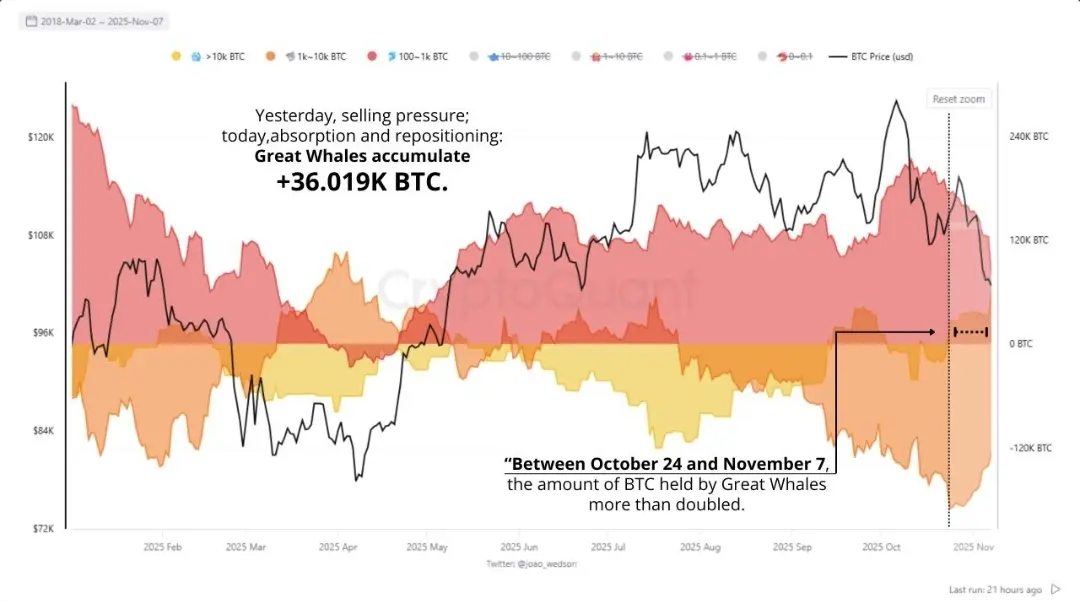

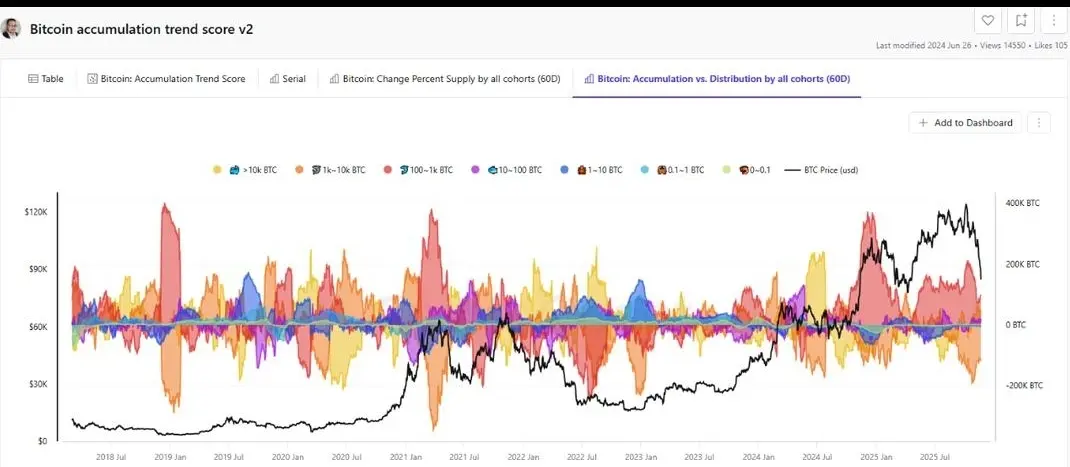

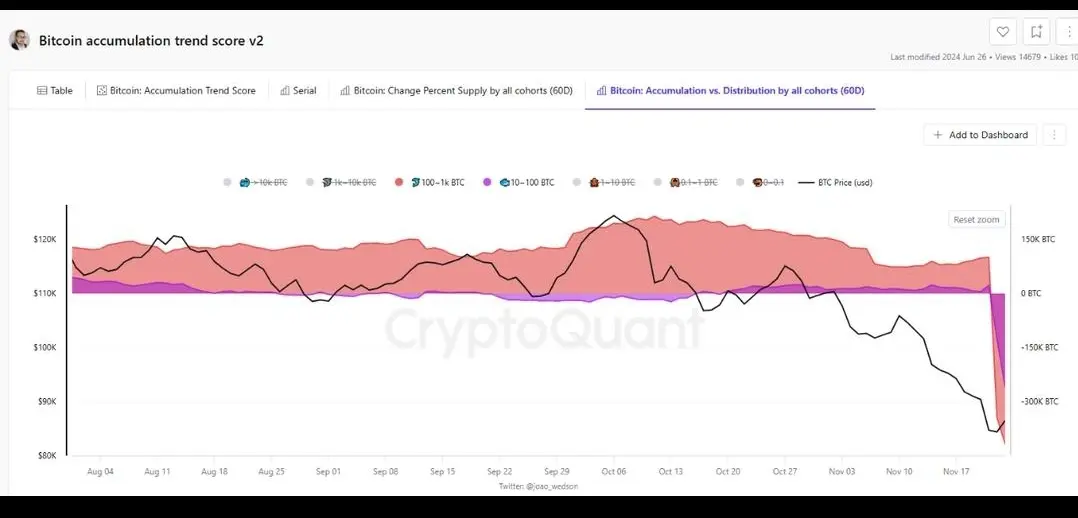

Old whales exit, and new whales enter

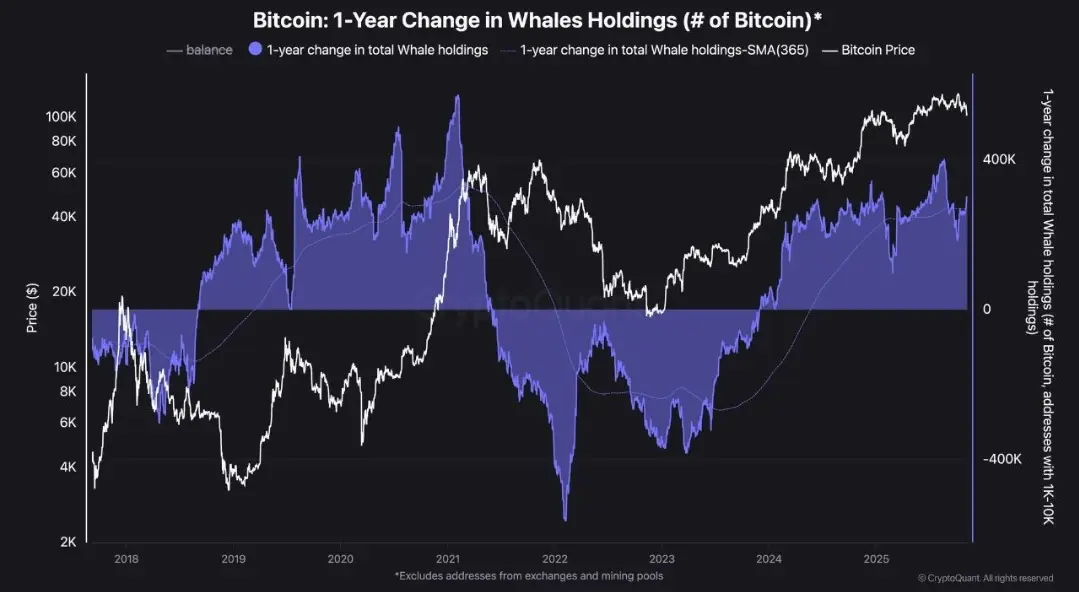

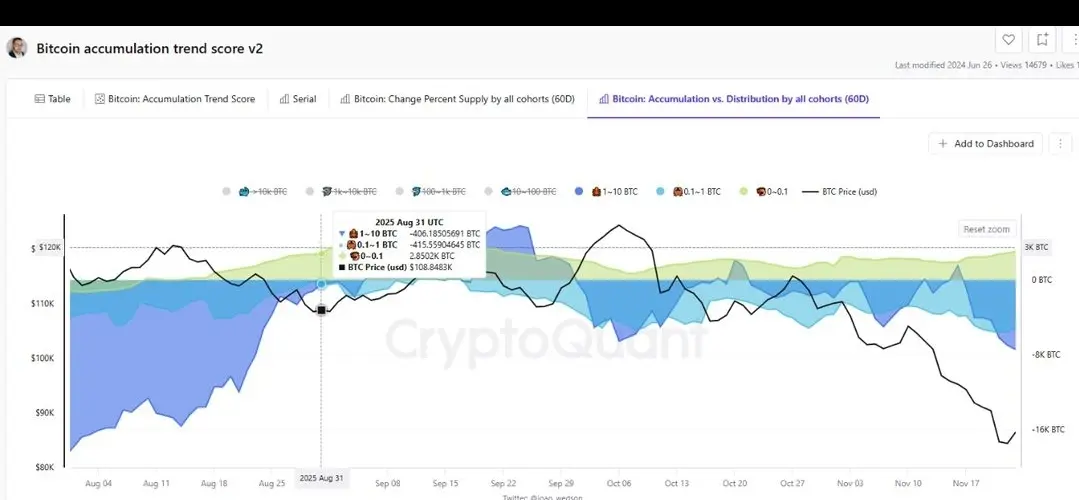

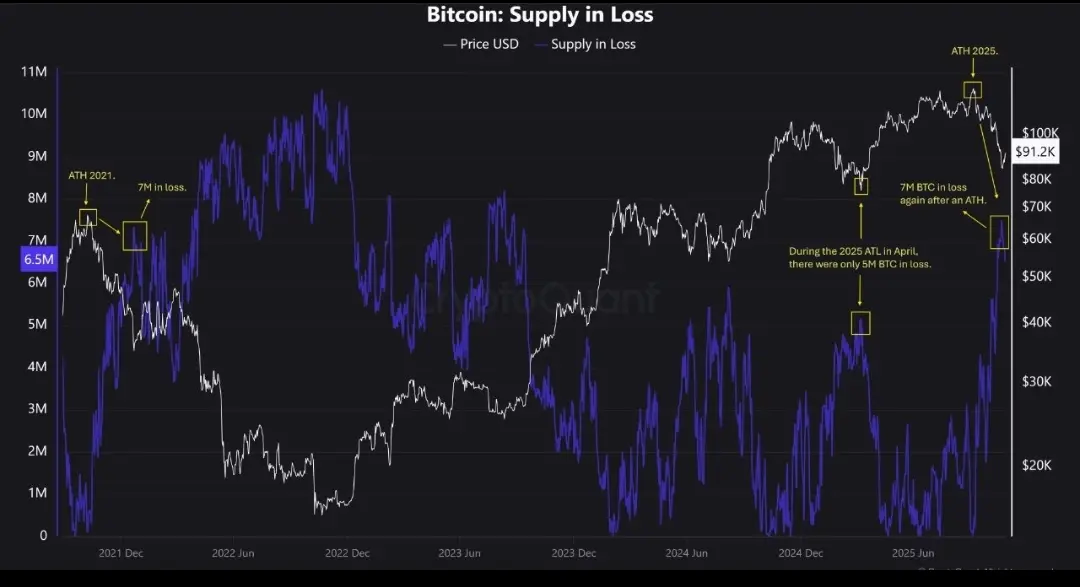

Some early whales have recently sold — and that’s a fact. But the overall trend still shows an increase in whale holdings over the past year.

The difference now is liquidity:

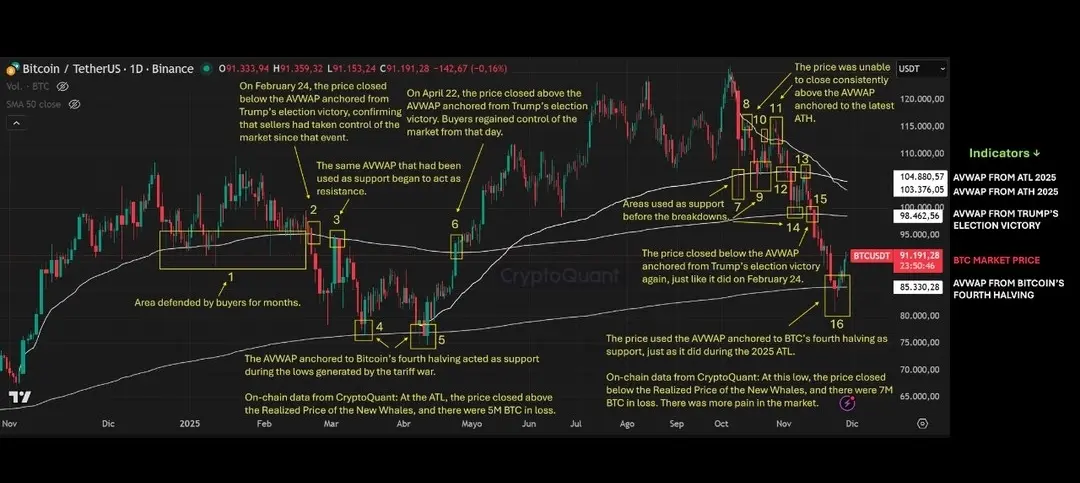

In previous cycles, it was difficult for large holders to exit without a market crash. With ETFs, larger market caps, and institutional demand, they can finally take profits without breaking the price.

So, we are seeing a rotation in investments, not an exit:

🐋 Old whales reduce their exposure

🐋 New whales and institutions accumulate

🐋 Net whale holdings have started rising again s

Some early whales have recently sold — and that’s a fact. But the overall trend still shows an increase in whale holdings over the past year.

The difference now is liquidity:

In previous cycles, it was difficult for large holders to exit without a market crash. With ETFs, larger market caps, and institutional demand, they can finally take profits without breaking the price.

So, we are seeing a rotation in investments, not an exit:

🐋 Old whales reduce their exposure

🐋 New whales and institutions accumulate

🐋 Net whale holdings have started rising again s