九思量子U财

Employment Suddenly Tight: Why Did Initial Jobless Claims Drop Below 200,000 and What Does It Say About the US Labor Market?

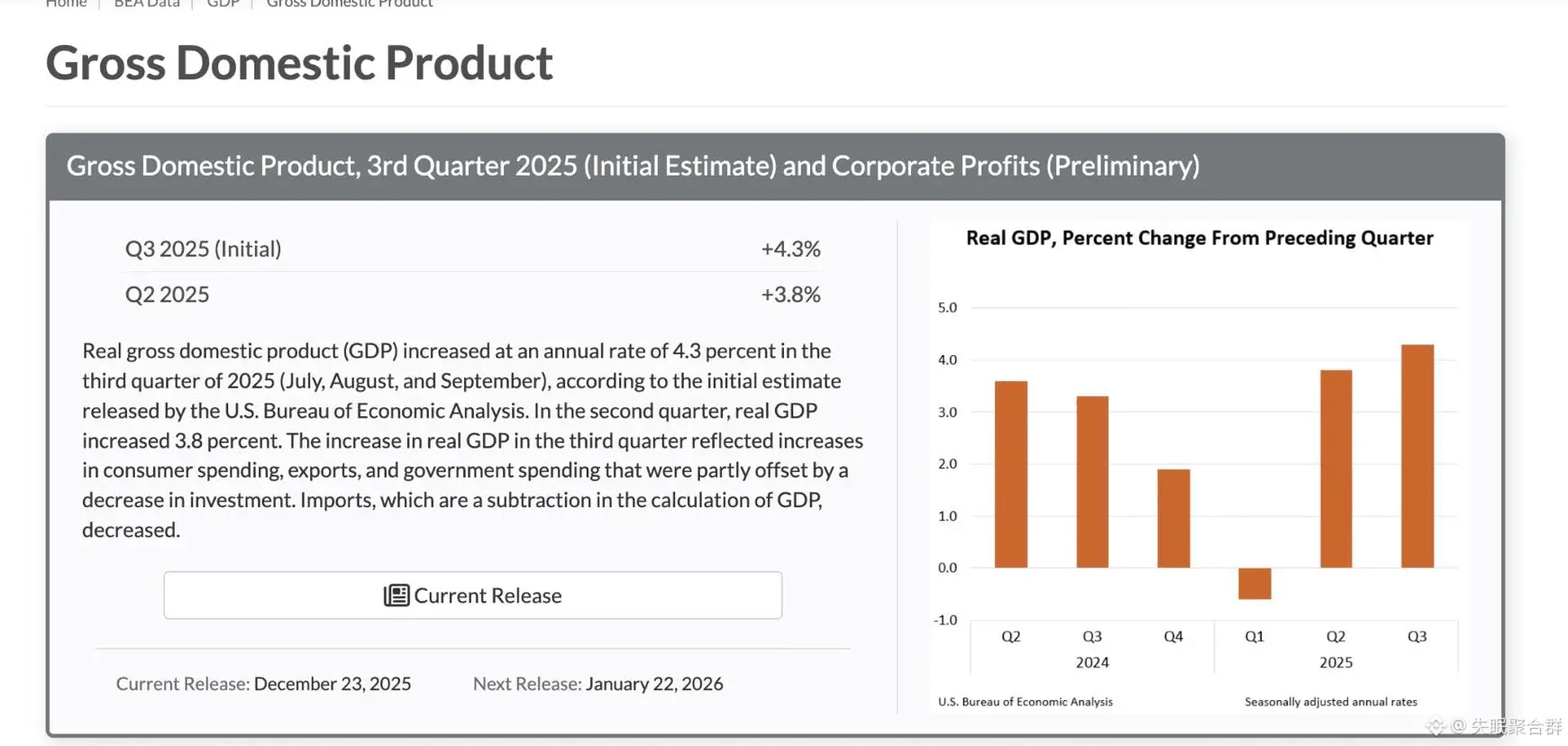

The US labor market provided a set of quite impressive short-term data at the end of the year: during the week of December 20th, initial unemployment claims fell to 199,000, a decrease of 16,000 from the previous figure, significantly below the market expectation of 218,000; meanwhile, continued claims also dropped to around 1.87 million, remaining in a low range over the past few months. Falling below 200,000 in initial claims is uncommon historically and signals an ext

View OriginalThe US labor market provided a set of quite impressive short-term data at the end of the year: during the week of December 20th, initial unemployment claims fell to 199,000, a decrease of 16,000 from the previous figure, significantly below the market expectation of 218,000; meanwhile, continued claims also dropped to around 1.87 million, remaining in a low range over the past few months. Falling below 200,000 in initial claims is uncommon historically and signals an ext