Mikhailovna

@everyone

Putin Says Russia and the U.S. May Develop Nuclear Power for Bitcoin Mining

Russian President Vladimir Putin has claimed that the United States is interested in using the Zaporizhzhia Nuclear Power Plant (ZNPP) for cryptocurrency mining. According to him, Russia and the U.S. are currently discussing the possibility of jointly managing the nuclear facility.

The proposed plan is reportedly being discussed without the involvement of Ukraine, including the idea of utilizing the plant’s electricity output for Bitcoin mining, which Putin says has attracted interest from the U.S. side.

This

Putin Says Russia and the U.S. May Develop Nuclear Power for Bitcoin Mining

Russian President Vladimir Putin has claimed that the United States is interested in using the Zaporizhzhia Nuclear Power Plant (ZNPP) for cryptocurrency mining. According to him, Russia and the U.S. are currently discussing the possibility of jointly managing the nuclear facility.

The proposed plan is reportedly being discussed without the involvement of Ukraine, including the idea of utilizing the plant’s electricity output for Bitcoin mining, which Putin says has attracted interest from the U.S. side.

This

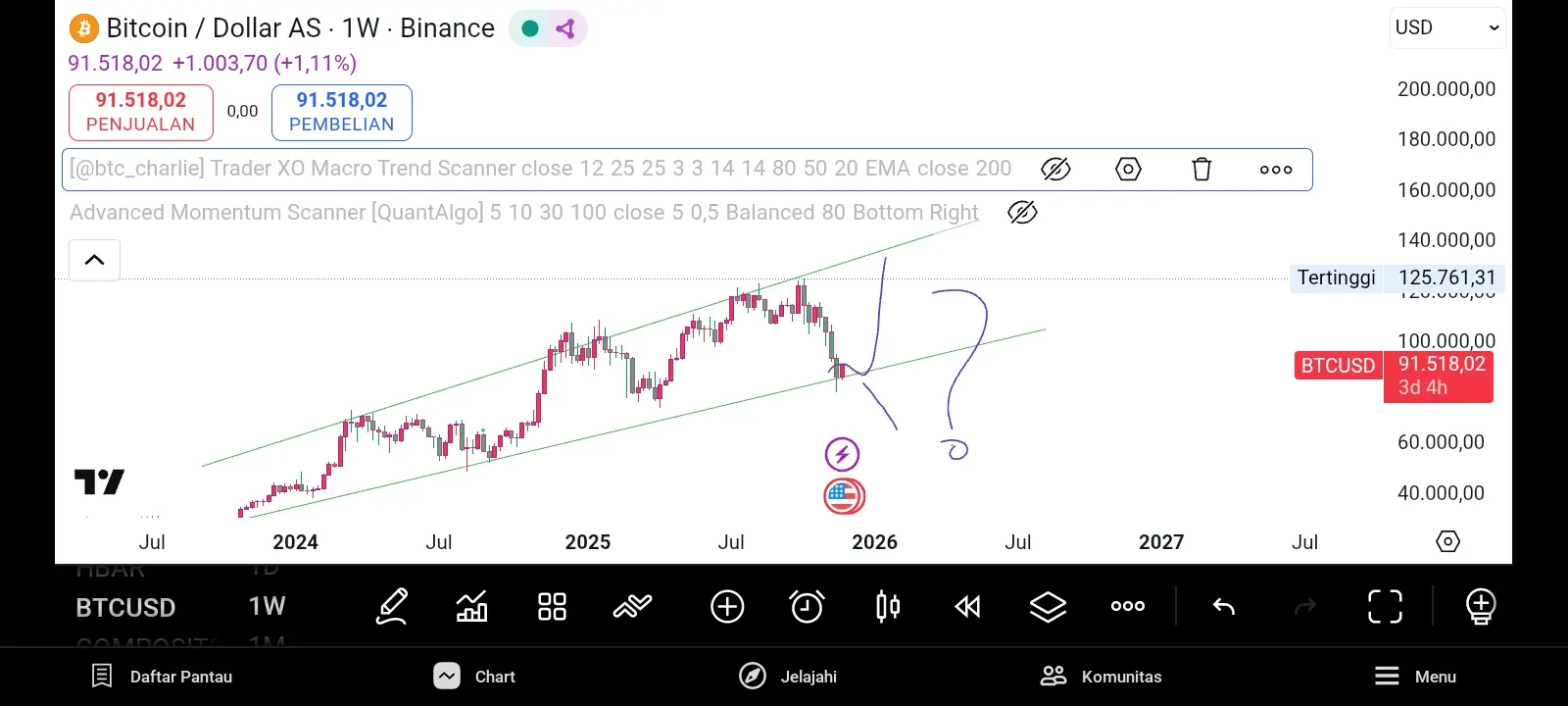

BTC0,59%