.

📊 Market Analysis:

Catch-Up Potential: Historically, silver often lags gold during bull runs, offering a “catch-up trade” when macro drivers like inflation, geopolitical risk, or industrial demand accelerate. On-chain market

According to Dragon Fly Official, silver’s transition to on-chain trading is a structural shift in how precious metals can be accessed and allocated. This move doesn’t just mimic gold — it potentially opens a distinct investment corridor with unique liquidity, transparency, and accessibility benefits.

📊 Market Analysis:

Catch-Up Potential: Historically, silver often lags gold during bull runs, offering a “catch-up trade” when macro drivers like inflation, geopolitical risk, or industrial demand accelerate. On-chain market

- Reward

- 1

- 1

- Repost

- Share

GateUser-c79e323c :

:

2026 GOGOGO 👊$NEAR price is holding above a short-term demand zone after a sharp sell-off, and the structure is compressing — this is usually where momentum prepares for its next move.

Market read

I’m seeing $NEAR drop aggressively from the 1.42 area and sweep liquidity near 1.28, where buyers stepped in immediately. That rejection tells me sellers exhausted their move. Price is now hovering around the 1.30–1.33 range with tight, overlapping candles. Volatility has cooled, selling pressure has slowed, and the market is clearly balancing. As long as this base holds, I’m leaning toward a recovery move rath

Market read

I’m seeing $NEAR drop aggressively from the 1.42 area and sweep liquidity near 1.28, where buyers stepped in immediately. That rejection tells me sellers exhausted their move. Price is now hovering around the 1.30–1.33 range with tight, overlapping candles. Volatility has cooled, selling pressure has slowed, and the market is clearly balancing. As long as this base holds, I’m leaning toward a recovery move rath

NEAR0,4%

- Reward

- like

- Comment

- Repost

- Share

初雪

初雪

Created By@GateUser-6b44c9e2

Listing Progress

0.00%

MC:

$3.22K

Create My Token

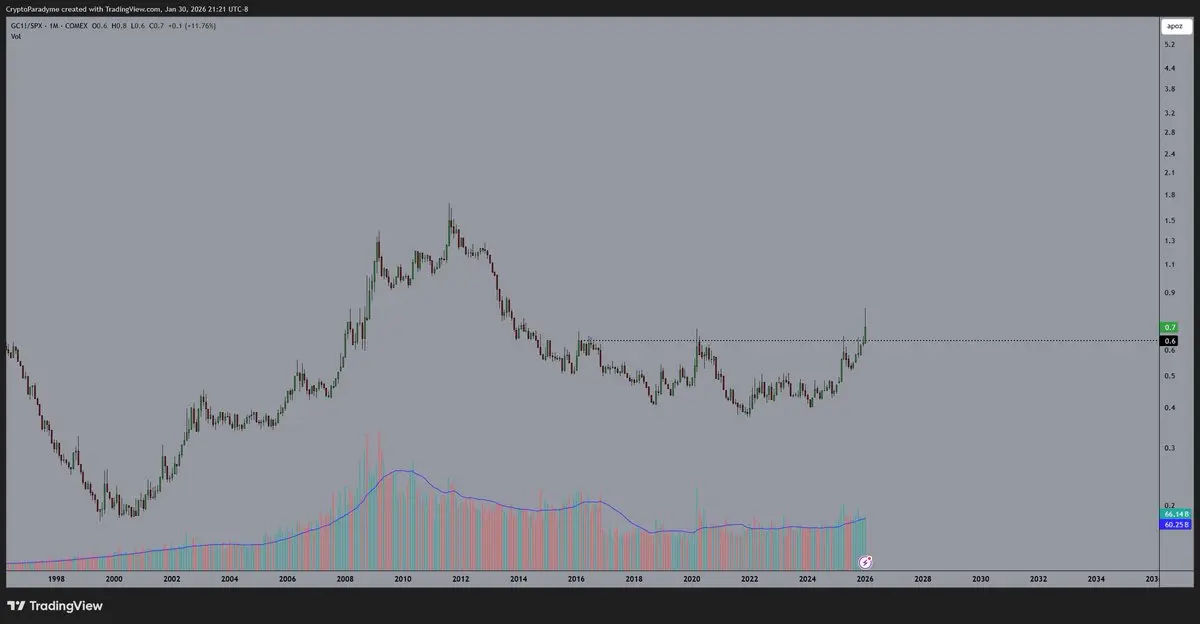

despite the fun todayGold Vs SPX made a pretty wild monthly close.

- Reward

- 1

- Comment

- Repost

- Share

Happy weekend fam!Another weekend to touch some grass

- Reward

- like

- Comment

- Repost

- Share

The U.S. dollar posted its biggest single-day gain since July, triggering a sharp sell-off in gold and silver. Are risk assets facing renewed pressure?

- Reward

- 2

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

In the crypto world, I ask everyone a question: if you have a way to make money, would you tell the people around you?

View Original

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Do you remember the day you registered on X? #MyXAnniversary

View Original

- Reward

- like

- Comment

- Repost

- Share

中国心

中国心

Created By@YanyanAngelPromoterYanyanAngel

Listing Progress

0.00%

MC:

$3.23K

Create My Token

- Reward

- 2

- Comment

- Repost

- Share

#NextFedChairPredictions 🔥 Trump to Announce New Fed Chair Tonight

Markets are buzzing as Kevin Warsh, a hawkish candidate, is tipped to take the top spot at the Fed.

💡 What this could mean:

Higher interest rates for longer → tighter monetary policy

Crypto impact: Stronger dollar + reduced risk appetite could pressure Bitcoin and altcoins

Silver lining: Clear guidance may reduce market uncertainty after initial volatility

📊 Tonight’s announcement could set the tone for both macro markets and crypto — brace for movement!

Markets are buzzing as Kevin Warsh, a hawkish candidate, is tipped to take the top spot at the Fed.

💡 What this could mean:

Higher interest rates for longer → tighter monetary policy

Crypto impact: Stronger dollar + reduced risk appetite could pressure Bitcoin and altcoins

Silver lining: Clear guidance may reduce market uncertainty after initial volatility

📊 Tonight’s announcement could set the tone for both macro markets and crypto — brace for movement!

BTC1,66%

- Reward

- 1

- Comment

- Repost

- Share

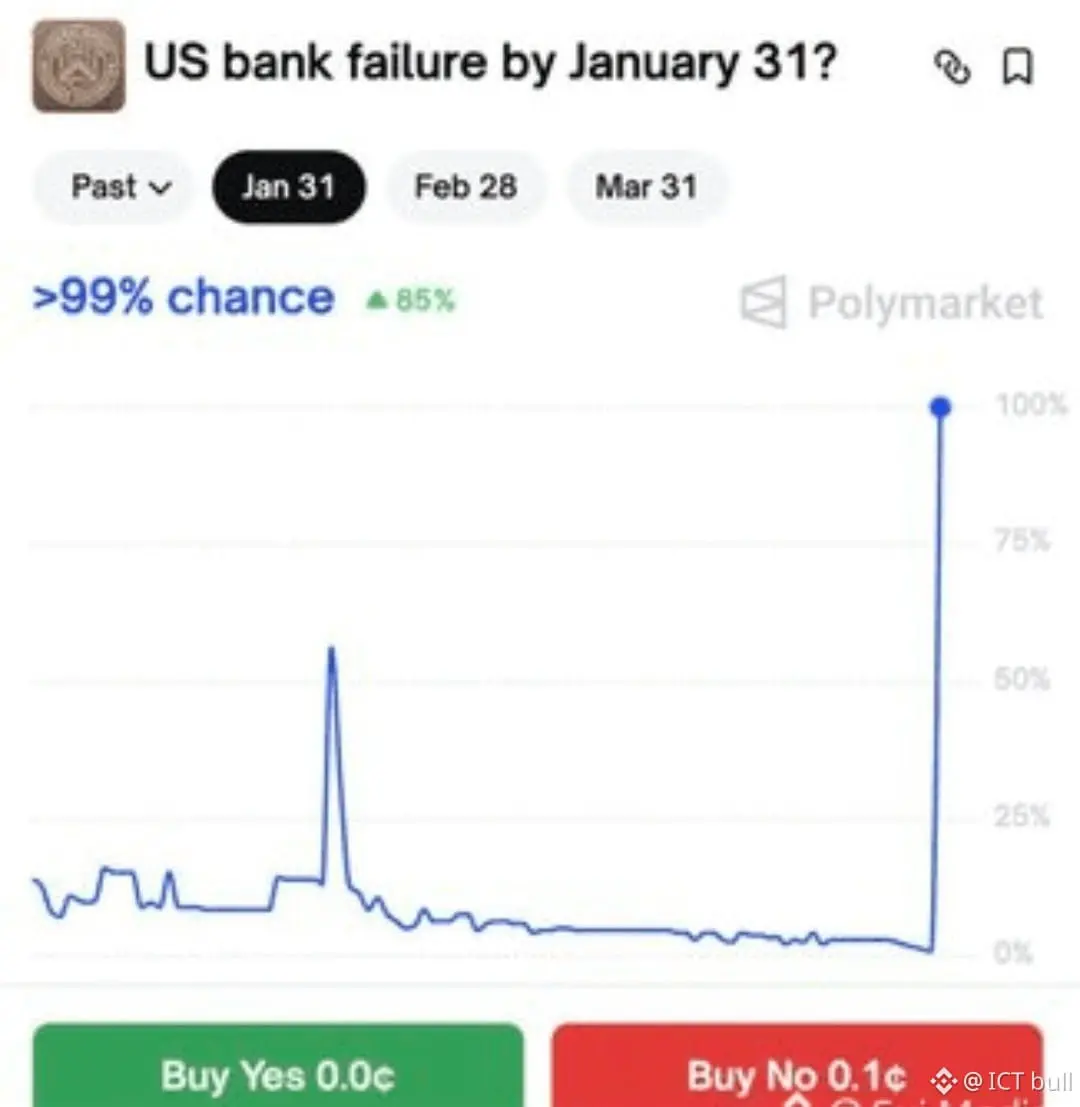

BREAKING:

Polymarket odds just exploded — a 99% probability of a U.S. bank failure on January 31. Markets don’t price this kind of risk without reason.

$SYN $INIT $ENSO are flashing as traders start positioning early. Liquidity stress, hidden balance-sheet pressure, and silent risk are back in focus.

When probabilities move this fast, it usually means information is moving faster than headlines.

Something big is coming.

Polymarket odds just exploded — a 99% probability of a U.S. bank failure on January 31. Markets don’t price this kind of risk without reason.

$SYN $INIT $ENSO are flashing as traders start positioning early. Liquidity stress, hidden balance-sheet pressure, and silent risk are back in focus.

When probabilities move this fast, it usually means information is moving faster than headlines.

Something big is coming.

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

$XAUT XAUT/USDT (Tether Gold) shows a sharp bearish move in the very short term, with the price at approximately $4,918.1 (down -5.54% in the last 24 hours, and the perp slightly lower at -5.83%).

Key Price Levels from the Chart

Current price: ~$4,918.1 (marked with a green cross at the bottom of a strong red candle).

24h High: $5,208.9.

24h Low: $4,714.2 (recent swing low, tested just before the current level).

Visible prior peaks around ~$5,610.6 (local high in the visible range), with the price having broken down from a consolidation/peak area near $5,478–$5,764.

The chart appears to be on

Key Price Levels from the Chart

Current price: ~$4,918.1 (marked with a green cross at the bottom of a strong red candle).

24h High: $5,208.9.

24h Low: $4,714.2 (recent swing low, tested just before the current level).

Visible prior peaks around ~$5,610.6 (local high in the visible range), with the price having broken down from a consolidation/peak area near $5,478–$5,764.

The chart appears to be on

- Reward

- like

- Comment

- Repost

- Share

Weekend market movements are like this: you never know if it will rebound if you don't place an order.

How magical is the weekend market?

One sentence summary: when you're not trading, it pulls; when you're heavily invested, it shocks.

So let's first answer the three core questions of interaction.

👉 Should I choose offense or defense?

The answer is: a tentative offense within a defensive stance.

That is—no all-in, but never hold an empty position.

The most common mistake in volatile markets is not misjudging the direction, but losing control of position size and emotions.

Weeken

View OriginalHow magical is the weekend market?

One sentence summary: when you're not trading, it pulls; when you're heavily invested, it shocks.

So let's first answer the three core questions of interaction.

👉 Should I choose offense or defense?

The answer is: a tentative offense within a defensive stance.

That is—no all-in, but never hold an empty position.

The most common mistake in volatile markets is not misjudging the direction, but losing control of position size and emotions.

Weeken

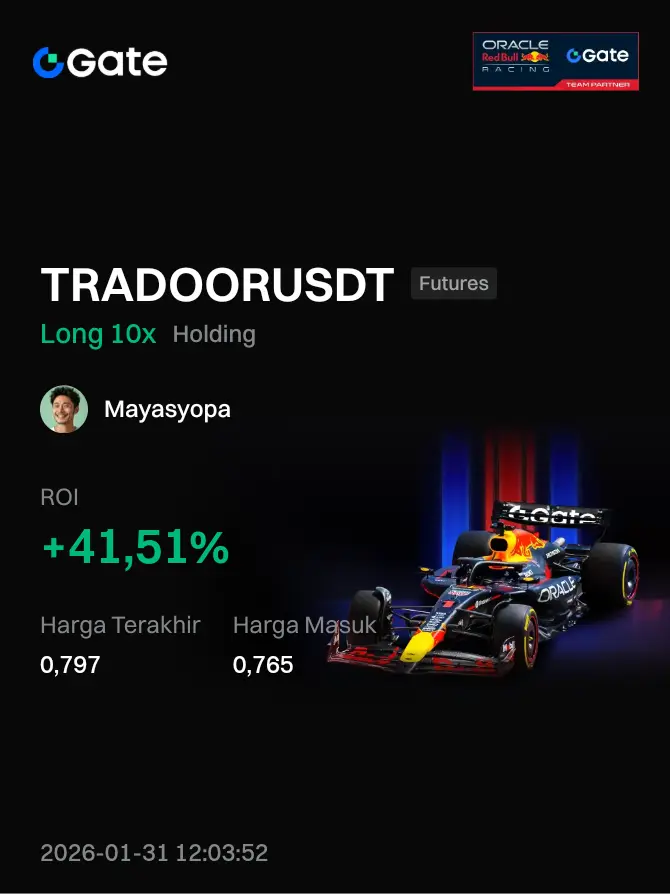

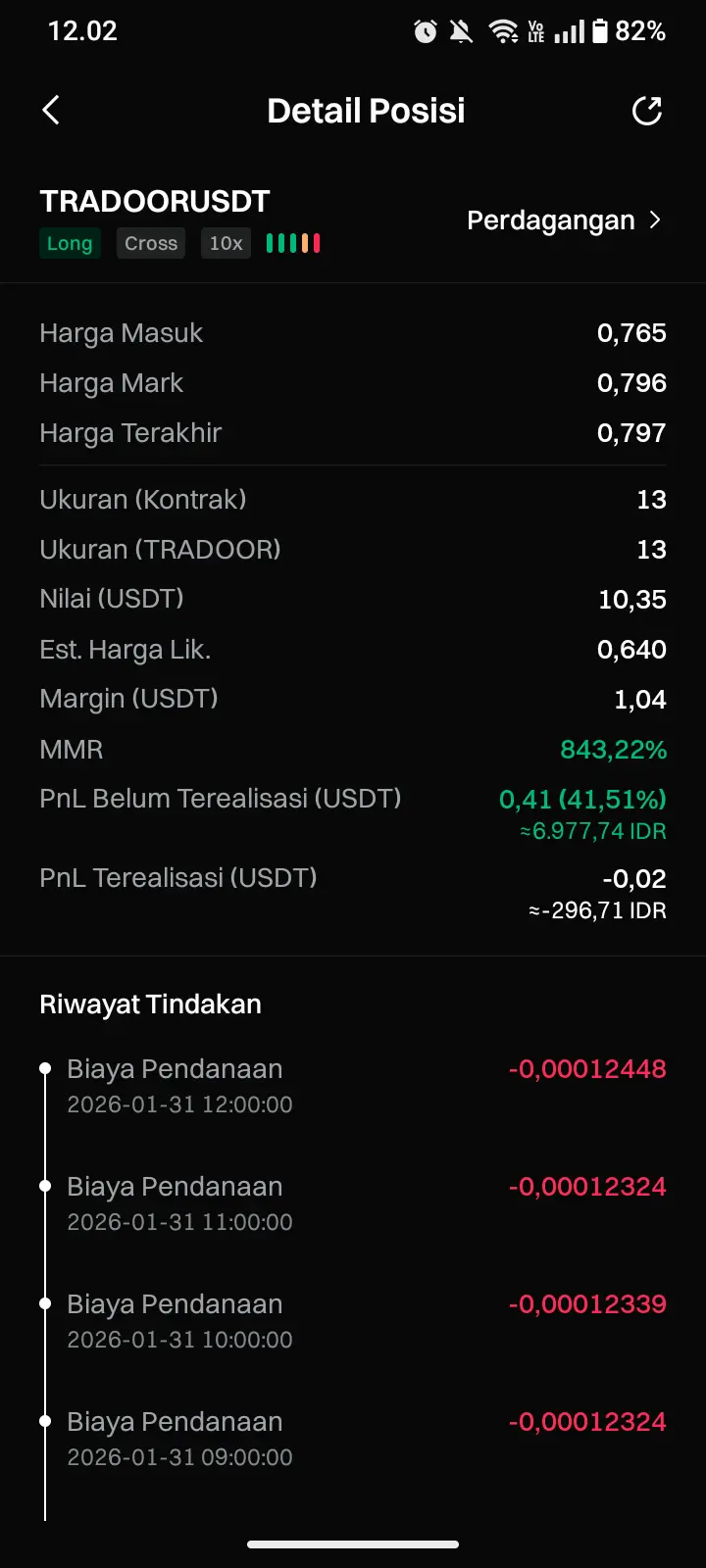

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- 2

- 3

- Repost

- Share

Short-TermContractKingS :

:

123466464664346868335588View More

#BITCOIN DAILY TF UPDATE :#BITCOIN moved as per the analysis and dropped till support zone. It broke the zone too and can #move further lower towards $74,600. Stay aware with your open positions and let the market stay down until any confirmation. $BTC#crypto

BTC1,66%

- Reward

- like

- Comment

- Repost

- Share

【$EGLD Signal】Empty Position + Volume-Price Divergence Observation

$EGLD Shows volume-price divergence after a slight increase, with open interest rising but price stagnating. Caution is advised for potential manipulation by the main players or distribution at high levels.

🎯 Direction: Empty Position

The current market lacks a clear driving structure, and price action is ambiguous. A slight increase accompanied by rising open interest but without effective breakout indicates genuine selling pressure above. Market sentiment is hesitant, with intensified bulls and bears struggle. Entering at

$EGLD Shows volume-price divergence after a slight increase, with open interest rising but price stagnating. Caution is advised for potential manipulation by the main players or distribution at high levels.

🎯 Direction: Empty Position

The current market lacks a clear driving structure, and price action is ambiguous. A slight increase accompanied by rising open interest but without effective breakout indicates genuine selling pressure above. Market sentiment is hesitant, with intensified bulls and bears struggle. Entering at

EGLD0,27%

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More29.82K Popularity

41.41K Popularity

359.12K Popularity

36.54K Popularity

57.89K Popularity

News

View MoreGate Research Institute: The market remains in defensive consolidation, with capital rotation shifting towards high-elasticity small-cap sectors

5 m

Huatai Macro: Wosh may promote the policy combination of "interest rate cuts + balance sheet reduction"

16 m

Santiment: The ongoing extreme panic in the crypto market is a "strong bullish" signal

18 m

Federal Reserve Chair Nominee Jerome Powell is revealed to have been involved in the Epstein case.

1 h

"Victory War God" shorts 136.15 BTC at 40x leverage, with an average entry price of $83,469.3

1 h

Pin