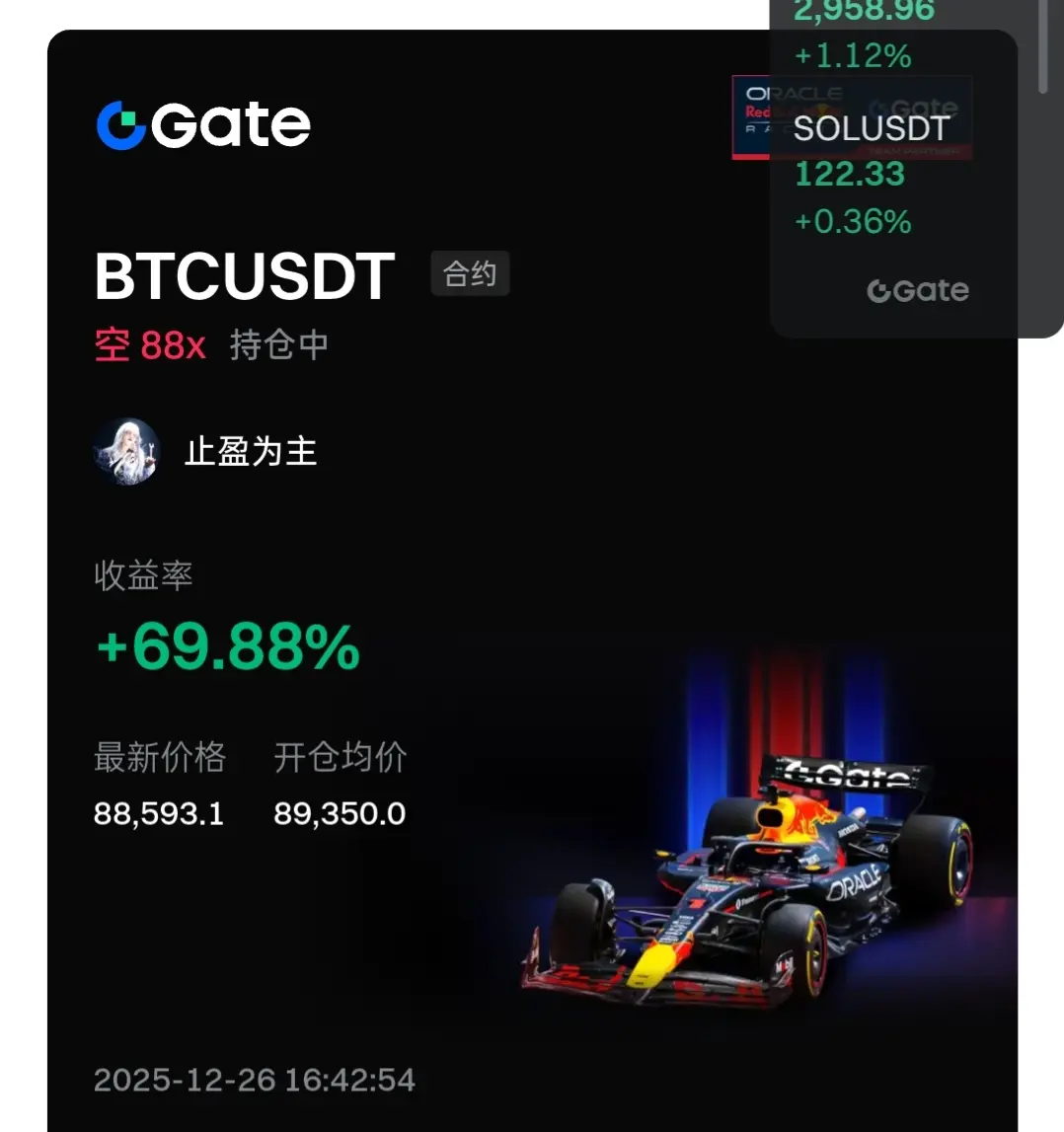

TakeProfitAsTheMainFocus.

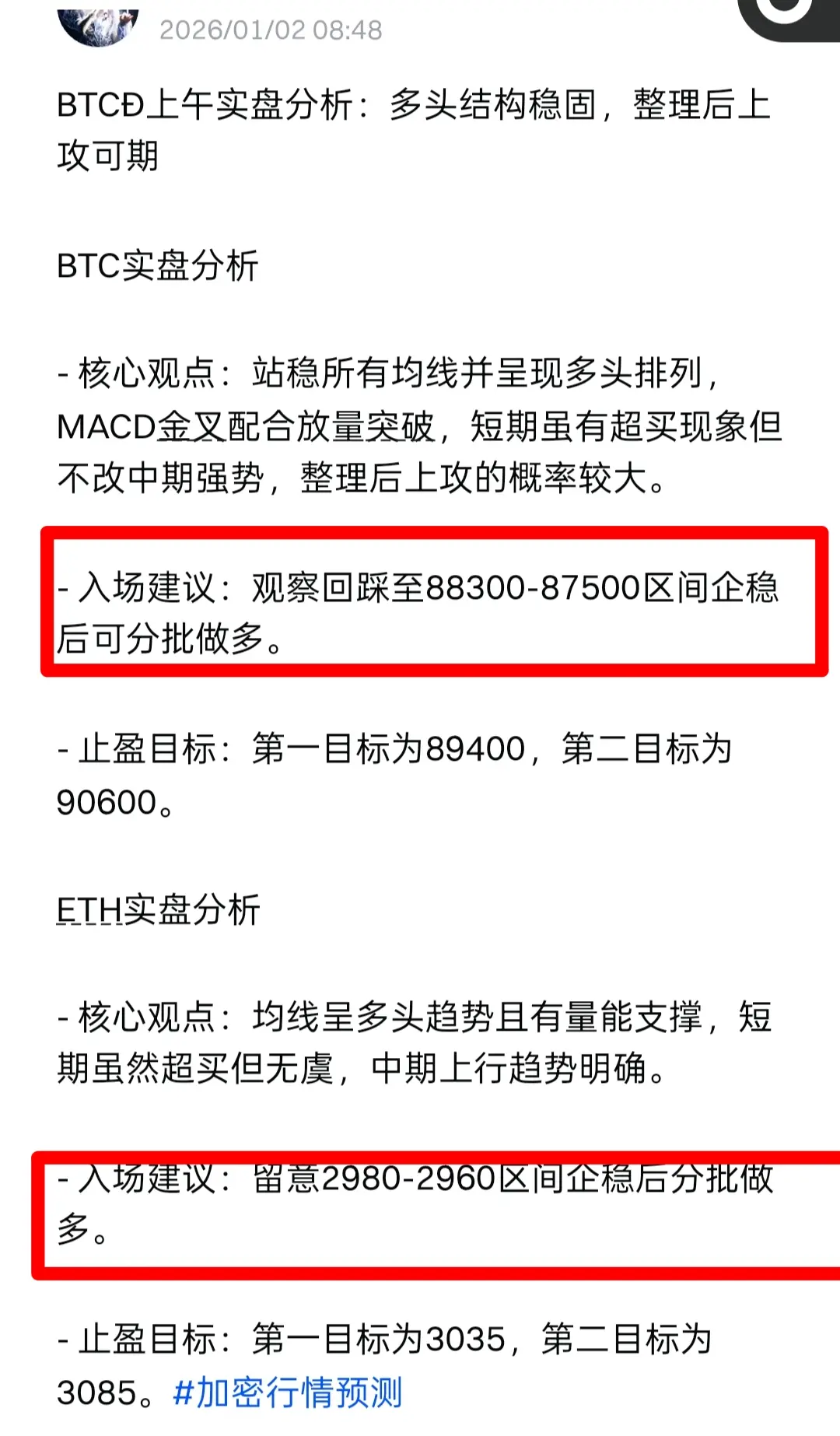

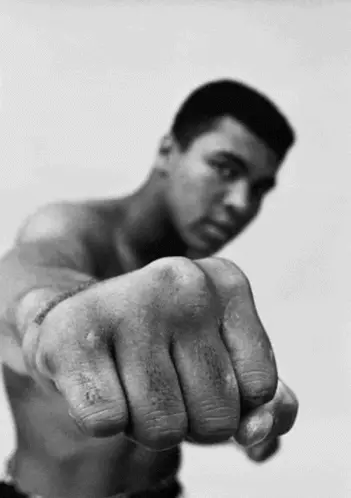

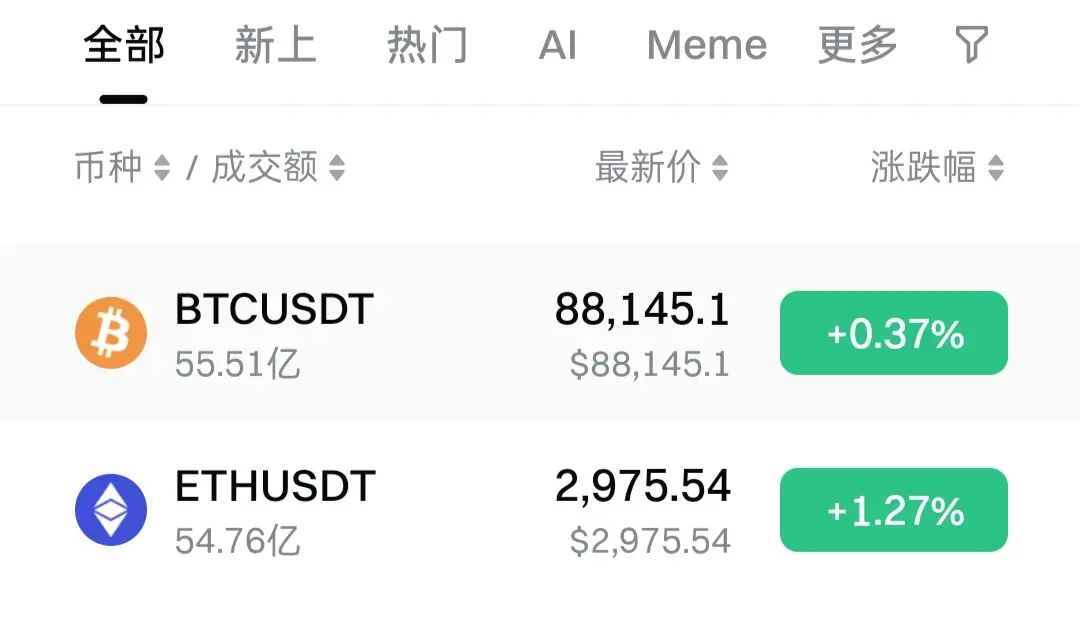

Cryptocurrency Short-Term Trading Analysis

The overall market is stabilizing at a key support zone, with rebound momentum gradually building. In the current consolidation pattern, bullish sentiment has not yet faded. The coordination between volume and price, as well as the breakout of the mid-line resistance, will serve as the core signals to confirm a short-term bullish trend.

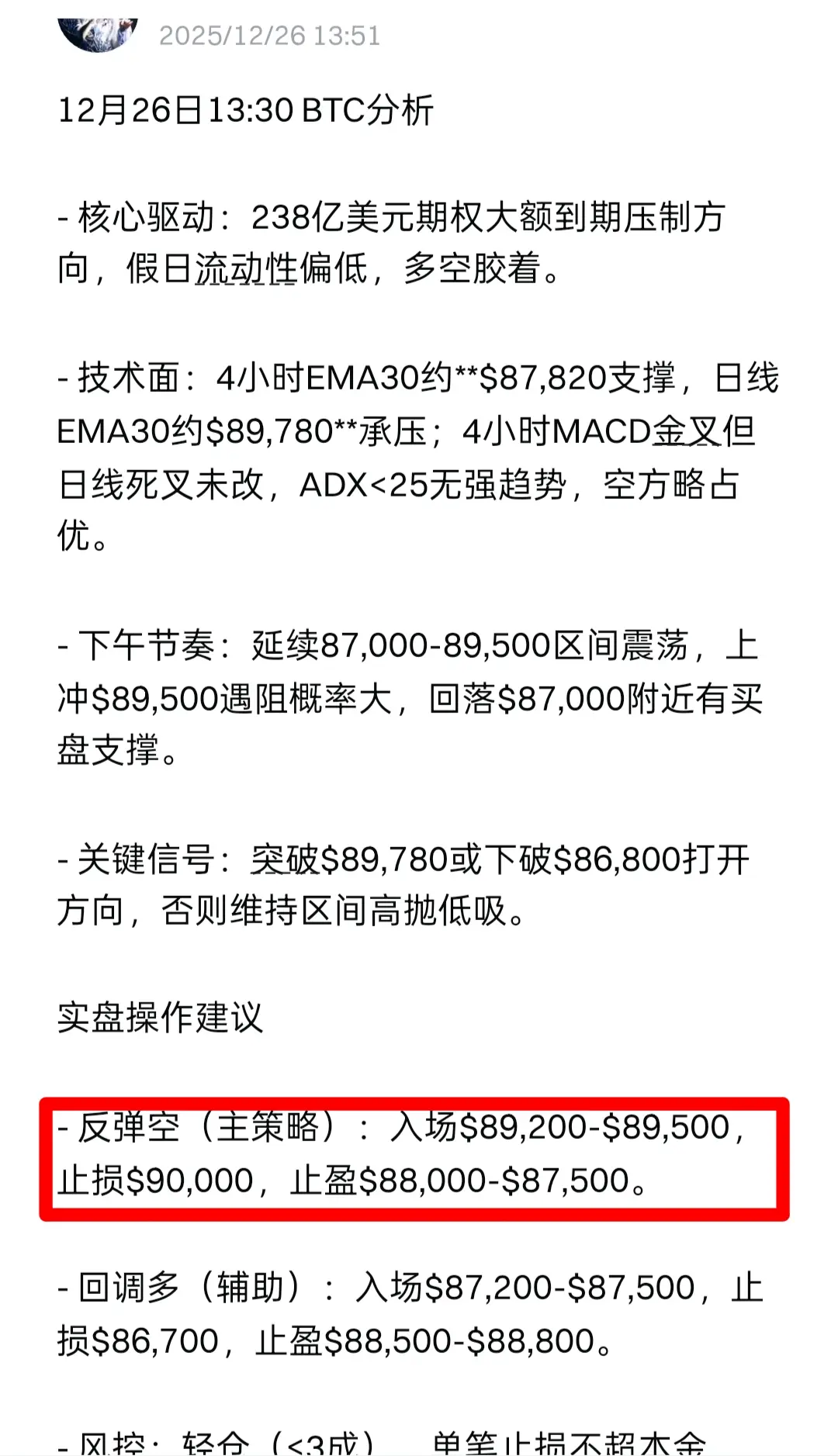

Live Trading Strategy

BTC

- Entry Range: 88800-89500 support zone stabilization

- Target Levels: First target 90800, second target 92000

- Stop-Loss: Below 88800 support

ETH

- Entry Range: 3060-3085 support zone stabil

View OriginalThe overall market is stabilizing at a key support zone, with rebound momentum gradually building. In the current consolidation pattern, bullish sentiment has not yet faded. The coordination between volume and price, as well as the breakout of the mid-line resistance, will serve as the core signals to confirm a short-term bullish trend.

Live Trading Strategy

BTC

- Entry Range: 88800-89500 support zone stabilization

- Target Levels: First target 90800, second target 92000

- Stop-Loss: Below 88800 support

ETH

- Entry Range: 3060-3085 support zone stabil