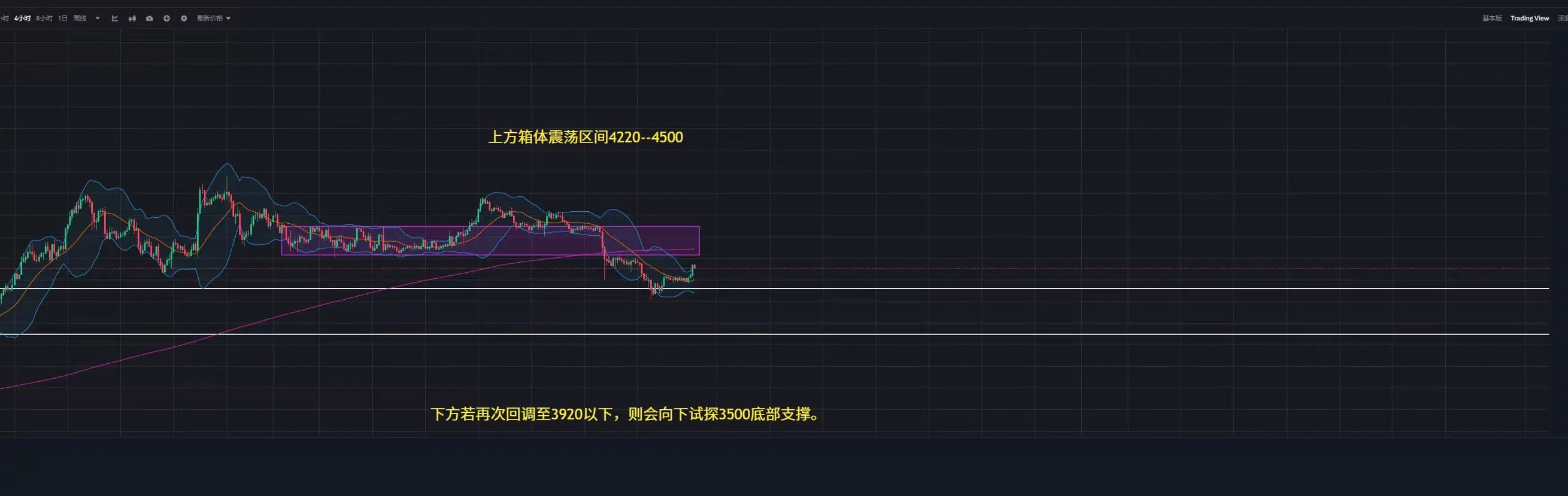

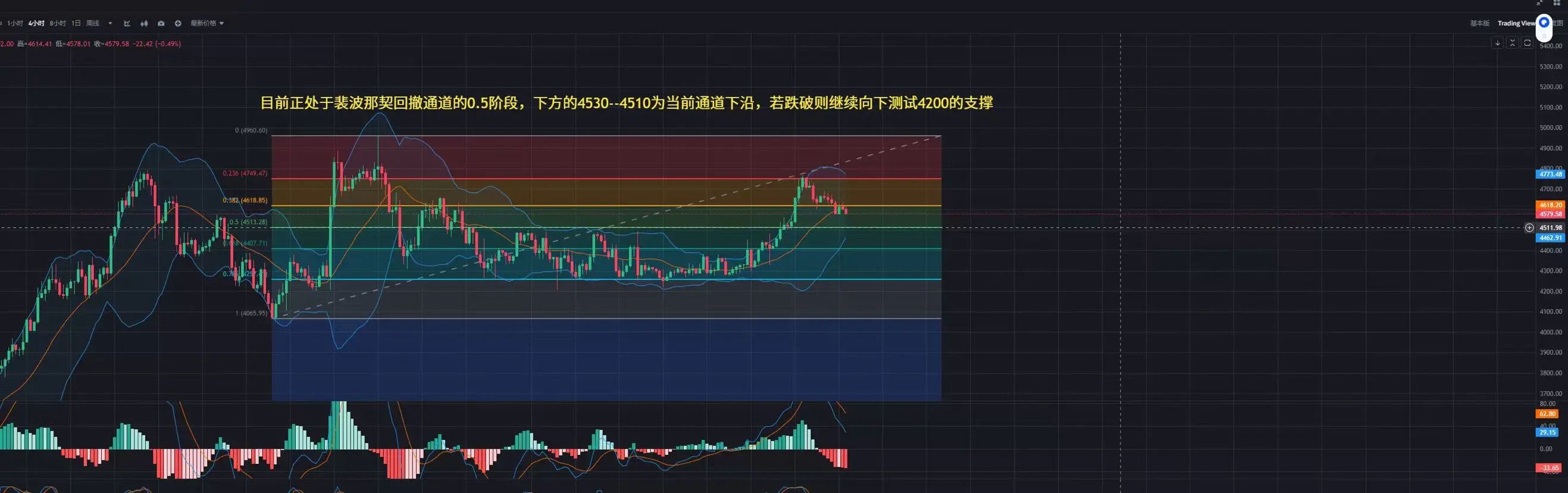

Based on the 4-hour chart, the Bollinger Bands are currently trending upward with the three lines moving higher. The price is testing the upper band and pulling back, with the three lines corresponding to prices of 3490, 3371, and 3252.

The short-term MA indicators on the 4-hour chart are rising, with MA5 about to cross above MA30. The price is currently trading between the MA30 moving average and the upper band. On the hourly chart, the short-term MAs MA5 and MA10 are crossing in a converging manner. If the price breaks through and stabilizes above MA5, a second upward movement is expected.

T

The short-term MA indicators on the 4-hour chart are rising, with MA5 about to cross above MA30. The price is currently trading between the MA30 moving average and the upper band. On the hourly chart, the short-term MAs MA5 and MA10 are crossing in a converging manner. If the price breaks through and stabilizes above MA5, a second upward movement is expected.

T

ETH-0,17%