# BItcoin

6.62M

DragonFlyOfficial

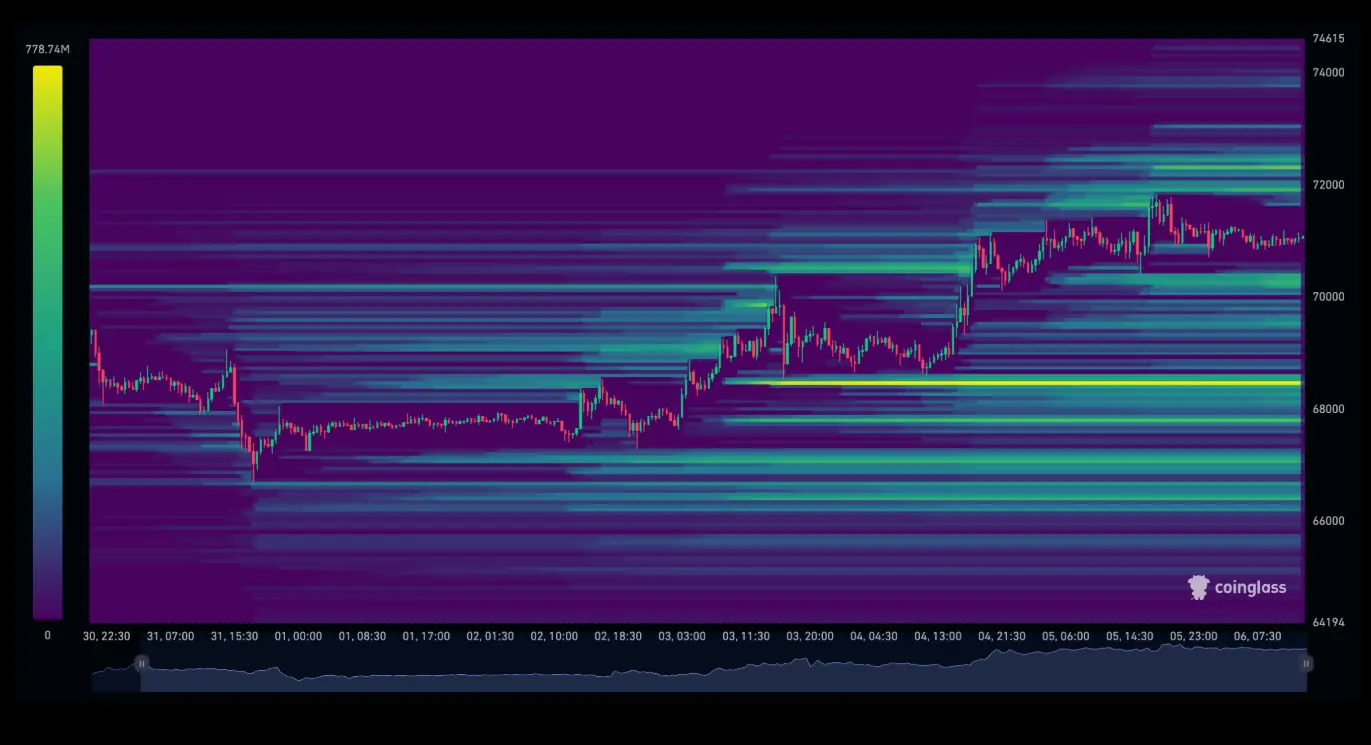

🚨 $60M Short Liquidated Amid Market Spike

According to BlockBeats News (Jan 24) and EmberCN monitoring, crypto market volatility struck again:

At around 1:00 a.m., Bitcoin briefly surged above $91,000 and Ethereum climbed past $3,000, triggering the liquidation of a massive short position held by “Rolling Trader 0xD83…Fd7”.

🔻 Key Details:

• Liquidation size: ~$60 million

• Total short position reduced from $300M → $238M

• Unrealized gains fell from $24M (2 days ago) to ~$4M

⚠️ This move once again highlights how high leverage + sudden volatility can quickly wipe out even large positions.

💬

According to BlockBeats News (Jan 24) and EmberCN monitoring, crypto market volatility struck again:

At around 1:00 a.m., Bitcoin briefly surged above $91,000 and Ethereum climbed past $3,000, triggering the liquidation of a massive short position held by “Rolling Trader 0xD83…Fd7”.

🔻 Key Details:

• Liquidation size: ~$60 million

• Total short position reduced from $300M → $238M

• Unrealized gains fell from $24M (2 days ago) to ~$4M

⚠️ This move once again highlights how high leverage + sudden volatility can quickly wipe out even large positions.

💬

- Reward

- 5

- 7

- Repost

- Share

QueenOfTheDay :

:

2026 GOGOGO 👊View More

🔥 Nasdaq Moves to Lift Position Limits on BTC & ETH ETF Options 🔥

Big signal from traditional finance 👀

Nasdaq has officially applied to remove the 25,000-contract position limit on spot Bitcoin & Ethereum ETF options, submitting a rule change to the U.S. SEC.

📌 What’s changing?

• ❌ Removes the 25,000 contract cap

• ⚖️ Treats crypto ETF options the same as commodity ETF options

• 🏦 Eliminates what Nasdaq calls “unfair restrictions”

• 🗣️ SEC comment period is now open

• ⏰ Final decision expected by end of February

💡 Why this matters:

This could unlock larger institutional participation,

Big signal from traditional finance 👀

Nasdaq has officially applied to remove the 25,000-contract position limit on spot Bitcoin & Ethereum ETF options, submitting a rule change to the U.S. SEC.

📌 What’s changing?

• ❌ Removes the 25,000 contract cap

• ⚖️ Treats crypto ETF options the same as commodity ETF options

• 🏦 Eliminates what Nasdaq calls “unfair restrictions”

• 🗣️ SEC comment period is now open

• ⏰ Final decision expected by end of February

💡 Why this matters:

This could unlock larger institutional participation,

- Reward

- 14

- 15

- Repost

- Share

ybaser :

:

Happy New Year! 🤑View More

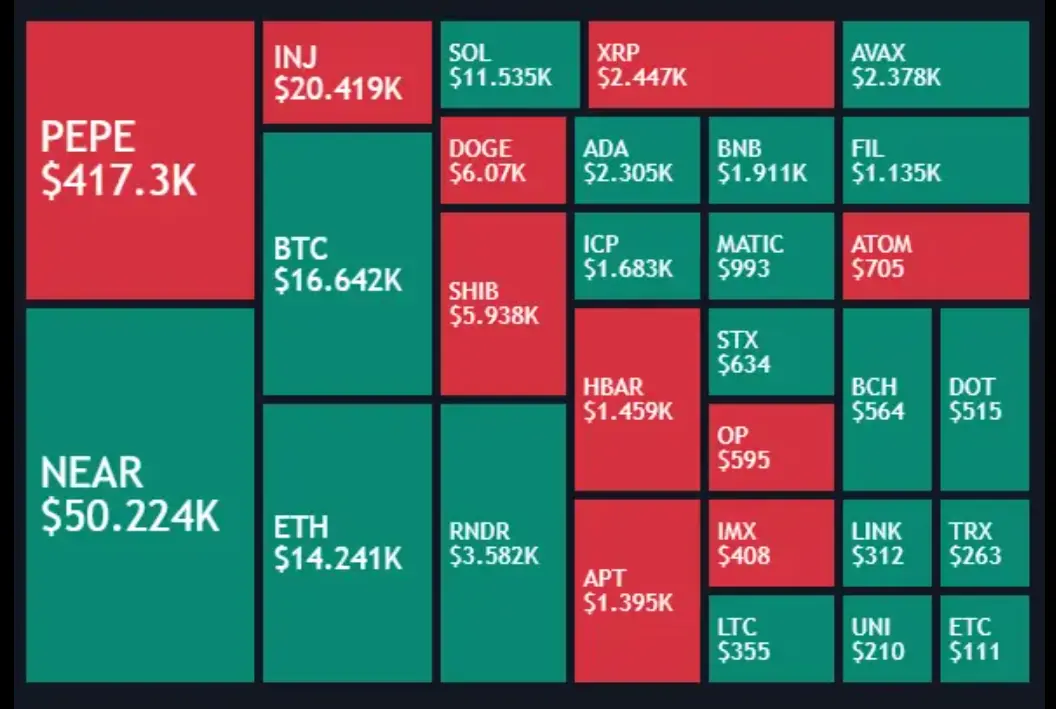

📉 #TariffTensionsHitCryptoMarket — 22 January 2026 Update

Global trade tensions, especially renewed US–EU tariff threats tied to the Greenland dispute, have pushed investors into risk-off mode — including in cryptocurrency markets. These tariff threats triggered volatility across stocks, bonds, and digital assets, causing sharp sell-offs and fear-driven trading early this week.

🔹 Bitcoin and major altcoins weakened as traders reduced risk exposure, with BTC sliding more than 7% at one point and broader crypto sell-offs intensifying.

🔹 Large liquidations were seen in leveraged crypto posit

Global trade tensions, especially renewed US–EU tariff threats tied to the Greenland dispute, have pushed investors into risk-off mode — including in cryptocurrency markets. These tariff threats triggered volatility across stocks, bonds, and digital assets, causing sharp sell-offs and fear-driven trading early this week.

🔹 Bitcoin and major altcoins weakened as traders reduced risk exposure, with BTC sliding more than 7% at one point and broader crypto sell-offs intensifying.

🔹 Large liquidations were seen in leveraged crypto posit

BTC0,11%

- Reward

- 1

- 3

- Repost

- Share

AYATTAC :

:

Happy New Year! 🤑View More

💥 BREAKING NEWS

🇺🇸 BlackRock Sells $56.9M in Bitcoin

In a surprising move, BlackRock has offloaded $56.9 million worth of BTC, signaling a notable shift in institutional positioning. This sale highlights ongoing market recalibration and may impact short-term price dynamics in the crypto space.

📊 Market Watch: Traders and investors are closely monitoring whether this triggers broader rebalancing across institutional portfolios.

#Bitcoin #CryptoNews #BlackRock #BTC

🇺🇸 BlackRock Sells $56.9M in Bitcoin

In a surprising move, BlackRock has offloaded $56.9 million worth of BTC, signaling a notable shift in institutional positioning. This sale highlights ongoing market recalibration and may impact short-term price dynamics in the crypto space.

📊 Market Watch: Traders and investors are closely monitoring whether this triggers broader rebalancing across institutional portfolios.

#Bitcoin #CryptoNews #BlackRock #BTC

BTC0,11%

- Reward

- 6

- 7

- Repost

- Share

BeautifulDay :

:

2026 GOGOGO 👊View More

💥 BREAKING: BlackRock $56.9M BTC “Sell” — Panic or Misread?

Headlines say BlackRock sold $56.9M worth of Bitcoin, triggering #CryptoMarketPullback fears. But the reality is more nuanced.

🔍 What’s REALLY happening?

This is ETF flow-driven selling, not BlackRock abandoning Bitcoin.

When investors redeem ETF shares, the fund must sell BTC to settle — it’s client-driven, not a strategic dump.

📉 Why price reacts anyway

ETF redemptions = real BTC hitting the market

Short-term supply shock → volatility

Retail often overreacts to “institutional sell” headlines

🧠 Bigger picture

✅ BlackRock still ho

Headlines say BlackRock sold $56.9M worth of Bitcoin, triggering #CryptoMarketPullback fears. But the reality is more nuanced.

🔍 What’s REALLY happening?

This is ETF flow-driven selling, not BlackRock abandoning Bitcoin.

When investors redeem ETF shares, the fund must sell BTC to settle — it’s client-driven, not a strategic dump.

📉 Why price reacts anyway

ETF redemptions = real BTC hitting the market

Short-term supply shock → volatility

Retail often overreacts to “institutional sell” headlines

🧠 Bigger picture

✅ BlackRock still ho

BTC0,11%

MC:$3.65KHolders:1

0.79%

- Reward

- 11

- 11

- Repost

- Share

ShainingMoon :

:

Happy New Year! 🤑View More

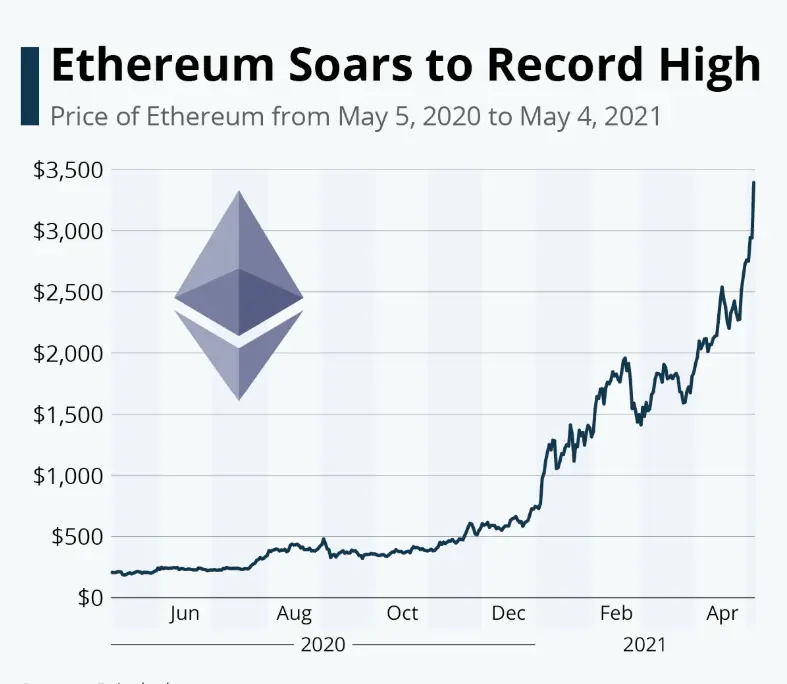

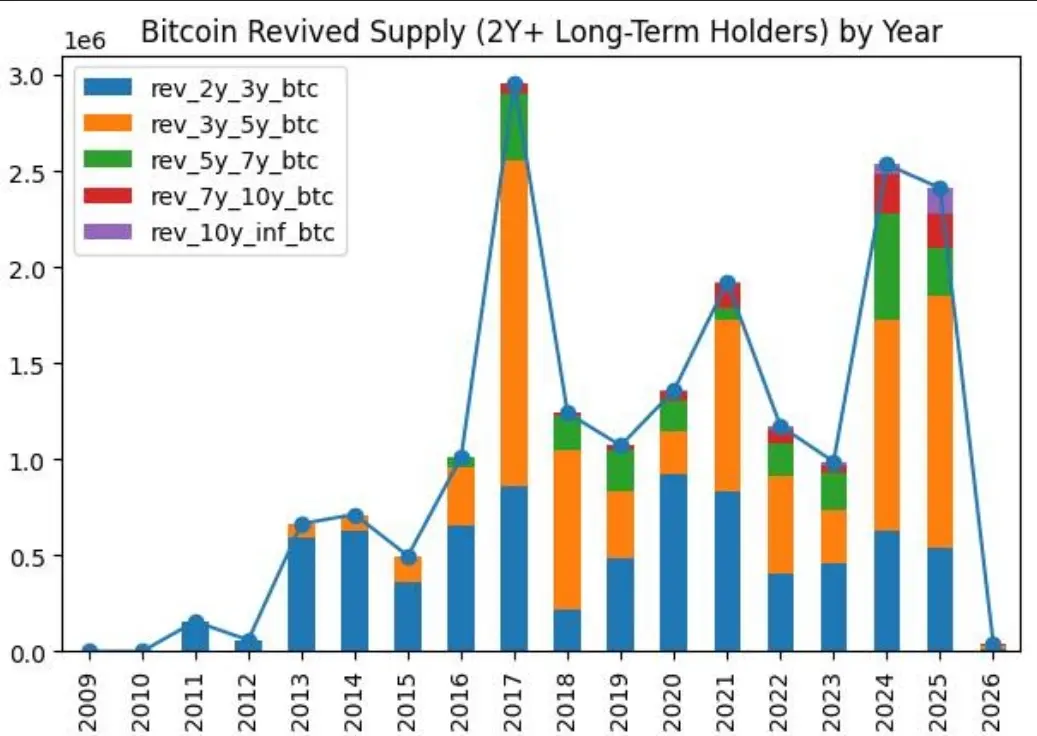

The biggest transformation in #البيتكوين 's offering you've ever seen

This is not a sale by weak investors, but rather a movement by some of the oldest #Bitcoin coins.

Between 2024 and 2025, a number of #BTC coins were sold by their long-term holders (more than two years) more than at any other time in #BTCUSDT 's history. It's not panic selling or forced liquidation, but rather a rebalancing by seasoned investors after a significant rise.

And most importantly: the price did not collapse significantly.

This indicates genuine demand. New buyers are taking the supply that was previously hard t

View OriginalThis is not a sale by weak investors, but rather a movement by some of the oldest #Bitcoin coins.

Between 2024 and 2025, a number of #BTC coins were sold by their long-term holders (more than two years) more than at any other time in #BTCUSDT 's history. It's not panic selling or forced liquidation, but rather a rebalancing by seasoned investors after a significant rise.

And most importantly: the price did not collapse significantly.

This indicates genuine demand. New buyers are taking the supply that was previously hard t

- Reward

- 2

- Comment

- Repost

- Share

The state of Kansas is moving towards adopting #البيتكوين as a strategic asset in the public treasury.

Kansas Senate Bill 352 proposes the creation of a dedicated Bitcoin and digital assets fund, funded through airdrops, staking rewards, interest, and even unclaimed digital currency holdings.

This comes in the context of a broader trend across the United States: more than 30 states are considering similar legislation, and New Hampshire has already enacted laws allowing for the creation of digital currency reserves, along with increasing institutional support following the launch of Bitcoin ex

View OriginalKansas Senate Bill 352 proposes the creation of a dedicated Bitcoin and digital assets fund, funded through airdrops, staking rewards, interest, and even unclaimed digital currency holdings.

This comes in the context of a broader trend across the United States: more than 30 states are considering similar legislation, and New Hampshire has already enacted laws allowing for the creation of digital currency reserves, along with increasing institutional support following the launch of Bitcoin ex

- Reward

- 1

- Comment

- Repost

- Share

#CryptoMarketOutlook2026 🚀

Beyond the Noise: Positioning for the Next Expansion Phase

As we move deeper into 2026, the crypto market is entering a phase that separates speculators from strategists.

This is not the end of the bull cycle, but a necessary recalibration before the next leg higher. Markets rarely move in straight lines—the strongest trends are forged during periods of doubt.

Bitcoin consolidating below major psychological levels and altcoins cooling off is structural strength in action, not weakness. Volatility is no longer driven by retail emotion alone—it’s now shaped by ETF flo

Beyond the Noise: Positioning for the Next Expansion Phase

As we move deeper into 2026, the crypto market is entering a phase that separates speculators from strategists.

This is not the end of the bull cycle, but a necessary recalibration before the next leg higher. Markets rarely move in straight lines—the strongest trends are forged during periods of doubt.

Bitcoin consolidating below major psychological levels and altcoins cooling off is structural strength in action, not weakness. Volatility is no longer driven by retail emotion alone—it’s now shaped by ETF flo

- Reward

- 4

- 2

- Repost

- Share

ShainingMoon :

:

2026 GOGOGO 👊View More

📉 #ExchangeBTCNetOutflowsExpand

Bitcoin exchanges are seeing a notable increase in net outflows, signaling that more BTC is moving off centralized platforms than coming in. This trend often indicates stronger long-term holding behavior among investors, as coins are being transferred to private wallets rather than remaining on exchanges for trading or selling.

Key Points:

🏦 Exchange Outflows Rising: The net outflows have expanded over the past week, showing growing investor confidence and potential accumulation.

🔒 HODL Signals: Higher outflows often correlate with longer-term holding, reduci

Bitcoin exchanges are seeing a notable increase in net outflows, signaling that more BTC is moving off centralized platforms than coming in. This trend often indicates stronger long-term holding behavior among investors, as coins are being transferred to private wallets rather than remaining on exchanges for trading or selling.

Key Points:

🏦 Exchange Outflows Rising: The net outflows have expanded over the past week, showing growing investor confidence and potential accumulation.

🔒 HODL Signals: Higher outflows often correlate with longer-term holding, reduci

BTC0,11%

- Reward

- 8

- 7

- Repost

- Share

Falcon_Official :

:

Buy To Earn 💎View More

🔥 Nasdaq Moves to Lift Position Limits on BTC & ETH ETF Options 🔥

A major signal from traditional finance 👀

Nasdaq has officially filed a proposal with the U.S. SEC to remove the 25,000-contract position limit on options for spot Bitcoin and Ethereum ETFs.

📌 What’s Changing?

• ❌ The 25,000 contract cap will be eliminated

• ⚖️ Crypto ETF options would be regulated the same way as commodity ETF options

• 🏦 Nasdaq calls the current limit an “unfair restriction”

• 🗣️ The SEC comment period is now open

• ⏰ A final decision is expected by the end of February

💡 Why This Matters:

If approved, t

A major signal from traditional finance 👀

Nasdaq has officially filed a proposal with the U.S. SEC to remove the 25,000-contract position limit on options for spot Bitcoin and Ethereum ETFs.

📌 What’s Changing?

• ❌ The 25,000 contract cap will be eliminated

• ⚖️ Crypto ETF options would be regulated the same way as commodity ETF options

• 🏦 Nasdaq calls the current limit an “unfair restriction”

• 🗣️ The SEC comment period is now open

• ⏰ A final decision is expected by the end of February

💡 Why This Matters:

If approved, t

- Reward

- 4

- 4

- Repost

- Share

EagleEye :

:

Buy To Earn 💎View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

35.87K Popularity

19.28K Popularity

13.91K Popularity

3.53K Popularity

10.41K Popularity

9.6K Popularity

8.25K Popularity

75.94K Popularity

36.66K Popularity

20.26K Popularity

7.13K Popularity

109.13K Popularity

254.34K Popularity

20.39K Popularity

179.46K Popularity

News

View MoreMoney laundering suspect Sen Hok Ling in the Zhimin Bitcoin case must return $7.6 million, or face an additional 8-year prison sentence

1 m

Data: 137.22 BTC transferred from an anonymous address, worth approximately $12.3 million

2 m

Data: 699.83 BTC transferred from an anonymous address, then routed through a relay and sent to another anonymous address

12 m

Analyst: SLV's increase is "exaggerated," and Bitcoin ETF attracting funds during a headwind period is more valuable.

13 m

Bitdeer mined 155 BTC this week, bringing the total Bitcoin holdings to 1504.4 BTC.

16 m

Pin