# ETHEREUM

605.96K

TAKD

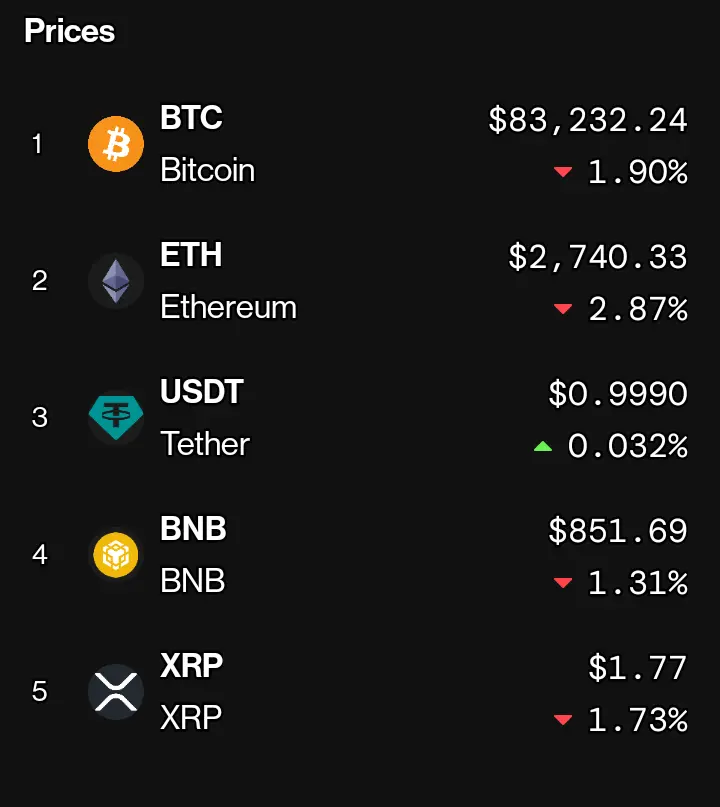

📊 Crypto Market Update

Bitcoin (BTC) trading at $83,232.24 📉 -1.90%

Ethereum (ETH) at $2,740.33 📉 -2.87%

Tether (USDT) stable at $0.9990 📈 +0.032%

BNB at $851.69 📉 -1.31%

XRP at $1.77 📉 -1.73%

Markets showing some red today with most major cryptocurrencies experiencing minor pullbacks. USDT holding steady near peg.

#Crypto #Bitcoin #Ethereum

Bitcoin (BTC) trading at $83,232.24 📉 -1.90%

Ethereum (ETH) at $2,740.33 📉 -2.87%

Tether (USDT) stable at $0.9990 📈 +0.032%

BNB at $851.69 📉 -1.31%

XRP at $1.77 📉 -1.73%

Markets showing some red today with most major cryptocurrencies experiencing minor pullbacks. USDT holding steady near peg.

#Crypto #Bitcoin #Ethereum

- Reward

- 3

- Comment

- Repost

- Share

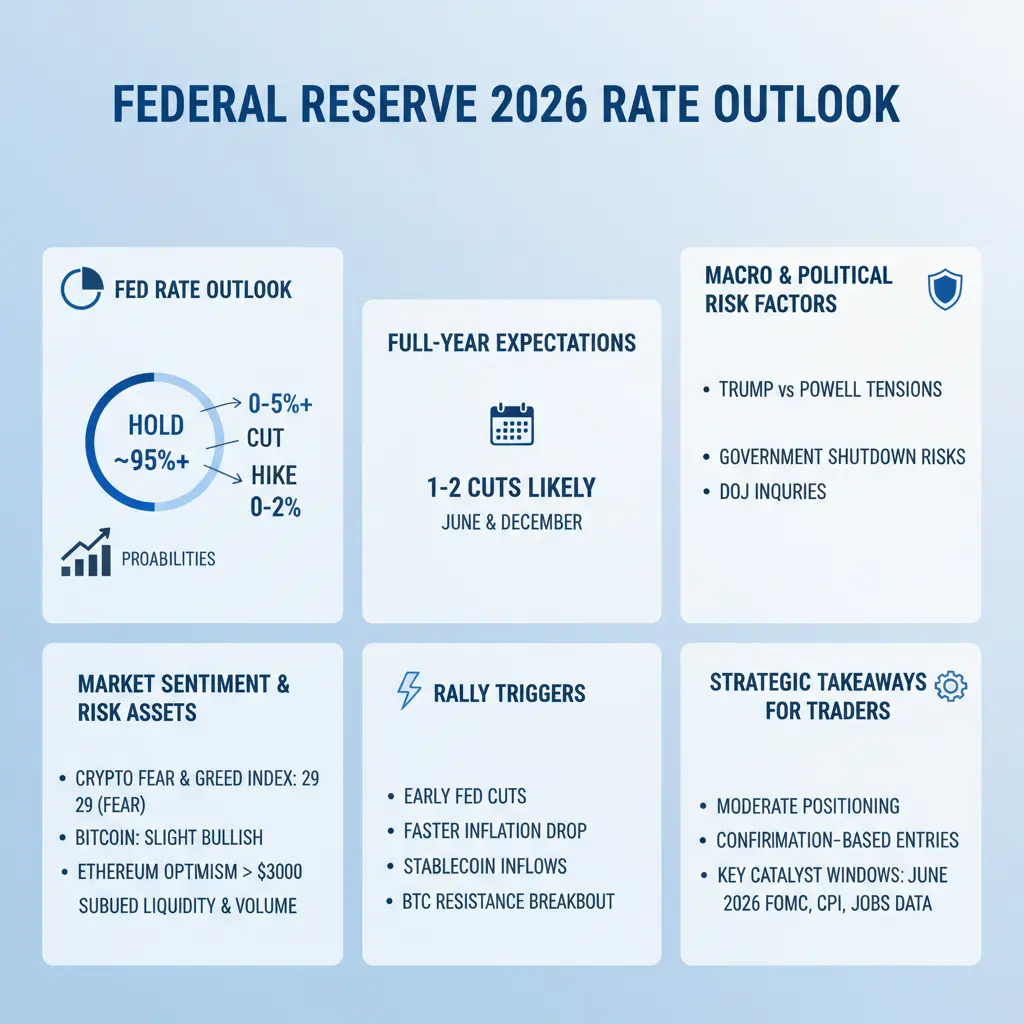

#FedRateDecisionApproaches 🚨

The Federal Reserve’s interest rate decision this Wednesday is widely expected to remain on hold, with markets assigning near-zero probability to an immediate hike or cut.

After three cuts at the end of 2025, the benchmark rate sits at 3.50%–3.75%, and policymakers are cautious as they monitor inflation stability and labor market strength.

📊 Fed Rate Outlook (2026)

This Meeting:

Hold probability: ~95%+

Rate cut probability: ~0–5%

Rate hike probability: ~0–2%

Full-Year Expectations: 1–2 rate cuts likely, primarily in June 2026, with a possible second cut in Decemb

The Federal Reserve’s interest rate decision this Wednesday is widely expected to remain on hold, with markets assigning near-zero probability to an immediate hike or cut.

After three cuts at the end of 2025, the benchmark rate sits at 3.50%–3.75%, and policymakers are cautious as they monitor inflation stability and labor market strength.

📊 Fed Rate Outlook (2026)

This Meeting:

Hold probability: ~95%+

Rate cut probability: ~0–5%

Rate hike probability: ~0–2%

Full-Year Expectations: 1–2 rate cuts likely, primarily in June 2026, with a possible second cut in Decemb

- Reward

- 8

- 11

- Repost

- Share

NovaCryptoGirl :

:

HODL Tight 💪View More

$ETH /USDT ASAP will hit the first target 3700$

#Ethereum is showing solid strength around the $2,700 daily support, and so far, buyers are doing their job. Price is holding where it matters, which keeps the door open for a bullish reversal rather than a deeper breakdown.

If this support continues to hold, the first real upside target sits around $3,700, where heavy resistance comes in. A clean break above $3,700, especially with strong volume, would be a big deal — that’s when momentum could really start to expand.

From there, $ETH could be looking at a run back toward prior highs or even

#Ethereum is showing solid strength around the $2,700 daily support, and so far, buyers are doing their job. Price is holding where it matters, which keeps the door open for a bullish reversal rather than a deeper breakdown.

If this support continues to hold, the first real upside target sits around $3,700, where heavy resistance comes in. A clean break above $3,700, especially with strong volume, would be a big deal — that’s when momentum could really start to expand.

From there, $ETH could be looking at a run back toward prior highs or even

ETH-4,21%

- Reward

- 1

- 2

- Repost

- Share

EagleEye :

:

This post is truly impressive! I really appreciate the effort and creativity behind it.View More

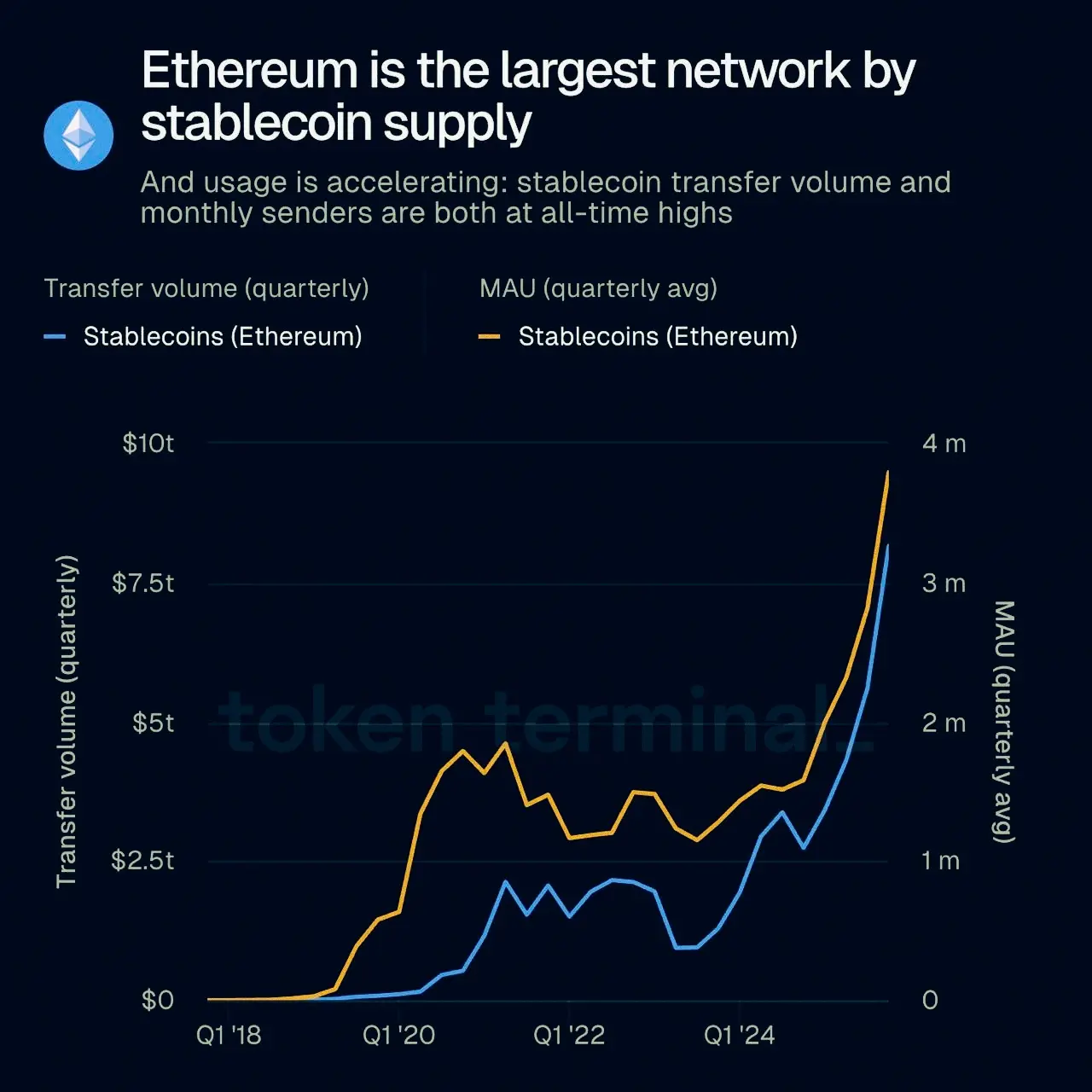

🔥 NEW: According to Token Terminal, Ethereum leads all networks in stablecoin supply, usage is increasing, and both transfer volume and monthly active senders reached all-time highs.

$ETH

#Ethereum #FedRateDecisionApproaches #CryptoRegulationNewProgress #CryptoMarketWatch #GateLiveMiningProgramPublicBeta

$ETH

#Ethereum #FedRateDecisionApproaches #CryptoRegulationNewProgress #CryptoMarketWatch #GateLiveMiningProgramPublicBeta

ETH-4,21%

- Reward

- 2

- Comment

- Repost

- Share

Old money wins (12-month snapshot):

🟡 Gold: +80%

⚪ Silver: +242%

Crypto portfolio check:

#Bitcoin : −14%

#Ethereum : −11%

🔻Altcoin bloodbath:

$DOGE: (−68%)

$LINK: (−48%)

$AVAX: (−68%)

$SHIB: (−65%)

$TON: (−71%)

$UNI: (−65%)

$PEPE: (−72%)

$ONDO: (−74%)

$APT: (−83%)

$TRUMP: (−82%)

$SEI: (−73%)

$INJ: (−80%)

$MELANIA: (−98.8%)

#GOLD is the new Boss😒🔥

I don’t make the rules

$Q $KITE $WLD

🟡 Gold: +80%

⚪ Silver: +242%

Crypto portfolio check:

#Bitcoin : −14%

#Ethereum : −11%

🔻Altcoin bloodbath:

$DOGE: (−68%)

$LINK: (−48%)

$AVAX: (−68%)

$SHIB: (−65%)

$TON: (−71%)

$UNI: (−65%)

$PEPE: (−72%)

$ONDO: (−74%)

$APT: (−83%)

$TRUMP: (−82%)

$SEI: (−73%)

$INJ: (−80%)

$MELANIA: (−98.8%)

#GOLD is the new Boss😒🔥

I don’t make the rules

$Q $KITE $WLD

- Reward

- like

- Comment

- Repost

- Share

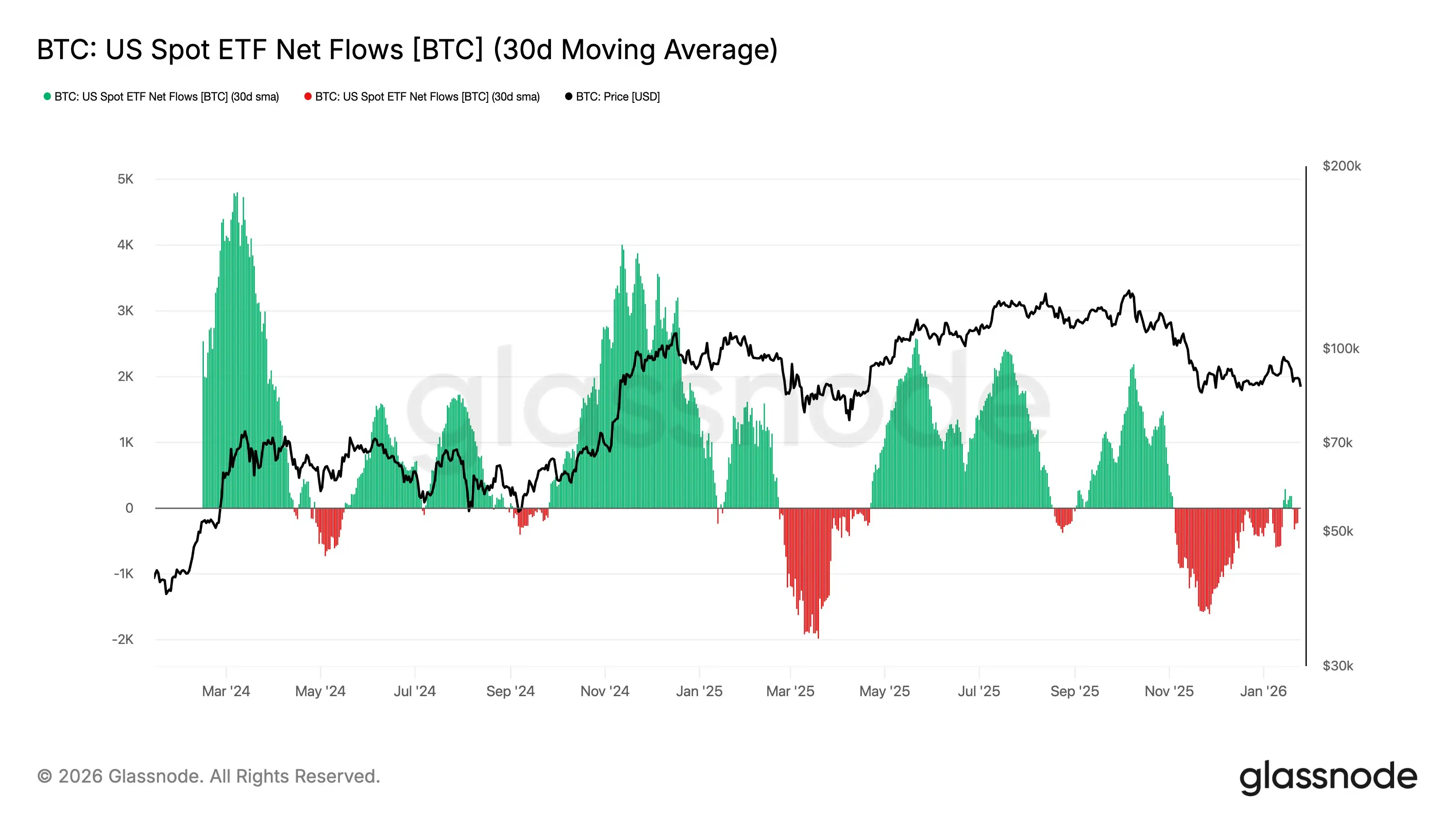

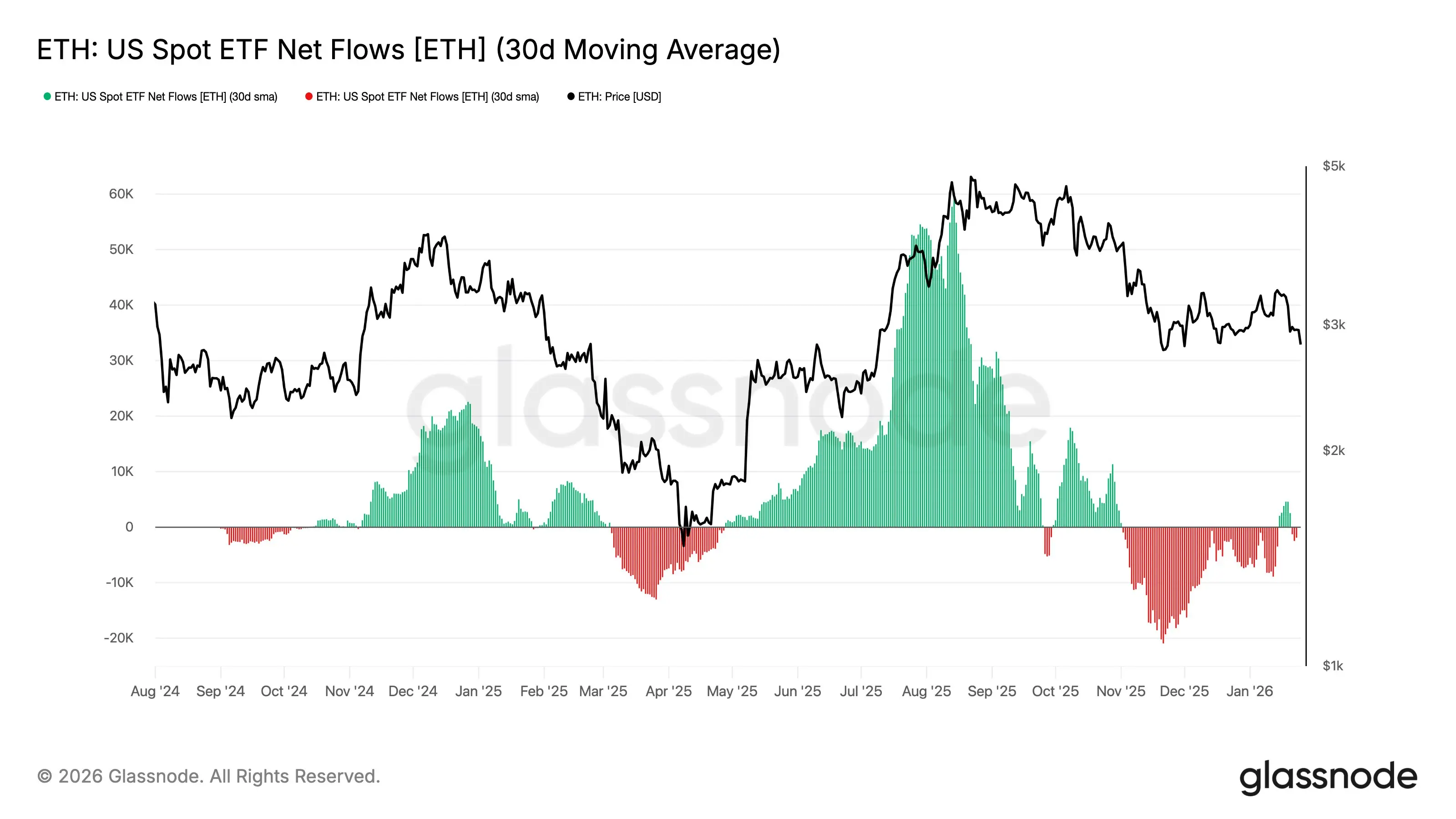

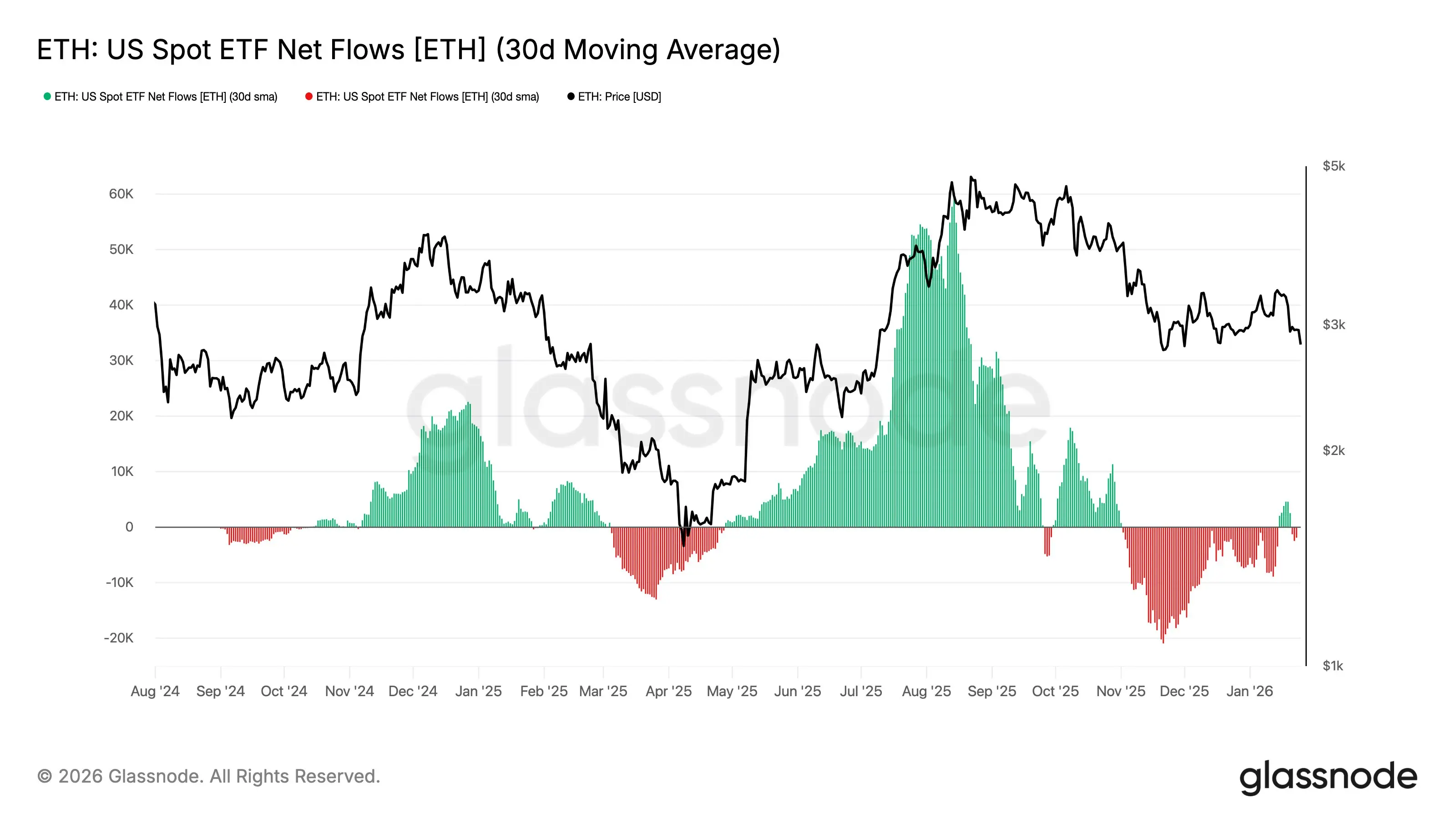

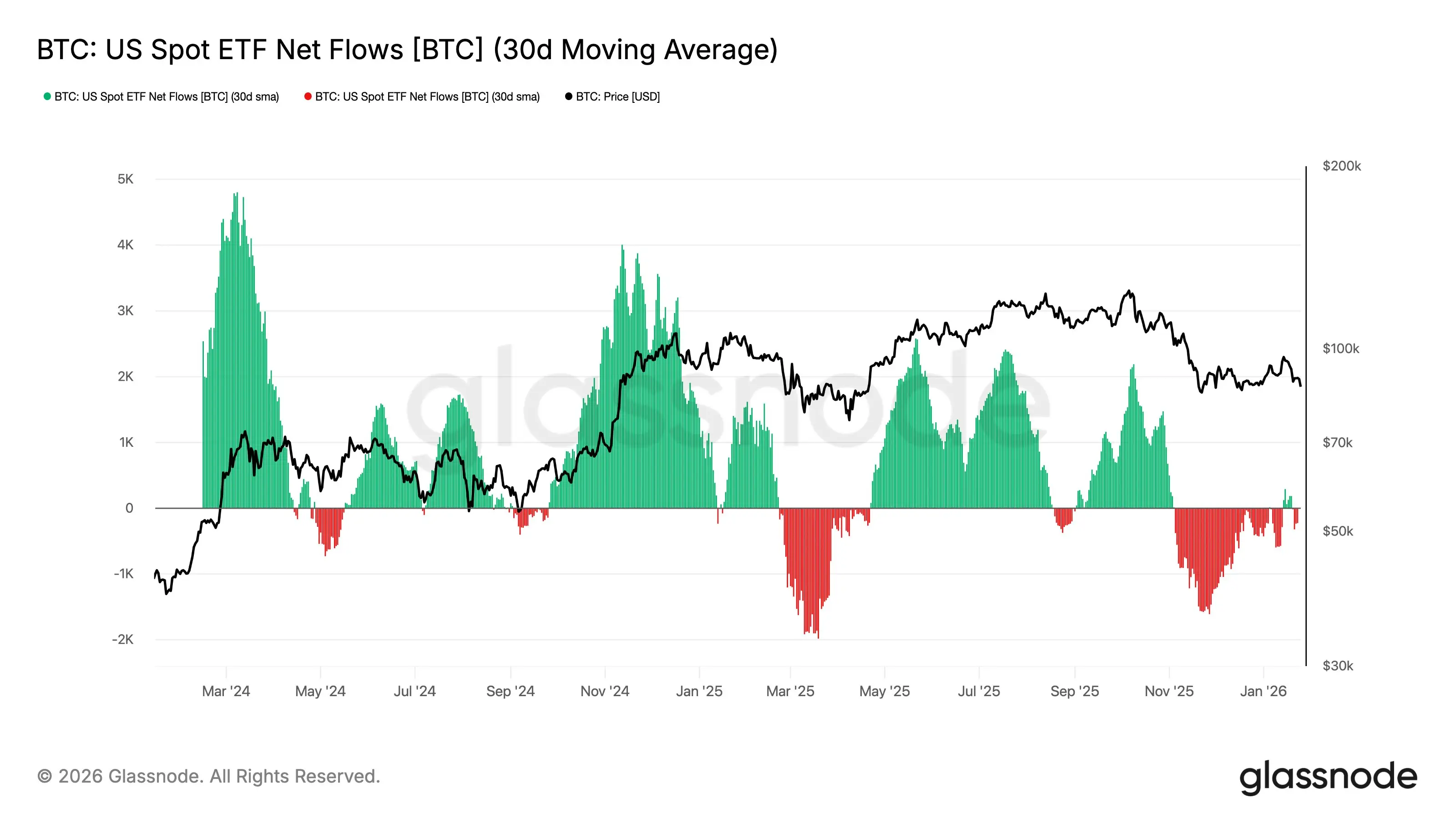

ETF Flow Divergence Highlights Structural Differences Between #Bitcoin and #Ethereum Demand

The 30-day moving average of US spot ETF net flows reveals a clear divergence between Bitcoin and Ethereum, offering insight into how institutional demand is evolving across the two assets. While both benefited from ETF-driven inflows during the mid-2025 risk-on phase, the persistence and price impact of those flows differ materially.

Bitcoin ETF flows show a more cyclical but resilient pattern. Periods of strong inflows tend to coincide with sustained price appreciation, and even during outflow phases,

The 30-day moving average of US spot ETF net flows reveals a clear divergence between Bitcoin and Ethereum, offering insight into how institutional demand is evolving across the two assets. While both benefited from ETF-driven inflows during the mid-2025 risk-on phase, the persistence and price impact of those flows differ materially.

Bitcoin ETF flows show a more cyclical but resilient pattern. Periods of strong inflows tend to coincide with sustained price appreciation, and even during outflow phases,

- Reward

- 1

- Comment

- Repost

- Share

ETF Flow Divergence Highlights Structural Differences Between #Bitcoin and #Ethereum Demand

The 30-day moving average of US spot ETF net flows reveals a clear divergence between Bitcoin and Ethereum, offering insight into how institutional demand is evolving across the two assets. While both benefited from ETF-driven inflows during the mid-2025 risk-on phase, the persistence and price impact of those flows differ materially.

Bitcoin ETF flows show a more cyclical but resilient pattern. Periods of strong inflows tend to coincide with sustained price appreciation, and even during outflow phases,

The 30-day moving average of US spot ETF net flows reveals a clear divergence between Bitcoin and Ethereum, offering insight into how institutional demand is evolving across the two assets. While both benefited from ETF-driven inflows during the mid-2025 risk-on phase, the persistence and price impact of those flows differ materially.

Bitcoin ETF flows show a more cyclical but resilient pattern. Periods of strong inflows tend to coincide with sustained price appreciation, and even during outflow phases,

- Reward

- 1

- 2

- Repost

- Share

CryptoZeno :

:

Good luck everyone View More

$ETH is sitting at 3,021.49, and this range looks like a spot where a bounce setup can develop if the market cooperates.

Entry Zone: 3,020.00 – 3,030.00

TP 1: 3,045.00

TP 2: 3,060.00

TP 3: 3,080.00

Stop Loss: 3,010.00

Clean structure...just let it play within the range. #ETH #Ethereum #Rmj-Trades

Entry Zone: 3,020.00 – 3,030.00

TP 1: 3,045.00

TP 2: 3,060.00

TP 3: 3,080.00

Stop Loss: 3,010.00

Clean structure...just let it play within the range. #ETH #Ethereum #Rmj-Trades

ETH-4,21%

- Reward

- like

- 1

- Repost

- Share

⚡️ Bloomberg Senior Analyst McGlone Reveals His Latest Prediction for Ethereum (ETH): “Get Ready for This Level!”

Bitcoin and altcoins have suffered greatly from the downtrend that began in October and is still ongoing. Ethereum (ETH) has also experienced significant losses, and these losses may deepen further.

Bloomberg senior analyst Mike McGlone stated that Ethereum could fall to as low as $2,000.

Ethereum is giving investors mixed signals as bearish macroeconomic signals clash with record-high on-chain data.

At this point, the seven-day simple moving average of active Ethereum addresses ha

Bitcoin and altcoins have suffered greatly from the downtrend that began in October and is still ongoing. Ethereum (ETH) has also experienced significant losses, and these losses may deepen further.

Bloomberg senior analyst Mike McGlone stated that Ethereum could fall to as low as $2,000.

Ethereum is giving investors mixed signals as bearish macroeconomic signals clash with record-high on-chain data.

At this point, the seven-day simple moving average of active Ethereum addresses ha

- Reward

- 2

- 2

- Repost

- Share

Falcon_Official :

:

2026 GOGOGO 👊View More

$ETH update ⚡️. This is exactly the moment when $ETH must show its dominance over $BTC. We saw it in January 2021. We saw it again in 2024. $ETH must start its parabolic move 🚀. And pull the entire altcoin market with it. Do not listen to those who bury altcoins. Remember one thing. The crypto industry is built on altcoins, not on Bitcoin. $BTC has become digital gold 🪙. Altcoins are the future 🔮. As soon as $ETH breaks above 3500 🔥. The real show begins. Do not dare to give up at the end of the road 💪. My portfolio: $TEL $TIA $APT $AVAX $ETHFI $LDO $OP $ETH $ONDO $ENA $M

- Reward

- 1

- 1

- Repost

- Share

Lee160 :

:

I like your posts please do for meLoad More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

15.81K Popularity

30.57K Popularity

354.45K Popularity

33.32K Popularity

50.4K Popularity

3.91K Popularity

19.98K Popularity

9.73K Popularity

83.88K Popularity

30.36K Popularity

22.46K Popularity

24.67K Popularity

9.99K Popularity

17.01K Popularity

206.98K Popularity

News

View MoreSpot gold falls below $4900, spot silver plunges 20% intraday

11 m

Total data: A total of 2,955,700 TON tokens transferred into the TON platform, with an approximate value of $4,285,700 USD.

18 m

U.S. stock indices generally declined, with the Dow Jones Industrial Average down 1% and the Nasdaq down over 0.9%

23 m

Trump: Will send more ships to Iran. If they don't reach an agreement, let's see what happens.

24 m

U.S. President Trump praises the S&P 500 Index for reaching a record high

26 m

Pin