A New Era for Precious Metals on the Blockchain

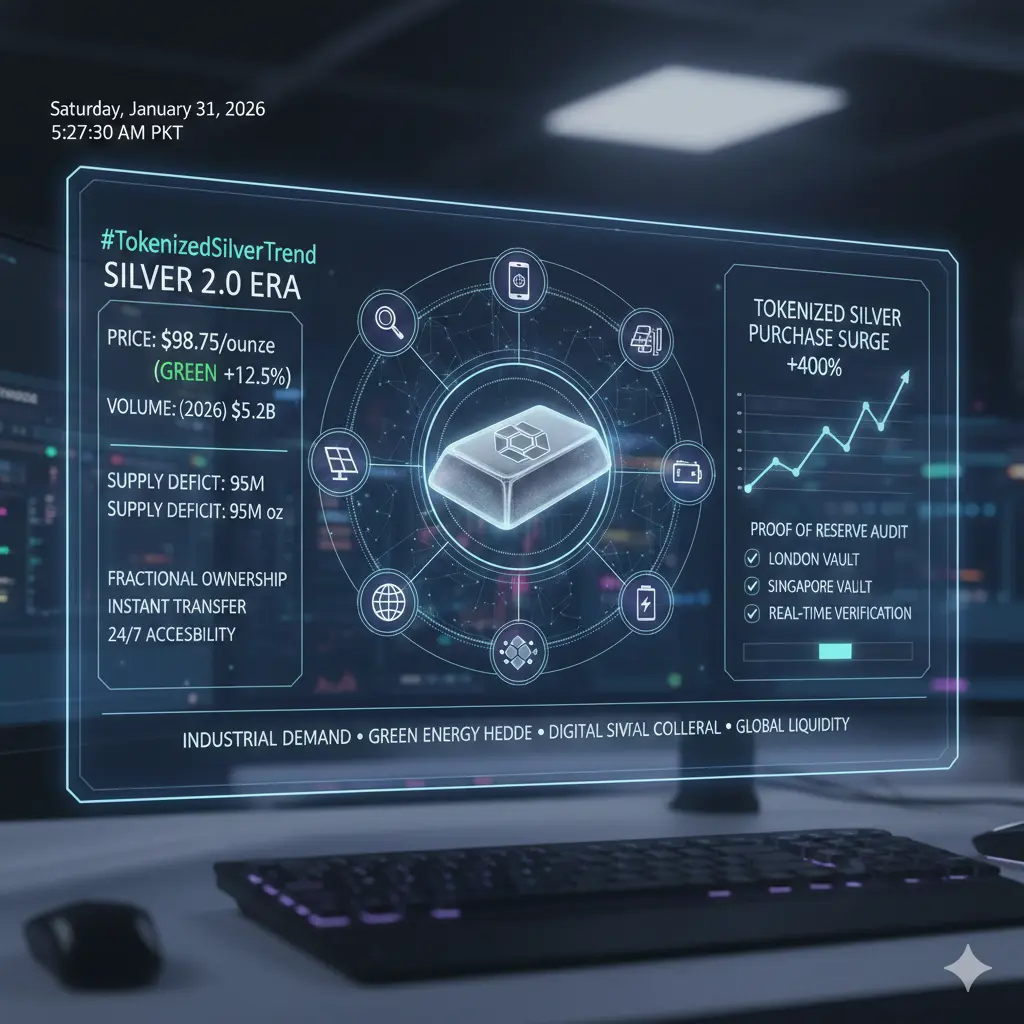

Silver is stepping into the digital age. With tokenized silver now on-chain, we’re witnessing a fundamental shift in how investors can access, trade, and integrate this historically undervalued metal into portfolios. This isn’t just about novelty or hype it’s about unlocking liquidity, fractional ownership, and programmable finance for a metal that has long been overshadowed by gold.

From my perspective, tokenized silver creates two simultaneous opportunities:

Catch-Up Potential vs Gold

Historically, silver has lagged gold in both price performance and market attention. Gold is the established safe haven, a primary store of value, and the default hedge in times of uncertainty. Silver, while valuable, has been more volatile and more closely tied to industrial demand. Tokenization could change that dynamic.

By moving silver on-chain, we create 24/7 access for investors worldwide, reduce barriers like storage and logistics, and open participation to both retail and institutional markets previously excluded. This increased accessibility could generate speculative momentum, effectively creating a catch-up trade relative to gold. Investors who have traditionally avoided silver for convenience or liquidity reasons now have a low-friction way to participate and that could drive short- to medium-term price alignment with gold trends.

Structural Allocation Opportunity

Tokenized silver isn’t just about chasing gold’s performance; it’s a standalone structural opportunity. Silver has unique characteristics that gold doesn’t:

Industrial demand exposure: Electronics, solar, and manufacturing cycles influence silver prices, offering a growth-linked complement to gold’s stability.

Portfolio diversification: Silver’s higher beta provides asymmetric upside potential, which can amplify returns when balanced correctly in a multi-asset strategy

Digital-native liquidity: On-chain silver allows for fractional holdings, instant settlement, and programmable finance applications, creating opportunities for DeFi integration, staking, and collateralized lending.

In my view, these factors make tokenized silver a compelling long-term portfolio allocation, not just a short-term momentum play. For investors seeking diversification, exposure to industrial trends, and a liquid digital metal, silver now offers all three and its underrepresentation relative to gold means there is significant structural upside if adoption grows.

Personal Insights and Strategy

Here’s how I personally approach tokenized silver:

I see short-term catch-up potential versus gold, particularly as adoption accelerates among retail and crypto-native investors. There’s a momentum angle here, but I’m cautious not to chase hype.

I treat silver as a strategic diversification asset: its industrial demand, dual monetary-industrial role, and now tokenized liquidity make it a natural complement to gold, BTC, and digital-native portfolios.

I’m watching adoption metrics closely: trading volume, staking participation, and integration into DeFi protocols will determine whether silver’s tokenization translates into structural value or remains a niche novelty.

For long-term investors, tokenized silver represents a convergence of traditional and digital finance. It provides the historical value of a physical asset, the accessibility and flexibility of blockchain, and optionality in portfolio construction that has never been available before.

Engagement Questions for the Community

💬 Do you view tokenized silver primarily as a catch-up trade to gold, or a distinct structural allocation in its own right?

How would you size silver in your long-term portfolio alongside gold, BTC, and other risk assets?

Are you exploring short-term on-chain strategies, or holding silver as a macro hedge and diversification tool?

What DeFi or digital finance applications for silver excite you most — staking, collateral, or programmable ownership?

Conclusion

Tokenized silver marks a new era for precious metals. It combines historical value with digital innovation, making silver more liquid, accessible, and strategically relevant than ever. From my perspective, this is one of the most exciting developments in precious metals and digital finance in years. For investors who embrace both short-term momentum and long-term structural opportunity, tokenized silver could redefine how we think about metals in portfolios, bridging traditional finance and the on-chain world.

In short: Silver is no longer “the overlooked metal.” On-chain, it’s accessible, programmable, and ready for both traders and strategic investors. This is a moment to watch, learn, and position wisely.

#TokenizedSilverTrend

Silver is stepping into the digital age. With tokenized silver now on-chain, we’re witnessing a fundamental shift in how investors can access, trade, and integrate this historically undervalued metal into portfolios. This isn’t just about novelty or hype it’s about unlocking liquidity, fractional ownership, and programmable finance for a metal that has long been overshadowed by gold.

From my perspective, tokenized silver creates two simultaneous opportunities:

Catch-Up Potential vs Gold

Historically, silver has lagged gold in both price performance and market attention. Gold is the established safe haven, a primary store of value, and the default hedge in times of uncertainty. Silver, while valuable, has been more volatile and more closely tied to industrial demand. Tokenization could change that dynamic.

By moving silver on-chain, we create 24/7 access for investors worldwide, reduce barriers like storage and logistics, and open participation to both retail and institutional markets previously excluded. This increased accessibility could generate speculative momentum, effectively creating a catch-up trade relative to gold. Investors who have traditionally avoided silver for convenience or liquidity reasons now have a low-friction way to participate and that could drive short- to medium-term price alignment with gold trends.

Structural Allocation Opportunity

Tokenized silver isn’t just about chasing gold’s performance; it’s a standalone structural opportunity. Silver has unique characteristics that gold doesn’t:

Industrial demand exposure: Electronics, solar, and manufacturing cycles influence silver prices, offering a growth-linked complement to gold’s stability.

Portfolio diversification: Silver’s higher beta provides asymmetric upside potential, which can amplify returns when balanced correctly in a multi-asset strategy

Digital-native liquidity: On-chain silver allows for fractional holdings, instant settlement, and programmable finance applications, creating opportunities for DeFi integration, staking, and collateralized lending.

In my view, these factors make tokenized silver a compelling long-term portfolio allocation, not just a short-term momentum play. For investors seeking diversification, exposure to industrial trends, and a liquid digital metal, silver now offers all three and its underrepresentation relative to gold means there is significant structural upside if adoption grows.

Personal Insights and Strategy

Here’s how I personally approach tokenized silver:

I see short-term catch-up potential versus gold, particularly as adoption accelerates among retail and crypto-native investors. There’s a momentum angle here, but I’m cautious not to chase hype.

I treat silver as a strategic diversification asset: its industrial demand, dual monetary-industrial role, and now tokenized liquidity make it a natural complement to gold, BTC, and digital-native portfolios.

I’m watching adoption metrics closely: trading volume, staking participation, and integration into DeFi protocols will determine whether silver’s tokenization translates into structural value or remains a niche novelty.

For long-term investors, tokenized silver represents a convergence of traditional and digital finance. It provides the historical value of a physical asset, the accessibility and flexibility of blockchain, and optionality in portfolio construction that has never been available before.

Engagement Questions for the Community

💬 Do you view tokenized silver primarily as a catch-up trade to gold, or a distinct structural allocation in its own right?

How would you size silver in your long-term portfolio alongside gold, BTC, and other risk assets?

Are you exploring short-term on-chain strategies, or holding silver as a macro hedge and diversification tool?

What DeFi or digital finance applications for silver excite you most — staking, collateral, or programmable ownership?

Conclusion

Tokenized silver marks a new era for precious metals. It combines historical value with digital innovation, making silver more liquid, accessible, and strategically relevant than ever. From my perspective, this is one of the most exciting developments in precious metals and digital finance in years. For investors who embrace both short-term momentum and long-term structural opportunity, tokenized silver could redefine how we think about metals in portfolios, bridging traditional finance and the on-chain world.

In short: Silver is no longer “the overlooked metal.” On-chain, it’s accessible, programmable, and ready for both traders and strategic investors. This is a moment to watch, learn, and position wisely.

#TokenizedSilverTrend