# USCoreCPIHitsFour-YearLow

1.07K

AYATTAC

#USCoreCPIHitsFour-YearLow 📉 The Case for "Wait and See" (The Bear View)

Macro Headwinds: We’re seeing a "risk-off" sentiment globally. High interest rates and sticky inflation are making investors cautious about speculative assets.

Technical Breakdown: Bitcoin recently slipped below its 200-week exponential moving average (EMA) near $68,000. Some analysts are eyeing $60,000 or even $52,000 as the next "true" floor if this support doesn't hold.

Institutional Outflows: While ETFs brought us to the dance, recent weeks have seen net outflows from spot BTC and ETH ETFs, suggesting some big player

Macro Headwinds: We’re seeing a "risk-off" sentiment globally. High interest rates and sticky inflation are making investors cautious about speculative assets.

Technical Breakdown: Bitcoin recently slipped below its 200-week exponential moving average (EMA) near $68,000. Some analysts are eyeing $60,000 or even $52,000 as the next "true" floor if this support doesn't hold.

Institutional Outflows: While ETFs brought us to the dance, recent weeks have seen net outflows from spot BTC and ETH ETFs, suggesting some big player

- Reward

- 1

- Comment

- Repost

- Share

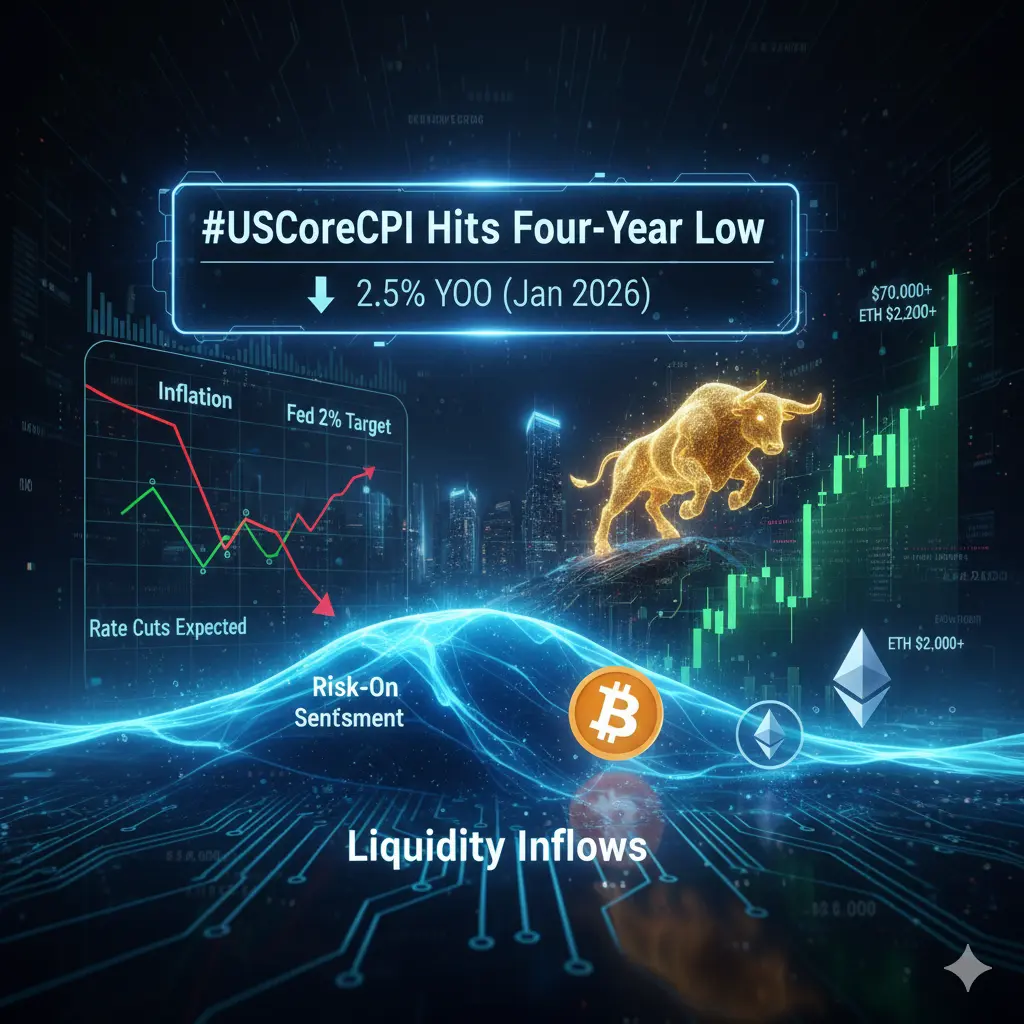

#USCoreCPIHitsFour-YearLow 📉 US Core CPI Hits Four-Year Low – Implications for Markets & Crypto

The U.S. Core Consumer Price Index (CPI), which excludes volatile food and energy prices, fell to 2.5% year-over-year in January 2026, marking its lowest level since 2021. Meanwhile, headline CPI dropped to 2.4% YoY, coming in below market expectations. This signals that inflationary pressures in the U.S. economy are steadily easing, as prices for services, rent, and goods rise at a slower pace, providing relief for consumers and businesses alike.

Core vs. Headline CPI: Core CPI removes food and en

The U.S. Core Consumer Price Index (CPI), which excludes volatile food and energy prices, fell to 2.5% year-over-year in January 2026, marking its lowest level since 2021. Meanwhile, headline CPI dropped to 2.4% YoY, coming in below market expectations. This signals that inflationary pressures in the U.S. economy are steadily easing, as prices for services, rent, and goods rise at a slower pace, providing relief for consumers and businesses alike.

Core vs. Headline CPI: Core CPI removes food and en

- Reward

- 1

- 1

- Repost

- Share

LittleQueen :

:

To The Moon 🌕#USCoreCPIHitsFour-YearLow

The U.S. Core Consumer Price Index (CPI) — which measures inflation excluding volatile food and energy — dropped to 2.5% year-over-year in January 2026, marking its lowest level since 2021. Headline CPI fell to 2.4% YoY, below expectations, signaling that inflationary pressures are steadily easing.

Prices for services, rent, and goods are rising slower, easing cost pressures for consumers and businesses, and signaling a smoother economic trajectory.

📉 Core CPI: Why It Matters

Core vs Headline CPI: Core strips out food and energy to show underlying inflation.

Main D

The U.S. Core Consumer Price Index (CPI) — which measures inflation excluding volatile food and energy — dropped to 2.5% year-over-year in January 2026, marking its lowest level since 2021. Headline CPI fell to 2.4% YoY, below expectations, signaling that inflationary pressures are steadily easing.

Prices for services, rent, and goods are rising slower, easing cost pressures for consumers and businesses, and signaling a smoother economic trajectory.

📉 Core CPI: Why It Matters

Core vs Headline CPI: Core strips out food and energy to show underlying inflation.

Main D

- Reward

- 7

- 6

- Repost

- Share

Yusfirah :

:

LFG 🔥View More

#USCoreCPIHitsFour-YearLow

#USCoreCPIHitsFourYearLow

The latest US inflation data has delivered one of the most important macro signals the market has been waiting for. US Core CPI has dropped to a four year low, and this development is already reshaping expectations across equities, bonds, gold, and crypto.

Core CPI excludes food and energy, making it one of the Federal Reserve’s most closely watched inflation indicators. When core inflation cools, it suggests underlying price pressures are easing across the broader economy. This is not just a headline number. It is a signal about monetary p

#USCoreCPIHitsFourYearLow

The latest US inflation data has delivered one of the most important macro signals the market has been waiting for. US Core CPI has dropped to a four year low, and this development is already reshaping expectations across equities, bonds, gold, and crypto.

Core CPI excludes food and energy, making it one of the Federal Reserve’s most closely watched inflation indicators. When core inflation cools, it suggests underlying price pressures are easing across the broader economy. This is not just a headline number. It is a signal about monetary p

BTC3,55%

- Reward

- 2

- 3

- Repost

- Share

Vortex_King :

:

Ape In 🚀View More

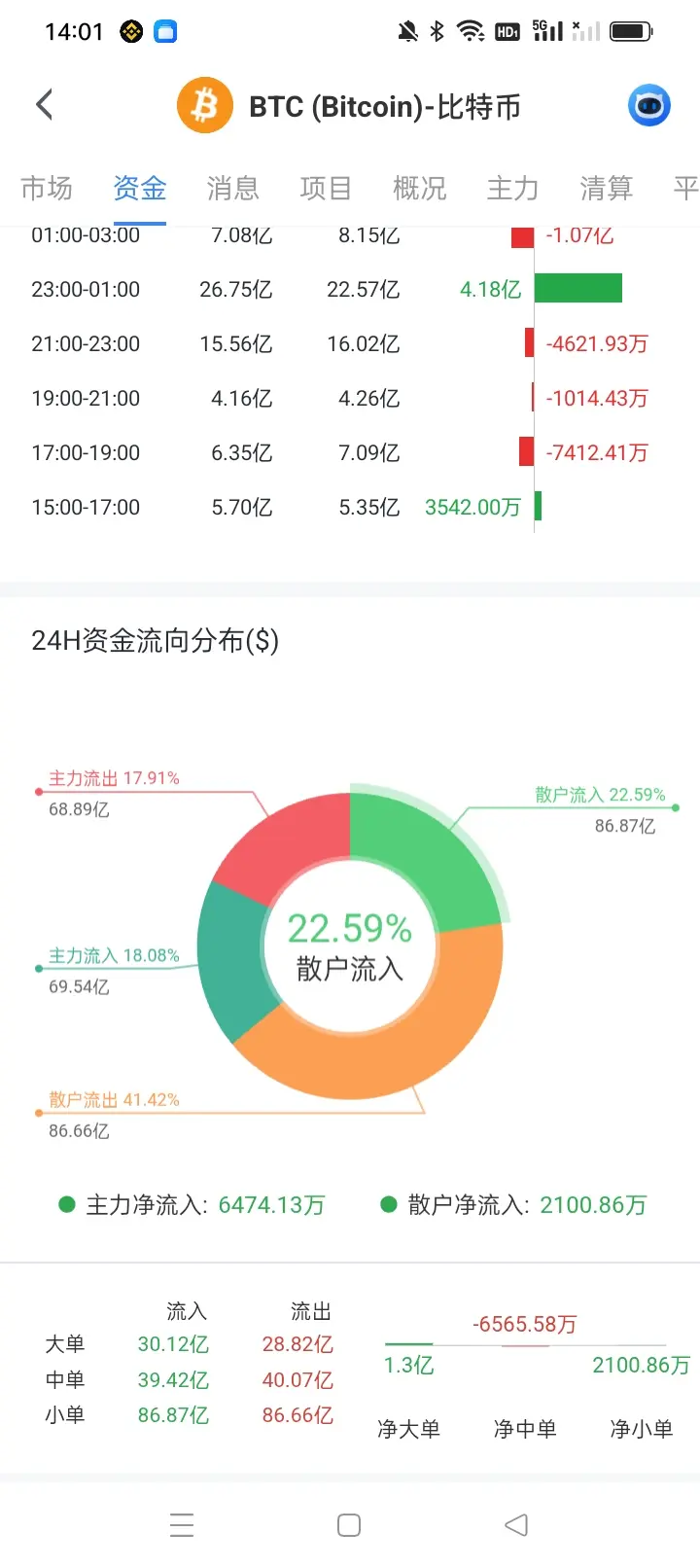

Friends, last night this wasn't a market; it was a slaughter!

The US dollar plummeted! As soon as the inflation data was released, the DXY was like being pushed off the top floor, dropping a staggering 20 points in an instant. The 96.87 level looks as fragile as paper. What strong dollar? It’s back to the pre-liberation era overnight!

But the real explosion is yet to come—

While everyone was staring at gold and laughing foolishly, I tell you, smart money has already secretly changed course! That $20 increase in spot gold? That’s nothing! Do you think institutions and whales care about those tr

The US dollar plummeted! As soon as the inflation data was released, the DXY was like being pushed off the top floor, dropping a staggering 20 points in an instant. The 96.87 level looks as fragile as paper. What strong dollar? It’s back to the pre-liberation era overnight!

But the real explosion is yet to come—

While everyone was staring at gold and laughing foolishly, I tell you, smart money has already secretly changed course! That $20 increase in spot gold? That’s nothing! Do you think institutions and whales care about those tr

BTC3,55%

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

66.34K Popularity

1.07K Popularity

1.3K Popularity

49.05K Popularity

264 Popularity

138.39K Popularity

228.53K Popularity

13.4K Popularity

586 Popularity

300 Popularity

327 Popularity

183 Popularity

1.24K Popularity

30.22K Popularity

News

View MoreETH returns to $2000! Ethereum ETF funds turn positive, signaling stabilization

4 m

Traditional indices fluctuate and rise, with trading activity in the Gate Index zone steadily increasing

16 m

The Oscars are about to begin, and betting on various awards on Polymarket has already started. The betting funds for Best Picture have exceeded $15 million.

25 m

Solana founder joins CFTC's core think tank, bringing a technical perspective to U.S. crypto policy

36 m

Alt5 Sigma transferred 75.8 million WLFI to the WLFI official address at midnight, approximately 8.02 million USD

37 m

Pin