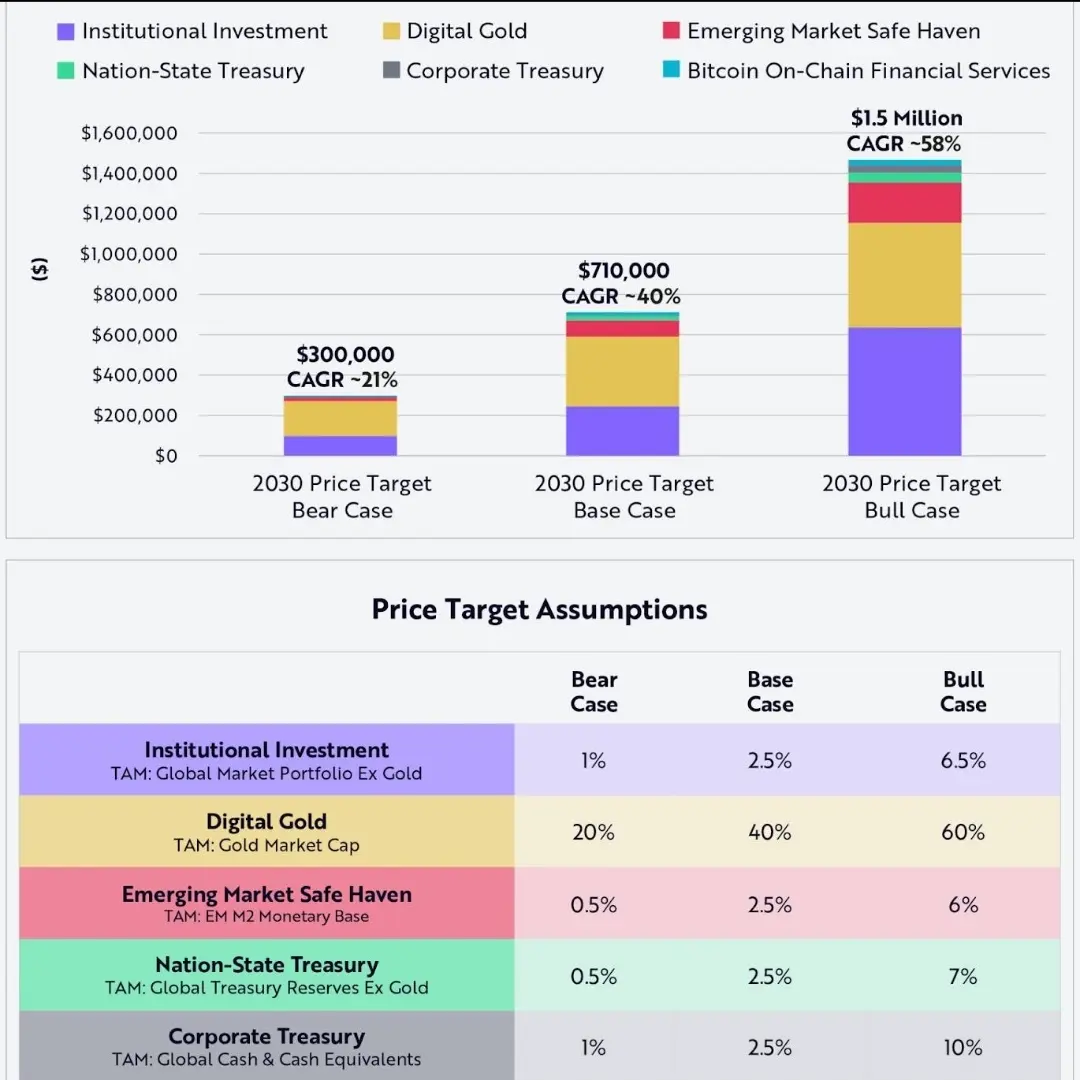

🚨 #BTC Bullish case of 1.5 million Dollar unchanged: Cathie Wood

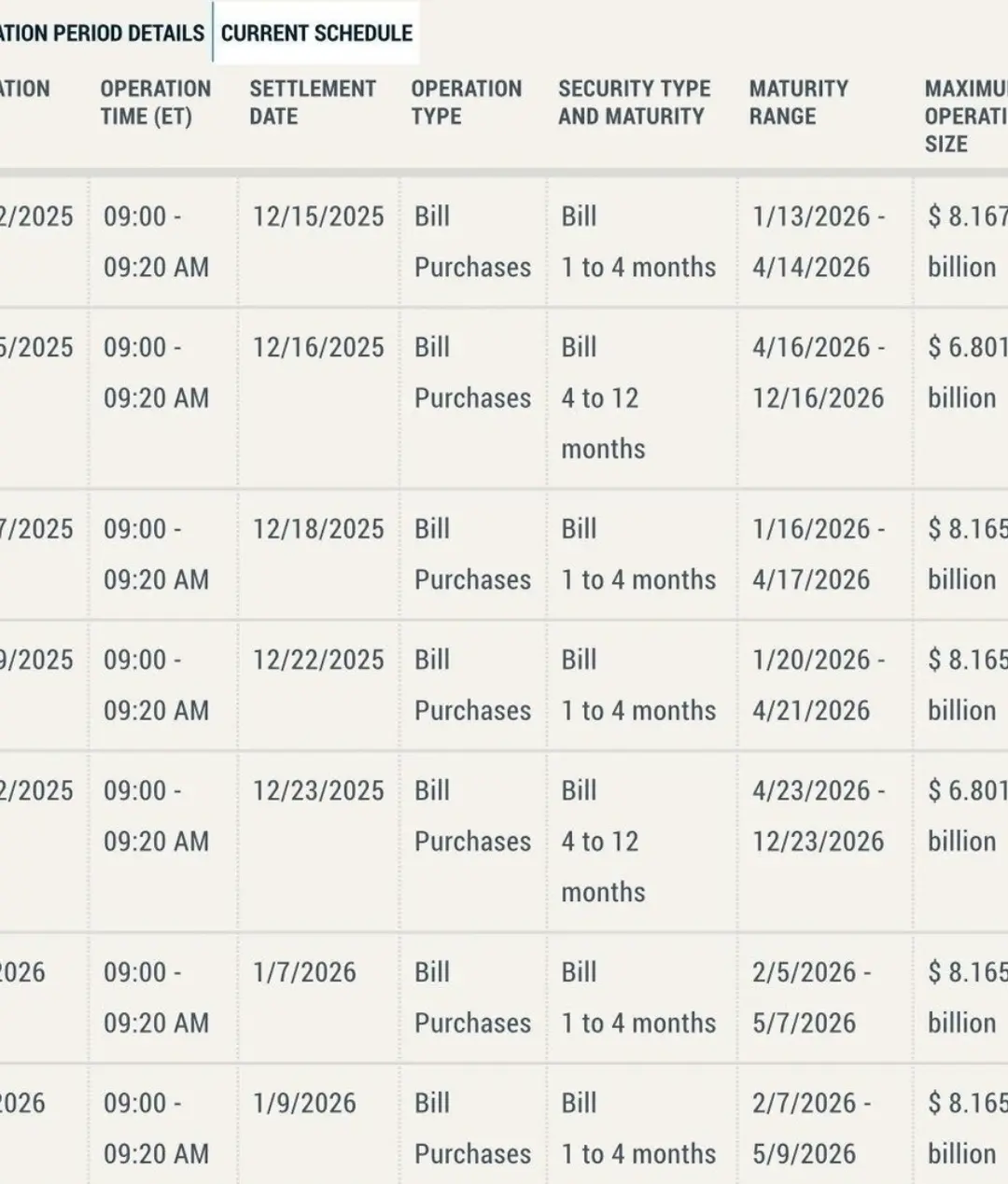

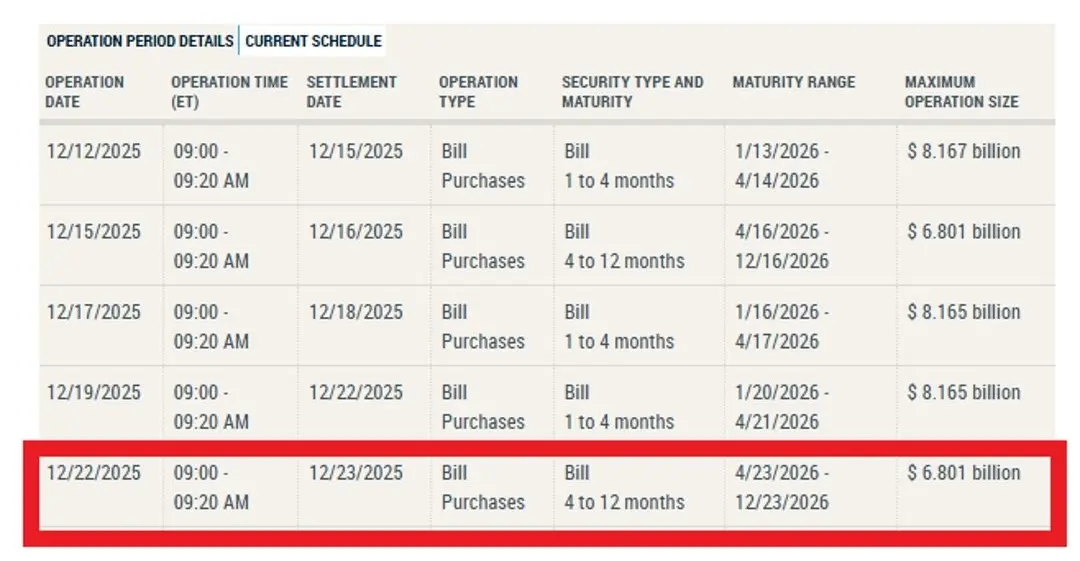

According to Ark-invest: liquidity is returning: $70 billion has flowed in since the closure of the U.S. government, with an expected influx of another $300 billion over the next 5-6 weeks. #الاحتياطي.الفيدرالي ended the quantitative easing program on December 1, and may shift to quantitative easing, supporting stocks and cryptocurrencies.

Wood says that the current "liquidity crunch" in cryptocurrencies and artificial intelligence may soon reverse. Despite market corrections and stablecoins that have diminished the role of #B

View OriginalAccording to Ark-invest: liquidity is returning: $70 billion has flowed in since the closure of the U.S. government, with an expected influx of another $300 billion over the next 5-6 weeks. #الاحتياطي.الفيدرالي ended the quantitative easing program on December 1, and may shift to quantitative easing, supporting stocks and cryptocurrencies.

Wood says that the current "liquidity crunch" in cryptocurrencies and artificial intelligence may soon reverse. Despite market corrections and stablecoins that have diminished the role of #B