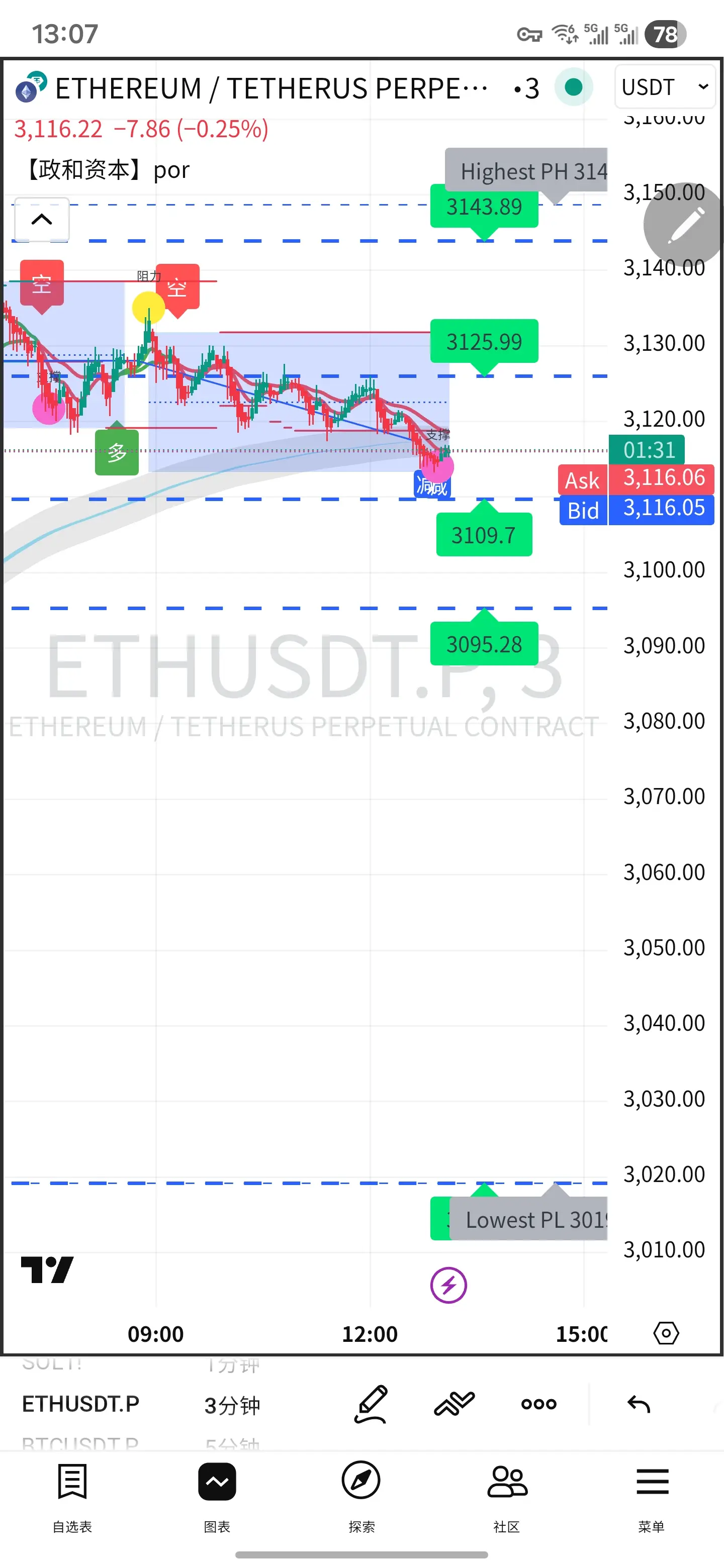

12th Long Strategy: Prioritize entering around the key support zone of 3150 - 3170. If the price pulls back to the strong support level of 3100 - 3120 and does not break below, add to your long positions. Take profit first at 3200 - 3230. If the price breaks through 3250 and stabilizes, extend to 3280; set stop-loss at 3080 to avoid larger losses from breaking below key support.

Short Strategy: Lightly open short positions on a rebound to the 3280 - 3300 range. If the price surges near 3350 and encounters resistance, consider adding to the short positions gradually. Take profit targets at 3200

Short Strategy: Lightly open short positions on a rebound to the 3280 - 3300 range. If the price surges near 3350 and encounters resistance, consider adding to the short positions gradually. Take profit targets at 3200

ETH-0,25%