Bitcoin hits 91,000 resistance, Ethereum leads the rally! Is this a short-term correction or a continuation of the rise?

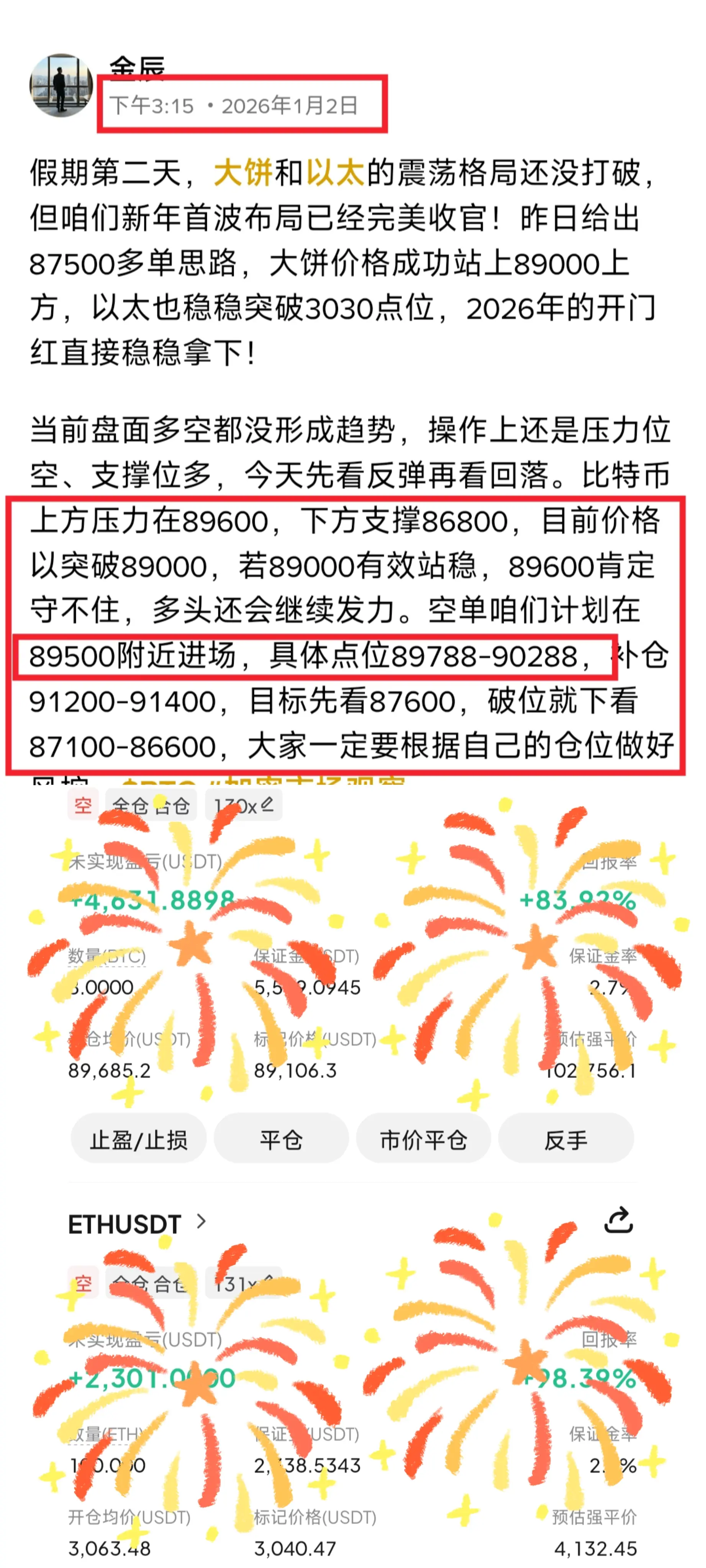

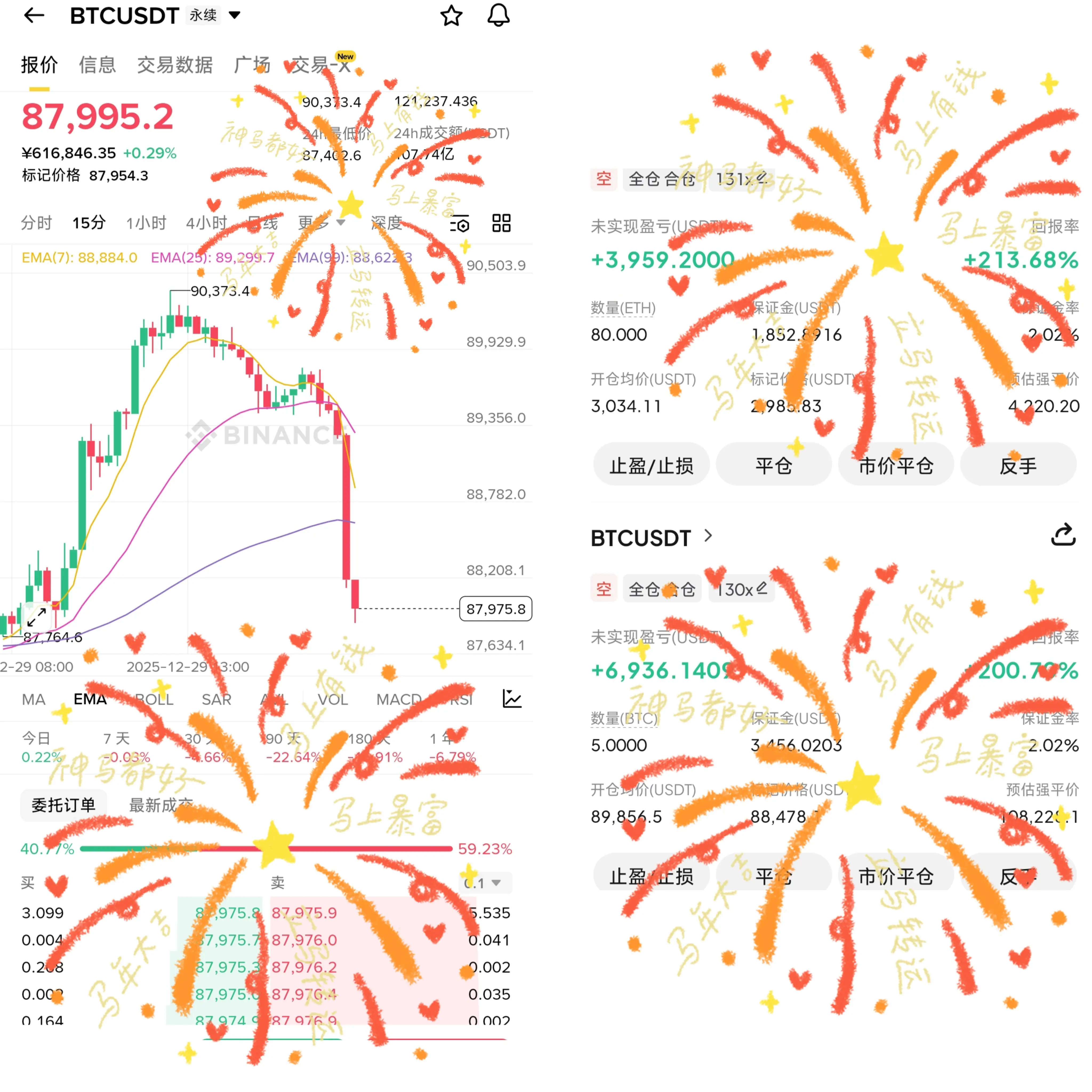

After the holiday break, Western institutions resume work, and liquidity in the crypto market quickly recovers. Bitcoin surged to 90,930 early yesterday morning before pulling back, currently oscillating near the 90,000 level; Ethereum performed even more strongly, breaking through the 3,050 resistance level that had been sideways for half a month, reaching a high of 3,150, now stabilizing in the 3,100-3,150 range.

This rebound is not surprising: on one hand, the Christmas a

After the holiday break, Western institutions resume work, and liquidity in the crypto market quickly recovers. Bitcoin surged to 90,930 early yesterday morning before pulling back, currently oscillating near the 90,000 level; Ethereum performed even more strongly, breaking through the 3,050 resistance level that had been sideways for half a month, reaching a high of 3,150, now stabilizing in the 3,100-3,150 range.

This rebound is not surprising: on one hand, the Christmas a

BTC1,11%