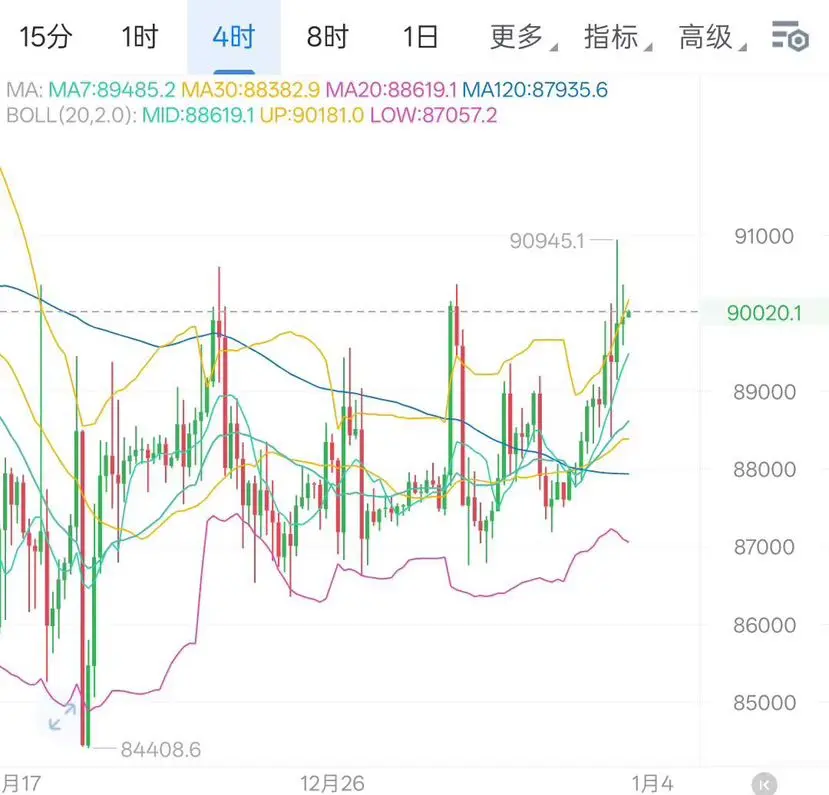

#ETH Yesterday's market trend rebounded as expected. Bitcoin experienced a surge in bullish volume during the US stock market opening phase. The market's second rebound recovered to around 89,000 but faced resistance and pulled back. The relative price comparison still cannot stabilize at the corresponding high levels, and the market is expected to see some retracement. The lowest support was around 87,800 before stopping the decline. Overall, the market remains in a consolidation range, with the lows moving higher but no clear breakout signals yet. Ethereum, in line with our consistent outloo

View Original龙晨聊趋势

No content yet

龙晨聊趋势

Simple review of yesterday's market: Bitcoin continued to consolidate during the white盘, with the price under pressure around the 90,000 level, leading to some pullback. However, as the lows were raised, the US session in the early morning finally saw the bulls regain control. Bitcoin temporarily recovered to around 91,000 but faced resistance, and the overall high point remains blocked at a key resistance level. The altcoins appeared stronger, with the market rising from 3,000 to around 3,150 before encountering resistance. The overall market reached a critical resistance and was blocked, and

View Original

- Reward

- like

- Comment

- Repost

- Share

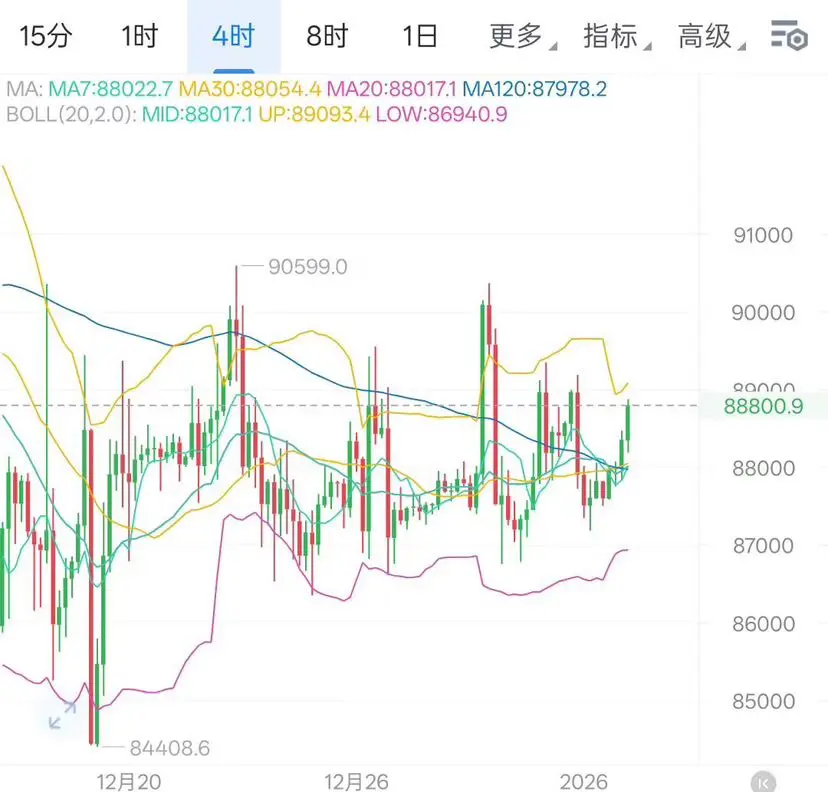

#BTC Yesterday, Bitcoin experienced a day of oscillation within a narrow range, with only about 1000 points of fluctuation between the high and low. Overall, it can be said that it traded sideways all day. In the early morning, Bitcoin finally stabilized firmly above the 88,000 level, marking a significant recovery for the bulls, and the current slow upward trend has pushed the price to around 88,800. However, there are still no signs of a short-term breakout to new highs.

Ethereum, on the other hand, moved in sync with Bitcoin, but its recovery strength is relatively stronger. Currently, it

View OriginalEthereum, on the other hand, moved in sync with Bitcoin, but its recovery strength is relatively stronger. Currently, it

- Reward

- like

- 1

- Repost

- Share

NingxiFour :

:

New Year Wealth Explosion 🤑Yesterday's market overall showed a pattern of initial rise followed by a decline. Bitcoin's price was under pressure after reaching a high of 89,400, falling back to around 87,900 before a brief rebound, with a correction during the daytime trading session. In the evening, after the US stock market opened, selling pressure intensified, and the market declined again, with the lowest point touching 87,766. Ethereum moved in sync, declining from a high of 3,027 and bottoming out at around 2,966 in the evening. Our strategy yesterday was also timely in reminding everyone to continue watching for

View Original

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Intraday Asian session as expected, the bulls saw increased volume. After Bitcoin closed the early session with a slight pullback testing the bottom support structure without success, it then staged a second rebound in the afternoon. Currently, Bitcoin's highest rally is around 88,000, facing resistance, and there has still been no further breakdown. Ethereum, as we recently analyzed, remains in a relatively volatile consolidation range, generally fluctuating between 2900 and 3000. The intraday rebound has also been achieved; we positioned long positions early on, and Ethereum took profit as e

View Original- Reward

- like

- Comment

- Repost

- Share

#ETH In the early morning US session, the overall market once again experienced a slight pullback test of the bottom structure. Bitcoin temporarily retreated to around 86,800 to halt its decline, then in the evening rebounded to around 88,200 before facing resistance and falling back. The overall relative strength remains within a consolidation range. Ethereum has experienced significant volatility recently, briefly retracing to around 2,900 to halt its decline, and continues to oscillate sideways. The overall movement is consistent with the strategy we discussed yesterday. During the early m

View Original- Reward

- like

- Comment

- Repost

- Share

#BTC After the weekend's sideways adjustment, the overall market trend surged after the morning session closed. Bitcoin, after hovering around 87,000, experienced a second volume increase and rose to around 90,300 before facing resistance and pulling back. Currently, it remains around 90,000 with sideways consolidation. Altcoins also saw volume increase along with Bitcoin, temporarily recovering to around 3,050 before encountering resistance. Our early morning strategy focused on key support levels for a rebound, which was achieved as planned. We entered long positions around 87,800, and as th

View Original

- Reward

- like

- Comment

- Repost

- Share

After experiencing Christmas and several days of narrow-range fluctuations over the weekend, the overall volatility of Bitcoin remains very limited, and it surged again over the weekend. A quick upward move in the early morning pushed it from a low of 87,402 up to a high of 88,023. Ethereum also followed suit, reaching a high of 2,954. The overall profit potential of the current layout is quite considerable. The current trend is basically consistent with previous ideas, with no significant directional bias. In the short term, focus on recent narrow-range consolidations that serve as resistance

View Original

- Reward

- 1

- Comment

- Repost

- Share

The weekend overall showed a horizontal consolidation adjustment. The Bitcoin price rebounded to around 89000 before facing resistance and falling back, with a lowest point around 87500 where it stopped declining. The price comparison remains in the current oscillating structure, continuing to correct its shape. Currently, we still need to pay attention to the upper pressure situation to determine the future trading strategy. Overall, during the weekend, our strategy of looking for high shorts and low longs with a focus on the 89000 resistance has once again been realized.

From the current mar

View OriginalFrom the current mar

- Reward

- 1

- 2

- Repost

- Share

KingaElvira :

:

Watching Closely 🔍View More

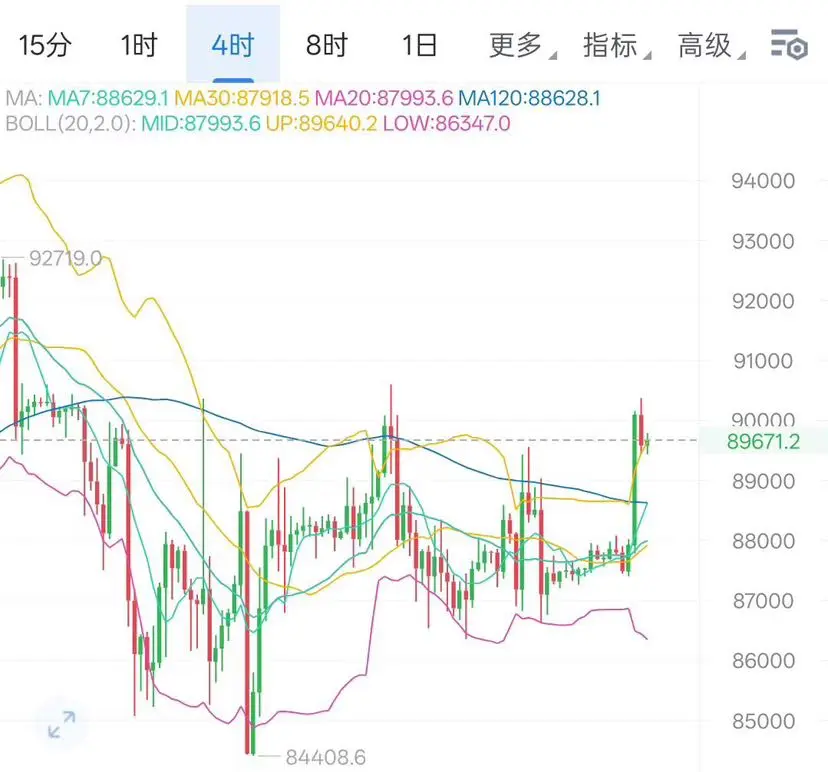

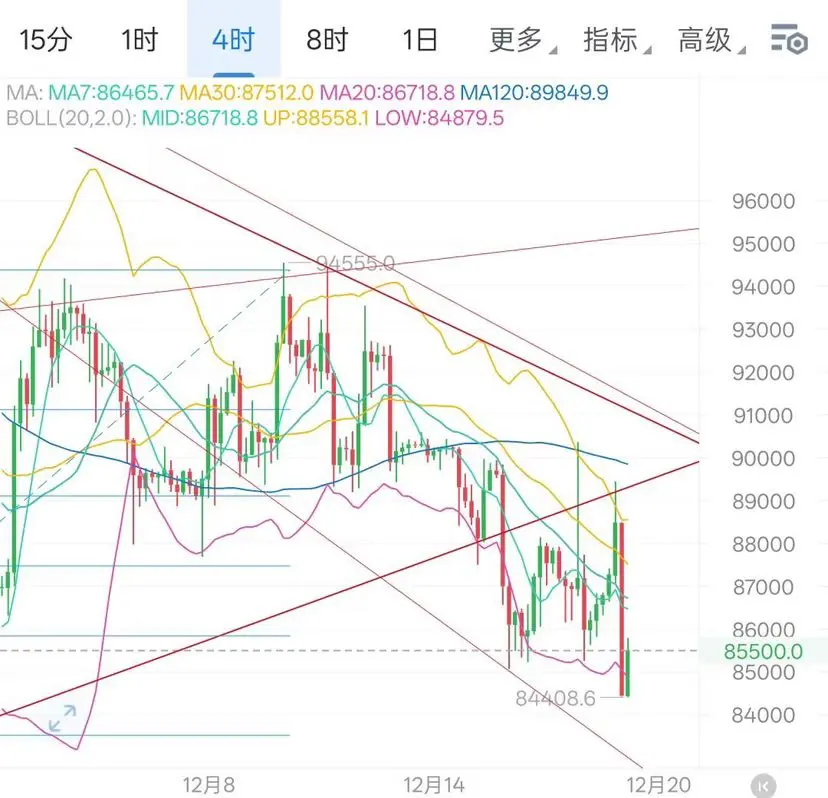

#BTC A brief review of yesterday's market: During the early trading hours, the market experienced a certain retracement, with the lowest dip around 85,000 to halt the decline. Later, with Japan's interest rate hike further stimulating market sentiment, the bullish recovery was quite strong. Bitcoin temporarily recovered to the key resistance near 89,500 but faced resistance and pulled back. As the US trading session approached, the overall trend showed signs of a rebound during the Asian session followed by a retracement in the US session. The early morning retracement also brought the price

View Original

- Reward

- like

- Comment

- Repost

- Share

Let's do a simple review of yesterday's market. During the daytime, the overall trend showed signs of breaking down and a recovery by the bulls, but there was no further volume surge to push prices higher. With the positive impact of tonight's CPI data, the bulls gained momentum and pushed higher, with Bitcoin's price once recovering to around 89,500 before facing resistance and pulling back. The price retraced to around 84,500 to stop the decline. Currently, there is some rebound, but it has not yet reclaimed the key level of 86,000. We have previously discussed the importance of the overall

View Original

- Reward

- like

- Comment

- Repost

- Share

Let's do a simple review of yesterday's market. The overall market closed with a strong bearish tone, testing the bottom support structure. Bitcoin's intraday price once dipped to around 86,000, which was our expected support level. Later in the evening, after a sharp rise that reclaimed and broke through the 90,000 mark, the price was fully retraced, once again playing out a "painting door" event, with the market retracing nearly 5,000 points. Recently, I have repeatedly mentioned two key levels: 86,000 and 90,000. These support and resistance levels are critical short-term oscillation resist

View Original

- Reward

- like

- Comment

- Repost

- Share

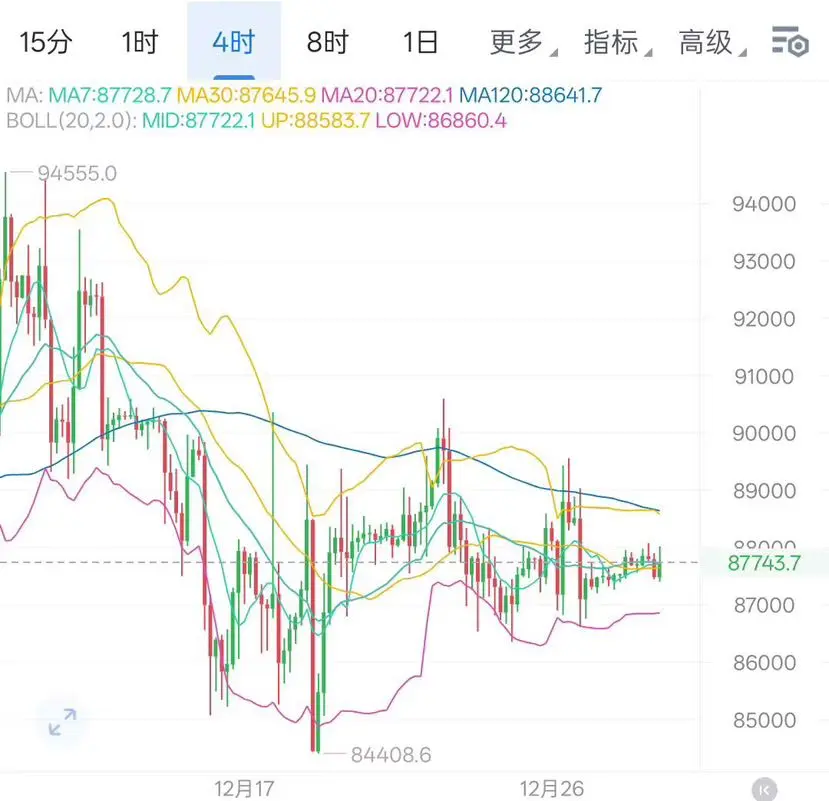

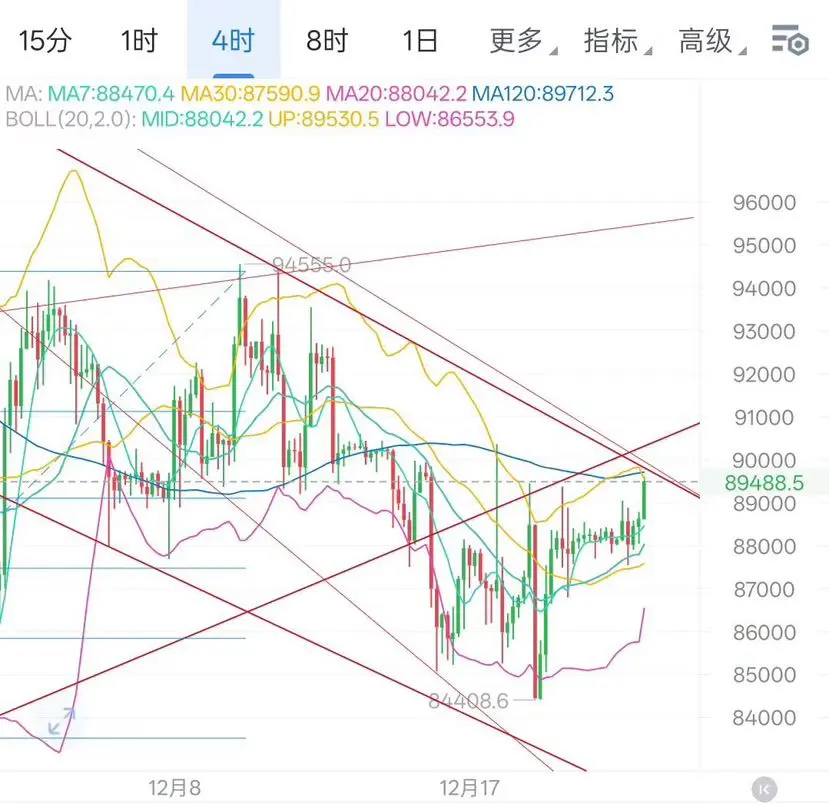

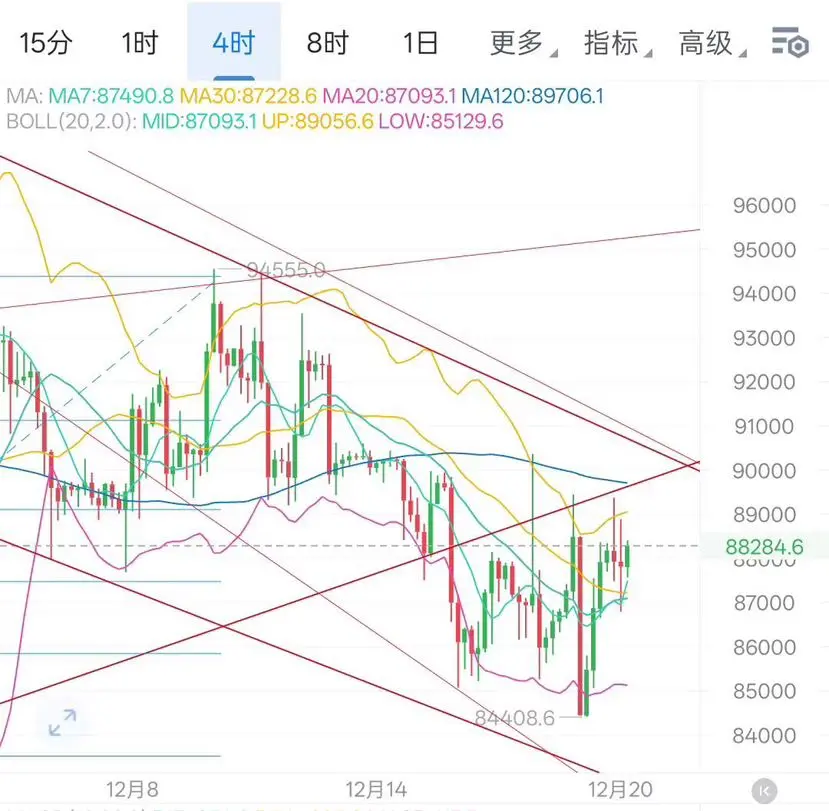

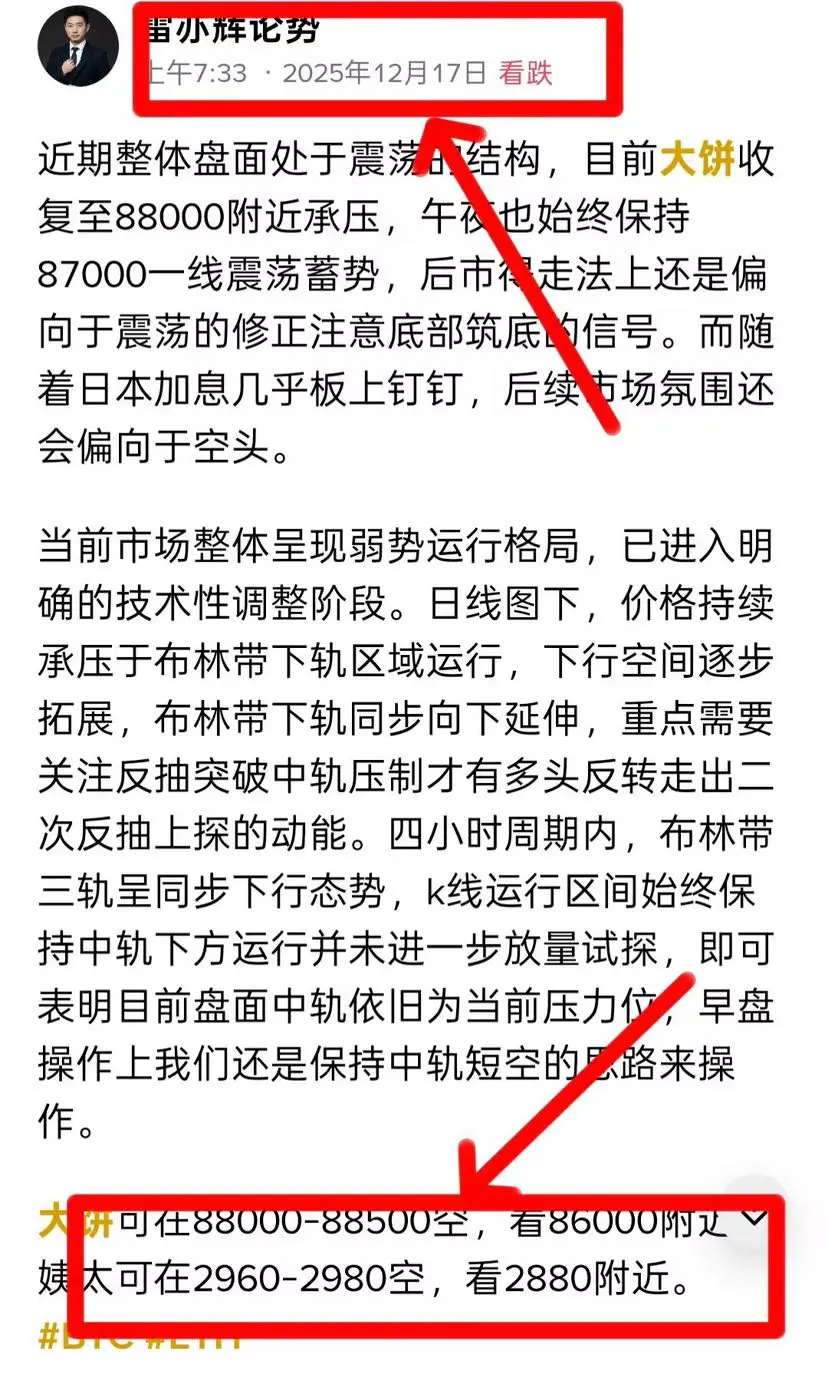

The overall market has been in a volatile structure recently. Currently, Bitcoin has recovered to around 88,000 but faces resistance, and during midnight, it has maintained a range around 87,000 with sideways consolidation. The future trend is still likely to be a correction with a focus on bottom-building signals. As Japan's interest rate hike is almost certain, the market sentiment will tend to be bearish.

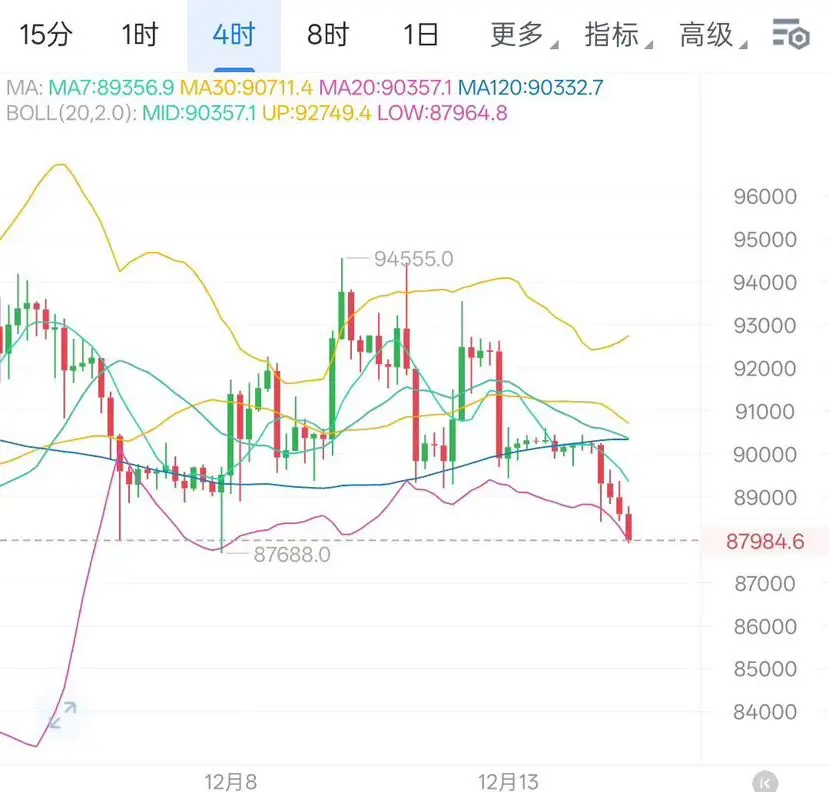

The current market is showing a weak overall trend and has entered a clear technical adjustment phase. On the daily chart, the price continues to be pressured below the lower band of the B

View OriginalThe current market is showing a weak overall trend and has entered a clear technical adjustment phase. On the daily chart, the price continues to be pressured below the lower band of the B

- Reward

- like

- Comment

- Repost

- Share

On Monday after the market closed, the early session saw a sharp rise, recovering nearly 2000 points, but failing to break the 90,000 level, which indicates that the bulls have not gained such strong momentum in the short term. It also suggests that this round of pullback is inevitable. After dipping to 85,000 and stopping the decline in the early hours, the market has now partially recovered, indicating that breaking below support requires a step-by-step approach rather than a sharp drop. Regarding the actual trading, we strictly followed our strategy in the early session: entered around 88,5

View Original

- Reward

- like

- Comment

- Repost

- Share

A new week, a new beginning. Before the early trading session closes, there is a certain pullback. The weekly chart pattern has not yet allowed Bitcoin to stabilize above the 90,000 level. In the short term, Bitcoin remains consolidating around 88,000. The weekend did not show significant volatility. In the short term, focus on the support levels at the bottom to monitor the range for the future market.

From the market performance perspective, Bitcoin's daily chart recorded three consecutive bearish days, dropping to the lower band of the Bollinger Bands. Although there was some consolidation

View OriginalFrom the market performance perspective, Bitcoin's daily chart recorded three consecutive bearish days, dropping to the lower band of the Bollinger Bands. Although there was some consolidation

- Reward

- like

- Comment

- Repost

- Share

During the early hours, the market began to slowly decline after a weak consolidation. BTC dipped to the line of 83780, then rebounded to around 85300 after some fluctuations, pushing the price back up to the vicinity of the 86000 integer mark for further consolidation; Ethereum simultaneously maintained a weak fluctuation pattern in the evening, retreating to a low around 2730 but failing to form an effective breakthrough, continuing to hover within this range, with overall fluctuation limited.

From the current market perspective, BTC shows a clear weak trend on the four-hour chart: after a r

View OriginalFrom the current market perspective, BTC shows a clear weak trend on the four-hour chart: after a r

- Reward

- like

- Comment

- Repost

- Share

In the new month's candlestick opening, the short positions have increased and prices are declining. In the early session, BTC surged to a high of 91000 but once fell below to around 86000, where it stopped declining. Overall, the market is still retracing to the Fibonacci key support level of this round of pullback. It is still too early to expect a deeper correction. As for Ethereum, it is also undergoing a deep pullback in sync with BTC, momentarily retracing to around 2800 without further breakdown, maintaining the key support level. This trend still indicates that long positions are h

View Original- Reward

- 1

- Comment

- Repost

- Share

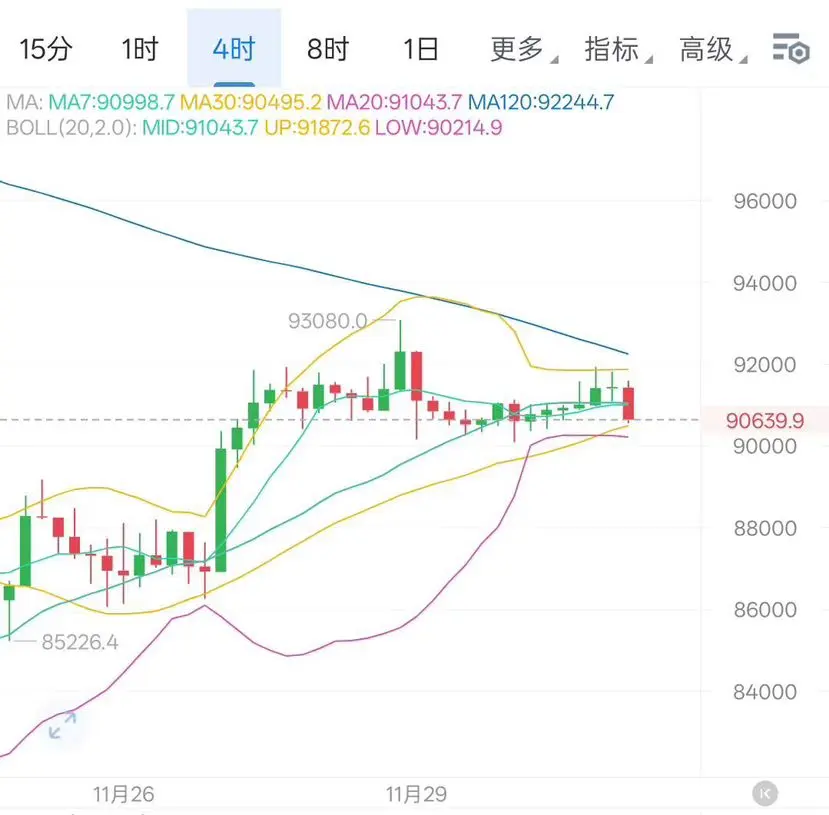

After the adjustments over the weekend, the overall market rebounded after testing the 90000 level. On Sunday night, long positions once again increased trading volumes to recover, but they did not break through the short-term resistance level of 92000. In the short term, the market has experienced some pullback, and BTC has once again fallen to around 91000 for consolidation, with no further signs of weakness overall. In terms of Ethereum, it is performing similarly to BTC, with the market not breaking below the 3000 mark during the pullback, and there are signs of bottoming out during the we

View Original

- Reward

- 4

- 6

- Repost

- Share

Alex_Choli :

:

.View More

Yesterday, the overall market showed a certain rebound, with BTC facing pressure around the 93000 level and the market overall retracing to the 90000 mark to stop falling, which is also consistent with our thoughts during the live broadcast in the early morning, indicating a certain depth dip. Currently, the key position is the 90000 level, which should not be broken. After hitting the top, the market is in a consolidation retracement, and the overall market trend still remains bullish. During our live broadcast yesterday, we also reminded everyone to pay attention to the 90000 level for BTC a

View Original

- Reward

- 2

- 1

- Repost

- Share

GoldMedalTrader1 :

:

From the daily chart perspective, BTC opened and closed with a bearish candle near 90800. The market tested the resistance level of 93000 before starting to pull back, closing still below 91500. Currently, the resistance level of 91500-92000 is effective, and a breakout is needed to continue looking towards 93000-94500, with support at 90500-90000, and a breakdown looking towards 88000-87000! Ether closed with a doji bullish candle near 3030, and the market also tested the resistance level of 3100 before starting to pull back, closing still below 3030. Currently, the resistance level of 3030-3050 remains effective, and a breakout of this resistance is needed to continue looking towards 3170, with support at 2950, and a breakdown looking towards 2850! On the 4-hour chart, BTC oscillated at a high level before accumulating momentum to test the range of 92500-93000, where it encountered resistance and pulled back. A breakout would look towards 93000-94500, while a downward movement would return to 88500-86500. Ether shows a similar trend, accumulating momentum to test the range of 3080-3100 before encountering resistance and pulling back. A breakout would look towards 3170, while a downward movement would return to 2950-2850!

The long orders for BTC and Ether that were set the previous day only reached the expected final targets last night, with BTC at 93000 and Ether at 3100. The long orders set yesterday did not get filled and broke out.

#BTC On Thursday, Thanksgiving, the US stock market is closed. Tonight, there is expected to be little market Fluctuation. BTC has recovered to around 92000 during the day and is currently maintaining a consolidation structure after a pullback. With no US stock market opening to drive the market, it is anticipated that there won't be much Fluctuation tonight. It is advisable to operate on short-term strategies by maintaining a consolidating approach.

From the current market perspective, the four-hour chart has rebounded to 92000, which is the top of the upward channel, and has turned bear

View OriginalFrom the current market perspective, the four-hour chart has rebounded to 92000, which is the top of the upward channel, and has turned bear

- Reward

- like

- Comment

- Repost

- Share