# BlockchainFinance

5.49K

MissCrypto

#FranklinAdvancesTokenizedMMFs

Institutional Finance Meets Blockchain Infrastructure

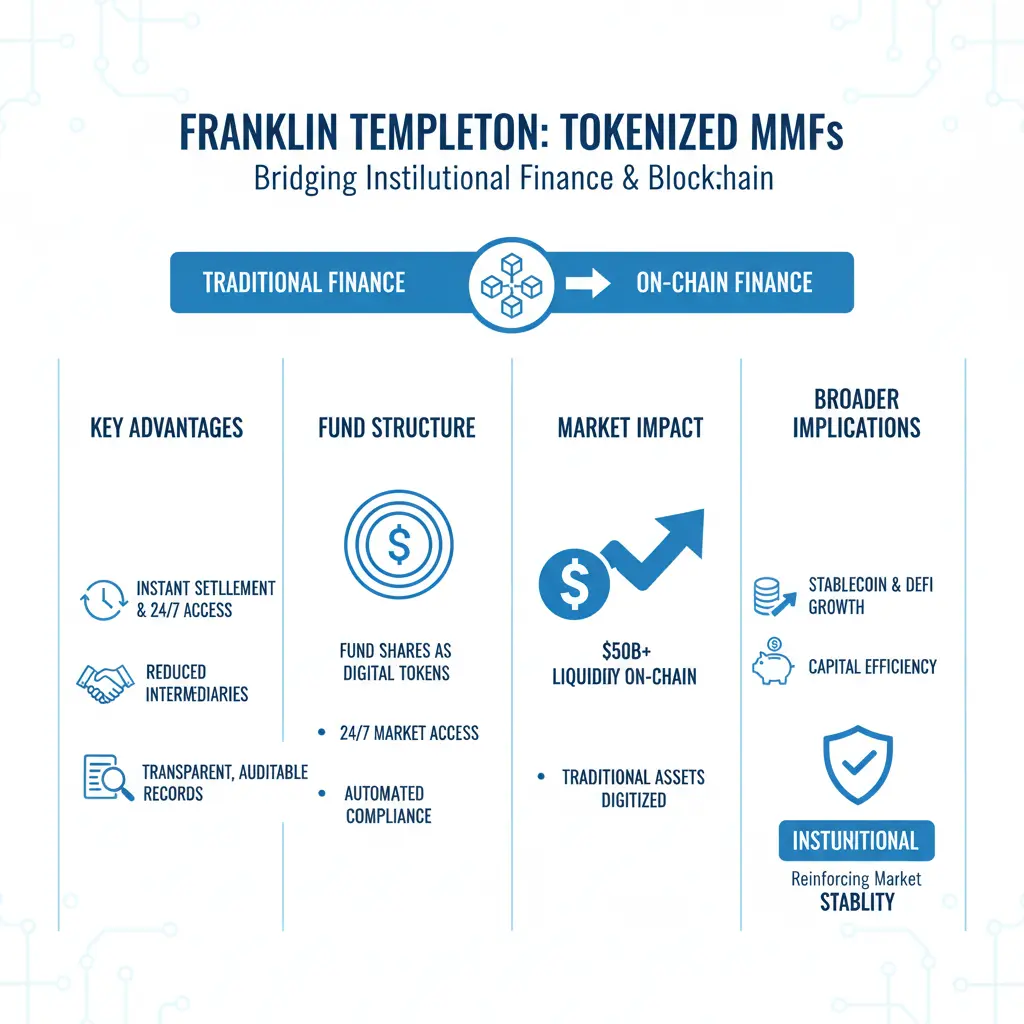

Franklin Templeton’s expansion of tokenized Money Market Funds (MMFs) marks a defining step in the convergence of traditional finance and blockchain technology. This development is not a digital experiment—it represents structural modernization of capital markets, where regulated, high-liquidity financial instruments are being integrated directly into on-chain ecosystems.

1️⃣ Blockchain-Based MMF Expansion

By deploying MMFs on distributed ledger infrastructure, Franklin Templeton is transforming traditional se

Institutional Finance Meets Blockchain Infrastructure

Franklin Templeton’s expansion of tokenized Money Market Funds (MMFs) marks a defining step in the convergence of traditional finance and blockchain technology. This development is not a digital experiment—it represents structural modernization of capital markets, where regulated, high-liquidity financial instruments are being integrated directly into on-chain ecosystems.

1️⃣ Blockchain-Based MMF Expansion

By deploying MMFs on distributed ledger infrastructure, Franklin Templeton is transforming traditional se

- Reward

- 7

- 11

- Repost

- Share

CryptoEye :

:

LFG 🔥View More

#SEConTokenizedSecurities

The world of finance is rapidly evolving, and one of the most transformative trends today is the rise of tokenized securities. Tokenization essentially means converting traditional financial assets, like stocks, bonds, or real estate, into digital tokens on a blockchain. This innovation is reshaping how investors access and trade assets, making markets more inclusive, transparent, and efficient.

Tokenized securities offer liquidity in previously illiquid markets. Traditionally, assets such as private equity or real estate required significant capital and long holding

The world of finance is rapidly evolving, and one of the most transformative trends today is the rise of tokenized securities. Tokenization essentially means converting traditional financial assets, like stocks, bonds, or real estate, into digital tokens on a blockchain. This innovation is reshaping how investors access and trade assets, making markets more inclusive, transparent, and efficient.

Tokenized securities offer liquidity in previously illiquid markets. Traditionally, assets such as private equity or real estate required significant capital and long holding

- Reward

- 10

- 12

- Repost

- Share

Vortex_King :

:

Buy To Earn 💎View More

#SEConTokenizedSecurities

The world of finance is rapidly evolving, and one of the most transformative trends today is the rise of tokenized securities. Tokenization essentially means converting traditional financial assets, like stocks, bonds, or real estate, into digital tokens on a blockchain. This innovation is reshaping how investors access and trade assets, making markets more inclusive, transparent, and efficient.

Tokenized securities offer liquidity in previously illiquid markets. Traditionally, assets such as private equity or real estate required significant capital and long holding

The world of finance is rapidly evolving, and one of the most transformative trends today is the rise of tokenized securities. Tokenization essentially means converting traditional financial assets, like stocks, bonds, or real estate, into digital tokens on a blockchain. This innovation is reshaping how investors access and trade assets, making markets more inclusive, transparent, and efficient.

Tokenized securities offer liquidity in previously illiquid markets. Traditionally, assets such as private equity or real estate required significant capital and long holding

- Reward

- 2

- Comment

- Repost

- Share

#SEConTokenizedSecurities The SEC Lays Down the Law for Tokenized Securities 🏛️⛓️

The regulatory fog is finally lifting. Yesterday, the SEC released a definitive statement clarifying that while the format of a security may change (from paper/digital to token), the legal obligations do not. The New Framework:

Issuer-Sponsored Tokens: These are the "gold standard." The company natively issues tokens where the blockchain is the official shareholder register.

Third-Party Tokenization: Includes custodial models (tokens representing shares held elsewhere) and synthetic models. The SEC warned these

The regulatory fog is finally lifting. Yesterday, the SEC released a definitive statement clarifying that while the format of a security may change (from paper/digital to token), the legal obligations do not. The New Framework:

Issuer-Sponsored Tokens: These are the "gold standard." The company natively issues tokens where the blockchain is the official shareholder register.

Third-Party Tokenization: Includes custodial models (tokens representing shares held elsewhere) and synthetic models. The SEC warned these

- Reward

- 5

- 5

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊View More

Dinari has announced a major collaboration with Chainlink to bring the next generation of financial data on chain. The partnership will support the tokenization of the upcoming S and P Dow Jones Crypto Market Index. This index known as the S and P Digital Markets 50 will track a basket of blockchain focused stocks and digital assets providing investors with an easy way to gain exposure to the wider crypto economy through traditional markets.

Chainlink’s decentralized oracle network will play a crucial role in this process. It will feed reliable and verified real world data to support the creat

Chainlink’s decentralized oracle network will play a crucial role in this process. It will feed reliable and verified real world data to support the creat

LINK-0,47%

- Reward

- 3

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

23.37K Popularity

10.2K Popularity

4.83K Popularity

36.84K Popularity

251.53K Popularity

154.83K Popularity

5.52K Popularity

4.93K Popularity

3.19K Popularity

4.95K Popularity

121.06K Popularity

26.1K Popularity

22.46K Popularity

19.85K Popularity

632 Popularity

News

View MoreData: 257.76 BTC transferred into BitGo, valued at approximately 16.92 million USD

2 m

Data: 671.41 BTC transferred from an anonymous address, valued at approximately $44,160,000

22 m

Data: 745.24 BTC transferred from an anonymous address to Wintermute, worth approximately 7.43 million USD

29 m

Data: 113 BTC transferred from an anonymous address, routed through a relay, and flowed into Wintermute

32 m

Data: 40.49 BTC transferred out from Wintermute, worth approximately 2,661,900 USD.

39 m

Pin