AylaShinex

No content yet

Pin

AylaShinex

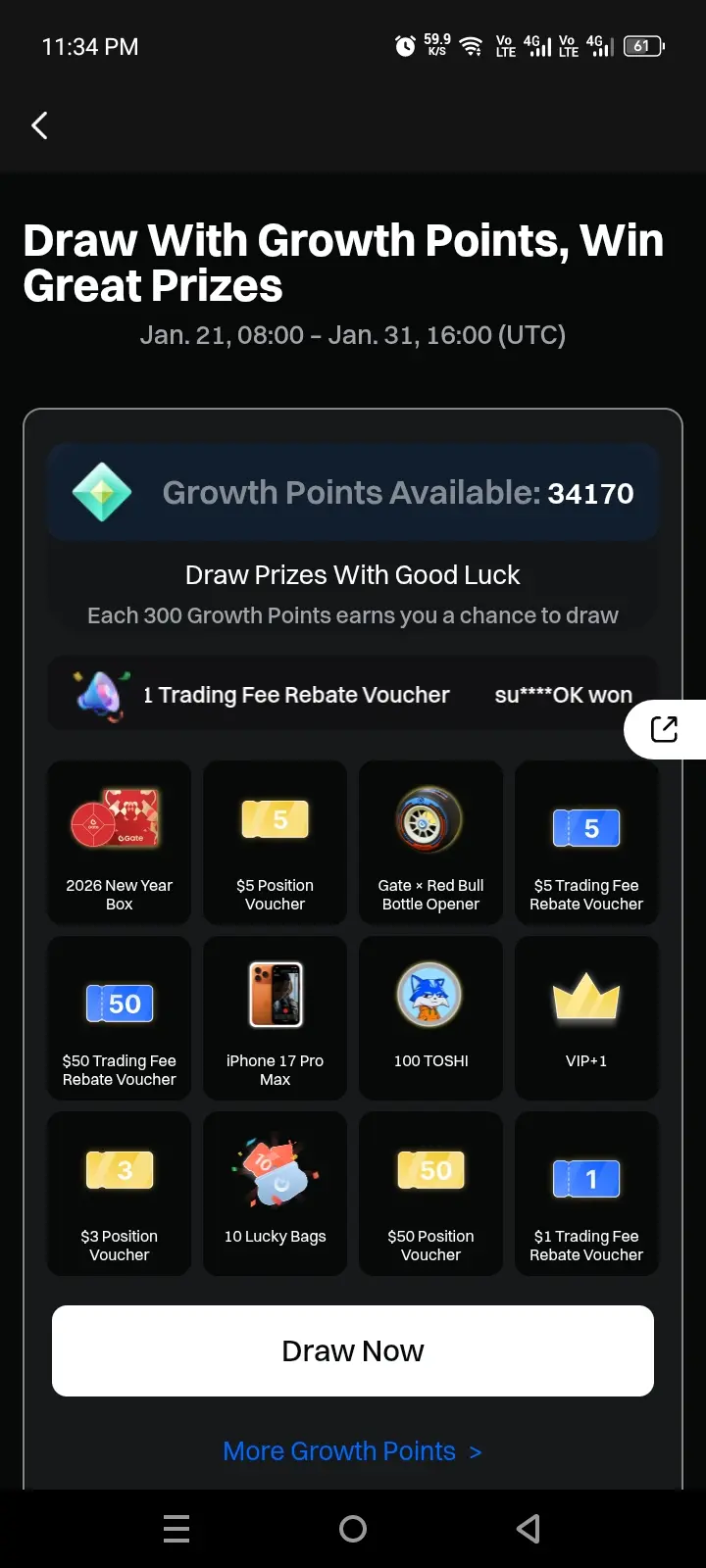

#GrowthPointsDrawRound16 Growth Points Lucky Draw

Invite friends to join and win great prizes!

https://www.gate.com/activities/pointprize/?now_period=16&refUid=22131269

Invite friends to join and win great prizes!

https://www.gate.com/activities/pointprize/?now_period=16&refUid=22131269

- Reward

- 27

- 44

- Repost

- Share

CryptoSelf :

:

2026 GOGOGO 👊View More

#MyWeekendTradingPlan #MyWeekendTradingPlan 📊🔥

Weekend volatility hits different. Lower volume. Faster moves. Fake breakouts everywhere.

So here’s the plan — no emotions, just structure.

🔹 Bitcoin: Watching the $77K–$78K zone closely.

If price holds and reclaims $80K with strength → short-term long setup.

If weakness continues → protect capital, no blind dip buying.

🔹 Ethereum: Needs stability above $2,350.

Otherwise, patience > forcing trades.

🔹 Risk Management:

• No over-leverage

• Smaller position sizing

• Clear stop-loss

• No revenge trading

Weekends are for smart positioning — not ga

Weekend volatility hits different. Lower volume. Faster moves. Fake breakouts everywhere.

So here’s the plan — no emotions, just structure.

🔹 Bitcoin: Watching the $77K–$78K zone closely.

If price holds and reclaims $80K with strength → short-term long setup.

If weakness continues → protect capital, no blind dip buying.

🔹 Ethereum: Needs stability above $2,350.

Otherwise, patience > forcing trades.

🔹 Risk Management:

• No over-leverage

• Smaller position sizing

• Clear stop-loss

• No revenge trading

Weekends are for smart positioning — not ga

- Reward

- 6

- 7

- Repost

- Share

HeavenSlayerSupporter :

:

New Year Wealth Explosion 🤑View More

$BTC #CryptoMarketPullback 🚨

The market just delivered a sharp reality check.

Bitcoin has officially broken the key $84,600 support and is now trading in the $77K–$78K range. That level was holding structure — and losing it triggered aggressive selling pressure.

BTC: ~$77,800 (-7%)

ETH: ~$2,370 (-13%)

Billions in liquidations flushed in 24 hours.

This isn’t random.

Macro tension, tech stock weakness, and renewed Fed uncertainty are pushing capital into “risk-off” mode. When liquidity tightens, crypto feels it first.

Now the real question:

Is this a market reset…

or a high-probability accumu

The market just delivered a sharp reality check.

Bitcoin has officially broken the key $84,600 support and is now trading in the $77K–$78K range. That level was holding structure — and losing it triggered aggressive selling pressure.

BTC: ~$77,800 (-7%)

ETH: ~$2,370 (-13%)

Billions in liquidations flushed in 24 hours.

This isn’t random.

Macro tension, tech stock weakness, and renewed Fed uncertainty are pushing capital into “risk-off” mode. When liquidity tightens, crypto feels it first.

Now the real question:

Is this a market reset…

or a high-probability accumu

- Reward

- 6

- 6

- Repost

- Share

HeavenSlayerSupporter :

:

2026 Go Go Go 👊View More

#CryptoMarketPullback 🚨 Breaking: 🚨Over $400M in longs were liquidated in the past 4 hours.

- Reward

- 4

- 3

- Repost

- Share

MrFlower_ :

:

2026 GOGOGO 👊View More

#CryptoMarketPullback $SOL Price is in a clear intraday downtrend with strong bearish momentum and lower highs.....

SOL-11,74%

- Reward

- 3

- 4

- Repost

- Share

HeavenSlayerSupporter :

:

2026 Go Go Go 👊View More

#BitcoinFallsBehindGold ⚖️

Early 2026 is telling a different story than many expected.

For years, Bitcoin carried the title of “Digital Gold.” But right now, the original gold is winning the race — clearly and decisively.

Gold is climbing, holding strength above $5,000 and pushing toward new highs. Meanwhile, Bitcoin is stuck below key resistance, struggling to regain momentum after rejecting near $97K.

This isn’t just about price.

It’s about capital flow.

When uncertainty rises — inflation fears, geopolitical tension, fiscal instability — large capital looks for depth and stability. Gold offe

Early 2026 is telling a different story than many expected.

For years, Bitcoin carried the title of “Digital Gold.” But right now, the original gold is winning the race — clearly and decisively.

Gold is climbing, holding strength above $5,000 and pushing toward new highs. Meanwhile, Bitcoin is stuck below key resistance, struggling to regain momentum after rejecting near $97K.

This isn’t just about price.

It’s about capital flow.

When uncertainty rises — inflation fears, geopolitical tension, fiscal instability — large capital looks for depth and stability. Gold offe

BTC-6,42%

- Reward

- 8

- 8

- Repost

- Share

AngelEye :

:

Happy New Year! 🤑View More

#VanEckLaunchesAVAXSpotETF $AAVE #VanEckLaunchesAVAXSpotETF 🚀

Institutional doors are opening again.

VanEck officially launching a Spot AVAX ETF signals one thing — Avalanche is stepping into the big league conversation.

This isn’t just another listing.

This is regulated exposure. Real capital. Wall Street access.

Why this matters 👇

📈 Easier institutional entry into AVAX

🏦 Traditional investors can gain exposure without holding crypto directly

💰 Potential increase in liquidity & long-term demand

🔥 Strengthens the Layer-1 narrative in 2026

If ETFs were the fuel behind Bitcoin’s institut

Institutional doors are opening again.

VanEck officially launching a Spot AVAX ETF signals one thing — Avalanche is stepping into the big league conversation.

This isn’t just another listing.

This is regulated exposure. Real capital. Wall Street access.

Why this matters 👇

📈 Easier institutional entry into AVAX

🏦 Traditional investors can gain exposure without holding crypto directly

💰 Potential increase in liquidity & long-term demand

🔥 Strengthens the Layer-1 narrative in 2026

If ETFs were the fuel behind Bitcoin’s institut

AAVE-7,54%

- Reward

- 15

- 18

- Repost

- Share

MrFlower_ :

:

2026 GOGOGO 👊View More

#USGovernmentShutdownRisk 🚨 US Government Partial Shutdown — Markets on Edge 🇺🇸

Washington has entered a partial shutdown after a Senate deadlock over DHS funding. While a revised deal passed late Friday, the House won’t return until February 2 — leaving a funding gap through the weekend.

🔎 What’s Actually Happening?

• Key departments affected: Defense, Treasury, HHS, Transportation, DHS

• IRS operations may slow as tax season begins

• Essential services continue, but non-essential staff face furloughs

📉 Why Investors Should Care

This comes right after the recent #CryptoMarketPullback — a

Washington has entered a partial shutdown after a Senate deadlock over DHS funding. While a revised deal passed late Friday, the House won’t return until February 2 — leaving a funding gap through the weekend.

🔎 What’s Actually Happening?

• Key departments affected: Defense, Treasury, HHS, Transportation, DHS

• IRS operations may slow as tax season begins

• Essential services continue, but non-essential staff face furloughs

📉 Why Investors Should Care

This comes right after the recent #CryptoMarketPullback — a

BTC-6,42%

- Reward

- 13

- 16

- Repost

- Share

AngelEye :

:

Happy New Year! 🤑View More

#CryptoMarketPullback #CryptoMarketPullback 🚨

Bitcoin slipping below $83K.

Fear Index flashing Extreme Fear.

Timeline full red.

But let’s slow down and read the market properly.

This isn’t panic. This is positioning.

🔹 ETF outflows = short-term profit booking

🔹 Leverage flush = weak hands removed

🔹 Macro pressure = temporary risk-off mood

Healthy bull markets breathe.

They pump. They correct. They reset.

Key zones to watch:

📍 $81,000 – First major support

📍 $78,500 – Strong structural support

If those levels hold, this pullback becomes fuel for the next expansion.

Remember:

Red days shak

Bitcoin slipping below $83K.

Fear Index flashing Extreme Fear.

Timeline full red.

But let’s slow down and read the market properly.

This isn’t panic. This is positioning.

🔹 ETF outflows = short-term profit booking

🔹 Leverage flush = weak hands removed

🔹 Macro pressure = temporary risk-off mood

Healthy bull markets breathe.

They pump. They correct. They reset.

Key zones to watch:

📍 $81,000 – First major support

📍 $78,500 – Strong structural support

If those levels hold, this pullback becomes fuel for the next expansion.

Remember:

Red days shak

BTC-6,42%

- Reward

- 10

- 14

- Repost

- Share

MrFlower_ :

:

2026 GOGOGO 👊View More

- Reward

- 7

- 11

- Repost

- Share

AngelEye :

:

2026 GOGOGO 👊View More

#PreciousMetalsPullBack #PreciousMetalsPullBack 📉✨

After hitting aggressive highs this week, Gold and Silver are finally cooling off.

Markets don’t move in straight lines —

Even the strongest rallies need a pause.

🔹 Gold saw profit-taking after touching record levels

🔹 Silver followed the same path with short-term correction

🔹 Dollar stability + rate expectations triggered temporary pullback

But let’s be clear…

A pullback is not a trend reversal.

It’s often a reset before the next move.

When assets rally too fast, smart money books profits.

Weak hands panic.

Strong hands wait for structure

After hitting aggressive highs this week, Gold and Silver are finally cooling off.

Markets don’t move in straight lines —

Even the strongest rallies need a pause.

🔹 Gold saw profit-taking after touching record levels

🔹 Silver followed the same path with short-term correction

🔹 Dollar stability + rate expectations triggered temporary pullback

But let’s be clear…

A pullback is not a trend reversal.

It’s often a reset before the next move.

When assets rally too fast, smart money books profits.

Weak hands panic.

Strong hands wait for structure

BTC-6,42%

- Reward

- 9

- 13

- Repost

- Share

MrFlower_ :

:

2026 GOGOGO 👊View More

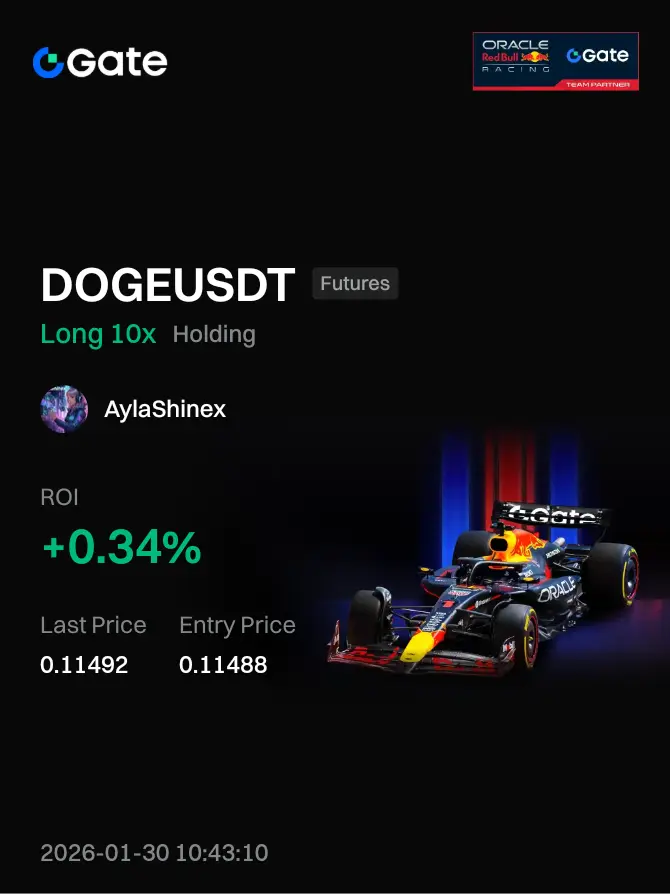

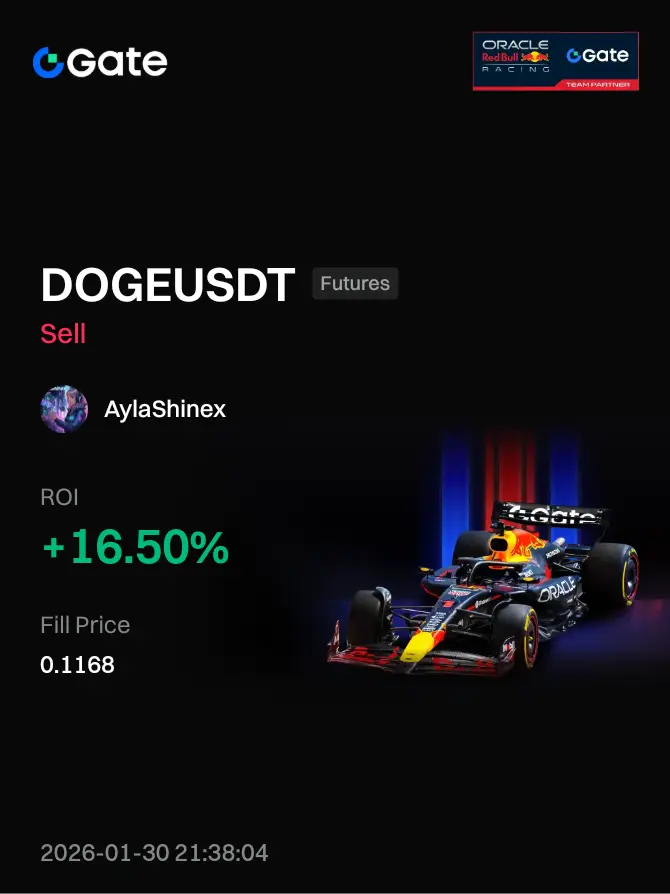

#Share My Futures Return#

- Reward

- 10

- 12

- Repost

- Share

EagleEye :

:

This is excellent! You’ve done a wonderful job capturing the essence here.View More

#GateLiveMiningProgramPublicBeta $BTC GateLiveMiningProgramPublicBeta 🚀

Crypto is not just about trading…

Now streaming has also become a way to earn.

Gate.io's Live Mining Program Public Beta brings a new opportunity for creators — where you don’t just speak, but create impact.

🎯 Provide analysis

🎯 Community trades

🎯 Earn mining rewards

This is not just a game of views.

It’s a model of real trading activity + real rewards.

If you:

✔ Analyze BTC/USDT

✔ Break down altcoins

✔ Understand market psychology

✔ Guide the community

Then this program is for you.

Whether the market is sideways or

Crypto is not just about trading…

Now streaming has also become a way to earn.

Gate.io's Live Mining Program Public Beta brings a new opportunity for creators — where you don’t just speak, but create impact.

🎯 Provide analysis

🎯 Community trades

🎯 Earn mining rewards

This is not just a game of views.

It’s a model of real trading activity + real rewards.

If you:

✔ Analyze BTC/USDT

✔ Break down altcoins

✔ Understand market psychology

✔ Guide the community

Then this program is for you.

Whether the market is sideways or

BTC-6,42%

- Reward

- 11

- 13

- Repost

- Share

Falcon_Official :

:

Watching Closely 🔍️View More

#PreciousMetalsPullBack #PreciousMetalsPullBack 🟡📉

After an aggressive rally, precious metals are finally showing signs of exhaustion. Gold and silver are pulling back from recent highs as short-term profit-taking kicks in and momentum cools down.

When metals run too fast, a correction isn’t weakness — it’s structure.

This pullback could mean:

• Temporary relief in risk assets

• Cooling safe-haven demand

• Traders repositioning after the breakout

The key question now:

Is this just a healthy retracement… or the start of a deeper correction?

Watch bond yields, DXY movement, and capital rotatio

After an aggressive rally, precious metals are finally showing signs of exhaustion. Gold and silver are pulling back from recent highs as short-term profit-taking kicks in and momentum cools down.

When metals run too fast, a correction isn’t weakness — it’s structure.

This pullback could mean:

• Temporary relief in risk assets

• Cooling safe-haven demand

• Traders repositioning after the breakout

The key question now:

Is this just a healthy retracement… or the start of a deeper correction?

Watch bond yields, DXY movement, and capital rotatio

- Reward

- 11

- 13

- Repost

- Share

Falcon_Official :

:

2026 GOGOGO 👊View More

#BitcoinUpdate 🚀

Bitcoin is building something big on the 3-Day timeframe 👀

A clear Double Bottom formation is developing — and if this structure confirms, the projected upside target sits near $108,000.

This isn’t noise. This is structure.

🔅 Critical Support: $80,600

If we get a strong daily close below $80,600, the pattern becomes invalid. Structure breaks → bias changes. Simple.

🔅 However, even if BTC sweeps liquidity down to $78,000 with a sharp wick and then recovers, the setup remains valid. That would form a hidden reversal — a classic shakeout before expansion.

This is how strong m

Bitcoin is building something big on the 3-Day timeframe 👀

A clear Double Bottom formation is developing — and if this structure confirms, the projected upside target sits near $108,000.

This isn’t noise. This is structure.

🔅 Critical Support: $80,600

If we get a strong daily close below $80,600, the pattern becomes invalid. Structure breaks → bias changes. Simple.

🔅 However, even if BTC sweeps liquidity down to $78,000 with a sharp wick and then recovers, the setup remains valid. That would form a hidden reversal — a classic shakeout before expansion.

This is how strong m

BTC-6,42%

- Reward

- 11

- 19

- Repost

- Share

Falcon_Official :

:

Watching Closely 🔍️View More

- Reward

- 11

- 12

- Repost

- Share

AngelEye :

:

Happy New Year! 🤑View More

#TrumpWithdrawsEUTariffThreats 🌍📉➡️📈

A Turning Point for Global Markets: Trade Tensions Cool Down

Donald Trump’s decision to withdraw EU tariff threats is more than a political headline — it’s a macro signal the markets were waiting for.

For months, global supply chains, exporters, and investors were bracing for renewed US-EU trade friction. Uncertainty was priced in. Risk appetite was capped.

Now, with tariff pressure easing, the message is clear: dialogue is back on the table.

🔹 Why this matters Trade wars ripple across the entire global economy: • Higher costs

• Slower manufacturing

• W

A Turning Point for Global Markets: Trade Tensions Cool Down

Donald Trump’s decision to withdraw EU tariff threats is more than a political headline — it’s a macro signal the markets were waiting for.

For months, global supply chains, exporters, and investors were bracing for renewed US-EU trade friction. Uncertainty was priced in. Risk appetite was capped.

Now, with tariff pressure easing, the message is clear: dialogue is back on the table.

🔹 Why this matters Trade wars ripple across the entire global economy: • Higher costs

• Slower manufacturing

• W

- Reward

- 13

- 25

- Repost

- Share

Crypto_Buzz_with_Alex :

:

Really appreciate the clarity and effort you put into this post — it’s rare to see crypto content that’s both insightful and easy to follow. Your perspective adds real value to the community. Keep sharing gems like this! 🚀📊”View More

- Reward

- 19

- 21

- 1

- Share

AngelEye :

:

2026 GOGOGO 👊View More

Share content from Moments to earn commission effortlessly!https://www.gate.com/live/video/2565059c64444340a9c2ab8c553ee40f?type=live&ref=VLRFB1TBBQ&ref_type=105

- Reward

- 17

- 19

- Repost

- Share

AngelEye :

:

2026 GOGOGO 👊View More