永乐的新征程new

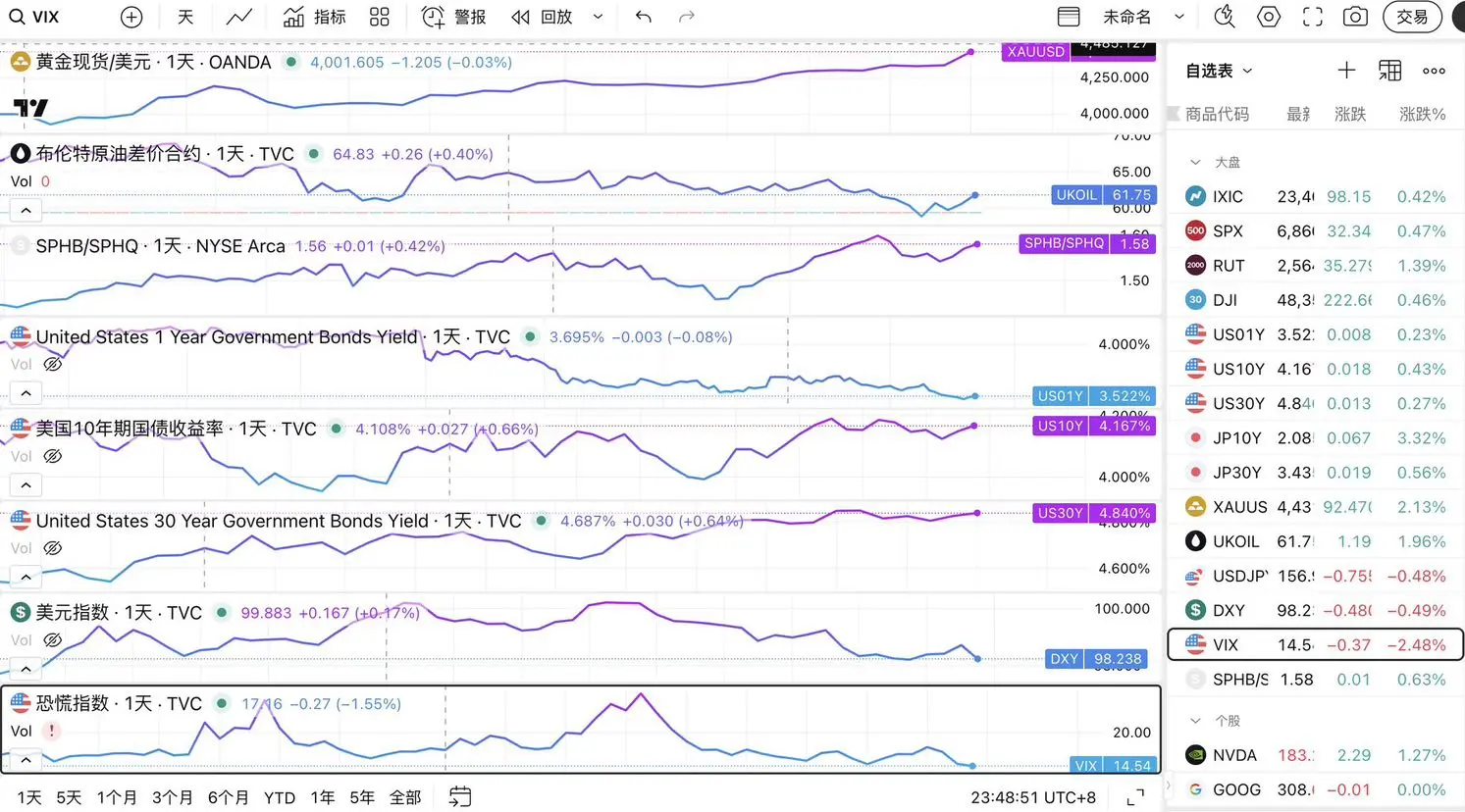

The overall situation in the financial markets tonight is in a self-correcting state, as the holiday liquidity is relatively low. The trends in the bond market, US dollar, and US stocks are temporarily undergoing self-correction without a clear main theme, so they have limited reference value.

It is worth noting that precious metals still show strong momentum, driven by market optimism, some geopolitical safe-haven factors, and other influences.

As for US stocks, the current performance is consistent with my pre-market judgment. The pre-market rebound has continued into the trading session, bu

View OriginalIt is worth noting that precious metals still show strong momentum, driven by market optimism, some geopolitical safe-haven factors, and other influences.

As for US stocks, the current performance is consistent with my pre-market judgment. The pre-market rebound has continued into the trading session, bu